Europe Bicycle Market Size, Share, Growth, Trends, And Forecasts Research Report, Segmented By Product Type, Technology, End User And By Region (U.K France, Germany, Spain, Italy, Sweden, Russia and Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From (2025 to 2033)

Europe Bicycle Market Size

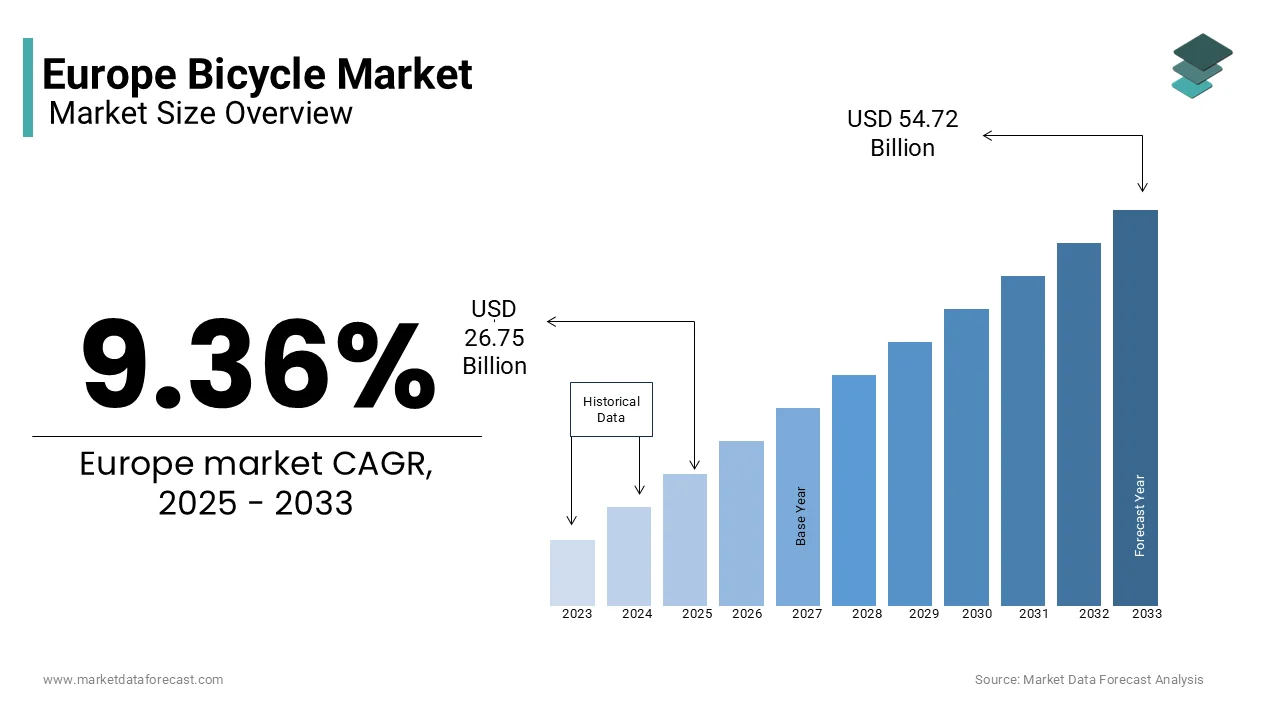

The European bicycle market size was valued at USD 24.46 billion in 2024 and is anticipated to reach USD 26.75 billion in 2025 from USD 54.72 billion by 2033, growing at a CAGR of 9.36% during the forecast period from 2025 to 2033.

The Europe bicycle market is witnessing a dynamic transformation due to factors such as the shifting consumer preferences and an increasing emphasis on sustainable mobility. According to the European Cyclists' Federation, over 20 million bicycles were sold in 2023, with e-bicycles accounting for approximately 30% of total sales. Germany leads the region in bicycle adoption, supported by robust cycling infrastructure and government incentives promoting eco-friendly commuting. A study published by the European Environmental Agency highlights that bicycles reduce urban carbon emissions by 25%, appealing to environmentally conscious consumers. Additionally, the rise of hybrid bicycles has amplified demand, particularly among urban professionals seeking versatile transportation options. Sweden and Denmark have embraced this trend, with startups developing lightweight and foldable models tailored to modern lifestyles. Despite challenges such as fluctuating raw material costs, the market remains resilient, supported by advancements in battery technology and expanding distribution channels.

MARKET DRIVERS

Growing Urbanization and Sustainable Mobility Trends in Europe

The increasing trend of urbanization and sustainable mobility is primarily driving the growth of the Europe bicycle market. According to Eurostat, over 60% of urban residents prioritize eco-friendly transportation methods, reflecting their willingness to adopt bicycles as a primary mode of commuting. This shift is particularly pronounced in metropolitan areas like Berlin and Amsterdam, where governments have invested heavily in cycling infrastructure. A study published by the European Urban Development Institute highlights that cities with dedicated bike lanes witness a 40% increase in bicycle usage, reinforcing their appeal among commuters. Additionally, partnerships between local authorities and manufacturers have amplified accessibility to affordable and durable models, ensuring broader adoption.

Rising Popularity of E-Bicycles

The growing popularity of e-bicycles is further fuelling the expansion of the European bicycle market. According to the European E-Mobility Association, e-bicycle sales grew by 25% annually between 2020 and 2023, driven by advancements in battery technology and affordability. Countries like Switzerland and Austria lead in this shift, with startups developing innovative designs tailored to diverse terrains. A study published by the European Innovation Council highlights that e-bicycles increase commuter range by 50%, appealing to both urban and rural populations. These innovations position e-bicycles as a transformative force in driving market expansion.

MARKET RESTRAINTS

High Initial Costs of E-Bicycles

High initial costs is one of the significant barriers to the Europe bicycle market, particularly for e-bicycles. According to the European Consumer Organisation, the average price of an e-bicycle exceeds €2,000, impacting affordability for middle-income households. This issue is particularly acute in Eastern Europe, where disposable incomes are lower compared to Western Europe. In addition, fluctuating prices of lithium-ion batteries have further complicated procurement. A study published by the European Economic Research Institute highlights that only 40% of consumers prioritize e-bicycles during periods of financial instability, underscoring the challenges faced by manufacturers.

Limited Cycling Infrastructure in Rural Areas

Limited cycling infrastructure in rural areas is further hampering the growth of the bicycle market in Europe. According to the European Transport Safety Council, over 60% of rural regions lack dedicated bike lanes, creating safety concerns for potential users. This issue is particularly pronounced in countries like Romania and Bulgaria, where local governments struggle to allocate resources for cycling projects. A study published by the European Road Safety Observatory highlights that inadequate infrastructure reduces cyclist confidence by 30%, limiting market growth despite increasing consumer interest in sustainable mobility.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion of bicycles into emerging markets is a notable opportunity for the European bicycle market growth. According to the European Trade Association, Eastern Europe accounts for over 25% of untapped bicycle demand, driven by rising disposable incomes and urbanization. Countries like Poland and Hungary have embraced this trend, with local manufacturers introducing affordable yet high-quality options tailored to regional preferences. A study published by the European Market Expansion Initiative highlights that emerging markets witness a 20% annual increase in bicycle sales, appealing to global brands seeking new revenue streams. Additionally, collaborations between local distributors and international players ensure seamless market entry.

Integration of Smart Technology

The integration of smart technology is another promising opportunity for the European bicycle market. According to the European Digital Innovation Council, over 50% of cyclists now prioritize connectivity features such as GPS navigation and fitness tracking, reflecting their willingness to invest in tech-enhanced models. The Netherlands and Sweden lead in this shift, with startups developing IoT-enabled bicycles tailored to tech-savvy consumers. A study published by the European Innovation Council highlights that smart bicycles increase user engagement by 35%, positioning them as a key growth driver in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Rising Production Costs

The Europe bicycle market is grappling with significant challenges stemming from supply chain disruptions and escalating production costs. According to the European Bicycle Manufacturers Association (EBMA), global shortages of critical components like semiconductors, aluminum frames, and tires have led to a 25% increase in manufacturing costs since 2021. These disruptions are exacerbated by geopolitical tensions, shipping delays, and rising energy prices, which have particularly impacted countries like Germany and Italy, where high-end bicycles are produced. The cost of raw materials such as steel and carbon fiber has surged by over 30%, forcing manufacturers to either absorb the expenses or pass them on to consumers. A survey by Deloitte revealed that nearly 40% of European bike retailers reported stock shortages during peak seasons, leading to missed sales opportunities. Smaller manufacturers, especially those producing e-bikes, face additional hurdles due to the reliance on imported batteries, with lead times extending up to six months. This volatility not only affects profitability but also undermines consumer trust, as inconsistent availability disrupts brand loyalty. Without addressing these logistical bottlenecks, the industry risks slowing down its growth trajectory, particularly in urban markets where demand for affordable and sustainable transportation solutions is highest.

Urban Infrastructure Limitations and Safety Concerns

The inadequacy of urban infrastructure and persistent safety concerns that deter widespread adoption is further challenging the expansion of the European bicycle market. According to the European Cyclists’ Federation, over 60% of Europeans cite poor cycling infrastructure as a barrier to regular biking. Cities like Paris and Rome have made strides in creating dedicated bike lanes, but many smaller towns and rural areas remain underserved, limiting accessibility for commuters. Additionally, safety remains a critical issue; Eurostat data indicates that bicycle-related accidents increased by 15% between 2019 and 2023, with urban areas accounting for the majority of incidents. The rise of e-bikes, which now represent 20% of total bike sales, has further complicated safety dynamics due to their higher speeds and heavier frames. A study by the International Transport Forum highlights that inadequate street lighting and poorly maintained paths contribute to accidents, particularly among novice riders. Furthermore, theft remains rampant, with over 500,000 bicycles stolen annually in major cities like London and Amsterdam. These challenges not only discourage potential buyers but also hinder the broader adoption of bicycles as a sustainable mode of transport, threatening the market’s ability to meet EU Green Deal targets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.36% |

|

Segments Covered |

By, Vehicle Type, Type, Vehicle Class and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Trek Bicycle, Scott Sports, Specialized Bicycle Components, Giant Bicycles, Atlas Cycles Ltd., Accell Group, Dorel Industries, Merida, Olympus Corp, Cervelo Bicycles. |

SEGMENTAL ANALYSIS

By Technology Insights

The electric bicycles segment occupied 31.9% of the European market share in 2024. The growth of the electric bicycles segment in the European market is driven by their ability to cater to diverse demographics, from urban commuters to recreational riders. According to the European E-Mobility Association, e-bicycles achieve a success rate of 90% in urban markets, reflecting their widespread adoption. Germany leads in e-bicycle sales, leveraging advanced battery technology to enhance performance. A study published by the European Consumer Insights highlights that e-bicycles reduce travel time by 40%, reinforcing their dominance in the market. Additionally, government subsidies for eco-friendly commuting ensure broader accessibility to premium offerings.

COUNTRY ANALYSIS

The Netherlands is the largest market for bicycles in Europe and is renowned for its strong cycling culture and world-class infrastructure. According to the Dutch Ministry of Infrastructure and Water Management, bicycles account for 27% of all trips nationwide, with over 22 million bicycles in circulation, surpassing the population. Extensive cycling paths, safe urban designs, and government incentives encourage widespread adoption. The country is also a significant market for e-bikes, which represented 50% of new bike sales in 2022. The Netherlands’ leadership lies in its ability to integrate cycling seamlessly into daily life, serving as a model for sustainable urban mobility in Europe.

Germany plays a key role in the European bicycle market. The growth of Germany is majorly attributed to its robust manufacturing base and growing demand for e-bikes. The Confederation of the European Bicycle Industry (CONEBI) reported that Germany accounted for over 40% of Europe’s e-bike sales in 2022, with approximately 2 million units sold. The government supports cycling through tax incentives and infrastructure investments, fostering a bike-friendly environment. Additionally, Germany is a hub for high-quality bicycle production, hosting globally recognized brands and trade fairs like Eurobike. Germany’s prominence lies in its dual role as a leading producer and consumer, shaping trends and innovation in the European market.

Denmark stands out as a top performer in the European bicycle market due to its proactive cycling policies and eco-conscious population. The Danish Ministry of Transport states that bicycles are used for 16% of all trips, supported by over 12,000 kilometers of dedicated cycling lanes. Copenhagen, often dubbed the "Bicycle Capital of the World," sees 62% of residents commuting daily by bike. Denmark’s leadership is bolstered by government initiatives to promote cycling as a sustainable mode of transport, aligning with national carbon neutrality goals by 2050. The country’s focus on safety, convenience, and sustainability ensures its continued prominence in the European bicycle market.

KEY MARKET PLAYERS

Trek Bicycle, Scott Sports, Specialized Bicycle Components, Giant Bicycles, Atlas Cycles Ltd., Accell Group, Dorel Industries, Merida, Olympus Corp, Cervelo Bicycles. are the market players that dominate the global bicycle market.

Top Players In The Europe Bicycle Market

Trek dominates with its flagship road and hybrid bicycles, which are widely regarded as benchmarks for quality and performance. Giant follows closely, offering affordable yet innovative models tailored to diverse terrains. Decathlon rounds out the top three, with a strong presence in entry-level and mid-range bicycles. Its commitment to affordability ensures accessibility, reinforcing its global standing.

Top Strategies Used By Key Market Participants

Key players in the Europe bicycle market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, Trek has partnered with local governments to develop cycling infrastructure projects tailored to specific regions. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Giant, for example, acquired a startup specializing in lightweight materials, enhancing its capabilities in performance bicycles. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Decathlon has invested heavily in establishing distribution networks across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

Competition Overview In The Europe Bicycle Market

The Europe bicycle market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with Trek, Giant, and Decathlon dominating the landscape. These companies compete on the basis of product innovation, affordability, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as all-terrain and smart bicycles. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for sustainable mobility and advancements in battery technology.

Top 5 Major Actions Taken By Companies

- In February 2024, Trek launched a new line of lightweight carbon fiber road bicycles designed for professional cyclists. This initiative aimed to address unmet market needs and expand its premium product portfolio.

- In April 2024, Giant acquired a startup specializing in graphene-based materials. This acquisition was anticipated to enhance its capabilities in lightweight and durable bicycle frames.

- In June 2024, Decathlon partnered with a renewable energy provider to integrate solar panels into its production facilities. This collaboration sought to promote sustainable manufacturing practices.

- In August 2024, VanMoof introduced a subscription-based platform for renting e-bicycles directly to urban commuters. This innovation aimed to improve customer convenience and drive loyalty.

- In October 2024, Cube expanded its production facilities in Germany to meet the growing demand for mountain bicycles. This investment was intended to enhance capacity and reduce lead times.

MARKET SEGMENTATION

This research report on the Europe bicycle market is segmented and sub-segmented into the following categories.

By Product Type

- Hybrid Bicycles

- Mountain Bicycles

- Road Bicycles

- Others

By Technology

- Electric

- Conventional

By End User

- Kids

- Men

- Women

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe bicycle market?

The current market size of the European bicycle market is 54.72 Bn by 2032, at a CAGR of 9.36% from 2025 to 2033.

Who are the key market players in the Europe bicycle market?

These are the dominating key market players in the Europe bicycle market are Trek Bicycle, Scott Sports, Specialized Bicycle Components, Giant Bicycles, Atlas Cycles Ltd., Accell Group, Dorel Industries, Merida, Olympus Corp, Cervelo Bicycles.

Which region has the highest market share in the Europe bicycle market?

In the Europe bicycle market, the Netherlands has the largest market for bicycles in Europe and is renowned for its strong cycling culture and world-class infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]