Europe Anaerobic Digestion Market Size, Share, Trends, & Growth Forecast Report By Feedstock (Organic Waste, Sewage Sludge, Energy Crops, and Others), Process, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Anaerobic Digestion Market Size

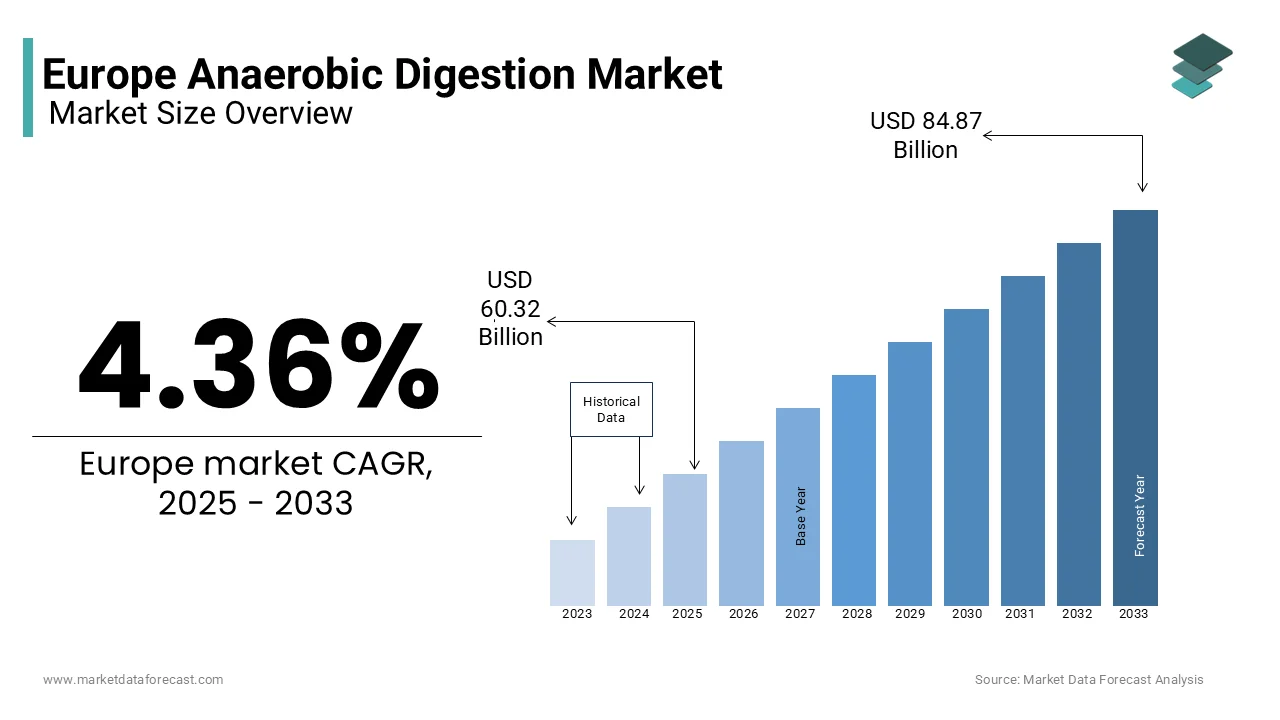

The Europe anaerobic digestion market was worth USD 57.8 billion in 2024. The European market is projected to reach USD 84.87 billion by 2033 from USD 60.32 billion in 2025, growing at a CAGR of 4.36% from 2025 to 2033.

Anaerobic digestion (AD) is a transformative biological process that converts organic materials into biogas and digestate, offering dual benefits of renewable energy generation and sustainable waste management. In Europe, this technology has gained significant traction as governments and industries align with ambitious climate goals. According to the European Biogas Association, anaerobic digestion currently supports over 18,000 biogas plants across the continent, contributing approximately 7% of the region’s renewable energy output. The process is particularly effective in addressing organic waste streams, which account for nearly 30% of municipal solid waste, as per Eurostat. By diverting organic waste from landfills, AD reduces methane emissions, which is a greenhouse gas 25 times more potent than carbon dioxide while producing clean energy.

The market is further bolstered by supportive policies such as the EU’s Renewable Energy Directive, which mandates a 32% share of renewables by 2030. Countries like Germany and Sweden have emerged as leaders, leveraging AD to power public transportation and generate electricity. For instance, Sweden now operates nearly 40% of its buses on biogas, showcasing the versatility of this technology. Despite its promise, the industry faces challenges such as high capital costs and technical complexities. Nevertheless, the convergence of environmental imperatives and economic incentives positions anaerobic digestion as a pivotal solution in Europe’s journey toward sustainability.

MARKET DRIVERS

Stringent Environmental Regulations

Europe’s stringent environmental regulations are propelling the adoption of anaerobic digestion as a key solution for reducing greenhouse gas emissions and managing organic waste. The European Green Deal, which aims to make Europe the first climate-neutral continent by 2050, has mandated significant reductions in landfill use and methane emissions. According to the European Environment Agency, landfills are responsible for 24% of Europe’s methane emissions, creating an urgent need for alternative waste management strategies. Anaerobic digestion offers a viable solution by converting organic waste into biogas, thereby mitigating these emissions. For example, Denmark has implemented policies requiring municipalities to divert all organic waste from landfills by 2025, driving investments in AD infrastructure. Furthermore, the EU’s Landfill Directive caps the amount of biodegradable municipal waste sent to landfills at 10% by 2035, incentivizing countries to adopt AD technologies. A study by the Fraunhofer Institute reveals that compliance with these regulations could reduce Europe’s methane emissions by 30% by 2030. This regulatory push underscores how policy frameworks are catalyzing the growth of the anaerobic digestion market, positioning it as a cornerstone of Europe’s sustainability agenda.

Increasing Focus on Decentralized Energy Systems

The growing emphasis on decentralized energy systems is another major driver fueling the expansion of anaerobic digestion across Europe. Unlike centralized power grids, decentralized systems enable localized energy production, enhancing energy security and resilience. According to the International Renewable Energy Agency, decentralized energy solutions account for nearly 25% of Europe’s renewable energy capacity, with anaerobic digestion playing a pivotal role. Rural communities, in particular, benefit from AD plants that utilize locally available organic waste to produce energy, reducing dependence on fossil fuels. For instance, in the Netherlands, cooperative AD initiatives among farmers have enabled small-scale energy generation, meeting up to 20% of local energy demands. Additionally, the European Network for Rural Development highlights that decentralized AD systems can create jobs and stimulate regional economies. Germany exemplifies this trend, with over 9,500 biogas plants distributed across rural areas, many of which are community-owned. These systems not only provide clean energy but also foster social cohesion by involving local stakeholders. As Europe seeks to transition away from centralized fossil fuel-based systems, the role of anaerobic digestion in enabling decentralized energy production becomes increasingly vital, driving market growth.

MARKET RESTRAINTS

High Initial Capital Costs

One of the primary barriers to widespread adoption of anaerobic digestion technology is the substantial upfront investment required for plant construction and operation. Establishing a medium-sized AD facility can cost between €2 million and €5 million, depending on scale and complexity, according to the European Investment Bank. These expenses encompass land acquisition, equipment procurement, and compliance with environmental standards. For smaller enterprises or municipalities with constrained budgets, such costs often act as a deterrent. Moreover, the return on investment (ROI) period for AD projects typically ranges from 8 to 12 years, discouraging potential investors seeking quicker financial returns. A study by the Fraunhofer Institute reveals that approximately 30% of proposed AD projects in Europe fail to secure funding due to high capital requirements. While technological advancements are gradually lowering operational costs, the initial financial burden remains significant. This challenge is particularly pronounced in Eastern European nations, where access to affordable financing is limited. Consequently, despite the long-term environmental and economic benefits of AD, the prohibitive entry costs continue to impede market expansion, underscoring the need for innovative financing mechanisms or public-private partnerships to bridge this gap.

Technical Challenges in Feedstock Management

The complexity associated with managing diverse feedstock materials that directly impacts the efficiency and scalability of anaerobic digestion systems. Variability in feedstock composition is ranging from organic waste to agricultural residues and that can lead to inconsistent biogas yields and operational disruptions. For instance, a study published in the Journal of Cleaner Production reveals that improper pre-treatment of feedstock can reduce methane production by up to 40%. Additionally, contamination risks, such as plastic particles in organic waste streams, pose significant challenges. The European Environment Agency estimates that sorting and cleaning feedstock accounts for nearly 25% of operational costs in AD facilities. Furthermore, seasonal fluctuations in feedstock availability, particularly for energy crops, exacerbate supply chain vulnerabilities. Countries like France and Italy, heavily reliant on crop-based feedstock, face periodic shortages during adverse weather conditions. These technical hurdles not only increase operational complexities but also necessitate continuous monitoring and skilled labor, adding to overall expenses. Addressing these issues requires advancements in feedstock processing technologies and standardized protocols, which remain underdeveloped in many regions, thereby constraining the broader adoption of anaerobic digestion solutions.

MARKET OPPORTUNITIES

Integration with Smart Grid Technologies

The integration of anaerobic digestion with smart grid technologies is a lucrative opportunity for enhancing energy efficiency and grid stability across Europe. Smart grids, which use digital communication to detect and react to local changes in energy usage, are increasingly being adopted to manage renewable energy sources like biogas. According to the European Commission, smart grids could reduce energy losses by up to 15% while improving the reliability of renewable energy integration. Anaerobic digestion plants, when connected to smart grids, can provide flexible and dispatchable energy, addressing the intermittent nature of other renewables such as wind and solar. For instance, Germany has pioneered this approach by linking its AD facilities to smart grids, enabling real-time adjustments in energy supply based on demand fluctuations. The International Energy Agency notes that such integration could increase the share of biogas in Europe’s energy mix by 20% by 2030. Furthermore, advancements in IoT-enabled sensors and data analytics allow AD operators to optimize feedstock processing and biogas production, reducing operational costs by up to 25%, as per a study by the Fraunhofer Institute. This synergy between anaerobic digestion and smart grids not only enhances energy security but also accelerates the transition to a low-carbon economy, unlocking significant economic and environmental benefits.

Expansion into Emerging Markets within Europe

Emerging markets in Eastern and Southern Europe offer untapped potential for the growth of anaerobic digestion, driven by increasing urbanization and agricultural activity. Countries like Romania, Bulgaria, and Greece generate substantial organic waste streams yet lack adequate infrastructure for sustainable waste management. According to Eurostat, these regions collectively produce over 40 million tons of organic waste annually, much of which is currently sent to landfills. Implementing anaerobic digestion systems in these areas could divert waste from landfills while generating renewable energy, creating a dual benefit. The European Bank for Reconstruction and Development highlights that investments in AD projects in Eastern Europe could yield annual returns of up to 12%, attracting both public and private sector interest. Additionally, EU funding programs such as Horizon Europe allocate grants specifically for renewable energy initiatives in underdeveloped regions, further incentivizing adoption. For example, Romania has recently launched pilot AD projects in rural areas, aiming to process agricultural residues and produce biogas for local communities. As these markets mature, anaerobic digestion is poised to play a pivotal role in bridging the energy gap while fostering sustainable development across Europe.

MARKET CHALLENGES

Limited Public Awareness and Acceptance

The limited public awareness and misconceptions surrounding the technology is one of the significant challenges to the European anaerobic digestion market. Many communities perceive AD facilities as potential sources of odor, noise, or environmental hazards, leading to resistance against new installations. A survey conducted by the European Social Survey found that only 30% of respondents were familiar with anaerobic digestion, with even fewer understanding its environmental and economic benefits. This knowledge gap often results in opposition during planning stages, delaying project timelines. For instance, in France, several proposed AD plants faced protests from local residents concerned about emissions and aesthetic impacts, despite evidence showing modern facilities adhere to strict environmental standards. Additionally, misinformation about digestate being harmful to soil quality persists, deterring farmers from adopting the technology. The European Biogas Association emphasizes that addressing these concerns requires targeted educational campaigns and transparent communication strategies. Without greater public acceptance, scaling up AD infrastructure becomes increasingly difficult, highlighting the urgent need for stakeholder engagement and community outreach efforts.

Dependence on Subsidies and Policy Uncertainty

The anaerobic digestion market in Europe remains heavily reliant on government subsidies and incentives, making it vulnerable to policy changes and funding uncertainties. According to the European Investment Bank, nearly 60% of AD projects depend on financial support mechanisms such as feed-in tariffs and tax credits to remain economically viable. However, shifts in political priorities or budget constraints can disrupt these incentives, jeopardizing ongoing and future projects. For example, the UK’s decision to reduce Renewable Heat Incentive (RHI) payments led to a 20% decline in new AD installations between 2019 and 2021, as reported by the UK Anaerobic Digestion and Bioresources Association. Similarly, Italy experienced a slowdown in AD adoption after revising its subsidy framework in 2020. This dependence on subsidies creates an unstable business environment, discouraging long-term investments. Moreover, the lack of standardized policies across European countries exacerbates the issue, with some nations offering robust support while others lag behind. To ensure sustained growth, the industry must explore alternative revenue models and advocate for consistent policy frameworks that provide clarity and stability for stakeholders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.36% |

|

Segments Covered |

By Feedstock, Process, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Agrikomp, Bioconstruct, BTS Biogas, Envirochemie, Envitec Biogas, FWE, Host Bioenergy Systems, Larsen Biogas, Linde Engineering, Planet Biogas, Scandinavian Biogas Fuels, Sebigas, Thoni, Valmet, Weltec Biopower, and Xergi. |

SEGMENTAL ANALYSIS

By Feedstock Insights

The organic waste segment accounted for the largest share of the European anaerobic digestion market in 2024. The dominating position of organic waste segment in the European market is driven by the abundant availability of food scraps, garden waste, and other biodegradable materials generated daily across households and industries. The European Environment Agency reports that cities alone produce over 88 million tons of food waste annually, providing a steady supply for AD plants. Germany leads this trend, processing nearly 7 million tons of organic waste through AD annually, thanks to robust waste segregation policies. The significance of organic waste lies in its dual impact: reducing landfill use while generating renewable energy. For instance, Sweden diverts 99% of its organic waste from landfills, utilizing it for biogas production instead. This not only mitigates methane emissions but also supports national energy goals. Moreover, the nutrient-rich digestate obtained post-digestion serves as a sustainable alternative to chemical fertilizers, enhancing agricultural productivity. Given these advantages, organic waste remains the backbone of Europe’s AD industry, driving both environmental and economic progress.

The energy crops segment is emerging as the fastest-growing feedstock segment and is projected to register a CAGR of 12.88% over the forecast period owing to the dedicated cultivation practices and favorable agronomic conditions across Europe. Maize and grass silage, the most commonly used energy crops, offer high biogas yields per hectare, making them economically attractive for AD operators. The Netherlands exemplifies this trend, where over 200,000 hectares are allocated to energy crop cultivation, supporting nearly 300 AD facilities. Additionally, advancements in breeding techniques have improved crop resilience and biomass output, further boosting their appeal. The European Agricultural Fund for Rural Development provides subsidies to farmers cultivating energy crops, incentivizing participation. Despite concerns about land-use competition, proponents argue that marginal lands unsuitable for food production can be utilized, minimizing trade-offs. As Europe strives to meet ambitious renewable energy targets, energy crops are poised to play a pivotal role in scaling up biogas production sustainably.

By Process Insights

The wet anaerobic digestion (AD) segment had 66.4% of the European market share in 2024. This process involves using feedstock with high moisture content, typically above 80%, making it ideal for organic waste streams such as food scraps and sewage sludge. The dominance of wet AD can be attributed to its efficiency in handling heterogeneous materials and its ability to produce consistent biogas yields. Germany, a leader in AD adoption, operates over 7,000 wet AD plants, processing nearly 10 million tons of organic waste annually. According to the Fraunhofer Institute, wet AD systems are particularly advantageous in urban areas where organic waste is abundant and moisture-rich. Furthermore, the digestate produced from wet AD serves as a nutrient-dense biofertilizer, enhancing soil fertility and reducing reliance on chemical alternatives. For instance, Denmark utilizes wet AD digestate to meet 30% of its agricultural fertilizer needs, as reported by the Danish Environmental Protection Agency. Despite requiring significant water usage and energy for heating, wet AD remains the preferred choice due to its scalability and compatibility with existing waste management infrastructure. Its widespread adoption underscores its importance in addressing Europe’s organic waste challenges while contributing to renewable energy goals.

The dry anaerobic digestion segment is anticipated to register the fastest CAGR of 15.5% over the forecast period. Unlike wet AD, dry AD processes feedstock with moisture content below 75%, making it suitable for agricultural residues, energy crops, and municipal solid waste. This technology is gaining traction due to its lower water requirements and reduced operational costs, which appeal to regions facing water scarcity or aiming to minimize resource use. France has been at the forefront of this trend, with over 100 dry AD plants installed in rural areas to process crop residues and manure. A study by the French National Institute for Agriculture, Food, and Environment highlights that dry AD reduces water consumption by up to 40% compared to wet systems. Additionally, advancements in modular dry AD designs have made the technology more accessible to small-scale operators, enabling decentralized energy production. For example, Italy has introduced compact dry AD units for farmers, allowing them to generate biogas on-site while managing agricultural waste. As Europe seeks sustainable solutions tailored to diverse feedstock types, dry AD’s adaptability and efficiency position it as a key driver of future growth in the anaerobic digestion market.

By Application Insights

The industrial segment captured the largest share of 51.5% of the European anaerobic digestion market share in 2024. Industries such as food processing, breweries, and paper manufacturing generate substantial organic waste streams, which serve as ideal feedstock for AD systems. For instance, the Netherlands has implemented large-scale AD plants within its dairy sector, processing over 2 million tons of whey and other by-products annually. According to Wageningen University, industrial AD systems not only reduce waste disposal costs by up to 40% but also generate renewable energy that offsets fossil fuel usage. In Sweden, industrial facilities utilizing AD contribute to powering nearly 20% of the country’s manufacturing sector, showcasing the technology’s versatility. Moreover, the digestate produced from industrial AD is increasingly being repurposed as biofertilizers, creating additional revenue streams. The Confederation of European Paper Industries notes that incorporating AD into paper mills has reduced their carbon footprint by 25%. This widespread adoption across industries underscores the critical role of anaerobic digestion in achieving sustainability targets while enhancing operational efficiency.

The residential segment is predicted to witness the highest CAGR of 10.8% over the forecast period owing to the increasing awareness of decentralized energy solutions and the rising demand for sustainable waste management at the household level. Countries like Germany and Austria have pioneered residential AD systems, enabling households to convert kitchen waste into biogas for cooking and heating. A study by the Austrian Energy Agency reveals that small-scale residential AD units can reduce household energy bills by up to 30% while diverting organic waste from landfills. Additionally, government incentives, such as subsidies for home-based renewable energy systems, have encouraged homeowners to adopt AD technology. For example, the UK’s Green Homes Grant program supports the installation of residential AD units, resulting in a 25% increase in adoption rates since 2021. These systems not only empower individuals to contribute to climate goals but also foster community engagement in sustainability initiatives. As urbanization intensifies and households seek greener alternatives, residential AD applications are poised to become a cornerstone of Europe’s renewable energy landscape.

REGIONAL ANALYSIS

Germany held the leading share of the European anaerobic digestion market in 2024. The dominance of Germany in the European market is attributed to its robust policy frameworks, such as the Renewable Energy Sources Act, which provides attractive feed-in tariffs for biogas producers. With over 9,500 operational biogas plants, Germany generates nearly 10 billion cubic meters of biogas annually, equivalent to powering 8 million households. According to the Fraunhofer Institute, German AD plants primarily utilize agricultural residues and energy crops, reflecting the nation’s strong agricultural base. Additionally, the government’s commitment to phasing out nuclear power has accelerated investments in renewable energy, with AD playing a pivotal role. Germany’s success serves as a model for other nations, demonstrating how supportive policies and technological innovation can drive market leadership.

Sweden is another major regional player in the European Anaerobic digestion market. The Swedish Energy Agency reports that biogas powers nearly 40% of the country’s public buses and accounts for 15% of its transportation fuel. Sweden’s advanced waste segregation policies ensure a steady supply of organic feedstock, enabling efficient biogas production. Furthermore, the country’s investment in upgrading biogas to biomethane has positioned it as a leader in clean energy exports. According to the European Biogas Association, Sweden’s AD sector has grown by 20% annually over the past decade, driven by strong public-private partnerships. This progress underscores Sweden’s ability to integrate AD into its broader sustainability strategy, setting a benchmark for others to follow.

France is a prominent player in the European market and the growth of the French market is driven by its focus on agricultural waste management and renewable energy diversification. The French Ministry of Ecology estimates that AD plants process over 5 million tons of agricultural residues annually, reducing methane emissions by 30%. France’s AD market is supported by initiatives like the Methanization Plan, which aims to double biogas production by 2025. According to the French National Institute for Agriculture, Food, and Environment, the country has installed over 600 AD plants, with many located in rural areas to support local economies. France’s strategic emphasis on circular economy principles has further bolstered AD adoption, making it a key player in Europe’s renewable energy landscape.

The UK is expected to hold a notable share of the European market over the forecast period with anaerobic digestion playing a vital role in its waste management and energy strategies. The UK Anaerobic Digestion and Bioresources Association reports that AD plants process over 35 million tons of organic waste annually, generating enough energy to power 1 million homes. Government programs like the Renewable Heat Incentive have spurred investments in AD infrastructure, particularly in rural communities. Additionally, the UK’s focus on reducing landfill use has driven innovations in feedstock management, enhancing operational efficiency. According to Eurostat, the UK’s AD sector has grown by 12% annually since 2018, reflecting its potential for further expansion.

Italy is a prominent market for Anaerobic digestion in Europe, leveraging its strong agricultural sector to drive AD adoption. The Italian Biogas Association highlights that the country operates over 1,700 AD plants, primarily utilizing livestock manure and crop residues. Italy’s AD market benefits from EU funding programs, which support rural development and renewable energy projects. According to the Italian Ministry of Agricultural Policies, biogas production has increased by 25% over the past five years, contributing to the nation’s energy security. Italy’s success demonstrates how regional strengths can be harnessed to advance anaerobic digestion, offering valuable lessons for other European nations.

KEY MARKET PLAYERS

The major players in the Europe Anaerobic digestion market include Agrikomp, Bioconstruct, BTS Biogas, Envirochemie, Envitec Biogas, FWE, Host Bioenergy Systems, Larsen Biogas, Linde Engineering, Planet Biogas, Scandinavian Biogas Fuels, Sebigas, Thoni, Valmet, Weltec Biopower, and Xergi.

MARKET SEGMENTATION

This research report on the Europe anaerobic digestion market is segmented and sub-segmented into the following categories.

By Feedstock

- Organic Waste

- Sewage Sludge

- Energy Crops

- Others

By Process

- Wet AD

- Dry AD

By Application

- Residential

- Commercial

- Industrial

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the primary feedstocks used in anaerobic digestion in Europe?

Common feedstocks include agricultural residues, food waste, municipal solid waste, and wastewater sludge. Some regions also use energy crops like maize and grass silage.

Are there any emerging technologies improving anaerobic digestion in Europe?

Advances include co-digestion techniques, improved pre-treatment methods, gas upgrading technologies, and digital monitoring systems for optimizing plant efficiency and biogas yields.

How does anaerobic digestion compare to other waste management solutions in Europe?

Compared to incineration and landfilling, anaerobic digestion is more sustainable as it recovers energy, reduces emissions, and produces valuable byproducts like digestate for soil improvement.

What is the future outlook for the anaerobic digestion market in Europe?

The market is expected to grow due to increasing waste-to-energy initiatives, stricter environmental regulations, and advancements in biogas upgrading technology, making anaerobic digestion a key player in Europe's renewable energy sector.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]