Europe Air Ambulance Services Market Size, Share, Trends & Growth Forecast Report By Type (Rotary Wing, Fixed Wing), Model and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Air Ambulance Services Market Size

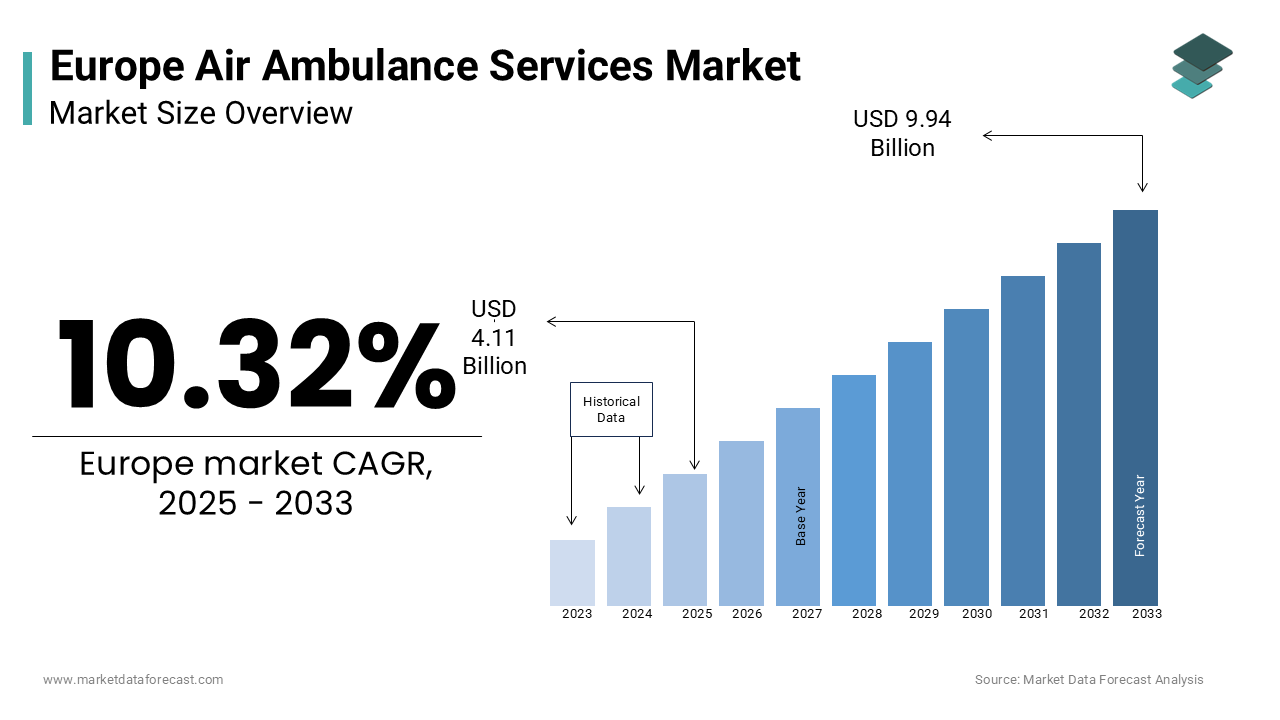

The europe air ambulance services market was worth USD 4.11 billion in 2024. The European market is estimated to grow at a CAGR of 10.32% from 2025 to 2033 and be valued at USD 9.94 billion by the end of 2033 from USD 4.53 billion in 2025.

The air ambulance services market in Europe includes the provision of medical transportation via helicopters and fixed-wing aircraft, designed to deliver critical care to patients in remote or inaccessible areas, during emergencies, or for inter-hospital transfers. These services are equipped with advanced medical equipment and staffed by specialized teams, including paramedics, nurses, and doctors, ensuring high-quality care during transit.

The rising prevalence of chronic diseases, road accidents, and natural disasters has heightened the need for efficient emergency medical services. The World Health Organization (WHO) states that road traffic injuries account for over 120,000 deaths annually in Europe, exhibiting the importance of timely medical interventions. Additionally, the European Aviation Safety Agency (EASA) shows that over 40% of air ambulance missions involve inter-hospital transfers, reflecting their role in facilitating access to specialized treatments. Technological advancements, such as GPS navigation systems and telemedicine integration, have further enhanced the capabilities of air ambulances, enabling real-time communication between onboard teams and hospital staff.

Government initiatives promoting emergency healthcare infrastructure, coupled with the growing aging population, are also driving market growth. As Europe prioritizes reducing emergency response times and improving patient outcomes, air ambulance services are becoming an indispensable component of the region’s healthcare ecosystem, ensuring equitable access to critical care across urban and rural areas alike.

MARKET DRIVERS

Increasing Prevalence of Chronic Diseases and Cardiovascular Emergencies

The rising burden of chronic diseases and particularly cardiovascular conditions are a significant driver of the Europe air ambulance services market. According to the report by European Society of Cardiology, cardiovascular diseases cause 3.9 million deaths annually in Europe, accounting for 45% of all deaths. This alarming statistic underscores the need for rapid medical interventions, which air ambulances are uniquely equipped to provide. The European Commission reveals that emergency medical services, including air ambulances, have improved survival rates by up to 25% in critical cases. With an aging population and increasing urbanization, the demand for swift medical transport continues to grow. The World Health Organization states that timely access to advanced care can reduce heart attack fatalities by 50%, emphasizing the life-saving potential of air ambulances in managing such emergencies.

Rising Incidence of Road Traffic Accidents

The growing number of road traffic accidents across Europe is another key factor propelling the air ambulance services market. Eurostat states that there were approximately 25,100 road accident fatalities in the EU in 2021, with many more severe injuries requiring urgent medical attention. Air ambulances play a pivotal role in reducing response times, particularly in rural or hard-to-reach areas. The European Automobile Manufacturers' Association observes that air ambulance services can cut emergency response times by up to 75% and is significantly improving patient outcomes. Nearly 30% of Europe's population lives in rural regions where ground transport may be inadequate, making air ambulances indispensable. The European Emergency Number Association emphasizes that integrating air ambulances into emergency response systems has enhanced trauma care efficiency, saving countless lives annually and highlighting their critical role in managing road accident emergencies.

MARKET RESTRAINTS

High Operational Costs and Financial Constraints

The high operational costs associated with air ambulance services pose a significant restraint to the Europe air ambulance market. The European Commission stresses that maintaining helicopters and fixed-wing aircraft along with advanced medical equipment can cost between €2,000 and €5,000 per flight hour. These expenses often translate into high service charges for patients, making air ambulances inaccessible for many. According to Eurostat, approximately 8% of Europeans lack health insurance coverage that includes emergency air transport, further limiting access. Additionally, the European Association of Aerospace Industries observes that fuel costs, which account for nearly 30% of operational expenses, have risen by 15% in recent years due to global supply chain disruptions. This financial burden restricts the expansion of air ambulance networks, particularly in economically disadvantaged regions, hindering equitable access to critical care.

Regulatory Challenges and Fragmented Policies

Regulatory challenges and fragmented policies across European countries significantly hinder the growth of the air ambulance services market. The European Aviation Safety Agency (EASA) mandates strict safety and operational standards, which, while ensuring quality, increase compliance costs for operators. A report by the European Parliament reveals that differing national regulations create logistical barriers, especially during cross-border operations, where permits and clearances can delay emergency responses by up to 40%. Furthermore, the Organisation for Economic Co-operation and Development (OECD) points out that inconsistent reimbursement policies for air ambulance services lead to financial uncertainty for providers. For instance, only 60% of EU member states have standardized reimbursement frameworks, leaving operators vulnerable to revenue losses. These regulatory complexities impede seamless service delivery and market expansion across Europe.

MARKET OPPORTUNITIES

Integration of Advanced Technologies and Telemedicine

The integration of advanced technologies, including telemedicine, presents a significant opportunity for the Europe air ambulance services market. The European Commission highlights that incorporating real-time patient monitoring systems and telemedicine capabilities can improve survival rates by up to 30% in critical cases. These technologies enable remote consultations with specialists during transit, ensuring timely interventions. According to Eurostat, over 70% of European hospitals now have telemedicine infrastructure, facilitating seamless coordination with air ambulance services. Additionally, the European Space Agency emphasizes the role of satellite navigation systems like Galileo, which enhance route optimization and reduce response times by 20%. With an estimated €1 billion investment in digital health technologies across Europe by 2025, as reported by the European Investment Bank, air ambulance operators can leverage these advancements to expand their service reach and improve operational efficiency.

Rising Demand for Cross-Border Medical Evacuations

The growing demand for cross-border medical evacuations offers another key opportunity for the Europe air ambulance services market. The European Union Aviation Safety Agency (EASA) reports that cross-border medical flights have increased by 15% annually over the past five years which is driven by the rise in international travel and medical tourism. The European Travel Commission estimates that over 50 million Europeans traveled abroad for medical treatment in 2022 and is creating a niche for specialized air ambulance services. Furthermore, the World Health Organization states that standardized protocols for cross-border medical transport could reduce evacuation delays by 40% and is improving patient outcomes. With the European Parliament advocating for harmonized regulations to facilitate smoother cross-border operations, air ambulance providers are well-positioned to capitalize on this growing trend and expand their networks across the continent.

Limited Infrastructure in Remote and Rural Areas

A significant challenge for the Europe air ambulance services market is the lack of adequate infrastructure in remote and rural areas. The European Commission reports that nearly 30% of Europe’s population resides in rural regions where helipads and landing zones are often unavailable or poorly maintained. This limits the accessibility of air ambulances during emergencies, particularly in mountainous or island regions. Eurostat found that only 45% of rural hospitals in the EU are equipped with facilities to support air ambulance operations and is creating logistical bottlenecks. Additionally, the European Environment Agency observes that adverse weather conditions, such as fog and heavy snowfall, further restrict air ambulance operations in these areas by up to 25% annually. These infrastructure gaps hinder timely medical interventions, exacerbating health risks for populations in underserved regions.

Workforce Shortages and Training Gaps

Workforce shortages and training gaps pose another critical challenge to the Europe air ambulance services market. The European Centre for Disease Prevention and Control (ECDC) focuses that there is a growing demand for specialized medical personnel trained in aeromedical care, yet only 10% of paramedics and doctors in Europe receive formal aeromedical training. This shortage is compounded by an aging workforce, with the European Commission estimating that 35% of healthcare professionals will retire by 2030. Furthermore, the European Association of Aerospace Industries lack that recruiting pilots with both aviation and medical emergency expertise remains a persistent issue, with only 500 qualified pilots available for air ambulance operations across the continent. These workforce challenges strain service delivery and limit the scalability of air ambulance networks in Europe.

SEGMENTAL ANALYSIS

By Type Insights

The Rotary wing air ambulances held the largest market share at 65.4% in 2024 due to their unmatched ability to access remote and confined areas. The European Aviation Safety Agency (EASA) shows that helicopters perform over 100,000 emergency missions annually in Europe, with a significant presence in mountainous regions like the Alps, where they account for 80% of rescues. Their vertical take-off and landing capabilities make them indispensable for time-sensitive emergencies. Despite high operational costs of €3,500 per flight hour, their versatility ensures dominance. The European Commission notes that rural areas, home to 30% of Europe’s population, rely heavily on rotary wing services, underscoring their critical role in saving lives.

The Fixed wing air ambulances segment is outpacing all others in growth, with a CAGR of 7.5% from 2025 to 2033. This growth is driven by rising demand for long-distance medical evacuations and cross-border repatriations, particularly among medical tourists, who account for 60% of fixed wing usage. The World Health Organization emphasizes their importance in transporting patients requiring advanced life support over distances exceeding 1,000 kilometers. With increasing international travel and medical tourism projected to grow by 10% annually, fixed wing aircraft are pivotal for intercontinental transfers. Their ability to integrate advanced medical equipment further solidifies their rapid expansion in the European market.

By Model Insights

The Hospital-based air ambulances segment dominated the market by holding a 60.8% share in 2024. Their integration with hospitals allows for rapid access to advanced medical facilities, reducing patient transfer times by up to 40%, according to the European Society of Intensive Care Medicine. In Germany alone, hospital-based fleets conduct over 25,000 missions annually, ensuring timely specialized care. Eurostat states their effectiveness in urban areas, where hospitals are densely located, enabling efficient emergency responses. This model’s ability to provide immediate access to critical care resources makes it indispensable. However, its reliance on hospital infrastructure limits flexibility in rural regions, underscoring the need for complementary models in underserved areas.

The Community-based air ambulances segment is the market's growth engine, with a highest CAGR of 8.2% from 2025 to 2033, . These models are crucial in rural and remote areas, where hospital-based services are scarce. Eurostat exhibited that community-based operations handle nearly 40% of missions in such regions, with Scandinavia relying on them for 70% of air ambulance needs. The European Commission observes they reduce response times by up to 50% in isolated areas, addressing critical gaps in healthcare access. Rising demand for equitable emergency services and increasing rural populations drive this growth, making community-based models vital for ensuring timely medical care across Europe’s diverse landscapes.

REGIONAL ANALYSIS

Germany led the Europe air ambulance services market with a 25.6% share in 2024. The country’s advanced healthcare infrastructure, including over 2,000 hospitals, supports its hospital-based air ambulance model, which handles more than 25,000 missions annually. The German Aerospace Center reveals that Germany’s dense network of helipads and landing zones ensures rapid response times, particularly in urban areas. Additionally, Eurostat draws attention on the fact that Germany’s aging population with over 21% aged 65 or above, drives demand for emergency medical services. The integration of cutting-edge technologies like satellite navigation further enhances operational efficiency. These factors, combined with strong government support for emergency care, solidify Germany’s leadership in the regional market.

The United Kingdom holds a significant market share and is growing at a CAGR of 7.2% in the forecast period. The National Health Service (NHS) plays a pivotal role in expanding air ambulance services, with over 30,000 missions conducted annually. The UK Civil Aviation Authority emphasizes that the country’s strategic use of both rotary and fixed-wing aircraft ensures comprehensive coverage, from rural Scotland to urban London. Furthermore, the British Helicopter Advisory Board reports that investments in telemedicine and real-time patient monitoring have improved survival rates by 30%. The UK’s focus on cross-border medical evacuations, particularly for repatriation cases, also boosts growth. These initiatives, coupled with public-private partnerships, position the UK as a leader in air ambulance innovation.

Switzerland exhibits a notable growth rate. The country’s mountainous terrain necessitates air ambulance services, with helicopters accounting for 80% of rescues in the Alps, according to the Swiss Air-Rescue Rega. Switzerland’s community-based air ambulance model is highly effective, serving remote and isolated regions where ground transport is impractical. The European Environment Agency reveals that Switzerland’s investment in all-weather capable aircraft ensures year-round operations despite challenging weather conditions. Additionally, the Swiss healthcare system’s emphasis on rapid emergency response has reduced mortality rates by 25% in critical cases. These factors, along with high public awareness and funding, reinforce Switzerland’s leading position in the market.

MARKET SEGMENTATION

This research report on the europe air ambulance services market is segmented and sub-segmented based on categories.

By Type

- Rotary Wing

- Fixed Wing

By Model

- Hospital-based

- Community-based

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the challenges in the European Air Ambulance Services market?

Challenges include high operational costs, regulatory and safety standards compliance, the need for highly trained medical staff, and the limited availability of air ambulance services in some rural or remote areas.

What is the future outlook for the Air Ambulance Services market in Europe?

The market is expected to grow as demand for fast medical transport increases, technological advancements improve service quality, and healthcare access expands, particularly in underserved areas.

How do healthcare policies in Europe influence the Air Ambulance Services market?

European healthcare policies supporting emergency medical care and patient transportation contribute to the growth of air ambulance services, with reimbursement programs and regulations ensuring the services meet high safety and quality standards.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]