Europe Aroma Chemicals Market Size, Share, Trends & Growth Forecast Report By Type (Terpenes, Benzenoids, Musk Chemicals, and Other Types), Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

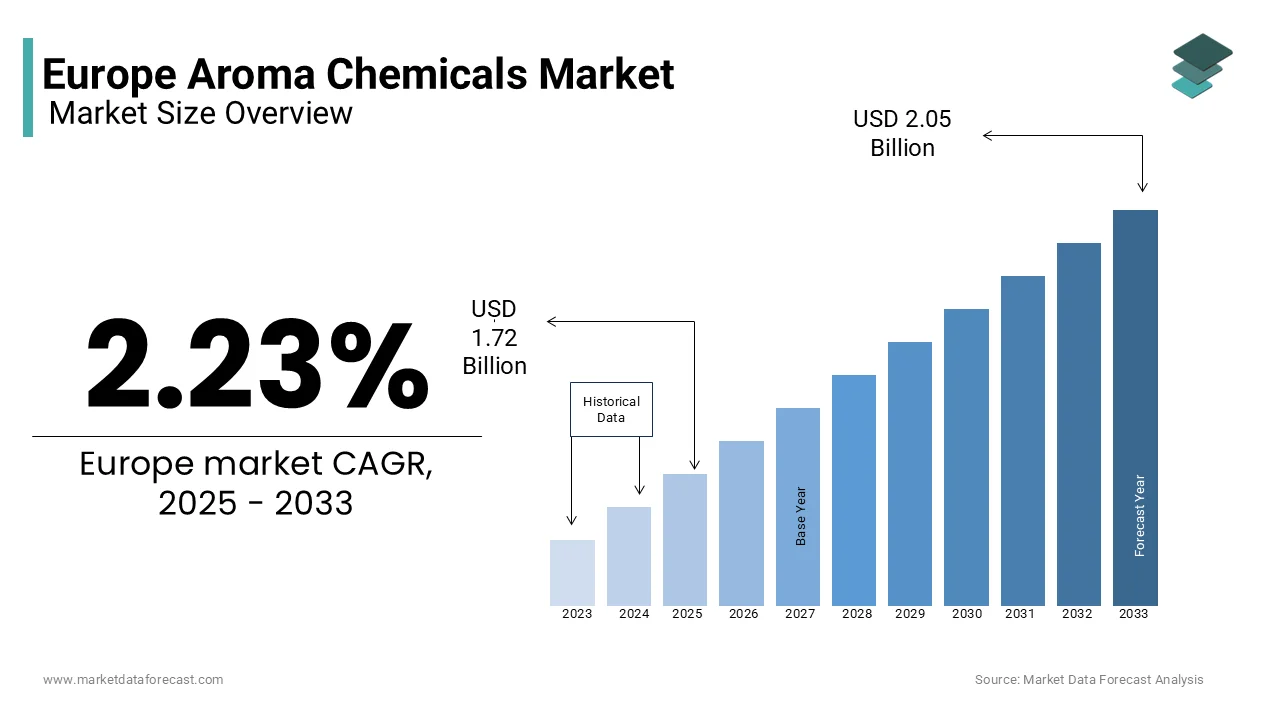

Europe Aroma Chemicals Market Size

The Europe aroma chemicals market size was valued at USD 1.68 billion in 2024. The European market is estimated to be worth USD 2.05 billion by 2033 from USD 1.72 billion in 2025, growing at a CAGR of 2.23% from 2025 to 2033.

The Aroma chemicals, also known as fragrance chemicals, are essential ingredients used in the formulation of perfumes, cosmetics, detergents, and food flavorings. These compounds are derived from natural or synthetic sources that impart distinctive scents and flavors that enhance consumer products' appeal. In Europe, the aroma chemicals market is driven by its integration into industries such as personal care, household products, and food and beverages, where sensory experiences play a pivotal role in consumer preferences. According to the European Chemical Industry Council, Europe accounts for approximately 30% of global aroma chemical consumption by reflecting its dominance in innovation and regulatory compliance. The market's growth is supported by advancements in biotechnology, which enable the production of sustainable and eco-friendly aroma compounds. Furthermore, according to Eurostat, investments in the European fragrance and flavor industry exceeded €15 billion in 2022, with a strong emphasis on natural and organic formulations.

MARKET DRIVERS

Rising Demand for Natural and Organic Fragrances

The growing consumer preference for natural and organic fragrances serves as a significant driver for the European aroma chemicals market. According to the European Consumer Organisation, over 60% of European consumers prioritize eco-friendly and sustainably sourced products is driving demand for plant-based aroma chemicals. Terpenes, derived from essential oils, are widely used in natural fragrances due to their biodegradability and non-toxic properties. According to the European Flavour and Fragrance Association, the demand for natural aroma chemicals grew by 8% in 2022, supported by increasing awareness of environmental sustainability.

Increasing Adoption in Cosmetics and Toiletries

Another major driver is the increasing adoption of aroma chemicals in cosmetics and toiletries, driven by the growing demand for premium and personalized beauty products. According to the European Cosmetics Association, the cosmetics industry in Europe generated revenues exceeding €80 billion in 2022, with fragrances accounting for approximately 20% of total product formulations. Consumers' desire for unique and long-lasting scents has amplified the use of complex aroma chemical blends in perfumes, lotions, and shampoos. The European Commission's Horizon Europe program emphasizes innovation in cosmetic formulations, further boosting demand for advanced aroma chemicals.

MARKET RESTRAINTS

Stringent Regulatory Standards

Stringent regulatory standards governing the use of aroma chemicals pose a significant restraint to the European market. According to the European Chemicals Agency, fragrance compounds must comply with REACH and CLP regulations, which mandate rigorous testing and documentation to ensure safety and environmental compliance. According to the European Commission, over 40% of manufacturers face delays in product certification due to these stringent requirements, impacting time-to-market. According to the European Flavour and Fragrance Association, compliance costs for fragrance manufacturers have risen by 25% over the past three years by limiting affordability for small and medium-sized enterprises (SMEs). These regulatory hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

Volatility in Raw Material Prices

Volatility in raw material prices, particularly essential oils and petrochemical derivatives, represents another critical challenge for the European aroma chemicals market. According to the European Chemical Industry Council, fluctuations in crude oil prices directly influence the cost of synthetic aroma chemicals, which account for nearly 70% of total production expenses. In 2022, crude oil prices surged by over 50%, causing synthetic aroma chemical costs to spike by 30%. According to the European Federation of Chemical Employers, over 60% of companies in the chemical sector reported reduced profitability in 2022 due to rising raw material costs. These financial pressures not only hinder market expansion but also constrain investments in capacity expansions and technological advancements.

MARKET OPPORTUNITIES

Growing Emphasis on Personalized Fragrances

The increasing emphasis on personalized fragrances presents a lucrative opportunity for the European aroma chemicals market. According to the European Consumer Trends Survey, over 40% of consumers are willing to pay a premium for customized scents tailored to their preferences. Advances in biotechnology and digital scent profiling enable manufacturers to create bespoke fragrance formulations, amplifying demand for specialized aroma chemicals. According to the European Flavour and Fragrance Association, the growing adoption of AI-driven scent design tools. This trend positions aroma chemicals as a critical enabler of innovation in the personalized fragrance segment.

Expansion into Food and Beverage Applications

The growing focus on enhancing sensory experiences in food and beverages offers another promising opportunity for the European aroma chemicals market. According to the European Food Safety Authority, the demand for natural flavor enhancers grew by 10% in 2022, driven by increasing consumer awareness of clean-label products. Aroma chemicals such as esters and aldehydes are extensively used in flavor formulations for beverages, confectionery, and savory products. Additionally, the European Commission's Farm to Fork Strategy supports the development of sustainable food solutions by amplifying the need for eco-friendly aroma chemicals.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the European aroma chemicals market, exacerbated by logistical bottlenecks and geopolitical tensions. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022 by affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as essential oils and petrochemical derivatives. According to the European Flavour and Fragrance Association, imports of certain raw materials declined by 40% in 2022. These disruptions not only elevate operational costs but also hinder production schedules. According to Eurostat, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges.

Limited Availability of Skilled Workforce

The limited availability of skilled professionals trained in advanced manufacturing technologies represents another critical challenge for the European aroma chemicals market. According to the European Centre for the Development of Vocational Training, less than 15% of chemistry graduates in Europe possess hands-on experience with aroma chemical synthesis by creating a significant skills gap. According to the European Commission, over 50% of manufacturing firms struggle to find qualified personnel to operate and maintain advanced production equipment. This shortage of expertise not only slows the adoption of advanced technologies but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive training initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.23% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Givaudan (Switzerland), Takasago International Corporation (U.S.), Solvay (France), BASF SE (Germany), De Monchy Aromatics (U.K.), Kao Corporation (Japan) and Others |

SEGMENTAL ANALYSIS

By Type Insights

The terpenes segment dominated the European aroma chemicals market by holding a share of 40.1% in 2024 due to their widespread use in natural fragrances and flavorings. The European Consumer Organisation reports that over 60% of European consumers prefer eco-friendly and sustainably sourced products. The versatility and performance of terpenes ensure their sustained dominance in the market for applications requiring natural and organic formulations.

The musk chemicals segment is esteemed to witness a fastest CAGR of 9.1% during the forecast period. This rapid growth is fueled by their increasing adoption in fine fragrances and luxury cosmetics, where they provide long-lasting and intense scents. The European Cosmetics Association reports that the demand for musk chemicals grew by 12% in 2022.

By Application Insights

The cosmetics and toiletries segment was the largest by capturing 35.6% of the European aroma chemicals market share in 2024 with the extensive use of aroma chemicals in perfumes, lotions, shampoos, and other personal care products. The European Commission's Horizon Europe program emphasizes innovation in cosmetic formulations that further boosts the demand for advanced aroma chemicals. The versatility and performance of aroma chemicals ensure their sustained dominance in this segment for applications requiring unique and long-lasting scents.

The food and beverage segment is anticipated to exhibit a CAGR of 8.5% from 2025 to 2033. This rapid growth is driven by the increasing demand for natural flavor enhancers with the rising awareness of clean-label products. Aroma chemicals such as esters and aldehydes are extensively used in flavor formulations for beverages, confectionery, and savory products. Additionally, the European Commission's Farm to Fork Strategy supports the development of sustainable food solutions, amplifying the need for eco-friendly aroma chemicals.

REGIONAL ANALYSIS

Germany led the European aroma chemicals market by holding a share of 25.6% in 2024 with the robust cosmetics and food and beverage industries, which are major consumers of aroma chemicals. According to the German Cosmetics Association, over 60% of premium fragrances produced in Germany utilize advanced aroma chemical formulations. Additionally, Germany's strong emphasis on sustainability aligns with the growing adoption of bio-based aroma compounds.

France aroma chemicals market is likely to register a CAGR of 5.5% in the next foreseen years. The country's cosmetics and fine fragrance sectors are key contributors to aroma chemical adoption. Paris, a global hub for luxury perfumery that leverages aroma chemicals extensively in niche fragrance formulations. Furthermore, France's focus on green chemistry boosts the use of sustainable aroma chemicals that is accelerating the growth of the market.

The UK holds a market share of approximately 15%, according to the UK Chemical Industries Association. The country's strong presence in the cosmetics and household products sectors drives aroma chemical demand. The increasing adoption of the aroma chemicals for premium and personalized fragrances is elevating the growth of the market. Additionally, the UK's commitment to sustainability supports the use of eco-friendly aroma compounds in household cleaning products.

Spain is merely to have steady growth of the European aroma chemicals market. The country's cosmetics and food and beverage industries are significant consumers of aroma chemicals. Spain's cosmetics sector focus on personalized fragrances is extending the utilization of the aroma chemicals extensively. According to the Spanish Ministry for Ecological Transition, the country's commitment to circular economy initiatives is driving demand for recyclable materials and sustainable aroma chemical practices.

KEY MARKET PLAYERS

The major key players in Europe aroma chemicals market are Givaudan (Switzerland), Takasago International Corporation (U.S.), Solvay (France), BASF SE (Germany), De Monchy Aromatics (U.K.), Kao Corporation (Japan) and Others

MARKET SEGMENTATION

This research report on the Europe aroma chemicals market is segmented and sub-segmented into the following categories.

By Type

- Terpenes

- Benzenoids

- Musk Chemicals

- Other Types

By Application

- Soap and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Household Products

- Food and Beverage

- Other Applications

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the expected growth rate of the Europe aroma chemicals market from 2025 to 2033?

The aroma chemicals market is expected to grow at a CAGR of 2.23% from 2025 to 2033.

2. What factors are driving the growth of the Europe aroma chemicals market?

The market growth is driven by increasing demand for fragrances and flavors in personal care, food and beverages, and household products. Additionally, consumer preferences for natural and organic products are influencing market expansion.

3. Which countries are leading in the Europe aroma chemicals market?

Countries like Germany, France, and the United Kingdom are prominent in the European aroma chemicals market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]