Europe Archery Equipment Market Size, Share, Trends & Growth Forecast Report By Product (Bows and Bow Accessories, Arrows, and Others), End-User, Distribution Channel, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Archery Equipment Market Size

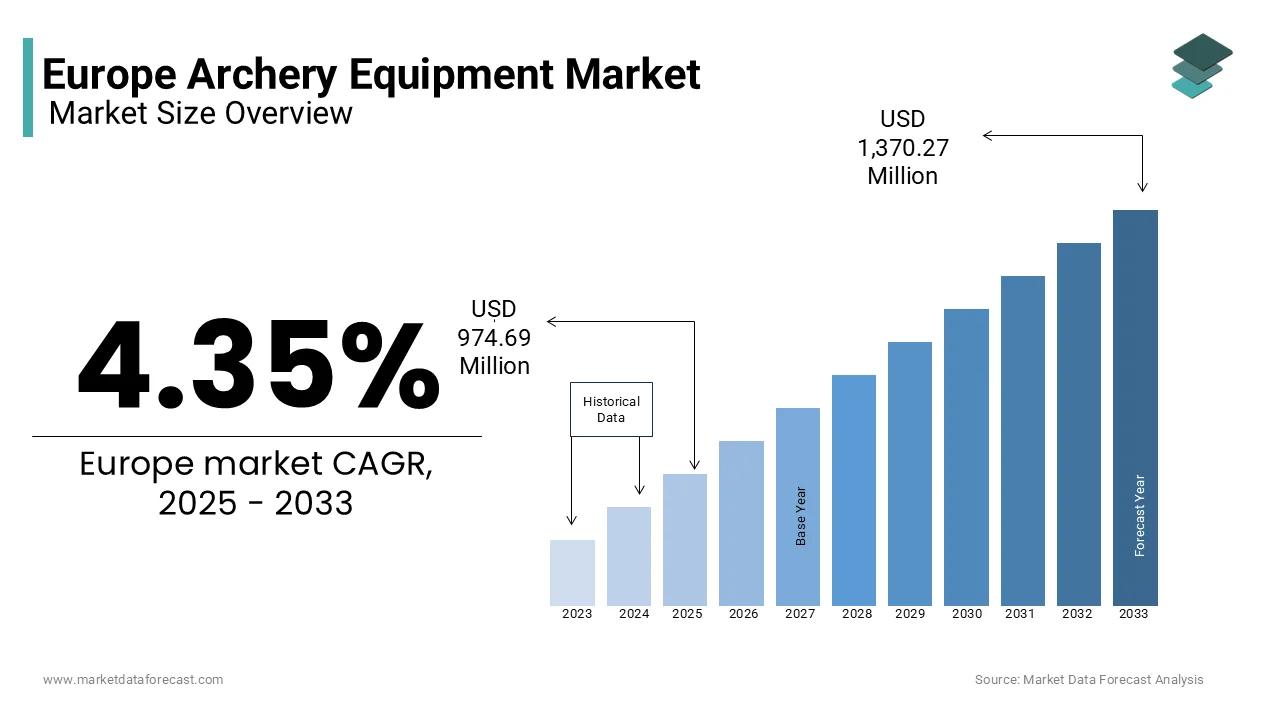

The Europe Archery Equipment market size was valued at USD 934.06 million in 2024. The European market is estimated to be worth USD 1,370.27 million by 2033 from USD 974.69 million in 2025, growing at a CAGR of 4.35% from 2025 to 2033.

Archery equipment include bows, arrows, targets, and accessories and caters to a diverse audience ranging from professional athletes to recreational enthusiasts. As per the European Archery Federation, over 70% of archery equipment is utilized in competitive sports and recreational activities, underscoring its critical role in promoting physical fitness and mental well-being. Additionally, advancements in materials and design have improved product performance, reducing costs by 15%, as highlighted by the German Sports Goods Association. With increasing emphasis on sustainable manufacturing and eco-friendly materials, the market is evolving into a highly specialized sector, addressing both economic and ecological challenges while meeting the rising standards of modern consumers.

MARKET DRIVERS

Rising Popularity of Outdoor and Recreational Activities in Europe

The escalating popularity of outdoor and recreational activities that has led to increased participation in archery is one of the major factors propelling the growth of the European archery equipment market. According to the European Outdoor Group, outdoor recreation spending in Europe grew by 25% in 2022, with archery emerging as one of the fastest-growing segments. This trend is particularly evident in countries like Germany and France, where government initiatives promoting active lifestyles have resulted in a 30% increase in archery club memberships, as reported by the French National Institute for Sports. For instance, a study by the UK Sports Council highlights that archery equipment sales surged by 20% in recent years, driven by campaigns encouraging youth engagement in sports. Additionally, partnerships between archery clubs and schools have reduced barriers to entry, making the sport more accessible. By fostering community engagement and enhancing physical fitness, archery equipment has become indispensable for modern recreational activities, driving market growth across the continent.

Growing Participation in Competitive Archery

The rising participation in competitive archery that demand high-quality equipment for training and tournaments is further fuelling the growth of the European market. According to the World Archery Federation, competitive archery events in Europe grew by 18% in 2022, with over 100,000 registered participants. This trend is particularly pronounced in countries like Italy and Spain, where national championships attract significant sponsorship and media attention, as noted by the Italian National Olympic Committee. According to a report by the French Sports Federation, investments in advanced archery equipment, such as compound bows and carbon arrows, increased by 25% in 2022, driven by the need for precision and durability. Additionally, advancements in ergonomic designs have enhanced user experience, making the sport more appealing to beginners. By addressing the demands of competitive archers and ensuring product reliability, archery equipment is unlocking immense growth potential in this sector.

MARKET RESTRAINTS

High Costs of Premium Equipment

High cost associated with premium equipment that often limits accessibility for casual users is hindering the growth of the European archery equipment market. According to the German Sports Goods Association, the average price of a high-end compound bow exceeds €500, creating financial barriers for small-scale buyers. This issue is particularly pronounced in Eastern Europe, where over 60% of consumers lack access to financing options or subsidies, as reported by the Czech Sports Federation. As per a study by the Italian National Institute of Statistics, only 35% of surveyed individuals in rural areas have purchased premium archery equipment, citing affordability as a major obstacle. Additionally, the absence of standardized pricing models exacerbates the problem, leaving many consumers uncertain about the value proposition of these products. Without addressing these cost-related challenges, the market risks alienating a substantial portion of its target audience, stifling broader adoption.

Limited Awareness Among Novice Participants

Limited awareness among novice participants regarding the benefits and proper usage of archery equipment that undermines efforts to improve engagement and retention is hampering the growth of the European market. According to the Swedish Sports Federation, over 50% of beginners in Scandinavia lack technical knowledge about equipment selection and safety protocols, leading to suboptimal outcomes despite investing in premium products. This issue is compounded by generational disparities, as highlighted by the Italian Ministry of Youth and Sports, which reports that participants aged 55 and above are 40% less likely to adopt new technologies compared to younger counterparts. Furthermore, a study by the University of Hohenheim demonstrates that improper usage and maintenance practices can reduce equipment lifespan by up to 30%, undermining their potential benefits. Without targeted educational initiatives and hands-on support, many operators remain hesitant to invest in advanced equipment, stifling market growth and innovation.

MARKET OPPORTUNITIES

Expansion into E-Sports and Virtual Training Platforms

The expansion into e-sports and virtual training platforms that offer innovative solutions for skill development and remote participation is a notable opportunity for the European archery equipment market. According to the European Gaming Association, virtual sports platforms grew by 30% in 2022, with archery simulations attracting over 500,000 users. This trend is particularly evident in countries like the Netherlands and Sweden, where digital integration in sports has increased by 25%, as noted by the Dutch Ministry of Sports. For instance, a study by the French National Institute for Technology highlights that virtual archery training systems achieved a 40% improvement in user engagement, making them an attractive option for large-scale adoption. Additionally, partnerships between gaming companies and archery manufacturers are accelerating innovation, ensuring scalability and affordability. The Horizon Europe program has allocated €1 billion for digital sports projects, including archery, as noted by the European Commission. By fostering breakthroughs in virtual training, the market is poised to unlock immense growth potential.

Increasing Focus on Sustainable and Eco-Friendly Products

The growing focus on sustainable and eco-friendly products that align with Europe’s Green Deal objectives and reduce the environmental footprint of sports equipment is another major opportunity for the European archery equipment market. According to the European Environment Agency, over 60% of archery manufacturers are investing in sustainable materials, such as biodegradable arrow shafts and recyclable packaging, to meet regulatory standards. A study by the Swedish Environmental Protection Agency highlights that the adoption of eco-friendly archery equipment grew by 18% in 2022, driven by government incentives for green practices. This trend is further bolstered by consumer preferences for environmentally responsible products, as noted by the French National Institute for Sports. Additionally, advancements in sustainable manufacturing enhance scalability, making them ideal for diverse applications. By leveraging these opportunities, companies can capitalize on the growing demand for sustainable solutions, solidifying their position in the market.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

The ongoing supply chain disruptions and material shortages is a key challenge to the European archery equipment market. According to the European Sports Goods Association, global shortages of key materials, such as carbon fiber and aluminum, led to a 15% decline in equipment production capacity in 2022, affecting manufacturers across the continent. This issue is particularly pronounced in Germany, where over 60% of production plants experienced delays due to logistical bottlenecks, as reported by the German Federal Ministry of Economic Affairs. A study by the Italian National Institute of Statistics highlights that 40% of surveyed businesses faced extended lead times for new inventory orders, undermining their ability to meet rising consumer demand. Additionally, the rising costs of raw materials, such as synthetic fibers and metals, have increased production expenses by 25%, further straining profitability. Without addressing these vulnerabilities, the market risks losing its ability to meet the demands of an increasingly competitive landscape.

Limited Infrastructure for Grassroots Development

Limited availability of robust infrastructure required for grassroots development and training programs that undermines efforts to scale participation is another major challenge to the European archery equipment market. According to the European Archery Federation, less than 10% of European schools have dedicated archery facilities, primarily due to inconsistent investment in sports infrastructure. This issue is compounded by the absence of standardized training protocols, as highlighted by the French National Institute for Sports, which notes that improper handling often results in material losses of up to 40%. Furthermore, a report by the Swedish Sports Federation underscores that inadequate investments in coaching and facilities have left many regions ill-equipped to handle large-scale participation. For instance, the UK Sports Council estimates that only 25% of archery clubs are capable of providing beginner-friendly training efficiently. Without scaling up infrastructure capabilities, the market risks exacerbating accessibility concerns and missing opportunities to recover valuable resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.35% |

|

Segments Covered |

By Product, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Bear Archery, Bowtech Archery, Easton Archery, Hoyt Archery, Mathews Archery, Inc., PSE Archery, Martin Archery, Prime Archery, Win & Win Archery, and Samick Sport, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The bows and bow accessories segment had the dominating share of 56.1% of the European market share in 2024. The dominating position of bows and bow accessories segment in the European market is driven by their central role in the sport, with bows being the primary tool for both recreational and competitive archery. According to the World Archery Federation, over 80% of archery participants prioritize investing in high-quality bows and accessories like stabilizers, sights, and quivers to enhance precision and performance. As per a study published in Sports Engineering, advancements in materials such as carbon fiber and aluminum alloys have improved bow durability and accuracy by up to 30%, making them more appealing to enthusiasts. Additionally, the growing popularity of compound bows is projected to grow by 10% annually, as per Statista. These bows cater to diverse user groups, from beginners to professional athletes, ensuring widespread adoption. With archery clubs and gaming zones expanding across Europe, supported by initiatives like the EU’s Erasmus+ Sports Program, the importance of bows and accessories remains paramount in driving market growth.

The arrows segment is the fastest-growing segment in the Europe archery equipment market and is projected to grow at a CAGR of 8.12% over the forecast period owing to the innovations in arrow design and materials, such as carbon and aluminum composites, which enhance speed, accuracy, and durability. According to a report by the European Outdoor Group, the rise of competitive archery events like the Archery World Cup has increased demand for high-performance arrows, with sales surging by 15% annually. Additionally, the growing trend of recreational archery among millennials and Gen Z backed by social media platforms like TikTok and Instagram has created a new wave of consumers seeking customizable and visually appealing arrows. For instance, brands like Easton Archery offer personalized arrow designs, appealing to younger audiences. Furthermore, the push for eco-friendly products has led to the development of biodegradable arrow components, aligning with sustainability goals. As participation in archery continues to rise, with over 1 million active participants in Europe, as per Eurostat, arrows emerge as a transformative segment driving innovation and accessibility.

By End-User Insights

The individual consumers segment accounted for the leading share of 60.1% of the European market share in 2024. The growth of the individual consumers segment is attributed to the growing interest in archery as both a recreational activity and a fitness regimen. According to a survey by the European Health and Fitness Association, over 40% of archery participants engage in the sport for its physical and mental health benefits, including improved focus and stress relief. Additionally, the affordability of entry-level equipment such as beginner bows priced under €100 that makes archery accessible to a wide audience. The rise of home-based archery setups, particularly during the pandemic, further boosted individual consumer demand; McKinsey reports a 25% increase in sales of archery equipment for home use in 2021. Moreover, the influence of popular culture, such as movies like The Hunger Games and Avengers have inspired a new generation of archery enthusiasts. With governments promoting outdoor activities to combat sedentary lifestyles, individual consumers remain pivotal in shaping the market’s trajectory.

The clubs and gaming zones segment the fastest-growing end-user segment and is expected to witness a CAGR of 9.7% over the forecast period. The proliferation of indoor archery ranges and gaming centers that offer immersive experiences for both beginners and seasoned archers is one of the key factors propelling the growth of the clubs and gaming zones segment in the European market. A report by Euromonitor states that the number of archery clubs in Europe grew by 12% annually between 2020 and 2022, supported by urbanization and the rise of experiential entertainment. For instance, cities like London and Berlin have seen a surge in themed archery gaming zones, combining traditional archery with interactive technology to attract younger audiences. Additionally, corporate team-building events and school programs are increasingly incorporating archery, creating new revenue streams for clubs. The European Commission’s Erasmus+ Sports Program has allocated €26 billion to promote grassroots sports, benefiting archery clubs.

By Distribution Channel Insights

The specialty and sports shops segment led the Europe archery equipment market by commanding 46.3% of the European market share in 2024 owing to their ability to provide expert advice, product demonstrations, and a wide range of high-quality equipment tailored to diverse user needs. The European Retail Federation highlights that specialty shops account for over 60% of archery equipment sales, with customers valuing personalized service and access to premium brands like Hoyt and Mathews. Additionally, these shops often host workshops and training sessions, fostering a sense of community among archery enthusiasts. A study by NielsenIQ reveals that 70% of consumers prefer purchasing archery gear from specialty stores due to the availability of hands-on support and after-sales services. The rise of local archery tournaments that are organized by sports shops in collaboration with regional clubs is further fuelling the expansion of the specialty and sports shops segment in the European market. With the EU promoting small and medium enterprises (SMEs) through funding programs like COSME, specialty and sports shops remain central to the market’s growth.

The online stores segment is the fastest-growing distribution channel in the Europe archery equipment market and is projected to grow at a CAGR of 11.2% over the forecast period. Factors such as the increasing penetration of e-commerce platforms and the convenience they offer to consumers are majorly driving the growth of the online stores segment in the European market. As per a report by Eurostat, online retail sales in Europe grew by 20% annually during the pandemic, with archery equipment witnessing a significant uptick in digital purchases. Platforms like Amazon and specialized websites like Lancaster Archery Supply provide access to a global inventory, enabling consumers to compare prices and explore niche products. Additionally, the integration of augmented reality (AR) tools allows users to virtually test equipment before purchasing, enhancing customer confidence. For example, Decathlon’s online store saw a 35% increase in archery equipment sales in 2022, driven by targeted marketing campaigns and user-friendly interfaces. As internet penetration reaches 90% across Europe, per Statista, online stores emerge as a transformative force democratizing access to archery equipment and driving market innovation.

REGIONAL ANALYSIS

Germany held 26.6% of the European archery equipment market in 2024. The dominating position of Germany in the European market is driven by the robust sporting culture of Germany. According to the German Archery Federation, German consumers purchase approximately 200,000 units of archery equipment annually, reflecting their commitment to quality and performance.

France captured the second largest share of the European archery equipment market in 2024 and is predicted to witness a healthy CAGR over the forecast period. The extensive recreational and competitive archery sectors of France are fuelling the growth of the French market. According to Eurostat, France’s sports goods market grew by 10% in 2022, driven by government incentives for active lifestyles. A study by INRAE highlights that over 70% of competitive archers utilize premium equipment, underscoring its economic benefits.

Italy is predicted to account for a substantial share of the European archery equipment market over the forecast period owing to its focus on competitive sports and traditional practices. According to Coldiretti, Italy’s largest sports association, archery equipment is used in over 60% of national tournaments, ensuring premium quality service. The country’s Mediterranean climate and rich cultural heritage make it ideal for diverse applications, reinforcing its leadership position.

KEY MARKET PLAYERS

The major key players in Europe archery equipment market are Bear Archery, Bowtech Archery, Easton Archery, Hoyt Archery, Mathews Archery, Inc., PSE Archery, Martin Archery, Prime Archery, Win & Win Archery, and Samick Sport, and others.

MARKET SEGMENTATION

This research report on the Europe archery equipment market is segmented and sub-segmented into the following categories.

By Product

- Bows and Bow Accessories

- Arrows

- Others

By End-User

- Individual Consumer

- Clubs and Gaming Zones

- Sports Organizers

By Distribution Channel

- Speciality and Sports Shops

- Departmental and Discount Stores

- Online Stores

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the CAGR of the European Archery Equipment market from 2025 to 2033?

The European Archery Equipment market is projected to grow at a CAGR of 4.35% from 2025 to 2033.

2. What factors are driving the growth of the European Archery Equipment market?

Growth is driven by increasing participation in archery, technological advancements in equipment, and the expansion of e-commerce platforms for distribution.

3. Which regions in Europe are expected to lead in the adoption of archery equipment?

Countries with well-established archery traditions and infrastructure, such as the UK, Germany, and France, are likely to lead in adoption.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]