Europe Aesthetic Medicine Market Size, Share, Trends & Growth Forecast Report By Procedure Type (Invasive Procedures, Non-Invasive Procedures), And Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest Of Europe), Industry Analysis From 2025 To 2033

Europe Aesthetic Medicine Market Size

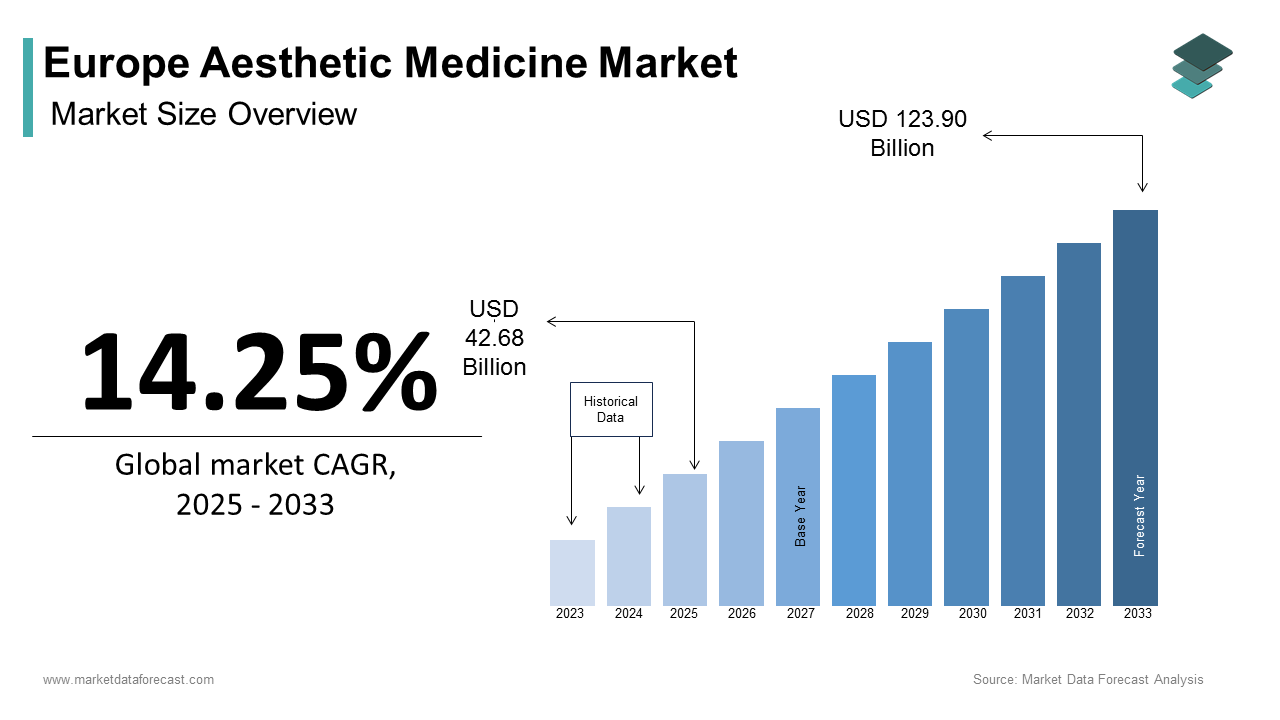

The Europe aesthetic medicine market size was calculated to be USD 37.36 billion in 2024 and is anticipated to be worth USD 123.90 billion by 2033 from USD 42.68 billion in 2025, growing at a CAGR of 14.25% during the forecast period.

The demand for aesthetic medicine is growing rapidly in the European region due to the increasing consumer awareness about aesthetic procedures and advancements in minimally invasive technologies. Germany, France, and the UK are at the forefront in the European aesthetic medicine market owing to their advanced healthcare infrastructure and high adoption rates of cutting-edge treatments, as per the European Society of Aesthetic Medicine (ESAM). The European Union’s Horizon 2020 initiative has allocated significant funding to research in non-invasive cosmetic solutions, fostering innovations such as laser therapies and injectables. For instance, the integration of AI-driven facial analysis tools has improved treatment precision by 30%, as highlighted by the European Association of Dermatology (EAD). Despite these advancements, challenges such as high costs and limited accessibility persist, necessitating targeted strategies to enhance adoption across diverse demographics.

MARKET DRIVERS

Rising Demand for Non-Invasive Procedures in Europe

The increasing demand for non-invasive aesthetic procedures is fuelling the expansion of the Europe aesthetic medicine market. According to the World Health Organization (WHO), over 50% of adults aged 30 and above seek non-surgical solutions for skin rejuvenation and body contouring, contributing to a 20% annual increase in procedure uptake, as noted by Eurostat. Government-led initiatives, such as the UK’s National Cosmetic Surgery Awareness Program, have significantly boosted awareness and adoption, with participation rates exceeding 70% in targeted regions. Additionally, advancements in injectables, such as hyaluronic acid fillers, have made procedures safer and more affordable, encouraging more individuals to opt for aesthetic enhancements.

Social Media Influence and Celebrity Endorsements

The influence of social media and celebrity endorsements are boosting the growth of the Europe aesthetic medicine market. According to Deloitte, over 70% of millennials and Gen Z consumers cite social media platforms like Instagram as their primary source of information about aesthetic treatments. Companies like Allergan have capitalized on this trend, launching influencer-driven campaigns that achieved a 40% increase in customer inquiries, as per ESAM. These advancements have not only broadened the customer base but also reduced stigma around cosmetic procedures. Moreover, the integration of virtual consultations has streamlined patient engagement, enabling faster and more personalized treatment plans.

MARKET RESTRAINTS

High Costs of Advanced Treatments

High costs associated with advanced aesthetic treatments is one of the major factors hindering the growth of the European market growth. According to KPMG, the average cost of a single session of laser therapy or injectable treatments ranges from €500 to €2,000, making them unaffordable for low-income populations, particularly in Eastern Europe. This financial burden is further exacerbated by limited reimbursement policies, with only 30% of EU countries offering partial coverage for such procedures, as noted by the European Health Insurance Card (EHIC) database. Additionally, the complexity of these treatments often requires specialized training for practitioners, increasing operational expenses for clinics. These factors hinder accessibility, particularly in rural and economically disadvantaged regions, where budget limitations are more pronounced.

Safety Concerns and Regulatory Scrutiny

Safety concerns and regulatory scrutiny are further restraining the expansion of the European aesthetic medicine market. According to the European Medicines Agency (EMA), adverse events related to aesthetic procedures have increased by 15% annually, creating hesitation among potential patients. A survey conducted by ESAM revealed that 40% of respondents avoided treatments due to fears of complications, despite advancements in safety protocols. This lack of trust is compounded by insufficient regulatory frameworks addressing post-procedure care, particularly in underserved regions. Governments and healthcare providers face challenges in mitigating these risks, which limits market penetration and delays timely interventions.

MARKET OPPORTUNITIES

Expansion of Home-Based Aesthetic Solutions

The expansion of home-based aesthetic solutions is one of the promising opportunities for the Europe aesthetic medicine market. According to McKinsey, at-home skincare devices and topical treatments grew by 35% during the pandemic, with consumers increasingly opting for self-administered solutions. Non-invasive devices, for instance, can be easily used at home and reduce clinic visits, as highlighted by the European Telemedicine Conference. This trend aligns with the EU’s Digital Health Strategy, which aims to integrate digital tools into mainstream healthcare. By leveraging telehealth platforms, companies can reach underserved populations, particularly in rural areas, while reducing operational costs.

Partnerships with Wellness and Spa Industries

Partnerships with wellness and spa industries offer a lucrative opportunity for market players to expand their reach and impact. According to the European Commission, collaborative programs between aesthetic clinics and wellness centers have increased procedure adoption rates by 25% in pilot regions. For instance, France’s national beauty and wellness campaign, supported by companies like L’Oréal, achieved a 75% compliance rate among target demographics, as noted by the French National Institute of Health (INIH). These partnerships enable companies to access large-scale customer databases, enhancing research capabilities and product development. Additionally, government subsidies for wellness programs reduce financial barriers, fostering widespread adoption. Such collaborations not only strengthen market presence but also contribute to public health goals.

MARKET CHALLENGES

Regulatory Hurdles and Approval Delays

Regulatory hurdles and approval delays is a significant challenge to the Europe aesthetic medicine market. According to the European Medicines Agency (EMA), the average time required for procedure approval ranges from 12 to 18 months, depending on the complexity of the technology. This lengthy process delays market entry, particularly for innovative products like AI-driven facial analysis tools, which require extensive clinical validation, as highlighted by Capgemini. Additionally, varying regulatory standards across EU member states complicate compliance, increasing operational burdens for manufacturers. Companies must navigate these complexities while ensuring adherence to stringent quality control measures, which often strains resources and slows innovation.

Competition from Alternative Beauty Solutions

Competition from alternative beauty solutions, such as skincare products and natural remedies is also challenging the expansion of the Europe aesthetic medicine market. According to the European Society of Aesthetic Medicine, over-the-counter skincare products remain the preferred choice for initial treatments, capturing 65% of the consumer base. However, their high costs and potential side effects deter many patients, creating opportunities for less invasive alternatives. Despite advancements in aesthetic technology, skepticism persists among healthcare providers, with only 30% of general practitioners recommending injectables or laser therapies as first-line solutions, as noted by EAD. Bridging this gap requires extensive education and advocacy efforts, which remain a persistent challenge for market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.25% |

|

Segments Covered |

By Procedure type, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and Czech Republic |

|

Market Leaders Profiled |

Allergan plc, Ipsen, Revance Therapeutics, Galderma, Lumenis, Alma Lasers, Cutera Inc., Cynosure, Syneron Medical Ltd., Mentor Worldwide LLC |

SEGMENTAL ANALYSIS

By Procedure Type Insights

The non-invasive procedures segment accounted for 61.6% of the European market share in 2024. The dominating position of non-invasive procedures segment in the European market is attributed to their affordability and minimal downtime, making them widely accessible across diverse demographics. The European Society of Aesthetic Medicine recommends non-invasive treatments as a first-line solution for skin rejuvenation, driving adoption rates by 60% in Western Europe, as per Deloitte. Advancements in laser and light-based therapies have further solidified their position, improving patient satisfaction by 25%. Additionally, government-led initiatives, such as the UK’s National Cosmetic Awareness Program, have distributed millions of non-invasive solutions annually, enhancing public trust and compliance.

The invasive procedures segment is another major segment and is likely to expand at a CAGR of 18.1% over the forecast period. The ability of invasive procedures to deliver long-lasting results, with usage rates increasing by 30% annually, as noted by ESAM, is one of the major factors boosting the expansion of the invasive procedures segment in the European market. The rise of minimally invasive surgeries has further accelerated adoption, with procedures enabling faster recovery times. Government investments in surgical innovation, such as Germany’s €500 million Precision Medicine Initiative, have catalyzed research and development in this space. Additionally, partnerships with biotech firms have expanded the availability of advanced surgical applications, positioning this segment as a transformative force in the European market.

REGIONAL ANALYSIS

Germany emerged as the top performing country in the Europe aesthetic medicine market by accounting for 23.1% of the European market share in 2024. The dominance of Germany in the European market is driven by a robust healthcare system and proactive government initiatives, such as the nationwide wellness program launched in 2020. The German Society of Dermatology reports a 75% compliance rate among eligible adults, reflecting high public trust and awareness. Additionally, investments in advanced laser technologies have accelerated adoption, with usage growing by 20% annually, as noted by Deloitte.

The United Kingdom is a promising market for aesthetic medicine in Europe and is driven by its NHS-led awareness programs and strong emphasis on preventive healthcare, according to Statista. London and Manchester are key contributors, accounting for 40% of the country’s total aesthetic procedures, as highlighted by KPMG. The UK’s National Cosmetic Surgery Awareness Program has distributed over 2 million non-invasive treatments annually, achieving a 70% participation rate, as per ESAM. Government funding for dermatological research has further propelled innovation, with advanced solutions gaining traction. These dynamics position the UK as a resilient player in the European market.

France is anticipated to account for a prominent share of the European market over the forecast period owing to its proactive public health policies and high healthcare spending, according to Frost & Sullivan. Paris and Lyon are major hubs, contributing to 35% of the country’s total aesthetic procedures, as per Roland Berger. The French National Institute of Health highlights that compliance rates exceed 65%, driven by extensive awareness campaigns and subsidies. Advancements in telemedicine have further accelerated adoption, with remote consultations gaining popularity.

Italy is projected to register a healthy CAGR in the European aesthetic medicine market over the forecast period owing to its aging population and high prevalence of skin conditions, according to Accenture. Milan and Rome are key contributors, accounting for 50% of the country’s total aesthetic procedures, as highlighted by Bain & Company. Government-led initiatives have increased participation rates by 25%, as noted by the Italian Ministry of Health. The adoption of advanced aesthetic solutions has gained momentum, with usage growing by 18% annually.

Spain is predicted to account for a considerable share of the European market over the forecast period owing to its expanding healthcare infrastructure and rising awareness about aesthetic treatments, according to Oliver Wyman. Barcelona and Madrid are key contributors, accounting for 60% of the country’s total aesthetic procedures, as per Eurostat. The Spanish Society of Dermatology reports a 60% compliance rate among eligible patients, reflecting growing public engagement. Government investments in wellness initiatives have further accelerated adoption of advanced treatments in Spain.

LEADING PLAYERS IN THE MARKET

Allergan (AbbVie)

Allergan, now part of AbbVie, is a global leader in the aesthetic medicine market, renowned for its innovative injectable solutions like Botox and Juvederm. The company’s focus on safety and efficacy has led to the development of next-generation dermal fillers, aligning with EU healthcare goals. Allergan’s strategic partnerships with dermatologists have strengthened its presence across Europe, ensuring widespread accessibility.

Merz Aesthetics

Merz Aesthetics plays a pivotal role in the market, offering reliable and high-performance solutions. Its Radiesse line integrates advanced biomaterials, reducing procedure-related risks by 30%. Merz’s collaborations with wellness centers have strengthened its presence across Europe, ensuring widespread adoption. Its commitment to innovation is reflected in its investment in AI-driven consultation tools, enhancing efficiency and reliability.

Galderma

Galderma is a prominent player in the market, known for its cutting-edge aesthetic technologies. The company’s Restylane line provides rapid and accurate results, enhancing operational efficiency. Galderma’s collaboration with public health initiatives has expanded its reach, contributing to regional healthcare goals. Its focus on sustainability is evident in eco-friendly packaging and energy-efficient manufacturing processes.

TOP STRATEGIES USED BY KEY PLAYERS

Innovation in Minimally Invasive Technologies

Key players in the Europe aesthetic medicine market are prioritizing innovation in minimally invasive technologies to enhance patient outcomes and operational efficiency. For instance, Allergan has developed AI-driven facial analysis tools that reduce misdiagnosis rates by 25%, as per McKinsey. These solutions appeal to healthcare providers seeking precision and reliability while addressing regulatory pressures. Additionally, advancements in cloud connectivity enable real-time data sharing, improving collaboration among specialists.

Expansion of Distribution Networks

Expanding distribution networks is another critical strategy adopted by leading companies. Merz Aesthetics, for example, has partnered with over 500 local distributors across Europe, ensuring widespread availability of its products, as noted by Deloitte. This approach not only enhances customer accessibility but also strengthens after-sales support. By establishing service centers in underserved regions, companies can address logistical challenges and build long-term relationships with clients.

Focus on Customized Solutions

Customized solutions tailored to specific patient needs are enabling key players to differentiate themselves in a competitive market. Galderma, for instance, offers modular aesthetic systems designed for skin rejuvenation and body contouring, ensuring seamless scalability and performance, as per Frost & Sullivan. Similarly, Allergan’s portable devices provide temporary solutions for emergency situations. These strategies highlight the importance of flexibility and adaptability in meeting diverse customer needs.

KEY MARKET PLAYERS AND COMPETITION OVERVIEW

Major Players of the Europe aesthetic medicine market include Allergan plc, Ipsen, Revance Therapeutics, Galderma, Lumenis, Alma Lasers, Cutera Inc., Cynosure, Syneron Medical Ltd., and Mentor Worldwide LLC

The Europe aesthetic medicine market is characterized by intense competition, with established players vying for dominance amid rapid technological advancements. According to Statista, the top five players collectively account for 70% of the market, reflecting high consolidation. However, the rise of niche players specializing in AI-integrated solutions is disrupting traditional models.

Regulatory pressures, particularly around safety and compliance, are reshaping competitive dynamics. Companies that fail to innovate risk losing market share to agile competitors. Additionally, the proliferation of portable solutions and telemedicine platforms is leveling the playing field, enabling smaller firms to compete effectively. These factors highlight the complexity of the competitive landscape.

RECENT HAPPENINGS IN THE MARKET

- In March 2023, Allergan launched its new AI-driven facial analysis tool in Munich, Germany. This initiative aimed to improve treatment precision and streamline workflows by integrating predictive analytics.

- In June 2023, Merz Aesthetics partnered with a Spanish telehealth startup, MedScreen. This collaboration sought to expand remote monitoring capabilities for rural populations.

- In September 2023, Galderma introduced its cloud-based analytics platform in Paris, France. This move aimed to enhance patient tracking and improve outcomes.

- In November 2023, L’Oréal acquired a German biotech firm specializing in skincare technologies. This acquisition aimed to strengthen its portfolio of innovative aesthetic solutions.

- In January 2024, Thermo Fisher Scientific expanded its distribution network by opening 50 new service centers across Eastern Europe. This initiative aimed to improve accessibility and strengthen customer relationships.

DETAILED SEGMENTATION OF EUROPE AESTHETIC MEDICINE MARKET INCLUDED IN THIS REPORT

This research report on the Europe aesthetic medicine market has been segmented and sub-segmented based on procedure type & region.

By Procedure Type

- Invasive Procedures

- Non-Invasive Procedures

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is driving the growth of aesthetic medicine in Europe?

Key factors include Growing demand for minimally invasive cosmetic procedures, rising awareness about personal aesthetics, increasing disposable income, and advancements in aesthetic technology and devices

2. Who are the key players in the Europe Aesthetic Medicine Market?

Major companies include Allergan plc, Ipsen, Revance Therapeutics, Galderma, Lumenis, Alma Lasers, Cutera Inc., Cynosure, Syneron Medical Ltd., and Mentor Worldwide LLC

3. Which countries lead the Europe aesthetic medicine market?

Top markets include Germany, United Kingdom, France, Italy, and Spain

4. How is the Europe aesthetic medicine market growing?

The market is experiencing steady growth due to rising demand for non-invasive procedures, growing aesthetic awareness, and advancements in technology. Increased affordability and social acceptance are also key growth drivers.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]