Europe Automotive Parts Remanufacturing Market Size, Share, Trends & Growth Forecast Report Segmented By Vehicle Type, Component, End-User, And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Parts Remanufacturing Market Size

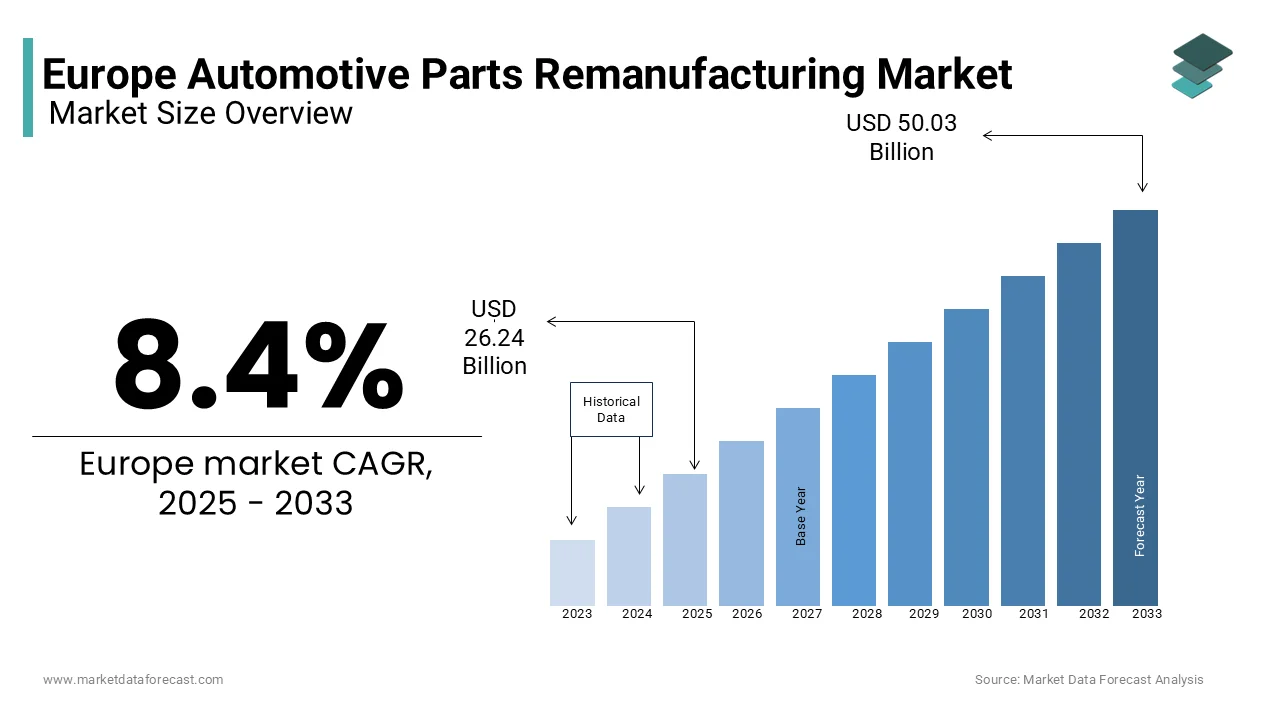

The Europe automotive parts remanufacturing market size was valued at USD 24.21 billion in 2024 and is anticipated to reach USD 26.24 billion in 2025 from USD 50.03 billion by 2033, growing at a CAGR of 8.4% during the forecast period from 2025 to 2033.

The Europe automotive parts remanufacturing market is focusing on the process of restoring used automotive components to a condition that meets or exceeds original equipment manufacturer (OEM) specifications. This process not only extends the life of automotive parts but also contributes to sustainability by reducing waste and conserving resources. The remanufacturing process typically involves disassembly, cleaning, inspection, repair, and reassembly of parts, ensuring that they function effectively and reliably. According to industry estimates, the European automotive parts remanufacturing market is expected to see steady growth driven by increasing environmental awareness and the rising cost of new automotive components.

The market features a diverse range of components, including engines, transmissions, and electronic systems, which are remanufactured for various vehicle types. As the automotive industry shifts towards sustainability and circular economy practices, remanufacturing is gaining traction as a viable alternative to traditional manufacturing. The European Union's commitment to reducing carbon emissions and promoting resource efficiency further supports the growth of this market.

MARKET DRIVERS

Environmental Sustainability and Circular Economy

The increasing emphasis on environmental sustainability and the principles of the circular economy are significant drivers of the Europe automotive parts remanufacturing market. As concerns about climate change and resource depletion grow, both consumers and manufacturers are seeking ways to minimize their environmental impact. Remanufacturing automotive parts not only reduces waste but also conserves energy and raw materials, making it an attractive option for environmentally conscious stakeholders. According to a report by the European Commission, remanufacturing can save up to 85% of the energy required to produce new parts is displaying its potential for reducing carbon emissions. The European Union has set ambitious targets for reducing greenhouse gas emissions, which has led to increased regulatory support for sustainable practices, including remanufacturing. As a result, many automotive manufacturers are integrating remanufactured parts into their supply chains to meet sustainability goals and comply with regulations. This trend is expected to drive significant growth in the remanufacturing market. The alignment of remanufacturing with sustainability initiatives positions it as a key component of the automotive industry's transition towards a more circular economy.

Cost-Effectiveness and Economic Benefits

The cost-effectiveness of remanufactured automotive parts is another major driver of the Europe automotive parts remanufacturing market. Since the prices of new automotive components continue to rise, consumers and businesses are increasingly turning to remanufactured options as a more affordable alternative. Remanufactured parts typically cost 30% to 50% less than their new counterparts, providing significant savings for both individual consumers and fleet operators. According to industry data, the remanufactured parts market is expected to grow as more consumers recognize the value of these cost-effective solutions. Additionally, the economic benefits of remanufacturing extend beyond individual savings. By investing in remanufacturing processes, companies can reduce their overall production costs and improve their profit margins. This is particularly relevant in the context of the ongoing economic challenges faced by the automotive industry, including supply chain disruptions and rising material costs.

MARKET RESTRAINTS

Perception and Awareness Challenges

The perception and awareness challenges associated with remanufactured parts is one of the primary restraints affecting the Europe automotive parts remanufacturing market. Despite the economic and environmental benefits, many consumers and businesses remain skeptical about the quality and reliability of remanufactured components. This skepticism can be attributed to a lack of understanding of the remanufacturing process and the rigorous quality control measures that are typically employed. According to a survey conducted by an industry association, approximately 40% of consumers expressed concerns about the performance and durability of remanufactured parts compared to new ones. To overcome this challenge, stakeholders in the remanufacturing market must invest in education and awareness campaigns to inform consumers about the benefits and quality assurances associated with remanufactured parts. Building trust through transparent communication and showcasing successful case studies can help alleviate concerns and encourage adoption.

Regulatory and Compliance Issues

Another significant restraint in the Europe automotive parts remanufacturing market is the complexity of regulatory and compliance issues. The automotive industry is subject to stringent regulations regarding safety, emissions, and quality standards, which can complicate the remanufacturing process. Manufacturers must ensure that remanufactured parts meet the same rigorous standards as new components, which often requires extensive testing and certification. According to industry experts, compliance with these regulations can increase operational costs and extend lead times for remanufactured parts. Furthermore, the evolving regulatory landscape poses challenges for manufacturers as they must continuously adapt to new requirements and standards. This can create uncertainty and hinder investment in remanufacturing processes, particularly for smaller companies with limited resources. To navigate these challenges, stakeholders must stay informed about regulatory changes and invest in compliance strategies that ensure their remanufactured products meet the necessary standards.

MARKET OPPORTUNITIES

Technological Advancements in Remanufacturing Processes

Technological advancements in remanufacturing processes present a significant opportunity for the Europe automotive parts remanufacturing market. Innovations in automation, robotics, and materials science are enhancing the efficiency and effectiveness of remanufacturing operations. For instance, the integration of advanced diagnostic tools and data analytics allows manufacturers to assess the condition of used parts more accurately, enabling more precise remanufacturing processes. According to industry forecasts, the adoption of advanced technologies in remanufacturing is expected to increase productivity by up to 30% over the next five years. Also, because manufacturers embrace these technological advancements, they can improve the quality and reliability of remanufactured parts, addressing consumer concerns and enhancing market acceptance. In addition, the implementation of Industry 4.0 principles, such as smart manufacturing and the Internet of Things (IoT), can streamline operations and reduce costs, making remanufacturing an even more attractive option for automotive companies. The ongoing evolution of remanufacturing technologies is poised to drive significant growth in the market, as companies seek to leverage these innovations to gain a competitive edge.

Expansion of the Circular Economy

The expansion of the circular economy presents a compelling opportunity for the Europe automotive parts remanufacturing market. Since governments and organizations increasingly prioritize sustainability and resource efficiency, the principles of the circular economy are gaining traction across various industries including automotive. Remanufacturing aligns seamlessly with circular economy objectives by promoting the reuse and recycling of materials, thereby reducing waste and conserving resources. According to a report by the Ellen MacArthur Foundation, transitioning to a circular economy could generate €1.8 trillion in economic benefits for Europe by 2030. Companies that embrace these principles can enhance their brand reputation and appeal to environmentally conscious consumers, further driving market growth. Additionally, the increasing focus on sustainability is prompting regulatory support for remanufacturing initiatives, creating a favorable environment for investment and innovation. The alignment of remanufacturing with circular economy goals positions it as a key driver of growth in the automotive parts market.

MARKET CHALLENGES

Supply Chain Vulnerabilities

A major challenge faced by the Europe automotive parts remanufacturing market is the vulnerability of supply chains. The remanufacturing process relies on a steady supply of used parts, which can be affected by fluctuations in availability and quality. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have brought to light the fragility of supply chains, leading to delays and increased costs. According to industry analysts, supply chain disruptions have resulted in a 20% increase in lead times for automotive components, including those used in remanufacturing. These disruptions can hinder manufacturers' ability to meet production schedules and fulfill customer orders, ultimately impacting revenue and market share. Additionally, fluctuations in the availability and cost of used parts can further complicate the supply chain, as manufacturers may struggle to source the necessary components for their remanufactured products. To mitigate this challenge, companies must develop robust supply chain strategies including diversifying suppliers and investing in inventory management systems to ensure continuity in production.

Competition from New Parts Market

The competition from the new parts market presents a significant challenge for the Europe automotive parts remanufacturing market. Despite the advantages of remanufactured parts, many consumers still prefer new components due to perceptions of quality and reliability. The automotive parts market is highly competitive, with numerous manufacturers offering a wide range of new parts at varying price points. According to market research, approximately 60% of consumers express a preference for new parts over remanufactured options, citing concerns about performance and durability. This scenario can make it difficult for remanufacturers to gain market share, particularly in segments where consumers prioritize brand reputation and perceived quality. To address this challenge, remanufacturers must focus on building trust and credibility through transparent communication about the quality and performance of their products. Additionally, marketing strategies that emphasize the economic and environmental benefits of remanufactured parts can help shift consumer perceptions and encourage adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.4% |

|

Segments Covered |

By Vehicle Type, Component, End-User and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Reman Auto Electronics, BBB Industries, Remanufacturing Solutions GroupReTech Engineered Solutions, AxleTech International, Cardone Industries Inc., ReMaTec, Reconit Electric Rebuilders Ltd., ARC Group Worldwide, Auto-Camping Limited, United Remanufacturing Co., Ernst Reconditioning GmbH, Greening Inc., Maval Manufacturing Inc., Refurbished Truck Engines Ltd., Re-Forma GmbH, ReTech Manufacturing Ltd., Specialized Truck Parts Inc., TransAxle LLC, Yasa Automotive Engineering Ltd. |

SEGMENTAL ANALYSIS

By Vehicle Type Insights

The passenger cars segment in 2024 represented the largest segment in the Europe automotive parts remanufacturing market by accounting for 65.5% of the total market share. High volume of passenger vehicles produced and sold in Europe, which reached over 15 million units in 2022 is the reason behind the dominance of this segment. The increasing focus on vehicle maintenance and the rising cost of new parts have driven the demand for remanufactured components in this segment. Moreover, passenger cars are equipped with various parts that can be remanufactured including engines, transmissions, and electronic systems. The manufacturers continue to innovate and develop advanced remanufacturing technologies, so, the passenger car segment is expected to remain a key driver of growth in the market.

On the other hand, the light commercial vehicle segment is the fastest-growing category within the Europe automotive parts remanufacturing market, with a projected CAGR of 6.1% from 2025 to 2033. The increasing demand for light commercial vehicles in various sectors involving logistics and transportation can be attributed for its growth. According to the European Automobile Manufacturers Association, the registration of new light commercial vehicles in Europe reached approximately 2.5 million units in 2022 reflects a robust market for commercial transportation. The significance of this segment lies in the unique thermal management challenges faced by light commercial vehicles which often operate under heavy loads and in demanding conditions. Effective remanufactured parts are essential for maintaining operational efficiency and ensuring vehicle reliability. The light commercial vehicle segment is poised for significant growth as the logistics and transportation sectors continue to evolve.

By Component Insights

The engine and related parts segment secured the highest position in this category in the Europe automotive parts remanufacturing market and accounted for 40.5% of the total market share in 2024. This spike in its prominence is basically caused by the critical role that engines play in vehicle performance and the high cost associated with new engine components. The remanufacturing of engines allows for major cost savings while ensuring that vehicles maintain optimal performance. The importance is showcased by the increasing focus on vehicle maintenance and the rising cost of new parts. According to industry forecasts, the engine and related parts segment is projected to see descent growth in the coming years which is driven by the rising production of vehicles and the need for cost-effective maintenance solutions.

The transmission and related parts segment is the rapidly advancing category within the Europe automotive parts remanufacturing market, with an expected CAGR of 6.7% during the forecast period. This rise can be linked to the increasing complexity of modern transmission systems and the rising demand for efficient and reliable performance. The vehicles are turning more technologically advanced hence, the need for high-quality remanufactured transmission components is becoming increasingly important. Its ability to meet the evolving demands of the automotive industry is holding its significance. Remanufactured transmission parts such as gearboxes and clutches provide a cost-effective solution for maintaining vehicle performance while reducing waste. Additionally, the growing focus on sustainability and environmental impact is driving the demand for remanufactured transmission components, as they can be produced with lower energy consumption and reduced emissions. The transmission and related parts segment is poised for substantial growth as manufacturers continue to innovate and explore new material options.

By End-User Insights

The automotive repair shops segment maintained its position of being the largest end-user in the Europe automotive parts remanufacturing market and captured a great portion of the total market share in 2024 due to the high volume of repairs and maintenance services provided by these establishments, which often rely on remanufactured parts to offer cost-effective solutions to their customers. According to industry data, the number of automotive repair shops in Europe exceeds 200,000 and is exhibiting the significant demand for remanufactured components. The importance of this segment is underscored by the increasing focus on vehicle maintenance and the rising cost of new parts. Automotive repair shops benefit from using remanufactured parts, as they can provide quality solutions at a lower price point, enhancing customer satisfaction and loyalty.

On the contrary, the DIY consumer segment emerged as the swiftest growing category within the Europe automotive parts remanufacturing market and is projected to grow at a CAGR of 5.0% from 2025 to 2033 which is propelled by the increasing popularity of DIY vehicle maintenance and repair among consumers. As more individuals seek to save money and take control of their vehicle maintenance, the demand for remanufactured parts is expected to rise. The significance of this segment lies in the ability of DIY consumers to access high-quality remanufactured components at a fraction of the cost of new parts. This trend is particularly prevalent among car enthusiasts and individuals with mechanical skills who are willing to undertake repairs themselves.

COUNTRY ANALYSIS

Germany was the leading country in the Europe automotive parts remanufacturing market by commanding 25.3% of the total market share in 2024. This presence is largely due to its robust automotive industry, which is one of the largest in the world. With over 47 million registered vehicles as of 2022, the demand for remanufactured automotive parts is significantly high. German manufacturers are known for their focus on quality and innovation often investing heavily in research and development to create advanced remanufacturing processes. The presence of major automotive manufacturers and suppliers in Germany further bolsters the market's growth, as these companies seek to enhance vehicle performance and sustainability through effective remanufacturing solutions.

The French market is expected to grow at a CAGR of 3.8% in the coming years, driven by the rising trend of electric and hybrid vehicles and the increasing popularity of advanced driver-assistance systems (ADAS). The combination of a strong automotive culture and a growing emphasis on sustainability positions France as a key player in the European automotive parts remanufacturing market. France follows closely by holding a notabke share of the market share in the Europe Automotive Parts Remanufacturing Market. The French automotive sector is characterized by a diverse range of vehicles, with over 38 million registered cars. The country’s manufacturers are increasingly prioritizing vehicle maintenance and sustainability, leading to a surge in demand for remanufactured components. A recent survey indicated that nearly 70% of French car owners engage in regular maintenance, highlighting the importance of effective remanufacturing practices.

The United Kingdom is another significant player in the Europe automotive parts remanufacturing market. With over 38 million registered vehicles, the UK market is characterized by a strong consumer preference for quality automotive products. British manufacturers are increasingly investing in advanced remanufacturing processes to meet the growing demand for cost-effective and sustainable solutions. According to market analysis, the UK automotive parts remanufacturing market is fueled by the rise of electric vehicles and the increasing popularity of lightweight materials. The UK’s diverse automotive landscape, combined with a growing awareness of the benefits of remanufactured parts, positions it as a vital market within the European automotive parts remanufacturing sector.

Italy holds a significant share of the Europe automotive parts remanufacturing market. The Italian automotive industry is known for its strong presence of luxury and sports car brands, which drives demand for high-performance remanufactured components. With over 38 million registered vehicles, Italian consumers are increasingly focused on maintaining their cars' performance and aesthetics. A recent study indicated that around 65% of Italian car owners regularly purchase automotive accessories, reflecting a strong commitment to vehicle maintenance. The combination of a rich automotive heritage and a growing emphasis on sustainability positions Italy as a key market in the European automotive parts remanufacturing landscape.

Spain rounds out the top five countries in the Europe automotive parts remanufacturing market. With over 25 million registered vehicles, the Spanish market is characterized by a growing interest in vehicle maintenance and aesthetics. Spanish consumers are increasingly investing in automotive products, driven by a desire to enhance their vehicles' performance and longevity.

KEY MARKET PLAYERS

Reman Auto Electronics, BBB Industries, Remanufacturing Solutions GroupReTech Engineered Solutions, AxleTech International, Cardone Industries Inc., ReMaTec, Reconit Electric Rebuilders Ltd., ARC Group Worldwide, Auto-Camping Limited, United Remanufacturing Co., Ernst Reconditioning GmbH, Greening Inc., Maval Manufacturing Inc., Refurbished Truck Engines Ltd., Re-Forma GmbH, ReTech Manufacturing Ltd., Specialized Truck Parts Inc., TransAxle LLC, Yasa Automotive Engineering Ltd. are the market players that are dominating the Europe automotive parts remanufacturing market.

MARKET SEGMENTATION

This research report on the Europe automotive parts remanufacturing market is segmented and sub-segmented into the following categories.

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

By Component

- Engine & Related Parts

- Transmission & Related Parts

By End-User

- Automotive Repair Shops

- DIY Consumers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Why is remanufacturing automotive parts gaining popularity in Europe?

Growing environmental concerns, strict EU regulations on waste reduction, cost-effectiveness, and the circular economy push for sustainable automotive solutions.

Which types of automotive parts are commonly remanufactured?

Popular remanufactured parts include engines, transmissions, alternators, starters, turbochargers, brake calipers, and steering systems.

How do government policies impact the remanufacturing market in Europe?

The EU promotes remanufacturing through regulations on emissions, extended producer responsibility (EPR), and incentives for circular economy initiatives.

Which European countries lead in automotive parts remanufacturing?

Germany, the UK, France, Italy, and the Netherlands are key players due to strong automotive industries and supportive policies.

Who are the major companies in the European remanufacturing market?

Leading players include Valeo, Bosch, ZF Friedrichshafen, Caterpillar, and Carwood, known for their innovations in high-quality remanufactured parts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]