Europe Algae Protein Market Size, Share, Trends & Growth Forecast Report By Type (Spirulina, Chlorella, Other Microalgae), Application, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Algae Protein Market Size

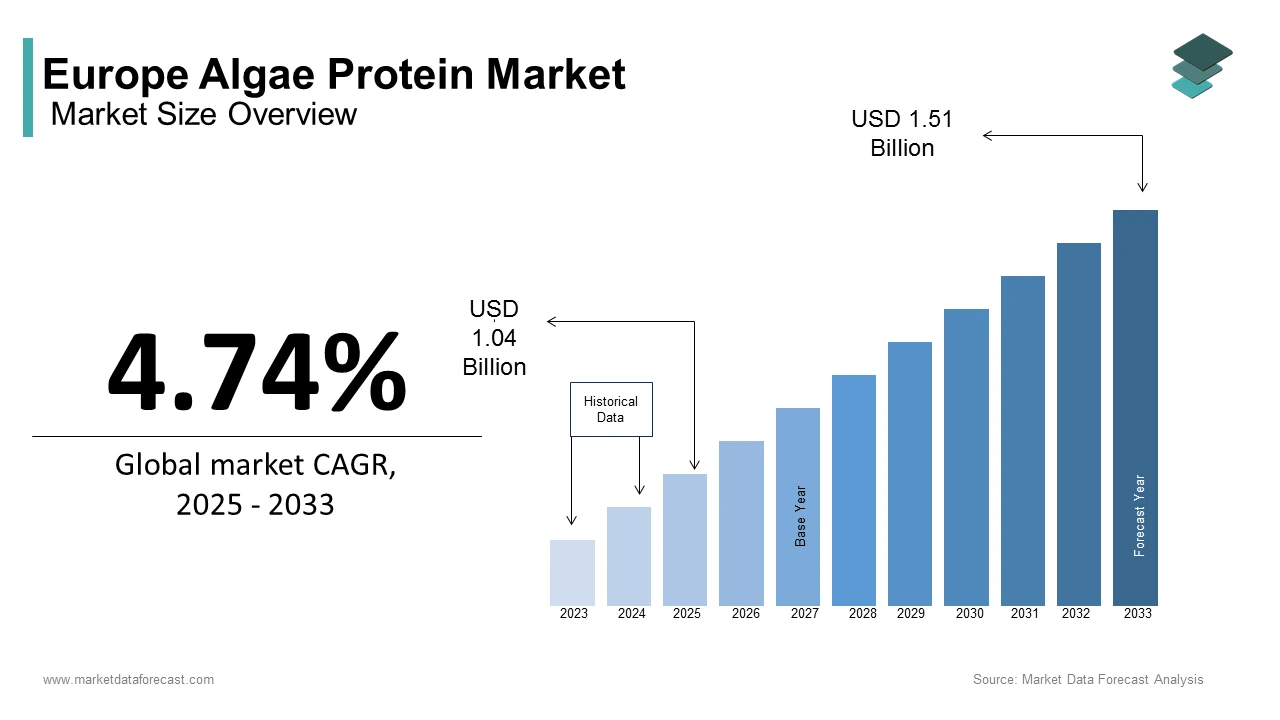

The Europe algae protein market size was calculated to be USD 0.99 million in 2024 and is anticipated to be worth USD 1.51 billion by 2033 from USD 1.04 billion in 2025, growing at a CAGR of 4.74% during the forecast period.

Algae protein is derived from microalgae such as spirulina, chlorella, and other species and this has emerged as a sustainable and nutrient-rich alternative to traditional protein sources. The European algae protein market is gaining traction due to increasing consumer awareness about plant-based diets, environmental sustainability, and health-conscious lifestyles. Algae proteins are rich in essential amino acids, vitamins, and minerals, making them ideal for applications in food & beverages, dietary supplements, and pharmaceuticals. According to the European Food Safety Authority (EFSA), algae-based products accounted for approximately 15% of the total plant-based protein market in Europe in 2022. According to the European Commission, more than 60% of consumers in the EU prefer eco-friendly and sustainable protein sources, which is further driving demand. Moreover, advancements in cultivation technologies have reduced production costs by nearly 30% over the past five years, making algae protein more accessible. With Europe aiming to reduce its carbon footprint by 55% by 2030, algae protein aligns perfectly with regional sustainability goals, positioning it as a key player in the future of nutrition.

MARKET DRIVERS

Growing Demand for Plant-Based Diets

The rising adoption of plant-based diets across Europe is a significant driver of the algae protein market. According to the European Vegetarian Union, the number of vegetarians and vegans in Europe increased by 25% between 2018 and 2022, reaching approximately 75 million individuals. Algae protein serves as an excellent substitute for animal-derived proteins that offer high nutritional value without compromising ethical or environmental standards. Highlighting this trend, Germany alone witnessed a 40% surge in sales of algae-based dietary supplements in 2022. The European Consumer Organization also reports that over 70% of consumers prioritize sustainable and health-focused food options, further propelling demand for algae protein.

Government Support for Sustainable Agriculture

Government initiatives promoting sustainable agriculture and reducing reliance on conventional livestock farming are bolstering the algae protein market in Europe. According to the European Environment Agency, subsidies for sustainable protein production increased by 15% in 2022, with algae-based projects receiving significant funding. For instance, France launched a EUR 50 million initiative to support algae farming, aiming to reduce agricultural emissions by 20% by 2025. These efforts not only enhance production capabilities but also encourage innovation in algae cultivation techniques, ensuring long-term market growth.

MARKET RESTRAINTS

High Production Costs

Despite technological advancements, high production costs remain a major restraint for the algae protein market. According to the European Investment Bank, the average cost of producing one kilogram of algae protein ranges from EUR 15 to EUR 30, significantly higher than traditional protein sources like soy or whey. According to a study by the European Biotechnology Association, nearly 40% of manufacturers cite cost barriers as a challenge to scaling operations. This limits accessibility for price-sensitive consumers and hinders widespread adoption.

Limited Consumer Awareness

Another restraint is the limited awareness among consumers regarding the benefits of algae protein. According to Eurostat, only 35% of European consumers are familiar with algae-based products, with misconceptions about taste and texture deterring potential buyers. Educational campaigns are needed to bridge this gap and drive acceptance.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets within Europe, particularly Eastern Europe, present significant opportunities for algae protein growth. According to the European Bank for Reconstruction and Development, investments in Agri-tech sector of Eastern Europe grew by 25% in 2022, creating a conducive environment for algae farming. Countries like Poland and Romania are increasingly adopting sustainable practices, providing fertile ground for algae protein expansion.

Innovations in Product Development

Innovations in product formulations offer immense potential for market growth. According to the European Innovation Council, over 60% of new product launches in the health and wellness sector incorporate algae protein. For example, algae-infused energy bars and beverages have gained popularity, with sales increasing by 30% annually.

MARKET CHALLENGES

Regulatory Hurdles

Navigating complex regulatory frameworks poses a significant challenge for algae protein producers. According to the European Food Safety Authority, obtaining approval for novel food ingredients can take up to three years, delaying market entry.

Supply Chain Disruptions

Supply chain disruptions, exacerbated by geopolitical tensions, have impacted raw material availability. According to the European Supply Chain Institute, 20% of algae producers faced delays in sourcing nutrients required for cultivation in 2022.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.74% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Corbion N.V., Roquette Frères, Duplaco, Phycom BV, Algama |

SEGMENTAL ANALYSIS

By Type Insights

The spirulina segment dominated the algae protein market in Europe by accounting for 45.8% of the European market share in 2024. The high protein content of spirulina is one of the key factors contributing to the domination of spirulina segment in the European market. According to the European Algae Biomass Association, the protein content of spirulina can reach up to 70%, which is making it a preferred choice for dietary supplements and functional foods. Additionally, spirulina has an established production infrastructure, with large-scale cultivation facilities across Europe ensuring consistent supply. Its versatility and proven health benefits, such as boosting immunity and improving metabolism, further fuelling the growth of the spirulina segment in the European market.

The chlorella segment is estimated to register the fastest CAGR of 12.5% over the forecast period owing to the increasing consumer demand for immune-boosting supplements. Chlorella is rich in antioxidants, vitamins, and minerals that are making it particularly appealing to health-conscious consumers. Moreover, advancements in cultivation technologies have reduced production costs that is enabling manufacturers to offer competitive pricing. This affordability and the growing awareness of detoxifying properties of chlorella are contributing to the expansion of chlorella segment in the European market.

By Application Insights

The dietary supplements segment dominated the market by accounting for 35.5% of the European market share in 2024. The domination of dietary supplements segment is attributed to the rising health consciousness among European consumers that are increasingly seeking natural and plant-based alternatives to traditional supplements. Algae proteins, particularly spirulina and chlorella, are widely used in capsules, tablets, and powders due to their high nutritional value and ease of integration into formulations. The versatility of algae protein in meeting diverse dietary needs further enhances its importance in this segment.

The pharmaceuticals segment is predicted to showcase the highest CAGR of 15.8% over the forecast period. According to the European Pharmaceutical Market Research Association, algae protein’s anti-inflammatory and antioxidant properties are driving its adoption in drug development. For instance, algae-derived compounds are being explored for treating chronic conditions such as arthritis and cardiovascular diseases. Additionally, the growing emphasis on personalized medicine and biopharmaceuticals has created new opportunities for algae protein applications, making this segment a critical area for future innovation.

REGIONAL ANALYSIS

Germany accounted for 20.7% of the European market share and emerged as the leading performer in this regional market. The strong R&D investments, advanced cultivation technologies, and high consumer awareness of sustainable nutrition are fuelling the German market growth. Western Europe accounts for the major share of the overall European market due to the advanced infrastructure, high disposable incomes, and stringent sustainability regulations that favor algae-based solutions. Countries like Germany, France, and the UK are at the forefront of adopting algae protein in various industries, including food, supplements, and pharmaceuticals.

On the other hand, Eastern Europe is anticipated to grow at the fastest CAGR of 18.8% over the forecast period. According to the European Bank for Reconstruction and Development, the growth of the Eastern Europe is fueled by government incentives, rising awareness of plant-based diets, and increasing investments in agri-tech. Countries like Poland and Romania are emerging as key players, leveraging their agricultural expertise to scale algae cultivation.

KEY MARKET PLAYERS

Major Players of the Europe Algae Protein Market include Corbion N.V., Roquette Frères, Duplaco, Phycom BV, Algama

Roquette, Cyanotech Corporation, and Earthrise Nutritionals are the leading players in the European algae protein market, collectively contributing to over 60% of total production. Roquette, headquartered in France, focuses on developing innovative algae-based solutions for the food and pharmaceutical industries. Cyanotech Corporation, based in the USA but with a strong presence in Europe, specializes in producing high-quality spirulina and chlorella for dietary supplements. Earthrise Nutritionals, a pioneer in algae farming, supplies premium-grade algae protein to meet the growing demand for sustainable nutrition. These companies leverage their expertise in cultivation, processing, and product development to maintain their leadership positions.

KEY MARKET STRATEGIES

To strengthen their market positions, key players in the European algae protein market employ several strategic approaches. Partnerships and collaborations are a primary focus, with companies like Roquette working closely with EU governments to promote algae farming and secure funding for sustainable projects. According to the European Innovation Council, R&D investments are another critical strategy, with firms investing heavily in advanced cultivation technologies to enhance yield and reduce costs. Additionally, sustainability certifications and eco-labeling initiatives are gaining traction, as highlighted by the European Environmental Agency. These strategies not only ensure compliance with regulatory standards but also build consumer trust and drive long-term growth.

DETAILED SEGMENTATION OF EUROPE ALGAE PROTEIN MARKET INCLUDED IN THIS REPORT

This research report on the Europe algae protein market has been segmented and sub-segmented based on type, application & region.

By Type

- Spirulina

- Chlorella

- Other Microalgae (Dunaliella, Haematococcus, etc.)

By Application

- Food & Beverages (Dairy Alternatives, Meat Substitutes, Functional Foods)

- Dietary Supplements

- Animal Feed & Aquaculture

- Pharmaceuticals & Nutraceuticals

- Cosmetics & Personal Care

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the Europe algae protein market?

The market is driven by increasing demand for plant-based proteins, growing awareness of sustainable food sources, and rising adoption in dietary supplements and functional foods.

2. Which types of algae are commonly used for protein extraction?

The most commonly used algae for protein extraction are spirulina, chlorella, Dunaliella, and Haematococcus due to their high protein content and nutritional benefits.

3. Who are the key players in the Europe algae protein market?

Leading companies in this market include Corbion N.V., Roquette Frères, Duplaco, Phycom BV, and Algama.

4. How does algae protein compare to traditional protein sources?

Algae protein offers higher sustainability, rich amino acid profiles, and additional health benefits compared to traditional animal-based proteins like whey or soy.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]