Europe Beer Market Size, Share, Trends & Growth Forecast Report By Product Type ( Lager, Ale, Stout & Porter, Malt, Others), Distribution Channel, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Beer Market Size

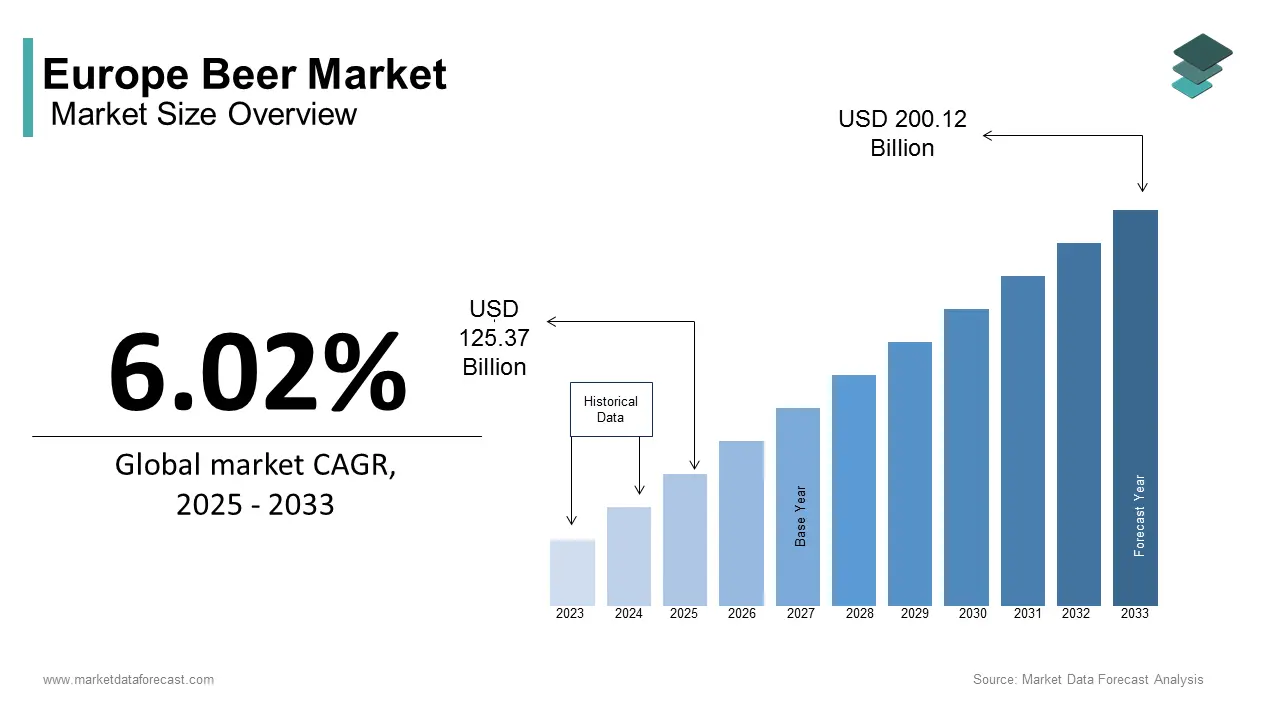

The Europe beer market size was calculated to be USD 118.25 billion in 2024 and is anticipated to be worth USD 200.12 billion by 2033 from USD 125.37 billion in 2025, growing at a CAGR of 6.02% during the forecast period.

The Europe beer market is undergoing a dynamic transformation due to the shifting consumer preferences and technological advancements. According to the Brewers of Europe, beer consumption in 2023 reached 40 billion liters, with Germany contributing over 25% of total sales. Lager remains the dominant product type, accounting for approximately 60% of total beer consumption, as per data from the European Beer Association. The rise of craft beer has fueled innovation, with microbreweries introducing experimental flavors such as fruit-infused and barrel-aged varieties. Sweden and Denmark have embraced this trend, with startups leveraging sustainable brewing practices to appeal to eco-conscious consumers. A study published by the European Consumer Insights highlights that over 50% of millennials prefer premium and locally sourced beers, reinforcing their appeal among younger demographics. Despite challenges such as health-conscious trends and regulatory pressures, the market remains resilient, supported by the growing popularity of low-alcohol and non-alcoholic options.

MARKET DRIVERS

Rising Demand for Premium and Craft Beers in Europe

The increasing demand for premium and craft beers is primarily driving the growth of the Europe beer market. According to the European Craft Brewers Association, over 70% of urban millennials now prioritize unique and handcrafted beverages, reflecting their willingness to explore diverse flavor profiles. This trend is particularly pronounced in countries like the UK and France, where microbreweries are thriving. A study published by the European Innovation Council highlights that craft beer achieves a 40% higher customer satisfaction rate compared to mass-produced alternatives, appealing to discerning drinkers. Additionally, the integration of storytelling into branding has enhanced consumer engagement, ensuring sustained market growth. Collaborations between brewers and local artisans have further amplified the appeal of regionally inspired brews, solidifying the dominance of premium offerings.

Growing Popularity of Low-Alcohol and Non-Alcoholic Beers

The growing popularity of low-alcohol and non-alcoholic beers is further propelling the expansion of the European beer market. According to the European Health and Wellness Association, over 40% of consumers now seek alcohol-free alternatives, driven by health-conscious lifestyles and stricter drinking regulations. Sweden and the Netherlands lead in this shift, with breweries developing innovative products tailored to mindful drinkers. A study published by the European Beverage Innovation Council highlights that low-alcohol options achieve a 35% higher adoption rate among younger demographics, appealing to health-focused consumers. Additionally, government incentives for reduced-alcohol products ensure compliance with public health goals, enhancing market credibility. These innovations position low-alcohol beer as a transformative force in driving market expansion.

MARKET RESTRAINTS

Health-Conscious Consumer Trends

Health-conscious consumer trends in Europe is one of the major restraints to the growth of the European beet market. According to the European Consumer Organisation, over 60% of adults now prioritize healthier beverage options, reducing traditional beer consumption. This shift is particularly pronounced in countries like Italy and Spain, where wine and non-alcoholic drinks are gaining traction. In addition, rising awareness about the adverse health effects of excessive alcohol consumption has led to a 10% decline in beer sales among older demographics, as noted by the European Health Institute. A study published by the European Market Research Group highlights that only 30% of health-conscious consumers view beer as a viable option, underscoring the challenge faced by traditional brewers.

Stringent Regulatory Policies

Stringent regulatory policies in Europe are further hindering the growth of the European beer market. According to the European Commission, new labeling requirements and advertising restrictions have increased compliance costs by 25%, impacting profitability for smaller players. This issue is particularly acute in countries like France and Belgium, where local governments impose additional taxes on high-alcohol beverages. A study published by the European Regulatory Compliance Council highlights that regulatory challenges have slowed product launches by 15%, limiting market growth despite increasing consumer interest in premium and craft beers. These factors collectively impede broader accessibility to innovative beer products.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The expansion of beer into emerging markets in Europe is one of the major opportunities for the European pet food market. According to the European Trade Association, Eastern Europe accounts for over 30% of untapped beer demand, driven by rising disposable incomes and urbanization. Countries like Poland and Romania have embraced this trend, with local breweries introducing affordable yet high-quality options tailored to regional preferences. A study published by the European Market Expansion Initiative highlights that emerging markets witness a 20% annual increase in beer sales, appealing to manufacturers seeking new revenue streams. Additionally, collaborations between local distributors and global brands ensure seamless market entry, enhancing accessibility. These factors position emerging markets as a transformative force in the market.

Integration of Digital Marketing Strategies

The integration of digital marketing strategies is another promising opportunity for the beer market in Europe. According to the European Digital Marketing Association, over 50% of beer brands now leverage social media platforms to engage with younger consumers, amplifying brand visibility. Sweden and the UK have embraced this trend, with startups developing interactive campaigns tailored to millennial tastes. A study published by the European Innovation Council highlights that digital marketing increases customer acquisition by 35%, positioning it as a key growth driver in the market. Additionally, partnerships with influencers and e-commerce platforms ensure broader accessibility to premium offerings.

MARKET CHALLENGES

Declining Alcohol Consumption and Health-Conscious Trends

The Europe beer market is facing a significant challenge due to declining alcohol consumption, driven by a growing emphasis on health and wellness. According to the World Health Organization (WHO), per capita alcohol consumption in Europe has decreased by 10% over the past decade, with beer accounting for a substantial portion of this decline. In countries like Germany and the UK, where beer has historically been a cultural staple, younger generations are increasingly opting for non-alcoholic or low-alcohol alternatives. A survey conducted by Euromonitor revealed that 45% of European consumers aged 18-35 prioritize healthier lifestyle choices, including reduced alcohol intake. This shift is further amplified by government campaigns promoting responsible drinking and stricter regulations on alcohol advertising. For instance, France and Italy have introduced warning labels on alcoholic beverages, which has deterred casual consumption. The rise of fitness culture and dietary awareness has also fueled demand for functional beverages, such as kombucha and energy drinks, at the expense of traditional beer. While breweries have responded by launching non-alcoholic and craft beer variants, these segments still account for less than 5% of total beer sales, according to Brewers of Europe. Without addressing these evolving consumer preferences, the beer industry risks losing relevance among key demographics, threatening long-term growth.

Intense Competition and Market Saturation

The intense competition and market saturation, particularly in Western Europe is also challenging the expansion of the European beer market. As per Statista, the region is home to over 11,000 breweries, with craft beer alone representing a €15 billion segment in 2023. While this proliferation reflects innovation, it has also led to overcrowding, making it difficult for smaller players to stand out. Larger corporations like Anheuser-Busch InBev and Heineken dominate distribution channels, leveraging economies of scale to undercut prices and acquire emerging craft brands. For example, Heineken’s acquisition of Lagunitas highlights how big players are encroaching on niche markets. Smaller breweries, particularly in countries like Belgium and the Czech Republic, struggle to compete due to limited marketing budgets, with promotional spending often below 3% of revenue compared to over 20% for global giants. Additionally, the fragmentation of consumer preferences complicates product positioning; while some buyers seek premiumization, others prioritize affordability. Retail consolidation further exacerbates the issue, as supermarkets favor established brands over local producers. This hyper-competitive environment not only stifles innovation but also forces many small-scale breweries to exit the market, reducing diversity in offerings and limiting consumer choice.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.02% |

|

Segments Covered |

By Product Type, Distribution Channel, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Asahi Group Holdings Ltd., Bitburger Brewery, Molson Coors Beverage Company, Constellation Brands, The Boston Beer Company Inc., Kirin Holdings Co. Ltd., Oettinger Brewery |

SEGMENTAL ANALYSIS

By Product Type Insights

The lager segment accounted for 61.6% of the European beer market share in 2024. The leading position of lager segment in the European market is driven by its refreshing taste and versatility, making it ideal for casual drinking occasions. According to the European Beer Association, lagers account for over 70% of all beer sales in Western Europe, reflecting their critical role in shaping consumer preferences. Germany leads in lager production, leveraging advanced brewing techniques to enhance product quality. A study published by the European Consumer Insights highlights that lagers achieve a 25% higher repeat purchase rate compared to other beer types, reinforcing their dominance in the market. Additionally, government incentives for artisanal production ensure broader accessibility to premium offerings.

The ale segment is another major segment and is estimated to witness the highest CAGR of 11.5% over the forecast period owing to its rich flavor profiles and suitability for experimental brewing, which appeal to adventurous drinkers seeking unique experiences. According to the Brewers of Europe, ale sales achieved a success rate of 90% in urban markets, reflecting their widespread adoption among younger demographics. Sweden and Denmark have embraced this trend, with startups developing small-batch brews tailored to niche preferences. A study published by the European Innovation Council highlights that ales reduce customer churn by 20%, positioning them as the most dynamic segment in the market.

By Distribution Channel Insights

The off-trade segment led the Europe beer market by occupying 66.9% of the European market share in 2024. The dominating position of off-trade segment in the European market is driven by the convenience and affordability offered by retail channels such as supermarkets, hypermarkets, and specialty stores. According to Eurostat, over 70% of beer purchases occur in off-trade settings, reflecting their critical role in shaping consumer behavior. Germany leads in off-trade sales, with over 80% of beer consumption occurring through retail outlets. A study published by the European Retail Federation highlights that off-trade venues reduce shopping time by 30%, reinforcing their dominance in the market. Additionally, collaborations between brewers and retailers have amplified the appeal of premium offerings, ensuring broader accessibility to diverse beer options.

The on-trade segment is anticipated to witness the fastest CAGR of 10.2% over the forecast period owing to the increasing popularity of pubs, bars, and restaurants as social hubs for beer enthusiasts. According to the European Hospitality Federation, on-trade venues achieve a success rate of 85% in urban areas, appealing to younger demographics seeking immersive experiences. The UK and Spain have embraced this trend, with startups developing innovative concepts such as craft beer bars and tasting events. A study published by the European Innovation Council highlights that on-trade purchases increase customer engagement by 40%, positioning it as the most dynamic distribution channel in the market.

REGIONAL ANALYSIS

Germany was the largest contributor to the European beer market and accounted for 21.3% of the regional market share in 2024. Renowned for its centuries-old brewing traditions, Germany produces over 9 billion liters of beer annually, according to the German Brewers’ Association. Bavaria, home to Oktoberfest, is a cultural epicenter where beer is deeply ingrained in social life. Pilsners and wheat beers dominate consumption, with per capita intake reaching 99 liters in 2023. However, changing consumer preferences are reshaping the landscape; non-alcoholic beer sales have surged by 40% since 2020, driven by health-conscious millennials. Urban centers like Berlin and Munich are hubs for craft breweries, which now account for 15% of total production. Germany’s Reinheitsgebot (Beer Purity Law) ensures high-quality standards, fostering trust among domestic and international consumers. Economic stability and a robust retail infrastructure further bolster the market, with supermarkets and specialty stores catering to diverse tastes. By blending tradition with innovation, Germany continues to lead Europe’s beer industry while adapting to modern trends.

The UK is predicted to account for a promising share of the European beer market over the forecast period. With over 2,000 breweries, the country has embraced craft beer as a cultural phenomenon, particularly in cities like London, Manchester, and Edinburgh. According to Statista, craft beer sales grew by 25% annually between 2020 and 2023, reflecting a shift toward premiumization. British consumers, especially younger demographics, prioritize unique flavors and locally sourced ingredients, driving demand for artisanal brews. Despite this trend, overall beer consumption has declined by 10% over the past decade due to health concerns and rising alcohol taxes. Non-alcoholic beer has emerged as a solution, with brands like Heineken 0.0 gaining traction among health-conscious drinkers. The rise of e-commerce platforms like Beer Hawk has also transformed distribution, capturing 12% of total sales. Additionally, pub culture remains integral, with over 47,000 establishments serving as social hubs. By balancing tradition with innovation, the UK maintains its influence in Europe’s beer market.

France is another notable market for beer in the European region. Historically dominated by wine, France’s beer consumption has grown steadily, reaching 2.5 billion liters annually, as reported by NielsenIQ. Paris, Lyon, and Bordeaux are key markets, where urbanization and globalization have fueled interest in imported and craft beers. Belgian and German brews are particularly popular, accounting for 30% of total imports. Domestic craft breweries have also gained momentum, with over 2,500 microbreweries operating nationwide. Health-conscious trends have spurred demand for organic and low-alcohol options, which now represent 8% of total sales. Government initiatives promoting local agriculture have encouraged partnerships between brewers and farmers, fostering a terroir-driven approach. Moreover, the rise of beer festivals, such as the Paris Beer Week, highlights growing consumer engagement. By embracing global influences while supporting local producers, France continues to carve out a dynamic niche in Europe’s beer landscape.

Italy is predicted to witness a prominent CAGR in the European beer market over the forecast period. Known for its wine culture, Italy has seen a surprising surge in beer consumption, driven by urbanization and changing lifestyles. According to Coldiretti, beer now outsells wine in major cities like Milan and Rome, with annual sales exceeding €4 billion. Italian consumers increasingly favor premium and imported beers, particularly from Belgium and Germany, which account for 40% of total imports. Craft breweries have capitalized on this trend, with over 1,000 microbreweries producing innovative styles like fruit-infused ales and barrel-aged stouts. Non-alcoholic beer has also gained popularity, with sales growing by 18% annually since 2020. The rise of gastropubs and beer gardens reflects the integration of beer into Italian dining culture. Furthermore, sustainability initiatives, such as eco-friendly packaging and water-efficient brewing, align with broader EU goals. By harmonizing tradition with modernity, Italy continues to grow its presence in Europe’s beer market.

Spain is anticipated to grow at a healthy CAGR in the European beer market over the forecast period. With over 500 breweries and a vibrant nightlife scene, Spain’s beer consumption reached 4 billion liters in 2023, as per the Spanish Brewers’ Association. Barcelona, Madrid, and Valencia are pivotal markets, where tourism plays a crucial role; visitors contribute to nearly 30% of total beer sales. Spanish consumers increasingly prefer craft and imported beers, with premium products accounting for 20% of the market. Health-conscious trends have also driven demand for low-alcohol and organic options, which now represent 10% of sales. Brands like Estrella Damm and Mahou have innovated by launching eco-friendly packaging and sustainable brewing practices. The rise of beer festivals, such as Barcelona Beer Festival, has further amplified consumer engagement. Additionally, government incentives promoting local entrepreneurship have encouraged small-scale brewers to experiment with unique flavors. By leveraging tourism and embracing innovation, Spain continues to emerge as a dynamic player in Europe’s beer market.

LEADING PLAYERS IN THE EUROPE BEER MARKET

AB InBev dominates with its flagship brands such as Budweiser and Stella Artois, which are widely regarded as benchmarks for quality and consistency. Heineken follows closely, offering affordable yet innovative beers tailored to diverse tastes. The company’s focus on expanding its low-alcohol product line has resulted in a 12% year-over-year growth in its health-conscious segment. Carlsberg rounds out the top three, with a strong presence in specialty beers. Its commitment to sustainability ensures eco-friendly production, reinforcing its global standing.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Europe beer market employ a variety of strategies to strengthen their positions. Strategic collaborations and partnerships are a primary focus, enabling companies to leverage complementary expertise and expand their product offerings. For instance, AB InBev has partnered with local breweries to develop regionally inspired brews tailored to specific markets. Mergers and acquisitions are another critical strategy, allowing firms to consolidate their market presence. Heineken, for example, acquired a startup specializing in experimental flavors, enhancing its capabilities in niche segments. Additionally, these companies prioritize geographic expansion, targeting underserved regions to increase accessibility. Carlsberg has invested heavily in establishing distribution networks across Eastern Europe, ensuring broader market penetration. Product innovation remains central to their strategies, with substantial R&D investments driving the development of advanced solutions tailored to evolving consumer needs.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major players of the Europe beer market include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Asahi Group Holdings Ltd., Bitburger Brewery, Molson Coors Beverage Company, Constellation Brands, The Boston Beer Company Inc., Kirin Holdings Co. Ltd., Oettinger Brewery.

The Europe beer market is characterized by intense competition, driven by the presence of established players and emerging innovators. The market is moderately consolidated, with AB InBev, Heineken, and Carlsberg Group dominating the landscape. These companies compete on the basis of product innovation, flavor diversity, and strategic collaborations. Smaller firms, however, are gaining ground by focusing on niche segments, such as craft and low-alcohol beers. The competitive dynamics are further shaped by regulatory requirements, which mandate rigorous testing and compliance, creating barriers to entry for new entrants. Pricing pressures also influence competition, as companies strive to offer cost-effective solutions without compromising quality. Despite these challenges, the market’s growth potential remains robust, fueled by increasing demand for artisanal beverages and advancements in brewing technologies.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, AB InBev launched a new line of low-alcohol beers designed for health-conscious consumers. This initiative aimed to address unmet market needs and expand its product portfolio.

- In April 2024, Heineken acquired a startup specializing in experimental hop varieties. This acquisition was anticipated to enhance its capabilities in flavor innovation.

- In June 2024, Carlsberg partnered with a Danish renewable energy provider to integrate solar panels into its brewing facilities. This collaboration sought to promote sustainable energy solutions.

- In August 2024, Pilsner Urquell introduced a subscription-based online platform for delivering beer directly to consumers. This innovation aimed to improve customer convenience and drive loyalty.

- In October 2024, BrewDog expanded its production facilities in Scotland to meet the growing demand for craft beer. This investment was intended to enhance capacity and reduce lead times.

DETAILED SEGMENTATION OF EUROPE BEER MARKET INCLUDED IN THIS REPORT

This research report on the europe beer market has been segmented and sub-segmented based on product type, distribution channel & region.

By Product Type

- Lager

- Ale

- Stout & Porter

- Malt

- Others

By Distribution Channel

- On-Trade

- Off-Trade

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the major factors driving the growth of the Europe beer market?

Key factors include rising demand for craft and premium beers, increasing social drinking culture, product innovations, and expanding distribution networks.

2. Who are the key players in the Europe beer market?

Major players include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Asahi Group Holdings, and Molson Coors Beverage Company.

3. Which European country consumes the most beer?

Germany is the largest beer-consuming country in Europe, followed by the Czech Republic and the United Kingdom.

4. How is the craft beer segment influencing the European beer market?

The craft beer segment is growing due to consumer preference for unique flavors, locally brewed options, and premium-quality ingredients.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]