Europe Air Conditioners Market Size, Share, Trends & Growth Forecast Report By Product Type (Split, Window & Portable), End-users (Residential, Commercial & Industrial) & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Air Conditioners Market Size

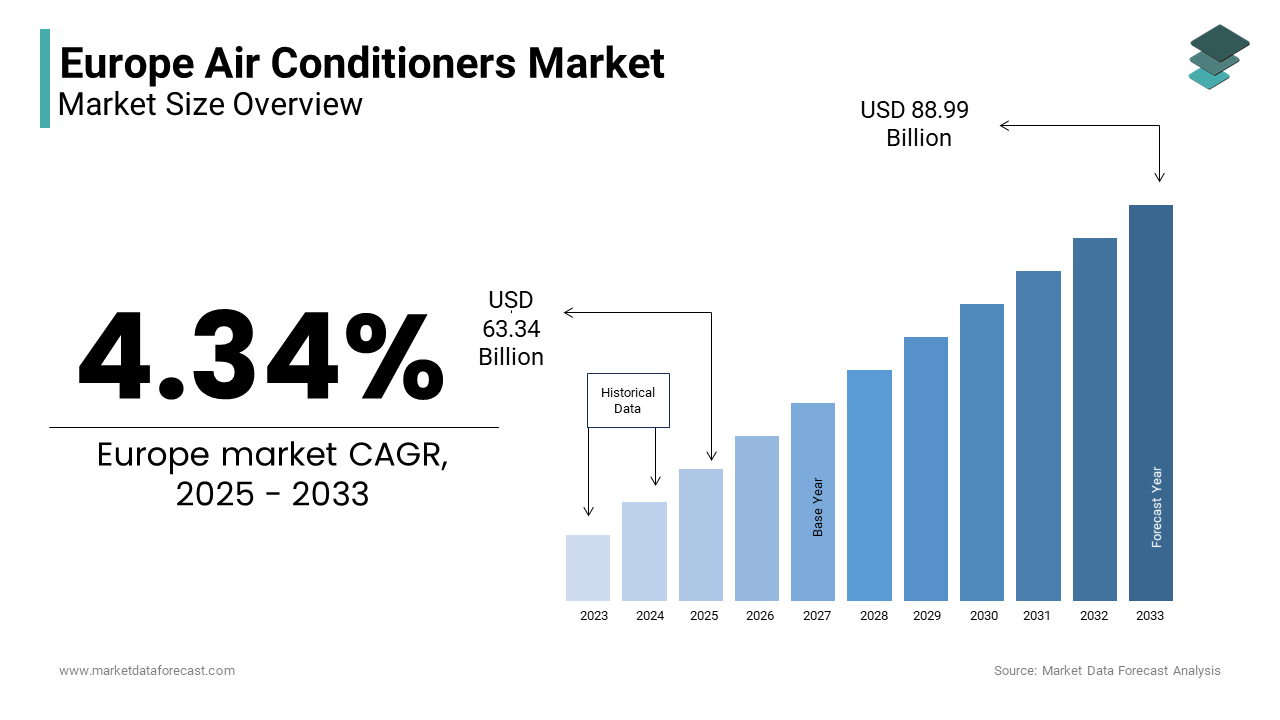

The European air conditioners market was valued at USD 60.71 billion in 2024 and is anticipated to reach USD 88.99 billion by 2033 from USD 63.34 billion in 2025, registering a CAGR of 4.34% from 2025 to 2033.

The Europe air conditioner market growth is driven by the rising temperatures and increasing urbanization. According to Eurostat, the region’s average summer temperature has risen by 1.5°C over the past decade by prompting a surge in demand for cooling solutions. Energy efficiency regulations, such as the EU Ecodesign Directive, have encouraged the adoption of inverter-based models, which reduce power consumption by up to 40%. Additionally, the rise of smart homes has fueled demand for IoT-enabled air conditioners, with predictive maintenance features gaining traction. As per study by the Fraunhofer Institute, smart air conditioners account for 25% of total installations in urban hubs like London and Paris.

MARKET DRIVERS

Rising Temperatures and Climate Change

The rising temperatures due to climate change are a significant driver for the Europe air conditioner market. According to the European Centre for Medium-Range Weather Forecasts, heatwaves have become 30% more frequent over the past two decades, with countries like Italy and Spain experiencing record-breaking summers. Consumers are increasingly investing in energy-efficient models to combat extreme heat while minimizing electricity costs. Additionally, governments across Europe are promoting the use of eco-friendly cooling systems through subsidies.

Urbanization and Smart Home Integration

Urbanization is another key driver for the Europe air conditioner market, with over 75% of the population residing in cities. High-rise apartments and compact living spaces necessitate efficient cooling solutions in metropolitan areas like Berlin and Madrid. Additionally, the integration of air conditioners with smart home ecosystems has enhanced their appeal. A study by the UK Smart Home Association reveals that 60% of urban households prefer IoT-enabled devices, including smart thermostats and air conditioners. These systems offer remote control, energy monitoring, and predictive maintenance by aligning with modern lifestyle preferences. Furthermore, the growing trend of co-living spaces and shared accommodations has increased demand for centralized cooling systems in commercial buildings.

MARKET RESTRAINTS

High Initial Costs and Budget Constraints

High initial costs remain a significant restraint for the Europe air conditioner market, particularly for energy-efficient models. This financial burden often deters budget-conscious consumers in economically weaker regions. Additionally, economic uncertainties, exacerbated by inflation and geopolitical tensions, have tightened household budgets. While energy-efficient models offer long-term savings, their upfront costs remain prohibitive for many stakeholders. This financial barrier hinders widespread adoption in rural areas.

Stringent Environmental Regulations

Stringent environmental regulations pose significant challenges for manufacturers in the Europe air conditioner market. Compliance with directives such as the EU F-Gas Regulation, which mandates the phase-down of hydrofluorocarbons (HFCs), demands costly redesigns and certifications. Additionally, frequent updates to these regulations create uncertainty, complicating product development. For instance, the introduction of stricter energy efficiency standards under the Ecodesign Directive has increased production timelines and costs. These challenges limit innovation and slow market expansion for budget-constrained stakeholders.

MARKET OPPORTUNITIES

Adoption of Renewable Energy-Compatible Systems

The integration of renewable energy-compatible air conditioning systems presents a transformative opportunity for the Europe air conditioner market. These systems leverage photovoltaic panels to reduce electricity consumption, aligning with Europe’s green energy initiatives. As per a study by the Fraunhofer Institute, solar-powered models can reduce energy costs by up to 60% by making them attractive to environmentally conscious consumers. Governments across Europe are incentivizing the adoption of such technologies through subsidies, such as Italy’s "Superbonus 110%," which provides financial support for energy-efficient upgrades. This convergence of innovation and sustainability

Expansion into Emerging Markets within Europe

Eastern European countries, such as Poland, Romania, and Hungary, represent untapped potential for the Europe air conditioner market. These regions are witnessing rapid industrialization and urbanization, leading to increased demand for cooling solutions. This growth translates into heightened demand for air conditioners in residential and commercial segments. The manufacturers can penetrate these emerging markets effectively by establishing localized distribution networks and offering cost-effective solutions.

MARKET CHALLENGES

Supply Chain Disruptions and Material Shortages

Supply chain disruptions and material shortages pose significant challenges to the Europe air conditioner market. The ongoing semiconductor shortage has impacted the production of smart air conditioners, which rely on advanced sensors and control systems. According to the European Semiconductor Industry Association, lead times for critical components have increased by 40% since 2021, delaying project timelines. Additionally, rising steel and copper prices are driven by geopolitical tensions, have escalated manufacturing costs. The European Steel Association reports that raw material prices surged by 25% in 2022 by affecting air conditioner production. These disruptions are compounded by logistical bottlenecks in cross-border shipments. As a result, manufacturers face delays and increased expenses by hindering their ability to meet growing demand. Addressing these supply chain vulnerabilities is crucial for sustaining market growth.

Intense Price Competition Among Manufacturers

Intense price competition among manufacturers is another challenge for the Europe air conditioner market. The market is highly fragmented, with numerous players vying for market share in the budget segment. Additionally, the prevalence of counterfeit products exacerbates the issue, as they flood the market with low-cost alternatives that compromise quality. This competitive environment forces manufacturers to balance affordability with innovation is straining resources.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.34% |

|

Segments Covered |

By Product Type, End-users, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe. |

|

Market Leaders Profiled |

Panasonic, LG Electronics, Mitsubishi Corporation, Haier Electronics Group Co., Ltd, Sharp Corporation, Daikin Industries Ltd., Samsung Electronics, Hitachi Ltd, Electrolux AB, and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The split and multi-split air conditioners segment was accounted in holding 60.3% of the Europe air conditioner market share in 2024 due to their energy efficiency and adaptability to diverse living spaces, particularly in urban areas. These systems offer superior cooling performance while consuming up to 40% less energy compared to window units, aligning with stringent EU Ecodesign Directive standards. Additionally, advancements in inverter technology have enhanced their appeal, with models capable of adjusting compressor speeds to optimize energy use.

By End User Insights

The residential applications segment was accounted in holding 70.1% of the Europe air conditioner market share in 2024 owing to the rising temperatures and urbanization trends in metropolitan areas like Madrid and Rome. Additionally, the growing trend of home automation has increased demand for smart air conditioners, which offer remote control and energy monitoring features.

The commercial applications segment is inclined to grow with a CAGR of 9.8% in the foreseen years. This growth is fueled by the expansion of office spaces, retail outlets, and hospitality facilities, particularly in emerging urban hubs. According to the European Commission, commercial construction spending increased by 12% in 2022, driven by economic recovery post-pandemic. High-rise commercial buildings rely heavily on advanced cooling systems, including VRF and centralized units, to ensure efficient temperature regulation. Additionally, the growing emphasis on sustainability has led to the adoption of energy-efficient models.

COUNTRY LEVEL ANALYSIS

Germany led the Europe air conditioner market with 25.4% of share in 2024. The growth of the market in this country is driven by the country’s robust manufacturing base and emphasis on energy-efficient solutions. Europe’s air conditioners demand is growing with a strong focus on inverter-based models that comply with stringent EU Ecodesign Directive standards. The rise of urbanization in cities like Berlin and Munich, has fueled demand for split and multi-split systems in metropolitan areas. Additionally, government incentives for sustainable living, such as subsidies for solar-powered cooling systems, have further propelled adoption.

France air conditioner segment is likely to register a CAGR of 10.5% throughout the forecast period. This growth is fueled by rising temperatures and urbanization trends, compounded by government initiatives like "Plan de Rénovation Énergétique," which promotes energy-efficient appliances. According to the European Centre for Medium-Range Weather Forecasts, France experienced a 30% increase in heatwave frequency over the past decade by driving demand for cooling solutions. Cities like Paris and Lyon are witnessing a surge in installations of VRF systems, which cater to commercial spaces and high-rise residential buildings.

Italy is also one of the top-performing markets for air conditioners in Europe owing to its warm Mediterranean climate and strong demand for residential cooling. The Italian National Institute of Statistics notes that approximately 40% of households now utilize air conditioning, a figure that has grown steadily with rising summer temperatures. Italy’s hospitality and tourism sector also drives demand, with hotels and resorts prioritizing cooling systems to enhance guest comfort. Government incentives for energy-efficient models under Italy’s Ecobonus program further boost adoption. Italy’s importance lies in balancing energy-efficient practices with increasing demand, making it a vital contributor to Europe’s air conditioner market expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the europe air conditioners market include Panasonic, LG Electronics, Mitsubishi Corporation, Haier Electronics Group Co., Ltd, Sharp Corporation, Daikin Industries Ltd., Samsung Electronics, Hitachi Ltd and Electrolux AB.

The Europe air conditioner market is highly competitive, characterized by the presence of global leaders like Daikin, Mitsubishi Electric, and LG, alongside regional players offering cost-effective solutions. Global players leverage innovation by offering advanced technologies such as IoT-enabled systems, predictive maintenance, and energy-efficient models. Regional players compete on price and customization, targeting niche segments like low-income households and small-scale commercial projects. The market’s fragmentation intensifies competition is prompting manufacturers to differentiate through value-added services like extended warranties and rapid installation timelines. Stringent environmental regulations and the rise of smart homes have shifted focus toward sustainable solutions is creating opportunities for innovation. Collaborations with governments ensure stable demand, while investments in R&D drive technological advancements.

Top Players in the Market

Daikin dominates the Europe air conditioner market with its innovative solutions, such as VRV (Variable Refrigerant Volume) systems and IoT-enabled models, cater to both residential and commercial segments, enhancing its global presence. Daikin’s commitment to sustainability is evident in its development of solar-powered air conditioners, which reduce energy consumption by up to 60%. Daikin’s focus on energy efficiency aligns with Europe’s green building initiatives will propel its position in the marketplace. The company’s strategic partnerships with governments and developers ensure compliance with stringent environmental regulations, while its localized production facilities enhance accessibility.

Mitsubishi Electric is known for its energy-efficient models, the company targets urbanization trends, particularly in emerging markets like Eastern Europe. Mitsubishi’s VRF systems, which provide zoned cooling and heating solutions, are highly sought after in commercial applications. The company’s focus on innovation is coupled with localized distribution networks, ensures consistent demand across Europe.

LG focus on smart home integration and sustainability strengthens its position globally. LG’s dual-inverter technology and IoT-enabled features appeal to modern consumers seeking convenience and energy savings. The company’s acquisition of a Polish manufacturer in 2023 expanded its production capacity by enabling it to meet growing demand in Eastern Europe.

Top strategies used by the key market participants

Key players employ diverse strategies to maintain their competitive edge in the Europe air conditioner market. Product innovation remains a cornerstone, with companies investing heavily in energy-efficient technologies, IoT-enabled systems, and renewable energy-compatible solutions. For instance, Daikin’s solar-powered air conditioners and Mitsubishi Electric’s VRF systems exemplify this trend. Geographic expansion is another critical strategy, with manufacturers targeting emerging markets in Eastern Europe to capitalize on urbanization trends. Strategic partnerships with governments and developers ensure compliance with environmental regulations, while collaborations with retailers enhance accessibility. Companies also invest in digital platforms, such as AR tools and online stores, to streamline customer engagement and boost sales. Mergers and acquisitions consolidate market positions by enabling access to new technologies and customer bases.

RECENT HAPPENINGS IN THE MARKET

- In March 2023 , Daikin launched a new line of solar-powered air conditioners in Germany, reducing energy consumption by 60%. This initiative strengthened its position in the sustainability segment by aligning with Europe’s green building initiatives.

- In June 2023 , Mitsubishi Electric partnered with a French developer to supply VRF systems for a smart city project in Lyon. This collaboration enhanced its technological portfolio and positioned Mitsubishi as a leader in intelligent cooling solutions.

- In September 2023 , LG acquired a Polish manufacturer, expanding its production capacity in Eastern Europe. This move enabled the company to meet growing demand in emerging markets while reducing logistical bottlenecks.

- In November 2023 , Carrier introduced a predictive maintenance system in Spain, targeting commercial high-rise projects. This innovation reduced downtime by 50%, appealing to property developers and facility managers.

- In January 2024 , Bosch launched an online platform for aftermarket services in Italy, improving accessibility and customer engagement. This platform streamlined maintenance scheduling and spare parts procurement by enhancing customer satisfaction and loyalty.

MARKET SEGMENTATION

This research report on the European air conditioner market has been segmented and sub-segmented based on product type, end-users, and region.

By Product Type

- Split

- Window

- Portable

By End-users

- Commercial

- Industrial

- Residential

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current size of the Europe air conditioners market?

The Europe air conditioners market is valued in the billions and continues to grow steadily, driven by climate change, rising temperatures, and increased urbanization.

Which countries in Europe have the highest demand for air conditioners?

Southern European countries like Spain, Italy, and Greece see the highest demand due to warmer climates. Northern countries are catching up due to shifting weather patterns.

What types of air conditioners are most popular in Europe?

Split air conditioners, portable AC units, and energy-efficient HVAC systems are the most in demand, especially for residential and commercial use.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]