Europe Ammonium Nitrate Market Size, Share, Trends & Growth Forecast Report Application (Explosives, Fertilizers, and Others), By End User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Ammonium Nitrate Market Size

The Europe ammonium nitrate market size was valued at USD 20.18 billion in 2024. The European market is estimated to be worth USD 32.56 billion by 2033 from USD 21.28 billion in 2025, growing at a CAGR of 5.46% from 2025 to 2033.

Ammonium nitrate, a chemical compound with dual applications in fertilizers and explosives, plays a pivotal role in Europe's agricultural and industrial sectors. As a nitrogen-rich fertilizer, it is indispensable for enhancing soil fertility and crop yields, while its use in explosives supports mining, construction, and defense activities. According to the European Fertilizer Manufacturers Association, ammonium nitrate accounts for approximately 30% of nitrogen-based fertilizers consumed in Europe due to its significance in agricultural productivity. According to the European Chemical Industry Council, ammonium nitrate production in the region exceeds 10 million metric tons annually by reflecting its widespread adoption across diverse industries. However, the market faces challenges such as stringent safety regulations, environmental concerns, and supply chain disruptions, which have intensified in recent years. Despite these hurdles, advancements in manufacturing technologies and increasing demand for high-yield crops continue to drive market growth.

MARKET DRIVERS

Rising Demand for High-Yield Crops in Agriculture

The escalating demand for high-yield crops to meet Europe's growing food requirements serves as a major driver for the ammonium nitrate market. According to the European Commission's Directorate-General for Agriculture and Rural Development, agricultural productivity in Europe must increase by 25% by 2030 to address food security concerns driven by population growth and urbanization. Ammonium nitrate, as a nitrogen-rich fertilizer, is widely used to enhance soil fertility and boost crop yields, particularly for cereals, vegetables, and fruits. According to the European Fertilizer Manufacturers Association, over 60% of ammonium nitrate produced in Europe is utilized in agriculture by making it a critical component of the farming value chain. According to Eurostat, the agricultural sector accounted for approximately 40% of total ammonium nitrate consumption in 2022. Furthermore, the European Union's Common Agricultural Policy (CAP) emphasizes sustainable farming practices by amplifying the need for efficient fertilizers like ammonium nitrate to optimize resource utilization.

Increasing Adoption in Mining and Construction Activities

Another significant driver is the growing adoption of ammonium nitrate in mining and construction activities, where it is used as an explosive for rock blasting and tunneling. According to the European Mining Association, the mining sector in Europe consumes approximately 25% of total ammonium nitrate production, which is driven by the expansion of mineral extraction projects and infrastructure development. According to the European Construction Industry Federation, investments in infrastructure projects exceeded €100 billion in 2022 by creating a favorable environment for ammonium nitrate-based explosives. The versatility and cost-effectiveness of ammonium nitrate ensure its sustained dominance in this segment for applications requiring controlled detonation and precision.

MARKET RESTRAINTS

Stringent Safety Regulations

Stringent safety regulations governing the storage, transportation, and use of ammonium nitrate pose a significant restraint to the European market. According to the European Chemicals Agency, ammonium nitrate is classified as a hazardous material due to its potential for accidental detonation if improperly handled or stored. The Industrial Explosives Directive, enforced by the European Commission, mandates strict safety protocols, compelling manufacturers to invest heavily in compliance measures. According to Eurostat, compliance costs for ammonium nitrate producers have risen by 20% over the past three years by impacting profit margins. According to the European Environment Agency, several small-scale ammonium nitrate facilities have ceased operations due to non-compliance or prohibitive expenses.

Environmental Concerns and Regulatory Scrutiny

The environmental concerns and regulatory scrutiny surrounding ammonium nitrate usage is another challenge for the European market. According to the European Environment Agency, the excessive use of nitrogen-based fertilizers contributes to water pollution through nitrate leaching, which poses risks to aquatic ecosystems and human health. The Nitrates Directive, enforced by the European Commission, imposes limits on fertilizer application to protect groundwater quality, further restricting ammonium nitrate usage. According to the European Federation of Chemical Employers, over 40% of farmers have reduced their reliance on ammonium nitrate due to environmental regulations.

MARKET OPPORTUNITIES

Growing Emphasis on Precision Agriculture

The increasing emphasis on precision agriculture presents a lucrative opportunity for the European ammonium nitrate market. Ammonium nitrate, when used in combination with precision farming tools such as GPS-guided equipment and soil sensors that enables targeted fertilizer application by minimizing waste and environmental impact. As per the European Fertilizer Manufacturers Association, the growing adoption of ammonium nitrate in controlled-release formulations that further amplifies the market growth.

Expansion into Renewable Energy Projects

The growing focus on renewable energy projects offers another promising opportunity for the European ammonium nitrate market. According to the European Renewable Energy Council, investments in renewable energy infrastructure are projected to reach €200 billion by 2030, with wind and solar energy being key contributors. Ammonium nitrate is extensively used in explosives for rock blasting during the construction of wind farms, solar parks, and hydroelectric dams. Additionally, the European Commission's Green Deal initiative supports the development of sustainable energy solutions, further boosting demand for advanced materials. This trend positions ammonium nitrate as a critical enabler of renewable energy infrastructure development.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the European ammonium nitrate market. According to the European Maritime Safety Agency, shipping delays increased by 25% in 2022, affecting the timely delivery of raw materials and finished products. The Russia-Ukraine conflict has further disrupted the supply of key raw materials such as ammonia, a primary feedstock for ammonium nitrate production. According to the European Fertilizer Manufacturers Association, imports of certain raw materials declined by 40% in 2022. These disruptions not only elevate operational costs but also hinder production schedules that is anticipated to hinder the growth of the market. According to Eurostat, over 30% of manufacturers experienced production halts in 2022 due to supply chain challenges.

Volatility in Raw Material Prices

Volatility in raw material prices, particularly ammonia and natural gas is a significant challenge for the European ammonium nitrate market. According to the European Chemical Industry Council, fluctuations in natural gas prices directly influence the cost of ammonia, which accounts for nearly 70% of ammonium nitrate production expenses. In 2022, natural gas prices surged by over 150% that is causing ammonia costs to spike by 50%. According to the European Commission, energy-intensive industries, including ammonium nitrate production, were disproportionately affected by the energy crisis by leading to reduced profitability. According to the European Federation of Chemical Employers, over 60% of companies in the chemical sector reported financial strain in 2022 due to rising raw material costs. These financial pressures not only hinder market expansion but also constrain investments in capacity expansions and technological advancements.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.46% |

|

Segments Covered |

By Application, End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Austin Powder, OSTCHEM, EuroChem Group, ENAEX, BOREALIS AG, Fertiberia SA, Incitec Pivot Limited, URALCHEM JSC, Neochim PLC, Orica Limited, and Yara, and others. |

SEGMENTAL ANALYSIS

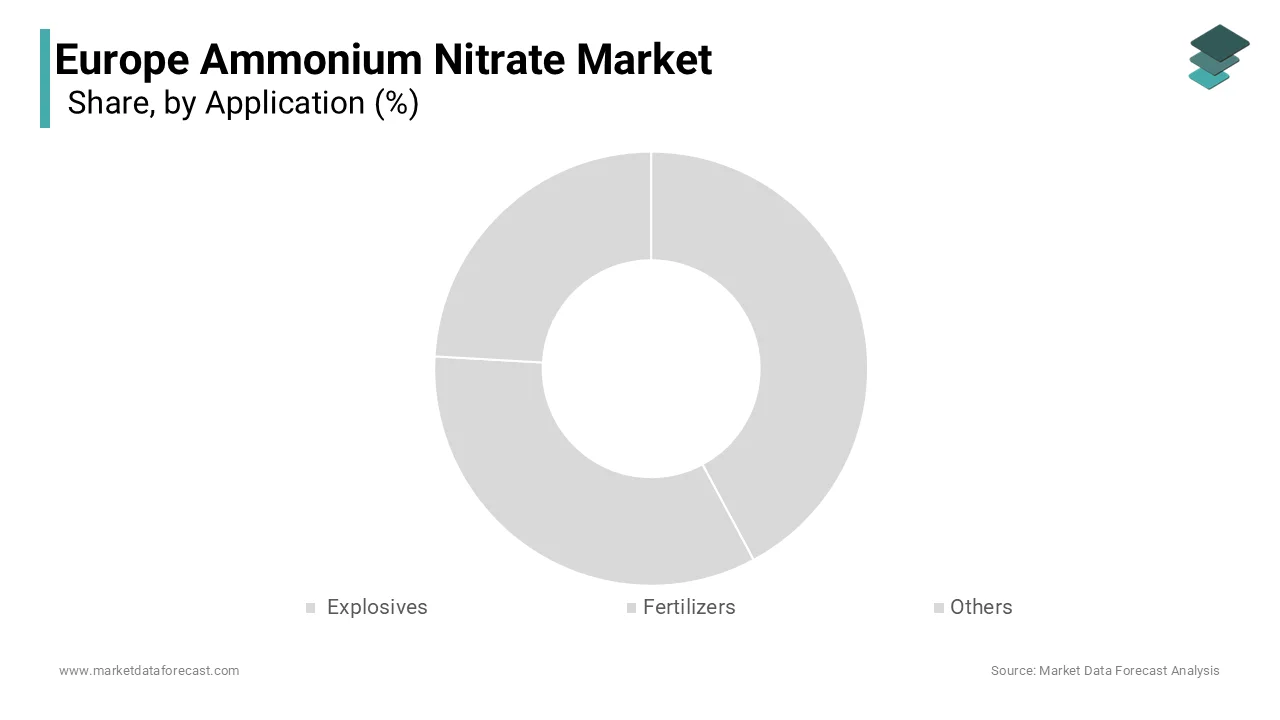

By Application Insights

The fertilizers segment dominated the European ammonium nitrate market with 59.1% of share in 2024. This dominance is attributed to ammonium nitrate's exceptional nitrogen content, which enhances soil fertility and boosts crop yields. According to the European Commission's Directorate-General for Agriculture and Rural Development, over 70% of nitrogen-based fertilizers used in Europe contain ammonium nitrate by making it a critical component of the farming value chain. Additionally, according to Eurostat, the agricultural sector accounted for approximately 40% of total ammonium nitrate consumption in 2022.

The Explosives segment is the likely to experience a CAGR of 9.2% from 2025 to 2033. This rapid growth is fueled by the increasing adoption of ammonium nitrate in mining and construction activities, where it is used for rock blasting and tunneling. Additionally, the European Commission's Green Deal initiative supports the development of renewable energy projects that further amplifies the demand for advanced materials.

By End-User Industry Insights

The agriculture segment was the largest and held 43.5% of the European ammonium nitrate market share in 2024 owing to the extensive use of ammonium nitrate as a nitrogen-rich fertilizer to enhance soil fertility and boost crop yields. According to the European Commission's Directorate-General for Agriculture and Rural Development, agricultural productivity in Europe must increase by 25% by 2030 to address food security concerns. The agricultural sector accounted for approximately 40% of total ammonium nitrate consumption in 2022, according to Eurostat. The versatility and performance of ammonium nitrate ensure its sustained dominance in this sector.

The mining segment is estimated to register a CAGR of 8.3% of the forecast period. This rapid growth is driven by the increasing adoption of ammonium nitrate in mining activities, where it is used as an explosive for rock blasting and mineral extraction. Additionally, the European Commission's Green Deal initiative supports the development of sustainable mining practices that is significantly to accelerate the growth of the market.

REGIONAL ANALYSIS

Germany ammonium nitrate market dominated the total share of 25.2% in 2024. This prominence is attributed to the country's robust agricultural and mining industries, which are major consumers of ammonium nitrate. According to the German Farmers' Association, over 60% of arable land in Germany utilizes ammonium nitrate-based fertilizers to enhance crop yields. Additionally, Germany's strong emphasis on sustainability aligns with the growing adoption of ammonium nitrate in renewable energy projects.

France is esteemed to witness a CAGR of 3.6% during the forecast period. The country's mining and agricultural sectors are key contributors to ammonium nitrate adoption. According to the French Mining Association, the growing use of ammonium nitrate explosives in mineral extraction projects. Furthermore, France's focus on sustainable farming practices boosts the use of ammonium nitrate in precision agriculture.

The UK is anticipated to have steady growth in the Europe ammonium nitrate market during the forecast period. The country's strong presence in the mining and defense sectors drives ammonium nitrate demand. According to the UK Defense Ministry, ammonium nitrate is extensively used in military-grade explosives that further fuels the consumption. Additionally, the UK's commitment to renewable energy supports the use of ammonium nitrate in infrastructure projects such as wind farms and solar parks.

Italy’s thriving agricultural and construction sectors rely heavily on ammonium nitrate for enhancing soil fertility and supporting infrastructure development. Italy's ammonium nitrate market growth is fueled with the adoption of the sustainable farming that amplifies demand for high-performance fertilizers. Furthermore, the Italian government's focus on green building initiatives aligns with the growing adoption of ammonium nitrate in construction activities.

KEY MARKET PLAYERS

The major key players in Europe ammonium nitrate market are Austin Powder, OSTCHEM, EuroChem Group, ENAEX, BOREALIS AG, Fertiberia SA, Incitec Pivot Limited, URALCHEM JSC, Neochim PLC, Orica Limited, and Yara, and others.

MARKET SEGMENTATION

This research report on the Europe ammonium nitrate market is segmented and sub-segmented into the following categories.

By Application

- Explosives

- Fertilizers

- Others

By End User

- Construction

- Mining, Quarry

- Agriculture

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. How is the European ammonium nitrate market expected to grow?

The market is projected to grow from USD 21.28 billion in 2025 to USD 32.56 billion by 2033, with a CAGR of 5.46% from 2025 to 2033.

2. Who are the major players in the European ammonium nitrate market?

Key players include YARA, Orica Limited, EuroChem Group, URALCHEM JSC, and ENAEX

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]