Europe Ball Bearing Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Deep-Groove Ball Bearings, Self-Aligning Ball Bearings, Angular Contact Ball Bearings, Thrust Ball Bearings, and Others), Distribution Channel (Automotive, Electronics, Aerospace & Defense, Constructions, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Ball Bearing Market Size

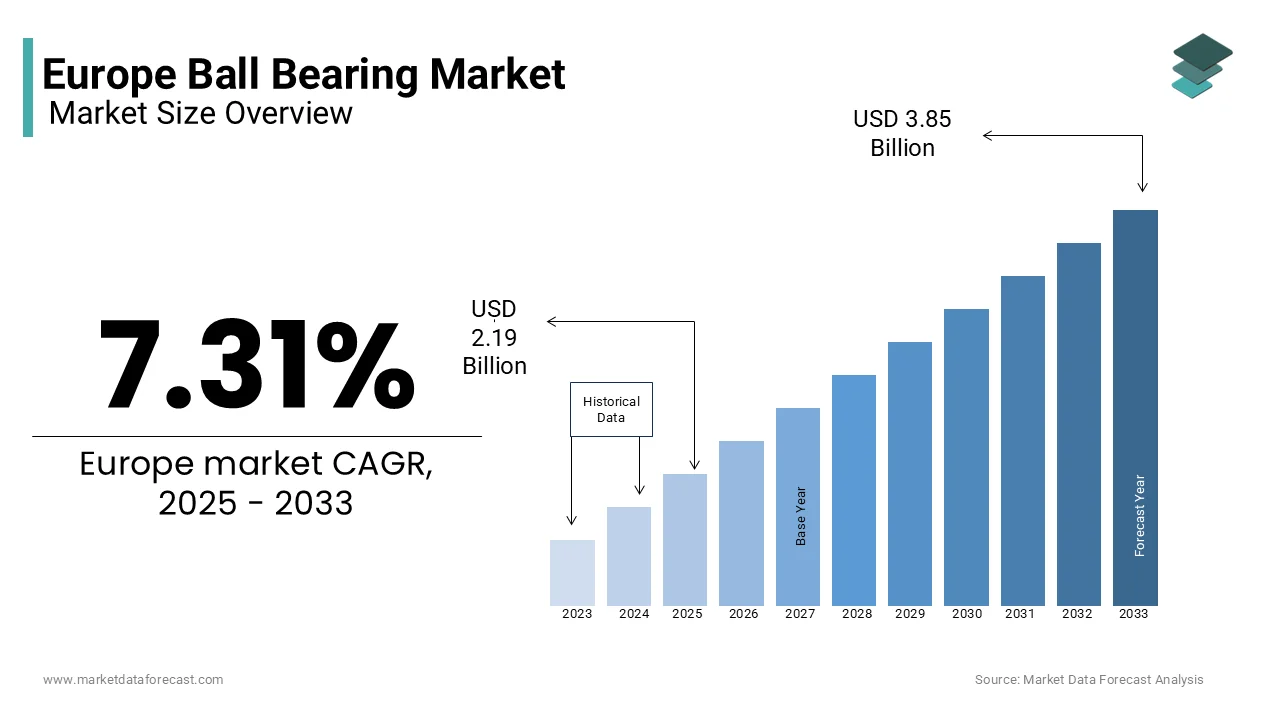

The Europe ball bearing market was valued at USD 2.04 billion in 2024. The European market is estimated to reach USD 3.85 billion by 2033 from USD 2.19 billion in 2025, rising at a CAGR of 7.31% from 2025 to 2033.

Ball bearings are precision-engineered components that facilitate efficient energy transfer and load distribution across a wide range of applications, including automotive manufacturing, aerospace, renewable energy systems, and industrial machinery. Germany, France, and Italy dominate the European ball bearing market. As per the German Mechanical Engineering Industry, Germany alone contributes 30% of demand for ball bearings in Europe due to its leadership in high-precision engineering and electric vehicle (EV) manufacturing. Furthermore, the growing adoption of EVs and wind turbines has spurred demand for specialized bearings capable of withstanding high-speed operations and extreme conditions. A report by the European Automobile Manufacturers' Association reveals that EV production in Europe grew by 25% in 2022, which is directly impacting the demand for lightweight and durable ball bearings.

MARKET DRIVERS

Rising Demand from the Automotive Sector in Europe

The automotive industry is a major driver of the Europe ball bearing market, with increasing production of electric vehicles (EVs) and traditional automobiles fueling demand. According to the European Automobile Manufacturers' Association, EV registrations in Europe surged by 65% in 2022, reaching over 2.3 million units. This growth has significantly increased the need for specialized ball bearings that can withstand high-speed operations and reduce energy losses in EV motors. As per the German Mechanical Engineering Industry Association, lightweight and durable bearings are critical for enhancing EV efficiency, with each vehicle requiring approximately 100-150 precision bearings. Furthermore, stringent EU regulations mandating reduced carbon emissions have accelerated the shift toward energy-efficient components. As automakers strive to meet these standards, the demand for advanced ball bearings is expected to grow.

Expansion of Renewable Energy Infrastructure

The expansion of renewable energy infrastructure, particularly wind energy, is another key driver of the Europe ball bearing market. According to the reports of the European Wind Energy Association, wind power capacity in Europe grew by 18% in 2022, with over 16 GW of new installations. Wind turbines rely heavily on large-sized ball bearings for rotor shafts, gearboxes, and generator systems, which must endure extreme conditions and high rotational speeds. As per the Swedish Energy Agency, each modern wind turbine requires up to 50 high-performance bearings, which is driving demand for durable and corrosion-resistant variants. Additionally, the Green Deal of the European Commission aims to achieve 40% renewable energy usage by 2030, which is further boosting investments in wind and solar projects. This focus on clean energy is propelling innovations in bearing technology, ensuring their compatibility with evolving renewable energy systems and sustaining market growth across the region.

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages have emerged as significant restraints for the Europe ball bearing market. As per the European Commission, the industry relies heavily on imported steel and rare earth metals, with over 70% of critical materials sourced from non-EU countries. Geopolitical tensions and trade restrictions have exacerbated these challenges, which is leading to price volatility. For instance, the cost of chromium and molybdenum, essential for high-performance bearings, increased by 25-30% in 2022, according to the European Association of Metals. These fluctuations have raised production costs, impacting manufacturers' profit margins. Additionally, logistical bottlenecks caused by global events, such as the pandemic, delayed shipments by an average of 4-6 weeks, as reported by Eurostat. Such disruptions hinder timely delivery, affecting industries reliant on just-in-time manufacturing processes, thereby constraining market growth.

High Costs of Advanced Bearing Technologies

The high costs associated with developing and adopting advanced bearing technologies pose another major restraint for the Europe ball bearing market. According to the French National Institute for Industrial Property, investments in research and development for innovations like ceramic and hybrid bearings can exceed €10 million per project, which is limiting accessibility for smaller manufacturers. Furthermore, as per the reports of the German Mechanical Engineering Industry Association, advanced bearings are priced 30-50% higher than conventional variants, which is making them less affordable for small and medium enterprises (SMEs). This cost barrier is particularly evident in sectors like renewable energy, where specialized bearings are crucial but often unattainable due to budget constraints. The European Investment Bank emphasizes that while subsidies exist, they are insufficient to bridge the financial gap for widespread adoption. Consequently, the inability to afford cutting-edge solutions slows technological advancements and restricts market expansion across Europe.

MARKET OPPORTUNITIES

Growth in Industrial Automation and Smart Manufacturing

The rise of industrial automation and smart manufacturing presents a significant opportunity for the Europe ball bearing market. As per the European Commission, the industrial automation sector in Europe is growing promisingly due to the Industry 4.0 initiatives. High-precision ball bearings are integral to robotics, conveyor systems, and automated machinery, with each robotic arm requiring approximately 20-30 specialized bearings. According to the German Mechanical Engineering Industry Association, more than 60% of EU-based manufacturers are investing in automation technologies to enhance productivity and reduce labor costs. Additionally, the French Directorate General for Enterprise emphasizes that the adoption of IoT-enabled machinery has increased demand for low-friction, energy-efficient bearings. As Europe aims to lead in smart manufacturing, the need for advanced ball bearings will surge, creating lucrative opportunities for manufacturers to innovate and cater to this rapidly expanding segment.

Expansion into Emerging Markets within Europe

The expansion into emerging markets within Europe offers another promising opportunity for the ball bearing industry. As per the reports of the European Investment Bank, Central and Eastern European countries, such as Poland, Hungary, and Romania, are witnessing rapid industrial growth, with manufacturing output increasing by 15% annually since 2020. These regions are becoming hubs for automotive and machinery production and driving demand for cost-effective yet durable ball bearings. As per the Polish Development Fund, investments in industrial infrastructure exceeded €20 billion in 2022 and creating a favorable environment for bearing suppliers. Furthermore, as per the Czech Ministry of Industry and Trade, SMEs in these regions are increasingly adopting advanced machinery, which is boosting the need for reliable components. By tapping into these underserved markets, European ball bearing manufacturers can diversify their revenue streams and strengthen their foothold across the continent.

MARKET CHALLENGES

Intense Competition from Low-Cost Imports

Intense competition from low-cost imports poses a significant challenge to the Europe ball bearing market. As per the reports of the European Commission, imports from countries like China and India account for over 40% of the total bearing supply in Europe, with prices often 20-30% lower than domestically produced alternatives. These imports, while cost-effective, sometimes compromise on quality and durability, which is creating pricing pressure on local manufacturers. According to the German Mechanical Engineering Industry Association, European manufacturers face an annual revenue loss of approximately €1.5 billion due to this competition. Additionally, as per the data of the Eurostat, import volumes surged by 15% in 2022, exacerbated by weaker trade barriers and currency fluctuations. This influx undermines the competitiveness of high-quality European bearings, forcing manufacturers to either lower margins or invest heavily in differentiation strategies to maintain market share.

Stringent Environmental Regulations and Compliance Costs

Stringent environmental regulations and the associated compliance costs present another major challenge for the Europe ball bearing market. The European Environment Agency mandates that manufacturers adhere to strict emissions and waste management standards, which require significant investments in sustainable production technologies. As per the French National Institute for Industrial Property, upgrading facilities to meet these standards can cost manufacturers between €5 million to €10 million per plant, straining financial resources. Furthermore, the Swedish Environmental Protection Agency emphasizes that non-compliance can result in fines exceeding €1 million, deterring smaller players from entering the market. These regulations, while essential for reducing the industry’s carbon footprint, increase operational costs and slow down innovation cycles. As a result, many manufacturers struggle to balance profitability with sustainability, hindering overall market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.31% |

|

Segments Covered |

By Type, Distribution Channel, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

NSK Ltd. (Japan), Nachi Fujikoshi Corp (Japan), Myonic GmbH (Germany), LYC Bearing Corporation (China), Luoyang Huigong Bearing Technology Co. Ltd. (China), ISB Industries (Italy), NTN Bearing Corporation (U.S.), SKF (Sweden), The Timken Company (U.S.), TBH Bearings (China), and Alchemy Immersive (U.S.). |

SEGMENTAL ANALYSIS

By Type Insights

The deep-groove ball bearings segment led the market by accounting for 36.8% of the European market share in 2024. The versatility of deep-groove ball bearings in handling both radial and axial loads makes them indispensable in automotive, industrial machinery, and renewable energy sectors is majorly contributing to the domination of the segment in the European market. As per the German Mechanical Engineering Industry Association, over 60% of electric vehicles rely on these bearings due to their high-speed efficiency and durability. Additionally, their cost-effectiveness and ease of maintenance further boost adoption. With applications ranging from wind turbines to household appliances, deep-groove ball bearings are critical for achieving energy efficiency and operational reliability.

The angular contact ball bearings segment is another notable segment and is expected to grow at a CAGR of 7.8% over the forecast period owing to the rising demand in precision industries like aerospace, robotics, and renewable energy. According to the UK Manufacturing Technologies Association, robotic joints and aircraft landing gear systems require 15-20 high-precision units per application, which is fueling adoption. The ability of angular contact ball bearings to handle combined loads at high speeds makes them ideal for advanced machinery. As Europe accelerates automation and sustainability initiatives, angular contact ball bearings are pivotal in enabling innovation and performance.

By Distribution Channel Insights

The automotive segment captured 35.5% of the European market share in 2024. Ball bearings are essential for vehicle components like wheel hubs and transmissions, with each car requiring 100-150 units. For instance, as per the German Mechanical Engineering Industry Association, shift toward electric vehicles (EVs) has further driven demand, as EVs rely on high-performance bearings to enhance efficiency. With over 2.3 million EVs registered in Europe in 2022, this trend amplifies the sector's dominance. The automotive industry’s reliance on durable, energy-efficient bearings underscores its leadership.

The aerospace & defense segment is predicted to grow at a promising CAGR of 8.5% over the forecast period. Ball bearings are vital for aircraft landing gear, jet engines, and satellites, with each commercial aircraft requiring over 500 specialized units. Rising investments in space exploration and defense technologies, alongside Europe’s focus on reducing reliance on non-EU suppliers, fuel this growth. The French National Institute for Industrial Property notes that innovations like urban air mobility (e.g., drones and air taxis) further boost demand. This segment’s rapid expansion highlights its importance in advancing cutting-edge technologies and strengthening Europe’s position in high-value industries.

KEY MARKET PLAYERS

The major players in the Europen ball bearing market include NSK Ltd. (Japan), Nachi Fujikoshi Corp (Japan), Myonic GmbH (Germany), LYC Bearing Corporation (China), Luoyang Huigong Bearing Technology Co. Ltd. (China), ISB Industries (Italy), NTN Bearing Corporation (U.S.), SKF (Sweden), The Timken Company (U.S.), TBH Bearings (China), and Alchemy Immersive (U.S.).

REGIONAL ANALYSIS

Germany dominated the ball bearing market in Europe by accounting for 30.2% of the European market share in 2024. The domination of Germany in the European market is majorly fuelled by its status as a global hub for automotive and industrial machinery manufacturing, with over 40% of EU bearings used in German-engineered products. The emphasis of Germany on precision engineering and innovation, coupled with government incentives for electric vehicle production, drives demand. According to the Federal Ministry for Economic Affairs, the advanced R&D ecosystem and localized supply chains of Germany ensure high-quality bearing production.

France is another notable market for ball bearings in Europe. The growth of the French market is majorly driven by the France’s aerospace and defense sectors, which are among the largest in Europe. As per the French National Institute for Industrial Property, France is the continent’s second-largest aerospace manufacturer, requiring specialized bearings for aircraft landing gear, jet engines, and satellites. Investments in renewable energy systems and smart manufacturing further boost demand. The French Directorate General for Enterprise emphasizes that the country’s focus on sustainability and technological advancements has positioned ball bearings as critical components in achieving energy-efficient solutions. This strong alignment with high-value industries ensures France remains a key contributor to the regional market’s growth.

Italy is likely to account for a prominent share of the European market over the forecast period owing to its robust automotive and industrial machinery sectors. According to the Italian Ministry of Economic Development, luxury automotive industry of Italy demands high-performance bearings, while its industrial automation initiatives increase adoption in manufacturing. Italy’s strategic investments in renewable energy projects, such as wind turbines, also create opportunities for specialized bearing applications. The Italian Association of Industrial Machinery Manufacturers notes that the country’s focus on quality and innovation strengthens its position in the European market. By catering to both traditional and emerging industries, Italy plays a pivotal role in shaping the future of the ball bearing market in Europe.

MARKET SEGMENTATION

This research report on the European ball bearing market is segmented and sub-segmented into the following categories.

By Type

- Deep-Groove Ball Bearings

- Self-Aligning Ball Bearings

- Angular Contact Ball Bearings

- Thrust Ball Bearings

- Others

By Distribution Channel

- Automotive

- Electronics

- Aerospace & Defense

- Constructions

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the Europe ball bearing market?

The market is driven by increasing demand from the automotive, aerospace, and industrial machinery sectors. Growth in automation, rising production of electric vehicles, and advancements in bearing technology are also contributing factors.

Which industries are the largest consumers of ball bearings in Europe?

The major industries using ball bearings in Europe include automotive, aerospace, industrial machinery, medical devices, and construction equipment manufacturing.

How is the growth of automation influencing the ball bearing market in Europe?

The rise of automation in manufacturing and robotics has increased the need for high-speed, low-friction ball bearings to enhance operational efficiency and reduce downtime.

What role does research and development play in the European ball bearing market?

R&D efforts focus on improving bearing durability, reducing friction, enhancing material strength, and developing smart bearings with embedded sensors for predictive maintenance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]