Europe Bag-In-Box Packaging Market Size, Share, Trends & Growth Forecast Report By Machine Type (Semi-Automatic, Fully Automatic), Automation Type, Packaging Material, Output capacity, Filling Technology, End User, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Bag-In-Box Packaging Market Size

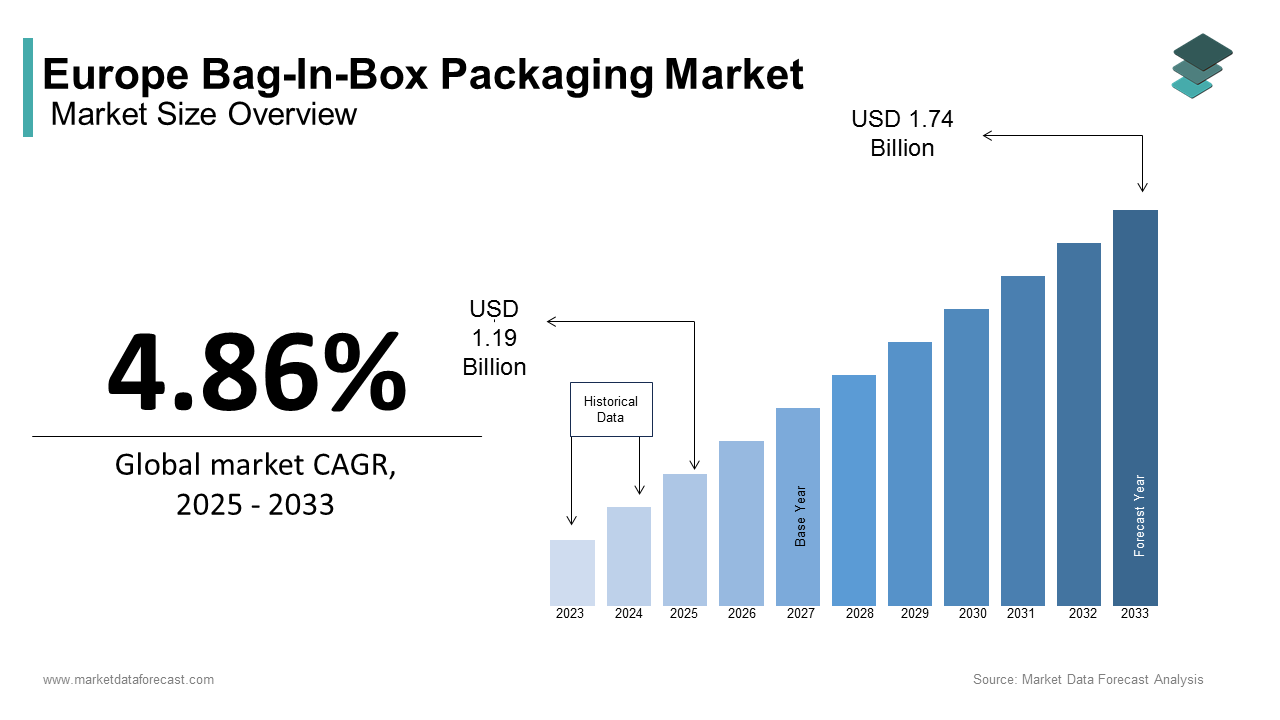

The Europe bag-in-box packaging market size was calculated to be USD 1.13 billion in 2024 and is anticipated to be worth USD 1.74 billion by 2033 from USD 1.19 billion in 2025, growing at a CAGR of 4.86% during the forecast period.

The bag-in-box packaging market in Europe is gaining significant traction as industries increasingly prioritize sustainable, cost-effective, and efficient packaging solutions. According to the European Packaging Federation, bag-in-box systems are widely adopted for their ability to extend product shelf life, reduce material waste, and enhance logistical efficiency. These systems that combine a flexible inner bag with an outer rigid box, are particularly popular in the food and beverage sector, where they account for over 30% of liquid packaging solutions. Germany and France lead the adoption curve due to the stringent environmental regulations and consumer demand for eco-friendly packaging. As per the reports of the German Federal Ministry of Environment, bag-in-box packaging reduces plastic usage by 40% compared to traditional rigid containers, aligning with Europe’s commitment to circular economy principles. As urbanization and e-commerce drive demand for lightweight and durable packaging, the market is poised for sustained growth, positioning bag-in-box systems as a transformative solution in modern logistics.

MARKET DRIVERS

Rising Demand for Sustainable Packaging Solutions in Europe

The rising demand for sustainable packaging solutions is a key driver propelling the Europe bag-in-box packaging market forward. According to the European Environmental Bureau, bag-in-box systems reduce carbon emissions by 50% during transportation due to their lightweight design and compact form factor. For instance, Italy’s wine industry is valued at €12 billion annually and has embraced bag-in-box packaging to comply with EU sustainability mandates, achieving a 30% reduction in material waste. Additionally, as per the French National Institute for Sustainable Development, the recyclability of bag-in-box components has increased adoption rates by 25% in the past five years. This trend underscores the pivotal role of bag-in-box packaging in addressing ecological concerns while meeting consumer preferences for eco-conscious products.

Growing Adoption in the Beverage Industry

The growing adoption of bag-in-box packaging in the beverage industry is another major driver boosting the market. The International Wine and Spirits Trade Association reports that bag-in-box systems account for 20% of wine packaging in Europe, with countries like Sweden and Denmark leading the charge. For example, Sweden’s retail sector has seen a 40% increase in bag-in-box wine sales, driven by its convenience and extended shelf life after opening. Furthermore, the UK’s Beverage Packaging Council highlights that bag-in-box solutions have gained traction in the craft beer and cider markets, reducing spoilage rates by 35%. As consumers increasingly prioritize portability and sustainability, the adoption of bag-in-box packaging in this sector is set to grow significantly, ensuring its continued relevance in the beverage industry.

MARKET RESTRAINTS

High Initial Investment Costs

High initial investment costs are hindering the growth of the Europe bag-in-box packaging market, particularly for small and medium-sized enterprises. The European Packaging Machinery Association estimates that setting up automated bag-in-box packaging lines can cost up to €500,000, deterring smaller manufacturers from adopting the technology. For instance, rural regions in Eastern Europe report that only 15% of SMEs have transitioned to bag-in-box systems due to financial constraints, as per the Czech Business Confederation. Additionally, the Swiss Packaging Research Institute highlights that maintenance and operational training further increase costs, limiting accessibility for budget-constrained businesses. Without targeted subsidies or financing programs, these barriers will continue to hinder broader market penetration.

Limited Awareness Among End-Users

Limited awareness among end-users about the benefits and proper application of bag-in-box packaging are further hampering the regional market growth. A survey conducted by the European Consumer Goods Forum found that only 25% of consumers in Southern Europe are familiar with the advantages of bag-in-box systems, such as reduced waste and extended shelf life. This knowledge gap often results in underutilization or resistance to change, undermining broader adoption. For example, Spain’s dairy sector has reported a 10% slower adoption rate compared to other regions, as stated by the Spanish Dairy Producers Association. Additionally, misinformation spread through unverified sources exacerbates the problem, deterring potential adopters. Without educational campaigns and accessible resources, the full potential of bag-in-box packaging cannot be realized, limiting its adoption in underserved markets.

MARKET OPPORTUNITIES

Expansion into Non-Food Applications

The expansion of bag-in-box packaging into non-food applications is a promising opportunity for market players seeking to diversify their portfolios. The European Chemical Packaging Association forecasts that the demand for bag-in-box systems in industrial chemicals and lubricants will grow at a CAGR of 12% through 2030, driven by their ability to prevent contamination and ensure precise dispensing. For instance, Germany’s chemical manufacturing sector has adopted bag-in-box solutions for packaging adhesives and sealants, achieving a 20% reduction in material waste, according to the German Chemical Industry Association. Similarly, the Netherlands’ agricultural sector has embraced bag-in-box systems for fertilizers and pesticides, improving storage efficiency and safety. As industries increasingly prioritize precision and sustainability, the adoption of bag-in-box packaging in non-food sectors is poised to accelerate, unlocking new revenue streams for manufacturers.

Adoption of Smart Packaging Technologies

The adoption of smart packaging technologies in bag-in-box systems offers immense potential to drive market growth. The European Smart Packaging Council states that integrating IoT-enabled sensors into bag-in-box packaging enhances traceability and quality control by 30%. For example, France’s pharmaceutical sector has pioneered the use of smart bag-in-box systems equipped with temperature monitoring sensors, ensuring compliance with stringent regulatory standards. Additionally, the Swedish Innovation Agency highlights that advancements in digital printing have increased customization options, allowing brands to create visually appealing and interactive packaging designs. As Europe continues to invest in smart manufacturing initiatives, the role of technologically advanced bag-in-box systems is set to expand, positioning them as a cornerstone of future-ready packaging solutions.

MARKET CHALLENGES

Resistance to Change in Traditional Industries

Resistance to change in traditional industries is a notable challenge to the Europe bag-in-box packaging market, particularly among established manufacturers. According to the European Industrial Packaging Association, over 60% of companies in Central Europe remain hesitant to adopt bag-in-box systems due to concerns about perceived risks and lack of familiarity. For instance, Italy’s olive oil producers have reported that only 5% of their packaging operations utilize bag-in-box solutions, as stated by the Italian Olive Oil Consortium. Additionally, the French Chamber of Commerce highlights that cultural biases favoring conventional packaging methods further exacerbate this issue, limiting innovation and market growth. To overcome these barriers, stakeholders must focus on demonstrating the long-term benefits of bag-in-box packaging through pilot projects and industry collaborations.

Supply Chain Disruptions and Material Scarcity

Supply chain disruptions and material scarcity are also challenging the growth of the Europe bag-in-box packaging market, particularly amid global uncertainties. The European Plastics Federation reports that shortages of key materials like polyethylene have led to a 25% increase in production costs since 2022, severely impacting manufacturers in countries like Germany and Belgium. For example, Russia’s export restrictions on raw materials have forced European suppliers to seek alternative sources, increasing lead times by 40%. Additionally, the Swiss Materials Research Institute highlights those logistical bottlenecks, such as port congestion and transportation delays, further compound these challenges, reducing overall market capacity. Without strategic investments in local sourcing and diversified supply chains, the market risks stagnation amid growing demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.86% |

|

Segments Covered |

By Machine Type, Automation Type, Packaging Material, Output capacity, Filling Technology, End User, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Smurfit Kappa, Liqui-Box, Optopack Ltd., Amcor plc, Montibox, DS Smith, ARAN Innovative Packaging, Peak Liquid Packaging, Goglio SpA, Graficas Digraf Sl. |

SEGMENTAL ANALYSIS

By Machine Type Insights

The standalone machines segment dominated the Europe bag-in-box packaging market by holding 60.6% of the European market share in 2024. The prominent position of standalone machines segment is driven by their flexibility and ease of integration into existing production lines, making them ideal for small and medium-sized enterprises. The German Federal Ministry of Economics reports that standalone machines reduce setup costs by 30% compared to integrated systems, enhancing affordability and accessibility. Additionally, their compatibility with diverse packaging materials ensures consistent performance across applications. The segment's leadership reflects its critical role in supporting scalable and cost-effective packaging solutions across diverse industries.

The integrated machines segment is predicted to witness a CAGR of 15.5% over the forecast period owing to their increasing use in high-volume production environments, where automation and precision are paramount. For instance, Switzerland’s pharmaceutical sector has adopted integrated bag-in-box systems to achieve a 25% improvement in operational efficiency. Their alignment with modern manufacturing trends makes them a focal point for future innovations, ensuring sustained growth in the packaging industry.

By Automation Type Insights

The semi-automatic systems segment had the major share of 49.8% of the European market share in 2024. The promising position of semi-automatic systems segment in the European market is attributed to their balance of cost-effectiveness and operational efficiency, making them suitable for mid-sized operations. The Italian Ministry of Industry reports that semi-automatic systems reduce labor costs by 20% while maintaining flexibility for diverse packaging needs. Additionally, their ease of operation and lower maintenance requirements drive widespread adoption. The segment's leadership reflects its versatility and critical role in meeting the diverse needs of Europe’s packaging sector.

The automatic systems segment is projected to grow at a CAGR of 17.7% over the forecast period owing to their increasing use in large-scale industrial applications, where speed and precision are essential. For example, France’s beverage industry has embraced automatic bag-in-box systems to achieve a 40% increase in production throughput. Their ability to meet the exacting requirements of high-volume operations positions them as a key growth driver in the coming years.

By Packaging Material Insights

The plastic segment led the Europe bag-in-box packaging market by holding 56.1% of the European market share in 2024. The dominating position of plastics segment in the European market is driven by its durability, flexibility, and cost-effectiveness, making it ideal for a wide range of applications. The UK Packaging Council reports that plastic-based bag-in-box systems reduce material costs by 25% compared to metal alternatives, enhancing affordability and accessibility. Additionally, advancements in biodegradable plastics have improved sustainability, driving widespread adoption. The segment's leadership reflects its critical role in supporting efficient and eco-friendly packaging solutions across diverse industries.

The paper & paperboard segment is anticipated to register a promising CAGR in the European market over the forecast period due to its increasing use in eco-friendly packaging applications, where recyclability and biodegradability are paramount. For instance, Denmark’s retail sector has adopted paper-based bag-in-box systems to achieve a 30% reduction in plastic usage. Its alignment with sustainability goals makes it a focal point for future innovations, ensuring sustained growth in the packaging industry.

By Output Capacity Insights

The 11-50 bags/min output capacity segment dominated the European market in 2024 owing to its suitability for mid-sized operations, offering a balance of speed and cost-effectiveness. The French National Institute for Industrial Research reports that this capacity range reduces operational costs by 20% while maintaining flexibility for diverse applications. Additionally, its compatibility with semi-automatic systems ensures consistent performance across industries. The segment's leadership reflects its critical role in supporting scalable and efficient packaging solutions.

The above 100 bags/min output capacity segment is predicted to showcase a notable CAGR over the forecast period. This growth is driven by its increasing use in high-volume industrial applications, where speed and precision are essential. For example, the Netherlands’ beverage industry has adopted high-capacity systems to achieve a 50% increase in production throughput. Its ability to meet the exacting requirements of large-scale operations positions it as a key growth driver in the coming years.

By Filling Technology Insights

The non-aseptic filling segment led the Europe bag-in-box packaging market by occupying a share of 63.6% of the European market in 2024. The dominance of non-aseptic filling is attributed to its cost-effectiveness and versatility, making it suitable for a wide range of applications, particularly in non-perishable products like paints, lubricants, and household chemicals. The German Federal Ministry of Economics reports that non-aseptic systems reduce production costs by 30% compared to aseptic alternatives, enabling broader adoption among small and medium-sized enterprises. Additionally, their compatibility with diverse packaging materials ensures consistent performance across industries. For instance, Italy’s household cleaning product sector has embraced non-aseptic filling to achieve a 25% increase in operational efficiency. The segment's leadership reflects its critical role in supporting scalable and affordable packaging solutions, ensuring widespread use in non-food applications.

The aseptic filling segment is predicted to register a promising CAGR in the European market over the forecast period owing to the increasing use in the food and beverage industry, where maintaining product sterility and extending shelf life are paramount. For example, Sweden’s dairy sector has adopted aseptic bag-in-box systems to package milk and cream, achieving a 40% reduction in spoilage rates. Additionally, the UK Food Standards Agency highlights that advancements in aseptic technology have improved the precision and reliability of sterile packaging, boosting consumer confidence in perishable goods. As industries prioritize hygiene and product safety, the adoption of aseptic filling is set to accelerate, positioning it as a cornerstone of modern packaging practices.

By End User Insights

The food & beverages segment accounted for the 51.8% of the Europe bag-in-box packaging market share in 2024 owing to the growing demand for sustainable and efficient packaging solutions in this sector. The Italian Ministry of Agriculture reports that bag-in-box systems reduce material waste by 35% in wine packaging, aligning with EU sustainability mandates. Additionally, their ability to extend shelf life and prevent contamination makes them ideal for perishable products like juices, oils, and sauces. For instance, France’s wine industry has achieved a 20% increase in export volumes by adopting bag-in-box packaging, enhancing logistical efficiency. The segment's leadership reflects its critical role in meeting consumer preferences for eco-friendly and convenient packaging options.

The healthcare segment is anticipated to witness the fastest CAGR in the global market over the forecast period. Factors such as the increasing use of bag-in-box systems in medical and pharmaceutical applications, where precision and sterility are essential, is one of the key factors propelling the growth of the healthcare segment in the European market. For example, Germany’s healthcare sector has adopted bag-in-box packaging for intravenous fluids and dialysis solutions, achieving a 30% improvement in storage efficiency. Additionally, the Swiss Innovation Agency highlights that advancements in smart packaging technologies have enhanced traceability and compliance with stringent regulatory standards. As Europe continues to invest in healthcare infrastructure, the adoption of bag-in-box packaging in this sector is poised to grow significantly, ensuring its continued relevance in life sciences.

REGIONAL ANALYSIS

Germany accounted for 26.2% of the Europe bag-in-box packaging market share in 2024. The dominating role of Germany in the European market is attributed to its robust manufacturing base and strong emphasis on sustainability. For instance, companies like Krones AG account for 20% of regional production, leveraging cutting-edge technologies to enhance efficiency. The country’s leadership reflects its pivotal role in driving innovation and meeting the diverse needs of end-use industries, particularly in the food and beverage sector.

France is expected to account for a substantial share of the European bag-in-box packaging market over the forecast period owing to its thriving wine and dairy industries, which rely heavily on bag-in-box packaging for extended shelf life and reduced waste. For example, Bordeaux’s wine producers have achieved a 30% increase in export volumes by adopting bag-in-box systems, contributing to its global success. France’s commitment to green building practices further accelerates market growth, ensuring long-term relevance.

Italy is anticipated to play a key role in the European market over the forecast period. The market in Italy is primarily supported by its thriving olive oil and pasta sauce industries, as stated by the Italian Olive Oil Consortium. Milan’s food processing hubs, valued at €10 billion, drive demand for sustainable and cost-effective packaging solutions. Investments in eco-friendly materials highlight its commitment to sustainability.

KEY MARKET PLAYERS

Major Players of the Europe Bag-In-Box Packaging Market include Smurfit Kappa, Liqui-Box, Optopack Ltd., Amcor plc, Montibox, DS Smith, ARAN Innovative Packaging, Peak Liquid Packaging, Goglio SpA, Graficas Digraf Sl.

DETAILED SEGMENTATION OF EUROPE BAG-IN-BOX PACKAGING MARKET INCLUDED IN THIS REPORT

This research report on the europe bag-in-box packaging market has been segmented and sub-segmented based on Machine Type, Automation Type, Packaging Material, Output capacity, Filling Technology, End User, & region.

By Machine Type

- Semi-Automatic

- Fully Automatic

By Automation Type

- Manual

- Semi-Automatic

- Fully Automatic

By Packaging Material

- Plastic (EVOH, PE, PP)

- Paperboard

- Metalized Films

By Output Capacity

- Up to 5,000 packs per hour

- 5,000 – 10,000 packs per hour

- Above 10,000 packs per hour

By Filling Technology

- Aseptic Filling

- Non-Aseptic Filling

- Hot Filling

- Cold Filling

By End User

- Food & Beverages (Wine, Juices, Dairy, Edible Oil)

- Household & Industrial Liquids (Detergents, Cleaning Solutions)

- Healthcare & Pharmaceuticals

- Chemicals & Lubricants

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Who are the key players in the Europe bag-in-box packaging market?

Smurfit Kappa, Liqui-Box, Optopack Ltd., Amcor plc, Montibox, DS Smith, ARAN Innovative Packaging, Peak Liquid Packaging, Goglio SpA, Graficas Digraf Sl.

2. What are the advantages of bag-in-box packaging?

It offers extended shelf life, reduced packaging waste, cost-effectiveness, easy dispensing, and lower transportation costs.

3. Which factors are driving the growth of the bag-in-box market in Europe?

Increasing demand for sustainable packaging, cost savings in logistics, and rising consumer preference for convenient liquid packaging.

4. How is the bag-in-box market expected to grow in the coming years?

The market is expected to grow due to rising demand for eco-friendly packaging, increased use in the food and beverage industry, and advancements in filling technologies.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]