Europe Apparel Market Size, Share, Trends & Growth Forecast Report By Type (Formal Wear, Casual Wear, Sportswear, Night Wear and Others), End-User (Men, Women and Children) and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Apparel Market Size

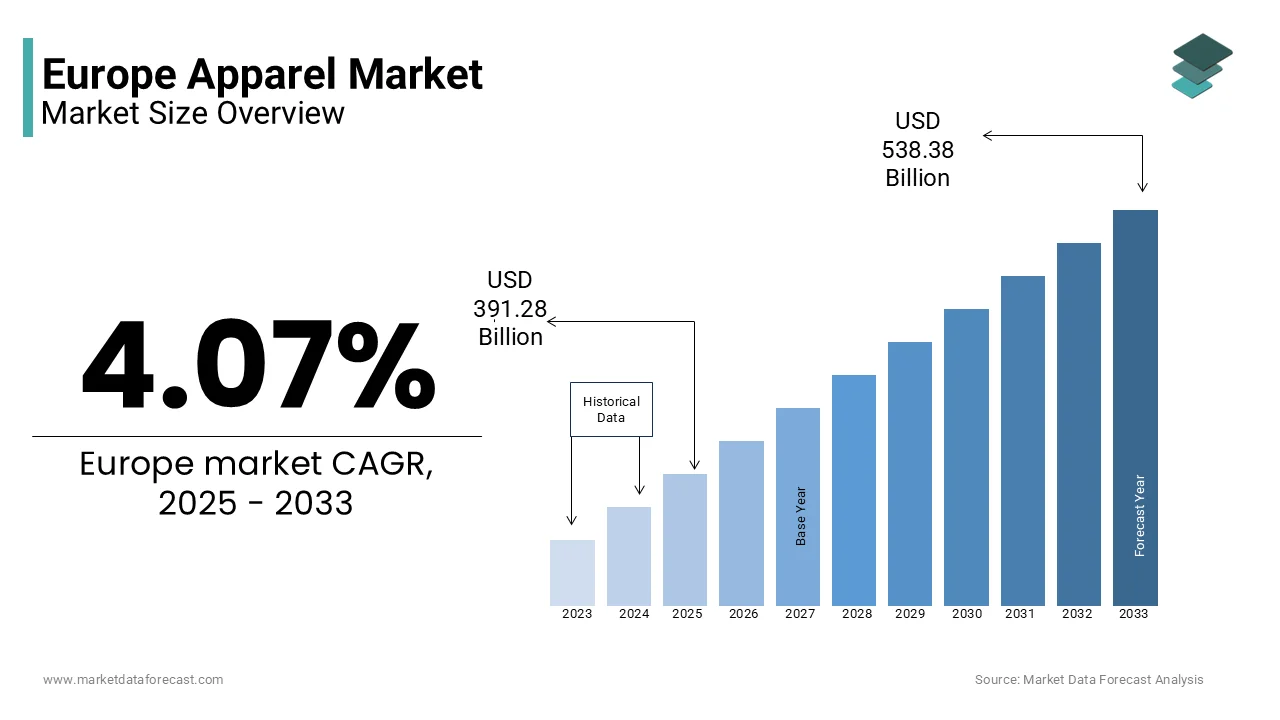

The apparel market size in Europe was valued at USD 375.98 billion in 2024. The European market is further projected to register a CAGR of 4.07% from 2025 to 2033 and be worth USD 538.38 billion by 2033 from USD 91.28 billion in 2025.

Europe remains a global fashion hub as countries such as Italy, France, and the UK are leading in design, innovation, and luxury apparel worldwide. According to the European Commission, the textile and clothing industry in the EU employs approximately 1.5 million people. Germany is the largest market for apparel in Europe and accounts for nearly 25% of total EU apparel sales due to the strong consumer spending and demand for high-quality products.

MARKET DRIVERS

Rising Consumer Demand for Sustainable Fashion

The growing consumer preference for sustainable and eco-friendly fashion is a significant driver of the European apparel market. According to the European Environment Agency, the EU generates over 5.8 million tonnes of textile waste annually, prompting a shift towards circular fashion models and sustainable materials. Consumers increasingly prioritize ethically produced garments made from organic cotton, recycled polyester, and biodegradable fabrics. This demand has led to a rise in brands adopting sustainable practices, with the European Commission’s Circular Economy Action Plan encouraging manufacturers to implement recycling and waste reduction strategies. The shift aligns with environmental goals and enhances brand loyalty among eco-conscious consumers.

Expansion of E-commerce and Digital Retailing

The rapid growth of e-commerce is revolutionizing the European apparel market, making fashion more accessible and personalized. The European Commission highlights that online sales in the EU accounted for 29% of total apparel sales in 2022, a figure expected to grow further. Technologies such as AI-driven personalization and virtual fitting rooms are enhancing the online shopping experience, boosting consumer engagement. Countries like Germany, the UK, and France lead in digital retail adoption, supported by robust logistics and payment infrastructures. This shift towards digital platforms caters to the growing demand for convenience, offering opportunities for both established brands and emerging designers to expand their reach.

MARKET RESTRAINTS

High Costs of Sustainable Production

The push toward sustainable fashion in Europe is restrained by the high costs associated with eco-friendly production methods. The European Environment Agency highlights that using organic materials, implementing recycling programs, and ensuring ethical labor practices significantly increase production expenses. For example, garments made from organic cotton can cost 20-30% more than conventional options due to limited supply and higher farming costs. These increased prices are often passed on to consumers, making sustainable fashion less accessible to price-sensitive shoppers. Smaller brands, in particular, face challenges in adopting sustainable practices, which can hinder their competitiveness and slow the overall transition to environmentally friendly apparel.

Stringent Regulatory Compliance

Strict environmental and labor regulations in Europe impose additional costs and complexities on apparel manufacturers. The European Commission’s Green Deal and its Circular Economy Action Plan set ambitious targets for reducing textile waste and promoting sustainable practices. While these policies aim to make the industry more sustainable, they require significant investment in new technologies, waste management systems, and compliance audits. Smaller manufacturers often struggle to meet these requirements due to limited resources. Additionally, the European Parliament’s proposed ban on greenwashing places stricter controls on marketing claims, increasing the risk of penalties for non-compliance and raising operational challenges for brands attempting to adapt.

MARKET OPPORTUNITIES

Growth of Circular Fashion Models

The rise of circular fashion presents a significant opportunity in the European apparel market, aligning with sustainability goals and shifting consumer preferences. Circular models prioritize recycling, repair, resale, and rental services, reducing waste and extending the lifecycle of garments. According to the European Commission, only 1% of textile waste is currently recycled into new clothing, highlighting immense potential for growth. Brands are increasingly adopting initiatives like take-back programs and upcycling, driven by EU policies such as the Circular Economy Action Plan. Countries like Sweden and Denmark lead in promoting second-hand fashion, creating a robust market for pre-owned and refurbished apparel. This trend supports environmental goals while unlocking new revenue streams for the industry.

Technological Advancements in Digital Fashion

Technological innovations such as AI, virtual reality (VR), and augmented reality (AR) are transforming the European apparel market, creating opportunities for digital fashion. AI-driven analytics enable brands to predict trends and personalize customer experiences, while AR and VR technologies allow for virtual fitting rooms and 3D garment visualization. According to the European Commission’s Digital Economy and Society Index, Europe is prioritizing digital innovation, with over 80% of enterprises integrating digital technologies into their operations by 2030. This shift enhances online shopping experiences, reduces return rates, and promotes sustainability by minimizing the need for physical samples, positioning digital fashion as a key growth area in the market.

MARKET CHALLENGES

Rising Raw Material Costs and Supply Chain Disruptions

The European apparel market faces significant challenges from rising raw material costs and supply chain disruptions. According to the European Commission, the cost of textile raw materials, such as cotton and synthetic fibers, increased by 30-50% between 2020 and 2022 due to global supply shortages and increased demand. These cost hikes are further exacerbated by logistical disruptions caused by the COVID-19 pandemic and geopolitical tensions, such as the Russia-Ukraine conflict. Delays in raw material delivery and increased freight costs have strained production timelines, impacting the availability of apparel products and driving up prices for consumers. These factors create operational and financial challenges for both manufacturers and retailers.

Labor Shortages and Rising Wage Demands

Labor shortages and increasing wage demands are major challenges for the European apparel industry. The European Labour Market Monitor highlights that the apparel and textile sector has experienced a workforce decline of approximately 20% over the past decade, driven by automation and reduced interest in manufacturing jobs. Simultaneously, wage inflation, particularly in Eastern Europe, where much of the production occurs, has added to operating costs. The European Commission’s push for higher minimum wages and better working conditions, while essential for ethical production, places financial pressure on manufacturers, particularly smaller enterprises. Balancing fair wages with cost efficiency remains a critical challenge for maintaining competitiveness in the European apparel market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.07% |

|

Segments Covered |

By Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

PVH Corp., Inditex, Kering SA, LVMH, Aditya Birla Group, Hennes & Mauritz AB, Nike Inc., Adidas AG, Puma, Shein, H&M Hennes & Mauritz Retail Pvt. Ltd., and Reliance Retail, and others. |

SEGMENTAL ANALYSIS

By End-User Insights

The women segment held the leading share of 56.1% of the European apparel market share in 2024. The dominance of women segment in the European market is attributed to diverse fashion trends and frequent wardrobe updates. According to the European Fashion Association, women spend over €150 billion annually on clothing, reflecting robust demand. The rise of influencer marketing and digital platforms has further amplified adoption, ensuring steady growth.

The children segment is another lucrative segment and is predicted to grow at a CAGR of 6.6% over the forecast period owing to the increasing birth rates and parental willingness to invest in quality clothing. The sustainable and durable designs resonate with modern parents are also contributing to the expansion of the children segment in the European apparel market.

REGIONAL ANALYSIS

The UK occupied the largest share of the European apparel market in 2024. The focus of the UK on e-commerce and fast fashion are primarily driving the growth of the UK apparel market. According to the British Retail Consortium, online apparel sales grew by 20% in 2022, reflecting robust demand. Innovations in digital platforms cater to diverse preferences, boosting adoption rates.

France holds a substantial share of the European market. The growth of the French apparel market is attributed to the luxury fashion and premium brands. According to Bpifrance, investments in haute couture and sustainable fashion amplify demand, ensuring sustained market growth.

Italy is predicted to account for a notable share of the European apparel market over the forecast period. The expertise of Italy in craftsmanship and design is propelling the Italian apparel market. According to Assobiotec, Italian brands prioritize quality and exclusivity, fostering innovation and adoption.

Spain is anticipated to witness a healthy CAGR over the forecast period. The apparel market in Spain is driven by urbanization and rising disposable incomes. According to Red Española de Moda, over €30 billion was spent on apparel in 2022, creating a robust demand.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

PVH Corp., Inditex, Kering SA, LVMH, Aditya Birla Group, Hennes & Mauritz AB, Nike Inc., Adidas AG, Puma, Shein, H&M Hennes & Mauritz Retail Pvt. Ltd., and Reliance Retail are some of the key players in the Europe apparel market.

The Europe apparel market is highly competitive, characterized by a mix of established global brands and emerging local players striving to capture consumer attention. Key participants focus on differentiation through sustainability, digital innovation, and strategic partnerships. The market faces intense competition due to shifting consumer preferences toward eco-friendly and ethically produced clothing, pushing brands to adopt sustainable practices. Additionally, the rise of e-commerce has intensified rivalry, with companies investing heavily in online platforms and omnichannel strategies to enhance customer experience. Fast fashion brands compete on price and trend responsiveness, while luxury labels emphasize exclusivity and craftsmanship. The market also witnesses consolidation as larger players acquire niche brands to diversify their portfolios. Overall, innovation, sustainability, and digital transformation are the primary drivers shaping competitive dynamics in this sector.

TOP PLAYERS IN THIS MARKET

Inditex (Zara)

Inditex, the parent company of Zara, is a leader in the Europe apparel market, renowned for its fast fashion model and global reach. The company’s focus on sustainability ensures high demand for its eco-friendly collections. Inditex invests heavily in R&D, ensuring continuous innovation and expanding its global footprint.

H&M Group

H&M Group is a key player, leveraging its expertise in affordable and sustainable fashion to develop advanced solutions. The company’s focus on carbon-neutral production aligns with EU priorities, ensuring steady growth. Its strategic acquisitions strengthen its position in the global market.

Adidas AG

Adidas AG contributes significantly to the Europe apparel market, focusing on sportswear and customization. The company’s partnerships with athletes and influencers drive innovation, ensuring leadership in the industry.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Sustainability Initiatives

Brands like H&M and Zara have adopted sustainable practices, such as using recycled materials and promoting circular fashion, to appeal to environmentally conscious consumers.

Digital Transformation

Companies are investing in AI-driven personalization, virtual try-ons, and robust e-commerce platforms to enhance customer engagement and streamline operations.

Strategic Collaborations

Partnerships with influencers, designers, and tech firms help brands expand their reach and innovate product offerings.

RECENT HAPPENINGS IN THE MARKET

RECENT HAPPENINGS IN THE MARKET

- In March 2023, H&M launched a new sustainable collection made from 100% recycled fabrics. This initiative aimed to reinforce its commitment to sustainability and attract eco-conscious shoppers.

- In June 2023, Zara introduced an AI-powered virtual styling tool on its app. This move was designed to enhance customer experience and increase online sales conversions.

- In September 2023, Adidas partnered with a European recycling firm to develop footwear made from ocean plastic. This collaboration sought to strengthen Adidas' position as a leader in sustainable sportswear.

- In November 2023, Uniqlo expanded its store network across Eastern Europe. This expansion aimed to tap into untapped markets and boost regional presence.

- In January 2024, Gucci collaborated with a renowned European artist to launch a limited-edition clothing line. This strategy aimed to elevate brand prestige and appeal to younger audiences.

MARKET SEGMENTATION

This research report on the European apparel market is segmented and sub-segmented into the following categories.

By Type

- Formal Wear

- Casual Wear

- Sportswear

- Night Wear

- Others

By End-User

- Men

- Women

- Children

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size of the Europe Apparel Market by 2033?

The European apparel market is estimated to reach USD 538.38 billion by 2033.

2. What factors are driving the growth of the Europe Apparel Market?

Key drivers include growing consumer demand for sustainable and eco-friendly fashion, strong retail infrastructure, and rising disposable incomes across Europe.

3. Which countries dominate the Europe Apparel Market?

Germany, Italy, France, and the UK are leading countries in the European apparel market due to their strong consumer spending and global influence in fashion.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com