Europe Automotive Chromium Finishing Market Size, Share, Trends & Growth Forecast Report By Type (Decorative Chromium Finishing, Hard Chromium Finishing), Application (Automotive Interiors, Automotive Exteriors, Automotive Components), Substrate Material (Steel, Aluminum, Plastics, Other Materials), End Use Vehicle Type (Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe) – Industry Analysis From 2025 to 2033.

Europe Automotive Chromium Finishing Market Size

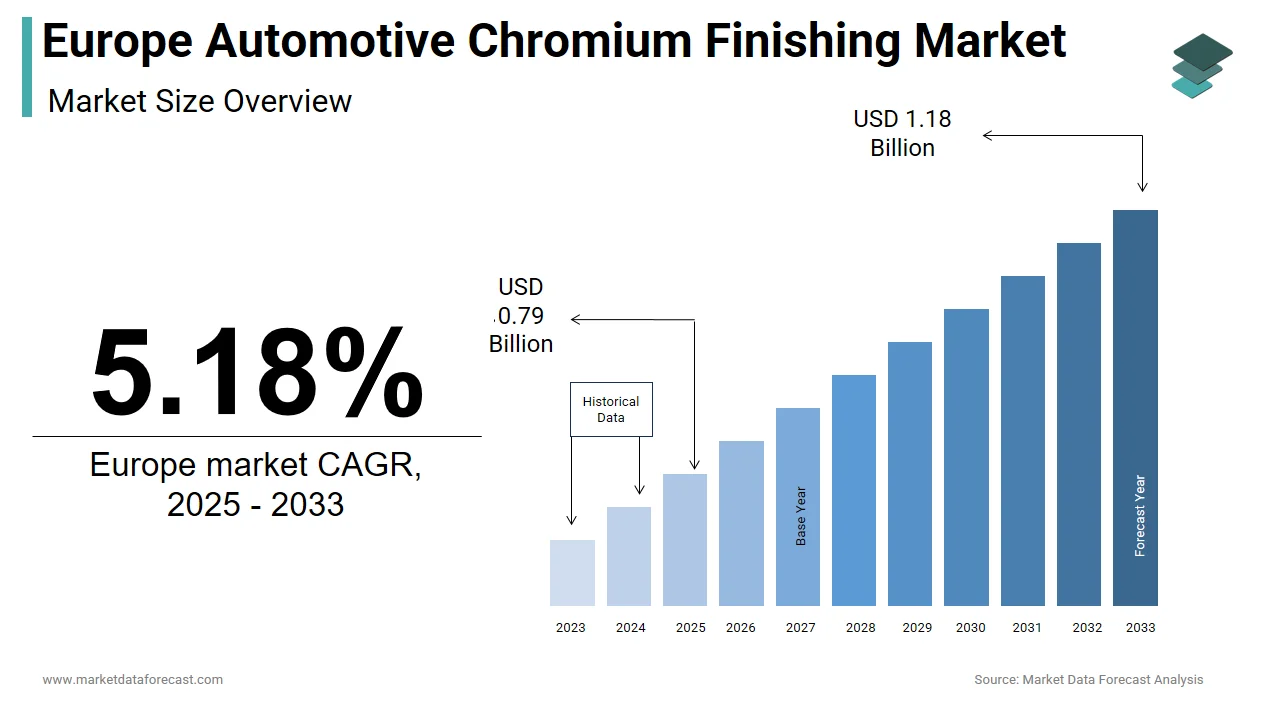

The automotive chromium finishing market size in Europe was valued at USD 0.75 billion in 2024. The European market is estimated to be worth USD 1.18 billion by 2033 from USD 0.79 billion in 2025, growing at a CAGR of 5.18% from 2025 to 2033.

The Europe automotive chromium finishing market has established a robust presence across the region and is driven by its integration into both luxury and mass-market automotive production. Also, the automotive sector accounts for a notable share the EU’s GDP, with Germany, France, and Italy leading in manufacturing output. This industrial backbone supports the demand for chromium finishing, which enhances durability and aesthetics. The market is further bolstered by stringent emission regulations, pushing manufacturers toward lightweight materials requiring protective coatings. Europe consumes a significant portion of global chromium chemicals, underscoring regional reliance on this technology. Despite economic fluctuations, the market remains resilient due to steady automotive exports and innovations in surface treatments.

MARKET DRIVERS

Rising Demand for Lightweight Automotive Components

The push for fuel-efficient vehicles has intensified the demand for lightweight materials like aluminum and advanced steel alloys, which require chromium finishing to enhance corrosion resistance. The aluminum usage in cars is expected to grow between 2020 and 2030, reaching 200 kg per vehicle. This surge directly correlates with increased adoption of chromium coatings, particularly hard chromium plating, to ensure component longevity. Also, reducing vehicle weight can improve fuel efficiency, driving automakers to adopt these technologies.

Growing Luxury Vehicle Segment

Europe's luxury automotive section, led by brands like Mercedes-Benz and BMW, heavily relies on decorative chromium finishing for aesthetic appeal. Decorative chromium finishing is pivotal in crafting premium interiors and exteriors, including grills, trims, and dashboard accents. In addition, affluent consumers prioritize design and quality, amplifying demand for chromium finishes. Furthermore, Germany alone accounts for a considerable portion of Europe’s luxury car production, reinforcing the material's critical role in high-end automotive manufacturing.

MARKET RESTRAINTS

Environmental Regulations and Toxicity Concerns

Stringent environmental regulations present a major challenge to the chromium finishing market. Hexavalent chromium, widely used in hard chromium plating, is classified as a carcinogen under the EU REACH regulation. This transition incurs additional costs for the automotive sector. Moreover, wastewater treatment requirements have escalated operational expenses. These regulatory pressures threaten to slow market growth unless sustainable substitutes are widely adopted.

High Initial Investment Costs

The capital-intensive nature of chromium finishing facilities acts as a restraint, particularly for small and medium enterprises (SMEs). Like, setting up a chromium plating unit requires a high initial investment, excluding ongoing maintenance and compliance costs. Advanced technologies like trivalent chromium plating demand specialized equipment, further increasing financial barriers. A report by the Federation of European Metalworking Industries highlights that only 20% of SMEs in the automotive supply chain can afford such upgrades. This limits market penetration, especially in economically weaker regions like Eastern Europe, where funding opportunities remain constrained.

MARKET OPPORTUNITIES

Adoption of Trivalent Chromium Technologies

Trivalent chromium, a safer alternative to hexavalent chromium, presents a lucrative opportunity for the market. This shift aligns with the EU’s Green Deal objectives, promoting eco-friendly manufacturing practices. Automakers like Volkswagen and BMW have already integrated trivalent chromium into their production lines, citing a key reduction in environmental impact. Furthermore, research by the Fraunhofer Institute indicates that trivalent chromium offers comparable performance to traditional methods while meeting REACH compliance. With increasing consumer awareness and regulatory support, this segment is poised for significant expansion.

Electric Vehicle (EV) Component Manufacturing

The rapid growth of electric vehicles (EVs) in Europe is opening new opportunities for chromium finishing, as EV registrations surged in 2022, capturing a notable share of total car sales. EV components, including battery casings and motor housings, require durable coatings to withstand thermal and mechanical stress. Chromium finishes enhance conductivity and protect against wear, making them indispensable. This trend positions the chromium finishing market as a key enabler of the EV revolution.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain vulnerabilities have emerged as a critical challenge for the chromium finishing market. Like, disruptions caused by geopolitical tensions and the COVID-19 pandemic led to a decline in raw material availability. A significant percentage of European manufacturers experienced production halts due to material shortages.

Competition from Alternative Coatings

The growing popularity of alternative coatings, such as PVD (Physical Vapor Deposition) and ceramic coatings, poses a threat to chromium finishing. Automotive giants like Audi and Tesla have begun adopting PVD for high-performance parts, citing an improvement in durability. Additionally, ceramic coatings offer enhanced heat resistance, appealing to EV manufacturers. While chromium remains dominant, the competitive landscape necessitates continuous innovation to retain market share.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Substrate Material, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

COLLINI GRUPPE (Austria), Eakas Corporation (USA), Synergies Castings Limited (India), MVC Holdings LLC (USA), Techmetals Inc. (USA), Allied Finishing Inc. (USA), United States Chrome Corporation (USA), Chem Processing Inc. (USA), Kakihara Industries Co., Ltd. (Japan), Borough Ltd. (UK), Taiyo America Inc. (USA), Hadronics Inc. (USA), Roll Technology Corp. (USA), Valley Chrome Plating Inc. (USA), SAT Plating LLC (USA), Element Solutions Inc. (USA), Joyson Safety Systems (USA), and others. |

SEGMENTAL ANALYSIS

By Type Insights

The Decorative chromium finishing segment dominated the market by holding a 60.8% share in 2024. This leading position in the market id because of its widespread use in automotive exteriors, particularly in luxury vehicles. Germany, contributing a notable portion of Europe’s automotive production, heavily utilizes decorative chromium for premium models. Apart from these, the aesthetic appeal of chromium-plated components drives consumer preference, with a significant percentage of buyers prioritizing visual quality. Furthermore, advancements in trivalent chromium have reduced environmental concerns, boosting adoption. The segment's dominance is reinforced by its alignment with evolving design trends.

The hard chromium finishing segment is the fastest-growing segment, with a CAGR of 7.8%. This growth is fueled by demand for durable components in EVs and hybrid vehicles. Like, EV motor housings require hard chromium to withstand high temperatures, driving an annual increase in usage. Additionally, lightweight materials like aluminum, which require hard chromium for corrosion resistance, are gaining traction. The segment's rapid expansion reflects its critical role in enhancing component longevity and performance.

By Application Insights

The automotive exteriors segment commanded the largest share of the Europe automotive chromium finishing market by accounting for 65.6% in 2024. This dominance is driven by the aesthetic and pr otective benefits of chromium finishes on grills, trims, and wheels. Germany, a global leader in premium car manufacturing, contributes significantly to this demand, with a noticeable portion of its production incorporating exterior chromium finishes. According to McKinsey & Company, consumer preference for visually appealing vehicles has surged, with decorative chromium being a key differentiator in luxury models. Additionally, advancements in UV-resistant chromium coatings have extended the lifespan of exterior components, further solidifying their market position.

The automotive interiors segment represents the fastest-growing application, with a CAGR of 8.3%. This progress is influenced by the rising demand for premium interior designs, particularly in high-end vehicles. A majority of luxury car buyers prioritize interior aesthetics and is driving the adoption of chromium-finished dashboard accents, door handles, and control panels. Furthermore, the shift toward EVs has amplified the focus on interior quality, as automakers aim to enhance the user experience. The integration of smart surfaces and touch-sensitive controls, often coated with chromium, shows the segment's rapid expansion.

By Substrate Material Insights

The steel segment held the largest share in the Europe automotive chromium finishing market in 2024. This widespread use is attributed to its strength and compatibility with chromium coatings, which enhance corrosion resistance and durability. Similarly, steel-based components treated with hard chromium are integral to engine parts, suspension systems, and chassis. The material's affordability and availability further bolster its dominance. Additionally, regulatory mandates promoting lightweight yet durable materials have encouraged manufacturers to refine steel-based solutions, ensuring its continued leadership in the market.

Aluminum is the fastest-growing substrate material, with a CAGR of 9.6%. The shift toward lightweight vehicles has propelled aluminum usage, with projections indicating a significant increase in automotive applications by 2030. Decorative and hard chromium finishes are essential for protecting aluminum against wear and corrosion, particularly in EV components. Aluminum's role in battery casings and motor housings has surged, driving demand for advanced surface treatments.

COUNTRY LEVEL ANALYSIS

Germany led the Europe automotive chromium finishing market in 2024 by capturing a 30.8% share. The country’s dominance is deeply rooted in its status as Europe’s automotive manufacturing hub, producing over 4 million vehicles annually. Germany is home to global automotive giants such as Volkswagen, BMW, and Mercedes-Benz, which heavily rely on chromium finishing for both functional and aesthetic applications. According to the European Automobile Manufacturers’ Association (ACEA), Germany accounts for a considerable portion of Europe’s total automotive production, with luxury vehicles driving significant demand for decorative chromium finishes. Furthermore, the German government’s commitment to sustainability has spurred investments in eco-friendly chromium technologies, including trivalent chromium plating. This financial backing, coupled with stringent quality standards, ensures Germany’s continued leadership in the market.

Spain is emerging as the fastest-growing market for automotive chromium finishing, with a projected CAGR of 8.7% through 2033. This growth is fueled by the rapid adoption of electric vehicles (EVs) and government incentives aimed at promoting sustainable manufacturing practices. Additionally, Spain benefits from EU funding programs such as the European Green Deal, which supports the transition to low-carbon technologies. The country’s strategic location and growing automotive supply chain further enhance its attractiveness for chromium finishing investments.

France, Italy, and the UK are set for steady growth in the automotive chromium finishing market, though at slower rates than Spain. France, with its strong focus on EV production led by Renault and PSA Group. Italy, renowned for its luxury car manufacturers like Ferrari and Lamborghini, continues to drive demand for decorative chromium finishes. Meanwhile, the UK, despite challenges posed by Brexit, remains a key player due to its advanced manufacturing capabilities and focus on high-performance vehicles. Like, the automotive sector contributes major share annually to the economy, ensuring sustained demand for chromium finishing solutions.

KEY MARKET PLAYERS

A few notable companies operating in the Europe automotive chromium finishing market profiled in this report are COLLINI GRUPPE (Austria), Eakas Corporation (USA), Synergies Castings Limited (India), MVC Holdings LLC (USA), Techmetals Inc. (USA), Allied Finishing Inc. (USA), United States Chrome Corporation (USA), Chem Processing Inc. (USA), Kakihara Industries Co., Ltd. (Japan), Borough Ltd. (UK), Taiyo America Inc. (USA), Hadronics Inc. (USA), Roll Technology Corp. (USA), Valley Chrome Plating Inc. (USA), SAT Plating LLC (USA), Element Solutions Inc. (USA), Joyson Safety Systems (USA), and others.

TOP LEADING PLAYERS IN THE MARKET

Atotech

Atotech, headquartered in Berlin, Germany, is leveraging its expertise in surface finishing technologies. The company specializes in developing trivalent chromium solutions that comply with stringent environmental regulations, such as the EU REACH framework. Atotech’s focus on sustainability has positioned it as a leader in eco-friendly coatings, catering to both mass-market and luxury automotive manufacturers. Its global presence and extensive R&D capabilities allow it to maintain a competitive edge, driving innovation in hard and decorative chromium finishes.

Coventya

Coventya, based in France, is renowned for its customer-centric approach and innovative product portfolio. The company collaborates closely with automakers to develop tailored chromium finishing solutions, particularly for EV components. Coventya’s emphasis on reducing the environmental impact of its products aligns with Europe’s Green Deal objectives, making it a preferred partner for sustainable manufacturing. Its partnerships with leading OEMs, including BMW and Renault, underscore its influence in the market.

Chemetall

Chemetall, a subsidiary of BASF, is recognized for its high-performance surface treatment technologies. The company focuses on enhancing the durability and corrosion resistance of automotive components through advanced chromium finishes. Chemetall’s global reach and strong distribution network enable it to serve diverse industries, while its commitment to regulatory compliance ensures long-term sustainability. Its acquisition of regional firms has further strengthened its position in Europe.

TOP STRATEGIES USED BY KEY PLAYERS

- Product Innovation: Companies like Atotech and Coventya invest heavily in R&D to develop next-generation chromium finishes, such as trivalent coatings that meet REACH regulations. These innovations not only enhance product performance but also address environmental concerns, aligning with Europe’s sustainability goals.

- Strategic Partnerships: Collaborations with automotive OEMs and Tier-1 suppliers are a cornerstone of market strategies.

- Acquisitions and Expansions: To expand their geographic footprint and product portfolios, companies are increasingly pursuing mergers and acquisitions.

- Sustainability Initiatives: Compliance with environmental regulations is a priority for all major players. Atotech and Coventya have launched initiatives to reduce VOC emissions and promote water recycling in their manufacturing processes, positioning themselves as leaders in green technologies.

- Customer-Centric Solutions: Tailoring products to meet specific customer needs is another key strategy. For example, Atotech offers modular solutions that can be adapted for both small-scale and large-scale applications, ensuring flexibility and scalability for its clients.

COMPETITION OVERVIEW

The Europe automotive chromium finishing market is characterized by intense competition, driven by technological advancements, regulatory pressures, and evolving consumer demands. Leading players such as Atotech, Coventya, and Chemetall dominate the market, leveraging their expertise in surface finishing technologies to differentiate themselves.

The shift toward sustainable manufacturing has intensified competition, with companies investing heavily in R&D to develop eco-friendly alternatives to traditional hexavalent chromium coatings.

Moreover, the rise of electric vehicles (EVs) has created new opportunities for differentiation, with players competing to provide durable and lightweight coatings for EV components. Strategic partnerships and collaborations with automotive OEMs are also critical, as they ensure long-term contracts and enhance brand reputation. Despite economic uncertainties and supply chain disruptions, the market remains resilient, with innovation and customer-centric strategies driving sustained growth.

RECENT MARKET DEVELOPMENTS

- April 2023 - Atotech Launches Trivalent Chromium Line: Atotech introduced a new line of trivalent chromium coatings designed to meet REACH compliance. This innovation enhances sustainability and reduces environmental impact, aligning with Europe’s Green Deal objectives.

- June 2023 - Coventya Partners with BMW: Coventya announced a strategic partnership with BMW to develop eco-friendly coatings for EV components. This collaboration underscores Coventya’s commitment to sustainability and strengthens its position in the luxury automotive segment.

- September 2023 - Chemetall Acquires French Firm: Chemetall acquired a French surface finishing company to expand its geographic footprint and enhance its product portfolio. This move solidifies Chemetall’s presence in Southern Europe and bolsters its supply chain capabilities.

- January 2024 - BASF Introduces Low-VOC Coatings: BASF launched a new line of low-VOC chromium coatings, targeting environmentally conscious manufacturers. This initiative aligns with regulatory mandates and positions BASF as a leader in green technologies.

- March 2024 - Henkel Invests €50 Million in R&D: Henkel announced a €50 million investment in R&D to develop advanced chromium finishes for EVs. This investment underscores Henkel’s focus on innovation and its commitment to meeting the growing demand for sustainable solutions.

MARKET SEGMENTATION

This Europe automotive chromium finishing market research report is segmented and sub-segmented into the following categories.

By Type

- Decorative Chromium Finishing

- Hard Chromium Finishing

By Application

- Automotive Interiors, Automotive Exteriors

- Automotive Components

By Substrate Material

- Steel, Aluminum, Plastics

- Other Materials

By End Use Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Heavy-Duty Vehicles

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What factors are driving the growth of the automotive chromium finishing market in Europe?

Growth is driven by the demand for lightweight materials in vehicles, stringent emission regulations, and the need for durable and aesthetically appealing coatings, especially in luxury and electric vehicles.

2. What are the main challenges faced by the chromium finishing market in Europe?

The market faces challenges from strict environmental regulations on hexavalent chromium, high capital investment requirements, and supply chain disruptions affecting raw material availability.

3. How is the market evolving with respect to sustainability and new technologies?

The shift toward eco-friendly trivalent chromium plating and the rise of electric vehicles are creating new opportunities, while alternative coatings like PVD and ceramic coatings are emerging as competitive threats.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]