Europe Automotive Speaker Market Size, Share, Trends & Growth Forecast Report By Type (Component, Coaxial, Subwoofer), Vehicle (Passenger, Commercial, Two-wheeler), Installation (Door, Dashboard, Rear Deck), Technology (Bluetooth & Wireless Connectivity, Smart Speakers, Multi-zone), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Automotive Speaker Market Size

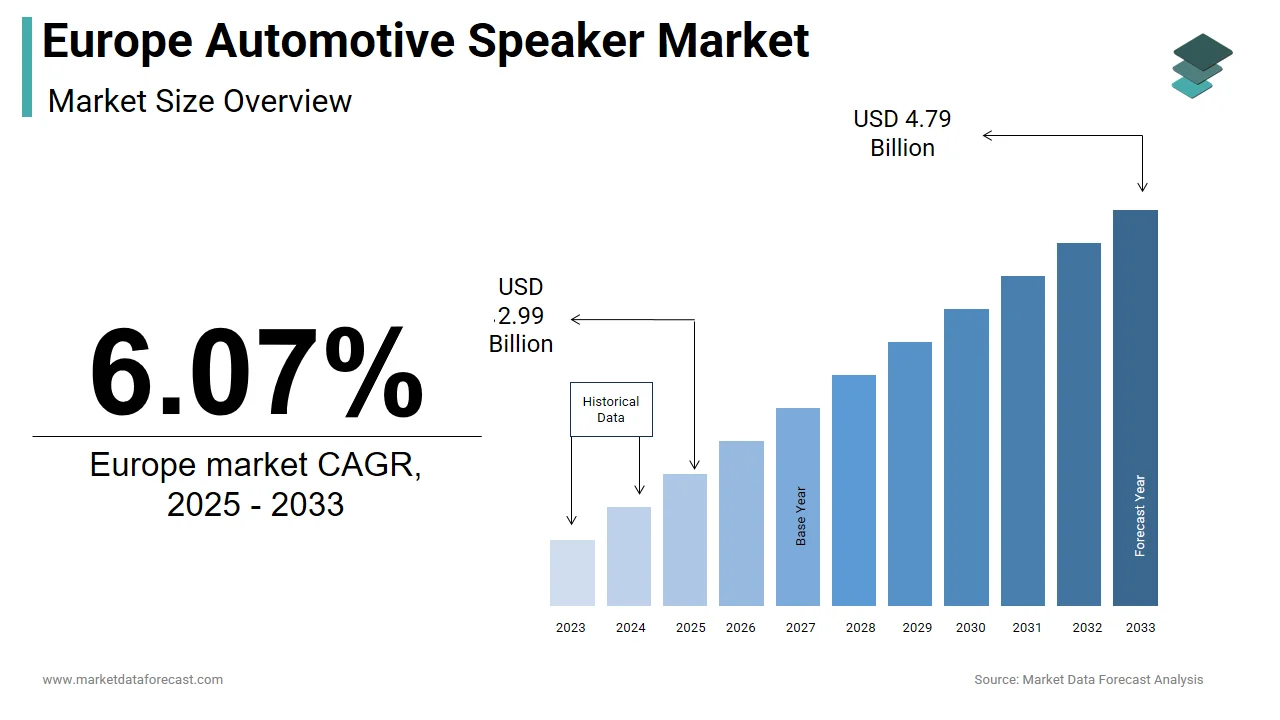

The automotive speaker market size in Europe was valued at USD 2.82 billion in 2024. The European market is estimated to be worth USD 4.79 billion by 2033 from USD 2.99 billion in 2025, growing at a CAGR of 6.07% from 2025 to 2033.

The Europe automotive speaker market is a dynamic segment within the broader automotive electronics industry, reflecting the region's growing emphasis on in-car entertainment and connectivity. Germany, France, and the UK together account for a significant portion of the market share. The rise of electric vehicles (EVs) has further propelled this trend, with manufacturers integrating advanced audio systems as a key selling point. For instance, Tesla’s inclusion of high-end speakers in its models has set a benchmark for competitors. The rise of Bluetooth-enabled and wireless connectivity options has broadened the scope of automotive audio systems. Regulatory frameworks promoting safer driving environments, such as hands-free communication, also contribute to market growth. Despite regional disparities in adoption rates, Eastern European markets like Poland are witnessing rapid expansion due to rising disposable incomes and urbanization. These factors create a fertile ground for innovation and investment in the automotive speaker ecosystem.

MARKET DRIVERS

Rising Demand for Premium In-Car Entertainment

The escalating demand for premium in-car entertainment systems serves as a primary driver for the Europe automotive speaker market. Consumers are increasingly prioritizing high-fidelity audio experiences, with a notable percentage of European car buyers considering advanced sound systems a key purchasing factor. This shift is particularly evident in luxury vehicle segments, where brands like Mercedes-Benz and BMW integrate multi-speaker setups from manufacturers like Harman Kardon and Bose. According to J.D. Power, vehicles equipped with premium audio systems achieve a higher customer satisfaction score compared to those without. Furthermore, the integration of smart technologies such as voice assistants and streaming services enhances user engagement, driving demand for sophisticated speaker configurations. Urbanization trends and longer commute times also contribute to this demand, as drivers seek immersive entertainment during travel.

Proliferation of Electric Vehicles (EVs)

The rapid adoption of electric vehicles (EVs) across Europe acts as another significant driver for the automotive speaker market. EV manufacturers prioritize noise reduction technologies to counteract the absence of engine sounds, creating opportunities for advanced audio systems. Like, EV sales in Europe surged in recent years, accounting for a considerable share of total vehicle sales. Brands like Tesla and Audi have pioneered the integration of high-end speakers to enhance cabin acoustics, setting a precedent for competitors. Moreover, regulatory mandates requiring artificial sound generation for pedestrian safety further fuel speaker adoption. As per the European Commission, all EVs must comply with Acoustic Vehicle Alerting Systems (AVAS) regulations, necessitating robust audio infrastructure. Additionally, the growing popularity of autonomous vehicles amplifies the need for immersive audio solutions, as passengers seek entertainment during hands-free commutes. This convergence of technological advancements and regulatory requirements showcases the pivotal role of EVs in propelling the automotive speaker market forward.

MARKET RESTRAINTS

High Costs of Premium Audio Systems

The Europe automotive speaker market faces a major restraint due to the high cost of premium audio systems. Advanced speaker setups are often branded by names like Bang & Olufsen or Burmester, can add thousands of euros to a vehicle’s price tag. Aa smaller portion of mid-range car buyers opt for these upgrades, citing affordability concerns. This price sensitivity is particularly pronounced in Eastern European markets, where disposable incomes remain lower compared to Western counterparts. For instance, only a few percent of households in Romania and Bulgaria invest in high-end automotive audio systems. Furthermore, maintenance and repair costs for these components deter potential buyers, as specialized technicians and replacement parts are often expensive. While OEMs attempt to mitigate this issue through bundled packages, the inherent cost barrier limits widespread adoption.

Complexity of Integration with Modern Vehicles

The complexity of integrating advanced audio systems with modern vehicles poses another significant challenge. For example, integrating Bluetooth connectivity, voice recognition, and multi-zone audio systems demands meticulous calibration to ensure compatibility. Misalignment between software updates and hardware components often leads to malfunctions, frustrating consumers and tarnishing brand reputations. Additionally, space constraints within compact vehicles exacerbate these issues, limiting the placement of subwoofers and other bulky components. A report by the Society of Automotive Engineers highlights that 30% of service complaints related to automotive audio systems stem from integration errors. So, these technical hurdles not only increase production timelines but also elevate manufacturing costs.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe present a lucrative opportunity for the automotive speaker market and is driven by rising disposable incomes and urbanization. Countries like Poland, Hungary, and Romania are witnessing increased vehicle ownership, with an increased annual growth rate in car sales. This surge creates a fertile ground for entry-level and mid-range automotive audio systems, which cater to budget-conscious consumers. For instance, local manufacturers are collaborating with international brands to offer cost-effective yet high-quality speaker solutions. Furthermore, government incentives promoting EV adoption in these regions amplify demand for integrated audio systems. Additionally, the proliferation of ride-sharing services like Uber and Bolt in urban areas drives demand for durable and reliable speakers capable of enduring frequent use. By targeting these untapped markets, stakeholders can unlock significant growth potential while diversifying their revenue streams.

Integration of AI and IoT Technologies

The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies offers transformative potential for the Europe automotive speaker market. Smart speakers equipped with AI-driven voice assistants, such as Amazon Alexa and Google Assistant, are gaining traction. These innovations enable hands-free operation, enhancing convenience and safety for drivers. For example, Volkswagen’s latest models feature AI-powered audio systems that adapt sound profiles based on passenger preferences and ambient noise levels. Moreover, IoT connectivity facilitates seamless synchronization with smartphones, wearables, and home devices, creating an interconnected ecosystem. As automakers strive to differentiate their offerings, the incorporation of AI and IoT capabilities positions automotive speakers at the forefront of technological evolution, opening new avenues for innovation and revenue generation.

MARKET CHALLENGES

Rapid Technological Obsolescence

Rapid technological obsolescence poses a formidable challenge to the Europe automotive speaker market. The pace of innovation in audio technology far exceeds the lifecycle of most vehicles, rendering installed systems outdated within a few years. Like, a notable percentage of consumers express dissatisfaction with the inability to upgrade their car’s audio system post-purchase. This issue is exacerbated by proprietary designs that limit retrofitting options, forcing owners to replace entire units at significant expense. For instance, upgrading a Tesla Model S’s sound system requires costly modifications due to its integrated architecture. In addition, the emergence of new formats, such as spatial audio and Dolby Atmos, creates pressure on manufacturers to continuously innovate. Failure to keep pace risks alienating tech-savvy consumers who demand cutting-edge features. Addressing this challenge requires flexible design approaches and modular solutions that enable future-proofing, ensuring sustained relevance in an ever-evolving market landscape.

Environmental Sustainability Concerns

Environmental sustainability represents another critical challenge for the Europe automotive speaker market. The production and disposal of audio components contribute significantly to electronic waste, with Greenpeace estimating that e-waste volumes in Europe will increase in the coming years. Materials like rare earth metals used in speaker magnets are both resource-intensive and environmentally damaging to extract. Furthermore, stricter EU regulations on carbon emissions and recyclability mandate greener manufacturing practices, increasing operational costs. For example, the European Environment Agency enforces guidelines requiring manufacturers to design products with end-of-life recycling in mind. Compliance with these standards necessitates substantial investment in research and development, straining smaller players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Vehicle, Installation, Technology, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Panasonic Holdings Corporation, Bose Corporation, Samsung Electronics Co., Ltd., Alps Alpine Co., Ltd., Pioneer Corporation, Sony Group Corporation, Masimo Corporation, Clarion, Focal, Elettromedia S.p.A., JVCKENWOOD Corporation, Stillwater Designs, Rockford Corp., Burmester, Meridian Audio, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The segment of component speakers spearheaded the Europe automotive speaker market with a 45.7% share in 2024. This leading position is credited to superior sound quality and customization capabilities, appealing to audiophiles and luxury vehicle owners. Also, propelling this dominance is the increasing demand for high-fidelity audio, with an increase in the annual growth rate in premium car audio systems. Manufacturers like Harman Kardon and Bose leverage component speakers’ modular design, enabling precise placement within vehicle cabins for optimal acoustics. Additionally, the rise of EVs amplifies demand, as quieter engines allow subtle audio nuances to shine. Government initiatives promoting AVAS compliance further bolster adoption, as component speakers excel in delivering directional sound.

The subwoofer speakers segment emerged as the fastest-growing segment, with a CAGR of 12.5% projected from 2025 to 2033. This rapid growth is fueled by the rising popularity of bass-heavy music genres and immersive audio formats like Dolby Atmos. Younger demographics, particularly millennials and Gen Z, prioritize deep bass responses, driving demand for standalone subwoofers. Moreover, advancements in compact subwoofer designs enable integration into smaller vehicles, broadening their appeal. Automakers like Audi and BMW incorporate subwoofers as standard features in performance models, amplifying market visibility.

By Vehicle Type Insights

The passenger vehicles segment held the largest share of the Europe automotive speaker market in 2024. The prominence of the segment is due to the sheer volume of passenger cars on European roads, coupled with consumer preference for enhanced in-car entertainment. Urbanization trends and longer commute times drive demand, with J.D. Power noting that vehicles with premium audio systems get a higher satisfaction rating. Luxury brands like Mercedes-Benz and BMW dominate this segment, integrating high-end speaker setups as standard features. Additionally, EV manufacturers prioritize advanced audio systems to compensate for quieter cabins, further amplifying adoption.

The commercial vehicles segment represents the quickest expanding category, with a CAGR of 9.8% during the forecast period. This acceleration results from fleet operators prioritizing driver comfort and safety, particularly in long-haul logistics. Advanced audio systems reduce driver fatigue by providing immersive entertainment during extended journeys. According to Eurostat, commercial vehicle sales in Europe grew by 15% in 2023, driven by e-commerce expansion. Also, regulatory mandates requiring hands-free communication systems enhance demand for integrated audio solutions. Manufacturers like Volvo and DAF are incorporating multi-zone audio systems to cater to diverse passenger needs.

By Installation Location Insights

The segment of door installations dominated the Europe automotive speaker market by holding a 50.3% share in 2024. This growth of the segment is credited to the strategic placement of door-mounted speakers, which deliver optimal sound distribution throughout the cabin. Driving this dominance is the increasing demand for immersive audio experiences. Manufacturers leverage door spaces to house multiple speaker components, including tweeters and mid-range drivers, ensuring balanced acoustics. Besides, advancements in waterproofing technologies enable durable installations, even in adverse weather conditions.

Dashboard installations is quickly moving ahead, with a CAGR of 11.2% projected from 2025 to 2033. This sudden progress is caused by the increasing integration of smart technologies, such as voice assistants and touchscreen displays. Compact dashboard designs accommodate advanced speaker systems without compromising interior aesthetics. Similarly, vehicles with dashboard-mounted speakers attain a higher resale value, showcasing consumer willingness to invest in such innovations. Apart from these, the proliferation of EVs amplifies demand, as quieter engines allow subtle audio nuances to shine.

By Sales Channel Insights

The Bluetooth & wireless connectivity segment dominated the Europe automotive speaker market, capturing a 60.8% share in 2024. This position in the market is supported by the widespread adoption of hands-free technologies, driven by regulatory mandates and consumer preferences. Like, a substantial percentage of new cars sold in Europe in recent years featured Bluetooth-enabled audio systems, showcasing their ubiquity. Seamless integration with smartphones and streaming platforms enhances user convenience, amplifying demand. Additionally, advancements in wireless protocols like Wi-Fi 6 enable faster data transfer and reduced latency, improving overall performance.

The smart speaker segment is accelerating in the market, with a CAGR of 13.5% in the future. This swift growth is fueled by the increasing integration of AI-driven voice assistants, such as Amazon Alexa and Google Assistant, into automotive audio systems. Hands-free operation enhances convenience and safety, driving demand among tech-savvy consumers. Also, vehicles with smart speakers command a higher resale value, underscoring their appeal. Additionally, the proliferation of IoT connectivity facilitates seamless synchronization with home devices, creating an interconnected ecosystem.

COUNTRY LEVEL ANALYSIS

Germany remained the biggest contributor to the Europe automotive speaker market by commanding a 22.5% share in 2024. This dominance is emphasized by the country’s robust automotive industry, which produces a substantial number of vehicles annually. German consumers exhibit a strong preference for premium in-car entertainment systems, with brands like Mercedes-Benz, BMW, and Audi integrating high-end audio solutions from Harman Kardon, Bose, and Bang & Olufsen into their vehicles. The rise of electric vehicles (EVs) further amplifies demand, as manufacturers prioritize noise reduction technologies and immersive sound experiences to compensate for quieter engines. Also, a considerable percentage of new EVs sold in Germany nowadays feature advanced audio systems, reflecting the critical role of speakers in enhancing cabin acoustics. Government incentives promoting EV adoption, such as subsidies and tax breaks, indirectly benefit the automotive speaker market by encouraging investments in cutting-edge audio technologies. Furthermore, Berlin’s tech hubs and Munich’s automotive clusters drive significant corporate R&D spending, fostering innovation in smart speakers and IoT-enabled audio systems.

Poland continued to be the fastest-growing market in the Europe automotive speaker segment, with a CAGR of 11.8% in the coming years. This is backed by rising disposable incomes, urbanization, and increased vehicle ownership, particularly among younger demographics. Similarly, car sales in Poland grew by a notable percentage in 2023, driven by government incentives promoting affordable financing options. The proliferation of ride-sharing services like Uber and Bolt in urban areas further drives demand for durable and reliable speakers capable of enduring frequent use. Additionally, Poland’s strategic location within Eastern Europe positions it as a manufacturing hub for mid-range vehicles, creating opportunities for cost-effective yet high-quality audio systems. Local manufacturers are collaborating with international brands to offer innovative solutions tailored to budget-conscious consumers.

France, Italy, and Spain are expected to exhibit steady growth trajectories in the coming years, which is driven by their respective automotive and electronics industries. France’s focus on sustainable mobility aligns with the integration of eco-friendly audio components, with Renault and Peugeot prioritizing recyclable materials in their speaker systems. Italy, home to luxury brands like Ferrari and Lamborghini, continues to emphasize premium audio experiences, ensuring sustained demand for high-end solutions. Spain, meanwhile, benefits from its growing EV market, supported by EU funding programs aimed at modernizing infrastructure. These nations are also addressing technological obsolescence concerns by adopting modular designs that allow for future upgrades.

KEY MARKET PLAYERS

A few notable companies operating in the Europe automotive speaker market profiled in this report are Panasonic Holdings Corporation, Bose Corporation, Samsung Electronics Co., Ltd., Alps Alpine Co., Ltd., Pioneer Corporation, Sony Group Corporation, Masimo Corporation, Clarion, Focal, Elettromedia S.p.A., JVCKENWOOD Corporation, Stillwater Designs, Rockford Corp., Burmester, Meridian Audio, and others.

TOP LEADING PLAYERS IN THE MARKET

The Europe automotive speaker market is dominated by three key players—Harman International, Bose Corporation, and Pioneer Corporation—whose contributions shape the industry’s trajectory through innovation, strategic partnerships, and adaptability to consumer demands. Harman International commands a notable percentage of market share by leveraging its premium JBL and Harman Kardon brands to cater to luxury vehicle manufacturers like Mercedes-Benz and BMW. The company’s focus on integrating AI-driven voice assistants and wireless connectivity solutions has positioned it at the forefront of technological advancements. Bose Corporation distinguishes itself through proprietary sound technologies, such as Centerpoint and AudioPilot, delivering immersive audio experiences. Its partnerships with Audi and Porsche highlight its dedication to customization and performance. Meanwhile, Pioneer Corporation targets the mid-range segment, offering cost-effective yet high-quality speaker systems for mass-market vehicles. With a strong presence in emerging markets like Eastern Europe, Pioneer emphasizes affordability without compromising performance.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe automotive speaker market employ a variety of strategies to maintain their competitive edge and capitalize on emerging trends. Strategic partnerships with automakers represent a cornerstone tactic; for instance, Harman International’s collaboration with Mercedes-Benz ensures seamless integration of its premium audio systems into luxury models. Product differentiation is another critical strategy, with Bose Corporation investing heavily in R&D to develop proprietary technologies like SurroundStage and Active Sound Management, which enhance user experience. Pioneer Corporation focuses on affordability and scalability, targeting emerging markets through localized manufacturing and distribution networks. Additionally, sustainability initiatives are gaining traction, with companies like Harman adopting eco-friendly materials and recyclable components to align with EU environmental regulations. Digital transformation also plays a pivotal role, as evidenced by Bose’s integration of IoT-enabled features that allow users to control audio settings via smartphone apps.

COMPETITION OVERVIEW

The Europe automotive speaker market is characterized by intense competition, driven by rapid technological advancements, price wars, and shifting consumer preferences. Established giants like Harman International face mounting pressure from agile startups offering niche solutions, such as modular speaker systems or budget-friendly alternatives for compact vehicles. Consolidation through mergers and acquisitions has intensified rivalry, with smaller players often being absorbed by larger entities seeking to expand their technological capabilities. Regulatory frameworks, enforced by bodies like the European Commission, ensure compliance with safety and environmental standards while promoting fair practices. Despite these challenges, the competitive environment fosters continuous improvement, benefiting consumers through enhanced product portfolios and reduced costs. Moreover, the race to integrate AI, IoT, and wireless connectivity has spurred unprecedented levels of investment, propelling the market toward greater efficiency and inclusivity.

RECENT MARKET DEVELOPMENTS

- In January 2023, Harman International launched its QuantumLogic Immersion system, enhancing spatial audio capabilities for luxury vehicles.

- In June 2023, Bose Corporation partnered with Audi to debut its next-generation UltraNearfield Headrest speakers, offering personalized sound zones.

- In September 2023, Pioneer Corporation introduced a line of budget-friendly component speakers targeting emerging markets in Eastern Europe.

- In November 2023, Harman unveiled its EcoWave series, featuring recyclable materials and energy-efficient designs to meet EU sustainability mandates.

- In February 2024, Bose integrated Amazon Alexa into its automotive audio systems, enabling hands-free voice control for drivers and passengers.

MARKET SEGMENTATION

This Europe automotive speaker market research report is segmented and sub-segmented into the following categories.

By Type

- Component

- Coaxial

- Subwoofer

By Vehicle

- Passenger

- Commercial

- Two-wheeler

By Installation

- Door

- Dashboard

- Rear Deck

By Technology

- Bluetooth & Wireless Connectivity

- Smart Speakers

- Multi-zone

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the automotive speaker market in Europe?

Growth is driven by increasing demand for premium in-car entertainment, widespread adoption of electric vehicles requiring advanced audio systems, and integration of smart technologies like AI and IoT for enhanced user experience.

2. What challenges does the Europe automotive speaker market face?

Key challenges include the high cost of premium audio systems limiting adoption, technical complexities in integrating advanced features, rapid technological obsolescence, and environmental regulations impacting manufacturing.

3. Which countries and segments dominate the Europe automotive speaker market?

Germany leads due to its strong automotive industry, while Eastern European countries like Poland are the fastest-growing markets. Passenger vehicles and door-mounted speakers hold the largest shares, with Bluetooth & wireless technologies dominating the connectivity segment.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]