Europe Air Traffic Management (ATM) Market Size, Share, Trends, & Growth Forecast Report Segmented By Domain (Air Traffic Control, Air Traffic Flow Management, and Aeronautical Information Management), Component (Hardware and Software Source), Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe) Industry Analysis From 2024 to 2032

Europe Air Traffic Management (ATM) Market Size

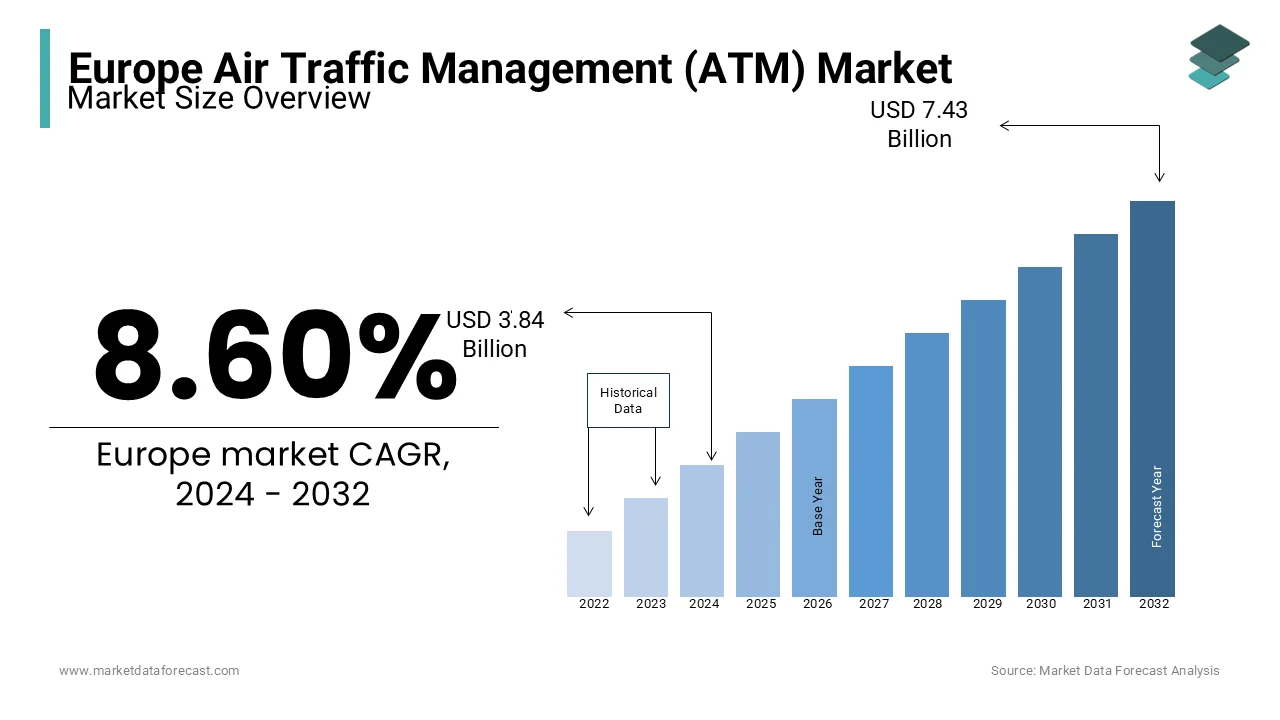

The Europe air traffic management (ATM) market was valued at USD 3.54 billion in 2023. The Europe market is expected to reach USD 3.84 billion in 2024 and is projected to reach USD 7.43 billion by 2032, growing at a CAGR of 8.60% during the foreseen period.

Air traffic management (ATM) is crucial for the aviation ecosystem to ensure safe and efficient airspace operations. With the focus of the European Union on modernizing aviation infrastructure and addressing environmental concerns, the ATM market plays a pivotal role in supporting sustainable air transport growth. Europe experiences some of the highest air traffic volumes globally. According to EUROCONTROL, the region managed over 10 million flights in 2022, reflecting a significant recovery from pandemic-induced declines. Countries like Germany, France, and the United Kingdom handle the majority of traffic, supported by advanced ATM systems. However, the anticipated growth in air travel demand necessitates further innovation and capacity expansion. The Single European Sky (SES) initiative, spearheaded by the European Commission is aiming to integrate and optimize airspace management across EU member states to reduce fragmentation and improving efficiency. This initiative is expected to save up to 10% in fuel consumption per flight, significantly cutting emissions. Furthermore, advancements in digital technologies such as artificial intelligence, satellite navigation, and data sharing are reshaping the ATM landscape, enhancing safety and operational efficiency.

MARKET DRIVERS

Increasing Air Traffic Volumes In Europe

The consistent growth in air traffic volumes across Europe is a key driver of the air traffic management (ATM) market. As international travel recovers post-pandemic, EUROCONTROL reported over 10 million flights in Europe in 2022, a 60% increase compared to 2021. Major airports in Germany, France, and the United Kingdom handle substantial traffic, with projections estimating a return to pre-pandemic levels by 2024. This surge in flights necessitates advanced ATM systems to prevent congestion, ensure safety, and optimize airspace usage. Enhanced air traffic volumes drive demand for modernizing ATC technologies, emphasizing Europe’s need for innovative solutions to accommodate growing passenger and cargo movements efficiently.

Implementation of the Single European Sky (SES) Initiative

The European Union’s Single European Sky (SES) initiative is a transformative driver of the Europe ATM market. Aimed at reducing airspace fragmentation, the SES program integrates national air traffic control systems, improving coordination and efficiency across EU member states. The European Commission estimates that SES could reduce delays by 10% and lower fuel consumption per flight by 10%, significantly enhancing operational efficiency. By leveraging technologies like satellite-based navigation and performance-based data sharing, the initiative facilitates seamless cross-border air traffic management. The SES program’s focus on sustainability and cost-efficiency underscores its critical role in driving the modernization and competitiveness of Europe’s ATM market.

MARKET RESTRAINTS

High Implementation Costs of Advanced Technologies

The high costs associated with deploying advanced air traffic management (ATM) technologies pose a significant restraint on the Europe ATM market. Modernizing systems to meet the goals of initiatives like the Single European Sky (SES) requires substantial investments in infrastructure, training, and software upgrades. According to the European Commission, achieving SES implementation across Europe will cost an estimated €3 billion by 2030. These expenses are challenging for smaller EU member states and air navigation service providers (ANSPs) with limited budgets. Financial constraints slow the pace of modernization, delaying critical upgrades and creating disparities in air traffic management capabilities across the region.

Complex Regulatory and Coordination Challenges

The Europe ATM market faces considerable regulatory and coordination challenges due to fragmented airspace management across member states. Despite the European Union’s efforts to unify air traffic through the SES initiative, varying national policies and operational priorities create implementation delays. EUROCONTROL highlights that airspace inefficiencies caused by fragmented management add an estimated €5 billion annually in costs to airlines. These challenges are further compounded by political and institutional hurdles, as some member states resist ceding control over their airspace. This regulatory complexity restricts the seamless integration of ATM systems, undermining efficiency and limiting the potential benefits of modernization initiatives.

MARKET OPPORTUNITIES

Adoption of Advanced Digital Technologies

The integration of advanced digital technologies offers significant opportunities for the Europe air traffic management (ATM) market. Innovations such as artificial intelligence (AI), machine learning, and big data analytics are transforming ATM operations, enhancing efficiency and safety. According to EUROCONTROL, AI-driven systems can reduce air traffic delays by up to 30% by optimizing flight routes and predicting traffic patterns. Satellite-based navigation systems like Galileo, the European Global Navigation Satellite System, further improve precision in airspace management. The adoption of such technologies aligns with the European Union’s digital transformation goals, providing a pathway for enhancing operational capabilities and achieving seamless air traffic coordination across the continent.

Growing Focus on Sustainable Aviation Practices

The emphasis on sustainability within the aviation sector creates significant opportunities for the Europe ATM market. Air traffic management plays a pivotal role in reducing carbon emissions by optimizing flight paths, enabling shorter routes, and minimizing delays. The European Commission’s Green Deal targets a 55% reduction in greenhouse gas emissions by 2030, highlighting the need for efficient ATM systems. EUROCONTROL reports that improved air traffic flow management could reduce CO2 emissions by 10% per flight. With increasing pressure on the aviation industry to adopt greener practices, the modernization of ATM infrastructure becomes critical for achieving these environmental objectives and supporting sustainable growth in air travel.

MARKET CHALLENGES

Airspace Congestion and Capacity Constraints

Airspace congestion remains a significant challenge for the Europe air traffic management (ATM) market. As air travel demand grows, the region's airspace faces increasing pressure, particularly in high-traffic zones like Western Europe. EUROCONTROL reports that air traffic in Europe is expected to grow by 45% by 2040, potentially leading to a capacity shortfall in handling flights efficiently. Airports and air navigation service providers (ANSPs) struggle to accommodate peak traffic volumes, resulting in delays and inefficiencies. In 2022, delays caused by airspace congestion cost airlines and passengers approximately €6 billion, underscoring the urgent need for capacity optimization and innovative solutions to mitigate this challenge.

Cybersecurity Risks and Vulnerabilities

The increasing reliance on digital technologies in ATM systems exposes the sector to significant cybersecurity risks. Advanced systems used for navigation, data sharing, and communication are vulnerable to cyberattacks that can disrupt operations and compromise safety. According to the European Aviation Safety Agency (EASA), the number of reported cyber incidents in the aviation sector rose by 23% in 2022 compared to the previous year. These risks pose challenges for ensuring the integrity and reliability of critical ATM infrastructure. Addressing cybersecurity vulnerabilities requires substantial investment in robust defense mechanisms, staff training, and regulatory compliance, further straining resources within the market.

REIGONAL ANALYSIS

Germany dominated the air traffic management (ATM) market in Europe in 2023. The domination of Germany in European market is estimated to continue owing to its strategic central location, high air traffic volume, and advanced infrastructure. EUROCONTROL reports that Germany handled over 2.5 million flights in 2022, making it one of the busiest airspaces in Europe. The country’s investment in state-of-the-art ATM technologies, such as digital towers and satellite navigation systems, enhances operational efficiency. Deutsche Flugsicherung (DFS), Germany’s air navigation service provider, plays a pivotal role in implementing innovative airspace management solutions. Germany’s leadership is critical for managing air traffic flow across Europe, serving as a key hub for both intra-European and international flights.

France is also one of the top performers in the Europe ATM market. The growth of the air traffic management market in France is driven by its extensive airspace and strong aviation sector. As home to Paris Charles de Gaulle Airport, one of Europe’s busiest hubs, France managed to get the second largest number of flights in 2022, according to EUROCONTROL. The French Directorate General for Civil Aviation (DGAC) has implemented significant modernization initiatives, including integrating AI and big data for airspace management. Additionally, France’s strategic role in transatlantic and Mediterranean flight routes reinforces its importance. The country’s leadership ensures efficient air traffic management in a highly congested region, aligning with Europe’s broader aviation goals.

The United Kingdom excels in the European air traffic management market. The market growth in the UK is attributed to its advanced infrastructure and significant international connectivity. The UK Civil Aviation Authority highlights that UK airspace managed many flights in 2022, with Heathrow Airport being a major global hub. The UK’s adoption of innovative technologies, such as satellite-based navigation and real-time data sharing, enhances its ATM capabilities. Projects like the UK’s Airspace Modernisation Strategy aim to optimize air traffic flow and reduce delays, further strengthening its leadership position. The UK’s strategic role in connecting Europe to global destinations underscores its critical importance in the UK air traffic management market.

KEY MARKET PLAYERS

Honeywell International Inc., RTX Corporation, Saab AB, SITA, and BAE Systems plc are leading players in the Europe Air Traffic Management (ATM) Market.

MARKET SEGMENTATION

This research report on the Europe air traffic management (ATM) market is segmented and sub-segmented into the following categories.

By Domain

- Air Traffic Control

- Air Traffic Flow Management

- Aeronautical Information Management

By Component

- Hardware

- Software Source

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the primary components of the ATM market?

The ATM market primarily consists of air traffic control systems, air traffic flow management systems, communication systems, navigation systems, and surveillance technologies, along with software for real-time data processing and decision-making.

Which sectors drive the demand for ATM solutions in Europe?

Key sectors driving demand include commercial aviation, defense, and private aviation, with a focus on improving airspace capacity, minimizing delays, and enhancing flight safety.

What technological trends are shaping the ATM market in Europe?

Emerging technologies include artificial intelligence for predictive traffic management, advanced satellite navigation systems, and digital communication systems to enhance operational efficiency and safety.

What is the future outlook for the European ATM market?

The future of the European ATM market is centered on modernization, driven by advancements in digitalization, automation, and sustainable solutions, along with growing collaboration between stakeholders to meet increasing aviation demands.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]