Europe Automation Testing Market Size, Share, Trends, & Growth Forecast Report Segmented By Component (Testing Type), Organization Size (Small And Medium-Sized Enterprises and Large Enterprises), Vertical (Healthcare, IT & Telecommunication, Energy & Utilities, BFSI, Government, Defense And Aerospace, and Others) Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Automation Testing Market Size

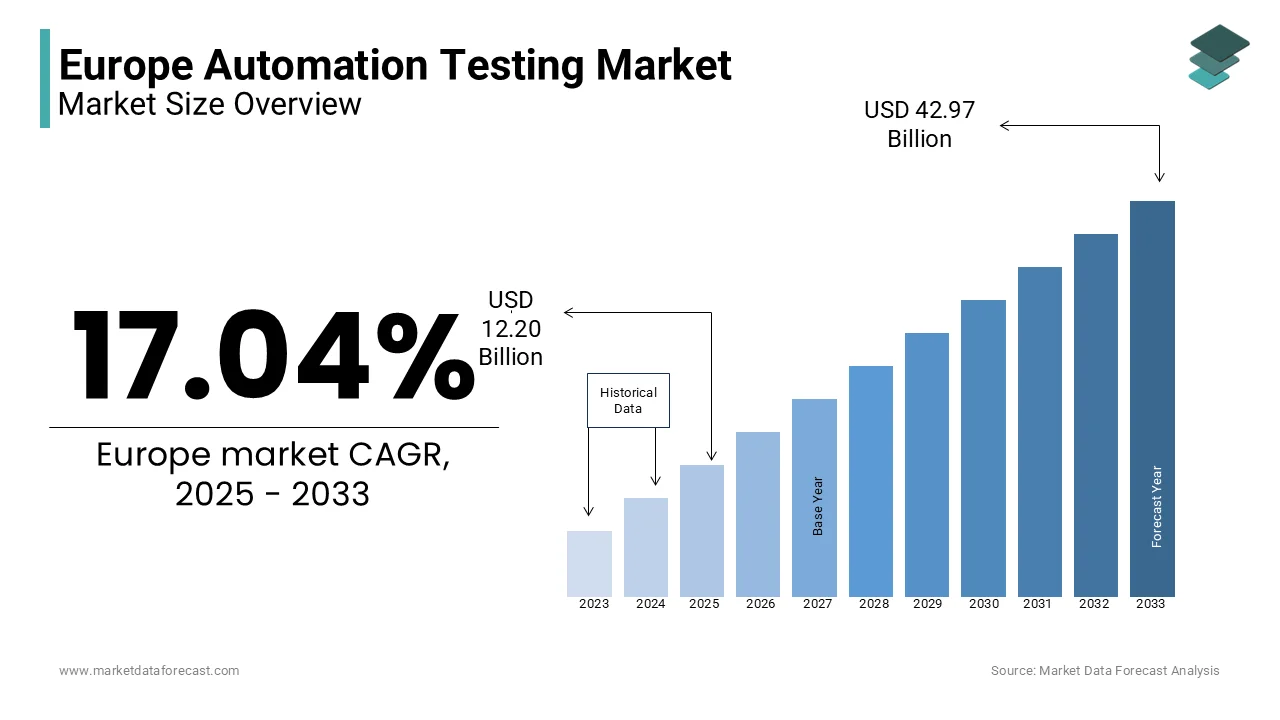

The Europe automation testing market was valued at USD 10.43 billion in 2024. The European market is estimated to reach USD 42.97 billion by 2033 from USD 12.20 billion in 2025, growing at a CAGR of 17.04% from 2025 to 2033.

Automation testing is a rapidly evolving sector and involves the use of specialized software to execute pre-scripted tests on applications, compare actual outcomes with expected results, and generate detailed reports. Automation testing include a wide range of solutions such as functional testing, performance testing, API testing, and continuous testing that cater to industries such as banking, healthcare, retail, and telecommunications.

The Europe automation testing market is experiencing robust growth. The growing adoption of agile and DevOps methodologies, the rise of digital transformation initiatives, and the increasing complexity of software applications are fuelling the demand for automation testing services. According to the European Commission, the demand for automation testing is further fuelled by stringent regulatory requirements, particularly in sectors like finance and healthcare, where software reliability and compliance are critical. Additionally, the growing adoption of IoT devices, cloud computing, and AI-driven applications has created a pressing need for advanced testing solutions. As per the International Data Corporation, over 60% of European enterprises have increased their investment in automation testing tools to ensure seamless digital experiences for end-users.

MARKET DRIVERS

Adoption of Agile and DevOps Methodologies

The widespread adoption of agile and DevOps practices is a major driver of the Europe automation testing market. As per the reports of the European Software Testing Board, more than 70% of European enterprises have integrated agile methodologies into their software development processes, necessitating continuous testing to ensure rapid and reliable releases. Automation testing aligns seamlessly with these practices, enabling faster feedback loops and reducing time-to-market. The European Commission highlights that DevOps adoption has increased by 25% annually since 2020, further boosting demand for automated testing tools. This trend is particularly prominent in the UK and Germany, where organizations prioritize efficiency and innovation in software delivery.

Increasing Complexity of Software Applications

The growing complexity of software applications, driven by advancements in IoT, AI, and cloud computing, is fueling the demand for automation testing in Europe. The International Data Corporation states that over 60% of European businesses are developing multi-platform applications, which require rigorous testing to ensure functionality and performance. The European Commission emphasizes that the proliferation of connected devices and smart technologies has increased the need for comprehensive testing solutions. Automation testing tools are essential for managing this complexity, as they enable efficient testing across diverse environments. According to the European Software Testing Board, investments in automation testing tools have grown by 20% annually, reflecting their critical role in ensuring software reliability.

MARKET RESTRAINTS

High Initial Implementation Costs

One of the primary restraints of the Europe automation testing market is the high initial cost of implementing automation testing tools and frameworks. The European Software Testing Board reports that small and medium-sized enterprises (SMEs) often face financial barriers, with setup costs ranging from €50,000 to €200,000 depending on the complexity of the systems. The European Commission highlights that 40% of SMEs delay adopting automation testing due to budget constraints. Additionally, the need for skilled personnel to manage these tools further increases expenses. While automation testing offers long-term savings, the upfront investment can be prohibitive, particularly for smaller organizations with limited resources.

Shortage of Skilled Professionals

The shortage of skilled professionals in automation testing is a significant challenge for the Europe market. The European Commission notes that the demand for automation testing experts has grown by 30% annually, outpacing the availability of qualified talent. According to the European Software Testing Board, 50% of organizations struggle to find professionals with expertise in advanced testing tools and frameworks. This skills gap leads to delays in implementation and suboptimal utilization of automation tools. Furthermore, the International Data Corporation emphasizes that the rapid evolution of testing technologies requires continuous upskilling, adding to the complexity of workforce development and hindering market growth.

MARKET OPPORTUNITIES

Rising Demand for Continuous Testing in DevOps

The increasing adoption of DevOps practices across Europe presents a significant opportunity for the automation testing market. As per the reports of the European Software Testing Board, 65% of organizations are integrating continuous testing into their DevOps pipelines to ensure faster and more reliable software releases. According to the European Commission, the demand for continuous testing tools has grown by 25% annually since 2021 due to the increasing need for seamless integration and delivery. This trend is particularly strong in sectors like finance and healthcare, where software reliability is critical. Automation testing enables real-time feedback and reduces bottlenecks, making it indispensable for organizations aiming to achieve agile and efficient development cycles.

Expansion of IoT and AI-Driven Applications

The proliferation of IoT and AI-driven applications across Europe offers a substantial growth opportunity for the automation testing market. According to the International Data Corporation, the number of connected devices in Europe is expected to reach 25 billion by 2025. This is demanding for robust testing solutions to ensure interoperability and performance. The European Commission emphasizes that AI-driven applications, particularly in healthcare and automotive sectors, require advanced testing frameworks to validate functionality and safety. Automation testing tools are essential for managing the complexity of these technologies. According to the European Software Testing Board, investments in IoT and AI testing solutions have increased by 30% annually, reflecting their critical role in supporting innovation and digital transformation.

MARKET CHALLENGES

Skill Gap in Automation Testing Workforce

One of the major challenges in the Europe automation testing market is the significant skill gap in the workforce. According to the European Commission's Digital Economy and Society Index (DESI) 2022 report, 44% of Europeans lack basic digital skills, and only 31% possess above-basic digital competencies. This shortage is particularly acute in specialized fields like automation testing, where advanced programming and analytical skills are required. The demand for skilled professionals is growing at a rate of 12% annually, as reported by Eurostat, but the supply is not keeping pace. This mismatch is hindering the adoption of automation testing technologies, especially in small and medium-sized enterprises (SMEs), which account for 99% of all businesses in the EU.

High Implementation Costs

Another critical challenge is the high cost of implementing automation testing solutions. According to the Digital Transformation Scoreboard 2021 of the European Union, 42% of companies cite financial constraints as a barrier to adopting advanced digital tools. Automation testing requires significant upfront investment in tools, infrastructure, and training, with costs ranging from €50,000 to €200,000 depending on the scale of implementation. For SMEs, which represent 85% of Europe's economy according to Eurostat, these costs are often prohibitive. Additionally, maintenance and updates further strain budgets, making it difficult for businesses to sustain long-term automation testing initiatives, thereby slowing market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.04% |

|

Segments Covered |

By Component, Organization Size, Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

IBM Corporation, Apexon, Accenture, Cigniti Technologies, Capgemini SE, Microsoft, Tricentis, Keysight technologies, Sauce Labs, and Parasoft are some of the key players in the Europe automation testing market. |

SEGMENTAL ANALYSIS

By Component Insights

The functional testing segment dominated the Europe automation testing market and accounted for 31.9% of the European market share in 2024. The domination of the functional testing segment is majorly driven by the role of functional testing in ensuring software applications perform as intended, which is essential for user satisfaction and compliance. According to the European Commission, 78% of software failures in 2023 were attributed to functional defects. Functional testing is widely adopted across industries, including finance, healthcare, and retail, where accuracy and reliability are paramount. Its prominence is further driven by the increasing complexity of software systems and the need for seamless user experiences.

The API testing segment is predicted to be the fastest-growing segment and is likely to exhibit a CAGR of 15.8% from 2025 to 2033 owing to the rising adoption of microservices architecture and cloud-based applications, which rely heavily on APIs for integration. According to the reports of Eurostat, more than 65% of European businesses now use APIs to enhance interoperability and scalability. API testing ensures seamless communication between systems, reducing downtime and improving performance. Its importance is underscored by the increasing reliance on digital ecosystems, where APIs serve as the backbone of modern software infrastructure, driving innovation and efficiency.

By Organization Size Insights

The large enterprises segment led the market and held 62.6% of the Europe automation testing market share in 2024. Their dominance stems from substantial financial resources and the need to maintain high-quality, secure, and compliant software systems. The European Commission's Digital Economy and Society Index (DESI) 2022 highlights that 68% of large enterprises have integrated automation testing into their workflows, driven by the complexity of their IT infrastructure. These organizations prioritize advanced testing types, such as performance and security testing, to ensure reliability and meet regulatory standards, making automation testing a critical component of their digital transformation strategies.

The SMEs segment is growing rapidly and is estimated to showcase a CAGR of 14.5% from 2025 to 2033 due to the increasing awareness of automation testing benefits and the availability of cost-effective solutions like managed services. According to the data of Eurostat, SMEs represent 99% of all businesses in the EU, yet only 34% have adopted advanced digital tools. The European Commission emphasizes that SMEs are increasingly investing in automation testing to improve software quality and competitiveness. This trend is vital for driving innovation and digital inclusion across Europe's diverse business landscape.

By Vertical Insights

The BFSI segment was the dominating segment and occupied 28.2% European market share in 2023 owing to the need of BFSI for secure, reliable, and compliant software systems. The European Central Bank reports that 70% of financial institutions prioritize automation testing to meet regulatory standards like PSD2 and GDPR. With increasing digital transactions and cybersecurity threats, automation testing ensures fraud detection, system stability, and customer trust. Its importance is further emphasized by the sector's contribution of over 20% to the EU's GDP, as highlighted by the European Commission.

The healthcare segment is expected to register a CAGR of 16.2% over the forecast period. This growth is fueled by the rapid adoption of digital health solutions, such as telemedicine and electronic health records (EHRs). Eurostat data shows that healthcare digital transformation spending increased by 12% in 2022. Automation testing ensures compliance with GDPR and other regulations, while enhancing patient safety and system reliability. The European Commission emphasizes its importance, noting that 76% of healthcare providers rely on testing to maintain data security and operational efficiency in an increasingly digitalized ecosystem.

REGIONAL ANALYSIS

The UK led the automation testing market in Europe and had 25.2% of the European market share in 2024. The dominance of the UK is driven by its advanced IT infrastructure, high adoption of agile and DevOps practices, and strong presence of leading automation testing solution providers. The growing demand for quality assurance in software development in the UK is further boosting the UK market growth.

Germany follows closely, accounting for 20.9% of the European market share in 2024. The German Federal Ministry for Economic Affairs and Energy highlights the country’s focus on Industry 4.0 and digital transformation as key drivers. The robust manufacturing and automotive sectors is contributing to the German market growth.

France is estimated to grow at an impressive CAGR of 14.7% over the forecast period. The investments of France in AI and cloud-based testing tools, particularly in the banking and retail sectors is likely to boost the French market growth.

The Netherlands is a noteworthy regional segment for automation testing in Europe. Netherlands is emerging as a hub for innovation in automation testing. The strong startup ecosystem and high adoption of cutting-edge technologies are propelling the automation testing market in Netherlands.

Sweden is anticipated to progress well in the European market over the forecast period. The Swedish Agency for Growth Policy Analysis notes that the country’s emphasis on digitalization and its thriving tech industry are propelling growth.

KEY MARKET PLAYERS

IBM Corporation, Apexon, Accenture, Cigniti Technologies, Capgemini SE, Microsoft, Tricentis, Keysight technologies, Sauce Labs, and Parasoft are some of the key players in the Europe automation testing market.

MARKET SEGMENTATION

This research report on the Europe automation testing market is segmented and sub-segmented into the following categories.

By Component

- Testing Type

- Static Testing

- Dynamic Testing

- Functional Testing

- Non-functional Testing

- Performance Testing

- API Testing

- Security Testing

- Load Testing

- Regression testing

- Others

- Service

- Managed services

- Professional services

By Organization Size

- Small And Medium-Sized Enterprises

- Large Enterprises

By Vertical

- Healthcare

- IT & Telecommunication

- Energy & Utilities

- BFSI

- Government

- Defense And Aerospace

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe Automation Testing Market?

Key drivers include the increasing demand for high-quality software, the need for faster software delivery cycles, and the adoption of Agile and DevOps methodologies, which require automated testing to ensure continuous integration and delivery.

Which industries are major contributors to the Europe Automation Testing Market?

The major contributors include the IT and software industry, automotive, healthcare, banking, financial services, and insurance (BFSI), and retail. These industries rely heavily on automation testing to ensure software performance and security.

What role do Artificial Intelligence and Machine Learning play in the Europe Automation Testing Market?

AI and ML enhance the automation testing process by enabling smarter test case generation, improved defect prediction, and self-healing capabilities, making the testing process more efficient and accurate.

What is the future outlook for the Europe Automation Testing Market?

The future of the market looks promising with an increasing focus on DevOps, continuous integration, and continuous delivery. Companies are expected to invest more in automation to improve software quality, reduce time to market, and optimize resource use.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]