Europe Automotive Coatings Market Size, Share, Trends & Growth Forecast Report Segmented By Resin Type, Technology, Layer, Application and By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Coatings Market Size

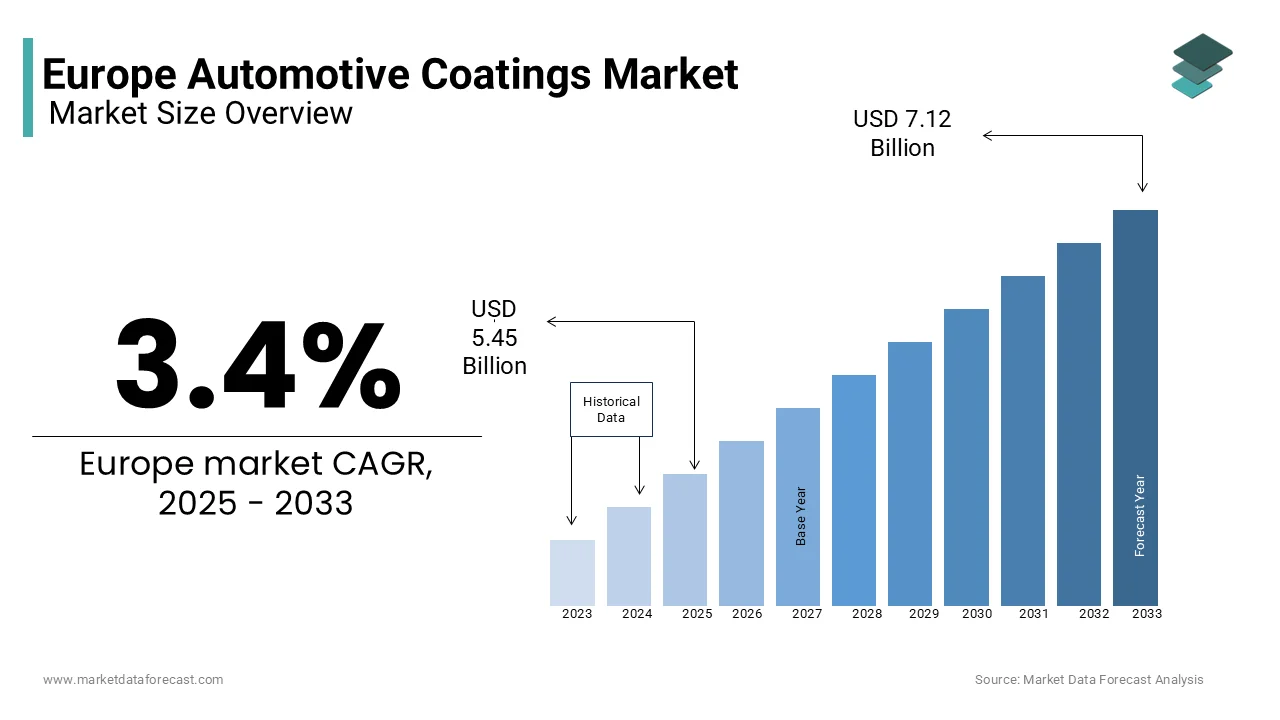

The Europe automotive coatings market size was valued at USD 5.27 billion in 2024 and is anticipated to reach USD 5.45 billion in 2025 from USD 7.12 billion by 2033, growing at a CAGR of 3.4% during the forecast period from 2025 to 2033.

Automotive coatings serve multiple purposes, including protection against corrosion, UV radiation, and environmental contaminants, while also providing a visually appealing finish. The European automotive coatings market includes a wide range of products, including primers, base coats, clear coats, and specialty coatings, each designed to meet specific performance requirements. The European automotive coatings market is characterized by various application methods, including solvent-borne, water-borne, and powder coatings, each offering distinct advantages in terms of environmental impact and performance. The growing emphasis on sustainability and regulatory compliance is propelling the demand for eco-friendly coating solutions, particularly water-borne and powder coatings, which emit fewer volatile organic compounds (VOCs). As the automotive industry continues to evolve, manufacturers are investing in innovative coating technologies to enhance the performance and sustainability of automotive coatings, positioning the Europe Automotive Coatings Market for significant expansion in the coming years.

MARKET DRIVERS

Increasing Vehicle Production and Sales in Europe

The increasing vehicle production and sales in Europe is one of the major factors driving the growth of the automotive coatings market in Europe. As the automotive industry rebounds from the impacts of the COVID-19 pandemic, vehicle manufacturers are ramping up production to meet the growing consumer demand for new vehicles. According to the European Automobile Manufacturers Association, approximately 15 million new cars were registered in Europe in 2022, marking a significant recovery from previous years. This surge in production directly correlates with the demand for automotive coatings, as each vehicle requires multiple layers of coatings for protection and aesthetics. The rising production of vehicles and the need for high-quality coatings that meet stringent performance standards is also contributing to the regional market expansion. As manufacturers continue to innovate and develop advanced coating technologies, the demand for automotive coatings is expected to remain strong, positioning this market for robust growth in the coming years.

Technological Advancements in Coating Solutions

Technological advancements in coating solutions are further boosting the growth of the Europe automotive coatings market. The automotive industry is increasingly adopting advanced coating technologies that enhance performance, durability, and environmental sustainability. Innovations such as high-performance water-borne coatings, powder coatings, and nanotechnology-based coatings are gaining traction due to their superior properties and reduced environmental impact. These advancements not only improve the quality and longevity of automotive coatings but also enable manufacturers to comply with stringent environmental regulations. As consumers become more environmentally conscious, the demand for sustainable coating solutions is expected to rise. Manufacturers that invest in research and development to create innovative coating technologies will be well-positioned to capitalize on this growing market opportunity, further driving the expansion of the automotive coatings market.

MARKET RESTRAINTS

Stringent Regulatory Compliance

One of the primary restraints affecting the Europe automotive coatings market is the stringent regulatory compliance associated with the production and application of automotive coatings. The automotive industry is subject to a myriad of regulations aimed at reducing environmental impact, particularly concerning volatile organic compounds (VOCs) and hazardous air pollutants. Compliance with these regulations often requires extensive testing, certification, and documentation, which can be time-consuming and costly for manufacturers. According to sources, the process of obtaining necessary certifications can extend lead times for new coating products by up to 25%. Additionally, the evolving nature of regulations can create uncertainty for manufacturers as they must continuously adapt to new requirements and standards. This can hinder innovation and slow down the introduction of new coating technologies, ultimately impacting market growth. To navigate these challenges, stakeholders must stay informed about regulatory changes and invest in compliance strategies that ensure their products meet the necessary standards while fostering innovation.

High Raw Material Costs

The high raw material costs associated with the production of automotive coatings is one of the major restraints of the Europe automotive coatings market. The prices of key raw materials, such as resins, pigments, and solvents, have been subject to volatility due to fluctuations in global supply chains and geopolitical factors. According to industry data, the cost of certain raw materials has increased by as much as 15% over the past year, impacting the overall production costs for automotive coatings. These elevated costs can pose challenges for manufacturers, particularly smaller companies with limited resources. As a result, some manufacturers may be hesitant to invest in advanced coating technologies, opting instead for more cost-effective alternatives. This reluctance can hinder the overall growth of the market, as the adoption of innovative coating solutions may be slower than anticipated. To overcome this challenge, manufacturers must explore cost-reduction strategies, such as optimizing production processes and leveraging economies of scale, to make high-quality coatings more accessible to a broader range of customers.

MARKET OPPORTUNITIES

Growth of Electric and Hybrid Vehicles

The growth of electric and hybrid vehicles is a significant opportunity for the Europe Automotive Coatings Market. As governments and consumers increasingly prioritize sustainability and environmental responsibility, the demand for electric and hybrid vehicles is surging. According to the European Commission, the market share of electric vehicles in Europe is projected to reach 30% by 2030, driven by regulatory incentives and advancements in battery technology. This shift towards electrification necessitates the use of specialized coatings that can withstand the unique requirements of electric powertrains and high-voltage systems. Manufacturers that focus on developing coatings specifically designed for electric and hybrid vehicles can capitalize on this growing market opportunity. The integration of advanced materials and technologies in coatings will enhance performance, durability, and aesthetics in electric vehicles. As the EV market continues to expand, the demand for high-quality coatings tailored for electric applications is expected to rise, positioning manufacturers for significant growth in the coming years.

Increasing Demand for Sustainable Coating Solutions

The increasing demand for sustainable coating solutions is another significant opportunity for the Europe automotive coatings market. As environmental concerns become more prominent, automotive manufacturers are seeking eco-friendly coatings that minimize their environmental impact. Water-borne and powder coatings, which emit fewer volatile organic compounds (VOCs) compared to traditional solvent-borne coatings, are gaining popularity in the market. This trend creates a growing need for manufacturers to innovate and develop sustainable coating solutions that meet the performance requirements of modern vehicles. Companies that prioritize the development of eco-friendly coatings can capitalize on this growing market opportunity, positioning themselves as leaders in the sustainable materials sector. The increasing focus on sustainability in the automotive industry presents a lucrative opportunity for growth in the automotive coatings market.

MARKET CHALLENGES

Supply Chain Disruptions

One of the major challenges facing the Europe automotive coatings market is the vulnerability of supply chains. The production of automotive coatings relies on a complex network of suppliers for various raw materials, including resins, pigments, and solvents. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted the fragility of supply chains, leading to delays and increased costs. According to industry analysts, supply chain disruptions have resulted in a 20% increase in lead times for automotive coatings. These disruptions can hinder manufacturers' ability to meet production schedules and fulfill customer orders, ultimately impacting revenue and market share. Additionally, fluctuations in the availability and cost of raw materials can further complicate the supply chain, as manufacturers may struggle to source the necessary components for their coatings. To mitigate this challenge, companies must develop robust supply chain strategies, including diversifying suppliers and investing in inventory management systems to ensure continuity in production.

Competition from Alternative Coating Technologies

The competition from alternative coating technologies is further challenging the growth of the Europe automotive coatings market. As the automotive industry evolves, various technologies are emerging that can perform similar functions to traditional coatings, such as nanocoatings and self-healing coatings. These alternatives may offer unique advantages, such as enhanced durability, reduced maintenance, and improved aesthetics. According to market research, approximately 30% of automotive manufacturers are exploring alternative coating technologies to enhance vehicle performance and efficiency. This competitive landscape can make it difficult for traditional coating manufacturers to maintain market share, particularly as companies seek innovative solutions to enhance their products. To address this challenge, manufacturers must focus on differentiating their products by emphasizing the unique benefits of automotive coatings, such as their reliability, durability, and ability to support advanced vehicle technologies. Additionally, investing in research and development to enhance the performance of automotive coatings can help manufacturers stay competitive in a rapidly evolving market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.4% |

|

Segments Covered |

By Product, Equipment Type, Propulsion Type, Engine Capacity, Power And Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, BASF SE, Axalta Coating Systems, Teknos Group, Akzo Nobel N V, Kansai Paints Co Ltd, National Paints Factories Co Ltd, SIKA AG, TIGER Coatings GmbH & Co KG. |

SEGMENTAL ANALYSIS

By Resin Type Insights

The polyurethane resin segment occupied 41.9% of the European market share in 2024. The dominance of polyurethane resin segment in the European market is primarily due to the excellent durability, flexibility, and chemical resistance offered by polyurethane coatings, making them ideal for various automotive applications, including exterior finishes and protective coatings. Polyurethane coatings are widely used in the automotive industry due to their ability to provide a high-gloss finish and superior protection against environmental factors. The rising production of vehicles and the need for advanced coating solutions are fuelling the growth of polyurethane resin segment in the European market. As manufacturers continue to innovate and develop polyurethane coatings with enhanced properties, this segment is expected to remain a key driver of growth in the automotive coatings market.

The epoxy resin segment is anticipated to register a CAGR of 6.2% over the forecast period owing to the increasing demand for epoxy coatings in automotive applications, particularly for their excellent adhesion, chemical resistance, and durability. Epoxy coatings are commonly used in primer applications and as protective coatings for various automotive components. The ability of epoxy resins to provide superior protection against corrosion and wear, making it essential for maintaining the longevity of automotive parts. As manufacturers invest in advanced epoxy coating technologies, the demand for epoxy resins in the automotive sector is expected to rise. The epoxy resin segment is poised for substantial growth as the automotive industry continues to prioritize performance and durability in coating solutions.

By Technology Insights

The solvent-borne technology segment held 50.7% of the regional market share in 2024. The dominating position of solvent-borne segment in the European market is primarily due to the widespread use of solvent-borne coatings in various automotive applications, including primers, base coats, and clear coats. Solvent-borne coatings are favored for their ease of application and ability to provide a smooth finish, making them a popular choice among manufacturers. As manufacturers continue to innovate and develop solvent-borne coatings with improved properties, this segment is expected to remain a key driver of growth in the automotive coatings market.

The water-borne technology segment is predicted to exhibit a CAGR of 6.5% over the forecast period. The growth of the water-borne segment in the European market can be attributed to the increasing demand for eco-friendly coatings that minimize environmental impact. Water-borne coatings emit fewer volatile organic compounds (VOCs) compared to solvent-borne alternatives, making them a preferred choice for manufacturers seeking to comply with stringent environmental regulations. As consumers become more environmentally conscious, the demand for water-borne coatings is expected to rise. Manufacturers that focus on developing advanced water-borne coating solutions can capitalize on this growing market opportunity, positioning themselves as leaders in the sustainable materials sector.

By Layer Insights

The e-coat segment held 30.9% of the European market share in 2024. The dominance of e-coat segment in the European market is primarily due to the excellent corrosion resistance and uniform coverage provided by e-coat technology, making it an essential part of the automotive coating process. E-coat is typically used as a primer layer, providing a strong foundation for subsequent layers of paint. As manufacturers continue to innovate and develop advanced e-coat technologies, this segment is expected to remain a key driver of growth in the automotive coatings market.

The clear coat segment is projected to grow at a healthy CAGR in the European market over the forecast period owing to the increasing demand for high-gloss finishes and enhanced protection against environmental factors. Clear coats are applied as the final layer in the automotive painting process, providing a protective barrier that enhances the appearance and durability of the underlying paint. The ability of clear coat to improve the aesthetic appeal of vehicles while providing essential protection against UV radiation, scratches, and chemical exposure is propelling the growth of the clear coat segment in the European market. As consumers increasingly prioritize vehicle appearance and longevity, the demand for clear coat applications is expected to rise. Manufacturers that focus on developing advanced clear coat technologies can capitalize on this growing market opportunity, positioning themselves for success in the competitive automotive coatings landscape.

By Application Insights

The automotive OEM segment held 70.1% of the European market share in 2024. The dominance of automotive OEM segment is primarily due to the high demand for coatings in the original equipment manufacturing process, where vehicles are painted and finished before being sold to consumers. The OEM segment encompasses a wide range of applications, including primers, base coats, and clear coats, all of which are essential for ensuring the quality and durability of the final product. As manufacturers continue to innovate and develop advanced coating technologies, the demand for automotive coatings in the OEM segment is expected to remain strong.

The automotive refinish segment is anticipated to exhibit a CAGR of 7.1% over the forecast period. This growth can be attributed to the increasing demand for vehicle repair and maintenance services, as consumers seek to restore the appearance and performance of their vehicles. The refinish segment includes a variety of coatings, such as primers, base coats, and clear coats, used in collision repair and touch-up applications. As the number of vehicles on the road continues to rise, the demand for automotive refinish coatings is expected to increase. Manufacturers that focus on developing high-quality refinish coatings can capitalize on this growing market opportunity, positioning themselves as leaders in the automotive coatings sector.

COUNTRY ANALYSIS

Germany was the leading country in the Europe automotive coatings market in 2024. The dominance of Germany in the European market is largely due to its robust automotive industry, which is one of the largest in the world. With over 47 million registered vehicles as of 2022, the demand for automotive coatings in Germany is significantly high. German manufacturers are known for their focus on quality and innovation, often investing heavily in research and development to create advanced coating technologies. The presence of major automotive manufacturers and suppliers in Germany further bolsters the market's growth, as these companies seek to enhance vehicle performance and sustainability through effective coating solutions.

France occupied the second leading share of the European automotive coatings market in 2024. The French automotive sector is characterized by a diverse range of vehicles, with a strong focus on public safety and environmental sustainability. The country has a well-developed automotive infrastructure, with numerous manufacturers producing coatings for various applications. The rising trend of electric and hybrid vehicles and the increasing demand for advanced automotive technologies are propelling the French market growth. The French government has also been proactive in promoting electric mobility, which further supports the growth of the automotive coatings market. As industries invest in modernizing their processes, the demand for automotive coatings is anticipated to rise, positioning France as a key player in the European automotive coatings landscape.

The United Kingdom is another significant player in the Europe Automotive Coatings Market. With over 38 million registered vehicles, the UK market is characterized by a strong consumer preference for quality automotive products. British manufacturers are increasingly investing in advanced coating technologies to meet the growing demand for efficient and sustainable solutions. The UK automotive sector is also adapting to the shift towards electric vehicles, which requires innovative coating solutions that enhance performance and durability. The UK’s diverse automotive landscape, combined with a growing awareness of the benefits of advanced coatings, positions it as a vital market within the European automotive coatings sector. The UK government’s commitment to enhancing vehicle safety and performance further ensures a steady demand for high-quality coatings, making it a key player in the overall market.

Italy holds a significant share of the Europe automotive coatings market. The Italian automotive industry is known for its strong presence of manufacturers producing specialized coatings. With over 38 million registered vehicles, Italian consumers and industries are increasingly focused on maintaining effective performance and sustainability. The Italian market is characterized by a blend of traditional automotive manufacturing and a growing emphasis on innovative technologies. A recent study indicated that around 65% of Italian manufacturers are investing in modern coating technologies to enhance their production capabilities. The combination of a rich manufacturing heritage and a growing emphasis on sustainability positions Italy as a key market in the European automotive coatings landscape.

Spain is predicted to account for a notable share of the Europe automotive coatings market over the forecast period. With over 25 million registered vehicles, the Spanish market is characterized by a growing interest in automotive coatings across various industries, including automotive and construction. Spanish manufacturers are increasingly investing in automotive coatings to enhance their product offerings and meet the rising demand for high-quality finishes. The combination of a strong automotive culture and a growing awareness of the benefits of high-quality coatings positions Spain as an important player in the European automotive coatings market. As the automotive industry continues to evolve, the demand for innovative coating solutions in Spain is expected to rise, further solidifying its position in the market.

KEY MARKET PLAYERS

The Sherwin-Williams Company, Jotun, RPM International Inc, PPG Industries Inc, Beckers Group, BASF SE, Axalta Coating Systems, Teknos Group, Akzo Nobel N V, Kansai Paints Co Ltd, National Paints Factories Co Ltd, SIKA AG, TIGER Coatings GmbH & Co KG. are the market players that are dominating the Europe automotive coatings market.

MARKET SEGMENTATION

This research report on the Europe automotive coatings market is segmented and sub-segmented into the following categories.

By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Other Resin Types

By Technology

- Solvent-Borne

- Water-Borne

- Powder

- Other Technologies

By Layer

- E-Coat

- Primer

- Base Coat

- Clear Coat

By Application

- Automotive OEM

- Automotive Refinish

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How is the Europe automotive coatings market evolving?

The market is growing due to advancements in eco-friendly coatings, rising vehicle production, and increasing demand for durable and aesthetic finishes.

Which types of coatings are commonly used in the automotive industry?

Common types include electrocoats, primers, basecoats, and clearcoats, with waterborne and powder coatings gaining popularity for sustainability.

What role does sustainability play in the automotive coatings market?

Manufacturers are shifting toward low-VOC, water-based, and bio-based coatings to comply with EU environmental regulations and reduce emissions.

Which European countries are driving the demand for automotive coatings?

Germany, France, Italy, Spain, and the UK are major markets, supported by strong automotive manufacturing and refinishing sectors.

Who are the leading companies in the Europe automotive coatings market?

Major players include Axalta, BASF, PPG Industries, AkzoNobel, and Sherwin-Williams, focusing on innovation and sustainable coating solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]