Europe Articulated Robot Market Size, Share, Trends, & Growth Forecast Report By Payload (Up to 16.00 Kg, 16.01 – 60.00 Kg, 60.01 – 225.00 Kg, and More Than 225.00 Kg), Function, Industry Automotive, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Articulated Robot Market Size

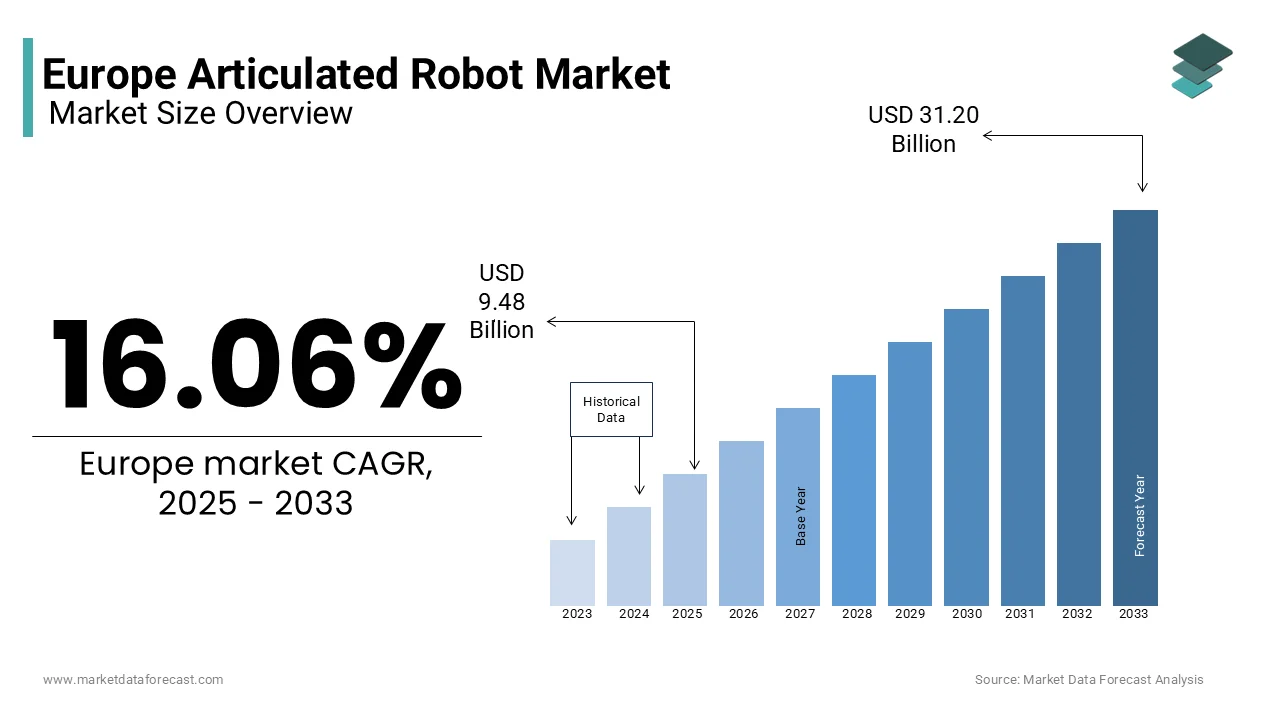

The Europe articulated robot market was worth USD 8.16 billion in 2024. The European market is projected to reach USD 31.20 billion by 2033 from USD 9.48 billion in 2025, growing at a CAGR of 16.06% from 2025 to 2033.

Articulated robots, which feature rotary joints allowing for multi-axis movement, are designed to perform complex tasks with precision, including welding, assembly, material handling, and packaging. According to the International Federation of Robotics (IFR), Europe accounts for 20% of the global industrial robot installations, with articulated robots comprising over 60% of the total units deployed in 2022. According to the European Commission, the region’s manufacturing sector is undergoing a transformative shift toward Industry 4.0, which is driving demand for advanced robotics solutions.

Europe’s articulated robot installations are driven by its robust automotive industry, which relies heavily on automation. The market growth rate is fueled by increasing labor costs and the need for enhanced productivity. Furthermore, the European Union’s emphasis on sustainability has accelerated the adoption of energy-efficient robotic systems. As per Eurostat, estimating a 15% annual increase in smart factory investments. These trends elevate the role of articulated robots in enabling scalable, flexible, and efficient manufacturing processes by positioning them as a key driver of Europe’s industrial competitiveness in the global arena.

MARKET DRIVERS

Increasing Adoption of Industry 4.0 Technologies

The rapid adoption of Industry 4.0 technologies is a major driver propelling the European articulated robot market. According to the European Commission, over 60% of manufacturing companies in Europe are integrating smart factory solutions by including articulated robots which is to enhance operational efficiency and flexibility. According to the International Federation of Robotics (IFR), Europe witnessed a 15% annual increase in industrial robot installations in 2022, with articulated robots accounting for 60% of these deployments. These robots, equipped with IoT sensors and AI-driven analytics that enable predictive maintenance and real-time monitoring, reducing downtime by up to 30%. Germany, a leader in automation is having a robust growth in automotive sector where there were installed over 20,000 articulated robots in 2022, as per Eurostat.

Rising Labor Costs and Workforce Shortages

The rising labor costs and workforce shortages are another significant driver accelerating the demand for articulated robots in Europe. According to the Eurostat, labor costs in the EU increased by an average of 8% annually between 2020 and 2022 by prompting industries to seek cost-effective automation solutions. The European Centre for the Development of Vocational Training notes that over 40% of European manufacturers face skilled labor shortages, particularly in repetitive and hazardous tasks. Articulated robots offer a viable solution by performing high-precision tasks such as welding and assembly at a fraction of the cost. For instance, the French manufacturing sector reported a 25% reduction in production costs after deploying articulated robots in material handling operations, according to the French Ministry of Economy. This economic advantage, coupled with their ability to operate continuously makes articulated robots indispensable for maintaining competitiveness in Europe’s evolving industrial landscape.

MARKET RESTRAINTS

High Initial Investment and Maintenance Costs

The high initial investment and ongoing maintenance costs, which hinder adoption among small and medium-sized enterprises (SMEs) is one of the restraining factors for the market to grow. According to the European Investment Bank, the average cost of an articulated robot ranges from €50,000 to €100,000 is excluding installation and programming expenses, which can increase the total cost by 25%. As per Eurostat, over 60% of SMEs in Europe cite financial constraints as a barrier to automation adoption. Additionally, maintenance costs account for approximately 10-15% of the initial investment annually, as per the International Federation of Robotics (IFR). These financial burdens disproportionately affect industries with thin profit margins, such as food and beverage or textiles. Many SMEs struggle to justify the upfront expenditure which is limiting the broader penetration of articulated robots in key sectors across Europe.

Limited Skilled Workforce for Robot Integration

Another major restraint is the shortage of skilled professionals capable of integrating and maintaining articulated robots, creating operational challenges. According to the European Centre for the Development of Vocational Training, over 40% of European companies face difficulties in finding workers proficient in robotics and automation technologies. According to the German Federal Ministry of Labour and Social Affairs, the demand for robotics technicians has surged by 30% since 2020. This skills gap leads to increased downtime and inefficiencies during robot deployment in countries like Italy and Spain, where vocational training programs lag behind. According to the French Ministry of Economy, inadequate training results in suboptimal utilization of articulated robots by reducing their return on investment. Addressing this workforce challenge is critical to unlocking the full potential of the articulated robot market in Europe.

MARKET OPPORTUNITIES

Expansion into Emerging Applications like Healthcare and Logistics

The growing adoption of articulated robots in emerging applications such as healthcare and logistics presents a significant opportunity for the European market. According to the European Commission, the healthcare sector is increasingly utilizing articulated robots for surgical assistance, rehabilitation, and pharmaceutical manufacturing with the medical robots. As per Eurostat, the e-commerce boom has driven a 20% annual increase in warehouse automation, with articulated robots playing a key role in order picking and packaging. For instance, the Netherlands, a hub for logistics, reported a 25% rise in robot installations in distribution centers in 2022, according to the Dutch Ministry of Economic Affairs. These advancements align with Europe’s focus on innovation by creating new revenue streams for manufacturers while addressing labor shortages and enhancing operational efficiency across diverse industries.

Government Initiatives and Funding for Automation

Government initiatives and funding programs aimed at promoting industrial automation offer another major opportunity for the European articulated robot market. The European Investment Bank has allocated €10 billion annually under the Horizon Europe program to support digital transformation and sustainable manufacturing technologies. According to the International Federation of Robotics (IFR), countries like Germany and France have introduced subsidies covering up to 40% of automation-related investments for SMEs, encouraging wider adoption of articulated robots. According to the German Federal Ministry for Economic Affairs, such incentives have led to a 15% increase in robot installations among SMEs in 2022. As per the European Green Deal, reducing carbon footprints through energy-efficient robotic systems is driving demand for eco-friendly solutions. These initiatives not only lower entry barriers but also position articulated robots as a cornerstone of Europe’s transition to smart.

MARKET CHALLENGES

Cybersecurity Risks in Connected Robotic Systems

The growing cybersecurity risk associated with connected robotic systems is attributed to pose a key challenge for the European articulated robot market players. According to the European Union Agency for Cybersecurity (ENISA), over 40% of industrial cyberattacks in 2022 targeted automated systems by including robots integrated into IoT networks. These attacks can disrupt operations, leading to significant financial losses; for instance, the German Federal Office for Information Security reported that a single cyberattack on an automotive plant caused €5 million in downtime damages. As per Eurostat, only 30% of European manufacturers have implemented robust cybersecurity measures for their robotic systems. Their vulnerability to hacking and data breaches rises as articulated robots increasingly rely on cloud-based platforms and AI-driven analytics. Addressing these risks requires substantial investment in cybersecurity infrastructure which many SMEs struggle to afford is posing a critical challenge to market growth.

Ethical and Social Concerns Over Job Displacement

Another significant challenge is the ethical and social concern surrounding job displacement due to the adoption of articulated robots. According to the European Centre for the Development of Vocational Training, automation could replace up to 20% of manufacturing jobs in Europe by 2030 that will disproportionately affect the low-skilled workers. According to the French Ministry of Labour, regions heavily reliant on manual labor, such as Southern Italy and Eastern Europe, face potential unemployment rates of up to 15% in industries adopting robotics. According to the International Labour Organization (ILO), public resistance to automation has increased, with over 50% of Europeans expressing concerns about job security. This societal pushback not only slows adoption but also pressures governments to balance technological advancement with workforce retraining programs by complicating the broader integration of articulated robots across Europe.

REPROT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.06% |

|

Segments Covered |

By Payload, Function, Industry Automotive, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

ABB Ltd. (ABB (Switzerland)), KUKA AG (KUKA (Germany)), Mitsubishi Electric Corp. (Mitsubishi (Japan)), Kawasaki Heavy Industries Ltd., (Kawasaki Heavy Industries (Japan) |

SEGMENTAL ANALYSIS

By Payload Insights

The 60.01 – 225.00 Kg payload segment dominated the market and held 40% of the European articulated robot market share in 2024 owing to its suitability for medium-to-heavy industrial applications like welding and material handling in automotive and metal fabrication. According to the Eurostat, over 50% of robots in Germany’s automotive sector fall within this range by reducing production times by 25%. According to the French Ministry of Economy, its role in enhancing precision and scalability. This segment’s versatility and alignment with Europe’s manufacturing needs make it indispensable for achieving operational efficiency and competitiveness.

The Up to 16.00 Kg payload segment is anticipated to witness a fastest CAGR of 10.5% during the forecast period. This growth is fueled by rising adoption in precision-driven industries like food processing and electronics assembly. According to the European Commission, SMEs account for 60% of installations which is driven by affordability and ease of integration. According to the Italian manufacturers, 30% increase in lightweight robot adoption for packaging in 2022. These robots align with EU Green Deal goals is offering energy efficiency and flexibility. Their ability to address labor shortages and perform delicate tasks escalates their importance in Europe’s evolving industrial landscape.

By Function Insights

The Handling segment was the largest by capturing 35% of the European articulated robots market share in 2024 owing to its material handling, palletizing, and logistics, particularly in e-commerce and manufacturing. As per Eurostat, handling robots reduce operational costs by up to 30% while improving supply chain efficiency. According to the Dutch warehouses study report, a 20% increase in robot installations in 2022 to meet rising online retail demands. The French Ministry of Economy study report revealed that the ability to address labor shortages and enhance workplace safety. These factors make handling robots indispensable for modern industrial operations across Europe.

The Assembly segment is likely to witness a fastest CAGR of 9.8% in the coming years. This growth is fueled by increasing demand for precision in electronics and automotive manufacturing. According to the European Commission, a 25% rise in assembly robot adoption in Germany in 2022, driven by miniaturization trends. These robots reduce cycle times by up to 40% by boosting productivity. Assembly robots enable flexible and scalable production systems by addressing the need for high-quality outputs.

By Industry Automotive Insights

The Automotive segment led the market by capturing 30% of European articulated robot market share in 2024. The sector's reliance on automation for welding, painting, and assembly tasks, which require precision and repeatability is ascribed to bolster the growth rate of the market. According to the Eurostat, over 60% of robot installations in Germany’s automotive hubs reduce production cycle times by up to 40%. As per the French Ministry of Economy, articulated robots enhance scalability and cost efficiency by enabling manufacturers to meet global demand. This industry remains pivotal in driving innovation and adoption of articulated robots with Europe being a global leader in automotive production.

The Electrical & Electronics segment is anticipated to experience a CAGR of 10.2% during the forecast period. This growth is fueled by increasing demand for miniaturization and precision in electronics manufacturing, such as semiconductor assembly. According to the European Commission, 25% rise in robot installations in this sector in 2022, particularly in Germany and the Netherlands. These robots reduce error rates by 35%, enhancing product quality and efficiency. With Europe’s focus on Industry 4.0, articulated robots are critical for maintaining competitiveness in advanced electronics manufacturing, making this segment a key driver of technological advancement across the region.

REGIONAL ANALYSIS

Germany dominated the European articulated robot market with 35% share in 2024 owing to rising automotive and manufacturing sectors, which account for over 60% of robot installations in Europe, according to the International Federation of Robotics (IFR). Germany’s emphasis on Industry 4.0 has driven investments in automation, with Eurostat highlighting a 20% annual increase in smart factory adoption since 2020. The country’s strong R&D ecosystem and government subsidies for SMEs further accelerate the growth rate of the market. Additionally, Germany’s focus on sustainability aligns with energy-efficient robotic systems, that boost the position as a hub for innovation and industrial automation.

France articulated robot market is esteemed to grow at a CAGR of 7.8% during the forecast period. The automotive, aerospace, and food processing industries, which rely heavily on articulated robots for precision tasks. According to the IFR, France installed over 4,500 industrial robots in 2022, with articulated robots accounting for 70% of these deployments. Government initiatives, such as the "France Relance" plan, allocate €1 billion annually to digital transformation, boosting automation adoption. According to the French National Centre for Scientific Research, advancements in AI-driven robotics by enhancing productivity and operational efficiency. These factors position France as a key player in driving technological advancements in the European articulated robot market.

Italy articulated robot market is likely to grow at steady pace in the next coming years. The country’s dominance in the metal fabrication, packaging, and ceramics industries, which increasingly adopt articulated robots for material handling and assembly. The Italian Institute for Foreign Trade reports a 25% rise in robot installations among SMEs in 2022 is supported by EU funding programs like Horizon Europe. Italy’s focus on lean manufacturing and cost-effective automation solutions has made articulated robots indispensable for maintaining competitiveness. Additionally, the Italian Association of Industrial Automation emphasizes the role of collaborative robots in addressing labor shortages that further propel the market growth across diverse industrial applications.

KEY MARKET PLAYERS

The major players in the Europe articulated robot market include ABB Ltd. (ABB (Switzerland)), KUKA AG (KUKA (Germany)), Mitsubishi Electric Corp. (Mitsubishi (Japan)), Kawasaki Heavy Industries Ltd., (Kawasaki Heavy Industries (Japan)

MARKET SEGMENTATION

This research report on the Europe articulated robot market is segmented and sub-segmented into the following categories.

By Payload

- Up to 16.00 Kg

- 16.01 – 60.00 Kg

- 60.01 – 225.00 Kg

- More Than 225.00 Kg

By Function

- Handling

- Welding

- Dispensing

- Assembly

- Processing

- Others

By Industry Automotive

- Electrical & Electronics

- Chemicals. Rubbers & Plastics

- Metal & Machinery

- Food & Beverages

- Precision Engineering and Optics

- Pharmaceuticals & Cosmetics

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key factors driving the growth of the Europe articulated robot market?

The growth is driven by increasing automation in manufacturing, advancements in AI and machine learning, rising demand for industrial robots in automotive and electronics sectors, and government initiatives supporting robotics adoption.

Which industries are the primary users of articulated robots in Europe?

The major industries using articulated robots in Europe include automotive, electronics, food and beverage, pharmaceuticals, and logistics.

What are the latest technological advancements in articulated robots in Europe?

Recent advancements include AI-powered robotic vision, improved collaborative robot (cobot) capabilities, faster and more precise motion control, and enhanced energy efficiency.

What is the expected future trend for the Europe articulated robot market?

The market is expected to see increased adoption of AI-driven automation, expansion in non-industrial sectors like healthcare and agriculture, and a shift towards more flexible and intelligent robotic systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]