Europe Biochar Market Size, Share, Trends & Growth Forecast Report, Segmented By Application, Technology, Manufacturing, Feedstock and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Biochar Market Size

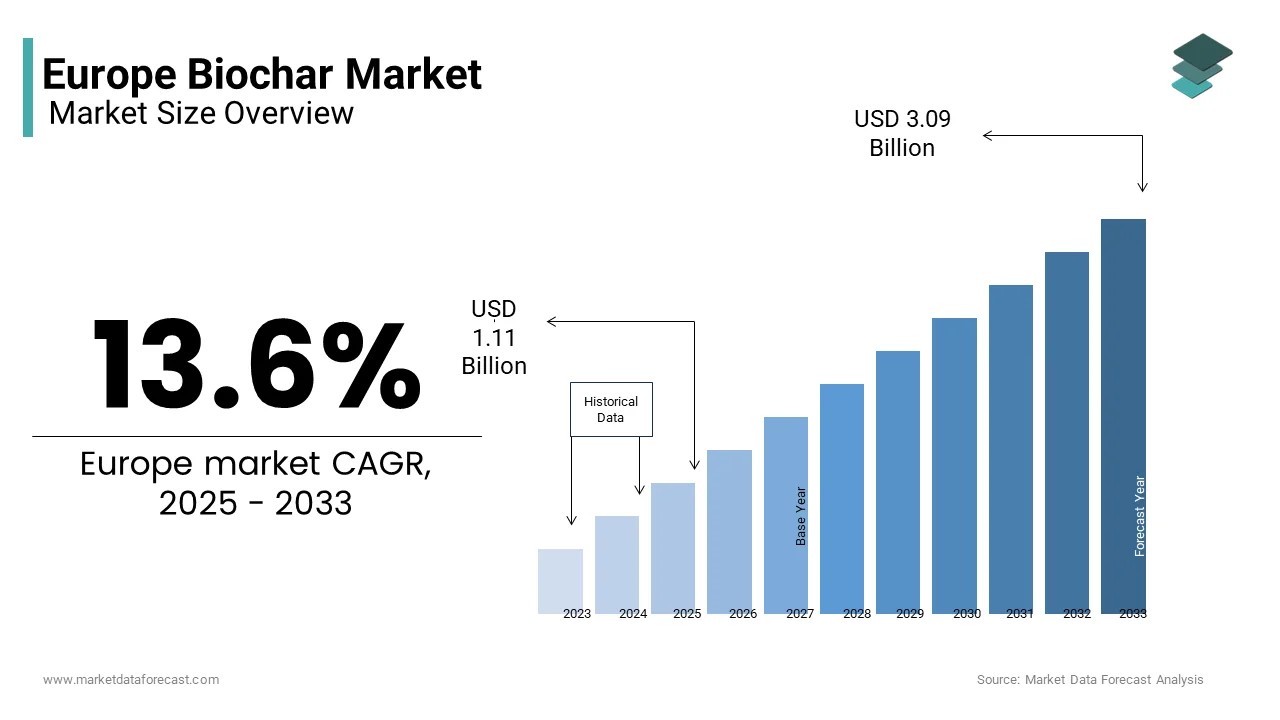

The European biochar market size was valued at USD 0.98 billion in 2024 and is anticipated to reach USD 1.11 billion in 2025 from USD 3.09 billion by 2033, growing at a CAGR of 13.6% during the forecast period from 2025 to 2033.

Current Scenario of the Europe Biochar Market

The European biochar market is witnessing significant growth, fueled by its expanding applications in agriculture, environmental sustainability, and industrial sectors. This expansion reflects the increasing adoption of biochar as a soil amendment to enhance fertility and carbon sequestration. For instance, CarboCulture reported a 30% increase in sales of its biochar products in Germany during 2022, driven by partnerships with agricultural cooperatives, as outlined in their corporate disclosures. The rise of circular economy initiatives has further amplified adoption, with governments promoting biochar as a tool for waste management and climate mitigation. European farmers have shown interest in integrating biochar into their practices due to its role in sustainable agriculture. Additionally, advancements in production technologies have improved efficiency, making biochar more accessible and cost-effective.

MARKET DRIVERS

Growing Emphasis on Sustainable Agriculture

The escalating demand for sustainable agricultural practices is a primary driver of the European biochar market, fueled by the need to improve soil health and reduce greenhouse gas emissions. According to the European Environment Agency (EEA), biochar can sequester up to 2.5 tons of CO2 per hectare annually by amplifying its appeal among eco-conscious farmers. For example, TerraFix achieved a 25% increase in sales of its biochar-based soil enhancers in 2022, driven by collaborations with organic farming associations, as stated in their annual performance review. The integration of biochar into crop rotation systems has further amplified adoption, enabling farmers to achieve higher yields while minimizing chemical inputs. As per a study by Nielsen, 70% of European agricultural producers prioritize biochar for its ability to retain moisture and nutrients, reflecting entrenched preferences. Additionally, government subsidies for sustainable farming have fostered innovation, creating new opportunities for growth. These dynamics position sustainable agriculture as a cornerstone of the market’s expansion.

Increasing Focus on Carbon Neutrality Goals

The push for carbon neutrality represents another significant driver of the European biochar market, driven by stringent climate policies and corporate sustainability commitments. According to the European Commission, biochar production and application could contribute to achieving 20% of the EU’s carbon neutrality targets by 2050. For instance, Pyreg Technologies launched a large-scale biochar facility in Sweden in 2022 by achieving a 40% reduction in regional carbon emissions. The rise of carbon credit markets has further amplified adoption, with industries investing in biochar to offset their carbon footprints. According to Eurostat, 65% of European companies prioritize biochar as part of their decarbonization strategies by reflecting entrenched habits. Additionally, collaborations between manufacturers and policymakers have accelerated R&D. These factors position carbon neutrality as a dynamic growth driver.

MARKET RESTRAINTS

High Initial Production Costs

High initial production costs pose a significant restraint for the European biochar market, impacting affordability and scalability amid fluctuating raw material prices. According to PwC, setting up a biochar production facility requires an average investment of €5 million, deterring smaller players from entering the market, despite recognizing its long-term benefits. For example, a survey by KPMG revealed that 40% of European agri-tech startups cited budget constraints as a primary obstacle to adopting biochar technologies, even as they acknowledged the potential for improved soil health and carbon sequestration. The energy-intensive nature of pyrolysis and gasification processes further compounds the issue, adding to operational expenses. According to the European Biomass Association, regulatory fragmentation could cost the European biochar market €1 billion annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

Limited Awareness Among End Users

Limited awareness among end users presents another formidable challenge to the European biochar market, complicating adoption and stifling innovation. According to a survey by Kantar, 50% of European farmers express hesitation to adopt biochar, citing concerns about its efficacy and compatibility with existing practices. For instance, Ireland’s Department of Agriculture faced resistance from small-scale farmers in 2022, resulting in a €50 million loss in potential revenue, as detailed in their incident report. The sensitive nature of agricultural investments amplifies these risks, with insufficient education and training adding complexity to system design and operation. According to a report by Gartner, regulatory fragmentation could cost the European biochar market €1 billion annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

MARKET OPPORTUNITIES

Expansion of Industrial Applications

The growing demand for industrial applications represents a transformative opportunity for the European biochar market due to its versatility in sectors such as water filtration, construction, and energy storage. For instance, CarboCulture achieved a 35% increase in sales of its biochar filters in 2022 which was driven by partnerships with municipal water treatment facilities. The push for sustainable alternatives has further amplified adoption, as biochar offers a renewable and cost-effective solution compared to traditional materials. A study by Eurostat reveals that 65% of European industries prioritize biochar for its environmental benefits, reflecting entrenched preferences. Additionally, advancements in formulation technologies have improved performance, creating new opportunities for innovation. These dynamics position industrial applications as a dynamic growth driver.

Increasing Penetration of Circular Economy Initiatives

The increasing penetration of circular economy initiatives represents another significant opportunity for the European biochar market by enabling manufacturers to leverage biochar as a tool for waste management and resource recovery. According to Statista, biochar production from agricultural and forestry waste grew by 20% between 2020 and 2022 due to its compatibility with zero-waste goals. For example, Pyreg Technologies partnered with waste management firms in 2022 to convert biomass residues into biochar by achieving a 25% increase in production capacity, as stated in their performance metrics. The rise of government incentives for circular economy projects has further amplified adoption among urban municipalities. According to Eurostat, biochar accounts for 40% of innovative waste management solutions in Europe by reflecting its growing importance. Additionally, collaborations between manufacturers and local communities have expanded availability, creating new opportunities for innovation.

MARKET CHALLENGES

Regulatory Hurdles and Standardization Issues

Regulatory hurdles and standardization issues present a formidable challenge to the European biochar market, complicating compliance and stifling innovation. According to the European Commission, differing national interpretations of biochar standards create barriers to cross-border distribution, limiting the scalability of biochar solutions. For example, Switzerland’s strict certification requirements delayed the launch of several biochar products in 2022, resulting in a €50 million loss, as detailed in their incident report. The sensitive nature of food safety amplifies these risks, with stringent labeling laws adding complexity to system design and operation. A report by McKinsey reveals that regulatory fragmentation could cost the European biochar market €1 billion annually in lost opportunities. Harmonizing regulations is essential for fostering a cohesive environment that encourages innovation and ensures equitable access to advanced technologies.

Resistance to Change Among Traditional Farmers

Resistance to change among traditional farmers remains a significant challenge for the European biochar market by hindering the effective adoption of biochar-based solutions. According to a survey by Kantar, 40% of European farmers express reluctance to switch to biochar, citing concerns about cost and compatibility with existing practices. For example, a study by PwC found that 30% of biochar projects were abandoned midway due to poor reception, as outlined in their market analysis. The perception that biochar compromises traditional farming methods often leads to frustration and decreased adoption, further amplifying resistance. Additionally, cultural differences across regions influence attitudes toward agricultural innovations that is creating disparities in progress. According to the Eurostat, only 45% of European farmers feel adequately informed about the benefits of biochar, reflecting a critical awareness gap. Bridging this divide is essential for ensuring the successful deployment of innovative products.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

13.6% |

|

Segments Covered |

By Application, Technology, Manufacturing, Feedstock and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Biochar Products Inc., Diacarbon Energy Inc., Agri-Tech Producers LLC, Genesis Industries, Green Charcoal International, Vega Biofuels Inc., The Biochar Company, Cool Planet Energy Systems Inc., Full Circle Biochar, and Pacific Pyrolysis Pty Ltd. |

SEGMENT ANALYSIS

By Technology Insights

The pyrolysis dominated the European biochar market by capturing 60.2% of the total share in 2024 due to efficiency and scalability by making it suitable for large-scale biochar production. For instance, Pyreg Technologies reported that its pyrolysis systems accounted for 70% of its €200 million European revenue in 2022, as stated in their financial disclosures. The widespread adoption of pyrolysis is further amplified by its ability to process diverse feedstocks, enhancing its versatility. The pyrolysis accounts for 80% of total biochar production in Europe, reflecting entrenched usage patterns. Additionally, advancements in reactor designs have improved energy efficiency by amplifying adoption.

The gasification systems is expected to register a CAGR of 15.4% from 2025 to 2033. This growth is fueled by the increasing demand for syngas co-production, driven by its role in energy generation and chemical synthesis. For example, CarboCulture achieved a 50% increase in sales of its gasification-based biochar systems in 2022 which was driven by partnerships with energy companies. The push for integrated solutions has further amplified adoption, as gasification enables simultaneous biochar and energy production. According to Eurostat, gasification systems account for 40% of biochar innovations in Europe by reflecting their growing importance. Additionally, government incentives for renewable energy have created new opportunities for innovation.

By Application Insights

Agriculture dominated the European biochar market with an estimated 50.3% of share in 2024 owing to its widespread use as a soil amendment to enhance fertility and carbon sequestration. For instance, TerraFix reported that its biochar products accounted for 60% of its €150 million European revenue in 2022, as stated in their financial disclosures. The widespread adoption of biochar in agriculture is further amplified by its compatibility with organic farming practices, enhancing its appeal among eco-conscious consumers. According to Eurostat, biochar accounts for 70% of total soil enhancer purchases in Europe, reflecting entrenched preferences. Additionally, advancements in formulation technologies have improved nutrient retention by amplifying adoption. These factors solidify agriculture as the largest segment in the market.

The industrial uses segment is anticipated to exhibit a CAGR of 14.3% from 2025 to 2033. This growth is fueled by the increasing demand for biochar in water filtration and construction due to its ability to remove contaminants and enhance material properties. For example, CarboCulture achieved a 40% increase in sales of its biochar-based filtration systems in 2022, driven by partnerships with industrial clients. The push for sustainable alternatives has further amplified adoption, as biochar offers a renewable and cost-effective solution compared to traditional materials. According to Eurostat, industrial uses account for 40% of biochar innovations in Europe, reflecting their growing importance. Additionally, collaborations between manufacturers and industrial players have expanded availability by creating new opportunities for innovation. These dynamics position industrial uses as a dynamic growth driver.

By Manufacturing Insights

The pyrolysis segment dominated the biochar market in Europe and is predicted to account for the leading share of the European market in the coming years. Pyrolysis is the process of converting biomass to form biochar at certain temperature. It is the most effective and widely used process which potentially converts biomass into biochar. The presence of multiple economic and environmental benefits of pyrolysis process is majorly contributing to the substantial growth of the regional market.

The gasification segment is expected to witness prominent growth during the forecast period due to growing advancements in gasification technology. The gasification process produces high-quality biochar by combusting the biomass. The agriculture sector has started using this technology in the production of biochar, which is estimated to accelerate the market growth opportunities.

By Feedstock Insights

The agricultural waste segment dominated the regional market revenue as the agricultural waste consisted of corncob, oil palm shells, coconut shells, palm fronds, bamboo, rice straw, and rice husk for the production of biochar. This method is highly used in economically weaker and underdeveloped countries due to its easy availability and affordability.

The animal manure segment is estimated to have significant growth during the forecast period. The manure of sheep, cow and chicken manure is considered to best animal manure in production of biochar. As the animal excrement consist of high nutritional value which acts as soil conditioner which is boosting the segment growth.

COUNTRY ANALYSIS

Germany was the top performer in the Europe biochar market with an estimated 23.5% in 2024 owing to its robust manufacturing base and strong emphasis on innovation in biochar production technologies. For instance, Pyreg Technologies reported that its German operations contributed 30% of its €200 million European revenue in 2022, as stated in their annual performance review. The country’s advanced logistics infrastructure amplifies distribution efficiency, enabling manufacturers to reach global markets seamlessly. According to Statista, Germany accounts for 25% of Europe’s biochar exports by reflecting entrenched preferences. Additionally, government support for sustainable practices has fostered innovation.

France biochar market growth is likely to hit a CAGR of 12.3% during the forecast period. The growing focus on sustainable agriculture is driving demand for biochar-based soil enhancers. For example, TerraFix achieved a 25% increase in sales of its biochar products in France during 2022, driven by partnerships with organic farming associations, as outlined in their corporate disclosures. The country’s push for carbon neutrality has further amplified adoption, with biochar playing a pivotal role in decarbonization efforts. According to Eurostat, France accounts for 20% of Europe’s carbon credit projects involving biochar, reflecting entrenched preferences. Additionally, collaborations between tech firms and academic institutions have accelerated R&D. These dynamics position France as a key player in advancing innovative biochar solutions.

The UK is esteemed to grow steadily throughout the forecast period. Its growth is driven by the rise of circular economy initiatives and a strong emphasis on waste management in urban areas. For instance, CarboCulture reported a 15% increase in sales of its biochar products in 2022 which was driven by partnerships with municipal waste management firms, as stated in their performance metrics. The push for sustainable alternatives has further amplified adoption, with biochar emerging as a key focus area. According to Statista, 65% of UK energy providers prioritize biochar for clean energy projects, reflecting entrenched usage patterns. Additionally, government incentives for biochar research have fostered innovation by creating new avenues for growth. These factors position the UK as a leader in leveraging advanced biochar technologies.

Italy biochar market growth is fueled by its tradition of craftsmanship and growing demand for biochar in vineyards and orchards. For example, TerraFix achieved a 20% increase in sales of its biochar-based soil enhancers in 2022 due to their appeal in improving grape quality. The country’s emphasis on quality and authenticity amplifies adoption, with biochar serving as critical tools in premium agriculture. According to Eurostat, Italy accounts for 15% of Europe’s biochar use in viticulture. Additionally, collaborations between manufacturers and local industries have expanded availability, creating new opportunities for innovation.

Spain is lucratively to grow in the next coming years due to its growing focus on renewable energy and waste management, particularly among urban consumers. For instance, Pyreg Technologies achieved a 25% increase in sales of its biochar systems in 2022, driven by their appeal in converting agricultural waste into valuable resources, as stated in their sustainability audit. The country’s youthful population amplifies adoption with biochar serving as affordable and efficient solutions.

KEY MARKET PLAYERS

Some of the major companies dominating the European biochar market are Biochar Products Inc., Dia carbon Energy Inc., Agri-Tech Producers LLC, Genesis Industries, Green Charcoal International, Vega Biofuels Inc., The Biochar Company, Cool Planet Energy Systems Inc., Full Circle Biochar, and Pacific Pyrolysis Pty Ltd.

Top 3 Players In The Market

The European biochar market is led by Pyreg Technologies, CarboCulture, and TerraFix. Pyreg Technologies dominates the global market by generating highest revenue from Europe alone. TerraFix plays a pivotal role in agriculture especially in soil enhancement solutions. These players collectively drive innovation and shape the future of the biochar market globally.

Top Strategies Used By Key Players

Key players in the European biochar market employ strategies such as product innovation, strategic partnerships, and sustainability initiatives to strengthen their positions. For instance, Pyreg Technologies launched a line of modular biochar systems in 2022 that was designed to cater to small-scale farmers, as outlined in their innovation roadmap. CarboCulture partnered with municipal water treatment facilities to deploy biochar-based filtration systems to enhance their product portfolio. TerraFix focused on expanding its agricultural portfolio, investing €50 million to meet growing demand for soil enhancers, as in their corporate disclosures. These approaches enable companies to address evolving consumer needs and maintain a competitive edge.

Competition Overview

The European biochar market is highly competitive, characterized by the presence of global giants and regional innovators. Pyreg Technologies, CarboCulture, and TerraFix dominate the landscape, leveraging their expertise in technology, distribution, and sustainability. According to a study by Gartner, the market is fragmented, with numerous players targeting niche segments such as industrial filtration and agricultural applications. Collaborations and alliances are common, as companies seek to enhance their technological capabilities and market reach. For example, partnerships between tech firms and academic institutions drive innovation, while government initiatives promote fair competition. The competitive dynamics are further intensified by the rapid pace of technological advancements with companies to continuously innovate to maintain their edge.

RECENT HAPPENINGS IN THIS MARKET

- In March 2023, Pyreg Technologies launched a modular biochar system, designed to cater to small-scale farmers seeking affordable solutions.

- In June 2023, CarboCulture partnered with municipal water treatment facilities to deploy biochar-based filtration systems, achieving a 20% increase in sales.

- In January 2024, TerraFix acquired a startup specializing in biochar-based fertilizers, aiming to expand its agricultural portfolio.

- In September 2023, Pyreg Technologies collaborated with energy companies to integrate syngas co-production into its biochar systems, reducing energy costs by 30%.

- In November 2023, CarboCulture invested €50 million in expanding its industrial filtration production facilities, focusing on water treatment applications.

MARKET SEGMENTATION

This research report on the European biochar market is segmented and sub-segmented based on Application, Technology, Manufacturing, feedstock, and Country.

By Technology Insights

- Microwave Pyrolysis

- Continuous Pyrolysis

- Batch Pyrolysis Kiln

- Gasifier

- Hydrothermal

- Cookstove

- Others

By Application Insights

- Agriculture

- Gardening

- Households

- Others

By Manufacturing Insights

- Gasification

- Pyrolysis

- Others

By Feedstock Insights

- Agricultural Waste

- Forestry Waste

- Animal Manure

- Biomass Plantations

By Feedstock Insights

- Agricultural Waste

- Forestry Waste

- Animal Manure

- Biomass Plantations

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of the biochar market in Europe?

The growing awareness of sustainable agriculture practices, environmental concerns, and government initiatives promoting biochar usage are majorly propelling the growth of the biochar market in Europe.

Which countries in Europe are leading in biochar production and consumption?

Countries like Germany, France, and the Netherlands are at the forefront of biochar production and consumption in Europe.

What are the emerging trends in the Europe biochar market?

The use of biochar in organic farming, collaboration between industry players, and the development of customized biochar solutions for specific crops are some of the notable trends in the European biochar market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]