Europe Augmented and Virtual Reality Market Size, Share, Trends, & Growth Forecast Report Segmented By Organization Size (Large Enterprises, and SMEs), Application (Consumer and Enterprise), Industry Vertical (Gaming, Entertainment and Media, Aerospace and Defense, Healthcare, Education, Manufacturing, Retail, and Others), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2033

Europe Augmented and Virtual Reality Market Size

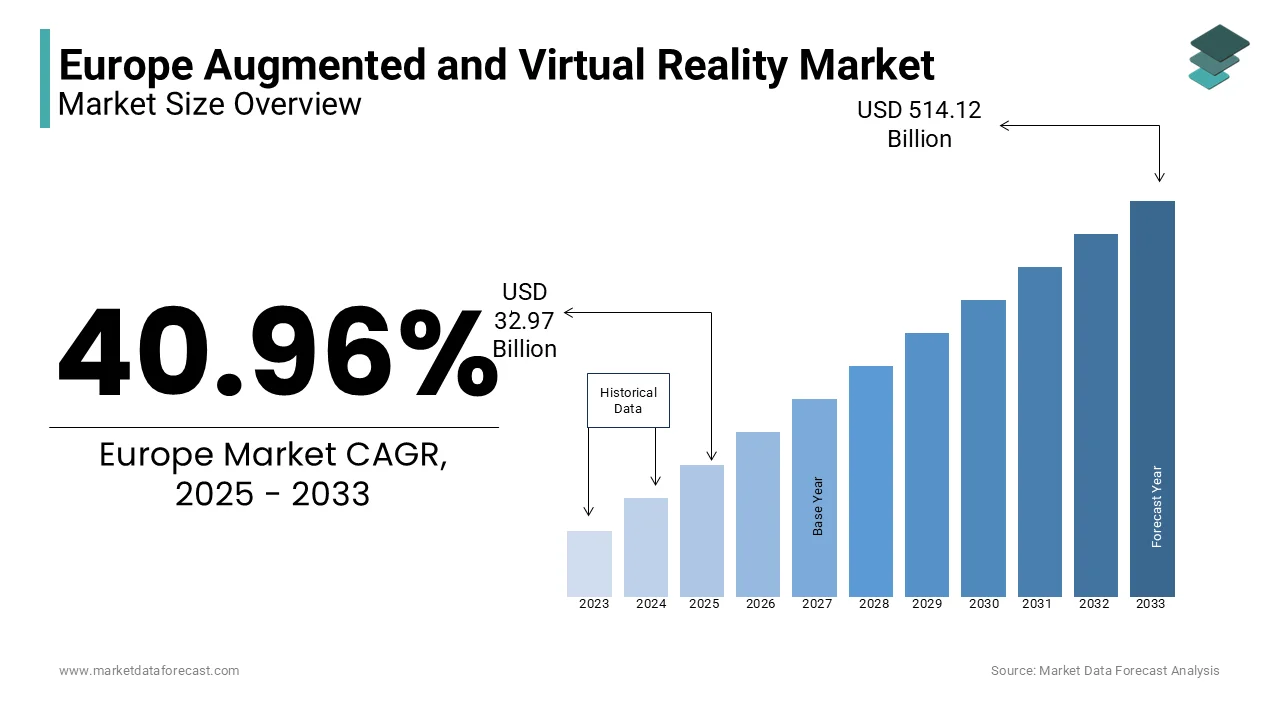

The Europe augmented and virtual reality market was valued at USD 23.39 billion in 2024. The European market is projected to reach USD 514.12 billion by 2033 from USD 32.97 billion in 2025, growing at a CAGR of 40.96% from 2025 to 2033.

The Europe augmented and virtual reality (AR/VR) market has emerged as a pivotal force in reshaping industries ranging from gaming and entertainment to healthcare, education, and manufacturing. As of 2023, augmented reality refers to the integration of digital overlays into real-world environments, enhancing user experiences through interactive and context-aware content. Virtual reality, on the other hand, immerses users in entirely simulated environments, often through headsets or specialized equipment. Together, these technologies are revolutionizing how businesses operate and how consumers interact with digital ecosystems.

This rapid expansion is fueled by increasing investments in AR/VR startups, government initiatives promoting digital innovation, and the widespread adoption of 5G networks that enhance connectivity and reduce latency. A report by Deloitte highlights that Germany, France, and the United Kingdom collectively account for nearly 60% of the region's AR/VR revenue, driven by strong industrial applications in automotive design, retail, and smart manufacturing. Furthermore, Statista notes that the gaming sector remains the largest adopter of VR technology, while AR is gaining traction in retail, where brands like IKEA and Zara have implemented virtual try-ons and immersive shopping experiences. Despite challenges such as high development costs and concerns over data privacy, the European AR/VR market continues to thrive, supported by robust R&D efforts and partnerships between tech giants and SMEs.

MARKET DRIVERS

Growing Adoption of AR/VR Technologies in Industrial and Manufacturing in Europe

The adoption of AR/VR technologies in industrial and manufacturing sectors, particularly within Germany, France, and Italy is growing significantly. These technologies are being leveraged for applications such as virtual prototyping, employee training, and predictive maintenance, which significantly enhance operational efficiency. According to a report by Eurostat, industries utilizing AR/VR solutions have reported a 25% reduction in production downtime and a 30% improvement in workforce productivity. The European Commission highlights those investments in Industry 4.0 technologies, including AR/VR, exceeded €20 billion in 2022, with manufacturing accounting for over 40% of this expenditure. This underscores the critical role of AR/VR in driving digital transformation across Europe’s industrial base. Furthermore, the German Federal Ministry for Economic Affairs notes that companies adopting AR/VR tools have experienced a 15% increase in annual revenue due to streamlined processes and enhanced innovation capabilities.

Increasing Integration of AR/VR in Healthcare and Medical Training

The World Health Organization (WHO) emphasizes that AR/VR applications in surgical simulations and patient rehabilitation have reduced medical errors by up to 20%. In the UK, the National Health Service (NHS) has implemented VR-based therapies for mental health treatment, benefiting over 10,000 patients annually. Additionally, a study by the French Ministry of Health reveals that hospitals using AR-assisted surgeries have achieved a 35% faster recovery rate for patients. The European Investment Bank reports that public and private investments in healthcare-focused AR/VR projects surpassed €5 billion in 2022, reflecting the sector's potential to revolutionize patient care. These advancements highlight how AR/VR is transforming healthcare delivery while addressing critical challenges such as resource shortages and rising costs.

MARKET RESTRAINTS

High Cost of Development and Implementation

One significant restraint hindering the growth of the Europe Augmented and Virtual Reality market is the high cost of development and implementation, which limits accessibility for small and medium-sized enterprises (SMEs). According to the European Commission, the average cost of developing a custom AR/VR solution ranges from €50,000 to €500,000, depending on complexity, making it prohibitive for smaller businesses. A report by Eurostat highlights that only 15% of SMEs in Europe have adopted AR/VR technologies due to financial constraints, compared to 60% of large corporations. The German Federal Ministry for Economic Affairs notes that despite government subsidies, over 40% of businesses cite budgetary limitations as a barrier to entry. Additionally, the UK Department for Business, Energy & Industrial Strategy reports that maintenance and updates for AR/VR systems can increase operational costs by 20-30%, further deterring adoption. These financial barriers underscore the need for more affordable solutions to democratize access to AR/VR technologies.

Data Privacy and Security Concerns

Another critical restraint is the issue of data privacy and security concerns associated with AR/VR applications, which deter widespread adoption across industries. The European Data Protection Board highlights that AR/VR systems often collect sensitive user data, including biometric information, raising compliance challenges under the General Data Protection Regulation (GDPR). France’s National Cybersecurity Agency reports that cyberattacks targeting AR/VR platforms increased by 25% in 2022, exposing vulnerabilities in data protection mechanisms. Furthermore, a study by the Italian Ministry of Technological Innovation reveals that 35% of European consumers are hesitant to adopt AR/VR due to fears of data misuse. The European Union Agency for Cybersecurity (ENISA) emphasizes that ensuring robust encryption and secure data storage could cost companies an additional 15% of their technology budgets, adding to the operational burden. These concerns highlight the urgent need for stronger regulatory frameworks and cybersecurity measures.

MARKET OPPORTUNITITES

Expansion Of AR/VR Applications Within The Education And Training Sector

One significant opportunity for the Europe Augmented and Virtual Reality market lies in the expansion of AR/VR applications within the education and training sector, driven by increasing government investments in digital learning tools. The European Commission reports that public funding for EdTech solutions, including AR/VR, exceeded €10 billion in 2022, with a focus on enhancing STEM education and vocational training. According to Eurostat, over 40% of European universities have integrated AR/VR into their curricula, resulting in a 30% improvement in student engagement and retention rates. The UK Department for Education highlights that AR/VR-based training programs have reduced skill acquisition time by 25% in technical fields such as engineering and healthcare. Furthermore, Germany’s Federal Ministry of Education and Research projects that the adoption of AR/VR in schools and universities could create over 100,000 new jobs by 2030, underscoring its potential to transform traditional learning paradigms while addressing workforce skill gaps.

Integration Of AR/VR Technologies In Tourism And Cultural Heritage Preservation

Another promising opportunity is the integration of AR/VR technologies in tourism and cultural heritage preservation, supported by initiatives from regional governments and EU bodies. The European Travel Commission estimates that immersive AR/VR experiences could boost tourism revenue by €15 billion annually by 2025, as travelers increasingly seek interactive and personalized experiences. Italy’s Ministry of Cultural Heritage reports that virtual tours of historical sites, such as the Colosseum and Pompeii, attracted over 5 million virtual visitors in 2022, generating €50 million in revenue. Similarly, France’s Ministry of Tourism highlights that AR-enhanced city guides have increased visitor satisfaction by 40%, driving repeat visits. The European Investment Bank notes that investments in AR/VR for tourism are expected to grow at a CAGR of 28% through 2030, reflecting the sector’s ability to revitalize cultural tourism while preserving fragile heritage sites for future generations.

MARKET CHALLENGES

Lack Of Standardized Regulations Governing AR/VR Content And Hardware

One of the major challenges facing the Europe Augmented and Virtual Reality market is the lack of standardized regulations governing AR/VR content and hardware, which creates uncertainty for developers and users alike. The European Committee for Standardization (CEN) highlights that inconsistent regulatory frameworks across member states have led to a 20% increase in compliance costs for AR/VR companies operating in multiple countries. According to the UK Office for Product Safety and Standards, over 30% of AR/VR products fail to meet basic safety and interoperability standards, posing risks to consumers. Furthermore, Germany’s Federal Institute for Occupational Safety and Health reports that prolonged use of VR headsets has been linked to health issues such as eye strain and motion sickness in 15% of users, raising concerns about long-term usability. These regulatory ambiguities hinder innovation and consumer trust, emphasizing the need for unified EU-wide standards to ensure product safety and compatibility.

Limited Availability Of Skilled Professionals

Another significant challenge is the limited availability of skilled professionals capable of developing and maintaining advanced AR/VR systems, creating a talent gap that stifles market growth. The European Centre for the Development of Vocational Training (CEDEFOP) estimates that by 2025, there will be a shortage of 500,000 AR/VR specialists across Europe, driven by rapid technological advancements outpacing workforce readiness. France’s National Agency for Skills Development notes that only 25% of engineering graduates possess the specialized skills required for AR/VR development, while Italy’s Ministry of Labour reports that upskilling existing employees in AR/VR technologies can cost businesses an additional €10,000 per employee annually. The European Investment Bank warns that this skills deficit could reduce the region’s competitiveness in the global AR/VR market by 10-15% if left unaddressed, underscoring the urgency of investing in education and vocational training programs tailored to emerging technologies.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

40.96% |

|

Segments Covered |

By Organization Size, Application, Industry Vertical, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

The major players in the Europe augmented and virtual reality market include Facebook, Samsung Electronics Co., Ltd, Sony Corporation, Microsoft Corporation, Alphabet, DAQRI, Wikitude GmbH, Magic Leap, Inc., HTC, Osterhout Design Group. |

SEGMENTAL ANALYSIS

By Organization Size Insights

The large enterprises segment dominated the European augmented and Virtual Reality market by accounting for 65.4% of the European market share in 2024. This dominance stems from their substantial financial resources, enabling significant investments in AR/VR technologies for applications like virtual prototyping and employee training. The European Investment Bank highlights that large enterprises allocate approximately 10-15% of their annual IT budgets to AR/VR, compared to just 2-3% for SMEs. This segment’s leadership underscores its critical role in driving innovation and scalability across industries, ensuring widespread adoption of AR/VR solutions.

The small & medium sized enterprises (SMEs) segment is projected to grow at the fastest CAGR of 40.4% over the forecast period. This rapid growth is fueled by increasing government subsidies and affordable AR/VR solutions tailored for SMEs. The UK Department for Business, Energy & Industrial Strategy notes that over 30% of SMEs have adopted AR/VR tools in 2023, up from just 10% in 2020, driven by their ability to enhance operational efficiency and customer engagement. Germany’s Federal Ministry for Economic Affairs reports that SMEs leveraging AR/VR have experienced a 25% increase in productivity. This segment’s growth highlights its pivotal role in democratizing access to advanced technologies, fostering innovation, and supporting Europe’s digital transformation agenda.

By Application Insights

The consumer segment holds the largest share of the Europe Augmented and Virtual Reality market and held 55.4% of the total market in 2024. This dominance is driven by the widespread adoption of AR/VR in gaming, entertainment, and immersive media experiences. The UK Office for National Statistics highlights that over 40% of European households own VR headsets, with gaming alone contributing €8 billion annually to the market. Consumer applications benefit from strong brand investments and increasing affordability of AR/VR devices. This segment’s leadership underscores its role in driving mass-market awareness and adoption, serving as a catalyst for technological advancements and broader industry growth.

The enterprise segment is projected to grow at the fastest CAGR of 45.2% over the forecast period. This rapid expansion is fueled by the integration of AR/VR in industrial training, healthcare, and remote collaboration, especially post-pandemic. Germany’s Federal Ministry for Economic Affairs reports that enterprises adopting AR/VR have reduced training costs by 30% while improving workforce efficiency by 25%. France’s Ministry of Industry notes that AR/VR adoption in manufacturing has increased by 60% since 2021, driven by Industry 4.0 initiatives. The European Investment Bank emphasizes that enterprise spending on AR/VR solutions will exceed €20 billion by 2025, reflecting its transformative potential. This segment’s growth highlights its critical role in enhancing productivity, reducing operational costs, and addressing complex business challenges across diverse industries.

By Industry Vertical Insights

The gaming industry represents the largest segment of the Europe Augmented and Virtual Reality market and occupied 40.4% of the market share in 2024. This dominance is driven by the immersive experiences AR/VR offers, coupled with the growing popularity of esports and virtual worlds. The UK Office for National Statistics highlights that AR/VR gaming generated €12 billion in revenue in 2022, with over 50 million users actively engaging in VR-based games. Gaming’s leadership is further supported by partnerships between tech giants and game developers, ensuring continuous innovation. This segment’s prominence underscores its role in driving consumer adoption of AR/VR technologies while serving as a testing ground for broader applications.

The healthcare segment is growing rapidly and is expected to showcase a CAGR of 50.5% during the forecast period. This rapid growth is fueled by AR/VR applications in surgical training, patient rehabilitation, and mental health therapies. Germany’s Federal Ministry of Health reports that VR-based therapies have reduced treatment costs by 25% while improving recovery rates by 30%. France’s National Health Agency notes that over 200 hospitals adopted AR-assisted surgeries in 2022, resulting in a 20% reduction in procedure errors. The World Health Organization emphasizes that AR/VR tools enhance medical training, reducing skill acquisition time by 40%. This segment’s expansion highlights its transformative potential in improving healthcare outcomes, addressing workforce shortages, and lowering operational costs, making it a cornerstone of Europe’s digital health revolution.

REGIONAL ANALYSIS

Germany leads the Europe Augmented and Virtual Reality market and captured 25.9% of the regional market share in 2024. This dominance is driven by its robust industrial base, with AR/VR extensively used in automotive design, manufacturing, and workforce training. Eurostat highlights that Germany’s investments in AR/VR technologies exceeded €8 billion in 2022, accounting for 40% of total European spending. The country’s leadership is further supported by strong government initiatives promoting Industry 4.0 solutions. Germany’s prominence underscores its role as a hub for innovation and technological adoption, driving the broader European AR/VR ecosystem.

The UK is the fastest-growing region and is estimated to grow at a CAGR of 48.9% during the forecast period. This growth is fueled by widespread adoption in healthcare, education, and retail sectors. The National Health Service reports that VR-based therapies have benefited over 10,000 patients annually, reducing treatment costs by 20%. Additionally, the UK Department for Business highlights that AR/VR startups received €3 billion in venture capital funding in 2022, fostering innovation. The British Retail Consortium notes that AR-driven virtual try-ons increased retail sales by 15%. The UK’s rapid expansion reflects its strategic focus on digital transformation, positioning it as a leader in AR/VR applications across diverse industries.

France, Italy, and Spain are expected to witness steady growth. In France, the market is driven by aerospace and defense applications, as per France’s Ministry of Armed Forces. Italy’s focus on cultural heritage preservation through AR/VR could generate €2 billion annually by 2026, according to Italy’s Ministry of Cultural Heritage. Spain’s tourism sector is adopting AR/VR, boosting revenue by 10%, as noted by Spain’s Ministry of Tourism. Russia, Sweden, and Switzerland are investing in AR/VR for advanced manufacturing and healthcare, while Turkey and the Czech Republic are emerging markets with a CAGR of 35%, supported by government incentives. These regions collectively contribute to Europe’s dynamic AR/VR landscape.

KEY MARKET PLAYERS

The major players in the Europe augmented and virtual reality market include Facebook, Samsung Electronics Co., Ltd, Sony Corporation, Microsoft Corporation, Alphabet, DAQRI, Wikitude GmbH, Magic Leap, Inc., HTC, Osterhout Design Group.

MARKET SEGMENTATION

This research report on the Europe augmented and virtual reality market is segmented and sub-segmented into the following categories.

By Organization Size

- Large Enterprises

- SMEs

By Application

- Consumer

- Enterprise

By Industry Vertical

- Gaming

- Entertainment and Media

- Aerospace and Defense

- Healthcare

- Education

- Manufacturing

- Retail

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the augmented and virtual reality market in Europe?

The growth is driven by increased adoption in gaming, healthcare, automotive, and manufacturing sectors, along with advancements in 5G, AI, and immersive technologies.

Which industries in Europe are seeing the most AR and VR applications?

Gaming and entertainment dominate, followed by healthcare, automotive, real estate, and retail sectors.

What role does 5G play in the European AR and VR market?

5G enables faster data transmission, low latency, and enhanced user experiences, making AR and VR applications more seamless and immersive.

What is the future outlook for the AR and VR market in Europe?

The market is expected to grow significantly, with increasing adoption in enterprise applications, consumer entertainment, and metaverse-related developments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]