Europe Biodegradable Polymers Market Size, Share, Trends & Growth Forecast Report By Type (PLA, Starch, PBS, PHA, and Others), Substrate, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Biodegradable Polymers Market Size

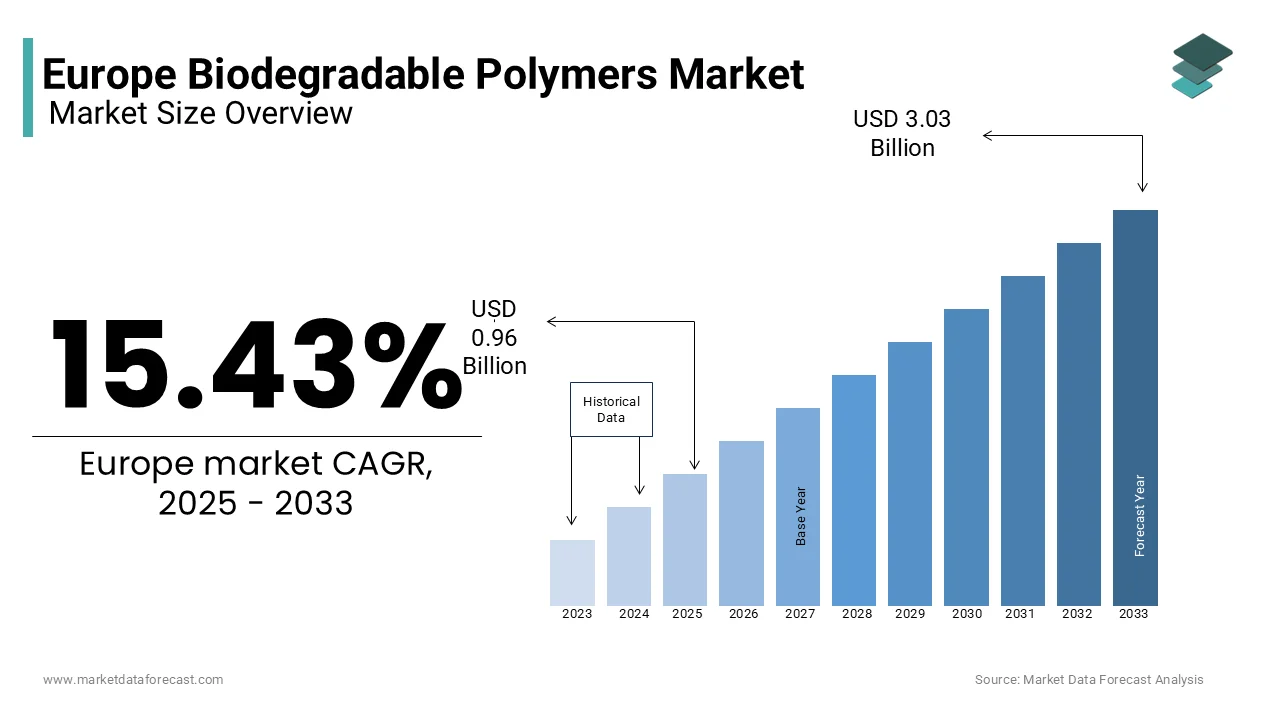

The Europe biodegradable polymers market size was valued at USD 0.83 billion in 2024. The European market is estimated to be worth USD 3.03 billion by 2033 from USD 0.96 billion in 2025, growing at a CAGR of 15.43% from 2025 to 2033.

Biodegradable polymers, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based blends that are designed to decompose naturally in composting environments, offering a sustainable alternative to conventional plastics. As per the European Bioplastics Association, over 70% of biodegradable polymers are utilized in packaging, agriculture, and consumer goods, underscoring their critical role in reducing environmental impact. Additionally, advancements in polymer chemistry have improved material performance, reducing production costs by 15%, as highlighted by the German Federal Ministry for the Environment. With increasing emphasis on circular economy practices, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern industries.

MARKET DRIVERS

Stringent Regulations on Single-Use Plastics in Europe

The implementation of stringent regulations targeting single-use plastics that have catalyzed the adoption of sustainable alternatives is one of the key factors driving the growth of the European biodegradable polymers market. According to the European Commission, the Single-Use Plastics Directive, enforced in 2021, mandates member states to reduce plastic waste by 25% by 2025, driving demand for biodegradable solutions. This trend is particularly evident in France, where the government has banned non-biodegradable plastic bags and cutlery, as reported by the French Ministry of Ecology. For instance, a study by the Italian National Institute for Environmental Research highlights that biodegradable polymer sales surged by 30% in 2022, driven by compliance requirements and consumer awareness campaigns. Additionally, the growing emphasis on extended producer responsibility (EPR) schemes has further amplified demand, with companies investing in eco-friendly packaging. By ensuring regulatory compliance and enhancing brand reputation, biodegradable polymers have become indispensable for modern industries, driving market growth across the continent.

Rising Consumer Awareness and Demand for Sustainable Products

The growing awareness from consumers and demand for sustainable products that aligns with the growing emphasis on environmental responsibility is further fuelling the growth of the European biodegradable polymers market. According to the European Consumer Organisation, over 60% of consumers actively seek out products made from biodegradable materials, driven by campaigns promoting eco-conscious lifestyles. This trend is particularly pronounced in urban areas, where awareness of climate change and plastic pollution is high. According to a report by the UK Department for Environment, Food & Rural Affairs, biodegradable packaging accounted for 40% of new product launches in 2022 due to the consumer willingness to pay a premium for sustainable options. Additionally, partnerships between retailers and biopolymer manufacturers have reduced production costs by 20%, making these products more accessible. For example, the Swedish Environmental Protection Agency notes that 50% of surveyed consumers expressed a preference for biodegradable alternatives, citing reduced environmental impact as a key motivator. By addressing ecological concerns and fostering community connections, biodegradable polymers are unlocking immense growth potential.

MARKET RESTRAINTS

High Production Costs Compared to Conventional Plastics

The high production cost associated with these materials is one of the key factors hindering the growth of the European biodegradable polymers market. According to the German Federal Ministry for Economic Affairs, the average cost of producing biodegradable polymers exceeds €3 per kilogram, compared to €1 for conventional plastics, creating financial barriers for small-scale producers. This issue is particularly pronounced in Eastern Europe, where over 60% of manufacturers lack access to advanced production technologies, as reported by the Czech Ministry of Industry and Trade. A study by the Italian National Institute of Statistics reveals that only 35% of surveyed companies in rural areas have transitioned to biodegradable materials, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of biodegradable polymers. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Limited Composting Infrastructure for Degradation

Limited availability of robust composting infrastructure required for the effective degradation of biodegradable polymers that undermines efforts to create a circular economy is another major factor restraining the growth of the European market. According to the European Environment Agency, less than 10% of biodegradable waste in Europe is currently processed in industrial composting facilities, primarily due to inconsistent waste management practices. This issue is compounded by the absence of standardized composting protocols, as highlighted by the French National Institute for Environmental Research, which notes that improper disposal often results in material losses of up to 40%. Furthermore, a report by the Swedish Waste Management Association underscores that inadequate investments in composting technologies have left many facilities ill-equipped to handle biodegradable polymers. For instance, the UK Department for Environment, Food & Rural Affairs estimates that only 25% of composting plants are capable of processing PLA efficiently. Without scaling up composting capabilities, the market risks exacerbating environmental concerns and missing opportunities to recover valuable resources.

MARKET OPPORTUNITIES

Expansion into Agricultural Applications

The growing adoption in agricultural applications, such as mulch films and crop protection materials that offer sustainable alternatives to traditional plastics is a major opportunity for the European biodegradable polymers market. According to the European Federation of Bioplastics, biodegradable mulch films accounted for 20% of total agricultural film usage in 2022, driven by their ability to degrade naturally without soil contamination. This trend is particularly evident in Spain and Italy, where organic farming practices have increased the adoption of biodegradable solutions by 25%, as noted by the Spanish Ministry of Agriculture. For instance, a study by the Dutch Ministry of Agriculture highlights that biodegradable mulch films achieved a 30% reduction in labor costs for farmers, as they eliminate the need for manual removal and disposal. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for sustainable agriculture projects, including biodegradable materials, as noted by the European Commission. By fostering breakthroughs in agricultural applications, the market is poised to unlock immense growth potential.

Increasing Focus on Biomedical and Pharmaceutical Uses

The growing focus on biomedical and pharmaceutical applications that leverage the unique properties of biodegradable polymers for drug delivery systems and medical implants is another significant opportunity for the European market. According to the European Medicines Agency, over 60% of new drug delivery systems developed in 2022 utilized biodegradable polymers, driven by their biocompatibility and controlled degradation rates. A study by the German Federal Institute for Materials Research highlights that the adoption of PHA-based implants grew by 18% in recent years, driven by advancements in tissue engineering. This trend is further bolstered by government incentives for sustainable healthcare solutions, as noted by the French National Institute for Health and Medical Research. Additionally, advancements in polymer synthesis techniques enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for innovative healthcare solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Shortages

The ongoing supply chain disruptions and raw material shortages is a major challenge to the European biodegradable polymers market. According to the European Bioplastics Association, global shortages of key raw materials, such as corn starch and sugarcane, led to a 15% decline in biodegradable polymer production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry for Economic Affairs. As per a study by the Italian National Institute of Statistics, 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as bio-based feedstocks, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Awareness Among Small-Scale Manufacturers

Limited awareness among small-scale manufacturers regarding the benefits and proper usage of biodegradable polymers is another significant challenge to the European market. According to the Swedish Board of Agriculture, over 50% of small-scale packaging and agricultural businesses lack technical knowledge about material selection and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that manufacturers aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce the lifespan of biodegradable polymers by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.43% |

|

Segments Covered |

By Type, Substrate, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Biotech (Germany), NatureWorks LLC (US), BASF SE (Germany), Total Corbion PLA (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Novamont S.P.A. (Italy), Biome Bioplastics (UK), Toray Industries (Japan), Bio-On (Italy), and Plantic Technologies (Australia), and others. |

SEGMENTAL ANALYSIS

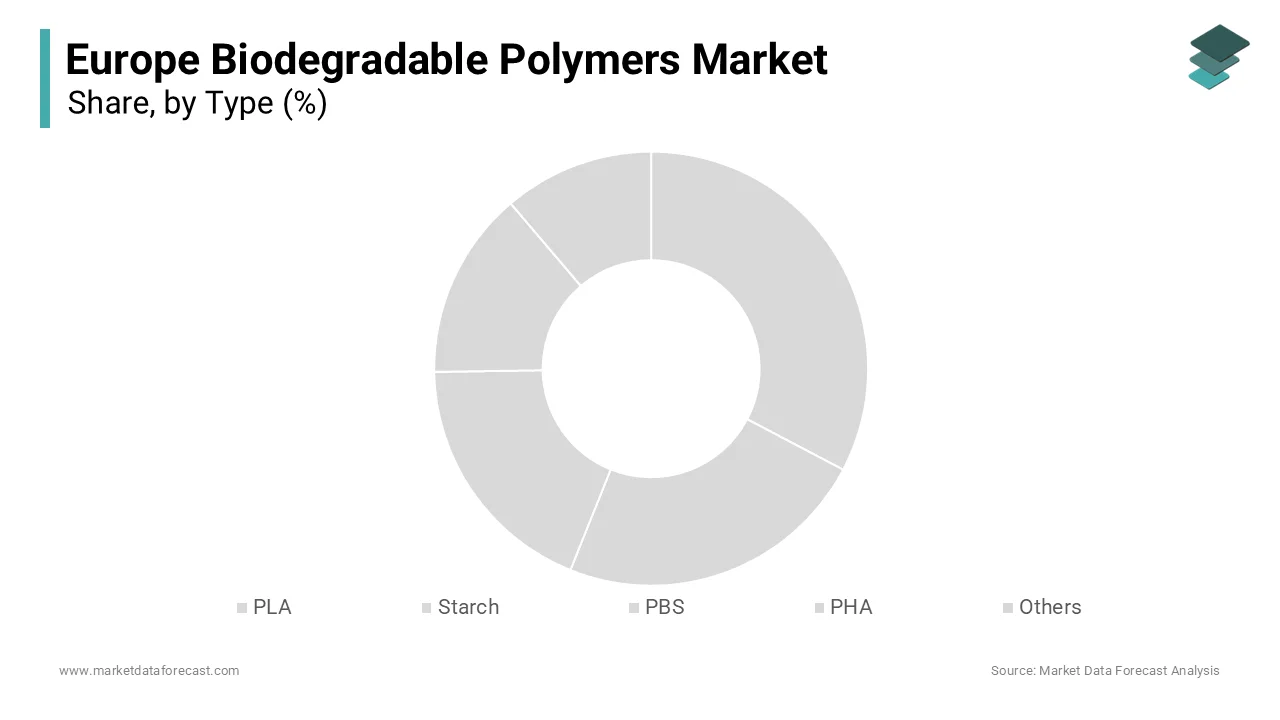

By Type Insights

The PLA segment had 40.7% of the Europe biodegradable polymers market share in 2024. The dominating position of PLA segment in the European market is driven by its versatility and widespread adoption across industries such as packaging, textiles, and agriculture. According to the European Bioplastics Association, PLA production capacity in Europe has surged by 25% annually, reaching over 300,000 metric tons in 2022. Derived from renewable resources like corn starch and sugarcane, PLA offers a carbon footprint reduction of up to 70% compared to traditional plastics, according to a study published in Environmental Science & Technology. Additionally, PLA’s compatibility with existing manufacturing processes, such as injection molding and 3D printing makes it a cost-effective alternative for rigid packaging applications. With the EU Single-Use Plastics Directive banning non-biodegradable plastics by 2025, demand for PLA-based solutions has skyrocketed. For instance, Coca-Cola’s PlantBottle initiative uses PLA to create sustainable beverage containers, reducing plastic waste by an estimated 20%. This regulatory push, combined with growing consumer awareness, ensures PLA remains at the forefront of the biodegradable polymer revolution.

The PHA segment is the fastest-growing segment in the Europe biodegradable polymers market and is predicted to witness the highest CAGR of 13.4% over the forecast period. The growth of the PHA segment in the European market is fueled by PHA’s unique ability to degrade in marine environments, addressing the growing issue of oceanic plastic pollution. A report by the Ellen MacArthur Foundation states that over 8 million tons of plastic enter oceans annually, creating a dire need for marine-safe alternatives. PHA’s natural origin isproduced through bacterial fermentation of sugars or lipids—ensures complete biodegradability within weeks, as confirmed by studies in the Journal of Applied Polymer Science. Moreover, PHA’s application in medical devices, such as sutures and implants, is gaining traction due to its biocompatibility and non-toxicity. The healthcare sector’s shift toward eco-friendly materials further amplifies demand; Frost & Sullivan estimates that biodegradable medical polymers will grow by 15% annually. As Europe intensifies efforts to combat plastic pollution under initiatives like the EU Green Deal, PHA emerges as a transformative solution with immense growth potential.

By Substrate Insights

The paper & paperboard segment was the largest substrate segment in the Europe biodegradable polymers market and held 61.7% of the European market share in 2024. The dominating position of paper & paperboard segment is attributed to their widespread use in food packaging, retail bags, and industrial applications. According to the Confederation of European Paper Industries (CEPI), Europe produces over 90 million tons of paper annually, with biodegradable coatings enhancing its sustainability profile. For instance, biodegradable polymers like PLA are increasingly used to coat paper cups and food containers, replacing traditional petroleum-based plastics. As per a study by the European Environment Agency, coated paper products reduce landfill contributions by 30%, aligning with the EU’s circular economy goals. Furthermore, the rise of e-commerce has spurred demand for biodegradable packaging solutions; McKinsey estimates that online retail packaging will grow by 20% annually through 2025. With governments imposing stricter regulations on single-use plastics, paper & paperboard substrates fortified with biodegradable polymers are becoming indispensable in achieving sustainability targets.

The cellulose films segment is experiencing explosive growth and is likely to register a CAGR of 9.5% over the forecast period due to their superior transparency, breathability, and compostability, making them ideal for flexible packaging applications. A report by Smithers Pira states that cellulose films are increasingly replacing polyethylene in snack packaging and fresh produce wraps, with demand expected to reach 500,000 tons by 2025. Their ability to decompose within 90 days in industrial composting facilities, which is verified by the TÜV Austria certification and this positions them as a key player in reducing plastic waste. Additionally, cellulose films are gaining traction in the pharmaceutical industry for blister packaging, offering moisture resistance while maintaining biodegradability. The European Pharmaceutical Market Research Association notes that sustainable packaging solutions are now a priority for 70% of pharmaceutical companies. As consumer preferences shift toward eco-friendly options and regulatory frameworks tighten, cellulose films emerge as a pivotal innovation driving the transition to sustainable packaging.

By Application Insights

The rigid packaging segment captured 44.7% of the Europe biodegradable polymers market share in 2024. The prominent position of rigid plastics segment in the European market is attributed to its extensive use in bottles, containers, and trays, particularly in the food and beverage sector. The European Food Safety Authority (EFSA) emphasizes that biodegradable rigid packaging reduces contamination risks during recycling, as it can be composted alongside organic waste. For example, Danone’s PLA-based yogurt pots have reduced plastic usage by 25%, while maintaining durability and shelf life. A study by the European Commission reveals that rigid packaging accounts for 60% of all plastic waste, underscoring the urgency of adopting biodegradable alternatives. Additionally, the EU Packaging and Packaging Waste Directive mandates a 55% recycling rate by 2030, pushing manufacturers to adopt sustainable materials. With the foodservice industry’s rapid recovery post-pandemic, the rigid packaging remains a cornerstone of the biodegradable polymer market in Europe.

The flexible packaging segment is the fastest-growing application segment and is predicted to witness a CAGR of 11.4% over the forecast period owing to its lightweight nature and adaptability to diverse formats, such as pouches, wraps, and sachets. According to a report by the Flexible Packaging Association, flexible packaging reduces material usage by up to 50% compared to rigid alternatives, making it a preferred choice for eco-conscious brands. The rise of convenience foods and single-serve portions is expected to grow by 15% annually, per NielsenIQ, which is further fuelling the demand for flexible packaging. Additionally, innovations in biodegradable barrier films are capable of extending shelf life while remaining compostable that are transforming the industry. For instance, Nestlé’s collaboration with BASF introduced fully biodegradable coffee capsules, addressing consumer concerns about plastic waste. With the EU targeting a 50% reduction in plastic packaging by 2030, flexible packaging fortified with biodegradable polymers emerges as a critical enabler of sustainable consumption patterns.

REGIONAL ANALYSIS

Italy has positioned itself as a frontrunner in the European biodegradable polymers market. The growth of the Italian market in Europe is largely attributed to Italy's robust food industry, which drives the demand for flexible packaging solutions. Products like biscuits, snacks, noodles, and pasta require sustainable packaging, leading to increased adoption of biodegradable polymers. Furthermore, Italy's proactive stance on environmental policies has fostered a favorable environment for the development and use of biodegradable materials, reinforcing its leadership in this market.

Germany plays a pivotal role in the European biodegradable polymers landscape. As one of the first nations to offer DIN CERTCO certification for biodegradable polymers, Germany has set high standards for product quality and environmental compliance. This certification has bolstered consumer confidence and encouraged widespread adoption of biodegradable products across various sectors, including packaging, agriculture, and consumer goods. Germany's strong industrial infrastructure and commitment to research and development have further solidified its position as a leader in this market.

France has emerged as a significant player in the biodegradable polymers market, with projections indicating a substantial growth trajectory. This growth is driven by stringent government regulations aimed at reducing plastic waste and a strong emphasis on environmental sustainability. France's proactive policies have spurred innovation and investment in biodegradable technologies, making it a key contributor to the European market.

The United Kingdom has been at the forefront of adopting biodegradable polymers, reflecting a strong commitment to environmental sustainability. The UK's proactive approach to reducing plastic waste has led to increased demand for biodegradable alternatives across various industries, including packaging and agriculture. This shift aligns with global trends towards sustainable materials and positions the UK as a significant player in the European biodegradable polymers market.

Spain has shown notable progress in the biodegradable polymers sector, driven by a combination of environmental policies and consumer awareness. The country's market is projected to grow steadily, reflecting a commitment to sustainable practices. Spain's focus on reducing plastic waste and promoting eco-friendly alternatives has led to increased adoption of biodegradable polymers in packaging, agriculture, and other industries. This trend underscores Spain's role in advancing the European biodegradable polymers market.

KEY MARKET PLAYERS

The major key players in Europe Biodegradable Polymers market are Biotech (Germany), NatureWorks LLC (US), BASF SE (Germany), Total Corbion PLA (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Novamont S.P.A. (Italy), Biome Bioplastics (UK), Toray Industries (Japan), Bio-On (Italy), and Plantic Technologies (Australia), and others.

MARKET SEGMENTATION

This research report on the Europe biodegradable polymers market is segmented and sub-segmented into the following categories.

By Type

- PLA

- Starch

- PBS

- PHA

- Others

By Substrate

- Paper & Paperboard

- Cellulose Films

- Others

By Application

- Rigid Packaging

- Flexible Packaging

- Liquid Packaging

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected size of the Europe biodegradable polymers market by 2033?

The European market is estimated to be worth USD 3.03 billion by 2033.

2. What factors are likely driving the growth of the biodegradable polymers market in Europe?

The growth is likely driven by increasing consumer preference for eco-friendly products, stringent environmental regulations, and the expanding use of biodegradable materials in packaging and other industries.

3. Which countries are key players in the European biodegradable polymers market?

Countries like Germany, Italy, and the UK are significant players due to their strong focus on sustainability and environmental policies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]