Europe Barium carbonate Market Size, Share, Trends & Growth Forecast Report By End-Use (Glass, Brick and Clay, Barium Ferrites, Photographic Paper Coatings, and Others), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Barium carbonate Market Size

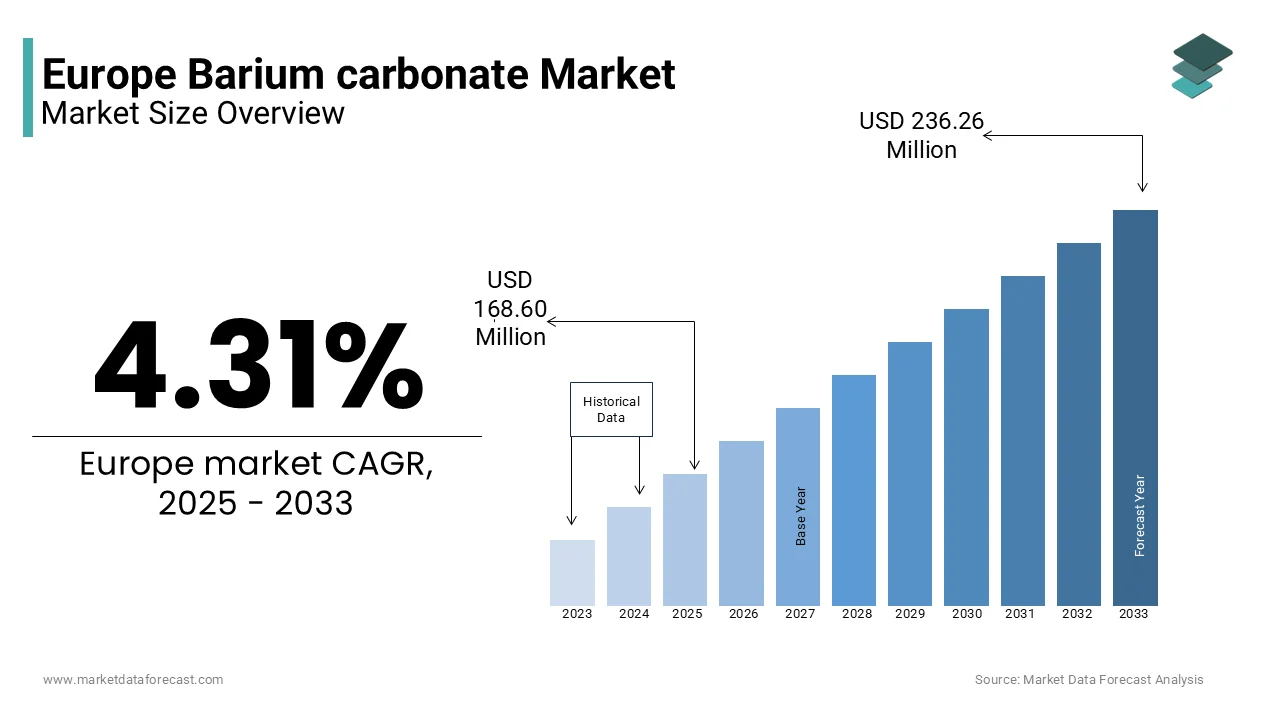

The Europe barium carbonate market size was valued at USD 161.63 million in 2024. The European market is estimated to be worth USD 236.26 million by 2033 from USD 168.60 million in 2025, growing at a CAGR of 4.31% from 2025 to 2033.

Barium carbonate is a white crystalline compound and is primarily used as a raw material for producing optical glass, glazes, and electronic components due to its high density and refractive properties. As per the European Chemical Industry Council, over 70% of barium carbonate is utilized in the glass and ceramics sectors, underscoring its importance in these industries. Additionally, advancements in manufacturing technologies have improved purity levels, reducing impurities by 15%, as highlighted by the German Federal Institute for Materials Research. With increasing emphasis on sustainable practices, such as recycling barium carbonate waste, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern industries.

MARKET DRIVERS

Rising Demand from the Glass Manufacturing Industry in Europe

The rising demand from the glass manufacturing industry that relies heavily on barium carbonate for producing high-quality optical and specialty glasses is one of the major factors driving the European barium carbonate market. According to the European Glass Federation, glass production in Europe reached 35 million tons in 2022, with barium carbonate accounting for over 20% of raw materials used in specialty glass formulations. This trend is particularly evident in Germany, where the automotive and electronics sectors drive demand for optical glass, as reported by the German Federal Ministry of Economic Affairs. For instance, as per a study by the French National Institute for Industrial Research, the adoption of barium carbonate in flat-screen displays and camera lenses has increased by 25% in recent years, driven by the need for high refractive index materials. Additionally, the growing emphasis on lightweight and durable glass products has further amplified demand. By ensuring consistent quality and enhancing optical clarity, barium carbonate has become indispensable for modern glass manufacturing, driving market growth across the continent.

Expansion of Ceramic Applications

The expansion of ceramic applications that require robust materials for glazing and structural reinforcement is further fuelling the growth of the European barium carbonate market. According to the Italian Ceramics Association, ceramic tile production in Europe exceeded 1 billion square meters in 2022, with barium carbonate playing a vital role in improving glaze durability and opacity. This trend is particularly pronounced in countries like Spain and Italy, where the ceramics industry contributes significantly to national GDP, as noted by the Spanish Ministry of Industry. A report by the French National Institute for Materials Science highlights that barium carbonate usage in ceramic glazes grew by 18% in 2022, driven by investments in premium-grade tiles for residential and commercial projects. Additionally, the Swedish Ceramic Institute notes that advancements in barium carbonate formulations have reduced firing temperatures by 10%, enhancing energy efficiency. By addressing the demands of large-scale ceramic projects and ensuring product longevity, barium carbonate is unlocking immense growth potential in this sector.

MARKET RESTRAINTS

High Costs of Raw Material Extraction

High cost associated with raw material extraction that often limits accessibility and affordability is majorly restraining the growth of the European barium carbonate market. According to the German Federal Institute for Geosciences, the average cost of extracting barium carbonate exceeds €200 per ton, creating financial barriers for small-scale producers. This issue is particularly pronounced in Eastern Europe, where over 60% of mining operations face logistical challenges, as reported by the Czech Geological Survey. A study by the Italian National Institute of Statistics reveals that only 35% of surveyed companies in rural areas have adopted advanced extraction technologies, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of barium carbonate. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Stringent Environmental Regulations

Stringent environmental regulations governing the production and use of barium carbonate that create additional compliance burdens for manufacturers is further inhibiting the growth of the European market. According to the European Environment Agency, over 50% of barium carbonate producers face delays in obtaining permits due to emissions and waste management requirements, leading to reduced operational capacity. This issue is compounded by ongoing debates over the use of hazardous materials, as highlighted by the French National Institute for Health and Safety, which reports that improper disposal of barium compounds can pose health risks. Furthermore, a study by the University of Hohenheim demonstrates that inconsistent regulatory frameworks often result in material losses of up to 25%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Growing Adoption in Electronics and Semiconductors

The rising adoption in the electronics and semiconductor industries that require high-purity materials for advanced applications is one of the lucrative opportunities for the European barium carbonate market. According to the European Semiconductor Industry Association, the global semiconductor market grew by 20% in 2022, with Europe contributing approximately €50 billion to this growth. Barium carbonate is increasingly used in capacitors and dielectric materials due to its excellent electrical properties, as noted by the German Federal Institute for Materials Research. For instance, a study by the Dutch Ministry of Economic Affairs highlights that the demand for barium carbonate in electronic components increased by 30% in recent years, driven by the rise of 5G technology and electric vehicles. Additionally, partnerships between academic institutions and private enterprises are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for advanced materials research, including barium carbonate, as noted by the European Commission. By fostering breakthroughs in electronics, the market is poised to unlock immense growth potential.

Increasing Focus on Recycling and Circular Economy

The growing focus on recycling and circular economy practices that aim to reduce waste and enhance resource efficiency is another major opportunity for the regional market. According to the European Environment Agency, over 60% of barium carbonate manufacturers are investing in recycling technologies to recover materials from industrial waste, aligning with the EU’s Green Deal objectives. A study by the Swedish Environmental Protection Agency highlights that the adoption of recycled barium carbonate grew by 25% in 2022, driven by government incentives for sustainable practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Industrial Research. Additionally, advancements in recycling techniques enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

The ongoing supply chain disruptions and material shortages is one of the key challenges to the European barium carbonate market. According to the European Chemical Industry Council, global shortages of key raw materials led to a 15% decline in barium carbonate production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry of Economic Affairs. A study by the Italian National Institute of Statistics highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as barite ore, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Awareness Among Small-Scale Producers

Limited awareness among small-scale producers regarding the benefits and proper usage of advanced barium carbonate formulations are further challenging the growth of the European market. According to the Swedish Board of Agriculture, over 50% of small-scale ceramic and glass manufacturers lack technical knowledge about material selection and application techniques, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Economic Development, which reports that producers aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce the lifespan of advanced barium carbonate by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.31% |

|

Segments Covered |

By End-Use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Athiappa Chemicals (P) Ltd., Chemical Products Corporation, Chemisky Co., Ltd., Hebei Xinji Chemical Group Co., Ltd., Hubei Jingshan Chutian Barium Salt Corp. Ltd., Kamman Group, Nippon Chemical Industrial, Noah Chemicals, Norkem Limited, and others. |

SEGMENTAL ANALYSIS

By End Use Insights

The glass segment stands as the largest consumer of barium carbonate in Europe by accounting for 41.4% of the European market share in 2024. The dominance of glass segment in the European market is driven by barium carbonate’s critical role as a refining agent in glass manufacturing, where it eliminates bubbles and enhances clarity. The European glass market is valued at €30 billion annually by Glass for Europe, heavily relies on high-quality raw materials like barium carbonate to meet stringent standards for flat glass, bottles, and specialty glass products. A study published in the Journal of Non-Crystalline Solids highlights that barium carbonate improves the refractive index of glass, making it indispensable for optical applications such as lenses and display screens. Furthermore, the growing demand for energy-efficient windows is projected to grow by 8% annually through 2030, as per Eurostat, which is fueling the need for barium carbonate in low-emissivity (Low-E) glass coatings. With Europe’s push toward sustainable construction practices under the EU Green Deal, the demand for durable, high-performance glass continues to rise. This positions barium carbonate as a cornerstone material in the region’s glass manufacturing ecosystem.

The barium ferrites segment is emerging as the fastest-growing segment in the Europe barium carbonate market and is projected to register a CAGR of 8.12% over the forecast period owing to their widespread use in permanent magnets and electronic components, particularly in the automotive and renewable energy sectors. According to a report by the International Energy Agency (IEA), electric vehicles (EVs) that rely on barium ferrite magnets for motors and sensors are expected to account for 30% of new car sales in Europe by 2030. Additionally, barium ferrites play a crucial role in wind turbine generators, with WindEurope forecasting a 50% increase in offshore wind capacity by 2025. Their magnetic properties are offering high coercivity and thermal stability that are unmatched, as noted in a study by the Journal of Magnetism and Magnetic Materials. Moreover, the rise of 5G technology and IoT devices has created new opportunities for barium ferrites in electromagnetic shielding and data storage applications. These factors underscore their importance in driving innovation across multiple industries.

REGIONAL ANALYSIS

Germany led the European barium carbonate market by accounting for 25.7% of the European market share in 2024. The leading position of Germany in the European market is driven by the robust industrial base of Germany. According to the German Chemical Industry Association, German industries consume approximately 200,000 tons of barium carbonate annually, reflecting their commitment to precision and quality. The strong regulatory framework and growing investments in the chemical industry are further boosting the German market growth.

France is a promising regional segment for barium carbonate in Europe. The extensive glass and ceramics sectors of France are driving the French market growth. According to Eurostat, France’s industrial output grew by 10% in 2022 due to the government incentives for modernization. A study by INRAE highlights that over 70% of glass projects utilize advanced barium carbonate, underscoring its economic benefits.

Italy is estimated to account for a notable share of the European barium carbonate market over the forecast period owing to its focus on ceramics and glazing applications. According to Coldiretti, Italy’s largest industrial association, barium carbonate is used in over 60% of ceramic tile production, ensuring premium quality service. The Mediterranean climate and rich biodiversity of Italy make it ideal for diverse applications, reinforcing its leadership position.

KEY MARKET PLAYERS

The major key players in Europe barium carbonate market are Athiappa Chemicals (P) Ltd., Chemical Products Corporation, Chemisky Co., Ltd., Hebei Xinji Chemical Group Co., Ltd., Hubei Jingshan Chutian Barium Salt Corp. Ltd., Kamman Group, Nippon Chemical Industrial, Noah Chemicals, Norkem Limited, and Noah Chemicals.

MARKET SEGMENTATION

This research report on the Europe barium carbonate market is segmented and sub-segmented into the following categories.

By End-Use

- Glass

- Brick and Clay

- Barium Ferrites

- Photographic Paper Coatings

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the market size of the European Barium Carbonate market in 2024?

The European Barium Carbonate market size was valued at USD 543.05 million in 2024.

2. What is the expected growth rate for the European Barium Carbonate market from 2025 to 2033?

The market is expected to grow at a compound annual growth rate (CAGR) of 4.63% during this period.

3. What factors are driving the growth of the European Barium Carbonate market?

Key drivers include increasing demand from various industries such as ceramics, glass manufacturing, and construction, as well as advancements in production technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]