Europe Automotive Tire Market Size, Share, Trends & Growth Forecast Report – Segmented By Rim Size, Season, Propulsion Type, Vehicle Type, Distribution Channel, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Automotive Tire Market Size

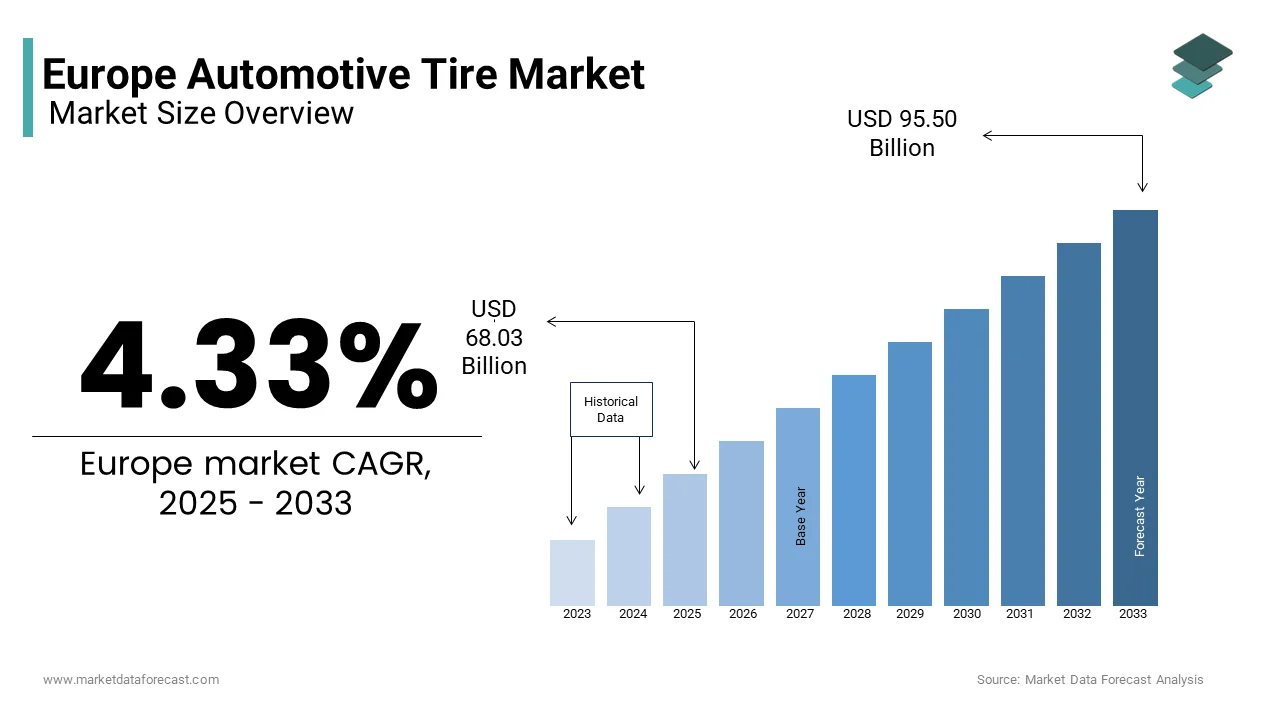

Europe's automotive tire market size was valued at USD 65.21 billion in 2024 and is anticipated to reach USD 68.03 billion in 2025 from USD 95.50 billion by 2033, growing at a CAGR of 4.33% during the forecast period from 2025 to 2033.

The European automotive tire market has registered significant growth in the last few years owing to the stringent environmental regulations and advancements in tire technology. The market is witnessing a pronounced shift towards eco-friendly solutions, including low rolling resistance tires and those made from sustainable materials, aligning with the European Union’s Green Deal objectives. Furthermore, the rise in electric vehicle (EV) adoption across Europe has significantly influenced the demand for specialized tires that cater to EV-specific requirements, such as enhanced load-bearing capacity and reduced noise emissions. A study by the European Tyre and Rubber Manufacturers' Association highlights that approximately 20% of new tire sales in Western Europe are now linked to EVs, underscoring the transformative impact of electrification on the industry. Additionally, key players like Michelin, Continental AG, and Bridgestone dominate the landscape, leveraging cutting-edge research and development to maintain their competitive edge.

MARKET DRIVERS

Surge in Electric Vehicle Adoption

The rapid adoption of electric vehicles (EVs) is a key driver propelling the Europe automotive tire market. EVs require specialized tires designed to handle higher torque, increased vehicle weight due to batteries, and reduced noise levels for enhanced ride comfort. According to the European Automobile Manufacturers' Association, EV registrations in Europe surged by 65% in 2022, reaching over 2.3 million units. This exponential growth has created a pressing demand for EV-compatible tires, prompting manufacturers to invest heavily in research and development. Continental AG, for instance, revealed that nearly 30% of its recent innovations are focused on developing tires tailored for electric mobility. Furthermore, the International Energy Agency highlights that Europe accounts for 43% of global EV sales, underscoring the region's pivotal role in shaping the future of the tire industry. As EV adoption continues to rise, the demand for advanced tire solutions is expected to grow in tandem.

Stringent Environmental Regulations

Stringent environmental regulations in Europe are another major factor driving innovation and growth in the automotive tire market. The European Union’s Green Deal and tire labeling regulations mandate that tires meet specific energy efficiency and rolling resistance standards to minimize carbon emissions. A report by the European Commission states that low rolling resistance tires can reduce fuel consumption by up to 7%, leading to a significant decrease in CO2 emissions. Additionally, governments across Europe are promoting the use of sustainable materials in tire production. France’s Environment and Energy Management Agency emphasizes that adopting eco-friendly tire technologies could cut annual greenhouse gas emissions by approximately 4 million tons. These regulatory frameworks are compelling manufacturers to innovate while ensuring compliance with sustainability goals. As a result, the market is witnessing a shift towards greener practices, further boosting its expansion.

MARKET RESTRAINTS

Rising Raw Material Costs

One of the significant restraints affecting the Europe automotive tire market is the volatility in raw material prices, particularly natural rubber and synthetic rubber, which are critical components in tire manufacturing. According to the European Tyre and Rubber Manufacturers' Association, fluctuations in natural rubber prices have surged by over 25% in the past two years due to supply chain disruptions and geopolitical tensions. Additionally, the International Rubber Study Group highlights that Europe relies heavily on imported raw materials, with nearly 70% of its natural rubber sourced from Southeast Asia, making it vulnerable to price hikes. These rising costs have forced manufacturers to increase tire prices, impacting consumer demand. Furthermore, inflationary pressures across Europe, as reported by Eurostat, have exacerbated the situation, with energy-intensive production processes further inflating operational costs. This financial strain poses a challenge to maintaining profitability while meeting sustainability goals.

Stringent Emission Norms and Compliance Costs

Another major restraint is the high cost associated with adhering to stringent emission norms and compliance standards imposed by European regulatory bodies. The European Commission’s regulations require tire manufacturers to meet strict rolling resistance and wet grip criteria, which necessitate significant investments in advanced technologies and R&D. A report by the European Environment Agency states that compliance-related expenses account for approximately 15-20% of total production costs for tire manufacturers. Moreover, small and medium-sized enterprises (SMEs) in the tire industry face challenges in keeping up with these regulations due to limited financial resources. The Federation of Small Businesses in Europe highlights that nearly 30% of SMEs in the automotive sector struggle to adopt eco-friendly practices due to high upfront costs. These factors collectively hinder market growth by increasing barriers to entry and limiting innovation among smaller players.

MARKET OPPORTUNITIES

Growing Demand for Smart and Connected Tires

The emergence of smart and connected tires presents a significant opportunity for the Europe automotive tire market. These advanced tires, equipped with sensors and IoT technology, provide real-time data on tire pressure, temperature, and tread wear, enhancing vehicle safety and performance. According to the European Investment Bank, the global market for connected car technologies, including smart tires, is projected to grow at a compound annual growth rate (CAGR) of 17% through 2030. The European Automobile Manufacturers' Association highlights that over 60% of new vehicles in Europe are expected to be equipped with connected features by 2025, creating a substantial demand for smart tires. Additionally, the European Commission emphasizes that integrating such technologies can reduce road accidents by up to 20%, further driving adoption. As automakers increasingly focus on vehicle connectivity, tire manufacturers have a unique opportunity to innovate and capture this high-growth segment.

Expansion of Sustainable Tire Solutions

The increasing emphasis on sustainability offers another major opportunity for the Europe automotive tire market. Governments and consumers alike are prioritizing eco-friendly products, prompting manufacturers to develop tires using sustainable materials like bio-based rubber and recycled components. A report by the European Environment Agency states that adopting sustainable practices in tire production could reduce the industry’s carbon footprint by approximately 25%. Furthermore, France’s Environment and Energy Management Agency notes that the demand for eco-friendly tires has grown by 30% annually in Europe, driven by regulatory incentives and consumer awareness. The European Tyre and Rubber Manufacturers' Association also reports that investments in sustainable tire technologies have increased by 40% since 2020. With the European Union’s Green Deal aiming for carbon neutrality by 2050, manufacturers have a clear pathway to innovate and align with sustainability goals, unlocking long-term growth potential.

MARKET CHALLENGES

Supply Chain Disruptions and Logistical Challenges

Supply chain disruptions have emerged as a significant challenge for the Europe automotive tire market, impacting production timelines and increasing costs. The European Commission reports that over 60% of tire manufacturers faced delays in raw material shipments in 2022 due to global logistical bottlenecks and geopolitical tensions. These disruptions have been particularly acute for natural rubber, with the International Rubber Study Group noting a 15% increase in lead times for rubber imports from Southeast Asia. Additionally, Eurostat highlights that transportation costs within Europe surged by 20% in 2022, further straining manufacturers. Such challenges have forced companies to rethink their supply chain strategies, often at significant expense. The Federation of European Industries underscores that nearly 40% of businesses in the sector are struggling to maintain consistent production levels, threatening market stability and growth.

Intense Market Competition and Price Wars

Intense competition and price wars among key players pose another major challenge to the Europe automotive tire market. The European Tyre and Rubber Manufacturers' Association reports that the market is highly fragmented, with the top five manufacturers controlling only 60% of the market share, leaving smaller players to compete aggressively on pricing. This has led to shrinking profit margins, with the European Investment Bank estimating that average profit margins in the industry have declined by 10% over the past three years. Furthermore, the European Automobile Manufacturers' Association highlights that price-sensitive consumers are increasingly opting for low-cost alternatives, particularly in Eastern Europe, where demand for budget tires has risen by 25%. This competitive pressure forces manufacturers to balance affordability with innovation, often at the expense of long-term sustainability investments.

SEGMENTAL ANALYSIS

Europe Automotive Tire Market By Rim Size

The 16" to 18" rim size segment had the largest share of 45.3% of the European market share in 2024. The alignment of 16" to 18" rim size with mid-sized sedans, crossovers, and entry-level SUVs that account for 35% of new car registrations in Europe is one of the key factors driving the growth of the segment in the European market. The rise of electric vehicles (EVs) has further solidified its lead, with 60% of EVs registered in 2022 using this rim size, according to the European Commission. Its importance lies in balancing affordability, performance, and aesthetics, making it a preferred choice for mainstream consumers.

The 19"-21" rim size segment is predicted to witness a CAGR of 8.5% during the forecast period owing to the increasing demand for premium SUVs and luxury vehicles, which saw a 12% sales increase in Western Europe in 2022. The shift towards high-performance tires for luxury EVs like Tesla and Audi e-tron also drives this trend. Eurostat highlights that luxury vehicle sales are rising due to higher disposable incomes, making this segment critical for manufacturers targeting high-margin markets.

Europe Automotive Tire Market By Season

The summer tires segment led the automotive tire market in Europe by accounting for 45.2% of the market share in 2024. The domination of the summer tires segment in the European market is majorly driven their suitability for Southern and Western Europe's mild winters and warm summers, where over 60% of vehicles use these tires, according to Eurostat. Their importance lies in superior fuel efficiency and low rolling resistance, aligning with the EU’s Green Deal objectives. The European Commission highlights that summer tires reduce fuel consumption by up to 5%, making them a preferred choice for eco-conscious consumers. Additionally, their affordability compared to winter and all-season tires further boosts demand, solidifying their leadership in the European market.

The all-season tires segment is expected to grow at the fastest CAGR of 10.4% over the forecast period due to the increasing urbanization and consumer preference for convenience, particularly in Central Europe. The European Automobile Manufacturers' Association notes that 30% of new car buyers now opt for all-season tires, driven by their ability to handle diverse weather conditions without seasonal changes. Their importance lies in addressing moderate climates and reducing maintenance costs, appealing to urban drivers. With growing awareness of practicality and sustainability, this segment is poised to capture a larger market share in the coming years.

Europe Automotive Tire Market By Propulsion Type

The ICE segment held the leading share of 71.8% of the European market share in 2024. The widespread presence of conventional vehicles, particularly in Eastern Europe, where EV adoption remains limited is boosting the growth of the ICE segment in the European market. The International Energy Agency reports that ICE vehicles account for over 80% of Europe’s current vehicle fleet, ensuring sustained demand for compatible tires. Their importance lies in serving the existing automotive base while providing manufacturers with a stable revenue stream. Despite the shift towards electrification, ICE tires remain critical due to their affordability and compatibility with traditional vehicles.

The electric vehicle (EV) segment is rapidly growing and is expected to register a CAGR of 15.5% over the forecast period owing to the surge in EV adoption, with Eurostat reporting a 65% increase in EV registrations in 2022, reaching over 2.3 million units. Michelin highlights that EV-specific tires now account for 20% of new tire sales in Western Europe. Their importance lies in addressing unique EV requirements, such as reduced rolling resistance and noise optimization, aligning with Europe’s sustainability goals. As EVs become mainstream, this segment will redefine tire innovation and drive long-term market expansion.

Europe Automotive Tire Market By Vehicle Type

The passenger cars segment ruled the market by holding 75.1% of the European market share in 2024. The lead of the passenger cars segment in the European market is majorly attributed to their high prevalence of passenger vehicles, with Eurostat estimating over 280 million cars in use across Europe in 2022. The segment's importance lies in its alignment with consumer demand for safety, comfort, and fuel efficiency. Additionally, the rise of electric vehicles (EVs) has further boosted demand, as EVs account for a growing share of new car registrations, particularly in Western Europe. With stringent emission regulations and increasing EV adoption, passenger car tires remain critical for manufacturers targeting mainstream consumers.

The light commercial vehicle (LCV) segment is anticipated to expand at a CAGR of 8.12% over the forecast period owing to the expansion of e-commerce and last-mile delivery services, with Eurostat reporting a 10% increase in LCV registrations in 2022. LCV tires are essential for urban logistics, supporting sustainable mobility solutions and efficient fleet operations. The International Energy Agency highlights that urban freight transport is expected to grow by 15% annually, further driving demand for durable and fuel-efficient LCV tires. This segment's importance lies in addressing the logistical needs of Europe’s rapidly evolving urban economies.

Europe Automotive Tire Market By Distribution Channel

The aftermarket segment led the European automotive tire market in 2024 by capturing 60.5% of the market share. The consistent replacement demand in Europe is primarily boosting the growth of the aftermarket segment in the European market. The average tire lifespan of 4-5 years ensures steady sales, while regulatory mandates, such as winter tire requirements in Nordic countries, further boost demand. The Federation of European Industries highlights that the aftermarket remains resilient to economic fluctuations, unlike OEM channels. Its importance lies in providing a stable revenue stream for manufacturers, addressing consumer needs for safety, affordability, and compliance with seasonal regulations.

The OEM segment is predicted to showcase a CAGR of 7.14% over the forecast period due to the rising vehicle production, particularly electric vehicles (EVs), which require specialized tires. Eurostat notes that EV registrations surged by 65% in 2022, reaching over 2.3 million units, driving demand for OEM tires. The segment's importance lies in its alignment with innovation and sustainability goals, as automakers collaborate with tire manufacturers to develop eco-friendly solutions. With Europe’s push toward electrification, this segment is critical for meeting the evolving needs of modern vehicles and supporting long-term industry growth.

REGIONAL ANALYSIS

Germany occupied 25.6% of the regional market share in 2024 and emerged as the leading player in the European market. The dominating position of Germany in the European market is majorly primarily driven by its robust automotive industry, which accounts for over 30% of Europe’s total vehicle production, according to the International Organization of Motor Vehicle Manufacturers. Germany’s leadership is further bolstered by its strong focus on innovation, particularly in electric vehicles (EVs), with EV registrations surging by 70% in 2022, as reported by Eurostat. The country’s stringent emission regulations and high consumer awareness of eco-friendly products also drive demand for advanced tires. Additionally, Germany’s well-established OEM partnerships and export-oriented manufacturing base ensure steady growth, with a projected CAGR of 6% through 2030, making it a pivotal player in shaping market trends.

France is one of the top performers in the Europe automotive tire market. The strategic focus of France on sustainability, with government incentives promoting low-emission vehicles and eco-friendly tires are driving the French automotive tire market growth. Eurostat highlights that France recorded a 20% annual increase in EV adoption in 2022, driving demand for specialized tires. Furthermore, France’s well-developed logistics sector fuels demand for commercial vehicle tires, with light commercial vehicle (LCV) sales growing by 8% annually. The nation’s emphasis on R&D, coupled with its leadership in sustainable mobility solutions, ensures steady market expansion. With a projected CAGR of 5.5%, France remains a key contributor to the region’s tire industry growth.

Italy is another promising market for automotive tires in Europe. The prominence of Italy in Europe is driven by its large vehicle parc size, estimated at over 40 million vehicles, and its thriving aftermarket segment, which benefits from frequent tire replacements due to diverse climatic conditions. According to the European Automobile Manufacturers' Association, Italy saw a 15% rise in new car registrations in 2022, supporting OEM tire demand. Additionally, Italy’s strategic location as a gateway to Southern Europe enhances its distribution capabilities, boosting both domestic and export sales. The nation’s focus on premium and performance tires aligns with consumer preferences, ensuring sustained growth with a projected CAGR of 5% through 2030.

KEY MARKET PLAYERS

Bridgestone Corporation, Michelin, The Hercules Tire and Rubber Company, Continental AG, Nitto tires, Pirelli & C. S.p.A., Yokohama Rubber Company Limited, Zhongce Rubber Group Co., Ltd., Cheng Shin Rubber Ind. Co. Ltd., Goodyear Tire & Rubber Company, KUMHO TIRE Co., Inc., HANKOOK TIRE & TECHNOLOGY Co., Ltd., Toyo Tires, Nankang Rubber Tire Corp., Ltd., NEXEN TIRE. These are the market players that are dominating in the Europe automotive tire market.

MARKET SEGMENTATION

This research report on the Europe tire market is segmented and sub-segmented into the following categories.

By Rim Size

- 13" to 15"

- 16" to 18"

- 19" to 21"

- >21"

By Season

- Winter

- Summer

- All-Season

By Propulsion Type

- ICE

- EV

By Vehicle Type

- Passenger Cars

- LCV

- HCV

By Distribution Channel

- OEM

- Aftermarket

By Country

- UK

- Russia

- Germany

- Italy

- France

- Spain

- Sweden

- Denmark

- Poland

- Switzerland

- Netherlands

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe automotive tire market?

The current market size of the Europe automotive tire market size was valued at USD 68.03 billion in 2025

What market drivers are driving the Europe automotive tire market?

The surge in electric vehicle adoption and stringent environmental regulations are major factors driving innovation and growth in the automotive tire market.

what are the market opportunities in the Europe automotive tire market?

The growing demand for smart and connected tires and the Expansion of sustainable tire solutions are the market opportunities in the Europe automotive tire market

What are the challenges faced by the Europe automotive tire market?

Supply Chain Disruptions and Logistical Challenges and Intense Market Competition and Price Wars are the market challenges faced by the European automotive tire market.

who are the market players that are dominated by the Europe automotive tire market?

Bridgestone Corporation, Michelin, The Hercules Tire and Rubber Company, Continental AG, Nitto tires, Pirelli & C. S.p.A., Yokohama Rubber Company Limited, Zhongce Rubber Group Co., Ltd., Cheng Shin Rubber Ind. Co. Ltd., Goodyear Tire & Rubber Company, etc....

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]