Europe Artificial Intelligence (AI) Market Size, Share, Trends, & Growth Forecast Report By Offering, Technology, Business Function, Deployment Mode, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe), Industry Analysis From 2024 to 2033

Europe Artificial Intelligence (AI) Market Size

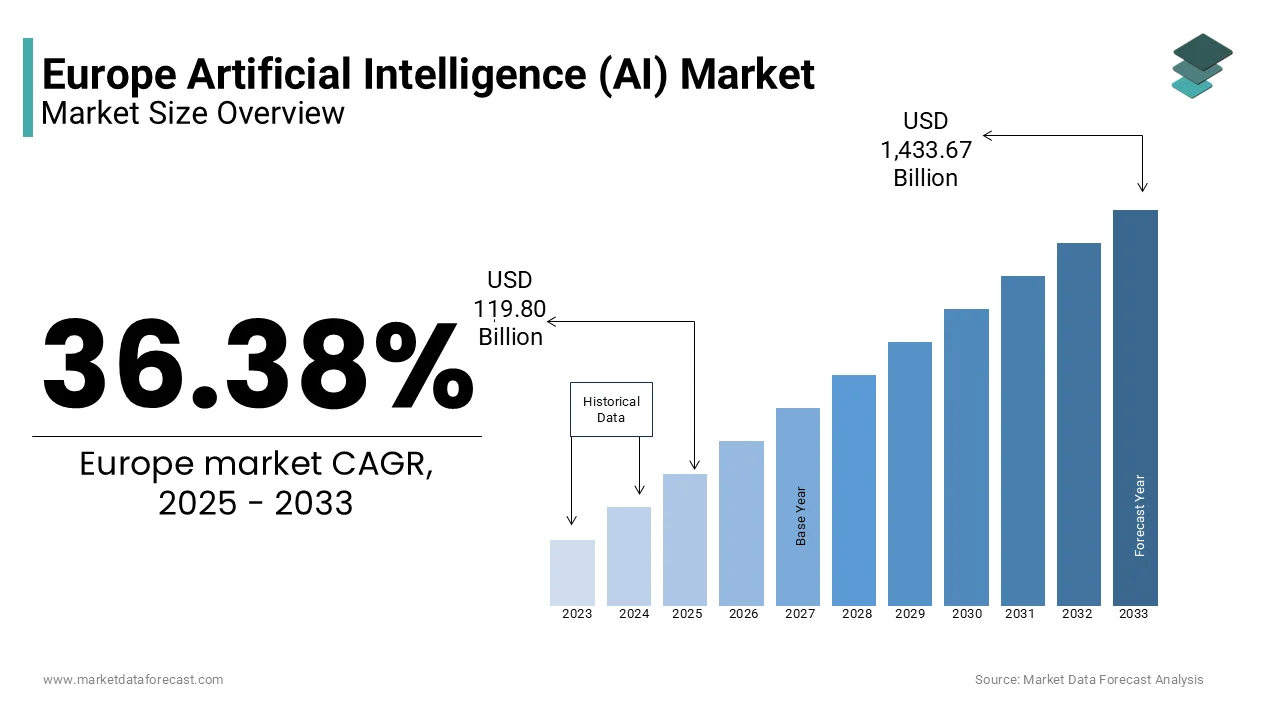

The Europe Artificial Intelligence AI market size was worth USD 87.84 billion in 2024. The Europe market is expected to be worth USD 1,433.67 billion by 2033 from USD 119.80 billion in 2025, growing at a CAGR of 36.38% during the forecast period 2025 to 2033.

Artificial intelligence is rapidly embedding itself into the fabric of Europe’s technological and economic landscape, with its presence felt across industries such as healthcare, automotive, finance, and manufacturing. According to a study by McKinsey, AI adoption in Europe has grown by over 50% since 2020, driven by increased investment in digital transformation and supportive government policies. The European Commission estimates that AI could add up to €2.7 trillion annually to the continent’s economy by 2030 if leveraged effectively.

The regulatory environment is shaping the European AI market significantly, with the EU’s Artificial Intelligence Act setting benchmarks for ethical AI development. As per PwC, over 70% of European businesses are prioritizing explainable AI systems to comply with these regulations while addressing consumer trust concerns. Meanwhile, startups in Scandinavia and the Netherlands are pioneering innovations in natural language processing and autonomous systems, attracting venture capital funding exceeding €5 billion in 2023. However, challenges remain, including a shortage of skilled AI professionals and regional disparities in adoption rates. Eastern Europe, for instance, lags behind due to limited infrastructure, despite showing potential for growth.

MARKET DRIVERS

Increasing Demand for Automation in Europe

The rising demand for automation across industries is one of the most significant drivers propelling the Europe AI market growth. According to Eurostat, over 70% of European manufacturing firms have adopted AI-powered automation tools to enhance operational efficiency and reduce labor costs. For instance, in Sweden, automotive giant Volvo has implemented AI-driven robotic systems that improved production efficiency by 30%, as per the Swedish Automobile Industry Association. This trend is further amplified by the need to address workforce shortages and optimize resource allocation. According to a study by Deloitte, AI-driven automation reduces operational costs by 25% while improving accuracy and scalability. Additionally, the integration of AI in supply chain management has enabled real-time tracking and predictive maintenance, addressing previous inefficiencies.

Rising Investments in AI Research and Development

The surge in investments in AI research and development that has accelerated innovation and commercialization is driving the European AI market expansion. According to the European Investment Bank, venture capital funding for AI startups in Europe exceeded USD 10 billion in 2022, reflecting investor confidence in the sector. For example, in France, companies like Deepomatic have secured substantial funding to develop AI solutions for industrial applications, as per the French Tech Council. Government initiatives have further bolstered this trend. As per the European Commission, the EU’s Horizon Europe program allocates USD 20 billion annually to support AI innovation, fostering collaboration between academia and industry. Additionally, cross-border partnerships have enabled knowledge-sharing and technological advancements, ensuring sustained growth.

MARKET RESTRAINTS

High Implementation Costs

One of the primary restraints hindering the Europe AI market is the high cost associated with implementing advanced AI solutions. According to PwC, deploying enterprise-grade AI systems can cost between USD 1 million and USD 5 million, depending on the scale and complexity. This financial burden is particularly challenging for small and medium-sized enterprises (SMEs), which account for over 90% of businesses in Europe, as per Eurostat. For instance, in Italy, a survey by the Italian Chamber of Commerce revealed that 60% of SMEs cite budget constraints as the main barrier to adopting AI technologies. While larger organizations can absorb these costs, smaller entities often struggle to justify the investment, leaving them at a competitive disadvantage. Furthermore, the recurring expenses associated with software updates, hardware maintenance, and employee training add to the financial strain, limiting the market’s accessibility.

Talent Shortage and Skill Gaps

The acute shortage of skilled AI professionals is further hindering the growth of the European AI market. According to a study by ISC², Europe faces a shortfall of over 500,000 AI experts, with demand outpacing supply by 40%. This talent gap hampers organizations’ ability to effectively implement and manage AI solutions, leading to operational inefficiencies. The European Cyber Security Organisation (ECSO) highlights that this shortage is exacerbated by the rapid evolution of AI technologies, which requires continuous upskilling. For example, in Germany, only 30% of IT professionals possess the expertise needed to address advanced AI challenges, as per Bitkom Research. Additionally, the lack of standardized training programs across the region complicates efforts to bridge this gap. These challenges not only hinder market growth but also increase reliance on external service providers, raising operational costs.

MARKET OPPORTUNITIES

Adoption of Generative AI

The integration of generative AI into various applications is a major opportunity for the Europe AI market. According to Gartner, generative AI tools are expected to account for 20% of all AI-related revenue by 2025, enabling organizations to create content, designs, and simulations autonomously. For instance, in the UK, companies like DeepMind are leveraging generative AI to develop innovative solutions for drug discovery and material science, as per the British AI Association. The rising emphasis on creativity and personalization is also favouring this trend. As per McKinsey & Company, generative AI can reduce content creation time by 50% while enhancing quality and relevance. Additionally, industries like advertising and media are adopting generative AI to produce hyper-personalized campaigns, driving consumer engagement. These innovations highlight the immense potential of generative AI to revolutionize traditional workflows and unlock new revenue streams.

Expansion of AI in Healthcare

The growing adoption of AI in healthcare, driven by the need for precision medicine and operational efficiency, is another promising opportunity in the European AI market. According to Statista, the European healthcare AI market is projected to grow at a CAGR of 35% through 2030, with applications ranging from diagnostics to patient care. For example, in Switzerland, hospitals are using AI-powered diagnostic tools to detect diseases like cancer with 95% accuracy, as per the Swiss HealthTech Association. According to the European Environment Agency, AI solutions can reduce diagnostic errors by 30% while optimizing resource allocation. Additionally, regulatory frameworks like the EU’s Medical Device Regulation (MDR) mandate stringent safety measures, further boosting demand for AI-driven innovations. These developments underscore the transformative potential of AI to address emerging challenges in healthcare.

MARKET CHALLENGES

Ethical and Regulatory Concerns

The ethical and regulatory scrutiny surrounding AI technologies is one of the major challenges to the growth of the European artificial intelligence market. According to ENISA, over 40% of European consumers express concerns about data privacy and algorithmic bias, undermining trust in AI-driven solutions. For instance, in France, a major retailer faced backlash after its AI-based hiring tool was found to favor male candidates, highlighting the risks of unchecked AI deployment, as per the French Data Protection Authority. This apprehension is exacerbated by the lack of standardized ethical guidelines across member states. As per the European Commission, the proposed AI Act aims to establish a unified regulatory framework, creating additional layers of complexity for businesses. Furthermore, compliance with GDPR requirements limits the scope of data usage, posing a significant obstacle for market participants striving to innovate responsibly.

Fragmented AI Ecosystems

The fragmented nature of AI ecosystems that hinders seamless integration and collaboration is also challenging the growth of the European AI market. According to Accenture, over 60% of European organizations use multiple, incompatible AI tools, leading to inefficiencies and gaps in protection. For example, in Germany, a survey by Bitkom revealed that 45% of companies struggle to unify their AI operations due to disparate systems. The lack of interoperability complicates efforts to achieve end-to-end visibility and real-time threat intelligence sharing. As per the European Cyber Security Organisation (ECSO), this fragmentation is exacerbated by varying regulatory requirements across member states, which create additional layers of complexity. Furthermore, the absence of standardized protocols for information sharing limits the effectiveness of collaborative defense mechanisms. These challenges underscore the need for greater harmonization and integration within the AI ecosystem.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

36.38% |

|

Segments Covered |

By Offering, Technology, Business Function, End Use, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Microsoft Corporation, Google Inc., IBM, Oracle Corporation, Apple Inc., Amazon Web Services, SAP, Salesforce, Cisco, Meta (Facebook), Intel Corp, H2O.ai., Hewlett Packard Enterprise, Siemens AG, Huawei, NVIDIA, OpenAI, SAS Institute, Baidu, Alibaba Cloud, AIBrain, Lumen5, Advanced Micro Devices, Iris.ai AS, Lifegraph, Sensely, Inc., and DiDi Global. |

SEGMENTAL ANALYSIS

By Offering Insights

The software segment dominated the market by holding 54.7% of the European AI market share in 2024. The leading position of software segment in the European market can be credited to the increasing demand for AI-powered software solutions, particularly among SMEs struggling to build in-house capabilities. For instance, in the UK, over 70% of small businesses rely on third-party providers for AI-driven threat detection and incident response, as per TechUK. The scalability and cost-effectiveness of outsourced solutions are further boosting the growth of the software segment in the European AI market. As per IDC, AI software reduces operational costs by 30% while enhancing threat visibility and response times. Additionally, the growing complexity of cyber threats has created a niche for specialized software, such as penetration testing and compliance audits.

The services segment is projected to witness the fastest CAGR of 30.9% over the forecast period owing to the increasing adoption of managed AI services and professional consulting, particularly in industries undergoing digital transformation. For example, in Sweden, companies like Ericsson are partnering with AI service providers to develop tailored solutions for hybrid cloud environments. The growing complexity of AI ecosystems that necessitates expert guidance is also supporting the expansion of the services segment in the European market. According to Eurostat, over 50% of European organizations cite integration challenges as a barrier to effective AI implementation, driving demand for professional services. Furthermore, the growing emphasis on compliance has spurred investments in risk assessments and audit services.

By Technology Insights

The machine learning segment led the Europe AI market by accounting for 41.7% of the European market share in 2024. The growth of the machine learning segment in the European market is driven by its versatility and applicability across diverse industries, from healthcare to finance. For instance, in Germany, over 80% of financial institutions use machine learning algorithms for fraud detection and credit scoring, as per the German Banking Association. The growing availability of large datasets and computational power that enable more accurate predictions and insights is also driving the growth of the machine learning segment in the European market. According to Eurostat, machine learning solutions reduce operational inefficiencies by 25% while improving decision-making processes. Additionally, advancements in deep learning have further enhanced the capabilities of machine learning models, ensuring sustained demand.

By Business Function Insights

The sales and marketing segment occupied 31.8% of the European market share in 2024. The dominance of sales and marketing segment in the European market is driven by the growing demand for AI-driven tools to enhance customer engagement and optimize marketing campaigns. For instance, in the UK, over 60% of retailers use AI-powered analytics to personalize product recommendations, as per the British Retail Consortium. The growing emphasis on data-driven strategies is also fuelling the growth of the sales and marketing segment in the European AI market. According to Nielsen, AI solutions improve customer retention rates by 20% while reducing marketing costs by 15%. Additionally, the integration of predictive analytics has enabled businesses to anticipate consumer behavior, ensuring sustained demand.

By End Use Insights

Based on end-use, the Healthcare segment is projected to elevate with a considerable growth rate during the forecast period in the European AI market. The ageing population and growing healthcare demand are taking the segment forward. AI has huge potential to increase accessibility, efficiency and diagnosis accuracy in considering the ageing population and rising demand for high quality healthcare. Other factors boosting the segment are drug discovery and development, robot assisted surgery and medical imaging analysis.

REGIONAL ANALYSIS

Germany is a technological powerhouse in the European AI landscape and accounted for leading share of 26.9% of the regional market in 2024. The robust industrial base and leadership of Germany in automotive, manufacturing, and healthcare sectors of Europe is majorly driving the leading position of Germany in the European market. According to the German Federal Ministry for Economic Affairs, over 60% of German companies have integrated AI into their operations, particularly for predictive maintenance and automation. Berlin and Munich are hubs for innovation, hosting startups like Celonis and global giants like Siemens, which invest heavily in AI-driven solutions. Germany’s government has allocated €3 billion under its AI Strategy 2023 to foster research and development. The country also leads in ethical AI adoption, with 70% of organizations prioritizing transparency, as per PwC. Furthermore, Germany’s strong emphasis on workforce upskilling ensures a steady pipeline of AI talent, addressing skill gaps.

UK is a hub for AI research and entrepreneurship and held a substantial share of the European market in 2024. London, Cambridge, and Edinburgh are pivotal centers for AI innovation in the UK market. The country boasts world-class universities and research institutions, such as the Alan Turing Institute, driving advancements in machine learning and natural language processing. Startups like DeepMind and BenevolentAI have gained international acclaim, attracting over £4 billion in venture capital funding since 2020. The UK government’s National AI Strategy emphasizes fostering collaboration between academia and industry while ensuring ethical deployment. Additionally, the financial services sector accounts for 30% of AI applications, particularly in fraud detection and algorithmic trading. Despite challenges like Brexit-related talent shortages, the UK remains a leader in AI entrepreneurship.

France is a pioneer in ethical and sustainable AI in the European market and occupied a considerable share of the European market in 2024. Paris and Lyon are key hubs, where AI startups like Dataiku and Criteo thrive alongside global corporations. The government initiatives in France such as the AI for Humanity plan that allocated €1.5 billion to AI research are driving the French market growth. France leads in ethical AI adoption, with 65% of businesses implementing frameworks to ensure fairness and transparency, as per Deloitte. The healthcare sector dominates AI applications, with tools for diagnostics and personalized medicine gaining traction. Moreover, France’s focus on sustainability aligns with EU goals, encouraging green AI solutions. Despite slower adoption in rural areas, urban centers drive innovation. By emphasizing ethics and sustainability, France carves out a unique niche in Europe’s AI market.

Sweden is a notable market for AI in the European region. Known for its tech-savvy population, Sweden’s AI sector was valued at €3 billion in 2023, according to the Swedish Innovation Agency. Stockholm is a hotspot for AI startups like Klarna and iZettle, supported by a thriving fintech ecosystem. Over 50% of Swedish companies utilize AI for customer experience enhancement and operational efficiency. The government’s Digitalization Commission promotes AI adoption while ensuring data privacy compliance. Sweden’s strong emphasis on digital infrastructure, with 95% of households having high-speed internet, accelerates AI integration. Additionally, the country’s commitment to sustainability drives AI applications in energy optimization and smart city development. Despite its small size, Sweden punches above its weight in innovation. By fostering collaboration and embracing digitalization, Sweden continues to emerge as a dynamic player in Europe’s AI market.

The Netherlands is likely to hold a prominent CAGR in the European AI market over the forecast period. Amsterdam and Eindhoven are key contributors, with the AI sector valued at €2.5 billion in 2023, as per the Dutch AI Coalition. The country serves as a gateway for AI innovation, attracting multinational corporations like Philips and ASML, which leverage AI for advanced manufacturing and healthcare solutions. Over 40% of Dutch businesses have adopted AI tools, particularly in logistics and agriculture, driven by the Netherlands’ role as a global trade hub. Government initiatives, such as the NL AI Strategy, emphasize public-private partnerships to accelerate adoption. Moreover, the Netherlands excels in AI education, with institutions like TU Delft producing top-tier talent. Despite challenges like regulatory alignment with the EU, the country’s strategic location and innovation-friendly policies ensure steady growth. By bridging technology and trade, the Netherlands maintains its prominence in Europe’s AI market.

TOP PLAYERS IN THE MARKET

The Europe AI market is led by Google DeepMind, SAP, and IBM Europe, each contributing significantly to the European market. Google DeepMind, headquartered in the UK, holds a substantial presence in Europe, offering cutting-edge AI solutions for healthcare, energy, and gaming. According to Statista, DeepMind accounts for over 15% of Europe’s AI research output, reflecting its dominance. SAP, based in Germany, specializes in enterprise AI applications, with a growing footprint in industries like manufacturing and logistics. As per Gartner, SAP’s AI-driven analytics tools command a 20% market share in the enterprise software segment. Meanwhile, IBM Europe is renowned for its Watson AI platform, widely adopted for customer service and data analysis. According to IDC, IBM’s AI solutions account for 12% of the European AI services market. These players collectively drive innovation and set benchmarks for the Europe AI market.

TOP STRATEGIES USED BY KEY PLAYERS

Key players in the Europe AI market employ diverse strategies to strengthen their positions. One prominent strategy is strategic acquisitions. For instance, in March 2023, Google DeepMind acquired a French AI startup specializing in natural language processing to enhance its multilingual capabilities.

Another strategy is collaboration with governments and academic institutions. In June 2023, SAP partnered with the German Research Center for AI (DFKI) to develop AI solutions for sustainable manufacturing. This move aligns with the company’s goal of addressing environmental challenges. Additionally, as per the European Investment Bank, IBM Europe has invested heavily in cloud-based AI platforms to cater to small and medium-sized enterprises. These strategies reflect a commitment to innovation and market leadership.

COMPETITIVE LANDSCAPE

The Europe AI market is characterized by intense competition, with established tech giants and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 25% of the share, fostering a highly dynamic environment. Key players like Google DeepMind and SAP dominate the enterprise segment, while niche players compete aggressively in specialized applications.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, companies like Graphcore are pioneering AI hardware solutions, challenging incumbents in the semiconductor sector. As per the European Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and talent shortages remain critical challenges for all participants, shaping the market’s evolution.

TOP 5 MAJOR ACTIONS BY KEY PLAYERS

- In April 2024, Google DeepMind acquired a Swiss AI research lab specializing in reinforcement learning. This acquisition aimed to expand its expertise in autonomous systems and robotics.

- In May 2024, SAP partnered with the European Space Agency to integrate satellite data into its AI-driven supply chain solutions. This initiative aimed to enhance real-time tracking and predictive analytics capabilities.

- In July 2024, IBM Europe introduced a new AI-powered cybersecurity platform targeting financial institutions. This move aimed to address rising concerns about cyber threats and regulatory compliance.

- In September 2024, Graphcore secured USD 500 million in funding from European investors to scale its AI chip production. This investment aimed to compete with global leaders like NVIDIA and AMD.

- In November 2024, Microsoft Europe launched a campaign promoting its AI ethics framework. This effort aimed to build trust among consumers and regulators by emphasizing transparency and accountability.

MARKET SEGMENTATION

This research report on the European artificial intelligence (AI) market has been segmented and sub-segmented into the following categories.

By Offering

-

Hardware

-

Software

-

Services

By Technology

-

Machine Learning

-

Natural Language Processing

-

Computer Vision

-

Context Awareness

By Business Function

-

Supply Chain Management

-

Finance

-

Law

-

Human Resources

-

Marketing & Sales

-

Service & Operations

-

Security

By End Use

-

Information Technology

-

BFSI

-

Healthcare

-

Automotive

-

Retail & E-commerce

-

Advertising & Media

-

Manufacturing

-

Transportation & Logistics

-

Military & Defense

-

Agriculture

-

Energy & Utilities

-

Telecommunication

-

Others

By Region

-

UK

-

France

-

Spain

-

Germany

-

Italy

-

Russia

-

Sweden

-

Denmark

-

Switzerland

-

Netherlands

-

Turkey

-

Czech Republic

-

Rest of Europe

Frequently Asked Questions

Which European countries are leading contributors to the AI market share?

Leading contributors to the AI market share in Europe include the United Kingdom, Germany, France, Sweden, and the Netherlands, each with a thriving AI ecosystem.

How are European governments supporting the growth of the AI market?

European governments are actively supporting the AI market through initiatives such as funding for research and development, regulatory frameworks, and collaborations between public and private sectors to promote innovation.

What are the key challenges faced by the AI market in Europe?

European countries may face challenges related to infrastructure development, digital literacy, and access to funding. Overcoming these challenges is essential for fostering AI growth in the region.

What impact has the COVID-19 pandemic had on AI adoption in Europe?

The COVID-19 pandemic has accelerated AI adoption in Europe, with increased demand for AI solutions in healthcare, remote collaboration, and supply chain optimization to address pandemic-related challenges.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]