Europe Aerial Imaging Market Size, Share, Trends, & Growth Forecast Report By Platform Type (Fixed-wing Aircraft, Helicopters, UAVs/Drones, and Other Platform Types), Application, End-user Industry, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2024 to 2033

Europe Aerial Imaging Market Size

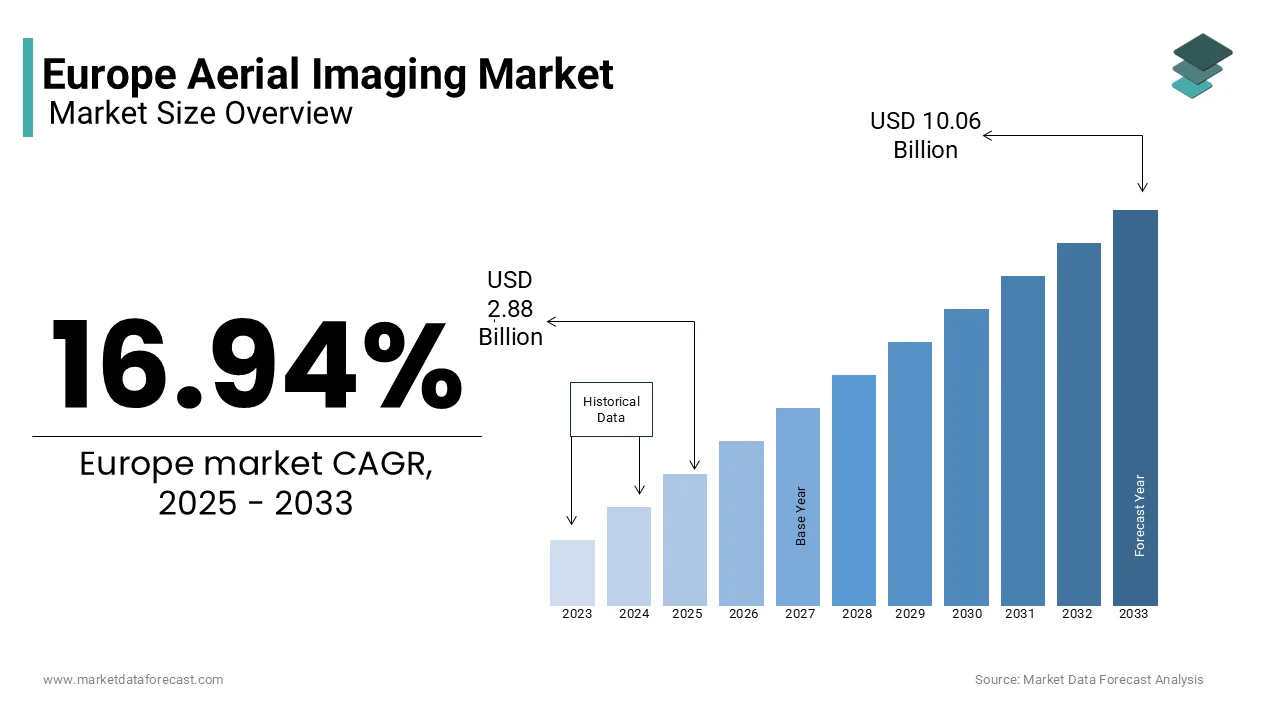

The Europe aerial imaging market was worth USD 10.06 billion in 2024. The European market is expected to reach USD 10.06 billion by 2033 from USD 2.88 billion in 2025, rising at a CAGR of 16.94% from 2025 to 2033.

Aerial imaging involves capturing images of the Earth’s surface from elevated platforms such as drones, aircraft, and satellites, which are then utilized for applications ranging from urban planning and agriculture to disaster management and environmental monitoring. According to Eurostat, the European Union has witnessed a 20% annual increase in the adoption of aerial imaging technologies, with over €3 billion invested in geospatial solutions in 2022 alone. As per the European Space Agency (ESA), satellite-based imaging accounts for approximately 40% of the market, while drones and manned aircraft contribute the remainder.

The demand for aerial imaging is further propelled by regulatory frameworks supporting smart city development and sustainable land use. As per the European Environment Agency (EEA), aerial imaging plays a critical role in monitoring deforestation, water quality, and climate change impacts across the continent. Additionally, the agricultural sector, which contributes €178 billion annually to the EU economy, relies heavily on aerial imaging for precision farming practices by enabling farmers to optimize crop yields and resource allocation. According to the International Civil Aviation Organization (ICAO), Europe accounts for over 35% of global drone operations with the region’s focus on unmanned aerial systems. The market is poised for exponential growth with the integration of artificial intelligence and machine learning into image processing.

MARKET DRIVERS

Increasing Demand for Precision Agriculture

The growing adoption of precision agriculture, which relies heavily on aerial imaging to optimize farming practices is certainly a major factor for the European aerial imaging market in the coming years. As per the European Environment Agency (EEA), over 40% of the EU’s land area is dedicated to agriculture, with precision farming technologies projected to grow at a CAGR of 12.8% through 2030. Aerial imaging enables farmers to monitor crop health, soil conditions, and irrigation needs by reducing resource wastage by up to 30%, as per the Eurostat. A study by the European Commission shown that precision agriculture contributes €178 billion annually to the EU economy with its economic significance. As per the Common Agricultural Policy (CAP), the use of advanced technologies like drones and satellite imaging to promote sustainable farming. Aerial imaging has become indispensable for enhancing agricultural productivity while minimizing environmental impact.

Expansion of Smart City Initiatives

The rapid expansion of smart city initiatives across Europe, which rely on aerial imaging for urban planning and infrastructure management is enhancing the growth rate of the Europe aerial imaging market. As per the European Commission, over 200 cities in Europe are actively implementing smart city projects, with investments exceeding €20 billion annually. Aerial imaging provides critical data for monitoring traffic patterns, managing waste, and assessing urban sprawl by enabling municipalities to make informed decisions. According to the Eurostat, cities utilizing aerial imaging have improved infrastructure efficiency by up to 25%. As per the European Space Agency (ESA), satellite-based imaging supports disaster management and emergency response systems which are integral to smart city frameworks. The urban populations in Europe are projected to grow by 15% by 2030, according to the United Nations. This factor is subsequently to escalate the demand for aerial imaging solutions that further drives the growth rate of the market.

MARKET RESTRAINTS

Stringent Data Privacy Regulations

A significant restraint in the Europe aerial imaging market is the stringent data privacy and protection regulations, which create operational challenges for service providers. The European Union’s General Data Protection Regulation (GDPR), enforced by the European Commission, imposes strict rules on the collection, storage, and processing of geospatial data, including aerial images. Non-compliance can result in fines of up to €20 million or 4% of annual global turnover, as per Eurostat. These regulations often delay projects in urban areas where imagery may inadvertently capture personal information. As per European Data Protection Board, over 30% of companies face difficulties in aligning their operations with GDPR requirements. Additionally, the complexity of anonymizing data while maintaining its utility increases costs for aerial imaging firms. This regulatory environment poses a barrier to innovation and limits the scalability of aerial imaging applications across sectors like real estate and infrastructure monitoring.

High Initial Investment Costs

The high initial investment required for acquiring advanced aerial imaging technologies limits the accessibility for smaller players that further restraints the growth rate of the market. According to the European Investment Bank, the cost of drones equipped with high-resolution cameras and LiDAR systems can exceed €50,000 per unit, while satellite imaging systems require investments of over €100 million. According to the Eurostat, only 20% of small and medium enterprises (SMEs) in Europe have the financial capacity to adopt such technologies that is solely to hinder market. According to the International Civil Aviation Organization (ICAO), additional expenses, such as licensing, training, and maintenance, increase operational burdens. For instance, pilot certification for drone operators can cost up to €5,000 per individual. These financial barriers are particularly pronounced in Eastern Europe, where funding for technological adoption remains limited.

MARKET OPPORTUNITIES

Integration of Artificial Intelligence and Machine Learning

A significant opportunity in the Europe aerial imaging market lies in the integration of artificial intelligence (AI) and machine learning (ML) for advanced data analytics. According to the European Commission, AI-driven image processing can reduce analysis time by up to 50% by enabling faster decision-making across sectors like agriculture, urban planning, and disaster management. For instance, AI-powered aerial imaging systems can detect crop diseases with 95% accuracy, as per the European Environment Agency (EEA), which is significantly boosting agricultural productivity. According to the European Space Agency (ESA), AI enhances satellite imagery interpretation by enabling real-time monitoring of environmental changes. This technological advancement not only improves operational efficiency but also opens new revenue streams for service providers by positioning AI as a transformative force in the aerial imaging market.

Rising Adoption in Environmental Monitoring and Climate Action

The growing adoption of aerial imaging for environmental monitoring and climate action initiatives, which are driven by Europe’s commitment to sustainability goals is substantially to pose great opportunities for the Europe aerial imaging market. According to the European Environment Agency (EEA), aerial imaging plays a critical role in tracking deforestation, glacier retreat, and air quality, with over €5 billion allocated annually to environmental monitoring projects. As per the Eurostat, aerial imaging has helped reduce illegal logging activities by 40% in monitored regions. Furthermore, the European Green Deal, which aims for carbon neutrality by 2050, relies heavily on aerial data to assess progress toward climate targets. The EEA drones and satellites provide cost-effective solutions for monitoring renewable energy installations, such as wind farms and solar parks by ensuring optimal performance. As per the European Commission, aerial imaging is poised to become indispensable for achieving environmental and sustainability objectives across the continent.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.94% |

|

Segments Covered |

By Platform Type, Application, End-user Industry, and Country |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Terra Flight Aerial Imaging Inc., Fugro Ltd, Nearmap Ltd, Eagle View Technologies Inc., and Digital Aerial Solutions LLC. |

SEGMENTAL ANALYSIS

By Platform Type Insights

The UAVs/drones segment led the Europe aerial imaging market by capturing a 45.1% market share in 2024 and is projected to exhibit a fastest CAGR of 15.2% during the forecast period. Cost-effectiveness, with operational costs ranging from €500 to €1,500 per day, and versatility in applications like agriculture, construction, and disaster management. According to the Eurostat, drones are particularly valued for their ability to access confined spaces and provide high-resolution imagery at lower altitudes. As per the International Civil Aviation Organization (ICAO), Europe accounts for over 35% of global drone operations. Their importance lies in enabling real-time data collection and analysis by making them indispensable for precision tasks. This segment's dominance reflects its transformative role in enhancing efficiency and accessibility across diverse industries. This growth is fueled by advancements in drone technology, such as LiDAR and thermal imaging, which expand their application scope.

According to the European Space Agency (ESA), drones are increasingly used for environmental monitoring and smart city initiatives. Additionally, regulatory frameworks supporting drone integration is enforced by the European Union Aviation Safety Agency (EASA) that have streamlined operations. The affordability and flexibility of drones, with costs up to 70% lower than manned aircraft. Drones are pivotal in delivering scalable, real-time solutions as Europe invests heavily in sustainable technologies with significant position as the market’s fastest-growing platform type.

By Application Insights

The geospatial mapping segment was the largest and held 45.3% of the Europe aerial imaging market share in 2024. The land use planning, navigation systems, and policy implementation, such as the EU’s Common Agricultural Policy (CAP), which relies on precise geospatial data to allocate €58 billion annually in subsidies. According to the European Environment Agency (EEA), advancements in drone and satellite technologies have improved mapping accuracy to 10 cm per pixel. Additionally, over €2 billion is invested annually in geospatial projects across Europe by ensuring efficient resource management. This segment’s importance lies in its ability to support sustainable development, infrastructure planning, and environmental conservation by making it indispensable for both public and private sectors.

The environmental monitoring segment is expected to register a fastest CAGR of 14.5% from 2025 to 2033. This growth is driven by Europe’s commitment to climate action, including the European Green Deal, which mandates the use of aerial imaging to track deforestation, air quality, and glacier retreat. According to the Eurostat, aerial imaging has reduced illegal logging activities by 40% in monitored regions, underscoring its effectiveness. The EEA also notes that over €5 billion is allocated annually to environmental monitoring projects. The demand for real-time data to inform policymaking and ensure compliance with sustainability goals is rising As climate change intensifies in across the world.

By End-user Industry Insights

The government sector dominated the Europe aerial imaging market with 25.1% share in 2024 owing to the extensive use of aerial imaging for urban planning, environmental monitoring, and disaster management. As per the European Environment Agency (EEA), governments rely on satellite and drone data to implement policies like the EU’s Common Agricultural Policy (CAP), which allocates €58 billion annually based on geospatial analysis. As per the Eurostat, over €2 billion is spent annually on government-led aerial imaging projects. This segment’s importance lies in its role in ensuring sustainable development by enhancing public safety, and supporting evidence-based decision-making with indispensable governance and policy implementation across Europe.

The agriculture segment is anticipated to witness a CAGR of 16.2% from 2025 to 2033. This growth is driven by the adoption of precision agriculture practices, supported by drones equipped with multispectral sensors that improve crop yields by up to 30%. As per the European Environment Agency (EEA), aerial imaging reduces water and fertilizer usage by 20% with the EU’s Farm to Fork strategy for sustainable farming. As per the European Commission, agriculture contributes €178 billion annually to the EU economy, with aerial imaging playing a pivotal role in modernizing the sector. As climate change pressures mount, this segment’s ability to enhance food security and promote eco-friendly practices leverages its rapid expansion and critical importance.

REGIONAL ANALYSIS

Germany led the Europe aerial imaging market with 25.6% of share in 2024. The growing industrial base, including construction, agriculture, and energy sector, which extensively utilize aerial imaging for precision applications. According to the European Commission, Germany accounts for over €3 billion in annual investments in geospatial technologies, supported by government initiatives like the Digital Strategy 2025. Additionally, the country’s focus in renewable energy, with over 50% of its electricity generated from renewables, drives demand for aerial imaging in monitoring wind farms and solar parks. According to the Eurostat, Germany’s advanced drone manufacturing sector also contributes to its market growth. These factors are combined with stringent environmental regulations with Germany as a hub for innovation and adoption in aerial imaging.

France aerial imaging market is likely to experience a fastest CAGR of 15.2% during the forecast period. The presence of strong aerospace and defense sector is leveraging the demand of aerial imaging for surveillance, border security, and disaster management. According to the European Environment Agency (EEA), France invests heavily in smart city initiatives by using aerial imaging for urban planning and infrastructure development. Additionally, the country’s agricultural sector, contributing €75 billion annually to the economy, relies on drones for precision farming, as per Eurostat. France’s commitment to sustainability, including its €30 billion investment in green technologies, further accelerates market growth by making it a key player in advancing aerial imaging applications.

The United Kingdom is deemed to maintain steady growth rate in the next coming years. The UK’s market growth is fueled by its advanced construction and infrastructure sectors, which utilize aerial imaging for large-scale projects like HS2 rail development. As per the Eurostat, the UK allocates over €1.5 billion annually to geospatial data collection by supporting urban planning and environmental monitoring. As per the British Geological Survey, the UK’s focus on climate resilience drives demand for aerial imaging in tracking coastal erosion and flood risks. The favorable regulatory frameworks from the Civil Aviation Authority (CAA) in UK is amplifying the growth of the market.

KEY MARKET PLAYERS

The major players in the Europe aerial imaging market include Terra Flight Aerial Imaging Inc., Fugro Ltd, Nearmap Ltd, Eagle View Technologies Inc., and Digital Aerial Solutions LLC.

MARKET SEGMENTATION

This research report on the Europe aerial imaging market is segmented and segmented and sub-segmented into the following categories.

By Platform Type

- Fixed-wing Aircraft

- Helicopters

- UAVs/Drones

- Other Platform Types

By Application

- Geospatial Mapping

- Infrastructure Planning

- Asset Inventory Management

- Environmental Monitoring

- National and Urban Mapping

- Surveillance and Monitoring

- Disaster Management

- Other Applications

By End-user Industry

- Construction

- Aerospace and Defense

- Government

- Oil and Gas

- Energy and Power Agriculture

- Other End-user Industries

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of the Europe aerial imaging market?

The Europe aerial imaging market is driven by advancements in drone technology, increasing demand for geospatial data, growing applications in agriculture, urban planning, and environmental monitoring, and the rising adoption of aerial surveys for infrastructure development.

Which industries are the major consumers of aerial imaging in Europe?

Key industries using aerial imaging in Europe include agriculture, forestry, defense, real estate, urban planning, oil & gas, and environmental monitoring. Governments and municipal bodies also rely on aerial imaging for mapping and disaster management.

What technologies are enhancing aerial imaging capabilities in Europe?

Technologies such as LiDAR, AI-powered image analytics, multispectral and hyperspectral imaging, and high-resolution satellite integration are enhancing aerial imaging accuracy and usability across various sectors.

What are the emerging trends in the Europe aerial imaging market?

Emerging trends include the use of AI and machine learning for automated image processing, increased adoption of autonomous drones, real-time aerial monitoring solutions, and rising demand for aerial imaging in renewable energy projects.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]