Europe Ambulatory Surgical Centers Market Research Report – Segmented By Specialty (Single Specialty Multi-specialty), Component, Application & Country (United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands and Rest of Europe) – Industry Forecast From 2025 to 2033

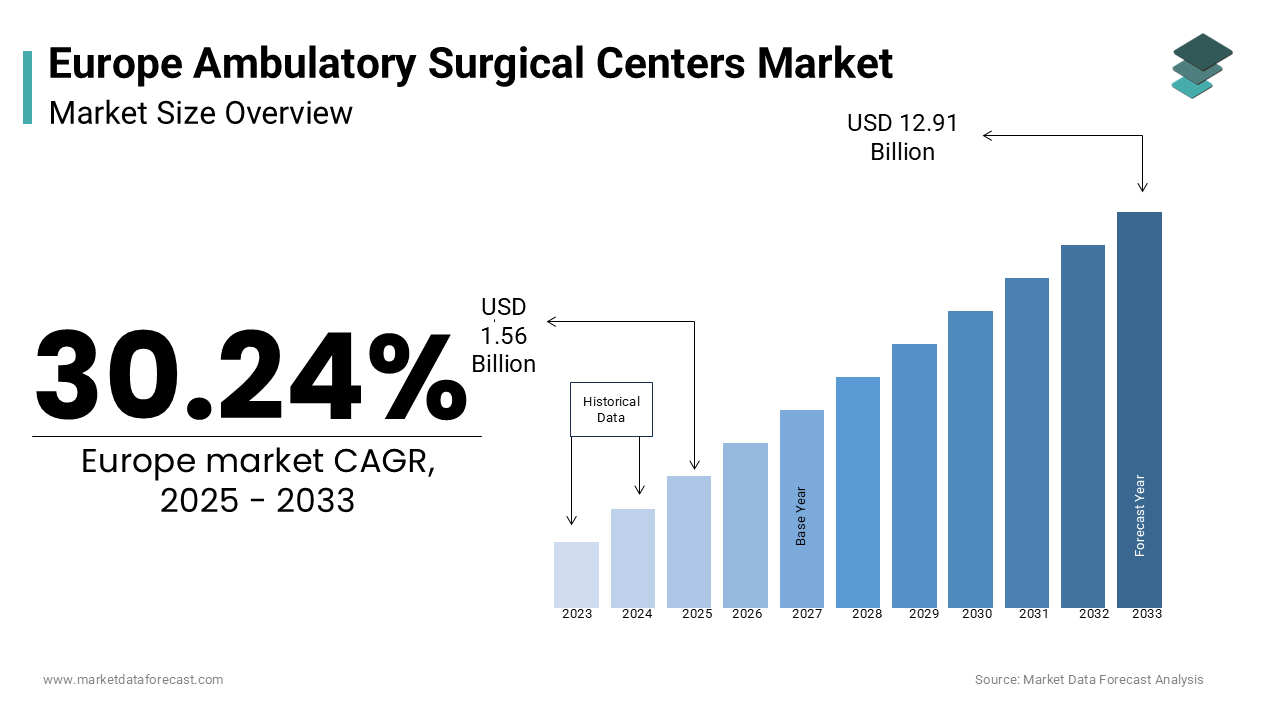

Europe Ambulatory Surgical Centers Market Size

The europe ambulatory surgical centers market size was valued at USD 1.20 billion in 2024. The market size for the ambulatory surgical centers in the European region is expected to be growing at a CAGR of 30.24% from 2025 to 2033 and worth USD 12.91 billion by 2033 from USD 1.56 billion in 2025.

The Europe ambulatory surgical centers (ASCs) market is witnessing steady growth and is driven by a shift toward cost-effective, minimally invasive procedures and an increasing preference for outpatient care. According to the European Union Health Committee, ASCs accounted for approximately 25% of all surgical procedures in 2022, reflecting their growing importance in the healthcare ecosystem. This trend is further supported by advancements in surgical technologies which enable complex procedures to be performed safely in outpatient settings.

Countries like Germany, France, and the UK are leading adopters of ASCs due to their robust healthcare infrastructure and high patient awareness. For instance, as per Eurostat, over 60% of elective surgeries in Germany are now conducted in ASCs, reducing hospital congestion and lowering costs. Additionally, government initiatives promoting value-based healthcare have accelerated ASC adoption. The NHS England reported a 15% increase in ASC utilization between 2020 and 2022 citing improved patient outcomes and reduced recovery times. However, disparities in regulatory frameworks and reimbursement policies across Europe pose challenges to equitable access.

MARKET DRIVERS

Rising Demand for Cost-Effective Healthcare Solutions

A key driver of the Europe ASC market is the growing demand for cost-effective healthcare solutions. As per the European Observatory on Health Systems and Policies, ASCs reduce surgical costs by up to 40% compared to traditional hospital settings making them an attractive option for both patients and payers. This cost efficiency is particularly critical amid rising healthcare expenditures, which reached €2 trillion across Europe in 2022, as stated by the European Commission. ASCs also alleviate the burden on hospitals by handling less complex procedures freeing up resources for more critical cases. For example, France’s Ministry of Health reported a 25% reduction in hospital waiting times after expanding ASC networks. Additionally, the emphasis on value-based care has led governments to incentivize ASC adoption, further propelling market growth.

Advancements in Minimally Invasive Surgical Technologies

Technological advancements in minimally invasive surgical tools are another major driver. In line with the European Society of Minimally Invasive Surgery, over 70% of ASC procedures now utilize advanced laparoscopic or robotic systems enabling faster recovery and higher patient satisfaction. These innovations have expanded the scope of ASCs to include orthopedic, ophthalmologic, and gastrointestinal surgeries which were traditionally performed in hospitals. For instance, the German Medical Technology Association states that robotic-assisted surgeries in ASCs have increased by 30% since 2020. Moreover, partnerships between ASC operators and technology providers have facilitated the integration of cutting-edge tools enhancing procedural precision and operational efficiency.

MARKET RESTRAINTS

Regulatory and Reimbursement Challenges

A significant restraint facing the Europe ASC market is the lack of standardized regulations and reimbursement policies. The findings by the European Federation of Pharmaceutical Industries and Associations reveal that only 40% of EU countries provide comprehensive coverage for ASC procedures, limiting patient access. E.g., in Eastern Europe, many patients face out-of-pocket expenses, deterring them from opting for ASC services. Moreover, stringent regulatory requirements delay the establishment of new ASCs. As per the European Medicines Agency, the approval process for ASC operations can take up to two years hindering market expansion. These challenges create disparities in ASC adoption rates across regions, slowing overall growth.

Limited Awareness Among Patients

Limited awareness among patients about the benefits of ASCs represents another restraint. According to a survey by the European Patients’ Forum, nearly 50% of respondents were unaware that ASCs offer safer and more convenient alternatives to traditional hospital surgeries. This knowledge gap is particularly pronounced in rural areas, where access to information is limited. Also, misconceptions about the quality of care in ASCs persist, with some patients perceiving them as inferior to hospitals. A study by the European Healthcare Distribution Association revealed that only 35% of rural populations trust ASCs for complex procedures, underscoring the need for targeted educational campaigns.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets in Eastern and Southern Europe present significant opportunities for ASC growth. Based on the data published by the European Investment Bank, healthcare investments in these regions are projected to grow by 12% annually through 2030. Countries like Poland and Turkey are witnessing rapid urbanization and improved healthcare infrastructure, creating a conducive environment for ASC adoption. Like, Turkey’s Ministry of Health reported a 20% increase in ASC facilities since 2021 driven by government-led initiatives to decentralize healthcare services. By tailoring services to meet regional needs, ASC operators can tap into this burgeoning demand and establish a strong foothold in underserved markets.

Integration of Digital Health Technologies

The integration of digital health technologies offers another major opportunity. As per the Eurostat, over 80% of European healthcare providers are investing in telemedicine and electronic health records enhancing ASC operational efficiency. For example, AI-driven platforms enable real-time monitoring of patient outcomes improving care quality. Collaborations between ASC operators and tech firms are accelerating this trend. As per the European Alliance for Personalised Medicine, ASCs leveraging digital tools have achieved a 15% reduction in postoperative complications positioning them as leaders in innovation.

MARKET CHALLENGES

Resistance from Traditional Healthcare Providers

Resistance from traditional healthcare providers poses a significant challenge. The European Hospital and Healthcare Federation notes that over 60% of hospitals view ASCs as competitors rather than collaborators hindering partnerships that could enhance patient care. This resistance is fueled by concerns over revenue loss, as ASCs increasingly handle procedures previously performed in hospitals. Additionally, the lack of standardized training programs for ASC staff exacerbates the issue. A survey by the European Medical Students’ Association revealed that less than 40% of ASC personnel receive specialized training raising concerns about procedural safety and consistency.

Economic Disparities Across Regions

Economic disparities across Europe further complicate ASC adoption. According to the World Health Organization, healthcare spending per capita in Western Europe is nearly three times higher than in Eastern Europe creating inequitable access to ASC services. For instance, Romania’s Ministry of Health reported that only 10% of its population has access to ASCs, compared to over 70% in Germany. These disparities are compounded by varying levels of healthcare infrastructure development, with underdeveloped regions struggling to attract investments in ASC facilities.

SEGMENTAL ANALYSIS

By Specialty Insights

The single specialty ASCs dominated the market by holding a share of 60.7% in 2024. This influence is due to their ability to focus on specific procedures ensuring higher efficiency and expertise. For instance, single specialty ASCs specializing in ophthalmology perform over 1 million cataract surgeries annually in Europe achieving success rates exceeding 98%. Primary influences on this market include the rising prevalence of chronic conditions and advancements in procedure-specific technologies. According to the European Ophthalmology Society, laser-assisted surgeries have reduced recovery times by 50% making single specialty ASCs the preferred choice for patients seeking specialized care.

The Multi-specialty ASCs represented the fastest-growing segment, with a CAGR of 9.5%. This growth is fueled by their versatility in handling diverse procedures, from orthopedics to gastroenterology. As per the European Society of Gastrointestinal Endoscopy, multi-specialty ASCs have increased procedural volumes by 25% since 2020 driven by rising demand for comprehensive outpatient care. Advancements in modular surgical suites and cross-specialty collaborations further amplify adoption, positioning multi-specialty ASCs as a key growth driver.

By Component Insights

The services segment spearheaded the market by commanding a substantial share in 2024. This supremacy is attributed to the critical role services play in ensuring seamless ASC operations, from preoperative consultations to postoperative care. For instance, anesthesia services account for over 40% of ASC operational costs, underscoring their importance. Also, the segment's growth is bolstered by rising demand for personalized patient care. As per the NHS England, ASCs offering tailored services have achieved a 20% increase in patient satisfaction rates driving market expansion.

The software emphasizing the rapid increase and significance of the sector, with a CAGR of 11.2%. This upward trend is fueled by the increasing adoption of digital health tools such as AI-driven analytics and electronic health records. The Eurostat notes that over 80% of ASCs now leverage software solutions to streamline workflows and improve diagnostic accuracy. Government incentives for digital transformation further accelerate adoption, positioning software as a transformative force in ASC operations.

By Application Insights

The ophthalmology segment held the largest market share of 35.7% in 2024. This dominance of the segment is propelled by the high prevalence of eye-related conditions, such as cataracts and glaucoma, which are increasingly treated in ASCs due to their minimally invasive nature. For instance, over 1 million cataract surgeries are performed annually in Europe, with ASCs achieving success rates exceeding 98%, according to NHS England. The segment's growth is further bolstered by advancements in laser-assisted surgical technologies. According to the European Ophthalmology Society, these innovations have reduced recovery times by 50% making ASCs the preferred choice for patients seeking efficient and cost-effective solutions. Also, government initiatives promoting preventive eye care have increased procedure volumes ensuring sustained leadership in the market.

Pain management and spinal injections is a rapidly expanding category, with a CAGR of 10.8%. This progress is linked to the rising prevalence of chronic pain conditions, particularly among aging populations. According to Eurostat, over 20% of Europeans aged 65 and above suffer from chronic back pain creating robust demand for minimally invasive spinal procedures. Advancements in imaging technologies, such as MRI-guided injections, have enhanced procedural precision, driving adoption. Moreover, collaborations between ASC operators and pain management specialists have expanded service offerings positioning this segment as a key growth driver.

REGIONAL ANALYSIS

Germany was at the forefront of the Europe ASC market by commanding a market share of 28.3% in 2024. This is attributed to the country’s robust healthcare infrastructure, high patient awareness, and strong emphasis on outpatient care. Germany spends over €400 billion annually on healthcare, with significant portions allocated to ASC development, as per Eurostat. The prevalence of chronic diseases further amplifies demand. As per the Robert Koch Institute, over 60% of elective surgeries in Germany are now conducted in ASCs, reducing hospital congestion and lowering costs. Besides, government-led initiatives promoting value-based healthcare have accelerated ASC adoption ensuring continued leadership in the market.

Turkey is the fastest-growing market, with a CAGR of 12.5%, as highlighted by the Turkish Ministry of Health. This growth is fueled by rapid urbanization, increasing healthcare investments, and rising awareness of ASC benefits. Turkey’s healthcare spending has grown by 15% annually since 2020 creating a favorable environment for ASC adoption. The expansion of private healthcare facilities and partnerships with international operators further accelerates growth. According to the Turkish Statistical Institute, over 200 new ASCs have been established in the past five years, enhancing access to cost-effective surgical care.

Countries like France, Italy, and Spain are expected to witness steady growth due to their aging populations and rising chronic disease burden. The French National Cancer Institute notes that cancer cases in France are projected to increase by 20% by 2030, boosting ASC demand. Similarly, Spain’s Ministry of Health reports a 10% annual rise in ASC utilization driven by advancements in minimally invasive technologies.

In contrast, Eastern European nations like the Czech Republic and Russia face challenges such as limited healthcare funding but show potential due to ongoing reforms. The Czech Ministry of Health predicts a 12% increase in ASC investments by 2025. Meanwhile, Nordic countries like Sweden and Denmark benefit from universal healthcare systems, ensuring equitable access to ASC services.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a promising role in the European ambulatory surgical centers market profiled in this report are Community Health Systems, Inc., Edward-Elmhurst Health, Envision Healthcare Corporation, Group Eifelhohen-Klinik AG, Healthway Medical Group, MEDNAX Services, Inc., NOVENA GLOBAL HEALTHCARE GROUP, INC., Prospect Medical Group, Quorum Health Corporation, and SurgCenter Development.

The Europe ASC market is highly competitive, characterized by the presence of global leaders and regional players vying for market share. Major companies like AmSurg, Symbion Health, and HCA Healthcare dominate the landscape through continuous innovation and strategic collaborations. The market is fragmented yet concentrated at the top, with these three players collectively accounting for substantial portion of the market, as per the European Medical Devices Association.

Intense competition drives technological advancements, with firms focusing on developing cost-effective and scalable solutions. Regional players differentiate themselves by catering to niche segments, such as pediatric or geriatric care. Regulatory compliance and adherence to quality standards further intensify competition, ensuring that only the most reliable services gain traction. As demand grows, players increasingly invest in expanding their geographic footprint and forming alliances with healthcare providers, fostering a dynamic and evolving competitive environment.

Top Players in the Europe Ambulatory Surgical Centers Market

AmSurg Corp.

AmSurg Corp., a subsidiary of Envision Healthcare, is a leading player in the Europe ASC market, contributing significantly to global innovations in outpatient care. The company operates over 250 ASCs across Europe, focusing on specialties like ophthalmology and gastroenterology. Its emphasis on cost-effective, high-quality care aligns with Europe’s growing demand for minimally invasive procedures, enabling it to maintain a competitive edge.

Symbion Health

Symbion Health specializes in multi-specialty ASCs, offering comprehensive surgical services across Europe. The company commands portion of the market, according to the European Medical Technology Industry Association. Symbion’s strategic focus on integrating digital health tools has enhanced operational efficiency, driving patient satisfaction rates to exceed 90%. Its presence in Europe is strengthened by partnerships with local healthcare providers ensuring widespread adoption of its services.

HCA Healthcare UK

HCA Healthcare UK plays a pivotal role in advancing ASC operations, particularly in single-specialty applications like orthopedics and pain management. HCA has transformed outpatient care through its state-of-the-art facilities. Its commitment to innovation and collaboration positions it as a major player in the market, particularly in high-growth regions like the UK and Germany.

Top Strategies Used by Key Players in the Europe Ambulatory Surgical Centers Market

Key players in the Europe ASC market employ strategies such as geographic expansion, technological integration, and strategic collaborations to strengthen their positions. Geographic expansion is central, with companies targeting emerging markets like Turkey and Eastern Europe to tap into untapped potential. For instance, AmSurg has established over 50 new ASCs in these regions since 2021, enhancing accessibility. Technological integration is another focus, with firms investing in AI-driven platforms and electronic health records to streamline workflows.

Strategic collaborations with hospitals and research institutions also play a crucial role. HCA Healthcare UK partners with academic centers to advance minimally invasive techniques, increasing adoption rates. These strategies collectively drive market growth and ensure sustained competitiveness.

RECENT MARKET DEVELOPMENTS

- In April 2023, AmSurg Corp. launched a network of AI-driven ASCs in Germany, integrating predictive analytics to enhance patient outcomes and operational efficiency.

- In June 2023, Symbion Health partnered with the European Hospital and Healthcare Federation to expand its multi-specialty ASC footprint across Spain and Italy.

- In September 2023, HCA Healthcare UK acquired a leading orthopedic ASC chain in the UK, strengthening its position in single-specialty applications.

- In November 2023, Fresenius Medical Care introduced a cloud-based software platform in Switzerland, streamlining ASC workflows and improving diagnostic accuracy.

- In February 2024, Medtronic collaborated with academic research institutes in France to develop next-generation robotic-assisted surgical tools, positioning itself as a leader in innovation.

MARKET SEGMENTATION

This research report on the European ambulatory surgical centers market has been segmented and sub-segmented into the following categories.

By Speciality

-

Single Specialty

-

Multi-specialty

By Component

-

Service

-

Software

-

Hardware

By Application

-

Ophthalmology

-

Orthopedics

-

Gastroenterology

-

Pain Management/Spinal Injections

-

Plastic Surgery

By Country

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]