Europe Automotive Glass Market Size, Share, Trends & Growth Forecast Report – Segmented By Type, Application Type, Vehicle Type End-User And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From (2025 to 2033)

Europe Automotive Glass Market Size

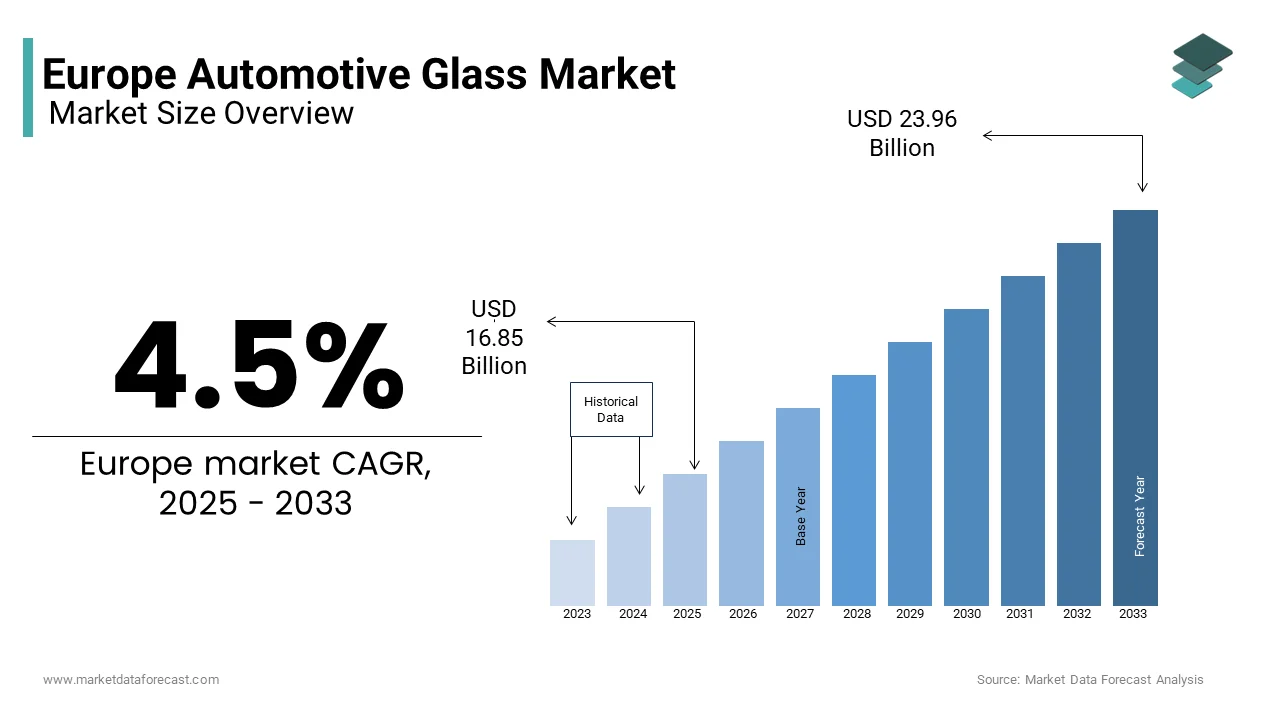

The Europe automotive glass market was USD 16.12 billion in 2024 and is anticipated to reach at USD 16.85 billion in 2025 from USD 23.96 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033.

Automotive glass, which includes windshields, side windows, rear windows, and sunroofs is designed to meet stringent safety standards while offering advanced functionalities such as UV protection, acoustic insulation, and heads-up display (HUD) compatibility. Increasing vehicle production, rising consumer demand for premium vehicles, and advancements in smart glass technologies are driving the growth rate of the market. According to the European Automobile Manufacturers’ Association (ACEA), over 18 million vehicles were produced in Europe in 2022, with nearly all new vehicles incorporating advanced glazing solutions.

Europe’s rapid adoption of eco-friendly and energy-efficient materials has significantly influenced the automotive glass market. According to the European Commission, laminated and tempered glass, which enhance safety and reduce cabin heat, are now standard in over 90% of vehicles. Additionally, innovations such as electrochromic and thermochromic smart glass are gaining traction in electric vehicles (EVs), where energy efficiency is paramount. Germany, France, and Italy lead consumption patterns by reflecting robust automotive manufacturing hubs and investments in lightweight, high-performance materials. As automakers prioritize innovation and regulatory compliance, the European automotive glass market stands poised for transformative growth, balancing technological advancement with sustainability goals.

Market Drivers

Growing Demand for Electric Vehicles (EVs)

The surging demand for electric vehicles (EVs), which rely on advanced glazing solutions to enhance energy efficiency and passenger comfort, is one of the key drivers for one of the major drivers of the European automotive glass market. According to Eurostat, EV sales in Europe grew by 65% in 2022 is accounting for over 20% of total vehicle sales. Automotive glass technologies, such as solar control and electrochromic smart glass, play a pivotal role in reducing cabin heat and improving battery efficiency. As per the European Commission, these innovations can reduce HVAC-related energy consumption by up to 30%, extending the EV range. According to the Confederation of European Construction Industries, laminated acoustic glass is increasingly adopted in EVs to minimize noise pollution by enhancing the driving experience.

Advancements in Smart Glass Technologies

The rapid advancement of smart glass technologies, which are transforming vehicle functionality and aesthetics, is escalating the growth rate of the European automotive glass market. According to the European Automobile Manufacturers’ Association (ACEA), over 15% of premium vehicles in Europe now incorporate heads-up display (HUD) compatible windshields, a figure expected to double by 2028. Innovations such as electrochromic and thermochromic glass enable dynamic tinting by reducing glare and enhancing passenger comfort. According to the German Federal Ministry for Economic Affairs, investments in smart glass R&D exceeded €2 billion in 2022 was driven by their application in autonomous vehicles and connected car systems. Additionally, Eurostat notes that smart glass adoption reduces interior heat buildup by 40%, which is improving energy efficiency. Smart glass technologies are set to revolutionize the European automotive glass market by ensuring sustained growth and differentiation.

High Production Costs of Advanced Glazing Solutions

The European automotive glass market has a high production cost associated with advanced glazing technologies, such as smart glass and acoustic laminated glass. According to the Eurostat, integrating these innovations increases manufacturing costs by up to 25% by making them less accessible for budget-friendly vehicles. According to the European Automobile Manufacturers’ Association (ACEA), only 10% of mid-range vehicles currently adopt premium glazing solutions due to affordability concerns. As per the German Federal Ministry for Economic Affairs, the R&D investments in advanced glass technologies exceed €1 billion annually is further raising barriers for smaller manufacturers. These costs are often passed on to consumers is limiting adoption rates. The financial burden of advanced automotive glass remains a significant challenge in price-sensitive markets across Europe.

Supply Chain Disruptions and Raw Material Shortages

Another significant restraint is the ongoing supply chain disruptions and shortages of critical raw materials, such as float glass and specialized coatings. As per Eurostat, global supply chain bottlenecks caused a 15% decline in automotive glass production capacity in 2022 by directly impacting vehicle manufacturing schedules. According to the Confederation of European Construction Industries, the rising cost of silica sand, a key raw material, has increased by 20% over the past year due to geopolitical tensions and logistical challenges. Additionally, the European Commission study reveals that lead times for automotive glass components have extended by 30%, creating uncertainties for automakers. These disruptions not only increase production costs but also hinder the timely delivery of vehicles is posing significant challenges to market growth and operational efficiency in the European automotive glass market.

Stringent Environmental Regulations on Manufacturing

The stringent environmental regulations targeting manufacturing processes is certainly to pose a challenge for the European automotive glass market. According to the European Environment Agency, glass production is energy-intensive, accounting for approximately 3% of industrial CO2 emissions in Europe. Under the EU Emissions Trading System (ETS), manufacturers face rising carbon credit costs, which have surged by 40% since 2020. As per Eurostat, compliance with REACH regulations has increased operational costs by 15%, as producers must adopt cleaner technologies to reduce emissions. These regulatory pressures, coupled with public concerns over air quality, pose significant challenges to smaller manufacturers. Balancing cost-efficiency with eco-friendly production methods remains a critical hurdle for the market players.

Intense Competition from Alternative Materials

Another significant challenge is the intense competition from alternative lightweight materials, such as polycarbonates, which are gaining traction due to their durability and cost-effectiveness. According to the European Commission, polycarbonate glazing is up to 50% lighter than traditional glass by making it ideal for electric vehicles (EVs) aiming to maximize energy efficiency. According to Eurostat, the demand for polycarbonate windows has grown by 10% annually in Europe, which is escalating the market growth of Europe's conventional automotive glass. Additionally, advancements in scratch-resistant coatings have addressed previous limitations of polycarbonates will further boost the market’s growth rate. As automakers increasingly prioritize weight reduction and fuel efficiency, automotive glass manufacturers face mounting pressure to innovate and justify their market position amidst evolving consumer preferences and technological advancements.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Application, Vehicle Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Saint-Gobain, Webasto, Asahi Glass, Nippon Sheet Glass, Xinyi Glass, Fuyao Group, Gentex Corporation, Magna International, Corning, Samvardhana Motherson. |

SEGMENTAL ANALYSIS

Europe Automotive Glass Market By Type

Regular glass dominated the market and held 8% of the European automotive glass market share in 2024. As per the European Commission, laminated and tempered glass reduces road noise by up to 30% by enhancing passenger comfort while meeting stringent safety standards. Additionally, regular glass is affordable and compatible with mass-market vehicles, ensuring its dominance. Government support through various initiative schemes is attributed in elevating the growth rate of the market. The priority to provide essential safety features and maintaining accessibility is greatly influencing the market growth rate in the coming years.

The smart glass segment is anticipated to experience the fastest CAGR of 14.5% during the forecast period. This growth is fueled by increasing adoption in electric vehicles (EVs) and premium cars, where energy efficiency and innovation are prioritized. According to the German Federal Ministry for Economic Affairs, smart glass reduces HVAC-related energy consumption by up to 30%, extending EV range. Advancements in electrochromic technologies have also improved functionality is attributed to boost the demand of the smart glass. Smart glass’s ability to enhance comfort and reduce emissions positions it as a transformative solution is aligned with regulatory goals and consumer preferences for advanced and eco-friendly technologies.

Europe Automotive Glass Market By Application Type

The windshield segment was the largest and held 65% of the European automotive glass market share in 2024. Its role in safety and providing structural integrity during collisions and ensuring driver visibility are ascribed to fuel the growth rate of the market. As per the European Commission, laminated windshields reduce road noise by up to 30% and offer UV protection by enhancing passenger comfort. Innovations like HUD-compatible and heated windshields are increasingly adopted in premium vehicles, further boosting the growth rate of the market. As per the Confederation of European Construction Industries, over 95% of new vehicles are equipped with advanced windshields due to the importance of meeting regulatory standards and consumer expectations for safety, innovation, and comfort.

The sunroof segment is projected to witness a CAGR of 8.5% during the period 2025 - 2033. This growth is fueled by rising demand for premium vehicles and enhanced cabin comfort. According to the German Federal Ministry for Economic Affairs, panoramic sunroofs, made from lightweight glass, have seen a 20% annual increase in adoption. Advancements in solar control coatings reduce cabin heat by up to 40%, improving energy efficiency. Sunroofs are becoming a key differentiator as automakers focus on luxury features to attract buyers. Their ability to enhance aesthetics and functionality positions them as a transformative solution in the automotive glass market by aligning with consumer preferences for premium and innovative vehicle designs.

Europe Automotive Glass Market By Vehicle

The passenger cars segment led the market by capturing 80% of the Europe automotive glass market. The high production volume of passenger vehicles, with over 14 million units manufactured annually in Europe, is majorly prompting the growth rate of the market. As per European Commission, nearly all new passenger cars are equipped with advanced glazing solutions, such as laminated windshields and acoustic glass, which enhance safety and reduce noise pollution by up to 30%. Additionally, the rising adoption of electric vehicles (EVs) and premium cars has increased demand for innovative glass technologies like HUD-compatible windshields and solar control glass. According to the Confederation of European Construction Industries, passenger cars are pivotal in driving innovation and affordability in automotive glass is ensuring widespread adoption across diverse market segments.

The commercial vehicles segment is estimated to register a CAGR of 6.5% in the foreseen years. This growth is fueled by stringent safety regulations mandating advanced glazing solutions in commercial fleets to reduce accidents and enhance driver visibility. According to the German Federal Ministry for Economic Affairs, the integration of ADAS features in commercial vehicles, such as lane departure warnings and blind-spot detection, has increased demand for specialized automotive glass. Additionally, the rise of e-commerce and logistics has boosted the production of delivery vans and trucks, which further propels the growth rate of this segment. Commercial vehicles are set to play a transformative role in expanding the automotive glass market.

Europe Automotive Glass Market By End-user

OEMs registered the highest portion of the overall revenue due to the advances in technology and the demand for more safety in the production of vehicles.

COUNTRY LEVEL ANALYSIS

Germany was the top performer in the Europe automotive glass market with a share of 28% in 2024 owing to the growing automotive manufacturing base, home to global giants like BMW, Volkswagen, and Mercedes-Benz, which prioritize integrating advanced glazing solutions. According to the European Automobile Manufacturers’ Association (ACEA), Germany accounts for over 30% of Europe’s total vehicle production is driving demand for automotive glass. Additionally, the country’s strong focus on electric vehicles (EVs) and autonomous technologies has propelled innovations like HUD-compatible windshields and smart glass. As per Eurostat, Germany’s investments in lightweight materials and energy-efficient glazing align with EU sustainability goals, ensuring its dominance in the regional market.

France is experiencing the fastest CAGR of 6.8% during the forecast period with stringent safety regulations, such as the EU General Safety Regulation (GSR), mandating advanced driver-assistance systems (ADAS) that rely on specialized automotive glass. According to the French Ministry of Ecological Transition, France has implemented over 100 smart city projects by integrating intelligent transportation systems (ITS) to enhance road safety. Additionally, the rising demand for premium vehicles is supported by government incentives for EVs, which boosts the adoption of innovative glazing solutions. According to the Confederation of European Construction Industries, France’s focus on sustainable mobility and urban safety positions it as a key player in the European automotive glass market.

The United Kingdom is deemed to have a prominent growth rate in the coming years. The UK’s dominance is fueled by the high adoption of premium vehicles equipped with advanced glazing technologies, such as solar control and acoustic glass. According to the Society of Motor Manufacturers and Traders (SMMT), over 60% of new vehicles sold in the UK feature laminated windshields to promote safety and comfort. Additionally, the UK’s focus on reducing road fatalities through Vision Zero initiatives drives demand for innovative automotive glass. Investments in smart city infrastructure and connected vehicle technologies further boost growth with the UK’s prominence in the regional market.

KEY MARKET PLAYERS

Saint-Gobain, Webasto, Asahi Glass, Nippon Sheet Glass, Xinyi Glass, Fuyao Group, Gentex Corporation, Magna International, Corning, Samvardhana Motherson. These are some of the market players that dominate the Europe automotive glass market.

RECENT HAPPENINGS IN THIS MARKET

Increased demand for hybrid and electric vehicles to increase sales of automotive glass

Manufacturers are focusing more on the production of electric and hybrid cars on the market. With vehicle buyers and manufacturers seeking more sustainable alternatives, the need for hybrid and electric vehicles will multiply, fuelling the demand for automotive glass in Europe.

Growing demand for luxury vehicles to boost demand for automotive glass

Currently, Mercedes-Benz and BMW of Daimler AG are focused on improving the level of comfort in luxury cars. Western Europe accounted for over 771,001,000 units in 2017 in terms of luxury vehicle manufacturing. By 2026, it is projected to reach 1,143,840,000 units due to growing demand and increased spending on luxury vehicle consumption.

In January 2016, Corning and Saint-Gobain decided to create an independent joint venture to develop, manufacture and sell light automotive glazing solutions. Advanced glazing solutions can help OEMs develop head-up displays.

MARKET SEGMENTATION

This research report on the Europe automotive glass market is segmented and sub-segmented into the following categories.

By Type

- Regular Glass

- Smart Glass

By Application Type

- Windshield

- Rear View Mirrors

- Sunroof

- Other Application Types

By Vehicle

- Passenger Cars

- Commercial Vehicles

By End-User

- Original Equipment Manufacturers (OEMs)

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]