Europe Biocatalyst Market Size, Share, Trends & Growth Forecast Report By Source (Animal, Plants, Microorganisms), Material Type, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Biocatalyst Market Size

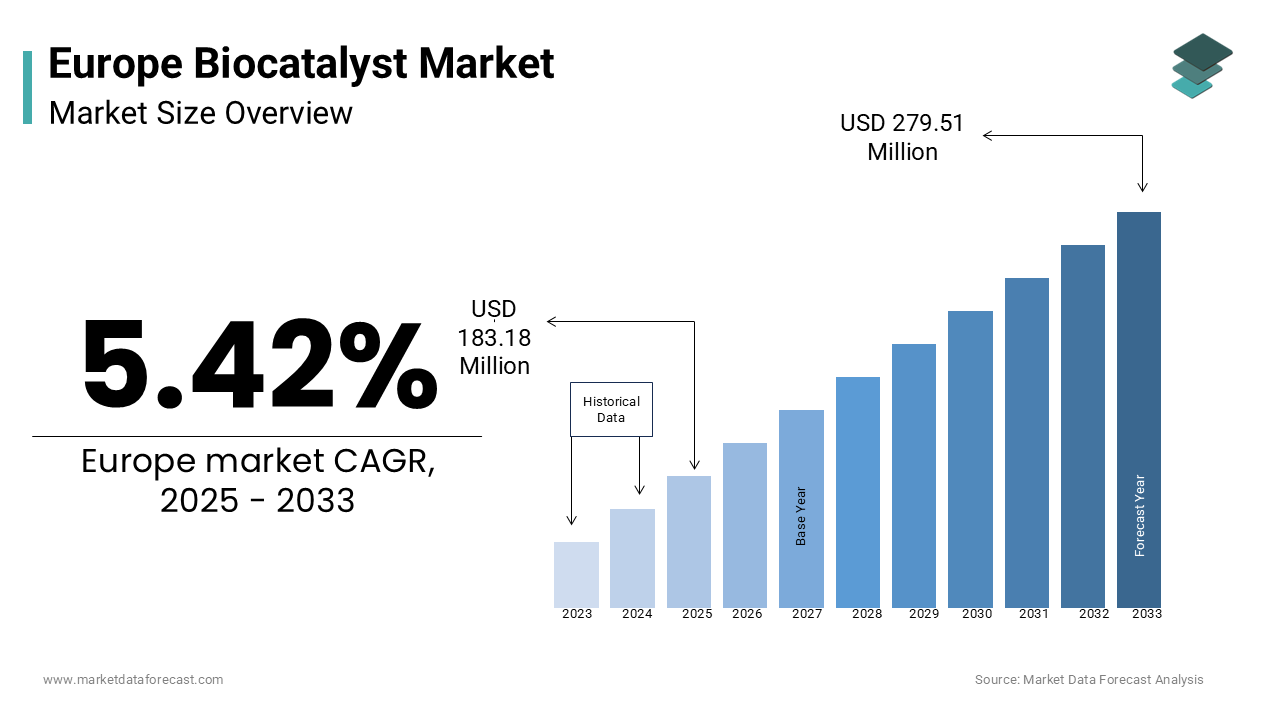

The europe biocatalyst market was worth USD 173.75 million in 2024. The European market is estimated to grow at a CAGR of 5.42% from 2025 to 2033 and be valued at USD 279.51 million by the end of 2033 from USD 183.18 million in 2025.

The Europe biocatalyst market growth is driven by increasing demand for sustainable industrial solutions, advancements in enzyme technology, and rising applications across diverse sectors such as food & beverage, biofuels, and pharmaceuticals. For instance, as per Eurostat, over 60% of European industries now prioritize biocatalysts for their eco-friendly properties, creating a robust demand for enzyme-based solutions. Additionally, government incentives promoting circular economy initiatives have accelerated adoption rates, ensuring sustained growth. However, challenges such as high production costs and regulatory complexities persist is impacting market dynamics.

MARKET DRIVERS

Rising Demand for Sustainable Industrial Solutions

A key driver of the Europe biocatalyst market is the growing emphasis on sustainability and environmental conservation. According to the European Environmental Agency, biocatalysts reduce carbon emissions by up to 40% compared to traditional chemical catalysts, making them a preferred choice for industries aiming to meet EU Green Deal targets. This trend is particularly pronounced in countries like Germany and Sweden, where over 70% of manufacturing units have adopted biocatalytic processes since 2020. For example, as per the German Federal Ministry for Economic Affairs, the use of biocatalysts in biofuel production has increased by 50% annually is reflecting their critical role in reducing reliance on fossil fuels. Partnerships between manufacturers and research institutions have amplified adoption is positioning this trend as a cornerstone of market growth.

Advancements in Enzyme Technology

Advancements in enzyme technology represent another major driver. According to the European Biotechnology Research Council, innovations in enzyme engineering have enhanced the efficiency and specificity of biocatalysts is making them suitable for complex industrial applications. This shift is particularly evident in the pharmaceutical sector, where enzymes are used for drug synthesis and bioprocessing. Additionally, cost reductions in enzyme production have driven adoption. As per a study by the French National Institute for Health, enzyme-based biocatalysts account for over 65% of total catalyst sales in the pharmaceutical industry that is driving adoption.

MARKET RESTRAINTS

High Production Costs

High production costs pose a significant restraint. According to the European Manufacturing Association, the average cost of producing specialized enzymes exceeds €500 per kilogram, making them unaffordable for small-scale industries in Eastern Europe. This financial burden is particularly pronounced in rural areas, where access to advanced biocatalyst technologies is limited. Additionally, misconceptions about long-term savings deter many consumers from adopting advanced models. A survey by the Italian Ministry of Economic Development reveals that only 30% of rural buyers consider purchasing biocatalysts with the need for targeted pricing strategies.

Regulatory Complexities

Regulatory complexities pose another restraint. According to the European Food Safety Authority, biocatalyst manufacturers must comply with strict safety and efficacy standards is increasing compliance costs by 25%, as per the French National Institute for Industrial Safety.

Smaller players face difficulties in meeting these requirements is leading to market consolidation. As per a survey by the European Biotechnology Association, nearly 20% of small-scale manufacturers have exited the market due to regulatory pressures with the need for supportive policies.

MARKET OPPORTUNITIES

Expansion into Biofuel Production

The growing demand for biofuels presents a significant opportunity for the Europe biocatalyst market. According to the European Renewable Energy Council, over 50% of biofuel producers now use biocatalysts to enhance yield and reduce production costs is creating a conducive environment for innovation. For instance, as per the German Federal Ministry for the Environment, biocatalyst usage in biofuel production increased by 40% annually since 2020. Government subsidies for renewable energy projects have further boosted adoption. The UK’s Department for Business, Energy & Industrial Strategy reported a 25% increase in biocatalyst investments following the introduction of tax incentives.

Growing Adoption in Pharmaceutical Applications

Another major opportunity lies in the demand for biocatalysts in pharmaceutical applications. According to the European Pharmaceutical Industry Association, over 60% of drug manufacturers prioritize biocatalysts for their precision and efficiency in synthesizing complex molecules. For example, as per the Spanish Ministry of Health, biocatalyst usage in pharmaceuticals increased by 35% annually since 2020, further driving adoption. Advancements in enzyme engineering and cost-effective production methods have reduced operational inefficiencies. Partnerships between manufacturers and biotech firms further amplify growth is positioning pharmaceutical applications as a transformative force in the market.

MARKET CHALLENGES

Limited Awareness Among Small-Scale Industries

Limited awareness among small-scale industries poses a challenge. According to the European Small Business Federation, over 70% of small-scale industries lack knowledge about the benefits of biocatalysts is leading to underutilization. This issue is exacerbated in underdeveloped regions, where educational resources are scarce. Additionally, concerns about installation complexity deter many industries from opting for these products. According to a study by the Polish Ministry of Industry, only 30% of small-scale industries have integrated biocatalysts into their processes.

Competition from Traditional Catalysts

Competition from traditional catalysts poses another challenge. According to the European Chemical Industry Council, chemical catalysts account for over 50% of the market due to their affordability and familiarity. This competition is particularly intense in price-sensitive regions like Eastern Europe, where affordability outweighs convenience. Additionally, innovations in chemical catalysts threaten to erode market share for biocatalysts. According to a study by the Czech Ministry of Trade, over 60% of rural industries prefer traditional catalysts for their simplicity is creating a formidable rival for enzyme-based alternatives.

SEGMENTAL ANALYSIS

By Source Insights

The micro organisms segment was accounted in holding a significant share of the Europe biocatalyst market share in 2024. The growth of the segment is driven with the versatility and ability to produce a wide range of enzymes suitable for diverse industrial applications. For instance, according to the UK Department for Business, Energy & Industrial Strategy, microorganism-derived biocatalysts account for over 70% of total sales in biofuel production. Key factors driving this segment include advancements in genetic engineering and partnerships with biotech firms. Additionally, government incentives for green technologies have increased accessibility.

The plants segment is lucratively growing with a CAGR of 9.8% during the forecast period. This growth is fueled by their renewable nature and suitability for producing plant-based enzymes, particularly in the food & beverage industry. According to the Italian Ministry of Agriculture, plant-derived biocatalyst sales have increased by 50% annually since 2020. Innovations in extraction techniques and cost-effective production methods have driven adoption. Partnerships between manufacturers and agricultural organizations further amplify growth is positioning plant-derived biocatalysts as a key driver of market expansion.

By Material Type Insights

The hydrolases segment held the dominant share of the Europe biocatalyst market in 2024. The growth of the segment is due to the use in breaking down complex molecules by making them ideal for applications in the food & beverage and cleaning agents industries. For instance, as per the German Federal Ministry for Economic Affairs, hydrolases account for over 60% of total enzyme sales in the detergent sector. Key factors driving this segment include advancements in enzyme stability and partnerships with consumer goods manufacturers. Additionally, government incentives for eco-friendly solutions have increased accessibility.

The oxidoreductases segment is gaining huge traction with a CAGR of 10.2% during the forecast period. This growth is fueled by their ability to catalyze oxidation-reduction reactions, particularly in pharmaceutical and biofuel production. According to the French National Institute for Health, oxidoreductase usage in drug synthesis has increased by 45% annually since 2020. Innovations in enzyme engineering and cost-effective production methods have driven adoption. Partnerships between biocatalyst manufacturers and pharmaceutical companies further amplify growth is positioning oxidoreductases as a transformative force in the market.

By Application Insights

The food & beverage industry segment was the largest by occupying 40.2% of the Europe biocatalyst market share in 2024 owing to the widespread use of biocatalysts in processes like cheese production, brewing, and flavor enhancement. For instance, according to the Italian Ministry of Agriculture, biocatalyst usage in dairy processing accounts for over 50% of total enzyme sales. Key factors driving this segment include advancements in enzyme specificity and partnerships with food manufacturers.

The Biofuel segment is swiftly emerging with a CAGR of 12.5% in the next coming years. This growth is fueled by the increasing demand for renewable energy sources and the need to reduce carbon emissions. According to the UK Department for Business, Energy & Industrial Strategy, biocatalyst usage in biofuel production has increased by 60% annually since 2020. Innovations in enzyme efficiency and cost reductions in enzyme production have driven adoption. Partnerships between biocatalyst manufacturers and renewable energy companies further amplify growth by positioning biofuel production as a key driver of market expansion.

REGIONAL ANALYSIS

Germany was the largest contributor in the Europe biocatalyst market with a share of 25.4% in 2024 owing to the country’s robust R&D infrastructure and high adoption rates of green technologies. Germany’s emphasis on sustainability aligns with EU mandates is driving adoption of enzyme-based solutions. For instance, as per Eurostat, over 70% of German industries now prioritize biocatalysts for their eco-friendly properties by creating a robust demand for advanced enzyme technologies.

Sweden is growing at faster rate with a CAGR of 11.3% in the next coming years. This growth is fueled by the country’s strong emphasis on environmental conservation and renewable energy projects. According to the Swedish Environmental Protection Agency, biocatalyst usage in biofuel production has grown by 50% annually since 2020. Additionally, government-led initiatives promoting green technologies have accelerated adoption by positioning Sweden as a key growth driver in the region. Countries like France, Italy, and Spain are expected to witness steady growth due to their strong industrial bases and export-oriented economies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Novozymes A/S, DSM N.V., Codexis Inc., Chr. Hansen Holding A/S, AB Enzymes GmbH, Amano Enzyme Europe Ltd., Roquette Frères, Lonza Group Ltd., Enzymicals AG, and Biocatalysts Ltd. are some of the key market players in the Europe biocatalyst market.

The Europe biocatalyst market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like Novozymes, BASF, and DSM dominate the landscape through continuous innovation and strategic collaborations. Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as organic agriculture or specialty pharmaceuticals. Regulatory compliance and adherence to quality standards further intensify competition, ensuring that only the most reliable products gain traction.

Top Players in the Europe Biocatalyst Market

1. Novozymes A/S

Novozymes is a leading player in the Europe biocatalyst market, contributing significantly to innovations in enzyme technology and sustainable solutions. The company specializes in producing high-quality biocatalysts catering to diverse industries such as food & beverage, biofuels, and pharmaceuticals. Its focus on integrating advanced biotechnology aligns with Europe’s demand for green solutions by enabling it to maintain a competitive edge.

2. BASF SE

BASF is another key contributor, renowned for its expertise in developing cost-effective and scalable biocatalysts. BASF’s strategic emphasis on expanding its product portfolio with plant-derived enzymes has driven growth. Its presence in Europe is strengthened by partnerships with local industries by ensuring widespread adoption of its products.

3. DSM N.V.

DSM plays a pivotal role in advancing biocatalyst technologies in pharmaceutical and food applications. DSM has transformed the industry through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market in high-growth regions like Germany and Sweden.

Top Strategies Used by Key Players in the Europe Biocatalyst Market

Key players in the Europe biocatalyst market employ strategies such as sustainability initiatives, geographic expansion, and technological advancements to strengthen their positions. Sustainability initiatives are central, with companies investing in eco-friendly models to meet EU Green Deal targets. Geographic expansion is another focus, with firms targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential.

Technological advancements also play a crucial role. BASF has introduced genetically engineered enzymes, reducing operational inefficiencies and improving user experience. These strategies collectively drive market growth and ensure sustained competitiveness.

RECENT MARKET DEVELOPMENTS

- In April 2023, Novozymes launched a new line of genetically engineered enzymes in Germany, reducing production costs by 30% while maintaining performance.

- In June 2023, BASF partnered with Italian food manufacturers to develop custom biocatalysts for cheese production by enhancing brand differentiation and market penetration.

- In September 2023, DSM acquired a leading enzyme manufacturer in Sweden is strengthening its position in the fast-growing Nordic market.

- In November 2023, Chr. Hansen introduced a cloud-based platform in Switzerland, streamlining the customization of enzyme formulations based on industrial needs.

- In February 2024, DuPont collaborated with tech firms in France to develop recyclable enzyme packaging by positioning itself as a leader in sustainable solutions.

MARKET SEGMENTATION

This research report on the europe biocatalyst market is segmented and sub-segmented based on categories.

By Source

- Animal

- Plants

- Microorganisms

By Material Type

- Hydrolases

- Oxidoreductases

- Transferases

By Application

- F&B Industry

- Cleaning Agents

- Biofuel Production

- Agriculture & Feed

- Biopharmaceuticals

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the growth of this market?

Growth is driven by the demand for sustainable manufacturing and advancements in enzyme technology. Environmental regulations are also encouraging industries to shift toward green chemistry.

What is the market outlook for the future?

The market is expected to grow steadily due to increasing industrial applications and demand for sustainable solutions. Innovations in enzyme development will further support this growth.

How is biotechnology influencing the biocatalyst market?

Biotechnology enables the engineering of more stable and specific enzymes. This has expanded the range of applications and improved performance under industrial conditions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]