Europe Automotive Lead Acid Batteries Market Size, Share, Trends & Growth Forecast Report - Segmented By Type (VRLA, Flooded, Enhanced Flooded), Application (LCVs/HCVs, Three Wheelers, Two Wheeler, Passenger Car), Product (Micro Hybrid Batteries And SLI), By Customer (Aftermarket, OEM) And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Automotive Lead Acid Batteries Market Size

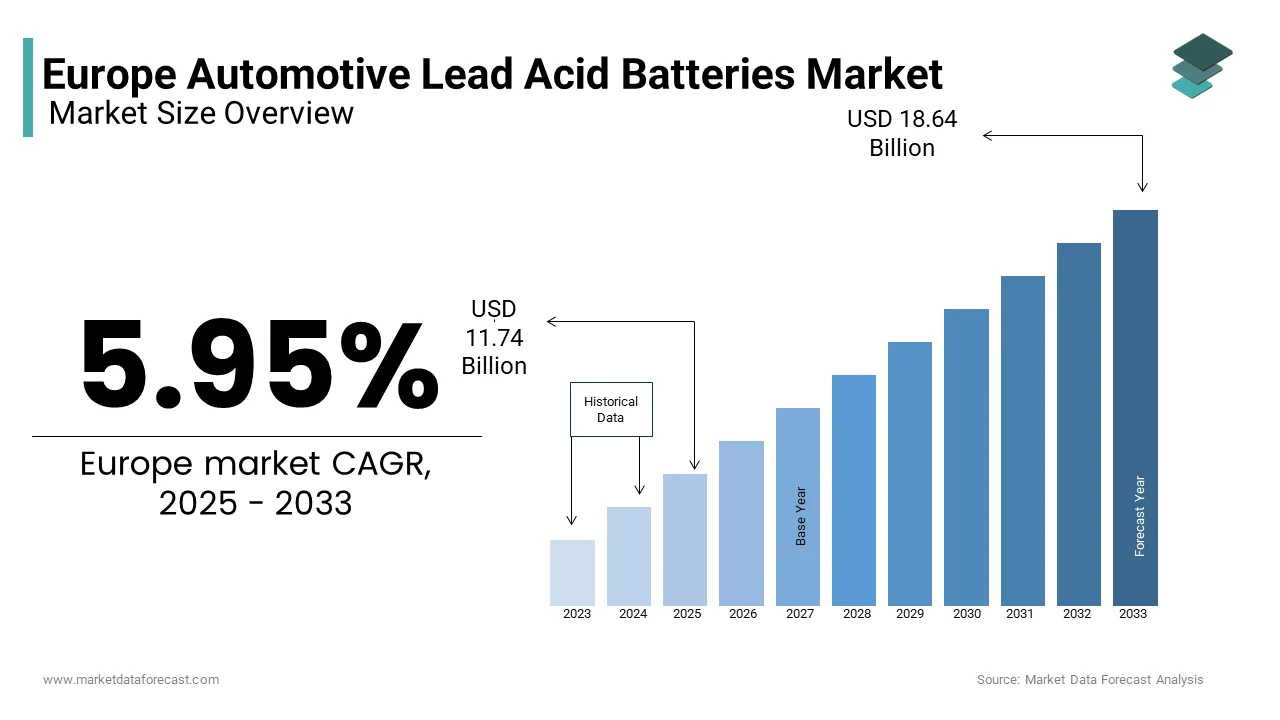

The Europe Automotive lead Acid Batteries Market Size was valued at USD 11.08 billion in 2024 from USD 11.74 billion in 2025 from USD 18.64 billion by 2033, growing at a CAGR of 5.95% during the forecast period from 2025 to 2033.

Automotive lead-acid batteries provide essential power solutions for a wide range of vehicles. Lead acid batteries are known for their reliability, affordability, and ease of recycling and are predominantly used in starting, lighting, and ignition (SLI) applications, as well as in micro-hybrid systems that enhance fuel efficiency. The demand for automotive lead acid batteries in Europe is growing considerably owing to the steady production of passenger cars and commercial vehicles. Despite the rise of alternative battery technologies, such as lithium-ion, lead acid batteries continue to dominate due to their cost-effectiveness and established recycling infrastructure. The European Battery Alliance emphasizes that over 90% of lead acid batteries are recycled in Europe, underscoring their sustainability credentials.

In this European market, Germany, France, and the UK are playing the leading role. These countries have robust automotive manufacturing bases and stringent regulations governing vehicle emissions, which drive the adoption of advanced SLI and micro-hybrid batteries. For instance, the European Commission mandates that all new vehicles meet specific CO2 emission targets, encouraging automakers to integrate energy-efficient technologies like enhanced flooded batteries (EFBs). This regulatory push, coupled with advancements in battery design, ensures the continued relevance of lead acid batteries in the European automotive landscape.

MARKET DRIVERS

Increasing Production of Passenger Cars in Europe

The increasing production of passenger cars serves as a significant driver for the European automotive lead acid battery market. According to the European Automobile Manufacturers Association, passenger car production in Europe exceeded 12 million units in 2022, with lead acid batteries being the primary choice for SLI applications. These batteries are indispensable for starting engines, powering electrical systems, and supporting auxiliary functions, which makes them critical for every vehicle. According to the European Commission, despite the growing popularity of electric vehicles (EVs), internal combustion engine (ICE) vehicles still dominate the market, accounting for over 70% of total sales in 2023. This sustained demand ensures a steady need for lead acid batteries, particularly in emerging markets within Eastern Europe. Additionally, the introduction of stop-start technology in micro-hybrid vehicles has further amplified the demand for advanced lead acid variants, such as enhanced flooded batteries (EFBs) and valve-regulated lead acid (VRLA) batteries. This trend is expected to persist as automakers strive to meet stringent emission standards while maintaining affordability.

Stringent Emission Regulations and Micro-Hybrid Adoption

Stringent emission regulations across Europe are propelling the adoption of micro-hybrid vehicles, thereby driving the demand for advanced lead acid batteries in Europe. According to the European Environment Agency, automakers are required to reduce fleet-wide CO2 emissions by 15% by 2025, pushing the integration of energy-efficient technologies like stop-start systems. Micro-hybrid vehicles, which rely on advanced lead acid batteries such as EFBs and VRLA batteries, are projected to account for 40% of new vehicle sales by 2030, as per the European Commission. These batteries enable improved fuel efficiency and reduced emissions by automatically shutting off the engine during idle periods and restarting it seamlessly. In 2022, the micro-hybrid segment witnessed a 12% growth in Europe, driven by incentives for low-emission vehicles and rising consumer awareness about environmental sustainability. The affordability and proven reliability of lead acid batteries make them a preferred choice for automakers transitioning to greener technologies. This regulatory push and technological advancement ensure sustained growth for the automotive lead acid battery market.

MARKET RESTRAINTS

Competition from Lithium-Ion Batteries

Competition from lithium-ion batteries is a significant restraint for the European automotive lead acid battery market. According to the European Battery Alliance, the demand for lithium-ion batteries surged by 25% in 2022, driven by the rapid adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs). Lithium-ion batteries offer superior energy density, longer lifespan, and faster charging capabilities compared to traditional lead acid variants, which is making them increasingly attractive to automakers. As per the European Commission, EV sales accounted for 15% of total vehicle sales in 2023, with projections indicating a 30% market share by 2030. This shift poses a challenge for lead acid battery manufacturers as automakers prioritize lightweight and high-performance alternatives for next-generation vehicles. Furthermore, government subsidies and incentives for EV adoption exacerbate the competition, limiting the growth potential of lead acid batteries in high-end and performance-oriented applications. Such trends create uncertainties for the market unless manufacturers innovate to retain competitiveness.

Environmental Concerns and Recycling Challenges

Environmental concerns and recycling challenges pose another major restraint affecting the European automotive lead acid battery market. According to the European Environment Agency, although lead acid batteries are highly recyclable, the extraction and processing of raw materials like lead and sulfuric acid remain environmentally hazardous. In 2022, the European Chemicals Agency reported that lead exposure from improper recycling practices resulted in significant health risks, prompting stricter regulations on battery disposal. The European Commission notes that compliance with these regulations increases operational costs for manufacturers, who must invest in advanced recycling technologies and waste management systems. Additionally, public perception of lead as a toxic material undermines consumer confidence, particularly in regions with limited awareness of recycling benefits. These challenges hinder market growth as industries seek sustainable alternatives that align with circular economy principles. Unless addressed through innovation and education, these restraints could limit the long-term viability of lead acid batteries.

MARKET OPPORTUNITIES

Growing Demand in Commercial Vehicles

The growing demand for commercial vehicles is a significant opportunity for the European automotive lead acid battery market. According to the European Road Transport Research Advisory Council, commercial vehicle sales in Europe increased by 8% in 2022, driven by the expansion of e-commerce and logistics sectors. These vehicles, including trucks, buses, and delivery vans, rely heavily on lead acid batteries for SLI applications and auxiliary power systems. The European Commission highlights that the logistics sector alone contributes €1.5 trillion annually to the EU economy, with a growing emphasis on reliable and cost-effective power solutions. Enhanced flooded batteries (EFBs) and valve-regulated lead acid (VRLA) batteries are particularly suited for commercial vehicles due to their durability and ability to withstand frequent stop-start cycles. In 2023, the commercial vehicle segment accounted for 25% of total lead acid battery demand, underscoring its importance. This trend is expected to grow as urbanization and online shopping drive the need for efficient transportation systems, positioning lead acid batteries as a key enabler of this growth.

Expansion into Emerging Markets

The expansion into emerging markets offers another promising opportunity for the European automotive lead acid battery market. According to the European Investment Bank, trade agreements between the EU and emerging economies in Africa, Asia, and Latin America have facilitated increased exports of automotive components, including lead acid batteries. For instance, in 2022, the EU exported approximately €2 billion worth of automotive batteries to these regions, with lead acid variants accounting for a significant share. Emerging markets are witnessing rapid industrialization and urbanization, creating a surge in demand for affordable and reliable power solutions. As per the International Monetary Fund, countries like India, Brazil, and South Africa are investing heavily in infrastructure development, all of which rely on stable power supply. By leveraging advanced technologies and sustainable designs, European manufacturers can position themselves as preferred suppliers in these markets. Furthermore, partnerships with local governments and energy providers can enhance market penetration, driving substantial revenue growth for the European automotive lead acid battery market.

MARKET CHALLENGES

Rising Raw Material Costs

Rising raw material costs pose a significant challenge to the European automotive lead acid battery market. According to the European Chemical Industry Council, the prices of lead and sulfuric acid, key components of lead acid batteries, have surged by 15% and 10%, respectively, in 2022 due to global supply chain disruptions and geopolitical tensions. The European Central Bank notes that inflationary pressures have further compounded the issue, with energy-intensive industries bearing the brunt of escalating expenses. Such fluctuations directly impact the profitability of battery manufacturers, as they face challenges in maintaining competitive pricing while absorbing rising input costs. The European Trade Union Confederation highlights that small and medium-sized enterprises (SMEs) are particularly vulnerable to these price volatilities, as they lack the financial resilience to mitigate risks. This instability creates uncertainty in the market, deterring long-term investments and innovation unless companies develop strategies to stabilize costs or explore alternative materials.

Shift Toward Electric Mobility

The shift toward electric mobility represents another critical challenge impacting the European automotive lead acid battery market. According to the European Alternative Fuels Observatory, electric vehicle (EV) registrations in Europe grew by 65% in 2022, driven by government incentives and consumer demand for sustainable transportation. This transition undermines the dominance of lead acid batteries, as EVs predominantly rely on lithium-ion batteries for propulsion. The European Commission projects that EVs will account for 50% of new vehicle sales by 2030, significantly reducing the market share of traditional lead acid batteries. Additionally, advancements in battery technology, such as solid-state and sodium-ion batteries, further threaten the relevance of lead acid variants. The European Investment Bank notes that automakers are increasingly prioritizing lightweight and high-performance alternatives, leaving lead acid batteries confined to niche applications. To remain competitive, manufacturers must innovate or diversify their product portfolios to align with evolving industry trends.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.95% |

|

Segments Covered |

By Product, Type, Application, Customers, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

C&D Technologies, Inc., CSB Battery Co., Ltd., Hitachi Chemical Energy Technology Co. Ltd., East Penn Manufacturing Company, Enersys Inc., Exide Industries Ltd., Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls Inc, and Others. |

SEGMENTAL ANALYSIS

By Application

The passenger cars segment dominated the European automotive lead acid battery market and accounted for 57.4% of the European market share in 2024. These vehicles rely heavily on lead acid batteries for SLI applications, ensuring reliable starting and powering of electrical systems. According to Eurostat, passenger car production in Europe exceeded 12 million units in 2022, which is indicting the importance of passenger cars in sustaining demand for lead acid batteries. Their affordability and proven reliability make them the preferred choice for automakers, particularly in emerging markets within Eastern Europe, which is one of the major factors boosting the expansion of the segment in the European market. The dominance of this segment is further reinforced by the widespread adoption of stop-start technology in micro-hybrid vehicles, which amplifies the demand for advanced lead acid variants like enhanced flooded batteries (EFBs). This segment’s leadership underscores its pivotal role in ensuring efficient and cost-effective power solutions, solidifying its position as the largest vehicle type category in the market.

By Type

The flooded batteries segment accounted for a dominating share of 50.1% of the European market share in 2024. These batteries are widely favored for their affordability, simplicity, and ease of maintenance, making them ideal for traditional SLI applications in passenger cars and commercial vehicles. According to Eurostat, the demand for flooded batteries increased by 6% in 2022, driven by their widespread use in emerging markets and cost-sensitive segments. Their robustness and proven reliability enhance their appeal in applications where budget constraints limit the adoption of advanced alternatives. The dominance of this segment is further reinforced by their compatibility with existing recycling infrastructure, ensuring minimal environmental impact.

The enhanced flooded batteries (EFBs) is estimated to progress at a CAGR of 12.8% over the forecast period. These batteries are increasingly adopted in micro-hybrid vehicles, which rely on stop-start technology to improve fuel efficiency and reduce emissions. As per the Environment Agency, the demand for EFBs surged by 18% in 2022 due to their ability to deliver higher charge acceptance and durability compared to traditional flooded batteries. Additionally, advancements in battery design, such as improved plate construction and electrolyte formulation, have expanded their applicability across diverse vehicle models.

REGIONAL ANALYSIS

Germany led the automotive lead acid battery market in Europe by occupying a share of 25.5% in the European market in 2024. The robust automotive manufacturing base and stringent emission regulations of Germany drive the demand for advanced SLI and micro-hybrid batteries to ensure compliance with environmental standards. According to Eurostat, Germany’s automotive industry generated €450 billion in revenue in 2022, which is confirming the reliance of the sector on reliable power solutions. The emphasis on sustainability has further propelled the adoption of recyclable lead acid batteries, aligning with national green initiatives.

France accounted for the second biggest share of the European market. The strong presence of France in the commercial vehicle sector drives the demand for durable and cost-effective lead acid batteries, particularly for logistics and public transportation. According to the French Ministry of Transport, commercial vehicle sales grew by 10% in 2022, indicating the sector’s dependence on efficient power solutions.

The UK is estimated to grow at a prominent CAGR over the forecast period in the European market owing to the increasing focus of the UK on urban mobility and last-mile delivery, which boosts the demand for lead acid batteries, ensuring a reliable power supply for commercial fleets.

Italy is predicted to account for a notable share of the European market over the forecast period. The automotive sector of Italy, particularly in passenger cars and two-wheelers, relies heavily on lead acid batteries to maintain affordability and accessibility.

Spain is likely to hold a notable position in the European market over the forecast period. The growing logistics and e-commerce sectors of Spain drive the demand for efficient and scalable power solutions, ensuring timely and sustainable operations.

KEY MARKET PLAYERS

Some of the major players in the Europe automotive lead acid batteries market are C&D Technologies, Inc., CSB Battery Co., Ltd., Hitachi Chemical Energy Technology Co. Ltd., East Penn Manufacturing Company, Enersys Inc., Exide Industries Ltd., Exide Technologies Inc., GS Yuasa Corporation, Johnson Controls Inc. Top of Form

MARKET SEGMENTATION

This research report on the Europe automotive lead acids market has been segmented and sub-segmented into the following categories.

By Type

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

By Product

- SLI Batteries

- Micro Hybrid Batteries

Application

- Passenger Car

- LCVs/HCVs

- Two Wheeler

- Three Wheelers

By Customers

- OEM

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe automotive lead acid batteries market?

The European automotive lead Acid Batteries Market Size was valued at USD 11.74 billion in 2025

How big is the Europe automotive lead acid batteries market?

The Europe Automotive lead Acid Batteries Market Size was valued at USD 11.08 billion in 2024 from USD 11.74 billion in 2025 from USD 18.64 billion by 2033, growing at a CAGR of 5.95% during the forecast period from 2025 to 2033.

Which region was the most dominant country in the Europe automotive lead acid batteries market?

Germany led the automotive lead acid battery market in Europe by occupying a share of 25.5% in the European market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]