Europe Animal Transportation Market Size, Share, Trends & Growth Forecast Report By Animal (Cattle, Pigs, Poultry, Pets, Sheep & Goats, Others), Type, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Animal Transportation Market Size

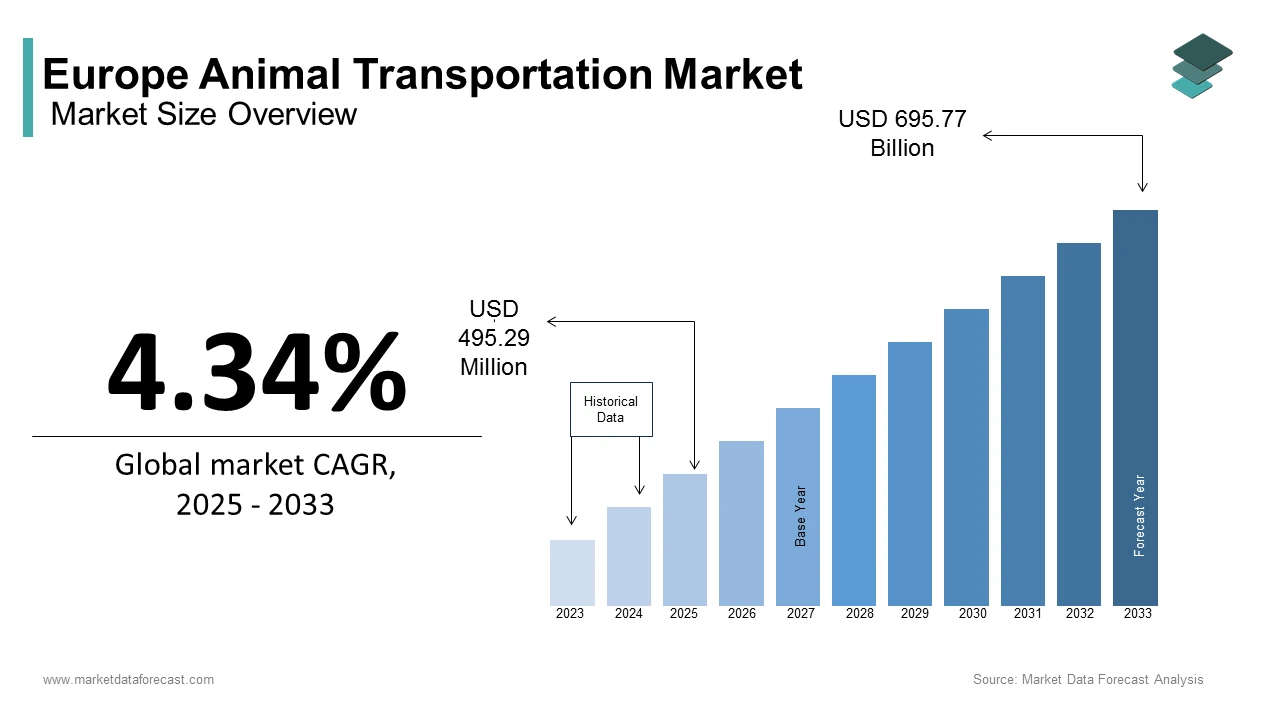

The Europe animal transportation market size was calculated to be USD 474.69 million in 2024 and is anticipated to be worth USD 695.77 million by 2033 from USD 495.29 billion in 2025, growing at a CAGR of 4.34% during the forecast period.

The animal transportation is the logistics and infrastructure required to safely and efficiently transport animals across various sectors, including livestock farming, companion animals, research laboratories, and zoological institutions. This market is driven by the increasing demand for meat, dairy, and other animal-derived products, as well as the growing emphasis on ethical and humane transportation practices. According to Eurostat, Europe accounts for approximately 30% of global livestock trade, with over 150 million animals transported annually within the region. According to the European Commission, livestock transportation alone generates €25 billion annually.

The market is governed by stringent regulations, such as those outlined in the European Union’s Transport Regulation (EC) No 1/2005, which mandates specific welfare conditions for animal transport, including temperature control, ventilation, and journey duration limits. Challenges persist as nearly 20% of animal transports face welfare-related issues, such as overcrowding or inadequate vehicle conditions, according to the European Food Safety Authority (EFSA). Additionally, the rise of e-commerce platforms has spurred growth in the transportation of companion animals, with an estimated 10 million pets being relocated annually across Europe, as per the Federation of European Companion Animal Veterinary Associations (FECAVA).

Technological advancements, such as GPS tracking systems and climate-controlled vehicles, are increasingly being adopted to enhance safety and compliance. There is also a push toward reducing the carbon footprint of animal transportation with the EU Green Deal emphasizing sustainability. As Europe continues to balance economic growth, animal welfare, and environmental concerns, the animal transportation market remains a critical component of the region’s agricultural and logistics ecosystems, which is poised for steady growth amidst evolving regulatory and consumer demands.

MARKET DRIVERS

Rising Demand for Animal-Derived Products

A key driver of the Europe animal transportation market is the rising demand for animal-derived products, fueled by population growth and dietary preferences. Eurostat reports that Europe’s livestock sector produces over 70 million tons of meat annually, with poultry and pork accounting for more than 60% of total production. According to the European Commission, cross-border trade in live animals exceeds €25 billion annually is driven by consumer demand for fresh and region-specific products. According to the International Organization for Standardization (ISO), countries like Germany and France import over 30 million live animals annually to meet domestic shortages. This demand necessitates efficient transportation systems to ensure timely delivery while maintaining animal welfare standards. The need for robust logistics networks has grown with urbanization increasing the reliance on centralized processing facilities, which is propelling investments in climate-controlled vehicles and advanced tracking systems to enhance efficiency and compliance.

Stringent Welfare Regulations Promoting Technological Adoption

Another major driver is the implementation of stringent animal welfare regulations, which encourage technological advancements in transportation. The European Food Safety Authority (EFSA) emphasizes that nearly 20% of animal transports face welfare-related issues, prompting stricter enforcement of EU Transport Regulation (EC) No 1/2005. To comply, operators are adopting innovations such as GPS tracking, real-time temperature monitoring, and ventilation systems, which collectively reduce welfare violations by up to 35%, according to Eurostat. According to the European Investment Bank, investments in welfare-compliant vehicles exceeded €1 billion in 2022 alone. As per the Federation of European Companion Animal Veterinary Associations (FECAVA), these technologies are increasingly used for transporting companion animals by ensuring safe relocations for an estimated 10 million pets annually. This regulatory push not only enhances animal safety but also drives market growth by fostering innovation and improving operational efficiency across the sector.

MARKET RESTRAINTS

High Operational Costs and Infrastructure Limitations

A significant restraint in the Europe animal transportation market is the high operational costs and inadequate infrastructure, which hinder efficiency and scalability. According to the European Commission, transportation costs account for up to 30% of the total expense in livestock trade, driven by fuel prices, vehicle maintenance, and compliance with welfare regulations. According to the Eurostat, nearly 25% of rural areas in Eastern Europe lack access to modern transport infrastructure, such as climate-controlled facilities is leading to delays and increased animal stress during transit. As per the European Investment Bank studies, upgrading vehicles to meet EU welfare standards can cost operators between €50,000 and €100,000 per unit, which is creating financial barriers for small-scale transporters. These challenges are exacerbated by fluctuating fuel prices, which have risen by 15% annually since 2021. Such constraints limit the sector’s ability to expand and maintain profitability while ensuring humane transportation practices.

Ethical Concerns and Public Opposition

Another major restraint is the growing ethical concerns and public opposition to live animal transportation, which disrupt operations and influence policy changes. According to the European Food Safety Authority (EFSA), over 40% of EU citizens oppose long-distance live animal transport, citing welfare issues such as overcrowding and prolonged journeys. This sentiment has led to protests and campaigns by pressuring governments to impose stricter regulations or outright bans on certain routes. For instance, Eurostat notes that Germany and the Netherlands have reduced live exports by 15% annually due to public backlash. As per the Federation of Veterinarians of Europe (FVE), negative media coverage of welfare violations during transport has intensified scrutiny by prompting calls for alternative solutions like local slaughtering and meat exportation. These factors create uncertainty for operators by increasing compliance costs and limiting cross-border trade opportunities in the region.

MARKET OPPORTUNITIES

Rising Demand for Livestock Exports

One major opportunity in the Europe animal transportation market is the increasing demand for livestock exports due to rising global food security concerns. According to Eurostat, the European Union exported approximately 1.8 million tons of live animals in 2022, with a significant portion being cattle and poultry destined for North Africa and the Middle East. This trend elevates the growing reliance on European livestock to meet international dietary needs. According to the European Commission, countries like Spain and France are leading exporters, benefiting from advanced logistics networks and compliance with stringent welfare regulations. In regions facing agricultural challenges, Europe's efficient transport systems and high animal welfare standards position it as a key player in addressing these demands sustainably.

Expansion of Pet Relocation Services

Another opportunity lies in the expansion of pet relocation services driven by increased pet ownership and mobility within the EU. A report by the European Pet Food Industry Federation (FEDIAF) states that over 85 million households in Europe own pets is creating a booming demand for safe and reliable pet transportation. In 2021, the European market for pet travel services grew by 12%, which is fueled by relaxed intra-EU movement rules under the Pet Passport Scheme. A study by the European Environment Agency revealed that roved road and air connectivity has further facilitated this growth. Specialized animal transport companies are capitalizing on this trend with more people relocating for work or leisure while taking their pets along by ensuring stress-free journeys for pets while adhering to health and safety protocols set by EU authorities.

MARKET CHALLENGES

Stringent Animal Welfare Regulations

One significant challenge in the Europe animal transportation market is the enforcement of stringent animal welfare regulations, which increase operational complexities and costs. The European Commission mandated that animals transported over long distances must adhere to strict guidelines, including rest periods, temperature control, and vehicle specifications. According to European Food Safety Authority (EFSA), non-compliance with these regulations led to over 2,000 reported violations in 2021, resulting in fines and shipment delays. These rules, while ensuring humane treatment, impose financial burdens on transporters for small-scale operators. The European Livestock and Meat Trades Union states that compliance costs have risen by 15% over the past five years due to frequent updates in legal requirements. Such regulatory pressures often discourage new entrants and strain existing businesses striving to balance profitability with ethical obligations.

Environmental Concerns and Carbon Emissions

Another challenge is the growing scrutiny over the environmental impact of animal transportation with its contribution to carbon emissions. According to the European Environment Agency, freight transport accounts for approximately 25% of the EU’s total greenhouse gas emissions, with animal transport being a notable contributor due to refrigeration needs and long-distance haulage. Public pressure to adopt sustainable practices has intensified, with organizations like Transport & Environment urging stricter emission controls. Additionally, the European Commission’s Green Deal aims to reduce transport-related emissions by 90% by 2050 by forcing companies to invest in eco-friendly vehicles and alternative logistics solutions. However, the high cost of transitioning to low-emission fleets poses a barrier, especially for smaller firms. This environmental challenge necessitates innovative strategies to align with sustainability goals without compromising efficiency or profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.34% |

|

Segments Covered |

By Animal, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Air France, Amerijet International, FedEx Corp., United Parcel Service (UPS), DSV Panalpina A/S, IAG Cargo, Lufthansa Cargo, American Airlines Cargo, Transfesa |

SEGMENTAL ANALYSIS

By Animal Insights

The poultry segment dominated the market and held 40.2% of the Europe animal transportation market share in 2024 with over 300 million broilers transported annually due to growing consumer demand for affordable protein. According to the European Commission, poultry's short production cycle and lower transportation costs compared to larger livestock make it economically significant. However, its fragility and strict biosecurity measures to prevent diseases like avian influenza add complexity. This segment's importance lies in its contribution to food security, supplying nearly 50% of the EU’s meat consumption by making it a cornerstone of the agricultural economy.

The pet transportation segment is anticipated to exhibit a CAGR of 12.3% from 2025 to 2033. This growth is driven by increased pet ownership, with over 85 million households owning pets, and relaxed intra-EU movement rules under the Pet Passport Scheme. According to the European Environment Agency, improved connectivity via road and air networks has further boosted this trend. Specialized services ensuring safe and stress-free journeys are thriving as more people relocate for work or leisure with their pets.

By Type Insights

The commercial animal transportation segment was the largest by occupying 50.5% of Europe's animal transport market share in 2024. This dominance is driven by the massive scale of livestock movement, including poultry, cattle, and pigs, to meet global food demands. According to the European Commission, poultry alone contributes 40% of this share, with over 300 million broilers transported annually. Its importance lies in ensuring food security and supporting the EU’s agricultural economy, which supplies nearly 50% of the region’s meat consumption. Commercial transport is important due to its role in international trade and sustaining Europe’s position as a leading livestock exporter.

The personal animal transportation segment is projected to experience a fastest CAGR of 12.6% from 2025 to 2033. This growth is fueled by rising pet ownership, with over 85 million European households owning pets, and increased mobility within the EU under the Pet Passport Scheme. According to the European Environment Agency, improved transport networks have further boosted demand for specialized services. The emotional and economic value of pets is combined with relaxed intra-EU travel rules that has made this segment pivotal. Its rapid expansion reflects shifting societal trends, where pets are increasingly viewed as family members is driving investments in safe and stress-free travel solutions.

REGIONAL ANALYSIS

Germany led the Europe animal transportation market with 22.4% of share in 2024. Its dominance stems from its robust logistics infrastructure, including advanced road and rail networks, which facilitate efficient livestock and pet movement. According to the Federal Ministry of Food and Agriculture, Germany is Europe’s largest livestock producer, exporting over 1.5 million tons of animals annually, primarily cattle and poultry. Additionally, Germany’s stringent animal welfare regulations set a benchmark for compliance by attracting international trade partners. The country’s central geographic location further enhances its role as a transit hub for cross-border transport.

France is esteemed to experience a CAGR of 7.9% during the forecast period. France benefits from being the EU’s largest agricultural producer, with over 20 million cattle and 15 million pigs transported annually, according to Eurostat. The country’s well-developed highway system and adherence to EU animal welfare standards enable seamless domestic and international trade. France’s strategic focus on exporting high-quality beef and dairy products to North Africa and the Middle East drives demand for livestock transport. Furthermore, the French government’s investments in sustainable transport solutions align with environmental goals by ensuring long-term growth.

Spain is attributed in having the prominent growth rate in the next coming years with its status as a major exporter of live animals, particularly cattle and sheep, to North Africa and the Middle East. Eurostat reports that Spain exported over 800,000 tons of livestock in 2022 alone. Additionally, the country’s growing pet ownership rates, with over 10 million households owning pets, have spurred demand for pet relocation services. The Spanish government’s investments in port and road infrastructure enhance connectivity, while relaxed intra-EU pet travel rules under the Pet Passport Scheme further boost growth. Spain’s dual focus on livestock exports and pet mobility escalates the growth of the market.

KEY MARKET PLAYERS

Major Players of the Europe Animal Transportation Market include Air France, Amerijet International, FedEx Corp., United Parcel Service (UPS), DSV Panalpina A/S, IAG Cargo, Lufthansa Cargo, American Airlines Cargo, Transfesa

DETAILED SEGMENTATION OF EUROPE ANIMAL TRANSPORTATION MARKET INCLUDED IN THIS REPORT

This research report on the Europe animal transportation market has been segmented and sub-segmented based on animal, type & region.

By Animal

- Cattle

- Pigs

- Poultry

- Pets

- Sheep & Goats

- Others

By Type

- Personal

- Commercial

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the major challenges in animal transportation?

Key challenges include compliance with animal welfare regulations, maintaining proper ventilation and temperature control, high transportation costs, and ensuring minimal stress for animals during transit.

2. Which animals are commonly transported in Europe?

Commonly transported animals include cattle, pigs, poultry, sheep, goats, horses, and pets such as cats and dogs. Exotic animals may also be transported for zoos and conservation efforts.

3. How is animal transportation regulated to ensure welfare?

Regulations require proper vehicle design, adequate ventilation, feeding and watering schedules, rest stops, and veterinary inspections to minimize stress and health risks during transportation.

4. Who are the key players in the Europe animal transportation market?

Major players include Air France, Amerijet International, FedEx Corp., United Parcel Service (UPS), DSV Panalpina A/S, IAG Cargo, Lufthansa Cargo, American Airlines Cargo, and Transfesa.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]