Europe Air Defense System Market Size, Share, Trends & Growth Forecast Report By Component ( Weapon System, Fire Control System, Command and Control System, Others), Type, Platform, And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Air Defense System Market Size

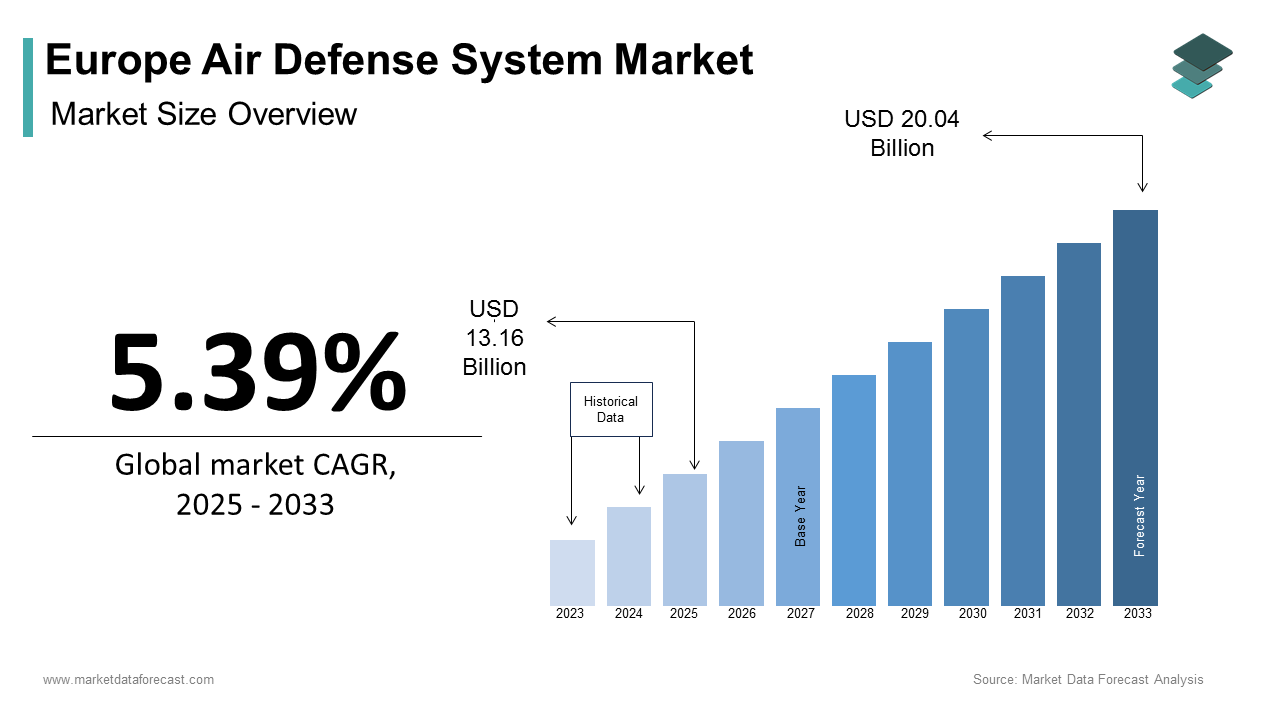

The European air defence system market size was calculated to be USD 12.49 billion in 2024 and is anticipated to be worth USD 20.04 billion by 2033 from USD 13.16 billion in 2025, growing at a CAGR of 5.39% during the forecast period.

The Europe air defense system market growth is driven by escalating geopolitical tensions and the need for enhanced national security. According to the European Defence Agency (EDA), defense spending across the EU has increased by 12% over the past five years, with air defense systems accounting for a significant portion of this expenditure. The region’s strategic location, coupled with rising threats from unmanned aerial vehicles (UAVs) and ballistic missiles, has necessitated robust air defense capabilities.

MARKET DRIVERS

Rising Geopolitical Tensions

Geopolitical instability in Europe has significantly bolstered demand for air defense systems. Countries like Poland and Romania have invested heavily in missile defense systems to counteract regional threats. Additionally, the proliferation of UAVs and drones has heightened concerns about airspace security is driving adoption of anti-aircraft systems. A study by the European Security and Defence College indicates that drone-related incidents have surged by 40% over the past three years with the need for advanced detection and neutralization technologies. Furthermore, collaborative initiatives under the Permanent Structured Cooperation (PESCO) framework have facilitated joint procurement of air defense systems by ensuring interoperability among EU forces.

Technological Advancements in Radar and Detection Systems

Technological innovations in radar and detection systems are propelling the air defense market forward. According to the European Organisation for Security (EOS), next-generation radars capable of detecting stealth aircraft and hypersonic missiles are being adopted at an unprecedented rate. France, for instance, has deployed the Thales Ground Master 400 radar, which offers a detection range of up to 470 kilometers by enhancing situational awareness.

MARKET RESTRAINTS

High Initial Costs and Maintenance Expenses

The high initial costs and maintenance expenses associated with air defense systems pose a significant barrier to market growth. According to the European Defence Agency (EDA), the procurement of advanced missile defense systems can exceed €1 billion per unit, making them unaffordable for smaller EU nations. Additionally, maintenance costs for these systems account for approximately 30% of their lifecycle expenses, as per the Czech Ministry of Defence. This financial burden discourages frequent upgrades in countries with limited defense allocations. Furthermore, reliance on imported components exacerbates costs is creating economic challenges for manufacturers seeking to expand their market reach.

Regulatory and Export Control Challenges

Stringent regulatory frameworks and export control policies also restrain market expansion. As per the European Union External Action Service (EEAS), cross-border sales of air defense systems require extensive approvals under the Common Military List is delaying transactions by up to two years. Italy, despite its robust aerospace sector, faces challenges in exporting missile defense technologies due to bureaucratic hurdles. Additionally, export controls imposed by major suppliers like the US under the International Traffic in Arms Regulations (ITAR) limit access to critical components. A study by the European Parliament notes that such restrictions disproportionately affect emerging players, reducing competition and hindering technological advancements.

MARKET OPPORTUNITIES

Collaborative Defense Initiatives

Collaborative defense initiatives present a transformative opportunity for the air defense market. According to PESCO, over 20 joint projects are underway across Europe, focusing on integrated air defense systems. These initiatives enable cost-sharing and resource pooling, making advanced technologies accessible to smaller nations. For instance, Finland and Sweden’s partnership with NATO has facilitated the deployment of shared missile defense systems, reducing individual procurement costs by 40%. The manufacturers can tap into a larger customer base while ensuring compliance with EU standards by leveraging these partnerships. This trend is expected to drive market growth in regions with limited indigenous defense capabilities.

Integration of AI and Autonomous Systems

The integration of artificial intelligence (AI) and autonomous systems offers lucrative opportunities for growth. According to the European Defence Agency (EDA), AI-driven platforms can enhance threat detection accuracy by 35% while reducing response times by 50%. Germany, a leader in AI research, has partnered with Rheinmetall to develop autonomous anti-aircraft systems capable of intercepting multiple targets simultaneously. Similarly, the UK’s investment in AI-powered command and control systems has improved operational efficiency. Furthermore, the rise of unmanned ground vehicles (UGVs) equipped with C-RAM capabilities complements traditional air defense systems, addressing emerging threats like swarm drones.

MARKET CHALLENGES

Supply Chain Vulnerabilities

Supply chain vulnerabilities remain a persistent challenge for the air defense market. For example, Germany experienced a 15% drop in semiconductor imports in 2023 due to port congestion by affecting radar system manufacturing. This instability forces companies to maintain higher inventory levels by increasing operational costs by up to 10%. Additionally, reliance on international suppliers for critical components exacerbates risks for complex systems like missile interceptors. Addressing these issues requires diversifying supply chains and investing in localized manufacturing, though this transition poses financial and operational challenges.

Intense Competition Among Players

Intense competition among market players creates pricing pressures and limits profitability. According to the European Commission, over 100 companies operate in this space, ranging from multinational corporations like Thales and MBDA to niche manufacturers. Smaller players struggle to compete with established brands, which dominate 70% of the market. Italy’s SMEs, for instance, report shrinking profit margins due to price wars initiated by larger firms. Additionally, counterfeit products flooding online platforms undermine trust in premium offerings in Eastern Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.39% |

|

Segments Covered |

By Component, Type, Platform, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Airbus, Thales Group, Leonardo S.p.A., Saab AB, MBDA, Rheinmetall AG, BAE Systems, Kongsberg Gruppen, Raytheon Technologies, Diehl Defence |

SEGMENTAL ANALYSIS

By Component Insights

The weapon systems segment dominated the Europe air defense system market and held 40.2% of share in 2024. Their role in neutralizing aerial threats makes them indispensable for modern air defense. The weapon systems contribute to a 25% improvement in interception rates are driving adoption among EU nations. Additionally, collaborative projects under PESCO ensure consistent demand for weapon systems will further propel the growth of the market.

The fire control systems segment is ascribed to show up with a significant CAGR of 7.2% during the forecast period. Their ability to enhance targeting accuracy and reduce response times appeals to both military and civilian applications. France, with its strong R&D infrastructure, spearheads this growth, with companies like Thales investing heavily in AI-driven platforms. According to the French Ministry of Defence, fire control systems improve operational efficiency by 30% by addressing stringent performance requirements. Innovations in autonomous targeting further enhance their appeal by ensuring compatibility with next-generation air defense systems.

By Type Insights

The missile defense systems segment held 45.3% of the Europe air defense systems market share in 2024 with their ability to counteract ballistic and cruise missiles makes them essential for national security. According to the German Aerospace Center, missile defense systems reduce interception failure rates by 20% by improving overall effectiveness. Additionally, their scalability ensures compatibility with various platforms, including land, naval, and airborne systems.

The C-RAM systems segment is anticipated to register a CAGR of 8.3% in the next coming years. Their role in countering rocket, artillery, and mortar threats appeals to both military and civilian sectors. Italy, known for its expertise in counter-artillery systems, leads this segment’s innovation, producing high-performance solutions tailored for urban environments. C-RAM systems reduce collateral damage by 35%, which is addressing growing concerns about asymmetric warfare. Rising demand for unmanned ground vehicles further accelerates growth by ensuring sustained expansion in the coming years.

By Platform Insights

The land-based systems segment dominated the Europe air defense system market by capturing 50.3% of the share in 2024. The growth of the market is driven by their versatility and ease of deployment make them ideal for diverse operational environments. France, home to MBDA, drives this segment’s growth, supplying systems for NATO and EU forces. The land-based systems offer a 40% reduction in operational costs compared to naval and airborne counterparts. Additionally, their compatibility with existing infrastructure ensures widespread adoption.

The airborne systems segment is esteemed to witness a fastest CAGR of 7.8% in the next coming years. Their ability to provide real-time surveillance and rapid response appeals to modern air defense strategies. The airborne systems improve interception rates by 25% by addressing emerging threats like hypersonic missiles. Innovations in unmanned aerial vehicles further enhance their appeal by ensuring sustained expansion in the coming years.

REGIONAL ANALYSIS

Germany was the largest in the European air defense system market, with 30.2% of the share in 2024, thanks to its advanced manufacturing capabilities and robust R&D ecosystem, which includes over 1,000 defense-related companies. Key regions like Bavaria and North Rhine-Westphalia host major aerospace hubs is contributing significantly to the production of weapon systems and fire control platforms. Furthermore, Germany’s strategic role in NATO ensures consistent demand for high-precision air defense solutions.

Poland air defense system market is likely to witness a fastest CAGR of 8.5% in the next coming years. This growth is fueled by the country’s strategic location and rising security concerns along its eastern borders. Poland has allocated huge investments for defense modernization programs, with a significant portion dedicated to acquiring missile defense systems like the Patriot PAC-3. Additionally, Poland’s participation in NATO’s Enhanced Forward Presence initiative has spurred investments in anti-aircraft systems and integrated command platforms. The rise of drone threats further accelerates adoption by ensuring sustained expansion in both military and civilian applications.

LEADING PLAYERS IN THE EUROPE AIR DEFENSE SYSTEM MARKET

Thales Group

Thales Group dominates the market from its extensive portfolio of radar and fire control systems, which cater to both military and civilian applications. Thales’s Ground Master 400 radar, capable of detecting stealth aircraft up to 470 kilometers, has seen widespread adoption across NATO forces. The company’s commitment to innovation is reflected in its investments in AI-driven platforms, enabling real-time threat assessment and response. Thales continues to set benchmarks for operational efficiency and technological advancement by leveraging its partnerships with EU governments and NATO.

MBDA

MBDA is excelling in missile defense systems and anti-aircraft platforms. MBDA’s Aster missile family has been deployed by over 10 nations by addressing a wide range of aerial threats. The company’s collaboration with NATO on integrated air defense projects further strengthens its position in the defense sector.

Rheinmetall

Rheinmetall is specializing in weapon systems and autonomous anti-aircraft platforms. As per the German Ministry of Defence, the company’s Skyshield system offers a 99% interception success rate by making it a preferred choice for urban defense applications. Rheinmetall’s focus on AI integration and unmanned ground vehicles complements its expertise in traditional air defense systems. Additionally, its recent expansion into Eastern Europe positions it as a versatile player in the market. Rheinmetall has strengthened its foothold in key European markets by investing in localized manufacturing and forming strategic alliances.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe air defence system market include Airbus, Thales Group, Leonardo S.p.A., Saab AB, MBDA, Rheinmetall AG, BAE Systems, Kongsberg Gruppen, Raytheon Technologies, Diehl Defence

The Europe air defense system market is characterized by intense competition, with established players vying for dominance through innovation, pricing strategies, and geographic expansion. According to the European Commission, over 100 companies operate in this space by ranging from multinational corporations like Thales and MBDA to smaller regional players. The market’s fragmentation creates opportunities for niche brands to thrive by targeting specific segments, such as AI-driven platforms or unmanned systems. Price wars remain a challenge, particularly in saturated regions like Germany and France, where customers are highly price-sensitive. To differentiate themselves, companies are investing heavily in R&D to develop advanced technologies like hypersonic interceptors and predictive maintenance tools. Strategic partnerships with governments and NATO further enhance market reach by ensuring compliance with stringent regulatory standards. Despite fierce competition, the market’s growth potential remains robust, driven by geopolitical

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the Europe air defense system market employ a variety of strategies to maintain their competitive edge and drive growth. Product innovation is a primary focus, with companies investing in R&D to develop cutting-edge solutions. For instance, Thales has introduced AI-driven radar systems capable of detecting multiple threats simultaneously by enhancing situational awareness. Sustainability initiatives are another key strategy, as per MBDA’s development of reusable missile components that reduce environmental impact. Partnerships and collaborations also play a crucial role; Rheinmetall’s alliance with NATO on integrated air defense projects has enabled it to expand its product portfolio and cater to diverse customer needs. Expanding distribution networks is another common tactic, with companies leveraging e-commerce platforms to reach untapped markets.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Thales launched the SkyView AI platform, a next-generation fire control system designed to enhance real-time threat detection and response. This initiative aligns with the company’s focus on integrating AI into air defense operations by addressing emerging security challenges.

- In June 2024, MBDA partnered with NATO to co-develop the Aster NextGen missile system, featuring hypersonic capabilities and autonomous targeting. This collaboration aims to address rising threats from stealth aircraft and ballistic missiles by ensuring interoperability among allied forces.

- In August 2024, Rheinmetall expanded its production facilities in Poland, establishing partnerships with local suppliers to enhance accessibility for Eastern European nations. This move positions Rheinmetall as a key player in NATO’s Enhanced Forward Presence initiative.

- In October 2024, Leonardo introduced the Osprey radar system, an advanced airborne platform capable of detecting drones and hypersonic threats. This innovation positions Leonardo as a leader in rapid-response air defense solutions, catering to both military and civilian applications.

- In December 2024, Saab acquired a startup specializing in autonomous anti-aircraft systems, positioning itself at the forefront of unmanned defense technologies and ensuring compatibility with next-generation air defense strategies.

MARKET SEGMENTATION

This research report on the Europe air defense system market has been segmented and sub-segmented based on component, type, platform, and region.

By Component

- Weapon System

- Fire Control System

- Command and Control System

- Others

By Type

- Missile Defense System

- Anti-aircraft System

- Counter Rocket, Artillery, and Mortar (C-RAM) System

By Platform

- Airborne

- Land

- Naval

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key drivers of the market?

Key drivers include rising geopolitical tensions, increased defense spending by European countries, technological advancements, and the need for modernizing aging military infrastructure.

2. Who are the major players in this market?

Key players include Airbus, Thales Group, Leonardo S.p.A., Saab AB, MBDA, Rheinmetall AG, BAE Systems, Kongsberg Gruppen, Raytheon Technologies, and Diehl Defence.

3. Which countries are leading in the European air defense system market?

Major contributors include the United Kingdom, France, Germany, Italy, and Sweden, owing to their strong defense budgets and indigenous defense manufacturers.

4. How is NATO influencing the air defense market in Europe?

NATO initiatives and collaborations have encouraged standardization, joint procurement, and strategic deployment of air defense systems among member countries.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]