Europe Biofertilizers Market Research Report – Segmented By Type, Crop Type, Microorganism, Mode Of Application, Form, And By Country (UK, Russia, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, and Rest of Europe) – Industry Analysis Size, Share, Trends, Covid-19 Impact and Growth, Forecast From 2025 to 2033

Europe Biofertilizers Market Size

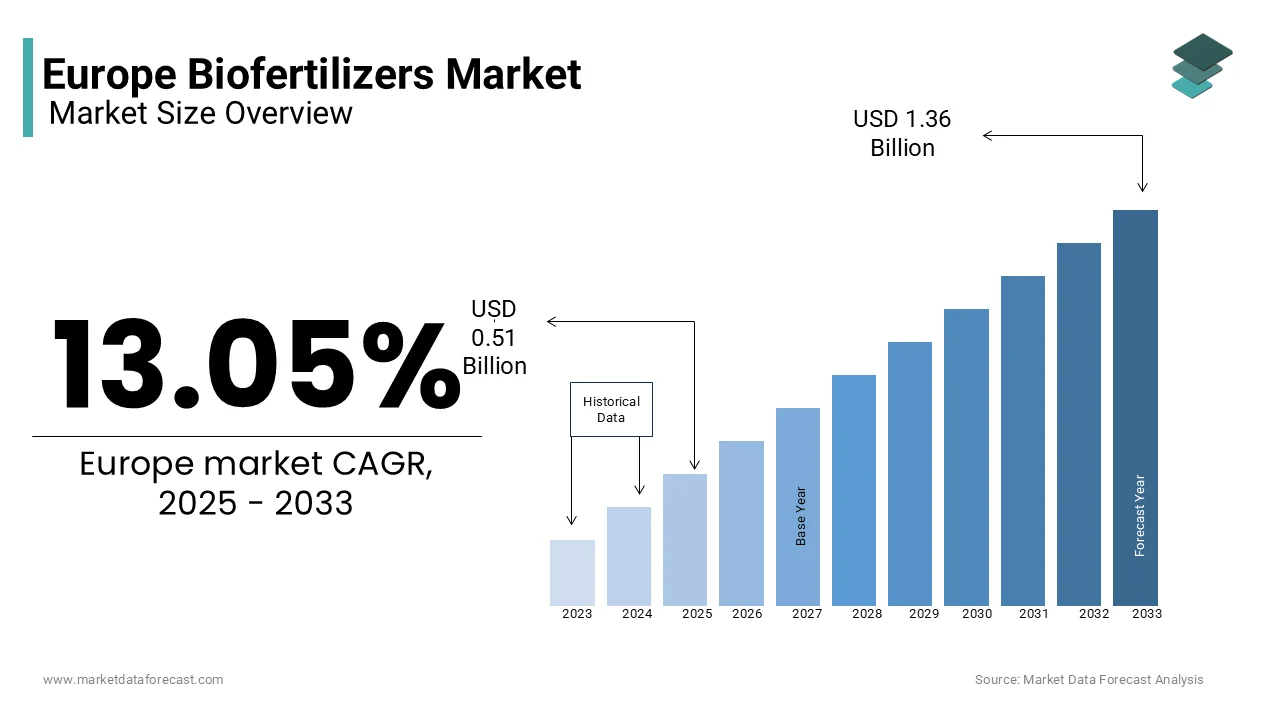

Europe's biofertilizers market was valued at USD 0.45 billion in 2024 and is anticipated to reach USD 0.51 billion in 2025 from USD 1.36 billion by 2033, growing at a CAGR of 13.05% during the forecast period from 2025 to 2033.

Biofertilizers are derived from beneficial microorganisms such as bacteria, fungi, and algae, enhance soil fertility, improve nutrient uptake, and reduce dependency on synthetic fertilizers. In Europe, the demand for biofertilizers has been growing gradually over the last few years due to the growing emphasis on sustainable farming practices and environmental conservation. According to Eurostat, over 60% of European soils are currently degraded due to excessive chemical fertilizer use, creating a pressing need for eco-friendly alternatives. The European Commission’s Farm to Fork Strategy further underscores this shift, aiming to reduce fertilizer usage by 20% by 2030. As per the Research Institute of Organic Agriculture (FiBL), organic farmland in Europe expanded by 7.4% between 2019 and 2020, reaching 14.6 million hectares, thereby amplifying demand for biofertilizers. Countries like Germany, France, and Italy collectively account for nearly 50% of the regional market share. With advancements in biotechnology enabling the development of highly efficient microbial strains, biofertilizers are increasingly integrated into precision farming systems. This alignment with sustainability goals positions the biofertilizer market as a cornerstone of Europe’s transition toward regenerative agriculture.

MARKET DRIVERS

Rising Demand for Organic Farming Practices

The increasing consumer preference for organic food products is a significant driver propelling the European biofertilizer market, as organic farming prohibits the use of synthetic fertilizers. According to FiBL, Europe witnessed a 7.4% increase in organic farmland between 2019 and 2020, reaching 14.6 million hectares, signaling a robust demand for natural agricultural inputs. A report by the French National Institute for Agricultural Research highlights that over 60% of organic farmers rely on biofertilizers to maintain soil fertility and crop yields. Additionally, the European Environment Agency notes that biofertilizers can reduce nitrogen runoff by up to 30%, addressing water pollution concerns. By aligning with consumer preferences and regulatory frameworks, biofertilizers have become indispensable for sustainable farming, driving market growth across the continent.

Stringent Environmental Regulations

Stringent environmental regulations aimed at reducing the ecological footprint of conventional farming practices are further fuelling the growth of the European biofertilizer market. According to the European Environment Agency, nitrogen runoff from synthetic fertilizers contributes to the eutrophication of water bodies, affecting over 40% of European rivers and lakes. To combat this, the EU’s Nitrates Directive mandates a reduction in nitrate pollution, encouraging farmers to explore sustainable alternatives like biofertilizers. A study by the Swedish Board of Agriculture reveals that Rhizobium-based biofertilizers have gained traction in legume cultivation, with Spain reporting a 30% increase in their usage over the past five years. Government subsidies and incentives, such as those offered under the Common Agricultural Policy (CAP), have further accelerated adoption, positioning biofertilizers as a vital tool in achieving the EU’s sustainability objectives.

MARKET RESTRAINTS

Limited Shelf Life and Storage Challenges

Limited shelf life and storage challenges associated with these products is one of the major restraints to the growth of the European biofertilizer market. According to the Food and Agriculture Organization (FAO), most biofertilizers remain viable for only three to six months under optimal storage conditions, making them less convenient compared to chemical fertilizers, which can be stored for extended periods. This limitation poses significant logistical challenges for manufacturers and distributors, particularly in regions with inadequate cold chain infrastructure. For instance, a report by the Swedish Board of Agriculture highlights that improper storage conditions led to a 15% loss in biofertilizer efficacy during transportation in Northern Europe in 2021. Furthermore, the sensitivity of biofertilizers to temperature fluctuations and moisture levels increases production costs, as specialized packaging and storage facilities are required. Without addressing these challenges, the market will continue to face inefficiencies and reduced competitiveness.

High Initial Costs and Farmer Skepticism

High initial cost of biofertilizers, coupled with farmer skepticism regarding their efficacy are also hampering the growth of the European market. According to the European Federation of Biotechnology, biofertilizers are priced 20-30% higher than conventional fertilizers, primarily due to the costs associated with research, development, and quality control. This price differential creates a financial burden for small-scale farmers, who constitute a significant portion of Europe’s agricultural workforce. For example, a survey conducted by the French National Institute for Agricultural Research revealed that 45% of farmers in rural France cited affordability as a major barrier to adopting biofertilizers. Additionally, skepticism about the performance of biofertilizers persists among traditional farmers accustomed to using chemical inputs. A report by the German Federal Ministry of Food and Agriculture indicates that only 35% of surveyed farmers fully trust the effectiveness of biofertilizers, despite evidence of their long-term benefits. Educating farmers about the correct application methods and potential yield improvements remains a critical challenge for stakeholders aiming to expand the market.

MARKET OPPORTUNITIES

Rising Investment in Biotechnological Innovations

The growing investments in biotechnological innovations aimed at enhancing product efficiency and scalability is a notable opportunity for the European biofertilizer market. According to the European Biotechnology Industry Association, venture capital funding for agri-biotech startups surged by 25% in 2022, with biofertilizers emerging as a key focus area. These investments are enabling the development of advanced microbial strains capable of delivering superior results under diverse environmental conditions. For instance, researchers at the University of Helsinki have engineered Azotobacter strains that exhibit a 40% higher nitrogen-fixation capacity compared to traditional variants, significantly boosting crop yields.

Such advancements are complemented by collaborations between academic institutions and private enterprises. The Horizon Europe program, a flagship initiative of the European Union, has allocated €10 billion for sustainable agriculture projects, including biofertilizer research. This financial support is fostering breakthroughs in formulation technologies, extending shelf life, and improving ease of application. By addressing existing limitations and fostering technological advancements, these innovations position biofertilizers as a cornerstone of future agricultural practices, unlocking immense growth potential.

Expansion into Emerging Markets within Europe

The untapped potential of emerging markets within Eastern and Southern Europe, where adoption rates of biofertilizers remain relatively low is another significant opportunity for the European biofertilizer market. According to the Czech Statistical Office, countries like the Czech Republic and Romania have experienced a 12% annual increase in organic farmland since 2018, signaling a growing appetite for sustainable agricultural inputs. However, penetration of biofertilizers in these regions is still nascent, presenting lucrative opportunities for market players.

Governments in these regions are also stepping up efforts to promote biofertilizers through subsidies and awareness campaigns. The Bulgarian Ministry of Agriculture recently launched a €5 million initiative to educate farmers about the benefits of biofertilizers, aiming to double their adoption rate by 2025. Additionally, partnerships with local cooperatives and agricultural extension services are helping bridge knowledge gaps and build trust among farmers. By targeting these underserved markets, companies can capitalize on the region’s burgeoning organic farming sector while contributing to the broader goal of sustainable agriculture across Europe.

MARKET CHALLENGES

Inconsistent Regulatory Frameworks Across Countries

The inconsistency in regulatory frameworks governing the approval and distribution of these products across member states is a major challenge to the European market. According to the European Commission’s Directorate-General for Health and Food Safety, each country maintains its own set of guidelines for registering biofertilizers, leading to fragmented market access. For instance, while Germany mandates rigorous testing for microbial viability and efficacy, countries like Greece have more lenient requirements, creating disparities in product quality. This lack of harmonization complicates cross-border trade and increases compliance costs for manufacturers.

A report by the Dutch Ministry of Agriculture highlights that navigating these regulatory hurdles adds an average of 18 months to the product launch timeline, deterring smaller players from entering the market. Furthermore, discrepancies in labeling and safety standards often result in consumer confusion, undermining trust in biofertilizers. Efforts to establish a unified regulatory framework, such as the EU Fertilizing Products Regulation, are underway but face resistance from national authorities reluctant to cede control. Until these inconsistencies are addressed, the market will continue to grapple with inefficiencies and reduced competitiveness.

Lack of Standardized Testing Protocols

The absence of standardized testing protocols to evaluate the efficacy and safety of biofertilizers is also challenging the growth of the European biofertilizer market. According to the European Committee for Standardization, the lack of universally accepted benchmarks makes it difficult to compare products or ensure consistent performance. For example, a study by the Italian National Research Council found that efficacy claims for phosphate-solubilizing bacteria varied by as much as 30% across different laboratories, raising questions about reliability.

This issue is exacerbated by the complexity of microbial interactions in diverse soil environments, which complicates the development of standardized tests. The UK Department for Environment, Food & Rural Affairs notes that inconsistent results in field trials have led to disputes between manufacturers and farmers, further eroding confidence in biofertilizers. Moreover, the absence of clear guidelines for post-market surveillance hampers efforts to monitor long-term impacts on soil health and crop productivity. Addressing these gaps requires collaboration between regulatory bodies, research institutions, and industry stakeholders to establish robust testing frameworks that can foster transparency and accountability in the market.

SEGMENT ANALYSIS

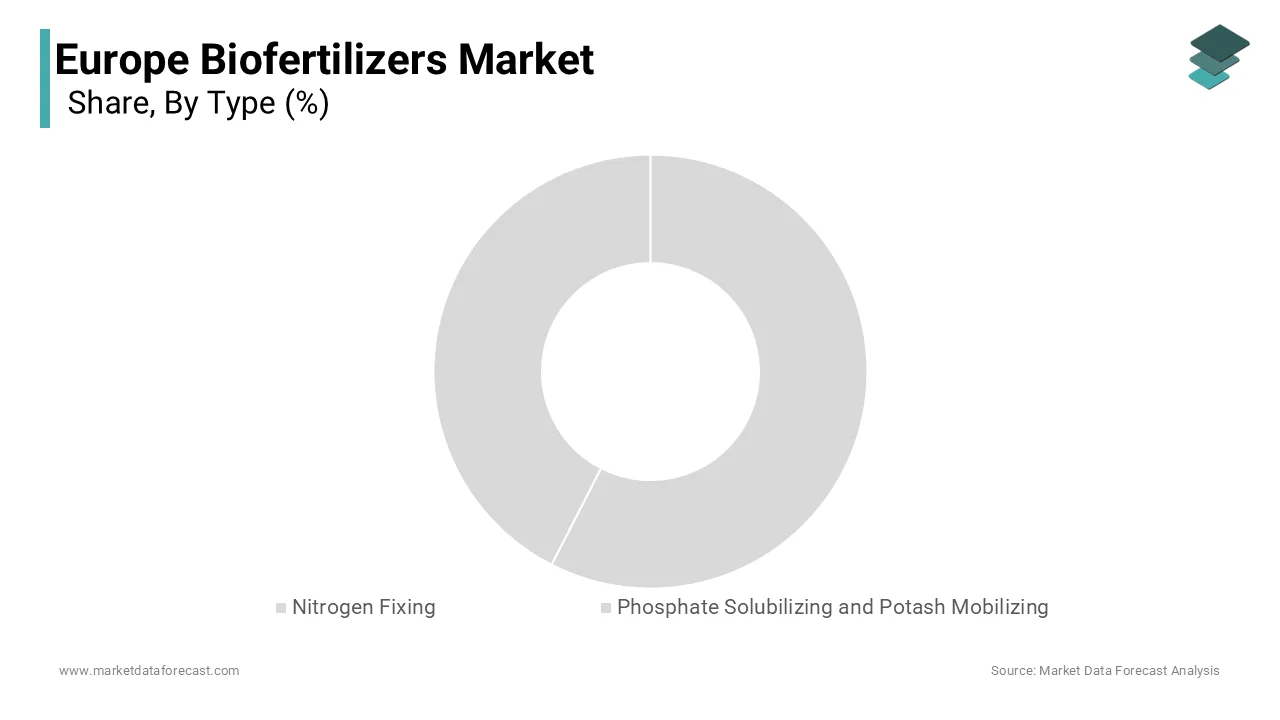

Europe Biofertilizers Market By Type

The nitrogen-fixing biofertilizers segment dominated the European market by holding a 56.8% of the European market share in 2024. The critical role that nitrogen-fixing biofertilizers play in addressing nitrogen deficiencies is majorly driving he segmental expansion in the European market. Their ability to reduce synthetic nitrogen fertilizer use by up to 30%, per the Food and Agriculture Organization, makes them indispensable for sustainable agriculture. With rising demand for organic farming and stringent EU regulations on chemical fertilizers, nitrogen-fixing biofertilizers are pivotal in enhancing soil fertility while minimizing environmental harm, solidifying their dominance.

The potassium solubilizing segment is growing rapidly and is estimated to expand at a CAGR of 14.5% over the forecast period due to the increasing potassium deficiencies in 30% of European soils, as stated by the European Commission’s Joint Research Centre. Their ability to improve drought resilience and disease resistance by 25%, according to the Food and Agriculture Organization, makes them vital for climate-resilient agriculture. Rising adoption in Eastern Europe, with a 10% annual increase reported by Eurostat, underscores their importance in addressing regional soil challenges and supporting sustainable farming practices.

Europe Biofertilizers Market By Crop Type

The cereals and grains held the leading share of the European market in 2024. The growth of the cereals and grains segment is majorly driven by the extensive cultivation of wheat, barley, and maize, which occupy over 50% of arable land in the EU, according to the European Environment Agency. Nitrogen-fixing biofertilizers are particularly crucial for this segment, reducing synthetic fertilizer dependency by up to 30%, per the Food and Agriculture Organization. With cereals being staple crops, their integration with biofertilizers supports the EU’s sustainability goals under the Farm to Fork Strategy. The segment's importance lies in its ability to balance high productivity with environmental protection, ensuring food security while minimizing ecological impact.

The fruits and vegetables segment is anticipated to grow at the fastest CAGR of 14.2% over the forecast period owing to the rising demand from consumers for organic produce, with Eurostat reporting a 15% annual increase in biofertilizer adoption for this segment since 2020. Potassium solubilizing and micronutrient-based biofertilizers enhance crop quality and resilience, addressing nutrient deficiencies in 20% of soils, according to the Food and Agriculture Organization. As urbanization drives demand for premium, pesticide-free produce, biofertilizers play a critical role in meeting these expectations while promoting sustainable farming practices, making this segment pivotal for future agricultural innovation.

Europe Biofertilizers Market By Mode of Application

The soil treatment held 60.6% of the European market share in 2024. The domination of soil treatment segment is majorly driven by its broad applicability across crops like cereals, fruits, and vegetables, addressing nutrient deficiencies in over 70% of EU farmland, according to the European Environment Agency. Nitrogen-fixing and phosphate solubilizing biofertilizers applied to soil enhance nutrient availability by up to 40%, per the Food and Agriculture Organization. This method aligns with the EU Green Deal’s sustainability goals, reducing chemical fertilizer dependency while improving soil health. Its importance lies in its ability to deliver large-scale, cost-effective solutions, ensuring both productivity and environmental preservation.

The seed treatment segment is projected to progress at a CAGR of 13.8% over the forecast period owing to its precision in delivering nutrients directly to seeds, improving germination rates by up to 25%, according to the Food and Agriculture Organization. Eurostat reports a 12% annual increase in adoption, fueled by innovations in microbial formulations and rising demand for efficient farming practices. Seed treatment minimizes input wastage and environmental impact, making it ideal for cereals and pulses. Its ability to optimize early crop development underscores its importance in sustainable agriculture and resource efficiency.

REGIONAL ANALYSIS

Germany led the biofertilizer market in Europe 2024 by accounting 24.7% of the European market share. The robust organic farming sector of Germany that spans over 2.2 million hectares is one of the major factors driving the domination of Germany in the European market. According to the Research Institute of Organic Agriculture (FiBL), German farmers spend approximately €500 million annually on biofertilizers, reflecting their commitment to sustainable practices. The prominence of Germany is further reinforced by its strong regulatory framework and investment in biotechnological research. A report by the Fraunhofer Institute highlights that German universities and research centers receive €150 million annually for biofertilizer innovation. Additionally, the country’s strategic location facilitates distribution across Europe, enhancing its market dominance.

France is another major regional segment for biofertilizers in Europe. The diverse agricultural landscape of France that spans through cereals, fruits, and vegetables that creates a fertile ground for biofertilizer adoption in France. According to Eurostat, France’s organic farmland grew by 10% in 2021, driving demand for natural inputs. Government initiatives, such as the Ecophyto Plan, have allocated €1.1 billion to reduce chemical fertilizer use, further propelling biofertilizer adoption. A study by INRAE reveals that French farmers using biofertilizers reported a 15% increase in crop yields, underscoring their economic benefits. The advanced agricultural infrastructure and strong export capabilities of France are further boosting the biofertilizers market expansion in France.

Italy is anticipated to account for a substantial share of the European biofertilizers market over the forecast period owing to its focus on high-value crops like tomatoes, olives, and grapes. According to Coldiretti, Italy’s largest farmers’ association, biofertilizers are used on over 30% of organic farms, ensuring premium quality produce. The country’s Mediterranean climate and rich biodiversity make it ideal for biofertilizer applications. A report by the University of Bologna highlights that Italian vineyards treated with biofertilizers achieved a 20% improvement in grape quality. Additionally, Italy’s participation in EU-funded sustainability projects has accelerated market growth, reinforcing its leadership position.

Spain is predicted to play a prominent role in the European market during the forecast period due to its extensive cultivation of cash crops like olives and almonds. According to the Spanish Federation of Organic Agriculture, biofertilizer usage has grown by 25% over the past five years, supported by favorable climatic conditions. Spain’s leadership is bolstered by its focus on water-efficient farming practices, where biofertilizers play a critical role. A study by the University of Seville demonstrates that biofertilizers reduce irrigation needs by 10%, addressing water scarcity challenges. Furthermore, Spain’s strategic investments in precision agriculture enhance biofertilizer adoption, solidifying its market standing.

The Netherlands estimated to exhibit a healthy CAGR over the forecast period in the European market due to its expertise in greenhouse farming and floriculture. According to Wageningen University, Dutch farms utilizing biofertilizers achieved a 30% reduction in chemical inputs, aligning with sustainability goals. The country’s leadership is supported by its advanced logistics network, enabling efficient distribution across Europe. A report by the Netherlands Enterprise Agency highlights that biofertilizer exports grew by 18% in 2022, underscoring its global influence. Additionally, the Netherlands’ focus on circular agriculture ensures continued market growth. The integration of biofertilizers into precision farming systems further amplifies their appeal, particularly in regions with intensive horticultural activities. By fostering innovation and scalability, the Netherlands solidifies its position as a key player in the European biofertilizer market.

KEY MARKET PLAYERS

The value chain includes producers in the Biofertilizers market and they are Lallemand Inc., Camson Bio Technologies Limited, Rizobacter Argentina S.A., Novozymes A/S, Camson Bio Technologies Limited and Nutramax Laboratories Inc., Symborg S.L., Mapleton Agri Biotech Private Ltd and AgriLife.

MARKET SEGMENTATION

This research report on the European biofertilizers market is Segmented and sub-segmented into the following categories.

By Type

-

Nitrogen Fixing

-

Phosphate Solubilizing and Potash Mobilizing

By Crop Type

-

Cereals & Grains

-

Pulses & Oilseeds

-

Fruits & Vegetables

By Microorganism

-

Azotobacter

-

Azospirillium

-

Rhizobium

-

Phosphate Solubilizing Bacteria and Cyanobacteria

Mode of Application

-

Soil treatment

-

Seed treatment

By Form

-

Pure & Mixed Liquid Fermentations

-

Dispersible Granules and Pellets

By Country

-

UK

-

Russia

-

Germany

-

Italy

-

France

-

Spain

-

Sweden

-

Denmark

-

Poland

-

Switzerland

-

Netherlands

-

Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe biofertilizers market?

The current market size of Europe's biofertilizers market was valued at USD 0.56 Billion in 2025.

What are the market drivers that are driving the Europe biofertilizers market?

The growing demand for organic food products and the regulatory push under the European Green Deal are the market players that are driving the europe biofertilizers market.

Who are the market players that are dominating the Europe biofertilizers market?

Lallemand Inc., Camson Bio Technologies Limited, Rizobacter Argentina S.A., Novozymes A/S, Camson Bio Technologies Limited and Nutramax Laboratories Inc., Symborg S.L., Mapleton Agri Biotech Private Ltd and AgriLife.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]