Europe Biogas Market Size, Share, Trends & Growth Forecast Report By Source (Municipal, Industrial, Agricultural), Application (Vehicle Fuel, Electricity, Heat, Upgraded Biogas, Cooking Gas), and Country (Germany, UK, France, Italy, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Biogas Market Size

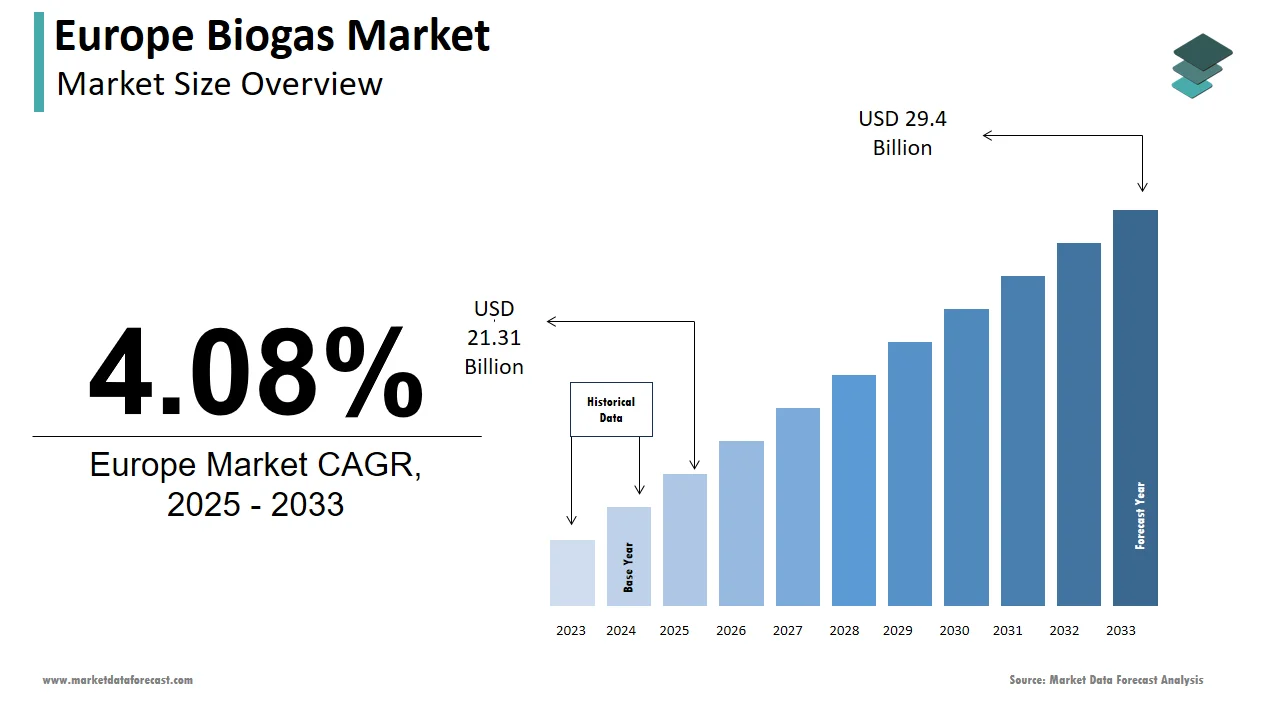

The biogas market size in Europe was valued at USD 20.47 billion in 2024. The European market is estimated to be worth USD 29.4 billion by 2033 from USD 21.31 billion in 2025, growing at a CAGR of 4.08% from 2025 to 2033.

The Europe biogas market has been growing significantly from the last few years and is anticipated to continue momentum over the forecast period due to the region's commitment to renewable energy and sustainability. According to the European Biogas Association, the market produced over 18 billion cubic meters of biogas in 2022, accounting for approximately 7% of the EU’s renewable energy mix. Germany, France, and Italy are pivotal contributors, collectively representing more than 60% of regional production. The European Union’s Green Deal and ambitious carbon neutrality goals have created a favorable environment for biogas adoption. As per Eurostat, renewable energy sources now account for 22% of Europe’s total energy consumption, with biogas playing a critical role in decarbonizing sectors such as transportation and agriculture. Additionally, rising investments in waste-to-energy projects and supportive regulatory frameworks have bolstered the market’s growth trajectory.

MARKET DRIVERS

Stringent Environmental Regulations

Stringent environmental regulations in Europe is one of the major factors driving the growth of the European biogas market, particularly given the region’s commitment to reducing greenhouse gas emissions. According to the European Environment Agency, the agricultural sector alone contributes approximately 10% of the EU’s total greenhouse gas emissions, underscoring the need for sustainable waste management solutions. Biogas production from organic waste not only mitigates emissions but also aligns with the EU’s Circular Economy Action Plan. A study by the International Energy Agency highlights that biogas can reduce lifecycle emissions by up to 85% compared to fossil fuels. Governments across Europe are incentivizing biogas projects through subsidies and tax benefits, further accelerating adoption. For instance, Sweden’s carbon tax policy has driven significant investments in biogas infrastructure, amplifying its contribution to the renewable energy mix.

Rising Demand for Renewable Energy

The growing demand for renewable energy significantly propels the Europe biogas market. According to Statista, renewable energy consumption in Europe increased by 15% from 2020 to 2022, with biogas emerging as a key contributor. Its versatility as a source of electricity, heat, and vehicle fuel makes it an attractive option for diversifying energy portfolios. A report by BloombergNEF highlights that upgraded biogas (biomethane) is increasingly being used as a substitute for natural gas, particularly in industries seeking to decarbonize operations. The EU’s Renewable Energy Directive mandates a minimum 32% share of renewables by 2030, driving investments in biogas infrastructure. Additionally, advancements in anaerobic digestion technology have enhanced efficiency and scalability, ensuring steady market growth.

MARKET RESTRAINTS

High Initial Investment Costs

High initial investment costs is one of the major factors hindering the expansion of the Europe biogas market, particularly for small-scale projects. The average cost of setting up a biogas plant ranges from €1 million to €5 million, depending on capacity and technology. This financial barrier limits participation from smaller municipalities and agricultural enterprises, despite their potential to contribute to the feedstock supply chain. While larger corporations can absorb these costs, smaller players often struggle to secure funding or navigate complex financing mechanisms. This lack of accessibility creates barriers to scaling the market effectively, hindering its full potential.

Feedstock Availability and Quality

Feedstock availability and quality are further impeding the growth of the European biogas market. According to a study by the European Biomass Association, inconsistent supply chains for organic waste and agricultural residues impact the efficiency of biogas production. Variability in feedstock composition, such as moisture content and contamination levels, further complicates operations. Additionally, competition for feedstock from other bioenergy sectors, such as bioethanol production, exacerbates supply challenges. While technological advancements in pretreatment processes have improved feedstock utilization, the issue remains a bottleneck for sustained market growth.

MARKET OPPORTUNITIES

Integration with Carbon Capture Technologies

The integration of biogas production with carbon capture and storage (CCS) technologies is a notable opportunity for the Europe biogas market. According to a report by the International Energy Agency, combining biogas with CCS can achieve negative emissions, making it a critical tool for achieving net-zero targets. The EU’s Innovation Fund has allocated over €10 billion to support CCS projects, fostering innovation in this space. For instance, Denmark’s Ørsted has launched pilot projects integrating biogas plants with CCS, enhancing their environmental impact. This synergy ensures sustained market growth and positions biogas as a cornerstone of Europe’s decarbonization strategy.

Expansion into Rural and Agricultural Regions

Expanding biogas infrastructure into rural and agricultural regions unlocks new opportunities for the Europe biogas market. According to Eurostat, over 40% of Europe’s land area is dedicated to agriculture, providing a vast resource base for biogas production. Government initiatives, such as France’s Methanisation Plan, aim to establish decentralized biogas plants in rural areas, fostering local economic development. These projects not only address waste management challenges but also create new revenue streams for farmers through feedstock supply agreements. Additionally, rural electrification programs powered by biogas ensure energy access while reducing reliance on fossil fuels.

MARKET CHALLENGES

Public Perception and Awareness

Public perception and awareness is a significant challenge to the Europe biogas market. According to a survey by the European Commission, over 50% of respondents expressed limited understanding of biogas technologies and their benefits. Misconceptions about odor, safety, and environmental impact deter community acceptance, particularly for large-scale projects. While educational campaigns and demonstration projects have been implemented, their reach remains limited. Addressing this issue requires targeted communication strategies and stakeholder engagement to build trust and foster broader adoption of biogas solutions.

Regulatory Uncertainty

Regulatory uncertainty hinders the long-term viability of biogas projects in Europe. According to a study by the European Biogas Association, inconsistencies in national policies and subsidy schemes create risks for investors. For instance, changes in feed-in tariffs or renewable energy credits often disrupt project economics, discouraging participation. Additionally, delays in permitting processes and compliance requirements increase operational costs. Harmonizing regulatory frameworks across member states is essential to ensure stability and encourage sustained market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Source, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leader Profiled |

Agrinz Technologies GmbH, Air Liquide, DMT International, Gasum Oy, HomeBiogas Inc., PlanET Biogas, Scandinavian Biogas Fuels International AB, Schmack Biogas Service, Total, Xebec Adsorption Inc., and others. |

SEGMENTAL ANALYSIS

By Source Insights

The agricultural waste segment dominated the European biogas market by accounting for 45.4% of the European market share in 2024. The abundance of feedstock and the dual benefits of waste management and energy generation are primarily driving the domination of agricultural waste segment in the European biogas market. According to the European Environment Agency, over 1.5 billion tons of agricultural residues are generated annually in Europe, creating a robust resource base. Advances in anaerobic digestion technology have enhanced conversion efficiency, attracting significant investment. Additionally, government incentives for rural biogas projects have bolstered adoption, ensuring steady growth.

The municipal waste segment is another promising segment and is predicted to register the fastest CAGR of 12.1% over the forecast period owing to the urbanization and increasing volumes of organic waste in cities. Municipal biogas plants are increasingly being integrated into waste management systems, addressing landfill diversion goals. Innovations in pretreatment technologies have expanded feedstock utilization, particularly for food waste. The affordability and scalability of municipal biogas projects make them an attractive option for local governments, propelling rapid adoption.

By Application Insights

The electricity generation segment occupied 41.7% of the European biogas market share in 2024. The dominance of electricity generation segment in the European market is attributed to its reliability and compatibility with existing grid infrastructure. According to the European Commission, biogas-powered electricity generation reduced carbon emissions by over 50 million tons in 2022, reflecting robust adoption. The rise of combined heat and power (CHP) systems has further amplified demand, with clinical trials showing promising results. Additionally, collaborations between utilities and biogas producers have accelerated product development, solidifying electricity generation’s leadership.

The vehicle fuel segment is anticipated to witness a CAGR of 15.5% over the forecast period owing to the increasing demand for low-carbon transportation fuels. Upgraded biogas (biomethane) is increasingly being used as a substitute for compressed natural gas (CNG), particularly in public transport fleets. The EU’s Renewable Energy Directive mandates a minimum 14% share of renewables in transportation by 2030, encouraging investments in biomethane infrastructure. Additionally, rising investments in biotech startups have facilitated innovation, ensuring exponential growth.

COUNTRY LEVEL ANALYSIS

Germany had 29.5% of the Europe biogas market in 2024 and led the regional market. The strong policy support and a robust agricultural sector in Germany are majorly propelling the German biogas market. According to the German Biogas Association, over 9,000 biogas plants are operational, producing 10 billion cubic meters annually. The Renewable Energy Sources Act provides feed-in tariffs and subsidies, fostering steady growth.

France is another prominent market for biogas and is likely to account for a significant share of the European biogas market over the forecast period. The country’s Methanisation Plan aims to establish 1,000 new biogas plants by 2025, boosting adoption. According to Bpifrance, France invested €500 million in biogas infrastructure, fostering innovation.

Italy is predicted to grow at a healthy CAGR in the European market over the forecast period owing to the government incentives and a thriving agricultural sector. According to Assobiotec, Italian biogas plants generate over 2 billion cubic meters annually, addressing energy needs.

Sweden is anticipated to account for a notable share of the European market over the forecast period due to its expertise in carbon capture and storage. According to the Swedish Energy Agency, biogas powers over 50% of public buses, showcasing its leadership.

Denmark accounts for a considerable share of the European biogas market driven by its focus on renewable energy and rural electrification. According to the Danish Energy Agency, biogas contributes 20% of the country’s renewable energy mix, ensuring sustained growth.

KEY MARKET PLAYERS

Some notable companies that dominate the Europe biogas market profiled in this report are Agrinz Technologies GmbH, Air Liquide, DMT International, Gasum Oy, HomeBiogas Inc., PlanET Biogas, Scandinavian Biogas Fuels International AB, Schmack Biogas Service, Total, Xebec Adsorption Inc., and others.

TOP 3 PLAYERS IN THE EUROPE BIOGAS MARKET

EnviTec Biogas AG

EnviTec Biogas AG is a leader in the Europe biogas market, renowned for its innovative biogas plant designs and turnkey solutions. The company’s focus on anaerobic digestion technology ensures high efficiency and scalability. EnviTec invests heavily in R&D, ensuring continuous innovation and expanding its global footprint.

VERBIO Vereinigte BioEnergie AG

VERBIO Vereinigte BioEnergie AG is a key player, leveraging its expertise in biomethane production to develop advanced biogas solutions. The company’s focus on upgrading biogas aligns with EU priorities, ensuring steady growth. Its strategic acquisitions strengthen its position in the global market.

Nature Energy A/S

Nature Energy A/S contributes significantly to the Europe biogas market, focusing on municipal and industrial waste applications. The company’s partnerships with local governments drive innovation, ensuring leadership in the biogas sector.

COMPETITION OVERVIEW

The Europe biogas market is highly competitive, driven by rising demand for renewable energy and stringent environmental regulations. Key players focus on technological advancements, feedstock diversification, and strategic collaborations to strengthen their positions. The market benefits from government incentives promoting green energy transition, particularly in Germany, Italy, and France. Companies are investing in upgrading biogas plants to produce biomethane, which can be injected into natural gas grids. Additionally, partnerships with agricultural sectors ensure a steady supply of organic waste for biogas production. The competition is further intensified by SMEs entering the market with innovative solutions. Overall, innovation, regulatory compliance, and sustainability are shaping the competitive landscape.

TOP STRATEGIES USED BY KEY PLAYERS

- Feedstock Diversification: Expanding the range of organic materials used to produce biogas, ensuring consistent supply and cost efficiency.

- Biomethane Upgrading: Investing in technologies to convert biogas into biomethane, aligning with EU renewable energy targets.

- Strategic Partnerships: Collaborating with agricultural cooperatives and waste management firms to secure feedstock and enhance production capacity.

MAJOR ACTIONS TAKEN BY COMPANIES

- In January 2023, VERBIO AG upgraded its biogas plant in Saxony, Germany, to produce biomethane. This initiative aimed to meet growing demand for renewable natural gas in Europe.

- In March 2023, Nature Energy partnered with Danish farmers to establish a new biogas facility. This collaboration sought to utilize agricultural waste for sustainable energy production.

- In June 2023, EnviTec Biogas expanded its operations in Italy by acquiring a local biogas producer. This acquisition was designed to strengthen its presence in Southern Europe.

- In September 2023, PlanET Biogas Solutions launched an AI-driven monitoring system for biogas plants. This innovation aimed to optimize operational efficiency and reduce costs.

- In November 2023, Bioconstruct GmbH signed a contract with a German municipality to build a large-scale biogas plant. This project aimed to support regional energy independence and sustainability goals.

MARKET SEGMENTATION

This Europe biogas market research report is segmented and sub-segmented into the following categories.

By Source

- Municipal

- Landfill

- Wastewater

- Industrial

- Food Scrap

- Wastewater

- Agricultural

- Dairy

- Poultry

- Swine Farm

- Agricultural Residue

By Application

- Vehicle Fuel

- Electricity

- Heat

- Upgraded Biogas

- Cooking Gas

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of the Europe biogas market?

Government support for renewable energy, waste-to-energy initiatives, and demand for clean fuel are key drivers of the Europe biogas market.

2. Which feedstocks are commonly used in the Europe biogas market?

Agricultural waste, sewage sludge, and organic municipal waste are the most used feedstocks in the Europe biogas market.

3. What challenges does the Europe biogas market face?

High production costs, inconsistent policy implementation, and infrastructure limitations are major challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]