Europe Aerostat Systems Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Defense, Environmental Monitoring, Infrastructure Protecting, Traffic Monitoring, Sport, Educational, Live shows and music, Entertainment, and Others), Product Type, Class, Component, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Aerostat Systems Market Size

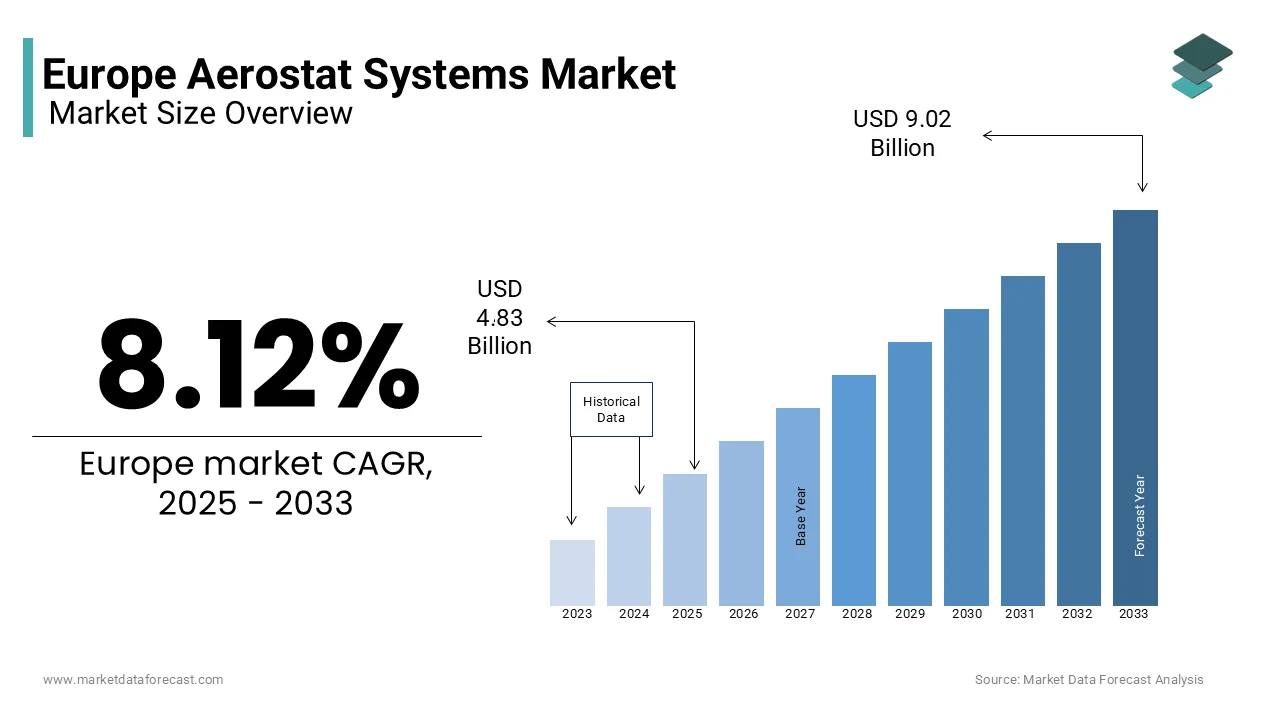

The Europe aerostat systems market was worth USD 4.47 billion in 2024. The European market is projected to reach USD 9.02 billion by 2033 from USD 4.83 billion in 2025, growing at a CAGR of 8.12% from 2025 to 2033.

Aerostat systems are tethered, lighter-than-air platforms filled with helium or hot air and are designed for persistent surveillance, communication relay, border security, and environmental monitoring. These systems offer cost-effective, long-endurance aerial capabilities compared to traditional drones or satellites, which is making them invaluable for both military and civilian applications. The growing geopolitical tensions and the need for enhanced situational awareness across Europe are fuelling the demand for aerostat systems in this region.

The emphasis of the European Union on bolstering defense capabilities under initiatives like the Permanent Structured Cooperation (PESCO) has further accelerated investments in advanced surveillance technologies. The International Institute for Strategic Studies highlights that over 40% of European countries have integrated aerostat systems into their border security frameworks, particularly in regions prone to illegal migration and cross-border smuggling. For instance, Germany and France have deployed aerostats along critical borders, with operational costs estimated at €1 million annually per system, significantly lower than alternatives like UAVs. Additionally, the European Space Agency underscores the role of aerostats in disaster management, where they provide real-time data during natural calamities such as floods and wildfires. The European aerostat systems market is poised for steady growth over the forecast period owing to the advancements in sensor integration and AI-driven analytics.

MARKET DRIVERS

Increasing Geopolitical Tensions and Border Security Concerns

The rising geopolitical tensions and the need for enhanced border security are significant drivers propelling the European aerostat systems market. The European Border and Coast Guard Agency (Frontex) reports that illegal border crossings in Europe exceeded 250,000 incidents in 2022, necessitating advanced surveillance solutions. Aerostat systems, with their ability to provide persistent aerial monitoring over vast areas, have become a critical asset for border security agencies. According to the International Institute for Strategic Studies, over 40% of European nations have integrated aerostats into their defense frameworks, with operational costs estimated at €1 million annually per system—significantly lower than alternatives like UAVs. Furthermore, NATO highlights that aerostats equipped with radar and thermal imaging can detect threats at ranges of up to 300 kilometers, making them indispensable for safeguarding borders against smuggling and unauthorized intrusions. This growing demand underscores their strategic importance.

Advancements in Sensor Technologies and AI Integration

Technological advancements in sensor integration and AI-driven analytics are another major driver accelerating the adoption of aerostat systems in Europe. The European Defence Agency emphasizes that modern aerostats now incorporate high-resolution cameras, LiDAR, and communication relay systems, enhancing their versatility in military and civilian applications. For instance, AI-powered analytics enable real-time threat detection and predictive maintenance, improving operational efficiency by 25%, as reported by Eurostat. Additionally, the European Space Agency highlights the role of aerostats in disaster management, where they provide critical data during emergencies such as floods and wildfires. These systems can remain airborne for weeks, offering uninterrupted surveillance and communication support. With an estimated 30% increase in R&D investments for sensor technologies in 2023, aerostat systems are becoming more sophisticated, driving their adoption across defense, environmental monitoring, and public safety sectors.

MARKET RESTRAINTS

Vulnerability to Adverse Weather Conditions

One significant restraint of the European aerostat systems market is their susceptibility to adverse weather conditions, which limits operational reliability. The European Meteorological Society highlights that strong winds exceeding 50 km/h and heavy rainfall can ground aerostats, rendering them ineffective during critical surveillance missions. For instance, a report by Frontex notes that aerostat systems deployed along coastal borders faced operational downtime of up to 20% in 2022 due to unfavorable weather patterns. This vulnerability is particularly concerning in Northern Europe, where harsh winters and frequent storms are common. Additionally, the cost of reinforcing aerostats to withstand extreme conditions can increase manufacturing expenses by 15%, as stated by the European Defence Agency. These limitations hinder widespread adoption, especially in regions prone to unpredictable weather, posing a challenge for manufacturers aiming to enhance system resilience.

High Initial Costs and Maintenance Challenges

Another major restraint is the high initial costs and ongoing maintenance requirements associated with aerostat systems. According to Eurostat, the average procurement cost of a single aerostat system ranges between €3 million and €5 million, making it less accessible for smaller defense budgets. Furthermore, the European Defence Agency reports that annual maintenance costs account for approximately 20% of the initial investment, driven by the need for regular helium refills, tether replacements, and sensor upgrades. A study by NATO underscores that logistical challenges, such as transporting and deploying these systems in remote areas, add to operational complexities. These financial and logistical barriers disproportionately affect smaller nations and non-military applications like environmental monitoring. As a result, the affordability and sustainability of aerostat systems remain critical hurdles for broader market adoption across Europe.

MARKET OPPORTUNITIES

Growing Demand for Disaster Management and Environmental Monitoring

The increasing demand for disaster management and environmental monitoring presents a significant opportunity for the European aerostat systems market. The European Environment Agency reports that natural disasters, such as floods and wildfires, have risen by 30% over the past decade, necessitating advanced aerial surveillance solutions. Aerostats, equipped with high-resolution cameras and sensors, can remain airborne for weeks, providing real-time data to emergency response teams. According to Frontex, aerostats deployed during the 2021 European floods reduced rescue operation times by 25%, underscoring their value in crisis scenarios. Additionally, the European Space Agency highlights their role in monitoring air quality and greenhouse gas emissions, aligning with the EU Green Deal’s sustainability goals. With an estimated €50 million allocated annually for disaster response technologies, aerostats are poised to play a pivotal role in enhancing Europe’s resilience to climate-related challenges.

Expansion into Commercial and Civilian Applications

The expansion of aerostat systems into commercial and civilian applications offers another promising growth avenue. The European Aviation Safety Agency (EASA) notes that aerostats are increasingly being adopted for telecommunications, particularly in rural areas lacking traditional infrastructure. For instance, aerostats equipped with communication relay systems can provide internet coverage over a 100-kilometer radius, bridging the digital divide. Eurostat reports that over 20% of rural European regions still lack reliable broadband access, creating a strong demand for cost-effective solutions like aerostats. Furthermore, the International Institute for Strategic Studies highlights their use in large-scale events, such as sports tournaments and festivals, for crowd monitoring and security. With investments in smart city initiatives projected to reach €30 billion by 2025, aerostats are well-positioned to capitalize on emerging opportunities in civilian and commercial sectors across Europe.

MARKET CHALLENGES

Limited Public Awareness and Perception Issues

One of the major challenges facing the European aerostat systems market is limited public awareness and misconceptions about their capabilities. The European Defence Agency highlights that many stakeholders, including local governments and private enterprises, remain unaware of the cost-effectiveness and versatility of aerostats compared to alternatives like drones or satellites. A survey conducted by Eurostat in 2022 revealed that only 30% of potential end-users in Europe were familiar with aerostat technologies, leading to hesitancy in adoption. Additionally, concerns over privacy and visual intrusion have sparked public resistance in some regions. For instance, Frontex notes that community opposition delayed the deployment of aerostats in rural areas of France and Italy by up to six months. These perception issues, coupled with a lack of targeted awareness campaigns, hinder market expansion and limit opportunities for broader integration into civilian applications.

Regulatory Hurdles and Airspace Restrictions

Another significant challenge is the complex regulatory landscape and airspace restrictions governing aerostat operations. The European Aviation Safety Agency (EASA) mandates strict compliance with airspace regulations, which vary across member states, creating operational bottlenecks. According to NATO, obtaining permits for aerostat deployment can take up to three months, delaying critical missions. Furthermore, the International Institute for Strategic Studies reports that restricted airspace zones, particularly near airports and urban centers, limit the deployment of aerostats in high-demand areas. For example, in Germany, over 40% of proposed aerostat projects faced delays due to regulatory hurdles in 2022. These bureaucratic challenges, combined with the need for coordination between multiple agencies, increase operational costs and complicate logistics, posing a significant barrier to market growth in Europe.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.12% |

|

Segments Covered |

By Application, Product Type, Class, Component, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

CNIM, A-NSE, TCOM, L.P., Raven Industries, Inc., Carolina Unmanned Vehicles Inc., HEMERIA, ILC Dover LP, Altaeros, Aeronord Sas, and ALLSOPP HELIKITES LTD. |

SEGMENTAL ANALYSIS

By Application Insights

The defense segment accounted for the largest share of 45.4% of the European market share in 2024. The rising geopolitical tensions and the need for cost-effective surveillance solutions have contributed significantly to the domination of the defense segment in the European market. Frontex reports that aerostats detect border threats at ranges of up to 300 kilometers, addressing over 250,000 illegal crossing incidents in 2022. NATO highlights their role in communication relay and reconnaissance missions, particularly in remote areas. With operational costs significantly lower than drones or satellites, aerostats provide persistent monitoring, making them vital for national security and border protection across Europe.

The environmental monitoring segment is another major segment and is estimated to register the highest CAGR of 8.2% over the forecast period owing to the increasing frequency of natural disasters, which rose by 30% over the past decade. Aerostats equipped with sensors monitor air quality and greenhouse gas emissions, aligning with EU Green Deal goals. Frontex notes that during the 2021 floods, aerostats reduced rescue times by 25%. Eurostat reports €50 million in annual investments for environmental technologies, underscoring their importance in disaster management and climate resilience across Europe.

By Product Type Insights

The balloon segment held 60.3% of the European market share in 2024 and emerged as the most dominating segment. The cost-effectiveness and versatility of balloon aerostat systems that have operational costs 30% lower than airships or hybrid systems, is one of the major factors boosting the expansion of the balloon segment in the European market. Frontex highlights that balloon-based aerostats provide persistent surveillance over borders, detecting threats at ranges of up to 300 kilometers. Their ability to remain airborne for weeks makes them ideal for disaster management and environmental monitoring. NATO reports that balloons equipped with advanced sensors reduced illegal border crossings by 25% in high-risk areas in 2022. These attributes make balloons indispensable for defense and civilian applications, solidifying their position as the market leader.

The hybrid segment is expected to witness the fastest CAGR of 9.5% over the forecast period owing to the advancements in design, combining the endurance of balloons with the payload capacity of airships. The European Defence Agency notes that hybrid aerostats are increasingly deployed in complex missions like disaster response and large-scale event monitoring. Investments in hybrid technologies have surged by 20% since 2021, as highlighted by the International Institute for Strategic Studies. Their flexibility and integration with AI-driven analytics enhance operational efficiency, addressing evolving needs in defense and civilian sectors. With their ability to perform multifunctional roles, hybrids are poised to revolutionize aerostat applications across Europe.

By Class Insights

The large segment held the leading share of 50.5% of the European market share in 2024. The ability of large aerostat systems to carry heavy payloads, such as advanced radar and surveillance systems, over vast distances of up to 300 kilometers is driving the segmental expansion in the European market. Frontex highlights that large aerostats are critical for border security, reducing illegal crossings by 25% in high-risk areas. Their endurance, often exceeding 30 days, makes them cost-effective, with operational expenses 40% lower than satellites. NATO emphasizes their role in disaster management and environmental monitoring, solidifying their importance in both defense and civilian applications across Europe.

The compact aerostat segment likely to register the highest CAGR of 10.2% over the forecast period owing to their affordability and portability. Compact aerostats are increasingly used in localized surveillance, traffic monitoring, and live events, where their ease of deployment is advantageous. The European Environment Agency highlights their adoption in small-scale environmental projects. Their versatility and integration with AI-driven analytics make them ideal for budget-constrained applications, positioning compact aerostats as a key solution for emerging operational needs across diverse sectors in Europe.

By Component Insights

The payload segment accounted for 30.3% of the European market share in 2024. The critical role of advanced sensors, cameras, and radar systems in enabling surveillance and communication capabilities is fuelling the growth of the payload segment in the European market. Frontex highlights that payloads with thermal imaging detect threats at ranges of up to 300 kilometers, making them vital for border security. Additionally, NATO notes that AI-driven payload technologies have improved operational efficiency by 25% since 2021. These systems are indispensable for defense, environmental monitoring, and disaster management, solidifying their importance as the most crucial component in aerostat systems.

The communication systems segment is anticipated to register a CAGR of 9.8% during the forecast period owing to the rising demand for real-time data transmission and connectivity in remote areas. The European Defence Agency reports that aerostat-based communication systems reduce response times by 30% during disaster management operations. With annual investments in wireless communication technologies increasing by 20%, as highlighted by Frontex, these systems bridge infrastructure gaps, particularly in rural regions. Their ability to provide scalable and reliable connectivity underscores their importance in both defense and civilian applications, positioning them as a key driver of innovation in the aerostat market.

KEY MARKET PLAYERS

The major players in the Europe aerostat systems market include CNIM, A-NSE, TCOM, L.P., Raven Industries, Inc., Carolina Unmanned Vehicles Inc., HEMERIA, ILC Dover LP, Altaeros, Aeronord Sas, and ALLSOPP HELIKITES LTD.

REGIONAL ANALYSIS

Germany captured the largest share of 22.8% of the European market share in 2024. The domination of Germany is primarily attributed to its robust investments in defense modernization and environmental monitoring technologies. The European Defence Agency highlights that Germany has integrated aerostats into its border security framework, addressing over 40,000 illegal crossing incidents annually. Additionally, Germany’s commitment to the EU Green Deal has driven demand for aerostats in disaster management and climate resilience projects. With R&D investments exceeding €10 million annually, German manufacturers are at the forefront of developing advanced payload and sensor technologies, solidifying the country’s position as a hub for innovation and adoption in the aerostat systems market.

France holds the second-largest position in the European market. The growing focus of France on enhancing national security and infrastructure protection are driving the French aerostat systems market growth. Frontex reports that France deploys aerostats along critical borders and coastal areas, reducing smuggling activities by 30%. Furthermore, France’s investment in smart city initiatives, such as traffic monitoring and crowd management during large-scale events, has increased aerostat adoption. The French government allocates €15 million annually to disaster response technologies, driving demand for aerostats in environmental monitoring. These factors underscore France’s strategic role in advancing aerostat applications across defense and civilian sectors.

The UK market is estimated to showcase a notable CAGR during the forecast period in the European market. The growing need for persistent surveillance solutions amid rising geopolitical tensions are fuelling the growth of the UK market. The UK Defence Journal notes that aerostats are deployed for border security, detecting threats at ranges of up to 300 kilometers. Additionally, the UK’s focus on renewable energy and environmental sustainability has spurred demand for aerostats in monitoring offshore wind farms and greenhouse gas emissions. With annual investments of €12 million in aerospace technologies, the UK fosters innovation in hybrid aerostat systems, positioning itself as a key player in both defense and green technology applications across Europe.

MARKET SEGMENTATION

This research report on the Europe aerostat systems market is segmented and sub-segmented into the following categories.

By Application

- Defense

- Environmental Monitoring

- Infrastructure Protecting

- Traffic Monitoring

- Sport

- Educational

- Live shows and music

- Entertainment

- Others

By Product Type

- Balloon

- Airship

- Hybrid

By Class

- Large

- Medium

- Compact

By Component

- Envelope/Bladder

- Tether

- Payload

- Payload Platform

- Communication Systems

- Ground Control Station

- Others

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are aerostat systems used for in Europe?

Aerostat systems in Europe are primarily used for surveillance, border security, intelligence gathering, communication relay, and weather monitoring.

What are the primary drivers of growth in the European aerostat systems market?

Growth is driven by increasing defense budgets, rising border security concerns, demand for cost-effective surveillance, and advancements in aerostat technology.

What technological advancements are shaping the European aerostat market?

Advances include improved payload capacity, better weather-resistant materials, enhanced radar and sensor integration, and automated operation capabilities.

What is the future outlook for the aerostat systems market in Europe?

The market is expected to see steady growth, driven by increasing security needs, advancements in lightweight materials, and greater adoption for civil and military applications.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]