Europe Additive Manufacturing With Metal Powder Market Size, Share, Trends & Growth Forecast Report By Technology (Laser Powder Bed Fusion (LPBF), Electron Beam Melting (EBM), Binder Jetting, Directed Energy Deposition (DED)), Metal Type, Application, and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Additive Manufacturing With Metal Powder Market Size

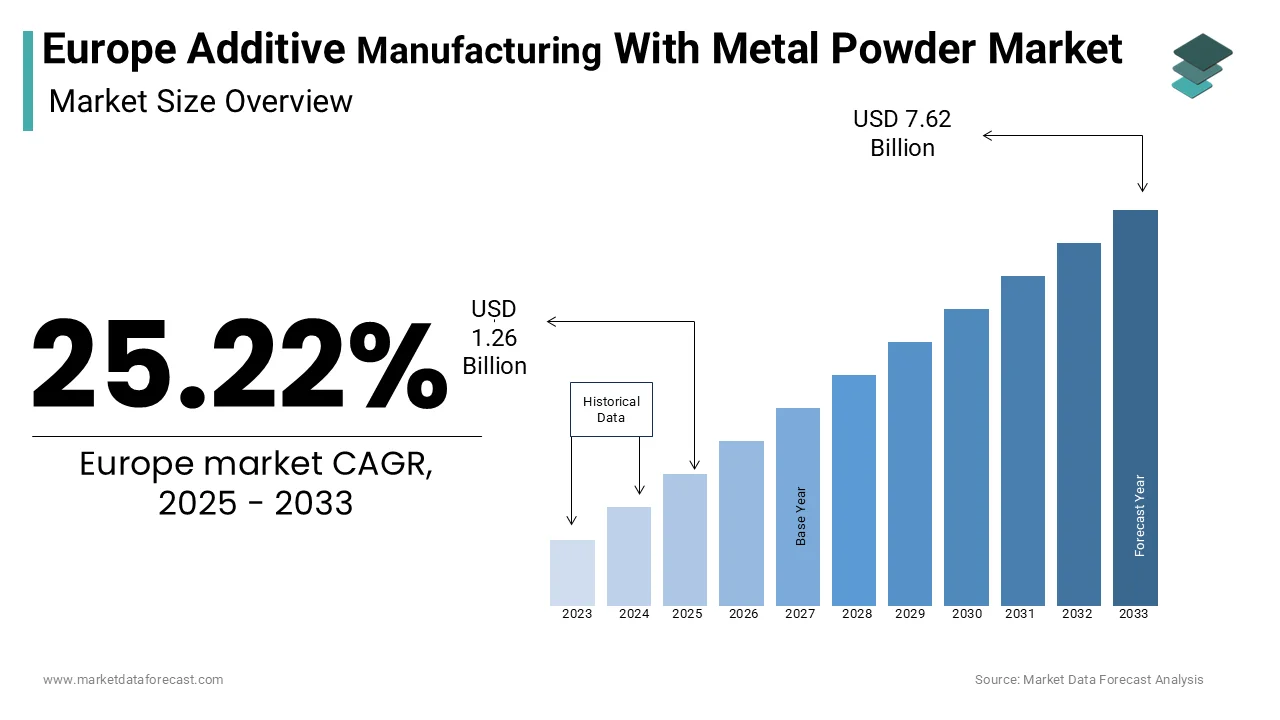

The Europe Additive Manufacturing With Metal Powder market size was valued at USD 1.01 billion in 2024. The European market is estimated to be worth USD 7.62 billion by 2033 from USD 1.26 billion in 2025, growing at a CAGR of 25.22% from 2025 to 2033.

Additive manufacturing (AM) with metal powders is commonly referred to as metal 3D printing, represents a transformative technology in advanced manufacturing. This process involves layer-by-layer fabrication of complex components using metal powders, enabling unparalleled design flexibility and material efficiency. In Europe, the market is driven by its integration into high-value industries such as aerospace, automotive, medical, and defense, where lightweight, durable, and intricate parts are essential. According to the European Association of the Machine Tool Industries, the region accounts for approximately 30% of global metal additive manufacturing activities, reflecting its leadership in innovation and industrial adoption. The technology's ability to produce near-net-shape components with minimal waste aligns with Europe's sustainability goals, as outlined by the European Green Deal. Furthermore, as per the Eurostat, investments in advanced manufacturing technologies in Europe exceeded €50 billion in 2022, with metal AM being a key focus area. Despite challenges such as high material costs and limited scalability, the market continues to grow, supported by advancements in powder metallurgy and increased adoption across diverse applications. This report explores the key drivers, restraints, opportunities, and challenges shaping the European additive manufacturing with metal powders market while also providing a detailed segmental analysis by technology, metal type, application, end-user, and regional breakdown.

MARKET DRIVERS

Rising Demand for Lightweight Components in Aerospace

The increasing demand for lightweight components in the aerospace industry serves as a major driver for the European additive manufacturing with metal powders market. In according with the European Space Agency, over 40% of aerospace manufacturers in Europe have adopted metal AM technologies to produce complex, lightweight parts that enhance fuel efficiency and reduce emissions. Titanium and aluminum alloys, widely used in aerospace applications, account for nearly 60% of metal powder consumption in this sector. The European Aeronautic Defense and Space Company (EADS) states that additive manufacturing has reduced material waste by up to 90% compared to traditional subtractive methods, making it a cost-effective solution for producing critical components. Furthermore, in line with Eurostat, the European aerospace industry produced over 1,200 commercial aircraft in 2022, with AM contributing significantly to the production of engine components and structural parts. The International Air Transport Association projects a 5% annual growth in air travel demand through 2030, further amplifying the need for advanced manufacturing solutions like metal AM.

Growing Adoption in Medical and Dental Applications

The growing adoption of additive manufacturing with metal powders in medical and dental applications, driven by the need for customized implants and prosthetics is another significant driver of the European market. According to the study by the European Federation of Pharmaceutical Industries and Associations, over 30% of orthopedic implants in Europe are now produced using metal AM technologies, leveraging materials such as titanium and stainless steel for their biocompatibility and strength. The European Medical Device Regulation emphasizes the importance of patient-specific solutions, further boosting demand for AM in healthcare. As per the European Investment Bank, investments in medical device manufacturing reached €20 billion in 2022, with AM playing a pivotal role in enabling precision manufacturing. Additionally, the European Dental Association reveals that the demand for custom dental crowns and bridges grew by 8% in 2022, driven by the ability of metal AM to produce highly accurate and durable components. This trend underscores the immense potential for market expansion in healthcare applications.

MARKET RESTRAINTS

High Costs of Metal Powders

High costs associated with metal powders represent a significant restraint for the European additive manufacturing market. The European Powder Metallurgy Association stresses that the price of high-performance metal powders, such as titanium and nickel-based alloys, can be up to five times higher than conventional raw materials. These elevated costs limit the widespread adoption of metal AM, particularly among small and medium-sized enterprises (SMEs). The European Commission notes that over 60% of SMEs cite material costs as a primary barrier to adopting advanced manufacturing technologies. Furthermore, the European Chemical Industry Council observes that fluctuations in raw material prices, driven by geopolitical tensions and supply chain disruptions, exacerbate this issue. For instance, the cost of titanium powder increased by 20% in 2022 due to supply constraints. These financial barriers not only hinder market growth but also constrain investments in scaling AM technologies for mass production.

Limited Scalability for Large-Scale Production

Limited scalability for large-scale production poses another critical challenge to the European additive manufacturing with metal powders market. According to the European Association of the Machine Tool Industries, current AM technologies are primarily suited for prototyping and small-batch production, with throughput rates significantly lower than traditional manufacturing methods. The European Federation of Manufacturers states that the average production time for a single component using metal AM is approximately 10 times longer than conventional techniques, making it unsuitable for high-volume applications. Additionally, the European Investment Bank said that less than 15% of manufacturing firms in Europe have integrated AM into their mainstream production processes due to these limitations. While advancements in multi-laser systems and larger build volumes are underway, the transition to scalable solutions remains slow. This challenge restricts the broader adoption of metal AM across industries requiring mass production capabilities.

MARKET OPPORTUNITIES

Expansion into Automotive Lightweighting Solutions

The increasing emphasis on lightweighting in the automotive industry presents a lucrative opportunity for the European additive manufacturing with metal powders market. As stated by the European Automobile Manufacturers' Association, the automotive sector produced over 17 million vehicles in 2022, with electric vehicles (EVs) witnessing a 40% year-on-year increase. Lightweight components, such as aluminum and titanium alloys, are critical for enhancing fuel efficiency and extending EV battery range. The International Energy Agency focuses Europe's commitment to achieving a 30% reduction in vehicle emissions by 2030, further driving the adoption of advanced manufacturing technologies like metal AM. According to Eurostat, investments in EV manufacturing infrastructure reached €30 billion in 2022 which is creating a favorable environment for AM solutions. Additionally, the European Investment Bank projects that the demand for lightweight automotive components will grow at a CAGR of 7% from 2023 to 2030 and is underscoring the immense potential for market expansion in this sector.

Advancements in Hybrid Manufacturing Technologies

Advancements in hybrid manufacturing technologies, which combine additive and subtractive processes, offer another promising opportunity for the European market. According to the European Machine Tool Industries Association, hybrid systems enable the production of complex geometries with superior surface finishes, addressing one of the key limitations of standalone AM technologies. The European Investment Bank states that investments in hybrid manufacturing equipment are expected to reach €15 billion by 2030, driven by the growing demand for high-precision components in industries such as aerospace and medical devices. Furthermore, the European Commission's Horizon Europe program emphasizes the development of next-generation manufacturing technologies, further supporting innovation in this space. According to the European Federation of Manufacturers, over 25% of advanced manufacturing firms in Europe are exploring hybrid solutions to enhance productivity and reduce lead times. This trend underscores the critical role of hybrid technologies in unlocking new applications for metal AM.

MARKET CHALLENGES

Stringent Regulatory Standards

Stringent regulatory standards governing the use of metal powders in critical applications pose a significant challenge to the European additive manufacturing market. As per the European Chemicals Agency, the classification and labeling of metal powders must comply with REACH and CLP regulations, which mandate rigorous testing and documentation to ensure safety and environmental compliance. The European Commission emphasizes that over 40% of manufacturers face delays in product certification due to these stringent requirements, impacting time-to-market. Additionally, the European Medical Device Regulation imposes strict quality control measures for AM-produced components used in healthcare, further complicating adoption. According to the European Federation of Pharmaceutical Industries and Associations, compliance costs for medical device manufacturers have risen by 25% over the past three years, limiting the affordability of AM solutions. These regulatory hurdles not only hinder market growth but also deter new entrants, constraining overall expansion.

Limited Availability of Skilled Workforce

The limited availability of skilled professionals trained in additive manufacturing technologies represents another critical challenge for the European market. The European Centre for the Development of Vocational Training focuses on the fact that less than 10% of engineering graduates in Europe possess hands-on experience with metal AM systems, creating a significant skills gap. The European Commission reveals that over 50% of manufacturing firms struggle to find qualified personnel to operate and maintain advanced AM equipment. Furthermore, the European Investment Bank reports that investments in workforce training programs for AM technologies remain insufficient, with only €5 billion allocated annually across the region. This shortage of expertise not only slows the adoption of metal AM but also limits innovation and technological advancement. Addressing this challenge requires coordinated efforts between governments, educational institutions, and industry stakeholders to develop comprehensive training initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.22% |

|

Segments Covered |

By Technology, Metal Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Arcam AB (GE Additive), EOS GmbH, SLM Solutions Group AG, Renishaw PLC, Carpenter Technology Corporation, Sandvik AB, Höganäs AB, LPW Technology Ltd., ATI Powder Metals, Praxair Surface Technologies (Linde plc), 3D Systems Corporation, Concept Laser, Trumpf, BEAMIT, and Poly-Shape (AddUp), and others. |

SEGMENTAL ANALYSIS

By Technology Insights

The Laser Powder Bed Fusion (LPBF) segment the primary driver of market growth by commanding a market share of 50.7% in 2024. This segment's growth is sustained by LPBF's ability to produce high-precision components with excellent mechanical properties, making it ideal for aerospace and medical applications. The European Space Agency states that over 70% of metal AM components used in satellites and spacecraft are manufactured using LPBF technology. Additionally, the European Investment Bank observes that investments in LPBF systems exceeded €10 billion in 2022, driven by advancements in multi-laser configurations and larger build volumes. The versatility and reliability of LPBF ensure its sustained dominance in the market, particularly for applications requiring intricate designs and superior material performance.

The Directed Energy Deposition (DED) segment emerges as the rapidly expanding category, with a projected CAGR of 12% during the forecast period. This rapid growth is fueled by DED's ability to repair and modify existing components, making it highly valuable in industries such as oil and gas and power generation. The European Investment Bank stresses that investments in DED systems are expected to reach €8 billion by 2030, driven by the growing demand for cost-effective repair solutions. Additionally, the European Commission's Horizon Europe program emphasizes the development of DED technologies for large-scale applications, further accelerating this trend. The segment's growth underscores the critical role of DED in enabling sustainable manufacturing practices and reducing material waste.

By Metal Type Insights

The Titanium and its alloys segment represented the largest segment in the European additive manufacturing with metal powders market and accounted for 40.9% in 2024. This dominance is caused by the titanium's exceptional strength-to-weight ratio and biocompatibility, making it ideal for aerospace and medical applications. The European Space Agency fouses that over 60% of AM components used in aerospace structures are made from titanium alloys. Additionally, the European Federation of Pharmaceutical Industries and Associations draws attention to the growing adoption of titanium in orthopedic implants, further fueling demand. The versatility and performance of titanium ensure its sustained leadership in the market, particularly for applications requiring high durability and corrosion resistance.

The Aluminum and its alloys emerge as the fastest-growing segment, with a projected CAGR of 10% from 2023 to 2030, as per the European Aluminium Association. This rapid growth is driven by the increasing adoption of aluminum in lightweighting applications, particularly in the automotive and aerospace industries. The European Automobile Manufacturers' Association reports that the demand for aluminum components in electric vehicles grew by 30% in 2022, driven by the need for energy-efficient solutions. Additionally, the European Investment Bank projects that investments in aluminum AM technologies will reach €12 billion by 2030, further accelerating this trend. The segment's growth underscores the critical role of aluminum in enabling sustainable manufacturing practices and reducing carbon emissions.

By Application Insights

The Aerospace and defense stands as the biggest application segment in the European additive manufacturing with metal powders market and commanded a market share of 35% in 2024. This growth is caused by the extensive use of AM in producing lightweight, high-strength components for aircraft and spacecraft. The European Aeronautic Defense and Space Company reports that over 50% of critical aerospace components are now manufactured using AM technologies. Additionally, the European Investment Bank provides that investments in aerospace AM infrastructure reached €25 billion in 2022, driven by the growing demand for fuel-efficient designs. The versatility and performance of AM ensure its sustained dominance in this sector, particularly for applications requiring complex geometries and material efficiency.

The Medical and dental applications segment is witnessing the quickest expansion, with a projected CAGR of 11.3% during the forecast owing to the increasing adoption of AM in producing customized implants and prosthetics. The European Dental Association emphasizes that the demand for AM-produced dental crowns and bridges grew by 8% in 2022, driven by the ability to achieve high precision and biocompatibility. Additionally, the European Investment Bank projects that investments in medical AM technologies will reach €20 billion by 2030, further accelerating this trend. The segment's growth underscores the critical role of AM in enabling personalized healthcare solutions and improving patient outcomes.

REGIONAL ANALYSIS

Germany dominated the European additive manufacturing with metal powders market and held a market share of 25.4% in 2024. This prominence of Germany is influenced to the robust automotive and aerospace industries, which are major consumers of AM technologies. The German Aerospace Center focuses that over 60% of aerospace components produced in Germany utilize AM for lightweighting and material efficiency. Additionally, Germany's strong emphasis on sustainability aligns with the growing adoption of AM in renewable energy applications, further driving demand.

France is experiencing a notable rise in the European market. The country's aerospace and medical sectors are key contributors to AM adoption. Airbus, headquartered in France, leverages AM extensively for producing engine components and structural parts, driving demand. Furthermore, France's focus on healthcare innovation boosts the use of AM in medical implants and prosthetics, underscoring the segment's importance.

The UK holds a considerable market share and is propelled by the strong presence in the aerospace and automotive sectors drives AM demand. The UK aerospace industry is producing over 1,000 commercial aircraft annually and is increasingly adopts AM for lightweighting and fuel efficiency. Additionally, the UK's commitment to renewable energy supports the use of AM in wind turbine components and EV manufacturing.

Italy accounts for a lower portion of the market. The country's thriving automotive and medical sectors rely heavily on AM for producing lightweight components and custom implants. Italy's leadership in luxury automotive manufacturing amplifies demand for high-performance materials. Furthermore, the Italian government's focus on sustainable manufacturing aligns with the growing adoption of eco-friendly AM solutions.

Spain contributed significantly to the expansion of the European market. The country's automotive and aerospace industries are significant consumers of AM technologies. Spain's automotive sector, emphasizing lightweighting for EVs, utilizes AM extensively. Additionally, the Spanish Ministry for Ecological Transition highlights the country's commitment to circular economy initiatives, driving demand for recyclable materials and sustainable AM practices.

KEY MARKET PLAYERS

The major key players in Europe Additive Manufacturing With Metal Powder market are Arcam AB (GE Additive), EOS GmbH, SLM Solutions Group AG, Renishaw PLC, Carpenter Technology Corporation, Sandvik AB, Höganäs AB, LPW Technology Ltd., ATI Powder Metals, Praxair Surface Technologies (Linde plc), 3D Systems Corporation, Concept Laser, Trumpf, BEAMIT, and Poly-Shape (AddUp), and others.

MARKET SEGMENTATION

This research report on the Europe Additive Manufacturing With Metal Powder market is segmented and sub-segmented into the following categories.

By Technology

- Laser Powder Bed Fusion (LPBF)

- Electron Beam Melting (EBM)

- Binder Jetting

- Directed Energy Deposition (DED)

By Metal Type

- Titanium and its Alloys

- Aluminum and its Alloys

- Stainless Steel and its Alloys

- Nickel-Based Alloys

- Superalloys

By Application

- Aerospace and Defense

- Automotive

- Medical and Dental

- Power Generation

- Oil and Gas

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What was the size of the Europe Additive Manufacturing with Metal Powder market in 2024?

The Europe Additive Manufacturing with Metal Powder market was valued at USD 1.01 billion in 2024.

2. What factors are driving the growth of the European Additive Manufacturing with Metal Powder market?

The growth is driven by increasing demand for complex and lightweight components in industries such as aerospace, automotive, and healthcare, along with advancements in technology and materials

3. What are some of the challenges facing the European Additive Manufacturing with Metal Powder market?

Challenges include high initial investment costs and regulatory hurdles, although ongoing research and development are addressing these issues.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]