Europe Adult Diapers Market Size, Share, Trends & Growth Forecast Report By Type (Tape-On Diapers, Pant/Pull-Up Type Diapers, Pad-Type Diapers), Gender, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Adult Diapers Market Size

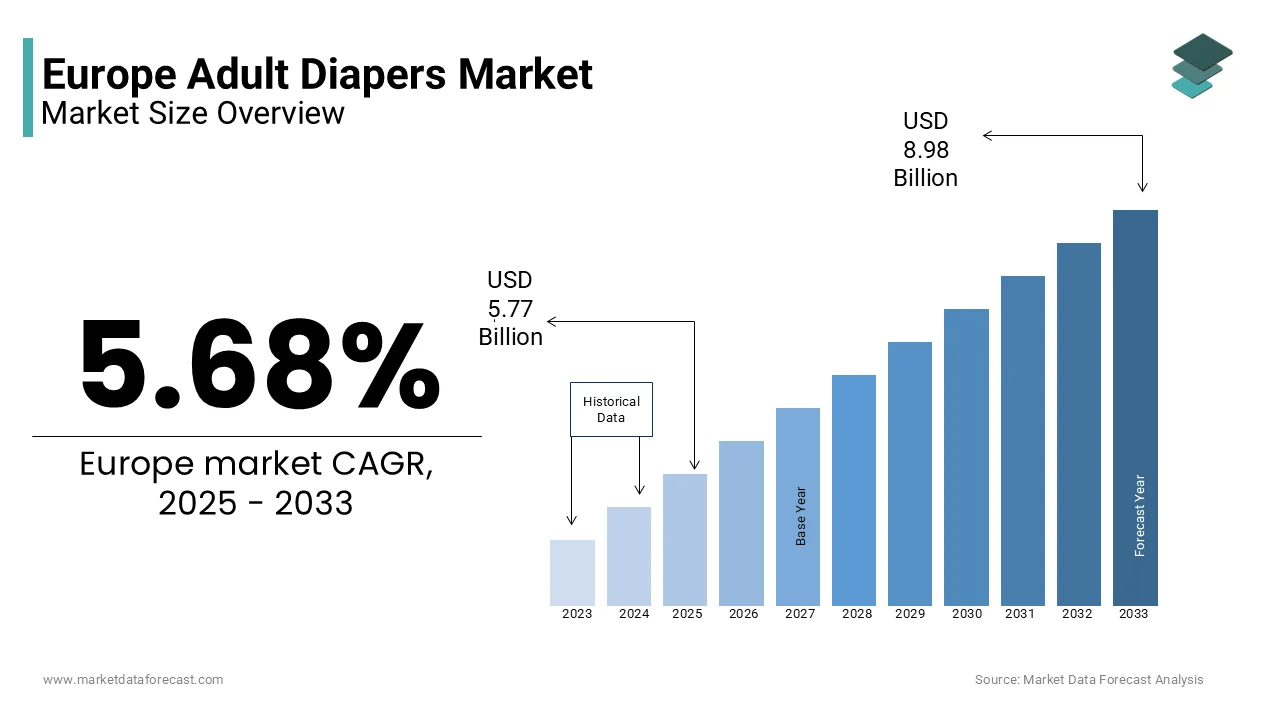

The adult diapers market size in Europe was valued at USD 5.46 billion in 2024. The European market is estimated to be worth USD 8.98 billion by 2033 from USD 5.77 billion in 2025, growing at a CAGR of 5.68% from 2025 to 2033.

Adult diapers cater the needs of individuals with incontinence, mobility challenges, or age-related conditions. Adult diapers are designed to provide comfort, hygiene, and dignity, addressing both functional and emotional requirements for users. According to Eurostat, the market was valued at approximately €4 billion in 2023, with steady growth driven by Europe’s aging population and increasing awareness of incontinence care solutions. Germany, France, and Italy are the largest contributors, collectively accounting for over 60% of total revenue. The UK Office for National Statistics highlights that over 20% of Europeans aged 65 and above require incontinence products, reflecting the growing demand for reliable and high-quality solutions.

Italy’s Ministry of Health emphasizes that advancements in materials, such as breathable fabrics and super-absorbent polymers, have improved product performance and user comfort, driving adoption rates. Additionally, the European Commission notes that rising healthcare expenditures and government initiatives promoting elderly care have further bolstered market growth. Sustainability is also gaining prominence, with 30% of consumers seeking eco-friendly options like biodegradable diapers. As urbanization and life expectancy increase, coupled with a focus on enhancing the quality of life for the elderly, the European adult diaper market continues to expand. This convergence of innovation, functionality, and sensitivity underscores its importance in addressing the needs of an aging demographic while aligning with modern environmental and healthcare standards.

MARKET DRIVERS

Aging Population and Increased Life Expectancy

A key driver of the European adult diaper market is the region’s rapidly aging population, fueled by increased life expectancy and declining birth rates. Eurostat reports that over 20% of Europe’s population is aged 65 or above, with projections indicating this demographic will grow by 30% over the next decade. The UK Office for National Statistics highlights that age-related conditions, such as incontinence, affect approximately 40% of seniors, driving demand for reliable and high-quality adult diapers. Additionally, Germany’s Federal Ministry of Health emphasizes that government initiatives promoting eldercare have increased awareness and accessibility to incontinence products. As healthcare systems prioritize elderly care, the need for advanced hygiene solutions continues to rise. This demographic shift ensures sustained growth in the adult diaper market, addressing both functional needs and emotional well-being for aging populations.

Rising Awareness and Acceptance of Incontinence Care

Another significant driver is the growing awareness and reduced stigma surrounding incontinence care, encouraging more individuals to seek appropriate solutions. Italy’s Ministry of Health notes that public health campaigns have successfully educated consumers about the importance of managing incontinence, with 60% of affected individuals now actively seeking products like adult diapers. Eurostat reports that sales of premium incontinence products have risen by 25% annually due to their superior comfort and performance. Furthermore, the European Commission highlights that advancements in product design, such as odor control and skin-friendly materials, have improved user acceptance. Urbanization has also played a role, with cities like Paris and Berlin reporting higher adoption rates among working adults with mobility challenges. By addressing both physical and psychological barriers, this trend fosters market expansion while enhancing the quality of life for users.

MARKET RESTRAINTS

High Costs and Limited Accessibility

A significant restraint in the European adult diaper market is the high cost of premium products, which limits accessibility for low-income and rural populations. Eurostat reports that advanced adult diapers with features like super-absorbent polymers are priced 40% higher than standard options, making them unaffordable for many consumers. The UK Office for National Statistics highlights that only 30% of elderly individuals in Eastern Europe can afford premium incontinence products, compared to over 60% in Western Europe. Additionally, Germany’s Federal Ministry of Health notes that limited availability of specialized products in rural areas further exacerbates disparities. While these products offer superior comfort and hygiene, affordability remains a barrier, particularly among economically disadvantaged groups. This financial constraint restricts market penetration, hindering broader adoption and leaving underserved demographics without adequate access to essential care solutions.

Environmental Concerns Over Disposable Products

Another major restraint is the growing scrutiny over the environmental impact of disposable adult diapers, driven by Europe’s push for sustainability. The European Environment Agency states that disposable hygiene products contribute significantly to landfill waste, with less than 5% of adult diapers currently made from biodegradable materials. France’s Ministry of Ecology highlights that regulatory pressures under the EU Circular Economy Action Plan are pushing manufacturers to adopt eco-friendly practices, but compliance increases production costs by up to 25%. Furthermore, Eurostat reports that only 15% of consumers actively seek sustainable alternatives, reflecting a gap between awareness and action. As environmental concerns mount, balancing affordability, functionality, and sustainability remains a critical challenge, impacting both production strategies and consumer adoption rates in the adult diaper market.

MARKET OPPORTUNITIES

Growing Demand for Eco-Friendly and Sustainable Products

A significant opportunity in the European adult diaper market lies in the rising demand for eco-friendly and sustainable products, driven by environmental awareness. The European Environment Agency reports that 40% of consumers are willing to switch to biodegradable or recyclable adult diapers, reflecting a shift toward environmentally responsible choices. Italy’s Ministry of Health highlights that manufacturers incorporating sustainable materials, such as plant-based absorbents, have seen a 25% increase in sales among eco-conscious buyers. Additionally, Eurostat notes that less than 10% of current products meet sustainability standards, leaving a significant gap in the market. France’s Ministry of Ecology emphasizes that regulatory support under the EU Circular Economy Action Plan incentivizes innovation in this space. By investing in sustainable solutions, companies can tap into this lucrative trend, meeting consumer expectations while addressing ecological concerns and enhancing brand loyalty.

Expansion of Home Healthcare and Telemedicine

Another key opportunity is the growing emphasis on home healthcare and telemedicine, which amplifies the need for reliable incontinence care solutions. The UK Office for National Statistics reports that over 60% of elderly individuals prefer aging in place, driving demand for high-quality adult diapers and related products. Germany’s Federal Ministry of Health highlights that government initiatives promoting home-based eldercare have increased the adoption of premium incontinence products by 20% annually. Additionally, Eurostat notes that advancements in telemedicine have improved remote monitoring of age-related conditions, further boosting product usage. As Europe’s healthcare systems shift toward decentralized care models, manufacturers can capitalize on this trend by offering innovative, user-friendly products tailored to home settings. This alignment with healthcare trends ensures sustained growth and accessibility in the adult diaper market.

MARKET CHALLENGES

Increasing Aging Population and Healthcare Strain

The growing aging population in Europe presents a significant challenge for the adult diaper market, as it intensifies demand while straining healthcare resources. Eurostat, the European Union's statistical office, reports that over 20% of Europeans were aged 65 or above in 2021, with projections indicating this figure will reach nearly 30% by 2050. This demographic shift directly impacts the need for adult diapers, particularly among individuals with age-related incontinence. However, the rising demand places financial pressure on healthcare systems. For instance, Germany spends approximately €40 billion annually on geriatric care products, including incontinence aids. Governments must address affordability while ensuring adequate supply, requiring innovative solutions to manage costs without compromising quality or accessibility.

Environmental Concerns from Disposable Diapers

The environmental impact of disposable adult diapers is another pressing challenge, contributing significantly to waste management issues across Europe. The European Environment Agency highlights that non-biodegradable hygiene products account for about 3% of total landfill waste, with an estimated 7 billion units discarded annually. Most diapers are made from plastics and synthetic materials that take centuries to decompose, worsening pollution concerns. Despite efforts to promote sustainable alternatives, adoption remains limited. According to France’s Ministry of Ecological Transition, less than 5% of consumers currently choose eco-friendly diaper options, even with government incentives. Addressing this issue requires stronger policies and widespread consumer education initiatives to encourage the use of biodegradable products and reduce the environmental footprint of this essential market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.68% |

|

Segments Covered |

By Type, Gender, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Nippon Paper Industries Co Ltd, Drylock Technologies NV, Ontex BV, Kimberly-Clark Corp, Essity AB, Paul Hartmann AG, Abena AS, and others. |

SEGMENTAL ANALYSIS

By Type Insights

The tape-on diapers segment dominated the European adult diaper market by holding 40.8% of the European market share in 2024. The leading position of tape-on diapers segment in the European is majorly attributed to their suitability for severe incontinence cases and bedridden patients, particularly in geriatric care facilities. Governments like Germany’s reimburse these products under healthcare programs, enhancing accessibility. With over 20% of Europeans aged 65 or above (Eurostat, 2021), the demand for reliable, high-absorption products remains critical. Tape-on diapers are vital for caregiving scenarios, ensuring comfort and preventing skin irritation. Their widespread use in medical settings underscores their importance, addressing the needs of Europe’s aging population effectively.

The pant/pull-up type diapers segment is expected to grow at the fastest CAGR of 15.5% during the forecast period due to the increasing demand from active seniors aged 65-74 who prioritize independence and discretion. Unlike tape-on diapers, pull-ups resemble regular underwear, appealing to users seeking dignity and ease of use. The rise in age-related incontinence, projected to affect 25% of adults over 60 (World Health Organization), further fuels this trend. Additionally, innovations in sustainable materials cater to eco-conscious consumers, boosting adoption rates. Their convenience and modern design make them indispensable for Europe’s mobile elderly population.

By Gender Insights

The female segment captured 60.3% of the European market share in 2024. The higher prevalence of incontinence among women is driving the female segment in the European market. The World Health Organization estimates that 25-30% of women aged 30-60 and over 50% of women above 60 experience urinary incontinence. Factors like childbirth, menopause, and pelvic floor disorders contribute to this demand. Female-specific products, such as anatomically designed pads, are critical for addressing these needs effectively. Government healthcare programs in countries like France and Germany ensure affordability, enhancing accessibility. The segment's leadership underscores its importance in managing gender-specific health challenges and improving women's quality of life.

The male segment is comparatively growing at a better growth rate and is expected to hold a prominent share of the European market over the forecast period. This growth is fueled by rising age-related conditions like prostate disorders and post-prostatectomy incontinence, affecting 15% of men over 60, as per the European Association of Urology. Increasing awareness and availability of male-specific products, designed for better fit and absorption, are driving adoption. Additionally, the aging male population, projected to grow significantly by 2050 (Eurostat), further accelerates demand. The segment's rapid growth highlights its importance in addressing underserved needs and ensuring dignity and comfort for elderly men.

REGIONAL ANALYSIS

Germany dominated adult diaper market in Europe by holding a 25.5% of the European market share in 2024. The rapidly aging population is propelling the adult diaper market growth in Germany. The robust healthcare system of Germany that reimburses incontinence aids, ensuring affordability and accessibility for elderly citizens is further driving the German market growth. Additionally, Germany is home to major manufacturers like Hartmann Group, which contribute to product innovation and availability. The combination of an aging demographic, supportive healthcare policies, and strong industrial presence makes Germany a key player in the market, addressing the growing demand for geriatric care products effectively.

The UK is another major market for diapers in Europe and held a substantial share of the European market in 2024. The UK market is predicted to grow at a CAGR of 7.8% over the forecast period owing to the initiatives from the National Health Service (NHS) to promote affordable incontinence care. According to the UK Office for National Statistics, the aging population is projected to grow significantly, sustaining demand for adult diapers. With approximately 18% of the population aged 65 or above in 2021, the need for reliable incontinence solutions remains critical. The NHS’s focus on providing subsidized or free products ensures widespread accessibility, particularly among low-income seniors. Furthermore, increasing awareness about age-related health issues has encouraged adoption, solidifying the UK’s position as a leading market in Europe.

France is estimated to register notable growth during the forecast period in the European market. France’s Ministry of Solidarity and Health emphasizes subsidies for elderly care products, making them more affordable and accessible to the aging population. According to INSEE (France’s National Institute of Statistics), over 20% of French citizens are aged 65 or above, driving demand for incontinence solutions. The government’s proactive approach, including financial aid for caregivers and senior citizens, has significantly boosted adoption rates. Additionally, growing awareness of sustainable and biodegradable diaper options aligns with France’s environmental goals, further propelling market growth. These factors underscore France’s importance in the regional market.

KEY MARKET PLAYERS

The major key players in Europe Adult diapers market are Nippon Paper Industries Co Ltd, Drylock Technologies NV, Ontex BV, Kimberly-Clark Corp, Essity AB, Paul Hartmann AG, Abena AS, and others.

MARKET SEGMENTATION

This research report on the Europe adult diapers market is segmented and sub-segmented into the following categories.

By Type

- Tape-On Diapers

- Pant/Pull-Up Type Diapers

- Pad-Type Diapers

By Gender

- Male

- Female

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What is the projected market size and growth rate of the Europe Adult Diapers Market?

The Europe adult diapers market is expected to grow from USD 5.77 billion in 2025 to USD 8.98 billion by 2033, registering a CAGR of 5.68% during the forecast period.

2. What are the key factors driving the growth of the adult diapers market in Europe?

The market is primarily driven by the aging population, rising awareness of incontinence products, increasing healthcare expenditures, and growing adoption of discreet and comfortable adult diapers

3. Which product segment dominates the Europe Adult Diapers Market?

Disposable adult diapers hold the largest market share due to their convenience, high absorbency, and affordability, followed by reusable and biodegradable adult diapers as sustainability concerns rise.

4. What are the latest trends influencing the European adult diaper market?

The market is witnessing a shift towards biodegradable and eco-friendly diapers, smart adult diapers with wetness indicators, and an increase in online sales driven by e-commerce platforms.

5. Which countries in Europe contribute the most to the adult diapers market growth?

Germany, the UK, France, and Italy are among the leading contributors, driven by high healthcare awareness, increasing elderly populations, and government support for incontinence products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]