Europe Automotive Aftermarket Market Size, Share, Trends & Growth Forecast Report By Replacement Type, Service Channel, Distribution Channel, Certification and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Automotive Aftermarket Market Size

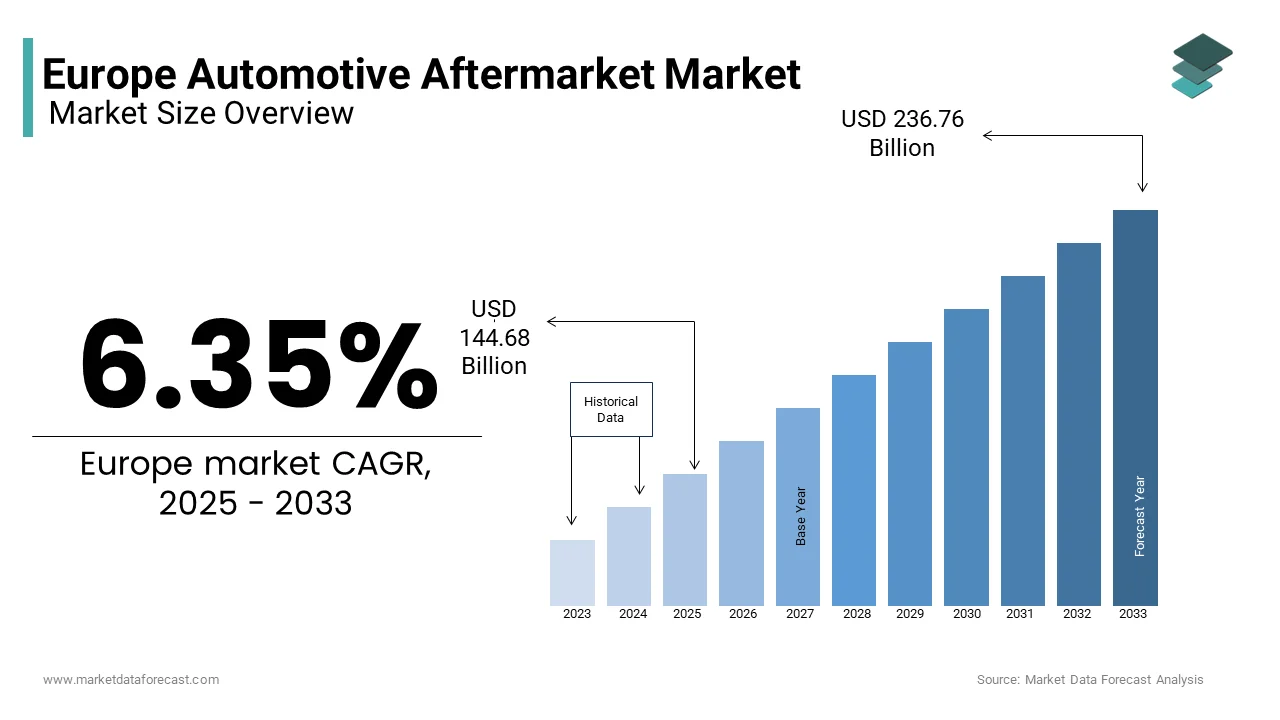

Europe's automotive aftermarket market size was valued at USD 136.04 billion in 2024. The European market size is anticipated to reach USD 144.68 billion in 2025 from USD 236.76 billion by 2033, growing at a CAGR of 6.35% during the forecast period from 2025 to 2033.

The automotive aftermarket is the secondary market of the automotive industry that includes vehicle components and accessories for manufacturing, distribution, retailing, and installation after the original sale by an automaker. The increasing vehicle parc (total number of vehicles in use), rising average vehicle age, and growing consumer preference for cost-effective repair solutions are driving the demand for automotive aftermarket. Technological advancements, such as smart diagnostics and telematics, are further transforming the market by allowing predictive maintenance and remote vehicle monitoring.

MARKET DRIVERS

Aging Vehicle Fleet in Fleet

The increasing average age of vehicles in Europe is a key driver of the European automotive aftermarket market growth. As vehicles age, they require more frequent repairs, maintenance, and part replacements to ensure performance and compliance with safety regulations. Consumers tend to keep their vehicles longer due to improved build quality, economic factors, and evolving ownership trends. The demand for replacement parts such as brake components, filters, batteries, and tires increase as older vehicles need more upkeep. Additionally, workshops and service providers see higher footfall as aging vehicles necessitate regular servicing. This trend fuels the aftermarket sector, encouraging manufacturers and retailers to expand their offerings to cater to the growing population of aging vehicles on European roads.

Expanding Vehicle Parc

The rising number of vehicles on European roads directly contributes to the demand for automotive aftermarket products and services. A growing vehicle parc means more cars, vans, and trucks requiring regular servicing, repairs, and component replacements throughout their lifecycle. The expansion is driven by increasing car ownership, urbanization, and longer vehicle retention periods. As a result, the aftermarket benefits from a steady stream of customers seeking cost-effective solutions for maintenance and enhancements. Additionally, the diversity of vehicle models in circulation encourages aftermarket suppliers to innovate and provide a wide range of compatible parts, ensuring accessibility and affordability for vehicle owners across different segments.

MARKET RESTAINTS

Technological Advancements in Vehicles

The increasing complexity of modern vehicles poses a significant restraint on the European automotive aftermarket. Advanced technologies, such as sophisticated sensors and electronic systems, require specialized knowledge and equipment for maintenance and repair. This complexity can limit the ability of independent repair shops to service newer vehicles, potentially reducing their market share. Additionally, the rise of electric vehicles (EVs), which have fewer moving parts and require less frequent maintenance, further challenges the traditional aftermarket model. According to a report by the Boston Consulting Group, the European aftermarket auto parts business, valued at €64 billion, faces challenges due to the rising complexity of auto parts and the reduced maintenance needs of EVs.

Economic Challenges and Market Saturation

Economic factors, including inflation and energy shortages, coupled with market saturation, present significant restraints on the European automotive aftermarket. These conditions can lead to decreased disposable income for car owners, reducing spending on vehicle maintenance and repairs. Furthermore, the high penetration of vehicles in Europe suggests a mature market with limited growth potential. The Boston Consulting Group highlights that uncertain economic conditions and a relatively high vehicle penetration rate may result in a slowing market for maintenance and repairs in the coming years.

MARKET OPPORTUNITIES

Digitalization and E-commerce Expansion

The growing adoption of digital platforms and e-commerce is transforming the European automotive aftermarket. Consumers increasingly prefer online channels to purchase vehicle parts, accessories, and services due to the convenience of price comparisons, wider product availability, and doorstep delivery. Automotive aftermarket players are leveraging digital tools such as AI-driven recommendations, online diagnostics, and virtual service bookings to enhance customer experience. Traditional brick-and-mortar stores are also integrating e-commerce solutions to expand their reach. This digital shift opens new revenue streams for aftermarket suppliers, allowing them to cater to a broader audience, improve operational efficiency, and optimize supply chain management. As digital adoption accelerates, businesses that invest in technology-driven solutions will gain a competitive edge in the market.

Sustainability and Circular Economy Initiatives

Sustainability and circular economy practices present a major opportunity for the automotive aftermarket in Europe. Consumers and businesses are increasingly prioritizing eco-friendly solutions, driving demand for remanufactured, refurbished, and recycled automotive parts. The focus on reducing carbon footprints and minimizing waste encourages aftermarket companies to expand their offerings of high-quality, cost-effective, and environmentally sustainable components. Vehicle owners are also showing greater interest in green repair solutions, such as eco-friendly lubricants, battery recycling programs, and energy-efficient vehicle upgrades. Companies that align with circular economy principles not only contribute to sustainability efforts but also unlock long-term profitability by tapping into the growing market for environmentally responsible automotive solutions.

MARKET CHALLENGES

Restricted Access to Vehicle Data

The European automotive aftermarket is facing significant challenges due to restricted access to vehicle data for independent service providers (ISPs). As vehicles become more software-driven, manufacturers are limiting access to real-time in-vehicle data, affecting the competitiveness of ISPs. The FIA European Bureau estimates that these restrictions could result in a €95 billion revenue loss by 2050. Additionally, around 5 million jobs in the European aftermarket sector are at risk due to these limitations. The lack of fair access to vehicle-generated data creates an uneven playing field, making it harder for independent workshops and suppliers to compete with manufacturers. The European Commission is working on new regulations to address this issue, ensuring fair market access and consumer choice.

Economic Downturn Impacting Suppliers

The European automotive aftermarket is also struggling with an economic downturn, leading to massive job losses among car parts suppliers. According to the European Association of Automotive Suppliers (CLEPA), over 30,000 jobs were lost in 2024 alone, doubling from previous years. Since 2020, the industry has experienced a net loss of 58,000 jobs due to factors such as inflation, geopolitical tensions, and increased competition from Chinese manufacturers. Major suppliers like Michelin and Schaeffler have announced large-scale layoffs and factory closures. The slowdown in vehicle production and rising material costs have further strained suppliers, forcing them to restructure operations and cut costs to stay competitive in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.35% |

|

Segments Covered |

By Replacement Type, Service Channel, Distribution Channel, Certification, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Continental AG (Germany), ZF Friedrichshafen AG (Germany), HELLA KGaA Hueck & Co. (Germany), ThyssenKrupp AG (Germany), Mahle GmbH (Germany), Delphi Tech (UK), Valeo Group (France), Faurecia (France), Gestamp (Spain), Magna International Inc (Canada), Lear Corp (US), and Others. |

SEGMENTAL ANALYSIS

By Replacement Part Insights

The tire & wheels segment led the European automotive aftermarket market in 2024 by capturing 25.8% of the European market share in 2024. According to the European Tyre and Rubber Manufacturers’ Association (ETRMA), over 350 million replacement tires were sold in Europe in 2023. The high demand is driven by tire wear, seasonal changes requiring winter and summer tires, and strict EU regulations on tread depth and safety. With an increasing focus on fuel efficiency and electric vehicles (EVs), tire manufacturers are innovating with low-rolling-resistance and durable tire options, further strengthening the segment’s dominance in the aftermarket.

The battery segment is estimated to register a CAGR of 6.2% over the forecast period. The rapid adoption of electric vehicles (EVs) and hybrid models is a major growth driver, as the European Environment Agency (EEA) reported that EV registrations increased by 35% in 2023. With more EVs on the road, demand for lithium-ion and lead-acid replacement batteries is rising. Additionally, cold weather conditions in many European regions accelerate battery degradation, increasing replacement frequency. This segment is crucial for supporting vehicle electrification and ensuring reliability in both passenger and commercial vehicle fleets.

By Service Channel Insights

With a market share of 72.9 % in 2023, the Original Equipment (OE) sector is expected to continue to dominate the market throughout the study period. Brand recognition and consumer loyalty are the major drivers of market growth in the OE sector. Aside from that, over the projection period, Do It Yourself (DIY) is predicted to grow at a respectable rate. This could be attributed to consumers' increasing technical knowledge and willingness to fix, maintain, and modify their vehicles themselves.

By Distribution Channel Insights

The wholesalers & distributors segment dominated the European automotive aftermarket market by occupying for 60.1% of the European market share in 2024. The growth of the wholesalers & distributors segment in the European market is primarily driven by its extensive supply networks, bulk purchasing advantages, and ability to serve independent workshops and fleet operators efficiently. According to the European Association of Automotive Suppliers (CLEPA), over 70% of independent garages source their parts through wholesalers, ensuring a steady supply of replacement components. With the growing complexity of modern vehicles, wholesalers play a vital role in providing a diverse range of high-quality parts, including OEM and aftermarket alternatives, making them essential for maintaining industry stability and competitiveness.

The retailers segment is gaining traction and is estimated to register a CAGR 5.5% over the forecast period owing to the increasing popularity of e-commerce and direct-to-consumer sales. According to Eurostat, online automotive parts sales grew by 18% in 2023, fueled by the rise in do-it-yourself (DIY) vehicle maintenance and the convenience of digital platforms. Retailers, including online marketplaces and brick-and-mortar auto parts stores, are expanding their offerings with same-day delivery and competitive pricing, making vehicle maintenance more accessible to consumers. This segment is crucial for enhancing aftermarket accessibility and driving innovation in distribution strategies.

By Certificate Insights

The genuine parts segment led the market with a share of 52.2% in the European market in 2023. In terms of scale, the genuine components market will have exceeded the aftermarket by 2026. In terms of revenue, the uncertified segment is likely to grow at a rapid pace. Counterfeit components are illegal, haven't been tested, and come with no warranty. Car manufacturers or OEMs, often known as subcontractors, make genuine components. Genuine replacement parts are more diverse, easier to find, and come with a warranty. The disadvantage is that these parts are expensive and only available through select retailers.

REGIONAL ANALYSIS

Germany holds the largest share of the European automotive aftermarket by accounting for 13.3% of the European market share in 2024. The dominance of Germany in the European market is majorly due to its strong automotive manufacturing base, extensive vehicle parc, and advanced aftermarket service networks. The country is home to leading automakers and suppliers, ensuring a steady demand for replacement parts and maintenance services. Germany also has a high vehicle ownership rate, with over 48 million registered passenger cars, as reported by the German Federal Motor Transport Authority (KBA). The emphasis on high-quality components and technological advancements in vehicle servicing further strengthens its aftermarket industry.

France is another key player in the European automotive aftermarket market. The growing demand for replacement parts and repair services is driving the automotive aftermarket market in France. The French vehicle parc consists of over 40 million passenger cars, driving the need for continuous maintenance and spare parts availability. According to the Comité des Constructeurs Français d'Automobiles (CCFA), the country is experiencing a strong shift toward digitalization in the aftermarket, with e-commerce sales of auto parts increasing significantly. The rise in electric and hybrid vehicle adoption also contributes to higher demand for specialized aftermarket services, positioning France as a rapidly expanding market in this sector.

The UK has one of the most dynamic automotive aftermarket industries in Europe, supported by a high vehicle ownership rate and a well-established service sector. The Society of Motor Manufacturers and Traders (SMMT) reports that the UK automotive aftermarket contributes over £21 billion annually to the economy. With an increasing number of older vehicles on the road—averaging over 9 years in age—the demand for replacement parts and repair services continues to grow. The UK’s strong e-commerce presence in auto parts sales and a rise in DIY vehicle maintenance further boosts aftermarket growth, making it one of the top-performing markets in Europe.

KEY MARKET PARTICIPANTS

Companies playing a key role in the Europe automotive aftermarket market include Continental AG, ZF Friedrichshafen AG, HELLA KGaA Hueck & Co., ThyssenKrupp AG, Mahle GmbH, Delphi Tech, Valeo Group, Faurecia, Gestamp, Magna International Inc. and Lear Corp. Bosch is the largest automotive aftermarket company in Europe. The world's largest service provider employs 400,000 people and operates 440 companies in 60 countries, generating $91.8 billion in revenue.

RECENT HAPPENINGS IN THE MARKET

- BMW and Bosch have now unveiled a technology solution that allows independent workshops to access connected car data and deliver the services required. The first practical use case is the transfer of BMW vehicle data in the event of a first indication of servicing necessity (FNOS). The purpose of Bosch and BMW's FNOS project was to demonstrate the technical feasibility of automatically sending vehicle data related to the need for service or repair to independent workshops.

- ZF Friedrichshafen AG, a German automotive supplier, will invest in Oxbotica, a British autonomous vehicle software firm, to work on developing driving systems for pod-like shuttles that can transport people and products.

- Delphi Technologies, an auto parts manufacturer, has introduced new aftermarket steering and suspension components for the Tesla Model S electric automobile. The components are the foundation for a complete chassis solution that will cover 165,000 Model S EVs in North America and 77,000 in Europe.

- Frost & Sullivan has awarded Valeo the 2021 European New Product Innovation Award based on its recent analysis of the European commercial vehicle wiper blades aftermarket. Valeo's SWF brand is the first and only Original Equipment Supplier (OES) in the independent aftermarket to offer a specially designed wiper blade for the Mercedes-Benz (MB) Actros MP5 (IAM). Its innovative connectors handle the wiper blade's fitting requirements, and its design differs from OE versions to prevent counterfeiting.

MARKET SEGMENTATION

This research report on the Europe automotive aftermarket market has been segmented and sub-segmented based on the following categories.

By Replacement Part

- Battery

- Tyre

- Filters

- Brake Parts

- Turbochargers

- Body Parts

- Wheels

By Service Channel

- DIFM (Do it for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEMs)

By Distribution Channel

- Wholesalers & Distributors

- Retailers (OEMs and Repair Shops)

By Certification

- Certified Parts

- Genuine Parts

- Uncertified Parts

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe's automotive aftermarket market?

The current market size of Europe's automotive aftermarket market was valued at USD 144.68 Bn by 2025.

How big is the Europe's automotive aftermarket market?

Europe's automotive aftermarket market size was valued at USD 136.04 billion in 2024. The European market size is anticipated to reach USD 144.68 billion in 2025 from USD 236.76 billion by 2033, growing at a CAGR of 6.35% during the forecast period from 2025 to 2033.

Who are the market players that are dominating the Europe's automotive aftermarket market?

Continental AG, ZF Friedrichshafen AG, HELLA KGaA Hueck & Co., ThyssenKrupp AG, Mahle GmbH, Delphi Tech, Valeo Group, Faurecia, Gestamp, Magna International Inc., and Lear Corp. are the market players that are dominating the Europe's automotive aftermarket market.

What factors are driving the growth of the automotive aftermarket industry in Europe?

The market is growing due to an aging vehicle fleet, rising vehicle ownership, increased demand for replacement parts, and advancements in e-commerce for auto parts. Additionally, stricter emission norms are pushing the demand for eco-friendly components.

Which segments hold the largest share in the European automotive aftermarket?

Replacement parts (engine components, brakes, tires), accessories, diagnostic tools, and repair services make up the largest share, with independent garages and OEM dealerships playing significant roles.

What role do sustainability and electric vehicles (EVs) play in the aftermarket industry?

As EV adoption rises, demand for battery replacements, regenerative braking systems, software updates, and lightweight components is growing. Additionally, circular economy trends, such as remanufactured parts and recycling initiatives, are gaining traction.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]