Europe Agriculture Equipment Market Size, Share, Trends & Growth Forecast Report, Segmented By Equipment Type, Application, Automation, Application And By Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Agriculture Equipment Market Size

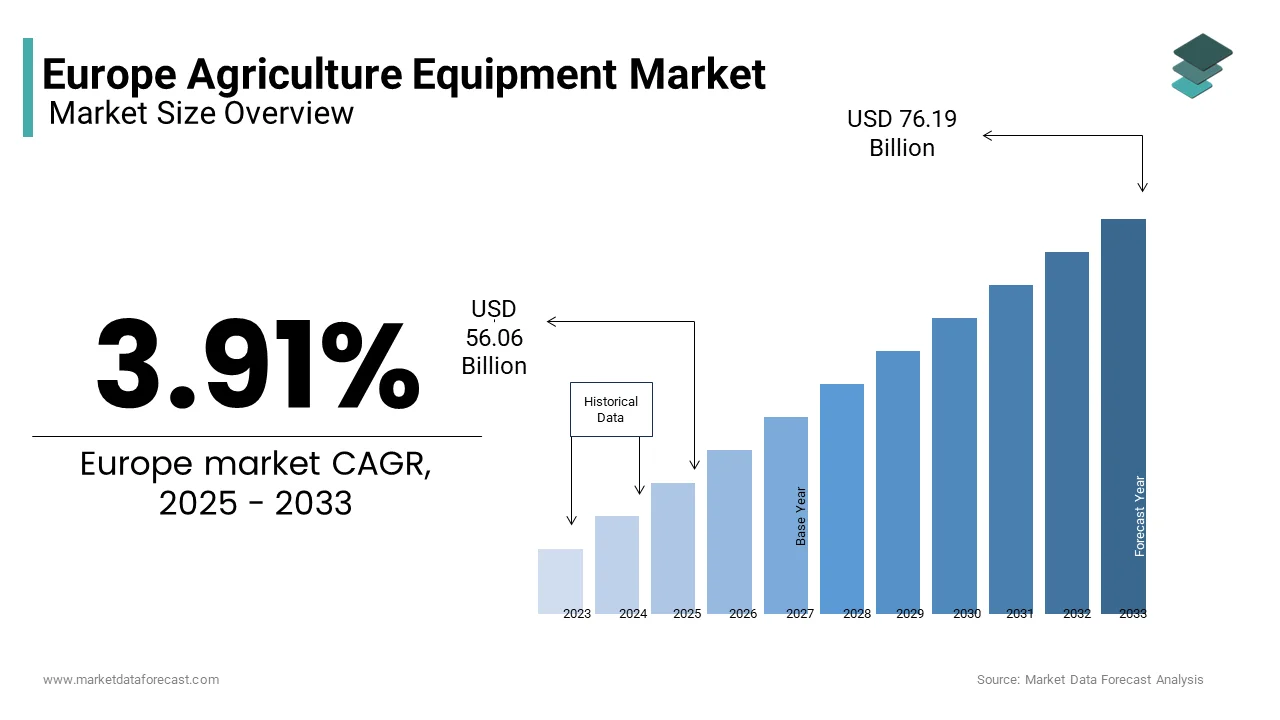

The European agriculture equipment market size was valued at USD 53.95 billion in 2024 and is anticipated to reach USD 56.06 billion in 2025 from USD 76.19 billion by 2033, growing at a CAGR of 3.91% from 2025 to 2033.

Europe is a global leader in agriculture innovation. The advanced technological infrastructure and policies promoting sustainable farming in Europe are driving the expansion of the agricultural equipment market. According to Eurostat, the agriculture sector of Europe accounts for approximately 10% of the global agriculture machinery demand. The Common Agriculture Policy (CAP) of the European Union heavily influences the sector that provides subsidies and support for modernizing farms. Europe has also embraced precision agriculture, where advanced equipment integrated with GPS and IoT technologies optimizes resource usage and enhances yields. As per the European Environment Agency, over 25% of EU farmland is now managed under sustainable practices, and this creates demand for advanced equipment that aligns with environmental goals.

MARKET DRIVERS

Technological Advancements in Precision Agriculture

The integration of advanced technologies such as GPS, sensors, and automation in agriculture equipment is a major driver for the European agriculture equipment market. Precision agriculture allows farmers to optimize resource utilization, improve yields, and minimize waste, meeting the increasing demand for sustainable farming practices. According to the European Environment Agency, over 30% of European farms have adopted some form of precision agriculture, supported by the region's robust technological infrastructure. Countries like Germany and France have led the implementation of IoT-enabled tractors and autonomous harvesters. These innovations reduce labor dependency and enhance productivity, ensuring that farms can meet the rising demand for food in a sustainable and cost-efficient manner.

Supportive Government Policies and Subsidies

Government initiatives and subsidies aimed at modernizing the agricultural sector significantly drive the demand for agriculture equipment in Europe. The European Union’s Common Agriculture Policy (CAP) provides over €50 billion annually to support farmers in adopting modern equipment and sustainable farming methods. According to Eurostat, funding through CAP and other national programs has increased agriculture equipment adoption by 15% between 2020 and 2023. Policies encouraging sustainable and organic farming practices have further fueled the need for advanced equipment, such as energy-efficient tractors and automated irrigation systems. These initiatives not only enhance productivity but also contribute to the long-term sustainability of the agriculture sector in Europe.

MARKET RESTRAINTS

High Initial Investment Costs

The high upfront costs associated with purchasing advanced agriculture equipment act as a significant restraint in the European market. Tractors, harvesters, and precision farming tools equipped with IoT and GPS technologies require substantial financial investment, making them unaffordable for small and medium-sized farms. According to Eurostat, nearly 40% of European farms operate on a small scale, earning less than €25,000 annually, which limits their ability to adopt expensive machinery. Additionally, the maintenance and operational costs of these machines, combined with volatile crop prices, further burden farmers. This financial barrier slows down the widespread adoption of modern equipment and creates a gap between large-scale commercial farms and smaller agricultural operations.

Fluctuating Farm Incomes and Economic Uncertainty

Economic instability and fluctuating farm incomes across Europe hinder investment in advanced agriculture equipment. External factors such as adverse weather conditions, global commodity price volatility, and increasing input costs significantly affect farm revenues. The European Environment Agency highlights that extreme weather events, including droughts and floods, have increased by 20% over the past decade, reducing crop yields and profits for farmers. Moreover, rising energy and raw material costs have elevated production expenses for manufacturers, leading to higher equipment prices. This economic uncertainty discourages farmers from committing to long-term investments in machinery, thereby restricting the growth of the agriculture equipment market.

MARKET OPPORTUNITIES

Rising Demand for Sustainable Farming Practices

The growing emphasis on sustainability in agriculture presents a significant opportunity for the European agriculture equipment market. The European Union’s Green Deal aims to reduce greenhouse gas emissions by 55% by 2030, driving the adoption of eco-friendly farming methods. According to the European Environment Agency, more than 25% of EU farmland is under organic cultivation, and this figure is projected to increase steadily. Advanced equipment such as low-emission tractors and solar-powered irrigation systems is in high demand to support sustainable practices. This trend enables manufacturers to innovate and develop equipment tailored to environmental regulations, positioning the market for growth while aligning with Europe’s sustainability goals.

Increasing Adoption of Smart Farming Technologies

The adoption of smart farming technologies, including automation, robotics, and AI, offers immense opportunities for the European agriculture equipment market. Smart systems improve operational efficiency, reduce resource waste, and enhance yields, making them attractive to farmers. According to Eurostat, the adoption of IoT-enabled equipment and robotic solutions in Europe has grown by 18% annually over the past five years, with Germany and France leading in implementation. Furthermore, European funding programs such as Horizon Europe encourage technological integration in farming by supporting research and development. This increasing shift towards smart technologies provides manufacturers with a lucrative market for advanced agriculture equipment in Europe.

MARKET CHALLENGES

Labor Shortages in the Agricultural Sector

One of the major challenges facing the European agriculture equipment market is the growing labor shortage in the agriculture sector. According to Eurostat, nearly 25% of agricultural jobs in the EU are vacant, with farmers increasingly struggling to find skilled workers. This shortage is compounded by the aging farming population and the migration of young people to urban areas. While advanced machinery can help mitigate this problem, the high cost of adopting such technologies often deters smaller farmers from making the investment. As a result, there is a growing gap between the demand for modern equipment and the ability of farmers to implement it due to insufficient labor availability and financial limitations.

Stringent Environmental Regulations

Stricter environmental regulations across Europe present a challenge for the agriculture equipment market. The European Union has set ambitious targets to reduce carbon emissions, with the European green deal aiming for net-zero emissions by 2050. While this is essential for long-term sustainability, it creates pressure on agriculture machinery manufacturers to develop low-emission, energy-efficient equipment. Compliance with such stringent standards often requires significant investment in R&D, which can increase the overall cost of machinery. According to the European Commission, the transition to greener technologies may slow market growth in the short term as manufacturers work to meet these evolving regulations, posing a barrier to the widespread adoption of new equipment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.91% |

|

Segments Covered |

By Equipment Type, Application, Automation, Sales Channel, and Country |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe |

|

Market Leaders Profiled |

Aaxa Technologies Inc., Acer Inc, Coretronic Corporation, Sony Corporation, Cannon Inc, Aiptek International Inc Koninklijke Philips NV, LG Electronics Inc, Samsung Group, Miroir USA. |

REGIONAL ANALYSIS

Germany held a dominant position in the European agriculture equipment market in 2023 owing to Germany's continuous innovation culture in machinery technology. It is home to major agriculture equipment manufacturers such as CLAAS and John Deere, which are recognized for their advanced, high-performance machinery. Germany’s agriculture sector is highly mechanized, and its focus on precision farming technologies, including automated machinery and IoT integration, drives demand for sophisticated equipment. According to Eurostat, Germany accounts for nearly 20% of Europe’s total agricultural machinery sales, supported by its robust industrial infrastructure and strong export markets. The country’s emphasis on sustainability and efficiency further boosts its leading role in the market.

France ranked second in the European agriculture equipment market in 2023. The large agriculture sector of France and the high demand for modern farming machinery are propelling the French market expansion. As the EU’s largest agriculture producer, France has seen increased adoption of advanced equipment, including precision agriculture tools, to optimize production and reduce environmental impact. French farmers have been actively modernizing their operations, with the French Ministry of Agriculture reporting significant growth in the use of automated machinery in crop and livestock management. This demand is driven by subsidies under the Common Agriculture Policy (CAP) that encourage farm modernization. France’s large farming sector ensures it remains a key player in the European market.

Italy stands out for its commitment to sustainable agriculture and the rapid adoption of green technologies. With a diverse agriculture landscape that includes both large-scale farms and smaller family-owned operations, Italy has embraced eco-friendly machinery such as energy-efficient tractors and low-emission harvesters. The Italian agriculture equipment market has grown as more farmers incorporate precision farming techniques to enhance productivity and reduce environmental impact. According to the Italian Agriculture Machinery Manufacturers Association (ASSOAGRI), the demand for sustainable agriculture machinery has increased by 12% over the past five years. Italy’s emphasis on organic farming and environmental sustainability has solidified its position as a leader in the European market.

KEY MARKET PLAYERS

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V, Deere & Company, Escorts Limited, Iseki & Co. Ltd, JC Bamford Excavators Ltd, Kubota Corporation, Mahindra & Mahindra Limited, SDF Group. Some of the market players are dominating the Europe agriculture equipment market.

MARKET SEGMENTATION

This research report on the Europe agriculture equipment market is segmented and sub-segmented into the following categories.

By Equipment Type

- Agriculture Tractor

- Harvesting Equipment

- Irrigation and Crop Processing Equipment

- Agriculture Spraying and Handling Equipment

- Soil Preparation and Cultivation Equipment

- Others

By Application

- Land Development

- Threshing and Harvesting

- Plant Protection

- After Agro Processing

By Automation

- Manual

- Semi-automatic

- Automatic

By Sales Channel

- Original Equipment Manufacturers (OEM)

- Aftermarket

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What is the current market size of the Europe agriculture equipment market?

The European agricultural equipment market's current size is 56.06 billion in 2025

How big is the Europe agriculture equipment market?

The Europe agriculture equipment market size is anticipated to reach USD 56.06 billion in 2025 from USD 76.19 Bn by 2033, growing at a CAGR of 3.91% from 2025 to 2033

Who are the key players that are dominating the Europe agriculture equipment market?

AGCO Corporation, Agromaster Agricultural Machinery, Argo Tractors S.p.A, Bellota Agrisolutions, China National Machinery Industry Corporation, CLAAS KGaA mbH, CNH Industrial N.V and Etc...

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]