Europe Automotive Composites Market Size, Share, Trends & Growth Forecast Report Segmented By Fibre Type, Resin Type, Application, and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Composites Market Size

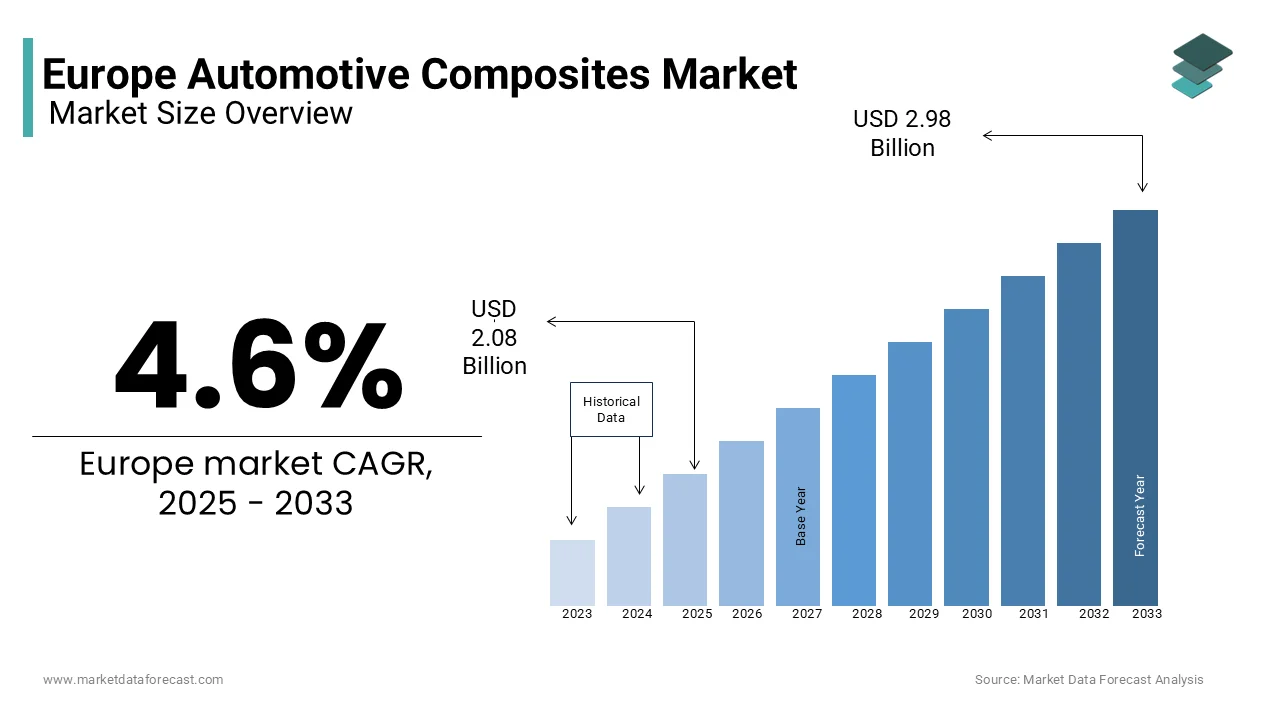

The Europe automotive composites market size was valued at USD 1.99 billion in 2024 and is anticipated to reach USD 2.08 billion in 2025 from USD 2.98 billion by 2033, growing at a CAGR of 4.6% during the forecast period from 2025 to 2033.

Composites, which typically consist of a matrix material reinforced with fibers, are increasingly being utilized in various automotive components, including body panels, interior parts, and structural elements. The market has experienced significant growth, driven by the rising demand for lightweight materials that contribute to improved fuel economy and reduced emissions.

The market is featured by various types of composites, including glass fiber-reinforced plastics (GFRP), carbon fiber-reinforced plastics (CFRP), and natural fiber composites, each tailored for specific applications. The increasing emphasis on sustainability and the circular economy is also propelling the demand for eco-friendly composite materials, particularly those derived from renewable resources. As the automotive industry continues to evolve, the demand for high-performance automotive composites is anticipated to rise, positioning this market for significant expansion in the coming years.

MARKET DRIVERS

Growing Focus on Lightweighting

The growing focus on lightweighting in the automotive industry serves as a primary driver for the Europe Automotive Composites Market. As manufacturers strive to meet stringent emissions regulations and improve fuel efficiency, the adoption of lightweight materials has become increasingly critical. Composites, known for their high strength-to-weight ratio, are ideal for reducing vehicle weight without compromising structural integrity. As per the European Automobile Manufacturers Association, reducing vehicle weight by 10% can lead to a fuel efficiency improvement of approximately 6% to 8% is making light weighting a key strategy for automakers. This factor is becoming more important as the shift to electric vehicles (EVs) continues, since EVs need lightweight materials to improve battery life and driving range. As carmakers keep working on new and better composite materials, the need for these products is likely to stay high. This will help the automotive composites market grow steadily and strongly over the next few years.

Technological Advancements in Composite Materials

Technological advancements in composite materials represent another significant driver of the Europe Automotive Composites Market. Innovations in manufacturing processes, such as automated fiber placement and resin transfer molding, are enhancing the efficiency and quality of composite production. These advancements enable manufacturers to produce complex geometries and high-performance components that meet the evolving demands of the automotive industry. The significance of this driver lies in its ability to support the development of innovative composite solutions that enhance vehicle performance and safety. As the automotive industry continues to invest in research and development to create cutting-edge composite materials, the demand for high-quality automotive composites is anticipated to rise. Companies that focus on leveraging these technological advancements to improve their product offerings can capture a significant share of the growing market, positioning themselves for long-term success in the competitive automotive composites landscape.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints affecting the Europe Automotive Composites Market is the high production costs associated with composite materials. The manufacturing processes for composites, particularly carbon fiber-reinforced plastics, require specialized equipment and advanced technologies, which can lead to elevated production expenses. According to industry estimates, the production costs for carbon fiber composites can be up to 30% higher than those for traditional materials, primarily due to the complexity of the manufacturing process and the need for stringent quality control measures. These high production costs can pose challenges for manufacturers, particularly smaller companies with limited resources. As a result, some manufacturers may be hesitant to invest in advanced composite technologies, opting instead for more cost-effective alternatives. This reluctance can hinder the overall growth of the market, as the adoption of innovative composite solutions may be slower than anticipated.

Limited Awareness and Acceptance

A key restraint in the Europe Automotive Composites Market is the limited awareness and acceptance of composite materials among some manufacturers and consumers. Despite the numerous advantages of composites, including weight reduction and enhanced performance, there remains a perception that traditional materials, such as steel and aluminium, are more reliable and easier to work with. The market research stated that close to 40% of automotive manufacturers still prefer conventional materials due to concerns about the long-term performance and recyclability of composites. This limited acceptance can hinder the growth of the automotive composites market, as manufacturers may be reluctant to invest in new technologies and materials without a clear understanding of their benefits. Additionally, the lack of standardized testing and certification processes for composite materials can create uncertainty for manufacturers regarding their performance and safety.

MARKET OPPORTUNITIES

Expansion of Electric Vehicle Production

The expansion of electric vehicle (EV) production presents a significant opportunity for the Europe Automotive Composites Market. As governments and consumers increasingly prioritize sustainability and environmental responsibility, the demand for electric vehicles is surging. The European Commission said that the share of electric vehicles in Europe is projected to reach 30% by 2030, driven by regulatory incentives and advancements in battery technology. This shift towards electrification necessitates the use of lightweight materials, such as composites, to maximize battery efficiency and range. Manufacturers that focus on developing composite materials specifically designed for electric vehicles can capitalize on this growing market opportunity. The integration of advanced composites in EVs not only reduces weight but also enhances structural integrity and safety. As the EV market continues to expand, the demand for high-quality composites tailored for electric applications is expected to rise, positioning manufacturers for significant growth in the coming years.

Increasing Demand for Sustainable Materials

The increasing demand for sustainable materials presents another major opportunity for the Europe Automotive Composites Market. As people become more concerned about the environment, car makers are looking for greener materials to replace traditional ones. Composites made from natural fibers and plant-based resins are becoming more popular because they are better for the environment and can often be recycled. A report from the European Bioplastics Association says the market for these eco-friendly materials could grow by 15% each year until 2025. This means companies need to create new, sustainable composites that still meet the needs of modern cars. Businesses that focus on making eco-friendly materials can take advantage of this growing market and become leaders in green technology. The push for sustainability is creating big opportunities for growth in the automotive composites market.

MARKET CHALLENGES

Supply Chain Disruptions

One big problem for the Europe automotive composites market is how easily supply chains can be disrupted. Making automotive composites depends on getting many different raw materials, like fibers and resins, from a wide range of suppliers. Recent events, such as the COVID-19 pandemic and political conflicts, have shown how weak these supply chains can be, causing delays and higher costs. Experts say these issues have increased the time it takes to get composite materials by 20%. This makes it harder for manufacturers to stay on schedule and deliver products to customers, which can hurt their sales and market position. On top of that, changing prices and shortages of raw materials make it even harder for companies to get what they need to make their products.

Competition from Alternative Materials

Competition from other materials is a big challenge for the Europe automotive composites market. As the car industry changes, materials like aluminium, high-strength steel, and thermoplastics are becoming popular options instead of traditional composites. These materials can sometimes be cheaper, lighter, or perform better in certain areas. Studies show that about 30% of car makers are looking into these alternatives to save money and make better products. Because of this, composite makers might find it harder to keep their market share. To stay ahead, they need to show why composites are special—like being strong, easy to recycle, and flexible for different uses. They also need to keep investing in new technology to make their products better and stand out in a fast-changing market.

REPORT COVARGAE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.6% |

|

Segments Covered |

By Fiber Type, Resin Type, Application and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

SGL Carbon, TEIJIN LIMITED, BASF, Solvay, Hexcel Corporation, Zoltek Corporation, Evonik Industries AG, Mitsubishi Chemical Group Corporation, Covestro AG, and LANXESS. |

SEGMENTAL ANALYSIS

By Fiber Type Insights

The glass fiber segment in the Europe Automotive Composites Market was the prominent category and contributed 60.3% of the total market share in 2024 due to the widespread use of glass fiber-reinforced composites in various automotive applications including body panels, structural components, and interior parts. Glass fiber composites are favoured for their excellent mechanical properties, lightweight nature, and cost-effectiveness, making them an ideal choice for manufacturers seeking to enhance vehicle performance while reducing weight. The importance of this segment is underscored by the increasing demand for lightweight materials in the automotive industry. As manufacturers continue to innovate and develop advanced glass fiber composites, this segment is expected to remain a key driver of growth in the automotive composites market.

The carbon fiber segment is swiftly progressing within the Europe Automotive Composites Market, with a estimated CAGR of 8.2% during the forecast period. The increasing demand for high-performance carbon fiber composites in automotive applications, particularly in high-end vehicles and motorsports which is supporting the segment’s growth. Carbon fiber composites offer superior strength-to-weight ratios and stiffness compared to glass fiber, making them ideal for applications where performance is critical. The significance of this segment lies in its ability to cater to the growing consumer preference for high-performance vehicles that prioritize speed and efficiency. As the automotive industry continues to invest in advanced materials to enhance vehicle performance, the demand for carbon fiber composites is expected to rise. Companies that focus on developing innovative carbon fiber solutions tailored for automotive applications can capitalize on this growing market opportunity, positioning themselves for success in the competitive automotive composites landscape.

By Resin Type Insights

The thermoset resins segment of the Europe Automotive Composites Market represented the largest category and accounted for a substantial portion of the total market share in 2024. This is due to the excellent mechanical properties, heat resistance, and dimensional stability offered by thermoset composites and is making them ideal for various automotive applications. Thermoset resins, such as epoxy and polyester, are widely used in the production of structural components, body panels, and interior parts. The importance of this segment is underscored by the increasing demand for high-performance composites that can withstand harsh operating conditions. According to industry forecasts, the demand for thermoset composites is projected to grow at a steady rate over the next five years, driven by the rising production of vehicles and the need for effective lightweight solutions. As manufacturers continue to innovate and develop advanced thermoset composites, this segment is expected to remain a key driver of growth in the automotive composites market.

The thermoplastic resin segment is the rapidly expanding the category within the Europe Automotive Composites Market, with a predicted CAGR of 7.5% from 2025 to 2033. This rise can be because to the increasing demand for thermoplastic composites in automotive applications, particularly for their recyclability, ease of processing, and impact resistance. Thermoplastic composites, such as polypropylene and polyamide, are gaining traction in the automotive industry due to their ability to be moulded and reshaped, making them suitable for various applications. The value of this segment is in its ability to cater to the growing consumer preference for sustainable materials and manufacturing processes. As the automotive industry continues to prioritize recyclability and environmental responsibility, the demand for thermoplastic composites is expected to rise. Companies that focus on developing innovative thermoplastic solutions tailored for automotive applications can capitalize on this growing market opportunity, positioning themselves for success in the competitive automotive composites landscape.

By Application Insights

The exterior segment is the largest in the Europe automotive composites market by making up around 50% of the total market. This is because composite materials are heavily used in making car body panels, bumpers, and other exterior parts. These materials are popular due to their lightweight, strength, and ability to handle tough weather, making them ideal for the outer parts of vehicles. The growing need for lightweight materials to boost fuel efficiency and improve vehicle performance makes this segment even more important. According to industry reports, demand for composites in exterior parts is expected to grow at a rate of 5.5% per year over the next five years. This growth will be driven by increasing vehicle production and the ongoing search for lighter, more efficient materials. As companies continue to create new and advanced composites for exterior use, this segment will stay a key driver of growth in the automotive composites market.

The interior application segment is developing at a quick pace in the Europe Automotive Composites Market, with a predicted CAGR of 6.5% over the forecast period. This can be caused by the increasing demand for lightweight and aesthetically pleasing materials in automotive interiors. These are widely used in the production of dashboards, door panels, and seating components, providing both functional and aesthetic benefits. This segment is important because it meets the rising demand for premium car interiors that improve the driving experience. As carmakers keep focusing on better designs and comfort, the need for composites in interiors is set to grow. Businesses that create new composite materials for car interiors can take advantage of this trend and strengthen their position in the competitive automotive composites market.

COUNTRY ANALYSIS

Germany's automotive composites market is experiencing steady growth and held 28.4% of the total market share in 2024. It is driven by its robust automotive industry and the increasing adoption of lightweight materials to enhance fuel efficiency. The demand for automotive composites is high, with a diverse customer base that includes major automotive manufacturers and suppliers. The presence of major automotive manufacturers and suppliers in Germany further bolsters the market's growth, as these companies seek to enhance vehicle performance and sustainability through effective composite solutions.

France’s automotive composites market is seeing steady growth, helped by the nation’s efforts to cut vehicle emissions and boost performance. The need for composites is balanced, with top carmakers driving demand and a rising focus on using eco-friendly materials. The French government has also been proactive in promoting environmental initiatives, which further supports the growth of the automotive composites market. As industries invest in modernizing their processes, the demand for composites is anticipated to rise, positioning France as a key player in the European automotive composites landscape.

The UK’s automotive composites market is growing as more attention is placed on electric vehicles and lighter materials. Demand for composites is going up, with both well-known carmakers and new electric vehicle brands using them more often. According to market analysis, the UK automotive composites market is projected to grow at a CAGR of 4.3% in the future is fuelled by the rise of electric vehicles and the increasing popularity of lightweight materials. The UK’s diverse automotive landscape, combined with a growing awareness of the benefits of composites, positions it as a vital market within the European automotive composites sector.

Italy’s automotive composites market is growing, especially in the luxury and sports car sectors. There is strong demand for advanced composites, mainly from high-end carmakers and racing teams looking for top performance. The Italian automotive industry is known for its strong presence of manufacturers producing specialized composite materials. With a focus on lightweighting and performance, Italian consumers and industries are increasingly investing in automotive composites to enhance their operational efficiency. A recent study indicated that around 65% of Italian manufacturers are investing in modern composite technologies to improve their production capabilities. The combination of a rich automotive heritage and a growing emphasis on sustainability positions Italy as a key market.

Spain's automotive composites market is growing, supported by the country's strong automotive manufacturing sector and the increasing integration of composites in vehicle production. The demand for composites is rising, with a customer base that includes both domestic and international automotive manufacturers. With a growing interest in automotive composites across various applications, including lightweighting and performance enhancement, the Spanish market is characterized by an increasing demand for high-quality composite materials. The automotive sector in Spain is experiencing a resurgence, with significant investments in manufacturing and innovation, particularly in the production of electric vehicles.

KEY MARKET PLAYERS

SGL Carbon, TEIJIN LIMITED, BASF, Solvay, Hexcel Corporation, Zoltek Corporation, Evonik Industries AG, Mitsubishi Chemical Group Corporation, Covestro AG, and LANXESS. Are the market players that are dominating the Europe automotive composites market.

MARKET SEGMENTATION

This research report on the Europe automotive composites market is segmented and sub-segmented into the following categories.

By Fiber Type

- Glass Fiber

- Carbon Fiber

By Resin Type

- Thermoset Resins

- Thermoplastic Resin

By Application

- exterior segment

- interior application

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Why are composites gaining popularity in the European automotive industry?

Composites offer lightweight, high strength, and fuel efficiency, helping automakers meet stringent EU emission regulations and improve vehicle performance.

What types of composites are commonly used in European automobiles?

Key materials include carbon fiber-reinforced plastics (CFRP), glass fiber-reinforced plastics (GFRP), and natural fiber composites, used in structural and interior components.

Which European countries drive the automotive composites market?

Germany, France, Italy, and the UK lead the market, driven by major automotive manufacturers and high R&D investments in lightweight materials.

What challenges does the automotive composites market face in Europe?

High production costs, complex recycling processes, and limited large-scale adoption due to the traditional reliance on metals in vehicle manufacturing.

Which companies are leading in the European automotive composites sector?

Key players include Hexcel Corporation, SGL Carbon, Solvay, Gurit, and Toray Industries, focusing on advanced composite solutions for electric and luxury vehicles.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]