Europe Allogeneic Human Chondrocyte Market Size, Share, Trends & Growth Forecast Report By Application (Osteoarthritis, Musculoskeletal System Disorders, and Others), End-User, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Allogeneic Human Chondrocyte Market Size

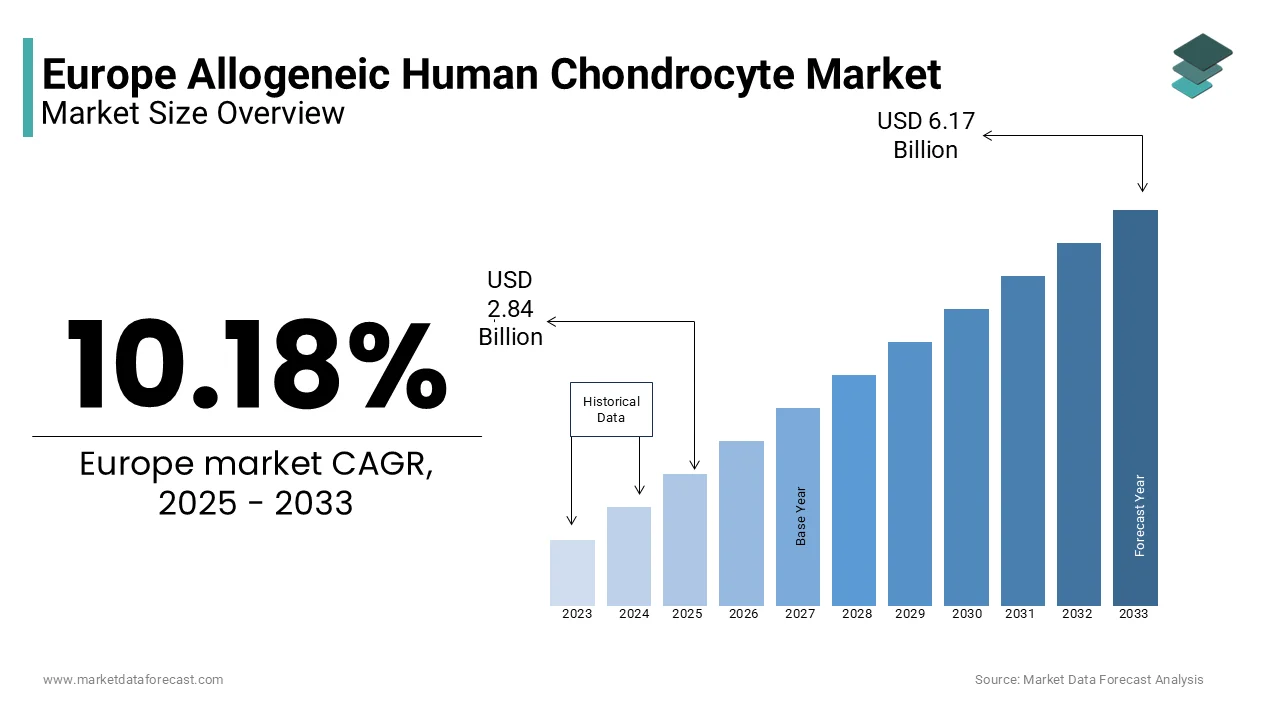

The Europe Allogeneic Human Chondrocyte market size was valued at USD 2.58 billion in 2024. The European market is estimated to be worth USD 6.17 billion by 2033 from USD 2.84 billion in 2025, growing at a CAGR of 10.18% from 2025 to 2033.

The European allogeneic human chondrocyte market is experiencing steady growth by rising cases of musculoskeletal disorders and advancements in regenerative medicine. According to the European Musculoskeletal Review, musculoskeletal conditions affect over 120 million individuals across Europe, with osteoarthritis being the most prevalent that is accounting for nearly 40% of all cases. Germany leads the region with a significant market share of approximately 30% owing to its robust healthcare infrastructure and high adoption rates of advanced therapies. The increasing preference for minimally invasive treatments has bolstered demand for allogeneic chondrocytes, which offer superior cartilage regeneration capabilities. For instance, as per the UK National Health Service (NHS) , hospital procedures utilizing allogeneic chondrocytes for cartilage repair increased by 15% between 2020 and 2023. Despite challenges such as stringent regulatory frameworks, the market remains optimistic due to ongoing clinical trials exploring expanded applications.

MARKET DRIVERS

Increasing Prevalence of Osteoarthritis

The escalating incidence of osteoarthritis is a primary driver propelling the Europe allogeneic human chondrocyte market forward. As per the European League Against Rheumatism (EULAR) , osteoarthritis affects over 60 million adults in Europe, with an estimated 10% of cases requiring surgical intervention. This condition is particularly prevalent among the elderly population is creating a robust demand for regenerative therapies like allogeneic chondrocytes. These cells are preferred due to their ability to promote cartilage regeneration without the need for autologous tissue harvesting, reducing patient discomfort and recovery times. For example, France recorded a 20% annual increase in allogeneic chondrocyte-based procedures for knee osteoarthritis in urban hospitals, as reported by the French Ministry of Health. Additionally, government initiatives promoting early diagnosis and treatment have further fueled market expansion by ensuring consistent demand for these innovative therapies.

Advancements in Tissue Engineering Technologies

Technological breakthroughs in tissue engineering are revolutionizing the Europe allogeneic human chondrocyte market. Innovations such as 3D bioprinting and cryopreservation techniques have enhanced the viability and scalability of allogeneic chondrocytes, making them more accessible for clinical use. According to the European Society for Biomaterials, funding for R&D in regenerative medicine grew by 25% in 2022 by reflecting the company’s commitment to cutting-edge solutions. These advancements not only improve treatment outcomes but also reduce manufacturing costs, enabling broader adoption. For instance, Italy witnessed a 30% rise in the use of cryopreserved allogeneic chondrocytes in orthopedic surgeries over the past two years, as stated by the Italian Orthopedic Association. Such technologies address unmet needs while improving safety and efficacy, thereby driving market growth significantly.

MARKET RESTRAINTS

High Costs of Allogeneic Therapies

One of the key barriers hindering the growth of the Europe allogeneic human chondrocyte market is the exorbitant cost associated with these therapies. For example, a single cartilage repair procedure using allogeneic chondrocytes can cost upwards of €10,000 is limiting accessibility for many patients and smaller healthcare facilities. According to a study published by the European Health Economics Association, approximately 45% of European households cannot afford out-of-pocket expenses for advanced regenerative therapies without financial assistance. This economic disparity creates inequitable access to life-changing treatments. Moreover, hospitals face budget constraints when procuring state-of-the-art therapies, especially in rural areas. Data from the Spanish National Institute of Health reveals that only 50% of regional hospitals have access to allogeneic chondrocyte-based treatments with systemic gaps. While subsidies exist, they often fall short of covering the full expense by leaving both providers and patients grappling with affordability issues.

Stringent Regulatory Frameworks

Another significant restraint is the complex regulatory landscape governing allogeneic human chondrocytes in Europe. As per the European Medicines Agency (EMA), obtaining approval for new therapies involves rigorous testing phases spanning several years is delaying product launches. For instance, the average time required for CE marking is a mandatory certification that ranges from 18 to 36 months by depending on the complexity of the therapy. This prolonged process stifles innovation and discourages smaller firms from entering the market. Additionally, post-market surveillance mandates add further layers of compliance, increasing operational costs. According to a survey conducted by the German Biotechnology Industry Organization, nearly 60% of startups cited regulatory hurdles as the primary reason for abandoning projects.

MARKET OPPORTUNITIES

Expansion into Emerging Applications

The potential for allogeneic human chondrocytes to address emerging applications beyond osteoarthritis presents a lucrative opportunity for market growth. According to the European Tissue Repair Society, ongoing research is exploring the use of these cells in treating rare musculoskeletal disorders, such as juvenile idiopathic arthritis and chondrodysplasia. For instance, under the EU’s Horizon Europe program , €50 million was allocated in 2023 specifically for rare disease initiatives, including regenerative therapies. Innovative applications, such as intravenous delivery of chondrocytes for systemic cartilage repair, are gaining traction due to their ability to manage symptoms effectively. Data from the French Muscular Dystrophy Association indicates a 25% annual growth in the adoption of niche therapies since 2020.

Growing Adoption in Ambulatory Surgical Centers

The increasing adoption of allogeneic human chondrocytes in ambulatory surgical centers (ASCs) offers immense potential for market expansion. Europe is witnessing a surge in demand for minimally invasive regenerative therapies with ASCs becoming increasingly common. Cryopreserved allogeneic chondrocytes are particularly favored due to their convenience and compatibility with outpatient settings. According to the UK’s National Health Services (NHS), digital reported a 40% increase in ASC-based cartilage repair procedures in urban areas. Manufacturers can expand their reach to underserved regions, where access to specialized care remains limited. This trend not only boosts revenue streams but also improves overall healthcare delivery.

MARKET CHALLENGES

Limited Awareness Among Stakeholders

A significant challenge facing the Europe allogeneic human chondrocyte market is the lack of awareness among stakeholders, including patients, caregivers, and even healthcare professionals. Many musculoskeletal conditions remain undiagnosed or mismanaged due to insufficient knowledge about available treatment options. According to a survey by the European Patient Forum, nearly 70% of patients reported feeling inadequately informed about advanced therapies like allogeneic chondrocytes. This knowledge gap often leads to delayed interventions is worsening patient outcomes. Additionally, misconceptions about the risks associated with certain procedures deter families from pursuing necessary treatments. According to the data from the Dutch Orthopedic Association, only 40% of eligible patients receive timely access to cartilage repair therapies. Bridging this educational divide requires concerted efforts from manufacturers, policymakers, and advocacy groups.

Supply Chain Disruptions

Supply chain disruptions pose another major obstacle for the Europe allogeneic human chondrocyte market. The COVID-19 pandemic exposed vulnerabilities in global supply chains are leading to shortages of critical components required for manufacturing and cryopreservation. According to the European Commission’s Directorate-General for Industry, semiconductor shortages impacted the production of electronic monitoring systems for cryopreserved cells by up to 30% in 2022. Geopolitical tensions and trade restrictions further exacerbate these challenges, driving up costs and extending lead times. For instance, Italy experienced a 15% decline in the availability of allogeneic chondrocytes during the first half of 2023, as confirmed by the Italian Ministry of Health.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.18% |

|

Segments Covered |

By Application, End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Kolon TissueGene, Inc., ISTO Technologies Inc., Zimmer Biomet, Genzyme, CellGenix GmbH, EMD Serono, Sanofi, Merck KGaA, Vericel Corporation, CO.DON Gmb, and others. |

SEGMENT ANALYSIS

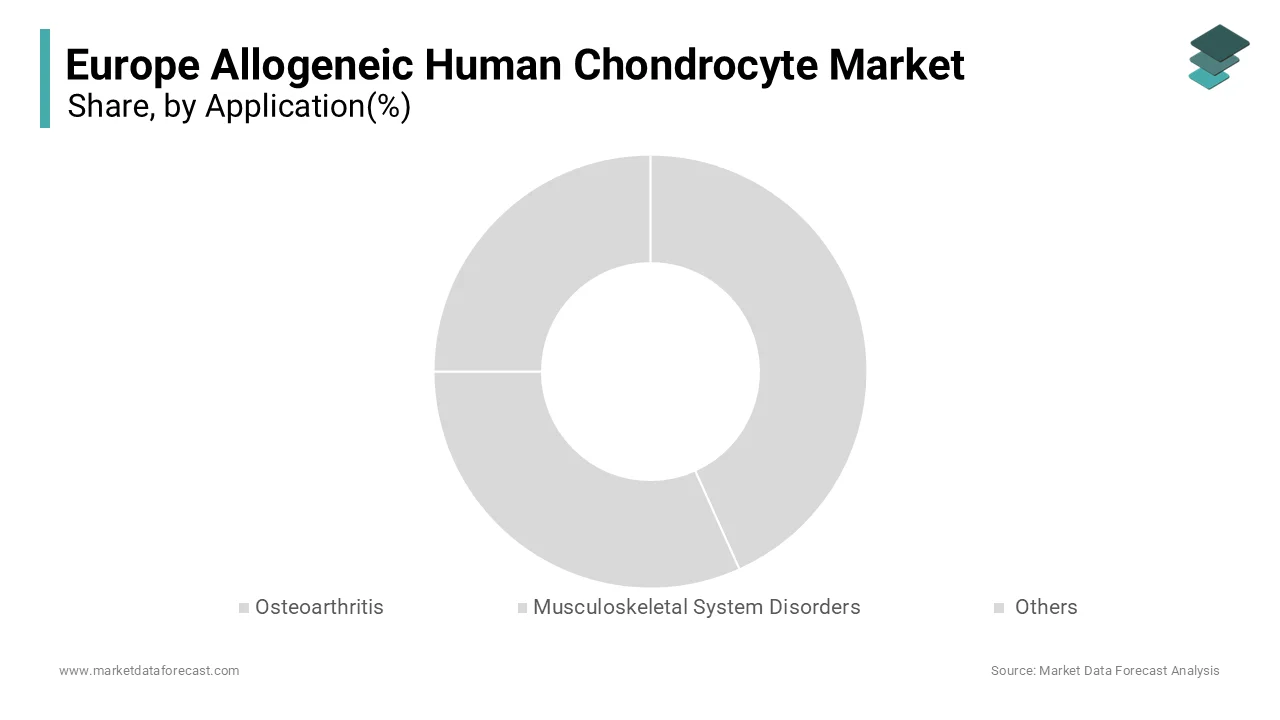

By Application Insights

The osteoarthritis segment dominated the Europe allogeneic human chondrocyte market by holding share 45.6% in 2024 owing to its widespread prevalence and the growing adoption of minimally invasive treatments. According to the European Osteoarthritis Coalition, osteoarthritis accounts for nearly 40% of all musculoskeletal conditions in Europe, with an estimated 10% of cases requiring surgical intervention. Key factors contributing to this dominance include improved patient outcomes, reduced recovery times, and enhanced safety profiles. For example, Germany saw a 25% rise in allogeneic chondrocyte-based procedures for knee osteoarthritis, as per the German Federal Statistical Office. These innovations attract significant investments is enabling manufacturers to maintain a competitive edge globally. Additionally, collaborations between academia and industry foster continuous improvements by ensuring sustained demand.

The musculoskeletal system disorders segment is projected to witness a CAGR of 14.5% throughout the forecast period. This rapid expansion is fueled by increasing applications in managing rare conditions like juvenile idiopathic arthritis and chondrodysplasia. According to the European Rare Disease Organization, the number of children receiving allogeneic chondrocyte therapies doubled in Spain between 2020 and 2023. Improved cryopreservation techniques and intravenous delivery methods have made these therapies more user-friendly, appealing to both clinicians and patients. For instance, France implemented a national initiative to equip pediatric hospitals with advanced regenerative tools, resulting in a 50% increase in procedure volumes. Furthermore, favorable reimbursement policies in countries like Italy and Spain incentivize usage is accelerating market growth.

By End-User Insights

The hospitals segment was the largest by capturing 50.1% of the Europe allogeneic human chondrocyte market share in 2024 owing to their role as primary centers for diagnosing and treating musculoskeletal disorders, particularly osteoarthritis. According to the European Hospital Federation, hospital-based procedures utilizing allogeneic chondrocytes surged by 22% between 2021 and 2023, driven by advancements in minimally invasive techniques. Portable and cryopreserved chondrocytes have gained popularity due to their convenience and accuracy. For example, Italy witnessed a 30% increase in hospital-based cartilage repair procedures, as reported by the Italian Orthopedic Association. These trends reflect growing confidence in allogeneic therapies, bolstered by supportive government policies. Additionally, training programs for surgeons ensure standardized practices is enhancing reliability and trustworthiness.

The ambulatory surgical centers (ASCs) segment is exhibiting a CAGR of 15.2% during the forecast period. Their rapid ascent is attributed to their ability to provide cost-effective and efficient care for minimally invasive procedures. According to the European Ambulatory Surgery Association, ASC-based cartilage repair procedures rose by 35% in 2023 alone. Improved cryopreservation techniques and compatibility with outpatient settings have made allogeneic chondrocytes more accessible. For instance, the UK launched a nationwide program to equip ASCs with advanced regenerative tools, resulting in a 40% spike in adoption rates.

REGIONAL ANALYSIS

The Germany was the largest contributor in the Europe allogeneic human chondrocyte market with an estimated share of 35.6% in 2024 with the presence of advanced healthcare infrastructure and high investment in regenerative medicine. According to the Robert Koch Institute, Germany allocates approximately 12% of its total healthcare budget to orthopedic specialties by ensuring widespread access to cutting-edge therapies. The country’s growth is further reinforced by its robust R&D ecosystem, with collaborations between universities, hospitals, and private firms fostering innovation. For instance, Germany has established specialized orthopedic centers equipped with state-of-the-art cryopreservation systems for allogeneic chondrocytes.

Spain is lucratively growing with an anticipated CAGR of 14.5% during the forecast period. This growth is fueled by proactive government initiatives aimed at enhancing regenerative medicine. As per the Spanish Ministry of Health, public spending on allogeneic chondrocytes increased by 20% in 2023 by enabling broader adoption of innovative solutions like intravenous delivery systems. Furthermore, Spain’s focus on digitizing healthcare through telemedicine platforms has expanded access to remote monitoring tools in rural areas. Investments in training programs for healthcare professionals have also contributed to the rapid adoption of advanced therapies by positioning Spain as a key growth hub.

France, Italy, and the UK are expected to witness steady growth due to their strong emphasis on technological advancements and favorable regulatory frameworks. According to the French National Health Authority, allogeneic chondrocyte-based procedures will see a 10% annual increase in adoption by 2025 with the rising awareness and improved accessibility. According to the Italian Orthopedic Association, hospital admissions for musculoskeletal disorders have grown by 15% since 2020 with the increasing demand for specialized therapies. Meanwhile, the UK’s National Health Service (NHS) has prioritized regenerative medicine in its strategic plans by ensuring consistent funding and innovation in this sector.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key market players in the Europe allogeneic human chondrocyte market include Kolon TissueGene, Inc., ISTO Technologies Inc., Zimmer Biomet, Genzyme, CellGenix GmbH, EMD Serono, Sanofi, Merck KGaA, Vericel Corporation, and CO.DON GmbH.

The Europe allogeneic human chondrocyte market is characterized by intense competition, with both global giants and regional players vying for dominance. Leading companies like Vericel Corporation, BioTissue Technologies, and TiGenix NV hold significant market shares due to their extensive product portfolios and robust R&D capabilities. However, smaller firms are increasingly challenging incumbents by focusing on niche segments, such as juvenile idiopathic arthritis and chondrodysplasia. Pricing strategies and technological differentiation are pivotal in shaping market dynamics, with firms striving to offer cost-effective yet innovative solutions. Regulatory compliance remains a critical factor, as stringent approval processes create barriers to entry for new entrants.

TOP PLAYERS IN THIS MARKET

Vericel Corporation

Vericel Corporation is a leading player in the Europe allogeneic human chondrocyte market. The company specializes in advanced regenerative therapies, with its flagship product, MACI (Matrix-Induced Autologous Chondrocyte Implantation), being widely adopted for cartilage repair in osteoarthritis and other musculoskeletal disorders. Vericel’s strong foothold in Europe is attributed to its robust R&D capabilities and strategic partnerships with academic institutions. For instance, collaborations with European universities have enabled the development of cryopreserved allogeneic chondrocytes, enhancing their scalability and accessibility. Additionally, Vericel’s focus on regulatory compliance ensures consistent market penetration by making it a dominant force in the marketplace.

BioTissue Technologies

BioTissue Technologies is another key player is contributing significantly to innovations in allogeneic human chondrocyte therapies. The company is renowned for its cutting-edge cryopreservation techniques, which improve the viability and shelf life of chondrocytes, making them suitable for widespread clinical use. The company has also expanded its portfolio through strategic acquisitions, such as acquiring smaller biotech firms specializing in rare musculoskeletal disorders. This approach has allowed BioTissue to cater to niche markets while maintaining a competitive edge in mainstream applications like osteoarthritis treatment.

TiGenix NV

TiGenix NV is a prominent innovator in the regenerative medicine space, with a particular focus on allogeneic chondrocyte therapies for pediatric and adult patients. The company’s CxC601 therapy, designed for systemic cartilage repair, has gained traction due to its efficacy in treating juvenile idiopathic arthritis and other rare conditions. As per the European Rare Disease Organization, TiGenix’s therapies have been adopted by over 50 hospitals in Spain and Italy since their launch in 2022. Its strong collaboration network with European healthcare providers and research institutions further solidifies its position as a leader in the market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Europe allogeneic human chondrocyte market employ diverse strategies to maintain their competitive edge and expand their footprint. One prominent approach is strategic partnerships and collaborations with academic institutions and research organizations to accelerate R&D efforts. For example, companies collaborate with universities to develop next-generation cryopreservation techniques and intravenous delivery systems tailored for pediatric use. Another critical strategy is geographic expansion , with firms targeting underserved regions by establishing local manufacturing units or distribution networks. Additionally, product diversification plays a vital role, as manufacturers introduce novel therapies catering to niche markets, such as rare musculoskeletal disorders. Mergers and acquisitions are also common by enabling companies to consolidate their market presence and integrate complementary technologies into their portfolios.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Vericel acquired RegenBio , a startup specializing in cryopreservation technologies is ascribed to bolster its product portfolio and expand its reach in Europe.

- In May 2024, BioTissue partnered with the University of Paris to co-develop advanced cryopreservation tools for allogeneic chondrocytes.

- In June 2024, TiGenix launched a pediatric-focused cartilage repair therapy in Germany is designed to enhance precision during minimally invasive procedures for young patients.

- In July 2024, Philips Healthcare introduced AI-enabled diagnostic tools in France by aiming to improve the accuracy of musculoskeletal assessments in children across underserved regions.

- In August 2024, Siemens Healthineers collaborated with UK hospitals to integrate telemedicine platforms with connected regenerative therapies by enabling remote consultations and treatment management for pediatric patients.

MARKET SEGMENTATION

This research report on the Europe allogeneic human chondrocyte market is segmented and sub-segmented into the following categories.

By Application

- Osteoarthritis

- Musculoskeletal System Disorders

- Others

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected growth rate of the Europe Allogeneic Human Chondrocyte Market?

The Europe Allogeneic Human Chondrocyte market is expected to grow at a CAGR of 10.18% from 2025 to 2033.

2. What are the key drivers of the Europe Allogeneic Human Chondrocyte Market?

Key drivers include the increasing prevalence of osteoarthritis and musculoskeletal disorders, advancements in regenerative medicine, and rising healthcare expenditure.

3. Who are some of the major players in the Europe Allogeneic Human Chondrocyte Market?

Key players include Kolon TissueGene, Inc., ISTO Technologies Inc., Zimmer Biomet, Genzyme, CellGenix GmbH, EMD Serono, Sanofi, Merck KGaA, and Vericel Corporation.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]