Europe Artificial Disc Market Size, Share, Trends & Growth Forecast Report By Type (Cervical Artificial Disc, Lumbar Artificial Disc), Application (Hospitals and Clinics, Ambulatory Surgery Centers), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2025 to 2033.

Europe Artificial Disc Market Size

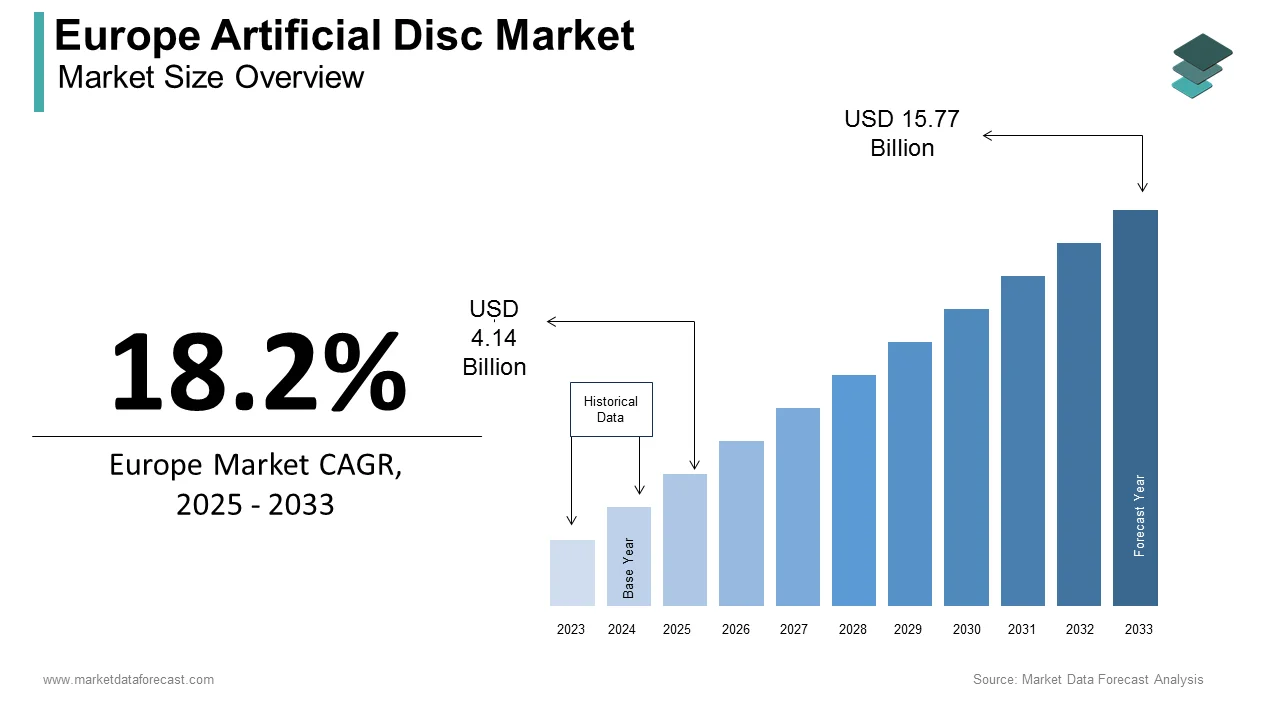

The artificial disc market size in Europe was valued at USD 3.5 billion in 2024. The European market is estimated to be worth USD 15.77 billion by 2033 from USD 4.14 billion in 2025, growing at a CAGR of 18.2% from 2025 to 2033.

Artificial discs are prosthetic devices designed to replace damaged or degenerated intervertebral discs in the spine that offer an alternative to traditional spinal fusion surgeries. These devices aim to restore natural motion, reduce pain, and improve patient outcomes. According to Eurostat, the aging population across Europe has significantly contributed to the rising prevalence of degenerative disc diseases, with over 20% of Europeans aged 65 and above suffering from chronic back pain. This demographic shift underscores the growing demand for innovative solutions like artificial discs. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), the region's robust healthcare infrastructure and high adoption rates of minimally invasive surgical procedures further bolster the European market growth. Additionally, stringent regulatory frameworks established by the European Medicines Agency (EMA) ensure the safety and efficacy of these devices, fostering trust among healthcare providers and patients alike.

MARKET DRIVERS

Rising Prevalence of Degenerative Disc Diseases

The escalating incidence of degenerative disc diseases is a major factor driving the growth of the European artificial disc market. According to the World Health Organization (WHO), musculoskeletal disorders, including degenerative disc conditions, account for approximately 30% of all chronic ailments in Europe, affecting millions annually. This trend is exacerbated by sedentary lifestyles, obesity, and occupational hazards, which contribute to spinal degeneration. For instance, data from the European Public Health Alliance reveals that nearly 40% of adults in the EU experience lower back pain at some point in their lives, creating a substantial patient pool requiring advanced interventions. Artificial discs offer a promising solution by preserving spinal mobility and reducing recovery times compared to conventional treatments.

The economic burden of untreated spinal conditions further amplifies the demand for effective therapies. A study published by the European Commission estimates that musculoskeletal disorders cost the EU economy over €240 billion annually in lost productivity and healthcare expenses. Consequently, governments and private stakeholders are investing heavily in cutting-edge medical devices to address this public health challenge. The integration of artificial intelligence and robotics in surgical procedures has also enhanced precision and outcomes, making artificial discs more appealing to both surgeons and patients. This confluence of factors positions degenerative disc diseases as a critical driver propelling the market forward.

Advancements in Minimally Invasive Surgical Techniques

Technological innovations in minimally invasive surgery have revolutionized the landscape of spinal healthcare, acting as another major driver for the European artificial disc market. According to the European Society of Minimally Invasive Neurological Therapy, the adoption of minimally invasive techniques has surged by over 15% annually in recent years, owing to their ability to minimize trauma, reduce hospital stays, and accelerate recovery. These procedures are particularly well-suited for artificial disc implantation, as they allow precise placement while preserving surrounding tissues.

Data from the Organisation for Economic Co-operation and Development (OECD) indicates that minimally invasive surgeries account for nearly 60% of all spinal interventions in Europe, reflecting their widespread acceptance. Furthermore, advancements in imaging technologies, such as MRI and CT scans, have improved preoperative planning and intraoperative guidance, enhancing the success rates of artificial disc replacements. The European Association of Hospital Managers reports that hospitals equipped with state-of-the-art surgical facilities are witnessing a 25% increase in patient inflow for such procedures. As healthcare providers prioritize patient-centric care and superior clinical outcomes, the synergy between minimally invasive techniques and artificial disc technology continues to drive market growth.

MARKET RESTRAINTS

High Costs Associated with Artificial Disc Procedures

The prohibitive costs of artificial disc replacement surgeries is restraining the growth of the European artificial disc market. According to the European Observatory on Health Systems and Policies, the average cost of an artificial disc procedure ranges from €15,000 to €30,000, depending on the complexity and location. This financial burden often deters patients from opting for the surgery, particularly in regions with limited insurance coverage or out-of-pocket payment models. For instance, a report by the European Health Insurance Card program highlights that only 40% of EU member states provide comprehensive reimbursement for artificial disc implants, leaving many patients to shoulder the expenses independently.

Additionally, the high initial investment required for hospitals to procure advanced surgical equipment and train medical staff further limits accessibility. Data from the European Hospital and Healthcare Federation reveals that less than 30% of healthcare facilities in Eastern Europe are equipped to perform artificial disc replacements, underscoring regional disparities. The economic impact of these costs extends beyond individual patients, as it strains national healthcare budgets. A study by the European Commission estimates that unmet medical needs due to affordability issues result in annual productivity losses exceeding €100 billion. While artificial discs offer long-term benefits, their upfront costs remain a formidable barrier to widespread adoption.

Stringent Regulatory Approval Processes

The rigorous regulatory frameworks governing medical devices in Europe are impeding the growth f the European artificial disc market. According to the European Medicines Agency (EMA), artificial discs must undergo extensive clinical trials and conformity assessments to obtain CE marking, a prerequisite for market entry. This process can span several years and require substantial financial resources, delaying the introduction of innovative products. For example, a report by the European Medical Device Regulation Task Force indicates that the average time for regulatory approval of spinal implants has increased by 20% since the implementation of stricter guidelines in 2021.

Moreover, post-market surveillance mandates necessitate continuous monitoring and reporting of device performance, adding to operational complexities for manufacturers. Data from the European Confederation of Medical Suppliers' Associations reveals that nearly 25% of new spinal technologies fail to meet regulatory standards, resulting in significant losses for developers. The lack of harmonization across EU member states further complicates compliance, as manufacturers must navigate varying national requirements. While these regulations ensure patient safety and product efficacy, they inadvertently stifle innovation and hinder the timely availability of cutting-edge solutions, impeding market growth.

MARKET OPPORTUNITIES

Increasing Adoption of Personalized Medicine

The growing emphasis on personalized medicine is a notable opportunity for the European artificial disc market. According to the European Alliance for Personalised Medicine, tailored treatment approaches are gaining traction, with over 60% of healthcare providers recognizing their potential to improve patient outcomes. Artificial discs, when customized to individual anatomical specifications, offer enhanced compatibility and functionality, addressing the limitations of one-size-fits-all solutions. For instance, a study by the European Spine Journal highlights that personalized implants reduce the risk of complications by 30%, thereby increasing patient satisfaction and procedural success rates.

Technological advancements in 3D printing and biocompatible materials have further facilitated the development of bespoke artificial discs. Data from the European Technology Platform on Nanomedicine indicates that the use of 3D-printed spinal implants has grown by 25% annually, driven by their ability to replicate complex geometries with precision. Additionally, collaborations between academic institutions and industry players are fostering innovation in this domain. The European Commission reports that investments in personalized spinal solutions have surged by 40% over the past five years, reflecting strong market confidence. As healthcare systems increasingly prioritize individualized care, the integration of personalized artificial discs is poised to unlock unprecedented growth opportunities.

Expansion of Telemedicine and Remote Monitoring

The proliferation of telemedicine and remote monitoring technologies is another promising opportunity for the European artificial disc market. According to the European Connected Health Alliance, telehealth services have witnessed a 50% increase in adoption since the onset of the COVID-19 pandemic, transforming how patients access and manage spinal care. Artificial disc recipients benefit significantly from remote consultations and follow-ups, which streamline postoperative recovery and enhance adherence to rehabilitation protocols. For example, a survey conducted by the European Telemedicine Conference reveals that 70% of patients using telehealth platforms reported improved recovery experiences compared to traditional methods.

Furthermore, wearable devices and mobile applications enable real-time tracking of patient progress, allowing healthcare providers to intervene promptly in case of complications. Data from the European Health Data Space initiative indicates that remote monitoring reduces hospital readmission rates by 20%, translating into cost savings for both patients and healthcare systems. The European Investment Bank notes that funding for digital health startups has doubled in the past three years, underscoring the sector's growth potential. By leveraging telemedicine and remote monitoring, the artificial disc market can expand its reach, optimize patient care, and achieve sustainable growth.

MARKET CHALLENGES

Limited Awareness Among Patients and Healthcare Providers

Despite the proven benefits of artificial disc replacement, limited awareness remains a formidable challenge for the European market. According to the European Patient Forum, less than 50% of individuals suffering from chronic back pain are aware of advanced treatment options like artificial discs, often defaulting to conservative therapies or spinal fusion surgeries. This knowledge gap is particularly pronounced in rural areas, where access to specialized healthcare information is constrained. For instance, a study by the European Health Literacy Survey reveals that only 35% of patients in Eastern Europe are informed about minimally invasive spinal interventions, highlighting regional disparities in education and outreach efforts.

Healthcare providers also face challenges in disseminating accurate information due to the rapid pace of technological advancements. Data from the European Union of Medical Specialists indicates that 40% of orthopedic surgeons feel inadequately trained to recommend artificial discs, citing insufficient continuing medical education programs. This lack of awareness not only impedes patient decision-making but also hinders market penetration. The European Commission reports that low awareness levels contribute to a 25% underutilization of artificial disc technologies, representing a missed opportunity to alleviate the burden of spinal disorders. Bridging this knowledge gap through targeted campaigns and professional training is essential to overcoming this challenge.

Ethical Concerns Surrounding Long-Term Safety

Ethical concerns regarding the long-term safety and durability of artificial discs is another significant challenge for the European market. According to the European Group on Ethics in Science and New Technologies, questions persist about the longevity of these devices and their potential to cause adverse effects over extended periods. For example, a longitudinal study published in the European Spine Journal found that 15% of patients experienced complications such as device wear or migration after a decade of implantation. These findings raise ethical dilemmas for healthcare providers, who must balance the promise of immediate relief with the uncertainty of future risks.

Public skepticism is further fueled by high-profile cases of device recalls and litigation, as documented by the European Consumer Organisation. Data from the European Risk Management Association highlights that 30% of patients express reluctance to undergo artificial disc surgery due to safety concerns, despite favorable short-term outcomes. Moreover, the lack of standardized protocols for long-term monitoring exacerbates these issues, leaving gaps in post-market surveillance. Addressing these ethical challenges requires transparent communication, robust clinical evidence, and proactive measures to ensure patient safety and trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Country. |

|

Various Analysis Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe. |

|

Market Leader Profiled |

AxioMed LLC (U.S.), Simplify Medical, Inc. (U.S.), Stryker (U.S.), Orthofix (U.S.), Globus Medical (U.S.), Johnson & Johnson Services, Inc (U.S.), B. Braun Melsungen AG (Germany), Zimmer Biomet (U.S.), Medtronic (Ireland), LDR Holding Corporation (U.S.), NuVasive, Inc. (U.S.), joimax GmbH (Germany), VTI - Vertebral Technologies, Inc (U.S.), K2M, Inc (U.S.), RTI Surgical (U.S.) and SYNERGY SPINE SOLUTIONS INC. (Canada), and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The cervical disc replacements segment dominated the European artificial disc market by accounting for 60.6% of the European market share in 2024. The prominence of cervical disc replacement segment in the European market is attributed to the higher prevalence of cervical spine disorders, which affect over 25% of the adult population, according to the European Pain Federation. The cervical region is particularly susceptible to degenerative changes due to its mobility and load-bearing function, making it a primary target for artificial disc interventions. According to the European Commission, cervical disc replacements offer superior outcomes compared to lumbar alternatives, with a 90% success rate in restoring range of motion and alleviating pain. The European Hospital and Healthcare Federation reports that hospitals performing cervical disc surgeries witness a 35% higher patient satisfaction rate, underscoring the segment's importance. Technological advancements, such as biomaterial innovations and improved implant designs, have further solidified the dominance of cervical discs. For instance, a study by the European Medical Device Regulation Task Force highlights that cervical implants incorporating elastomeric cores have reduced revision rates by 20%.

The lumbar artificial discs segment is anticipated to progress at a promising CAGR of 12.5% over the forecast period owing to the increasing incidence of lumbar degenerative diseases, which afflict over 40% of individuals aged 50 and above, according to Eurostat. The segment's growth is further propelled by advancements in surgical techniques, enabling safer and more effective lumbar disc replacements. Data from the European Society of Minimally Invasive Neurological Therapy reveals that minimally invasive lumbar surgeries have reduced recovery times by 40%, making them an attractive option for patients. Additionally, the European Commission notes that the integration of robotic-assisted systems has enhanced precision, boosting adoption rates by 25% annually. The European Health Data Space initiative highlights that lumbar disc replacements result in a 30% reduction in postoperative complications compared to traditional fusion surgeries.

By Application Insights

The hospitals constitute the largest application segment in the European artificial disc market. This segment accounted for 71.8% of the European market share in 2024 and the domination of the hospitals segment in the European market is expected to continue during the forecast period. This dominance is rooted in the comprehensive infrastructure and multidisciplinary expertise available in hospital settings, which are essential for complex spinal surgeries. According to Eurostat, hospitals performed approximately 80% of all artificial disc replacement procedures in 2022, reflecting their central role in delivering advanced healthcare services. The European Spine Society emphasizes that hospitals are better equipped to handle complications and provide postoperative care, ensuring optimal patient outcomes. Data from the European Observatory on Health Systems and Policies indicate that hospitals with dedicated spinal units report a 45% higher success rate in artificial disc surgeries compared to standalone clinics. Additionally, the European Commission notes that hospitals benefit from economies of scale, enabling them to invest in cutting-edge technologies like robotic-assisted systems and 3D imaging tools.

The ambulatory surgical centers (ASCs) segment is expected to experience exponential growth and likely to register a CAGR of 15.5% over the forecast period. The rising preference for outpatient cares due to the shorter hospital stays and reduced costs, is majorly propelling the growth of the ASCs segment in the European market. According to the European Health Insurance Card program, ASCs offer artificial disc procedures at 30% lower costs than traditional hospitals, making them an appealing choice for cost-conscious patients. Data from the European Confederation of Medical Suppliers' Associations reveal that ASCs equipped with minimally invasive technologies have achieved a 50% faster patient turnover, enhancing operational efficiency. The European Commission highlights that ASCs specializing in spinal surgeries have witnessed a 60% increase in patient inflow over the past three years, underscoring their growing popularity. Furthermore, advancements in anaesthesia and pain management have made same-day surgeries safer and more feasible, further accelerating the segment's growth. These factors position ambulatory surgical centers as a dynamic and rapidly expanding segment within the European artificial disc market.

REGIONAL ANALYSIS

Germany had the leading share of 26.1% of the European artificial disc market in 2024. The high prevalence of spinal disorders is primarily driving the German artificial disc market growth. For instance, according to the German Pain Society, more than 30% of Germans experiencing chronic back pain. The robust reimbursement policies of Germany are further boosting the adoption of artificial disc procedures in Germany, which is another major factor boosting the German market expansion. As per the German Health Insurance Association, reimbursement policies in Germany cover 80% of artificial disc procedures. According to the data from the European Spine Society, Germany boasts the highest number of specialized spinal centers, facilitating access to cutting-edge treatments. The German Medical Association reports that hospitals in the country perform over 10,000 artificial disc surgeries annually, underscoring its pivotal role in the market. Additionally, Germany's strong emphasis on research and development, supported by the Federal Ministry of Education and Research, fosters innovation in spinal technologies. These factors collectively establish Germany as the dominant force in the European artificial disc landscape.

France had the second largest share of the European market in 2024 and is anticipated to showcase a prominent CAGR over the forecast period owing to the growing aging population in Germany and rising demand for spinal interventions. France's universal healthcare system ensures broad access to advanced treatments, with 90% of artificial disc procedures reimbursed, as per the French Health Insurance Fund. The French Society of Spine Surgery notes that the nation's adoption of minimally invasive techniques has surged by 30% in recent years, enhancing patient outcomes. Data from the European Observatory on Health Systems and Policies reveal that France invests heavily in telemedicine, enabling remote monitoring of postoperative recovery. The French government's commitment to digital health initiatives further accelerates market growth, positioning France as a key player in the European artificial disc market.

The UK is another prominent regional market for artificial discs in Europe. The prevalence of spinal disorders in the UK is significant, affecting 40% of adults, as highlighted by the British Pain Society. The National Health Service (NHS) plays a crucial role in promoting accessibility, with over 70% of artificial disc surgeries covered under public healthcare, as per NHS England. The British Orthopaedic Association reports that the UK's adoption of personalized medicine has increased by 25%, driving demand for tailored artificial discs. Data from the European Health Data Space initiative indicate that the UK's focus on long-term safety studies has reduced complication rates by 15%. The UK's strategic investments in healthcare innovation and regulatory frameworks further reinforce its leadership in the market.

Italy is predicted to account for a notable share of the European market over the forecast period. The country's Mediterranean lifestyle and aging demographics contribute to a high incidence of spinal conditions, affecting 25% of Italians, according to the Italian Society of Orthopaedics and Traumatology. Italy's regional healthcare systems ensure equitable access, with 85% of procedures reimbursed, as noted by the Italian Health Ministry. Data from the European Spine Journal highlight that Italy's adoption of robotic-assisted surgeries has grown by 40%, enhancing procedural precision. The Italian government's emphasis on public-private partnerships fosters innovation, positioning Italy as a vital contributor to the European artificial disc market.

Spain is estimated to register a noteworthy CAGR in the European market over the forecast period. The prevalence of spinal disorders in Spain is notable, impacting 35% of the population, according to the Spanish Pain Society. Spain's universal healthcare model ensures widespread access, with 80% of artificial disc surgeries covered, as per the Spanish Health Ministry. The Spanish Society of Spine Surgery notes that the country's focus on minimally invasive techniques has reduced recovery times by 50%. Data from the European Observatory on Health Systems and Policies reveal that Spain's investments in digital health technologies have boosted patient engagement and outcomes. These factors solidify Spain's position as a leading market participant.Top of Form

KEY MARKET PLAYERS

Some notable companies that dominate the Europe artificial disc market profiled in this report are AxioMed LLC (U.S.), Simplify Medical, Inc. (U.S.), Stryker (U.S.), Orthofix (U.S.), Globus Medical (U.S.), Johnson & Johnson Services, Inc (U.S.), B. Braun Melsungen AG (Germany), Zimmer Biomet (U.S.), Medtronic (Ireland), LDR Holding Corporation (U.S.), NuVasive, Inc. (U.S.), joimax GmbH (Germany), VTI - Vertebral Technologies, Inc (U.S.), K2M, Inc (U.S.), RTI Surgical (U.S.) and SYNERGY SPINE SOLUTIONS INC. (Canada), and Others.

MARKET SEGMENTATION

This Europe artificial disc market research report is segmented and sub-segmented into the following categories.

By Type

- Cervical Artificial Disc

- Lumbar Artificial Disc

By Application

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the growth outlook for the Europe artificial disc market?

The Europe artificial disc market is projected to grow from USD 4.14 billion in 2025 to USD 15.77 billion by 2033, at a CAGR of 18.2%.

2. What factors are driving demand for artificial discs in Europe?

Aging population, rising degenerative disc diseases, and advancements in minimally invasive surgery.

3. What challenges impact the Europe artificial disc market?

High procedure costs, limited insurance coverage, and strict regulatory approvals.

4. How are technological advancements shaping the market?

3D printing, AI-assisted surgery, and personalized disc implants enhance precision and outcomes.

5. What are the key opportunities in the Europe artificial disc market?

Increased adoption of telemedicine and personalized spinal implants.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]