Europe Amino Acid Market Size, Share, Trends & Growth Forecast Report By Type ( Essential, Non Essential), Source, Grade, End Use, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Amino Acid Market Size

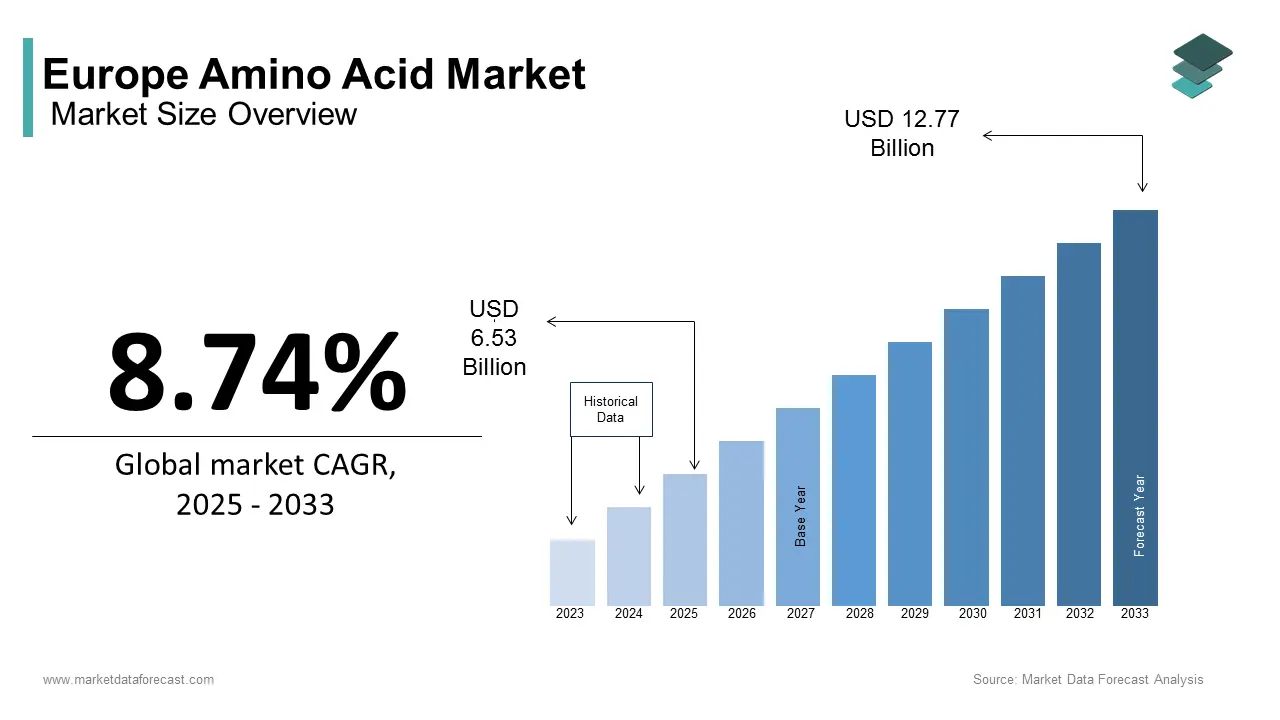

The Europe amino acid market size was calculated to be USD 6.01 billion in 2024 and is anticipated to be worth USD 12.77 billion by 2033 from USD 6.53 billion In 2025, growing at a CAGR of 8.74% during the forecast period.

Amino acids are organic compounds that serve as the building blocks of proteins is playing a critical role in human and animal nutrition, health, and metabolic processes. The European Union’s stringent regulations on food safety and animal welfare have further propelled the adoption of amino acids, particularly in animal nutrition, where they enhance feed efficiency and reduce environmental impact. Additionally, the growing consumer focus on health and wellness has spurred demand for amino acids like glutamine, arginine, and leucine in dietary supplements and sports nutrition products. According to the International Nutrition Council, the sports nutrition sector alone contributes nearly 25% to the market’s revenue.

Countries like Germany, France, and the UK lead in market share due to their advanced healthcare infrastructure and strong R&D capabilities. However, challenges such as high production costs and supply chain disruptions persist. Addressing both nutritional needs and environmental concerns while fostering economic growth as Europe prioritizes sustainability and innovation, the amino acid market is poised to evolve.

MARKET DRIVERS

Rising Demand for Animal Feed Additives

The rising demand for animal feed additives with the growing need to enhance livestock productivity and reduce environmental impact is significantly propelling the growth rate of the Europe amino acid market. According to the European Food Safety Authority, amino acids like lysine, methionine, and threonine account for over 70% of total consumption in animal feed applications, as they improve feed efficiency and reduce nitrogen emissions. According to the International Nutrition Council, stricter EU regulations on sustainable farming practices have increased the adoption of amino acids, which help minimize the use of crude protein in feed. As Europe prioritizes eco-friendly agricultural practices, the demand for amino acids in animal nutrition continues to grow, ensuring their pivotal role in the market.

Growing Popularity of Dietary Supplements and Sports Nutrition

The growing popularity of dietary supplements and sports nutrition products, fueled by increasing health consciousness and fitness trends across Europe. According to the International Nutrition Council, amino acids like glutamine, arginine, and leucine are widely used in supplements to support muscle recovery, immune function, and overall wellness. As per Eurostat, over 40% of Europeans aged 18-45 consume dietary supplements regularly is driving demand for functional ingredients. According to the European Commission, aging populations and rising healthcare costs have further boosted the nutraceuticals market. Amino acids are becoming indispensable in the formulation of innovative health and wellness products as consumers prioritize preventive healthcare.

MARKET RESTRAINTS

High Production Costs and Supply Chain Challenges

The high production costs associated with manufacturing is coupled with supply chain disruptions that is hampering the growth rate of the Europe amino acids market. As per the European Chemicals Agency, the production of synthetic amino acids like lysine and methionine requires significant energy inputs and raw materials such as petroleum derivatives, which are subject to price volatility. As per Eurostat, production costs for amino acids have increased by 15% since 2020 due to rising energy prices and logistical challenges caused by global trade uncertainties. According to the International Nutrition Council, Europe’s reliance on imports for certain raw materials, particularly from Asia, has created vulnerabilities in the supply chain. These factors limit profit margins for manufacturers and hinder market growth for small and medium enterprises (SMEs) by making cost management a persistent challenge.

Stringent Regulatory Frameworks and Approval Processes

Another significant restraint is the stringent regulatory frameworks and lengthy approval processes governing the use of amino acids in food, feed, and pharmaceutical applications. The European Food Safety Authority mandates rigorous testing and documentation to ensure safety and efficacy, which can delay product launches by up to two years. As per Eurostat, compliance costs for obtaining EU certifications can exceed €1 million per product, creating barriers for new entrants. Additionally, a study by European Commission reports that evolving regulations on genetically modified organisms (GMOs) and sustainable sourcing further complicate market entry for bio-based amino acids. While these measures ensure consumer safety and environmental protection, they also increase operational complexities and reduce innovation speed by slowing the overall growth of the amino acid market in Europe.

MARKET OPPORTUNITIES

Expansion of Bio-Based and Sustainable Amino Acid Production

A significant opportunity in the European amino acid market lies in the development of bio-based and sustainable production methods, driven by Europe’s focus on environmental sustainability. According to the European Environment Agency, bio-based amino acids, produced through fermentation using renewable resources, are projected to grow at a CAGR of 8% from 2023 to 2030. As per Eurostat, over 40% of consumers prefer eco-friendly products, creating demand for sustainably sourced amino acids in food, feed, and pharmaceuticals. Additionally, the International Nutrition Council notes that advancements in biotechnology have reduced production costs for bio-based alternatives by up to 20%, making them more competitive. Manufacturers investing in green technologies are poised to gain a competitive edge with the EU Green Deal emphasizing carbon neutrality. This shift aligns with regulatory goals and consumer expectations by offering lucrative growth opportunities.

Increasing Applications in Personalized Medicine and Functional Foods

Another major opportunity is the growing use of amino acids in personalized medicine and functional foods, which is fueled by advancements in healthcare and rising demand for tailored nutrition solutions. According to the European Food Safety Authority, amino acids like arginine and glutamine are increasingly incorporated into functional foods. According to the Eurostat, personalized nutrition accounts for nearly 15% of the health and wellness market, with aging populations driving demand for targeted dietary interventions. According to the International Nutrition Council, amino acids play a critical role in therapies for chronic diseases such as diabetes and cardiovascular conditions. As Europe prioritizes preventive healthcare and innovation, expanding applications in these high-growth sectors present significant opportunities for market players to diversify and scale their offerings.

MARKET CHALLENGES

Stringent Regulatory Framework

The stringent regulatory framework governing food additives and supplements is one of the major challenges for the market key players. The European Food Safety Authority (EFSA) imposes rigorous safety assessments, which can delay product approvals and increase compliance costs for manufacturers. According to EFSA's 2022, nearly 30% of new health claims for amino acids were rejected due to insufficient scientific evidence. This regulatory hurdle limits market expansion and innovation. Companies must invest heavily in research to meet these standards, which can be a barrier for smaller firms. The complexity of navigating diverse national regulations within the EU further complicates market entry, as per the study by the European Commission’s 2021 study on food additive legislation.

Fluctuating Raw Material Prices

The fluctuating raw material prices impacting production costs is also likely to hinder the growth rate of the market. Amino acids are primarily derived from natural sources like corn and soy, whose prices have been volatile due to climate change and geopolitical tensions. As per the Food and Agriculture Organization in 2023, global corn prices increased by 25% over the past two years which is directly affecting amino acid production costs. This volatility forces manufacturers to frequently adjust pricing strategies which can destabilize supply chains and reduce profit margins. Additionally, reliance on imports for key raw materials makes the market vulnerable to trade disruptions. As per the European Chemical Industry Council in its 2022, such economic pressures could hinder the competitiveness of European amino acid producers globally.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.74% |

|

Segments Covered |

By Type, Source, Grade, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Ajinomoto Co., Inc., Evonik Industries AG, Archer Daniels Midland Company (ADM), CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., Fufeng Group Company Limited, Meihua Holdings Group Co., Ltd., Sichuan Tongsheng Amino Acid Co., Ltd., Shijiazhuang Donghua Jinlong Chemical Co., Ltd., Adisseo France S.A.S, Glanbia Nutritionals, Sumitomo Chemical Co., Ltd., Merck KGaA, Prinova Group LLC, Daesang Corporation, Global Bio-chem Technology Group Company Limited, Sunrise Nutrachem Group Co., LTD. |

SEGMENTAL ANALYSIS

By Type Insights

The lysine segment dominated the market and held 30% of the Europe's amino acid market share in 2024. The demand for the animal feed in swine and poultry diets is enhancing the growth and protein synthesis that is augmented in levelling up the growth rate of the market. Europe is contributing significantly due to its robust livestock industry. Lysine's importance lies in its ability to improve feed efficiency to reduce costs for farmers. According to the FAO, lysine supplementation can increase livestock weight gain by up to 15%.

The citrulline is anticipated to witness a fastest CAGR of 7.8% during the forecast period. Its rapid growth is driven by rising demand in sports nutrition and dietary supplements, as citrulline boosts nitric oxide production is enhancing athletic performance. Studies from the European Food Safety Authority show that citrulline supplementation can improve exercise endurance by 12-15%. Additionally, its role in cardiovascular health has expanded its applications in medical supplements. Citrulline's prominence in promoting muscle recovery and blood flow ensures its continued expansion with Europe's fitness industry projected to grow at 5.2% annually.

By Source Insights

The chemical synthesis segment was the largest segment by capturing 35% of Europe's amino acid market share owing to its cost-effectiveness and scalability by making it ideal for mass-producing essential amino acids like methionine, which is critical for animal feed. Methionine production via chemical synthesis reduces feed costs by 10-15% by enhancing livestock productivity. However, environmental concerns over chemical residues have prompted research into sustainable alternatives, ensuring its continued relevance despite challenges.

The fermentation segment is projected to experience a CAGR of 6.5% from 2025 to 2033. This growth is driven by increasing demand for eco-friendly and high-purity amino acids like lysine and glutamic acid. Fermentation aligns with the European Green Deal’s sustainability goals by reducing carbon footprints by 20% compared to chemical synthesis. The rising clean-label trends is additionally to fuel the growth rate of the market. Also, the growing importance for the production of organic-certified amino acids for dietary supplements and functional foods with respective to the health-conscious consumers and regulatory compliance is solely to fuel the growth rate of the market in next coming years.

By Grade Insights

The feed-grade amino acids segment dominated the market by occupying 45% of the European market share in 2024. Methionine and lysine, key feed-grade amino acids to reduce nitrogen emissions by 20% with EU sustainability goals. Europe being a major consumer due to its advanced livestock industry is attributed to elevate the growth rate of the market. Feed-grade amino acids are indispensable for cost-effective and eco-friendly farming by ensuring high-quality protein production while minimizing environmental impacts.

The pharma-grade amino acids segment is likely to witness a CAGR of 5.3% from 2025 to 2033. This growth is fueled by rising demand for intravenous solutions and treatments for metabolic disorders. Aging populations and chronic diseases further drive the growth rate of the market. Pharma-grade amino acids are vital for precision medicine by offering high purity and compliance with stringent regulations. Their therapeutic benefits, such as supporting immune function and muscle recovery to make them crucial for advanced healthcare applications and improving patient outcomes.

By End Use Insights

The animal feed segment was the largest segment and held 40% Europe amino acid market share in 2024. The essential role of amino acids like lysine and methionine is enhancing livestock growth and feed efficiency. Lysine supplementation can reduce feed costs by 10-15%, while improving weight gain in poultry. These amino acids also align with EU sustainability goals by reducing nitrogen emissions by 20% along with prompting the importance.

The dietary supplement segment is projected to exhibit a CAGR of 7.2% from 2025 to 2033. This growth is driven by rising health consciousness and demand for fitness products. According to the EFSA, these supplements enhance muscle recovery and endurance, appealing to athletes and active consumers. Their importance lies in addressing nutritional gaps and supporting active lifestyles, ensuring sustained expansion in the health and wellness sector.

REGIONAL ANALYSIS

Germany led the Europe amino acid market with a significant share of 25% in 2024. The escalating pharmaceutical and animal feed industries which are supported by advanced manufacturing infrastructure and stringent quality standards is substantially to enhance the growth rate of the market. The country’s focus on sustainable agriculture has driven demand for feed-grade amino acids like lysine and methionine, which are critical for livestock productivity. Additionally, Germany’s strong R&D ecosystem fosters innovation in pharma-grade amino acids, aligning with global healthcare trends. This combination of industrial strength, sustainability goals, and technological advancements ensures Germany’s dominance in the market.

The UK amino acids market is esteemed to exhibit a CAGR of 5.2% during the forecast period. The growth is fueled by high demand for dietary supplements and sports nutrition products driven by health-conscious consumers. The UK’s regulatory framework ensures high-quality standards by making it a hub for premium amino acid products. Furthermore, the rise of veganism has boosted plant-based amino acid consumption by enhancing its market position. The UK’s proactive approach to adopting clean-label and organic products has positioned it as a leader in innovative applications of amino acids, particularly in the food and beverage sector.

France is likely to showcase a steady growth rate throughput the forecast period. France’s dominance is attributed to its thriving cosmetics and personal care industry, where amino acids like arginine and cysteine are widely used for anti-aging and hydrating formulations. The country’s emphasis on organic farming also supports the use of amino acids in biostimulants that is driving agricultural applications. France’s commitment to sustainability and innovation in both agriculture and beauty sectors has created a strong demand for versatile amino acid solutions. These factors collectively solidify France’s role as a key player in the European amino acid market.

KEY MARKET PLAYERS

Major players of the Europe Amino Acid Market include Ajinomoto Co., Inc., Evonik Industries AG, Archer Daniels Midland Company (ADM), CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., Fufeng Group Company Limited, Meihua Holdings Group Co., Ltd., Sichuan Tongsheng Amino Acid Co., Ltd., Shijiazhuang Donghua Jinlong Chemical Co., Ltd., Adisseo France S.A.S, Glanbia Nutritionals, Sumitomo Chemical Co., Ltd., Merck KGaA, Prinova Group LLC, Daesang Corporation, Global Bio-chem Technology Group Company Limited, Sunrise Nutrachem Group Co., LTD.

DETAILED SEGMENTATION OF EUROPE AMINO ACID MARKET INCLUDED IN THIS REPORT

This research report on the Europe amino acid market has been segmented and sub-segmented based on type, source, grade, end use & region.

By Type

- Essential

- Histidine

- Isoleucine

- Leucine

- Lysine

- Methionine

- Phenylalanine

- Threonine

- Tryptophan

- Valine

- Non-essential

- Alanine

- Arginine

- Asparagine

- Aspartic Acid

- Cysteine

- Glutamic Acid

- Glutamine

- Glycine

- Proline

- Serine

- Tyrosine

- Ornithine

- Citrulline

- Creatine

- Selenocysteine

- Taurine

- Others

By Source

- Plant-based

- Animal-based

- Chemical Synthesis

- Fermentation

By Grade

- Food Grade

- Feed Grade

- Pharma Grade

- Other Grades

By End Use

- Food & Beverage

- Animal Feed

- Pet Food

- Pharmaceuticals

- Vaccine Formulation

- Personal Care & Cosmetics

- Dietary Supplements

- Agriculture

- Other End-uses

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. Which industries primarily use amino acids in Europe?

The key industries utilizing amino acids include food & beverages, pharmaceuticals, animal feed, cosmetics, and dietary supplements.

2. Who are the major players in the Europe amino acid market?

Leading companies in the market include Ajinomoto Co., Inc., Evonik Industries AG, Archer Daniels Midland Company (ADM), CJ CheilJedang Corporation, Kyowa Hakko Bio Co., Ltd., and Fufeng Group Company Limited.

3. What are the key factors driving the growth of the Europe amino acid market?

Increasing demand for dietary supplements, rising awareness about protein-rich diets, expansion of the pharmaceutical sector, and growing applications in animal feed and cosmetics are key growth drivers.

4. How is the Europe amino acid market segmented?

The market is segmented by type (essential and non-essential amino acids), source (plant-based, animal-based, synthetic), grade (food, feed, pharmaceutical), end use (food & beverage, pharmaceuticals, animal nutrition, cosmetics), and country (UK, France, Germany, Italy, etc.)

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]