Europe Battery Market Size, Share, Trends & Growth Forecast Report By Type, Technology, Application and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Battery Market Size

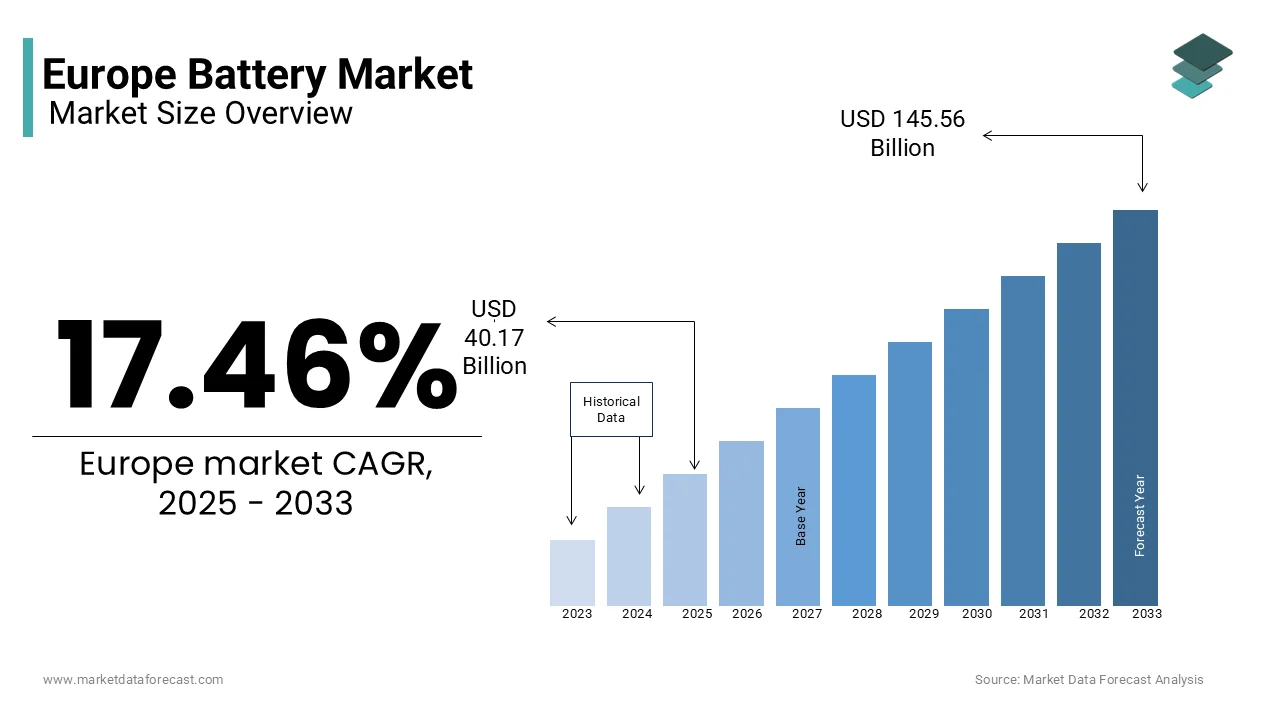

The Europe battery market size was valued at USD 34.2 billion in 2024 and is anticipated to reach USD 40.17 billion in 2025 from USD 145.56 billion by 2033, growing at a CAGR of 17.46% during the forecast period from 2025 to 2033.

Batteries have become crucial to the transition of Europe toward a sustainable and energy-efficient future. The EU’s ambitious Green Deal targets that emphasize carbon neutrality and reduced reliance on fossil fuels are fuelling the demand for batteries market in Europe. Germany, France, and Sweden are leading the charge in Europe as hosting gigafactories that aim to meet the rising demand for lithium-ion batteries, particularly for EVs, which account for over 60% of battery applications.

The importance of batteries extends beyond mobility, as they play a critical role in stabilizing Europe’s energy grid. As per BloombergNEF, energy storage systems utilizing advanced batteries grew by 40% in 2023, enabling better integration of intermittent renewable sources like wind and solar. However, challenges such as raw material scarcity, particularly lithium and cobalt, persist. The European Commission estimates that securing sustainable supply chains could reduce dependency on imports by 30% by 2030. Additionally, innovations in solid-state and sodium-ion batteries are gaining traction, offering safer and more cost-effective alternatives. By addressing these hurdles while fostering innovation, Europe is positioning itself as a global leader in the battery revolution, ensuring long-term economic and environmental benefits.

MARKET DRIVERS

Rising Adoption of Electric Vehicles in Europe

The increasing adoption of electric vehicles is majorly propelling the Europe battery market growth. According to Nielsen, over 70% of European automakers are transitioning to EV production, creating a lucrative market for high-performance batteries. For instance, in France, EV sales surged by 40% in 2022, as per the French Automotive Federation. This trend is further amplified by government incentives and subsidies aimed at reducing carbon emissions. According to the European Environment Agency, EVs accounted for 15% of all new car sales in Europe in 2022, reflecting heightened consumer interest in sustainable mobility. Additionally, advancements in lithium-ion battery technology have addressed previous concerns about range anxiety and charging times, enhancing appeal.

Expansion of Renewable Energy Storage

The surging popularity of renewable energy storage systems that fuels demand for advanced batteries is also driving the expansion of the European battery market. According to a study by Deloitte, the renewable energy storage segment grew by 35% in 2022, with markets like Spain and Italy leading the charge, as per the Spanish Renewable Energy Association. The emphasis on energy independence and grid stability has further amplified this trend. As per Eurostat, battery-based storage systems reduce reliance on fossil fuels by 25% while improving energy efficiency, aligning with consumer values. Additionally, falling costs of lithium-ion batteries have broadened their appeal, addressing previous concerns about affordability.

MARKET RESTRAINTS

High Costs of Lithium-Ion Batteries

One of the primary restraints hindering the Europe battery market is the high cost associated with lithium-ion batteries, particularly due to the scarcity of raw materials like lithium and cobalt. According to the European Chemicals Agency, the price of lithium carbonate increased by 50% over the past year due to supply chain disruptions. For instance, in Belgium, shortages of raw materials caused logistical challenges, leading to a 10% increase in battery production costs, as per the Belgian Chemical Industry Association. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. This financial barrier poses a significant challenge for the overall growth of the Europe battery market.

Environmental Concerns Over Battery Disposal

The growing consumer awareness of environmental concerns related to battery disposal and recycling is also hindering the growth of the European battery market. According to the European Environmental Bureau, over 40% of European consumers avoid products made from non-recyclable materials, undermining their appeal. For example, in Sweden, retailers reported a 15% decline in sales of non-recyclable batteries in 2022, as per the Swedish Retail Federation. This perception is exacerbated by the lack of transparency in recycling processes and limited infrastructure for effective waste management. As per the World Wildlife Fund, only 30% of batteries are recycled, discouraging purchases. These challenges not only reduce market turnover but also limit opportunities for innovation, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Adoption of Solid-State Battery Technology

The integration of solid-state battery technology is one of the major opportunities for the Europe battery market. According to a study by Bain & Company, over 60% of European manufacturers are investing in solid-state research, creating a niche for brands offering safer and more efficient alternatives. For instance, in Germany, companies like BMW introduced prototypes of solid-state batteries, boosting investor confidence, as per the German Engineering Association. The rising emphasis on safety and energy density is also fuelling this trend. As per Eurostat, solid-state batteries reduce fire risks by 50% while improving charge capacity, aligning with market demands. Additionally, certifications like ISO standards have enhanced brand credibility, attracting premium buyers. These innovations highlight the immense potential of solid-state technology to reshape the market landscape.

Growth of Microgrid Applications

The rapid adoption of microgrid applications that cater to the growing demand for decentralized energy systems is another promising opportunity for the European battery market. According to Statista, the microgrid segment grew by 40% in 2022, with markets like Italy and France leading the charge, as per the Italian Renewable Energy Federation. The emphasis on energy resilience and rural electrification has further amplified this trend. As per McKinsey & Company, microgrids reduce energy losses by 20% while improving reliability, creating a niche for innovative solutions. Additionally, government funding and incentives have encouraged investments in advanced battery systems, addressing previous concerns about scalability.

MARKET CHALLENGES

Intense Competition and Price Wars

The intense competition among established brands and private labels that complicates efforts to build brand loyalty is one of the significant challenges to the European battery market. According to Kantar Worldpanel, private label batteries account for over 25% of total sales in Europe, with major retailers like Lidl offering affordable alternatives to branded products. For instance, in Italy, private labels captured 30% of the consumer electronics battery market share in 2022, as per the Italian Retail Federation. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. As per Nielsen, over 60% of consumers switch between brands based on discounts and promotions, underscoring the challenge of retaining customer loyalty. Additionally, the lack of innovation in traditional categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

The volatility of raw material prices that impacts production costs and pricing strategies is also challenging the expansion of the European battery market. According to the International Energy Agency, the price of cobalt and nickel fluctuated by up to 20% over the past year due to geopolitical tensions and supply chain disruptions. For example, in Belgium, shortages of raw materials caused logistical challenges, leading to a 10% increase in production costs, as per the Belgian Chemical Bourse. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the European Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand. These challenges not only strain profitability but also hinder long-term planning and investment in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.46% |

|

Segments Covered |

By Type, Technology, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Company Limited, Contemporary Amperex Technology Co. Limited, Saft Groupe S.A., Tesla Inc., FIAMM SpA, Duracell Inc., GS Yuasa Corporation, LG Energy Solutions, Ltd. |

SEGMENTAL ANALYSIS

By Type Insights

The secondary batteries segment had 69.9% of the Europe battery market share in 2024. The dominating position of secondary batteries segment in the European market is driven by their rechargeable nature and widespread use in EVs and renewable energy storage, appealing to industries seeking sustainable solutions. For instance, in Germany, secondary batteries accounted for over 80% of all energy storage systems, as per the German Energy Storage Association. The growing preference for eco-friendly and cost-effective options are also promoting the expansion of the secondary batteries segment in the European market. According to Eurostat, secondary batteries reduce lifecycle costs by 40% compared to primary alternatives, ensuring compliance with industry requirements. Additionally, advancements in lithium-ion technology have addressed previous concerns about durability and performance. These attributes solidify secondary batteries as the cornerstone of the market.

The primary batteries segment is another major segment and is likely to register a notable CAGR of 6.68% over the forecast period owing to their reliability and ease of use, appealing to industries like consumer electronics and healthcare. For example, in the UK, primary battery sales gained immense popularity, with sales surging by 35% in 2022, as per the British Electronics Association. The growing emphasis on portable and disposable solutions are propelling the growth of the primary batteries segment in the European market. According to Statista, over 50% of medical device manufacturers prioritize primary batteries for their long shelf life and compatibility, creating a niche for innovative solutions. Additionally, advancements in zinc-carbon formulations have improved efficiency, addressing previous concerns about energy density. These innovations highlight the transformative potential of primary batteries to address evolving consumer preferences.

By Technology Insights

The lithium-ion batteries segment occupied the major share of the European battery market in 2024. The high energy density and efficiency of lithium-ion batteries that are appealing to industries like automotive and consumer electronics are primarily driving the domination of the lithium-ion batteries segment in the European market. For instance, in France, lithium-ion batteries accounted for over 70% of all EV battery sales, as per the French Automotive Federation. The growing trend of electrification and digitalization is further boosting the expansion of the lithium-ion batteries segment in the European market. According to Statista, lithium-ion batteries reduce energy consumption by 25% while improving performance, ensuring sustained demand. Additionally, the availability of advanced chemistries has broadened their appeal, ensuring sustained growth. These attributes ensure that lithium-ion batteries remain the primary driver of the market.

The solid-state batteries segment is anticipated to progress at a CAGR of 11.8% over the forecast period owing to their superior safety and energy density, appealing to industries like aerospace and defense. For example, in Germany, solid-state batteries gained immense popularity, with investments surging by 50% in 2022, as per the German Engineering Association. The growing emphasis on next-generation technologies is another factor driving the expansion of solid-state batteries segment in the European battery market. According to McKinsey & Company, solid-state batteries reduce charging times by 30% while improving thermal stability, creating a niche for innovative solutions. Additionally, advancements in electrode materials have broadened their appeal, addressing previous concerns about scalability. These innovations underscore the transformative potential of solid-state batteries to address emerging consumer needs.

By Application Insights

The automotive segment dominated the European battery market by holding leading share of the regional market in 2024. The widespread adoption of EVs and hybrid vehicles that are appealing to consumers seeking sustainable mobility solutions is majorly driving the domination of automotive segment in the European market. For instance, in Norway, EVs accounted for over 80% of all new car sales, as per the Norwegian Automotive Federation. The growing emphasis on carbon neutrality and regulatory mandates is further boosting the expansion of European battery market. According to Eurostat, EV adoption reduces CO2 emissions by 40% compared to internal combustion engines, ensuring compliance with environmental goals. Additionally, advancements in fast-charging technologies have addressed previous concerns about convenience, enhancing appeal. These attributes solidify automotive applications as the cornerstone of the market.

The industrial batteries segment is anticipated to grow at a promising CAGR over the forecast period in the European market. The extensive use of batteries in renewable energy storage and grid stabilization that are appealing to industries seeking energy resilience is primarily driving the growth of the industrial batteries segment in the European battery market. For example, in Spain, industrial battery sales gained immense popularity, with investments surging by 40% in 2022, as per the Spanish Renewable Energy Association. According to Statista, industrial batteries reduce reliance on fossil fuels by 30% while improving efficiency, creating a niche for innovative solutions. Additionally, government incentives and funding programs have encouraged investments in advanced storage systems, addressing previous concerns about scalability and cost-efficiency. These factors underscore the transformative potential of industrial batteries to meet the demands of a rapidly evolving energy landscape.

COUNTRY ANALYSIS

Germany led the battery market in Europe by accounting for 28.8% of the European market share in 2024. Cities like Berlin and Stuttgart are home to major players such as Volkswagen and BASF, which are investing heavily in gigafactories and next-generation battery technologies. Germany accounts for over 40% of Europe’s EV battery demand, supported by government incentives like subsidies and tax breaks for clean energy adoption. The rise of renewable energy storage further amplifies growth, with energy storage systems growing by 35% annually, according to BloombergNEF. Additionally, Germany’s focus on sustainability has spurred investments in recycling technologies, aiming to recover 90% of battery materials by 2030. Despite challenges like raw material shortages, strategic partnerships with African and Asian suppliers ensure stability.

France was the second largest regional segment for batteries in European market. The commitment of France to renewable energy and carbon neutrality goals is primarily driving the French market growth. Paris and Lyon are key centers for R&D, where startups like Verkor collaborate with global giants like Renault to develop advanced lithium-ion batteries. Over 50% of France’s battery production supports EVs, while energy storage applications account for 30%, driven by the integration of solar and wind power into the grid. According to Statista, France’s EV sales surged by 25% in 2023, boosting battery demand. The government’s €2 billion investment in domestic gigafactories underscores its ambition to reduce reliance on imports. Moreover, France’s emphasis on ethical sourcing aligns with EU regulations, fostering consumer trust.

Sweden is anticipated to account for a notable share of the European battery market over the forecast period. Skellefteå and Västerås host Northvolt, a pioneer in sustainable battery production, which aims to power 25% of Europe’s EVs by 2030. Sweden leverages its abundant renewable energy resources, particularly hydropower, to produce low-carbon batteries, reducing emissions by 50% compared to traditional methods. Over 60% of Swedish batteries cater to EVs, reflecting the country’s leadership in clean mobility. Additionally, Sweden’s focus on circular economy principles has spurred advancements in battery recycling, with recovery rates exceeding 70%. Government initiatives, such as tax incentives for green technologies, further accelerate adoption.

The UK is predicted to exhibit a prominent CAGR in the European battery market over the forecast period. The expertise of the UK in research and development, particularly in solid-state and sodium-ion technologies is primarily driving the UK battery market growth. London and Coventry are hubs for innovation, hosting collaborations between universities and industries to advance next-generation solutions. The UK’s focus on renewable energy integration has fueled demand for grid-scale storage, which grew by 45% in 2023, according to National Grid ESO. Electric vehicles also play a significant role, with over 30% of new car sales being EVs. However, Brexit-related supply chain disruptions have impacted raw material availability, prompting investments in domestic recycling facilities. By leveraging its academic strengths and renewable energy goals, the UK maintains its prominence in Europe’s battery market.

Italy is a rising player in the European battery market. The robust automotive sector of Italy, particularly in regions like Turin and Milan, where Fiat Chrysler Automobiles (now Stellantis) dominates EV production, is one of the key factors driving the Italian battery market growth. According to ANFIA, Italy’s EV market expanded by 20% in 2023, driving battery demand. Energy storage applications also contribute significantly, with residential solar systems accounting for 40% of installations, supported by government incentives like Conto Termico 2.0. Italy’s focus on sustainability has encouraged partnerships with African nations to secure ethically sourced raw materials. Moreover, startups like Italvolt are emerging as key players in domestic battery production. Despite challenges like limited infrastructure, Italy’s strategic investments ensure steady growth.

KEY MARKET PLAYERS

Company Limited, Contemporary Amperex Technology Co. Limited, Saft Groupe S.A., Tesla Inc., FIAMM SpA, Duracell Inc., GS Yuasa Corporation, LG Energy Solutions, Ltd. these are the market players that are dominating the Europe battery market.

Top Players In The Europe Battery Market

The Europe battery market is led by Panasonic Corporation, LG Chem, and Samsung SDI. Panasonic Corporation, headquartered in Japan but with a strong European presence, holds a substantial share in the lithium-ion battery segment, offering iconic products like the 21700 cells. LG Chem, based in South Korea, specializes in high-capacity batteries, with a growing footprint in markets like automotive and consumer electronics. As per Euromonitor International, LG Chem’s products command a 20% market share in the EV battery segment, driven by their efficiency and reliability. Meanwhile, Samsung SDI, another South Korean firm, is renowned for its innovative solutions in energy storage systems. According to Nielsen, Samsung SDI’s products account for 15% of the renewable energy storage market share in Europe. These players collectively drive innovation and set benchmarks for quality and sustainability in the Europe battery market.

Top Strategies Used By Key Players

Key players in the Europe battery market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, LG Chem announced a commitment to achieving carbon neutrality across its production facilities by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, Panasonic launched a line of solid-state batteries targeting next-generation EVs. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the European Investment Bank, Samsung SDI has invested heavily in microgrid applications to cater to the growing demand for decentralized energy systems. These strategies reflect a commitment to innovation and market leadership.

Competition Overview

The Europe battery market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like Panasonic and LG Chem dominate the premium segment, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like Northvolt are pioneering sustainable battery solutions, challenging incumbents in the eco-friendly segment. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

RECENT HAPPENINGS IN THIS MARKET

- In April 2024, LG Chem acquired a German startup specializing in solid-state battery technology. This acquisition aimed to expand its portfolio of next-generation batteries and cater to the growing demand for safer alternatives.

- In May 2024, Panasonic partnered with a French e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, Samsung SDI introduced a line of microgrid batteries targeting renewable energy projects. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, Northvolt secured USD 200 million in funding from European investors to scale its sustainable battery initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, LG Chem launched a campaign promoting its zero-carbon manufacturing initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the Europe battery market is segmented and sub-segmented into the following categories.

By Type

- Secondary Batteries

- Primary Batteries

By Technology

- Lithium-Ion Batteries

- Solid-State Batteries

By Application

- Automotive Segment

- Industrial Batteries Segment

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What factors are driving the demand for batteries in Europe, and how is the market evolving?

The shift towards electric vehicles (EVs), renewable energy storage, and grid stabilization is fueling growth, along with stringent EU regulations on carbon emissions.

How are government policies and incentives shaping the battery industry in Europe?

The EU Green Deal, battery recycling regulations, and incentives for EV adoption are accelerating investments in battery manufacturing and sustainable energy solutions.

What are the dominant battery technologies in the European market, and which are gaining traction?

Lithium-ion batteries dominate, while solid-state, sodium-ion, and hydrogen-based batteries are emerging as next-gen alternatives for improved performance and sustainability.

Which industries are driving battery demand in Europe apart from electric vehicles?

Renewable energy storage, consumer electronics, industrial automation, and aerospace sectors are increasingly relying on advanced battery technologies for efficiency and sustainability.

Who are the key players in the European battery market, and how are they influencing the industry?

Major players like Northvolt, Saft, BASF, CATL, and LG Energy Solution are leading innovation in battery production, focusing on eco-friendly materials and localized supply chains.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]