Europe Behavior Analytics Market Size, Share, Trends, & Growth Forecast Report By Component (Solution and Services), Deployment Type (On-premise and Cloud), Vertical (Retail & E-commerce, BFSI, IT & Telecom, Energy & Utilities, Healthcare, Government & Defense, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Behavior Analytics Market Size

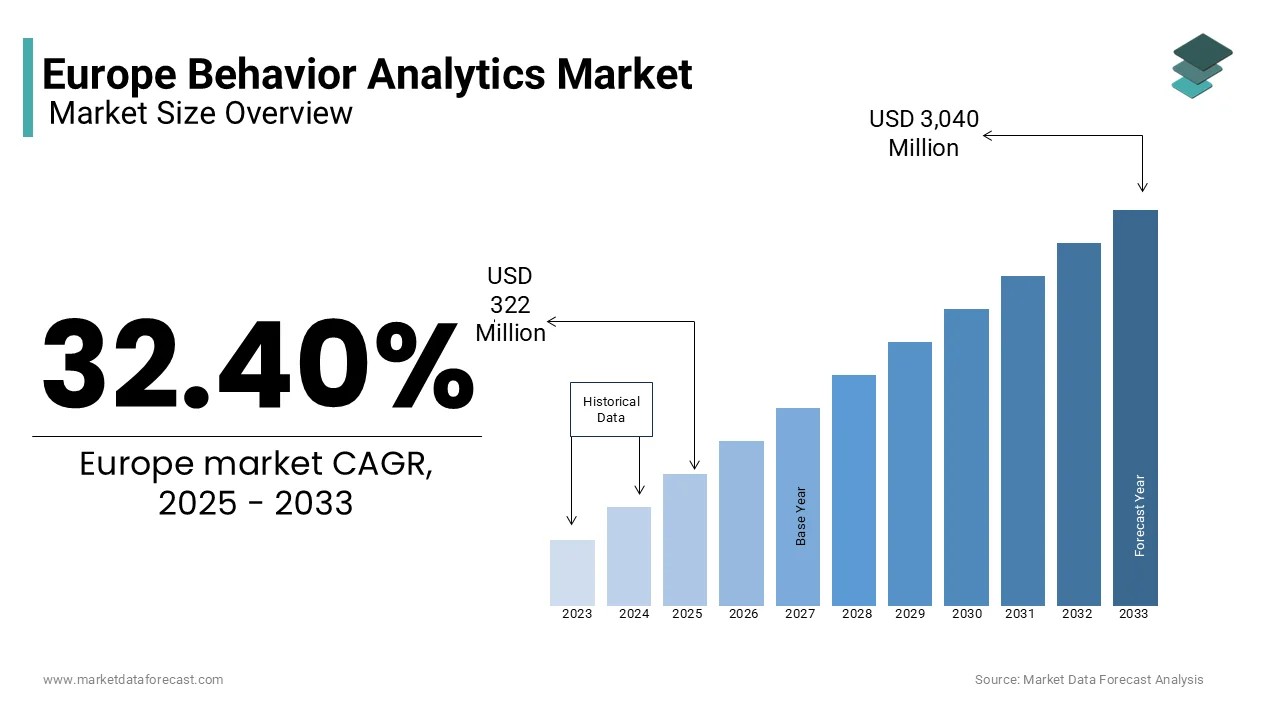

The Europe behavior analytics market was worth USD 243.20 million in 2024. The Europe market is estimated to reach USD 3,040 million in 2033 from USD 322 million in 2025, rising at a CAGR of 32.40% from 2025 to 2033.

Behaviour analytics involves the use of machine learning algorithms, statistical models, and data mining techniques to analyse patterns in human behaviour across digital platforms and enable organizations to identify anomalies, predict risks, and enhance decision-making processes. As cyber threats grow more sophisticated, traditional security measures are proving insufficient and prompting enterprises to adopt behaviour analytics as a proactive solution.

In Europe, industries such as banking, healthcare, retail, and government are at the forefront of adopting behaviour analytics solutions. For instance, the European Central Bank highlights that over 70% of financial institutions in the region have implemented behaviour analytics tools to combat fraud and ensure compliance with regulations like GDPR. Furthermore, a study by Eurostat reveals that 45% of large enterprises in Europe utilize behaviour analytics to monitor employee productivity and enhance cybersecurity frameworks. The rise of remote work post-pandemic has further accelerated demand, with Statista reporting a 30% increase in investments in behaviour analytics tools since 2020. As Europe continues to prioritize digital transformation and data privacy, the behaviour analytics market is poised for exponential growth, reshaping how organizations safeguard their assets while optimizing operational efficiency and customer experiences.

MARKET DRIVERS

Increasing Cybersecurity Threats and Data Breaches

The growing frequency and sophistication of cybersecurity threats are a major driver of the Europe behaviour analytics market. According to the European Union Agency for Cybersecurity (ENISA), cyberattacks in Europe surged by 25% in 2022, with ransomware and phishing being the most prevalent threats. As per a report by the UK National Cyber Security Centre, 68% of businesses experienced at least one cyberattack in the past year, emphasizing the urgent need for advanced detection mechanisms. Behaviour analytics plays a pivotal role in identifying anomalous activities, such as unauthorized access or unusual transaction patterns, enabling proactive threat mitigation. For instance, Eurostat states that organizations using behaviour analytics have reduced incident response times by 40%, which is significantly enhancing their security posture. As regulatory frameworks like GDPR impose strict penalties for data breaches, enterprises are increasingly investing in behaviour analytics to safeguard sensitive information and maintain compliance, thereby driving the market growth in Europe.

Rising Adoption of Remote Work and Digital Transformation

The widespread adoption of remote work and digital transformation initiatives has further propelled the demand for behaviour analytics in Europe. According to Eurostat, 40% of European employees worked remotely during 2022, which is creating new vulnerabilities in enterprise networks due to decentralized access points. As per the German Federal Ministry for Economic Affairs, 55% of companies have accelerated their digital transformation strategies, which integrating cloud-based systems and IoT devices that require robust monitoring solutions. Behaviour analytics tools help organizations monitor user activity, detect insider threats, and ensure productivity in remote settings. According to Statista, 35% of European enterprises have adopted behaviour analytics to address challenges posed by hybrid work models. This shift underscores the importance of behaviour analytics in maintaining operational efficiency while mitigating risks associated with remote access and digital ecosystems, which making it a critical enabler of secure digital transformation across Europe.

MARKET RESTRAINTS

High Implementation Costs and Budget Constraints

One significant restraint in the Europe behaviour analytics market is the high cost of implementation, which poses a challenge for small and medium-sized enterprises (SMEs). As per the reports of the European Investment Bank, 60% of SMEs in Europe face financial barriers when adopting advanced technologies like behaviour analytics, as these solutions require substantial upfront investment in software, hardware, and skilled personnel. For instance, as per a study by the UK Office for National Statistics, the average cost of deploying behaviour analytics systems ranges between €50,000 and €150,000 that is depending on the scale of operations. Additionally, ongoing maintenance and updates further escalate expenses, discouraging widespread adoption. According to Eurostat, only 25% of SMEs have fully integrated such technologies into their workflows due to budgetary limitations. This financial burden creates a significant barrier, particularly in regions with weaker economic infrastructures, hindering the overall growth potential of the behaviour analytics market across Europe.

Complexity in Data Integration and Privacy Concerns

Another major restraint is the complexity of integrating behaviour analytics tools with existing IT systems, coupled with stringent data privacy regulations. As per the European Data Protection Board, 45% of organizations struggle to align behaviour analytics solutions with GDPR compliance requirements, which mandate transparent data collection and processing practices. As per a study by the French National Institute for Research in Digital Science and Technology, integrating these tools with legacy systems often leads to operational disruptions, with 30% of deployments facing delays due to technical challenges. Furthermore, consumer skepticism about data privacy remains a hurdle, as noted by the UK Information Commissioner’s Office, which found that 70% of individuals are concerned about how their behavioural data is used. These factors not only increase implementation complexity but also limit the scalability of behaviour analytics solutions, slowing market expansion in Europe.

MARKET OPPORTUNITIES

Expansion of Behaviour Analytics in Healthcare

A significant opportunity for the Europe behaviour analytics market lies in its growing adoption within the healthcare sector due to the need to enhance patient care and operational efficiency. The European Observatory on Health Systems and Policies reports that 60% of hospitals in Western Europe are exploring advanced analytics solutions, including behaviour analytics, to monitor patient adherence to treatment plans and detect anomalies in medical staff activities. For instance, according to a study by the UK National Health Service (NHS), behaviour analytics has reduced medication errors by 25% in pilot programs. Additionally, as per the estimations of Eurostat, the demand for eHealth services is expected to have a promising demand in the next 5 years and this create a fertile ground for behaviour analytics integration. With the aging population in Europe projected to reach 28% by 2030, as per the European Commission, the demand for predictive analytics in healthcare is expected to surge and position behaviour analytics as a key enabler of personalized and preventive care.

Integration with Smart City Initiatives

Another major opportunity lies in the integration of behaviour analytics with Europe’s smart city initiatives, which aim to enhance urban safety, mobility, and sustainability. As per the Smart Cities Marketplace by the European Commission, over 300 cities in Europe are actively implementing IoT-based solutions, including behaviour analytics, to optimize traffic management, public safety, and energy usage. For example, a report by the German Federal Ministry for Digital and Transport Affairs reveals that behaviour analytics has improved crowd management in urban areas by 30%, particularly during large-scale events. Furthermore, Statista projects that the European smart city market will reach €230 billion by 2025 due to the investments in data-driven technologies. As cities increasingly adopt digital tools to address urban challenges, behaviour analytics is poised to play a pivotal role in creating safer, more efficient, and sustainable urban ecosystems across Europe.

MARKET CHALLENGES

Limited Availability of Skilled Workforce

A significant challenge for the Europe behaviour analytics market is the shortage of skilled professionals capable of implementing and managing these advanced systems. The European Centre for the Development of Vocational Training (Cedefop) reports that 40% of European companies face difficulties in recruiting talent with expertise in artificial intelligence and data analytics, which are critical for deploying behaviour analytics solutions. For instance, as per the UK Office for National Statistics, only 25% of IT professionals in Europe possess the specialized skills required to handle machine learning algorithms and statistical models used in behaviour analytics. This skills gap is further exacerbated by the rapid pace of technological advancements, leaving many organizations ill-equipped to fully leverage these tools. According to Eurostat, 35% of enterprises delay or scale back their adoption of behaviour analytics due to a lack of technical expertise, which is hindering the growth potential and innovation capacity of the European behaviour analytics market.

Resistance to Change and Organizational Inertia

Another major challenge is the resistance to change within organizations, particularly among traditional industries slow to adopt new technologies. According to the European Investment Bank, 50% of enterprises in Europe exhibit hesitancy in integrating behaviour analytics due to concerns about disrupting existing workflows and processes. A report by the French Ministry of Economy and Finance highlights that 60% of employees express apprehension about behaviour analytics tools, fearing increased surveillance or job displacement. Additionally, the German Federal Ministry for Economic Affairs notes that organizational inertia, coupled with a lack of awareness about the benefits of behaviour analytics, results in underutilization of these solutions. Eurostat estimates that 45% of businesses fail to achieve full ROI from behaviour analytics investments due to poor internal alignment and insufficient training. This cultural and operational resistance poses a significant barrier to widespread adoption, limiting the market’s expansion across Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

32.40% |

|

Segments Covered |

By Component, Deployment Type, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Splunk, Inc., IBM Corporation, Microsoft Corporation, NTT Data Corporation, Oracle Corporation, SAP SE, Tibco Software, Inc. (Vista Equity Partners), Varonis Systems, Inc., Cynet Security, and LogRhythm, Inc. |

SEGMENTAL ANALYSIS

By Component Insights

The solution segment held the leading share of 60.3% of the European market in 2024 owing to their widespread adoption of advanced software platforms that leverage AI and machine learning to detect anomalies and predict risks. As per the UK National Cyber Security Centre, 70% of organizations prioritize solution-based tools for cybersecurity and GDPR compliance. These solutions are critical in sectors like banking and healthcare, where real-time threat detection reduces fraud by 30%.

The services segment is estimated to grow at the fastest CAGR of 18.5% over the forecast period. Factors such as the complexity of deploying behaviour analytics solutions. The rise of remote work has further increased demand for consulting and managed services, ensuring seamless implementation. A study by Statista reveals that businesses utilizing professional services achieve 25% faster deployment times.

By Deployment Type Insights

The on-premises segment captured 55.3% of the European market share in 2024 and this dominance of the segment is driven by industries like banking and healthcare, where data sovereignty and compliance with GDPR are critical. According to the UK National Cyber Security Centre, 70% of financial institutions prefer on-premises solutions to ensure sensitive data remains within organizational boundaries. Additionally, as per the German Federal Ministry for Economic Affairs, on-premises systems reduce reliance on third-party servers, enhancing security.

The cloud segment is growing rapidly and is expected to witness a CAGR of 20.3% over the forecast period owing to the increasing adoption of remote work and digital transformation, particularly among SMEs. As per a study by Statista reveals that 60% of European SMEs have adopted cloud-based solutions due to their scalability and cost-effectiveness, reducing implementation costs by 40% compared to on-premises systems. Furthermore, advancements in cloud security, such as encryption protocols, are addressing data breach concerns.

By Vertical Insights

The BFSI segment occupied for 28.8% of the European market share in 2024. The domination of BFSI segment is driven by the growing need for fraud detection and regulatory compliance, with the UK National Cyber Security Centre noting that 70% of financial institutions faced cyberattacks in 2022. Behaviour analytics enables real-time monitoring of transactions, reducing fraud-related losses by 40%, according to Statista. Additionally, GDPR compliance requirements have further accelerated adoption, with Eurostat reporting that 65% of banks use these tools to ensure data security. The segment's importance lies in its ability to safeguard sensitive financial data, enhance customer trust, and streamline operations, making it a cornerstone of the behaviour analytics market in Europe.

The retail & e-commerce vertical is projected to grow at a promising CARG of 21.5% over the forecast period owing to the surge in online shopping and demand for personalized experiences. According to the UK Office for National Statistics, 60% of retailers using behaviour analytics have achieved a 25% increase in sales conversion rates through targeted marketing. Furthermore, the French Ministry of Economy reports a 35% reduction in online fraud among e-commerce platforms adopting these solutions. The segment's importance lies in its ability to optimize customer engagement, improve supply chain efficiency, and mitigate risks, positioning it as a key driver of innovation and profitability in the behaviour analytics market across Europe.

REGIONAL ANALYSIS

Germany held the leading position in the Europe behaviour analytics market by accounting for 25.2% of the European market share in 2024. The domination of Germany in the European market is driven by a robust industrial base, stringent cybersecurity regulations, and high adoption rates in sectors like manufacturing, finance, and healthcare. The European Central Bank highlights that 70% of German financial institutions have integrated behaviour analytics to combat fraud and ensure GDPR compliance. Additionally, Germany’s focus on Industry 4.0 initiatives has accelerated the use of behaviour analytics in predictive maintenance and operational efficiency. Germany continues to innovate by leveraging AI-driven solutions to address evolving cyber threats and optimize digital transformation across industries and further strengthen its position in the European market.

The UK is another notable market for behaviour analytics in the European market. The widespread adoption of behaviour analytics in banking, retail, and government sectors and the UK’s advanced digital infrastructure are propelling the UK market growth. The UK National Cyber Security Centre reports that 65% of organizations have implemented behaviour analytics to enhance threat detection and mitigate risks. Furthermore, the rise of remote work post-pandemic has fueled demand, with Statista highlighting a 30% increase in investments in behaviour analytics tools since 2020. The UK’s emphasis on innovation, regulatory compliance, and cybersecurity ensures its continued leadership in driving behaviour analytics adoption across Europe.

France is projected to account for a notable share of the European market over the forecast period owing to the strong government initiatives promoting digital transformation and cybersecurity, particularly in the healthcare and retail sectors. A study by Eurostat highlights that 55% of French enterprises have adopted behaviour analytics to monitor user activity and prevent fraud. France’s commitment to sustainability and smart city projects, such as Paris’ use of behaviour analytics in public safety systems, further accelerates adoption. With a projected CAGR of 18.7%, France remains a pivotal player in advancing behaviour analytics solutions, addressing both security challenges and operational inefficiencies while fostering innovation across industries.

KEY MARKET PLAYERS

The major players in the Europe behavior analytics market include Splunk, Inc., IBM Corporation, Microsoft Corporation, NTT Data Corporation, Oracle Corporation, SAP SE, Tibco Software, Inc. (Vista Equity Partners), Varonis Systems, Inc., Cynet Security, and LogRhythm, Inc.

MARKET SEGMENTATION

This research report on the European behavior analytics market is segmented and sub-segmented into the following categories.

By Component

- Solution

- Services

By Deployment Type

- On-premise

- Cloud

By Vertical

- Retail & E-commerce

- BFSI

- IT & Telecom

- Energy & Utilities

- Healthcare

- Government & Defense

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe Behavior Analytics Market?

The growth is driven by increasing cybersecurity threats, the adoption of AI and machine learning in analytics, and the need for advanced fraud detection solutions across industries like banking, healthcare, and retail.

Which industries are the biggest adopters of behavior analytics in Europe?

Banking, financial services, and insurance (BFSI), retail, healthcare, and IT & telecom are the leading adopters due to their need for fraud prevention, compliance, and customer behavior insights.

What types of data are commonly analyzed in behavior analytics solutions?

User activity logs, transaction records, network traffic, biometric data, and social media interactions are commonly analyzed to identify patterns and detect anomalies.

What is the future outlook for the Europe Behavior Analytics Market?

The market is expected to grow steadily due to increasing cybersecurity concerns, AI advancements, and the rising demand for real-time threat detection across industries.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]