Europe Air Source Heat Pump (ASHP) Market Size, Share, Trends, & Growth Forecast Report Segmented By Product, Application, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Air Source Heat Pump (ASHP) Market Size

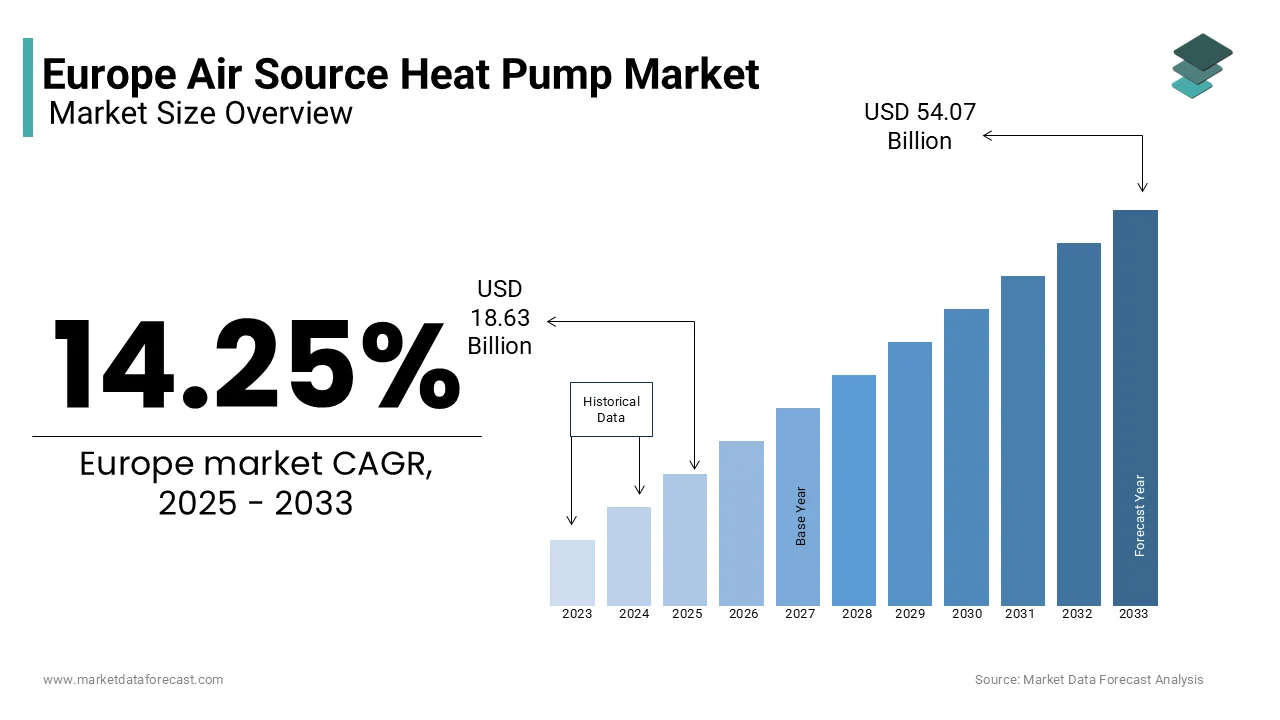

The European air source heat pump market was worth USD 16.30 billion in 2024. The European market is projected to reach USD 54.07 billion by 2033 from USD 18.63 billion in 2025, growing at a CAGR of 14.25% from 2025 to 2033.

Air source heat pumps extract heat from ambient air to provide heating and hot water and are gaining widespread adoption as an energy-efficient alternative to traditional fossil fuel-based systems. According to the European Heat Pump Association (EHPA), the ASHP segment accounted for over 70% of all heat pump installations in Europe in 2022, with approximately 2.5 million units sold across the region. The ambitious EU climate targets, including the European Green Deal’s goal to achieve net-zero carbon emissions by 2050 are promoting the demand for air source heat pumps.

The rising consumer awareness of energy-efficient technologies and government incentives aimed at promoting renewable heating solutions in Europe are likely to expand the European air source heat pumps market. According to Eurostat, residential applications dominate the market and represent nearly 65% of total installations due to retrofitting existing homes with ASHP systems. Countries like Germany, France, and Sweden lead in adoption owing to the favorable subsidies and tax benefits. For instance, Germany introduced the Federal Funding for Efficient Buildings (BEG) program, which contributed to a 40% year-on-year increase in ASHP installations in 2022. Furthermore, the International Energy Agency (IEA) reports that ASHPs can reduce household heating emissions by up to 50%, making them pivotal in decarbonizing Europe’s building sector. With technological advancements improving efficiency even in colder climates, the European ASHP market is poised for robust growth, projected at a compound annual growth rate (CAGR) of 10.5% through 2030.

As Europe transitions toward cleaner energy systems, air source heat pumps are set to play a transformative role in reshaping residential and commercial heating landscapes.

MARKET DRIVERS

Stringent Environmental Regulations and Decarbonization Goals

One of the major drivers of the European air source heat pump (ASHP) market is the implementation of stringent environmental regulations aimed at reducing carbon emissions from heating systems. The European Commission highlights that buildings account for approximately 40% of total energy consumption and 36% of greenhouse gas emissions in Europe, prompting policies like the European Green Deal to decarbonize this sector. Eurostat reports that over 75% of heating systems in EU households still rely on fossil fuels, creating a pressing need for renewable alternatives like ASHPs. The International Energy Agency (IEA) notes that ASHPs can reduce heating-related emissions by up to 50%, making them a key solution for meeting 2050 net-zero targets. Additionally, national initiatives such as Germany’s BEG program have incentivized ASHP adoption, contributing to a 40% annual growth in installations. These regulatory frameworks are pivotal in accelerating market expansion.

Rising Energy Costs and Consumer Awareness

Another significant driver is the surge in energy costs coupled with growing consumer awareness about energy-efficient technologies. Eurostat reports that natural gas prices in Europe increased by over 150% between 2021 and 2022, pushing households to seek cost-effective alternatives like ASHPs. The European Heat Pump Association (EHPA) highlights that ASHPs can reduce heating bills by up to 30%, particularly when paired with renewable electricity sources. Furthermore, a survey by the European Consumer Organisation (BEUC) reveals that over 60% of consumers prioritize energy-efficient appliances when replacing heating systems. Government campaigns promoting sustainability have also played a role, with countries like France offering subsidies covering up to 90% of installation costs for low-income households. As energy affordability becomes a critical concern, ASHPs are increasingly viewed as a viable solution, driving their adoption across Europe.

MARKET RESTRAINTS

High Initial Installation Costs

One of the major restraints in the European air source heat pump (ASHP) market is the high initial installation cost, which often deters potential adopters despite long-term savings. The European Heat Pump Association (EHPA) reports that the average cost of installing an ASHP ranges from EUR 10,000 to EUR 15,000, depending on system complexity and property size. Eurostat highlights that over 30% of European households cite affordability as a primary barrier to adopting renewable heating solutions. While subsidies exist, such as France’s MaPrimeRénov’ program, which covers up to 90% of costs for low-income households, these incentives are not uniformly accessible across all regions. Additionally, the International Energy Agency (IEA) notes that retrofitting older buildings with ASHPs can incur additional expenses due to insulation and system compatibility requirements. These financial barriers, particularly in lower-income demographics, continue to hinder widespread adoption.

Performance Limitations in Colder Climates

Another significant restraint is the reduced efficiency of ASHPs in colder climates, where external temperatures can fall below -10°C. The European Commission highlights that while technological advancements have improved performance, ASHPs still face challenges in maintaining optimal output during extreme winters, particularly in Northern and Eastern Europe. Eurostat reports that approximately 25% of ASHP installations in colder regions require supplementary heating systems, increasing operational costs and complexity. Additionally, the International Energy Agency (IEA) notes that the coefficient of performance (COP) for ASHPs can drop by up to 30% in sub-zero conditions, making them less appealing compared to alternative solutions like ground source heat pumps. Although innovations such as hybrid systems are emerging, their higher costs and limited awareness further restrict adoption, posing a challenge to market expansion in colder areas.

MARKET OPPORTUNITIES

Expansion in Retrofitting Existing Buildings

One of the major opportunities in the European air source heat pump (ASHP) market lies in retrofitting existing buildings, which account for approximately 75% of Europe’s building stock, according to Eurostat. Many of these buildings still rely on outdated fossil fuel-based heating systems, creating a vast potential for ASHP adoption. The European Commission highlights that retrofitting initiatives, supported by national programs like Germany’s BEG and France’s MaPrimeRénov’, have already led to a 30% increase in ASHP installations in older homes since 2021. Additionally, the International Energy Agency (IEA) notes that combining ASHPs with energy-efficient insulation upgrades can reduce heating costs by up to 40%, making them an attractive solution for homeowners. With EU policies mandating nearly zero-energy buildings (NZEB) by 2030, retrofitting presents a lucrative opportunity for manufacturers and installers to tap into this underserved segment, driving significant market growth.

Growing Adoption in Commercial and Industrial Sectors

Another key opportunity is the increasing adoption of ASHPs in commercial and industrial sectors, driven by stringent carbon reduction targets and rising energy costs. The European Heat Pump Association (EHPA) reports that non-residential applications accounted for 15% of total ASHP installations in 2022, with projections indicating a CAGR of 12% through 2030. The International Energy Agency (IEA) highlights that ASHPs can reduce heating-related emissions in commercial buildings by up to 60%, aligning with corporate sustainability goals. Furthermore, Eurostat notes that industries such as hospitality and retail are increasingly integrating ASHPs into their facilities due to their lower operational costs and compatibility with renewable energy sources. Government incentives, such as tax breaks for businesses adopting green technologies, further amplify this trend. As demand for sustainable heating solutions rises, the commercial and industrial sectors offer immense growth potential for the ASHP market.

High Upfront Costs Limiting Adoption

One major challenge for the Europe air source heat pump market is the high upfront cost of installation, which limits adoption among households and businesses. According to the European Heat Pump Association (EHPA), the average cost of installing an air source heat pump ranges from €10,000 to €18,000, depending on system size and property requirements. This is significantly higher than traditional heating systems like gas boilers, which cost around €2,500 to €4,000. The International Energy Agency (IEA) highlights that despite long-term energy savings, the initial investment remains a barrier, especially for low-income households. Governments have introduced subsidies, such as Germany’s €6,000 grant under the Federal Office for Economic Affairs and Export Control, but these are often insufficient to offset costs for many consumers, slowing market growth.

MARKET CHALLENGES

Skills Gap in Installation and Maintenance

Another significant challenge is the need for skilled labor to install and maintain air source heat pumps, which creates bottlenecks in scaling adoption. Eurostat reports that only 30% of HVAC technicians in Europe are trained to work with heat pump technologies, leaving a substantial skills gap. The European Commission estimates that approximately 1.2 million additional qualified workers will be needed by 2030 to meet renewable heating targets. A study by the UK's Department for Business, Energy & Industrial Strategy reveals that improper installations can reduce system efficiency by up to 30%, underscoring the importance of expertise. Without robust training programs, this shortage could hinder the market's ability to meet rising demand driven by decarbonization policies across the continent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.25% |

|

Segments Covered |

By Product, Application, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Bosch Thermotechnology Ltd, Carrier, Colmac Industries, DAIKIN INDUSTRIES Ltd, Fujitsu General, Glen Dimplex Group, Gree Electric Appliances, Inc., Guangzhou SPRSUN New Energy Technology Development Co., Ltd., LG Electronics,Mitsubishi Electric Corporation, NIBE Industrier AB, Panasonic Corporation, Rheem Manufacturing Company, SAMSUNG, Stiebel Eltron GmbH & Co. KG, Swegon Group AB, Systemair AB, Toshiba Air Conditioning, Trane, Vaillant Group, and WOLF GmbH. |

SEGMENTAL ANALYSIS

By Product Insights

The air to water heat pumps held the leading share of 60.1% of the European market share in 2024. The versatility of air to water heat pumps in providing both space heating and hot water makes them ideal for colder regions like Northern Europe is majorly driving the segmental expansion in the European market. The UK’s Department for Business, Energy & Industrial Strategy states these systems reduce household carbon emissions by up to 60% compared to gas boilers, aligning with EU decarbonization goals. With over 1.5 million units installed in 2022, their compatibility with district heating networks further boosts adoption. Their leadership stems from government incentives and growing demand for integrated renewable heating solutions, making them critical for achieving climate targets.

The air to air heat pumps segment is expected to witness the prominent CAGR of 12.5% over the forecast period due to the rising cooling demands in Southern Europe due to climate change, where temperatures have risen by 1.5°C since 1980, as reported by the European Environment Agency. These systems, with a COP of 3-4, are cost-effective for cooling and heating in milder climates. The International Energy Agency highlights that air to air heat pumps accounted for 40% of total sales in 2022, driven by urbanization and energy-efficient building codes. Their rapid adoption underscores their role in addressing both comfort needs and energy efficiency goals.

By Application Insights

The residential segment captured 65.5% of the European market share in 2024. Within this, single-family homes dominate due to rising awareness of energy efficiency and government incentives like Germany’s €5,000 subsidy for renewable heating systems. The UK Department for Business, Energy & Industrial Strategy highlights that domestic hot water heat pumps are gaining traction, with over 300,000 units installed in 2022, driven by their ability to reduce household emissions by up to 50%. Multi-family housing is also growing, supported by retrofitting initiatives in urban areas. This segment's leadership stems from EU mandates to decarbonize residential heating, making it pivotal for achieving climate neutrality by 2050.

Within the commercial segment, the hospitality sector is estimated to grow at the fastest CAGR of 14.2% over the forecast period owing to the increasing demand for energy-efficient HVAC systems in hotels and resorts, particularly in Southern Europe, where tourism contributes over 10% to the GDP. The International Energy Agency (IEA) notes that room heat pumps in hospitality settings can reduce energy costs by up to 40%, enhancing sustainability credentials. Additionally, stricter EU regulations on carbon emissions in commercial buildings are driving adoption. For instance, France mandates that all new commercial buildings achieve near-zero energy standards by 2025, further boosting demand. The hospitality sector's rapid growth underscores its role in balancing comfort, cost-efficiency, and environmental goals.

KEY MARKET PLAYERS

The major players in the Europe air source heat pump market include Bosch Thermotechnology Ltd, Carrier, Colmac Industries, DAIKIN INDUSTRIES Ltd, Fujitsu General, Glen Dimplex Group, Gree Electric Appliances, Inc., Guangzhou SPRSUN New Energy Technology Development Co., Ltd., LG Electronics,Mitsubishi Electric Corporation, NIBE Industrier AB, Panasonic Corporation, Rheem Manufacturing Company, SAMSUNG, Stiebel Eltron GmbH & Co. KG, Swegon Group AB, Systemair AB, Toshiba Air Conditioning, Trane, Vaillant Group, and WOLF GmbH.

REGIONAL ANALYSIS

Germany led the air source heat pumps market in Europe by accounting for 28.3% of the European market share in 2024. The domination of Germany in the European market is driven by its aggressive climate policies, including the phase-out of oil heating systems by 2026 and subsidies like the €6,000 grant for heat pump installations. Germany installed over 150,000 units in 2022, driven by rising energy prices and consumer awareness. The German Environment Agency highlights that heat pumps are pivotal in achieving the country’s target of reducing building emissions by 40% by 2030, making it a leader in renewable heating adoption.

France is another major market for air source heat pumps in Europe. The retrofitting initiatives of France in residential buildings further boost adoption, particularly in older housing stock are driving the French market expansion. According to the French Ministry for Ecological Transition, over 100,000 heat pumps were installed in 2022, reflecting a surge in demand due to rising gas prices and environmental awareness. France’s commitment to achieving carbon neutrality by 2050 has positioned heat pumps as a cornerstone of its energy transition strategy, particularly in urban areas where energy-efficient solutions are prioritized.

Sweden is likely to account for a notable share of the European market during the forecast period. The market growth in Spain is attributed to its cold climate and reliance on renewable energy. The Swedish Environmental Protection Agency highlights that over 50% of households use heat pumps, driven by stringent carbon neutrality goals and high electricity grid compatibility. Sweden’s strong emphasis on sustainability and district heating integration has made air-to-water heat pumps particularly popular. The Swedish Energy Agency notes that government incentives, such as tax deductions for energy-efficient upgrades, have accelerated adoption. With nearly all electricity in Sweden sourced from renewables, heat pumps align perfectly with the country’s vision of a fossil-free future, solidifying its leadership in Northern Europe.

MARKET SEGMENTATION

This research report on the Europe air source heat pump (ASHP) market is segmented and sub-segmented into the following categories.

By Product

- Air to Air

- Air to Water

By Application

- Residential

- Single Family

- Multi Family

- Residential, By Product

- Domestic Hot Water Heat Pump

- Room Heat Pump

- Commercial

- Education

- Healthcare

- Retail

- Logistics & Transportation

- Offices

- Hospitality

- Others’

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is driving the growth of the Europe air source heat pump market?

The market is growing due to increasing government incentives, stringent carbon reduction targets, and rising consumer awareness about energy-efficient heating solutions.

How are government policies influencing the air source heat pump market in Europe?

Governments are offering subsidies, tax credits, and grants to encourage adoption, while banning gas boilers in new homes in several countries is further driving demand.

What impact is climate change having on the air source heat pump market in Europe?

Rising temperatures and extreme weather events are increasing demand for energy-efficient heating and cooling solutions, making air source heat pumps a preferred choice.

What is the future outlook for the air source heat pump market in Europe?

The market is expected to grow steadily as governments phase out fossil fuel heating, technological advancements improve efficiency, and consumers seek sustainable heating solutions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]