Europe 5G Services Market Size, Share, Trends, & Growth Forecast Report By Communication Type (FWA, eMBB, uRLLC, and mMTC), and Vertical, Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe), Industry Analysis From 2024 to 2033

Europe 5G services Market Size

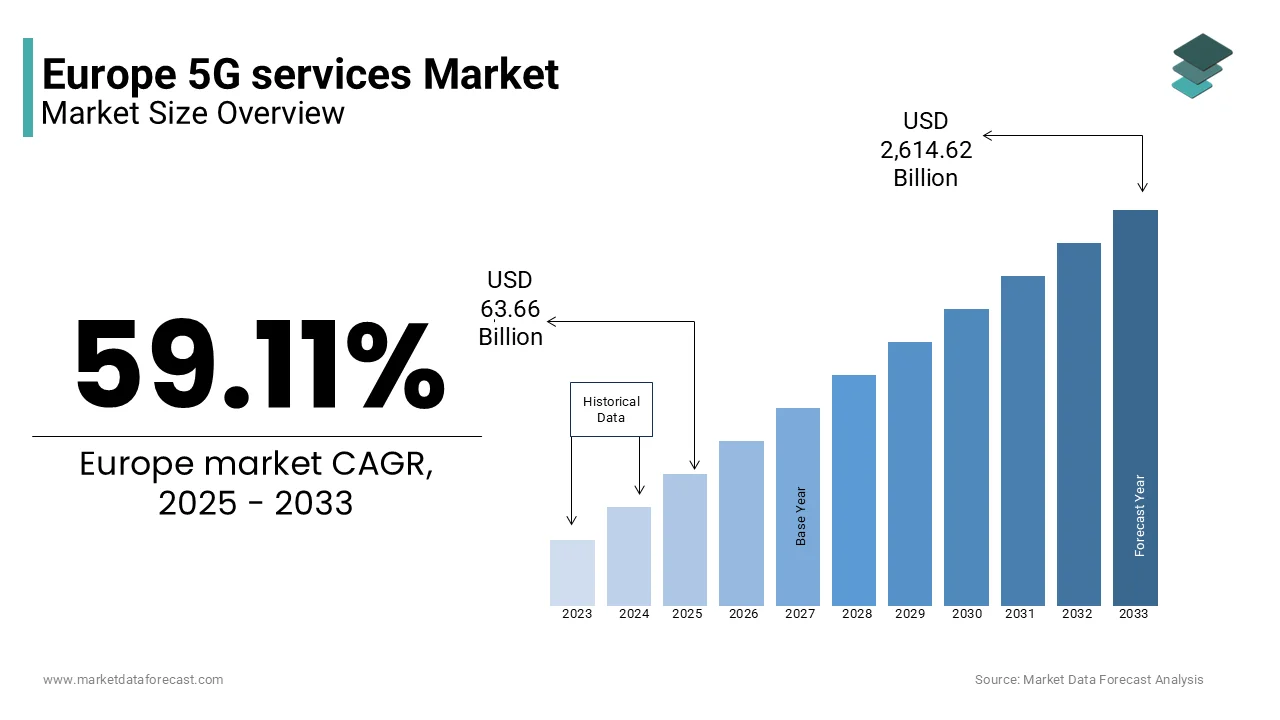

The size of the European 5G services market was worth USD 12.90 billion in 2024. The europe market is estimated at USD 63.66 billion in 2025 and is expected to reach USD 2,614.62 billion by 2033, growing at an annual compound rate of 59.11% during the forecast period 2025 to 2033.

The Europe 5G services market is rapidly evolving with the support from the convergence of technological advancements, regulatory support, and rising consumer demand for high-speed connectivity. According to Ericsson’s Mobility Report, 5G subscriptions in Europe are projected to reach 230 million by 2025, accounting for nearly 40% of total mobile subscriptions. This growth is fueled by the deployment of 5G networks across major cities, with Germany, the UK, and France leading the charge. The commitment of the European Union to digital transformation is one of the major trends fuelling the expansion of the European 5G services market. As per the European Commission, €150 billion has been earmarked for 5G infrastructure development as part of the Digital Decade initiative. This investment aims to ensure widespread 5G coverage by 2030, enabling industries like healthcare, manufacturing, and transportation to harness its potential. Additionally, the proliferation of IoT devices is amplifying demand for 5G. A study by McKinsey predicts that Europe will host over 10 billion IoT connections by 2026, necessitating robust and scalable 5G networks.

MARKET DRIVERS

Rising Demand for Enhanced Mobile Broadband in Europe

The escalating demand for enhanced mobile broadband (eMBB) is primarily driving the Europe 5G services market growth. Consumers are increasingly relying on high-speed internet for bandwidth-intensive applications such as streaming 4K/8K videos, online gaming, and virtual reality experiences. According to Nokia, data traffic generated by smartphones in Europe is expected to grow at a CAGR of 35% between 2022 and 2027, driven primarily by eMBB adoption. The proliferation of smart devices is further accelerating this trend. A report by Deloitte highlights that the average European household now owns six connected devices, creating a pressing need for faster and more reliable networks. 5G’s ability to deliver speeds up to 10 Gbps, significantly higher than 4G, makes it indispensable for meeting this demand. Moreover, the rise of remote work and digital-first lifestyles has intensified reliance on seamless connectivity, propelling the adoption of 5G-enabled services across the continent.

Industrial Digitization and IoT Integration

Industrial digitization and the integration of IoT solutions are further boosting the expansion of the Europe 5G services market. The manufacturing sector, in particular, is leveraging 5G to enable smart factories, where real-time data analytics and automation optimize production processes. According to Capgemini, 60% of European manufacturers plan to adopt 5G-powered IoT solutions by 2025, creating a surge in demand for ultra-reliable and low-latency communications (uRLLC). Additionally, sectors like healthcare and logistics are embracing 5G to enhance operational efficiency. For instance, a study by Siemens reveals that 5G-enabled IoT devices reduced supply chain inefficiencies by 20% in European logistics hubs during 2023. These advancements not only boost productivity but also align with the EU’s Green Deal objectives by promoting sustainable practices. The synergy between industrial digitization and 5G is thus reshaping the market landscape, fostering innovation and economic growth.

MARKET RESTRAINTS

High Infrastructure Costs

The substantial cost associated with building and maintaining 5G infrastructure is one of the key factors hindering the growth of the European 5G services market. According to PwC, deploying a nationwide 5G network requires an investment of €20-30 billion per country, depending on geographic size and population density. This financial burden often deters smaller operators from entering the market, limiting competition and innovation. Moreover, the ongoing expenses related to spectrum licensing exacerbate the challenge. A report by GSMA highlights that European governments collected €100 billion through spectrum auctions between 2019 and 2023, placing additional strain on telecom providers. These costs are often passed on to consumers, resulting in higher service fees and slower adoption rates. While larger players can absorb these expenses, smaller operators struggle to compete, creating a fragmented market landscape.

Security and Privacy Concerns

Security and privacy concerns are further restraining the growth of the Europe 5G services market. As per a study by Kaspersky, cyberattacks targeting 5G networks increased by 40% in 2023, raising fears about data breaches and unauthorized access. These vulnerabilities stem from the decentralized architecture of 5G, which relies on multiple nodes and edge computing systems. Furthermore, the lack of standardized security protocols across the region complicates efforts to safeguard networks. A report by Accenture indicates that 55% of European enterprises cited security risks as a barrier to adopting 5G-enabled IoT solutions. Addressing these concerns requires significant investments in advanced encryption technologies and threat detection systems, which may not be feasible for all stakeholders.

MARKET OPPORTUNITIES

Smart City Initiatives

Smart city initiatives is a promising opportunity for the Europe 5G services market. As per a report by Frost & Sullivan, over 200 European cities are currently implementing smart city projects, leveraging 5G to enhance urban infrastructure and improve quality of life. Applications include intelligent traffic management, smart lighting, and waste management systems, all of which rely on 5G’s low latency and high capacity. The European Investment Bank allocated €50 billion in 2023 to fund smart city projects, underscoring the region’s commitment to sustainable urban development. For instance, Barcelona’s 5G-enabled smart grid system reduced energy consumption by 25%, demonstrating the technology’s potential. By capitalizing on these initiatives, telecom providers can tap into a burgeoning segment, fostering long-term market expansion while contributing to societal benefits.

Edge Computing Expansion

The rapid expansion of edge computing is another lucrative opportunity for the Europe 5G services market. According to IDC, edge computing deployments in Europe grew by 30% in 2023, driven by the increasing demand for real-time data processing in industries like healthcare, retail, and manufacturing. 5G’s ability to support edge computing environments is critical for delivering low-latency services. For example, a study by IBM highlights that 5G-enabled edge computing reduced response times by 50% in European hospitals during emergency scenarios. Additionally, retailers are leveraging 5G-powered edge solutions to enhance customer experiences through augmented reality and personalized marketing. These innovations not only drive revenue but also position Europe as a global leader in next-generation technologies.

MARKET CHALLENGES

Spectrum Allocation Disparities

Disparities in spectrum allocation across European countries is a major challenge to the 5G services market. According to the European Telecommunications Standards Institute (ETSI), inconsistent spectrum policies have led to fragmented network deployments, hindering seamless cross-border connectivity. For instance, while Germany and the UK have allocated substantial mid-band spectrum for 5G, smaller nations like the Czech Republic and Slovakia face delays due to regulatory bottlenecks.

These disparities create operational inefficiencies for multinational operators. A report by Oliver Wyman highlights that 40% of European telecom providers cited spectrum allocation inconsistencies as a barrier to scaling their 5G networks. Harmonizing spectrum policies across the EU is crucial to achieving widespread coverage and ensuring interoperability, yet political and bureaucratic hurdles persist, complicating market progress.

Consumer Awareness and Adoption

Low consumer awareness and slow adoption rates are further challenging the expansion of the Europe 5G services market. According to a survey by Statista, only 30% of European consumers were aware of the benefits of 5G in 2023, with misconceptions about its necessity and functionality prevalent. This lack of understanding limits demand, particularly in rural and semi-urban areas where 5G penetration remains low. Additionally, affordability issues hinder adoption. A study by Omdia reveals that 5G-enabled devices are priced 30-40% higher than their 4G counterparts, making them inaccessible to budget-conscious consumers. While urban centers like London and Berlin exhibit higher adoption rates, bridging the awareness and affordability gap in underserved regions is essential to achieving equitable market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

59.11% |

|

Segments Covered |

By Communication Type, Vertical, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and Rest of Europe |

|

Market Leaders Profiled |

Ericsson, Nokia, Huawei, Vodafone Group Plc, Deutsche Telekom AG, British Telecommunications plc, Orange S.A., Telefónica S.A., Telecom Italia (TIM), Proximus Group, Telia Company, and Swisscom AG. |

SEGMENTAL ANALYSIS

By Communication Type Insights

The enhanced mobile broadband (eMBB) segment accounted for 46.4% of the European 5G services market share in 2024. The dominating position of eMBB segment in the European market is driven by the growing demand for high-speed internet among consumers and enterprises alike. Applications such as video streaming, cloud gaming, and virtual meetings rely heavily on eMBB’s superior speeds and capacity. The proliferation of 5G-enabled smartphones and the increasing reliance on digital platforms are also propelling the expansion of the eMBB segment in the European market. As per Qualcomm, 5G smartphone shipments in Europe grew by 50% in 2023, surpassing 100 million units. Additionally, the rise of remote work and digital-first lifestyles has amplified the need for seamless connectivity, solidifying eMBB’s position as the largest segment.

The ultra-reliable low-latency communications (uRLLC) segment is predicted to witness the highest CAGR of 28.8% over the forecast period owing to the increasing adoption of mission-critical applications in industries like healthcare, manufacturing, and transportation. For instance, a study by Siemens highlights that uRLLC-enabled systems reduced downtime by 25% in European manufacturing plants during 2023. The ability to deliver real-time data processing with minimal latency makes uRLLC indispensable for applications such as autonomous vehicles and remote surgeries. Additionally, the EU’s focus on industrial digitization has accelerated investments in uRLLC technologies, propelling its rapid expansion.

By Vertical Insights

The consumer segment captured the leading share of 58.8% of the European market share in 2024. The growth of the consumer segment in the European market is attributed to the widespread adoption of 5G-enabled smartphones and the growing demand for high-speed internet among individuals. Consumers are increasingly relying on 5G for bandwidth-intensive applications such as streaming ultra-high-definition content, online gaming, and virtual reality experiences. The affordability of 5G devices is also aiding the expansion of the consumers segment in the European market. According to Counterpoint Research, the average price of 5G smartphones in Europe dropped by 20% in 2023, making them more accessible to a broader audience. Additionally, telecom operators have introduced competitive pricing plans to attract subscribers, further boosting adoption. A study by Deloitte highlights that 5G penetration in urban areas like London and Berlin reached 70% in 2023, underscoring the segment’s prominence.

The enterprise segment is anticipated to grow at a promising CAGR of 23.1% over the forecast period owing to the increasing adoption of 5G-powered IoT solutions and industrial automation systems. Enterprises across sectors such as manufacturing, healthcare, and logistics are leveraging 5G to enhance operational efficiency and drive innovation. For instance, a report by McKinsey reveals that 5G-enabled IoT devices reduced production costs by 15% in European manufacturing facilities during 2023. The ability to deliver real-time data analytics and support edge computing environments makes 5G indispensable for enterprises aiming to achieve digital transformation. Additionally, government initiatives promoting smart factories and Industry 4.0 have accelerated investments in enterprise-grade 5G solutions, propelling the segment’s rapid expansion.

REGIONAL ANALYSIS

Germany held 23.7% of the Europe 5G services market share in 2024. The leading position of Germany in Europe is driven by its robust industrial base and strategic investments in 5G infrastructure. Major cities like Berlin and Munich have achieved near-complete 5G coverage, enabling innovative applications in industries such as automotive and manufacturing. The commitment of German government to digital transformation is further contributing to the growth of the German 5G services market. According to the Federal Ministry for Economic Affairs, €5 billion was allocated in 2023 to accelerate 5G deployment. Additionally, partnerships between telecom operators and manufacturers have fostered the development of 5G-powered smart factories. A study by Siemens highlights that 5G adoption in German industries increased productivity by 20% in 2023, solidifying the country’s position as a leader in the market.

The UK is a promising regional segment for 5G services and occupied for the second largest share of the European 5G services market in 2024. London serves as a critical hub, with over 80% of the city covered by 5G networks. The region’s strategic location and favorable regulatory frameworks have attracted significant foreign investments. The rise of fintech and e-commerce sectors has driven the demand for reliable 5G services. According to Barclays, 60% of UK businesses adopted cloud-based platforms in 2023, necessitating robust connectivity. Moreover, the UK government’s £1 billion investment in 5G testbeds and trials has spurred innovation. A study by TechUK highlights that 5G-enabled applications generated €15 billion in economic value during 2023, underscoring the nation’s prominence in the market.

France is a prominent market for 5G services in Europe. Paris has emerged as a key player, hosting over 50% of the country’s 5G deployments. The French government’s €3 billion investment in 5G infrastructure during 2023 has significantly boosted the sector’s growth. A major driver of this growth is the increasing adoption of 5G in healthcare and transportation. As per Capgemini, 5G-enabled telemedicine systems reduced response times by 30% in French hospitals during 2023. Additionally, the emphasis on sustainable practices has encouraged operators to integrate renewable energy-powered 5G networks. A report by EDF highlights that 40% of French 5G towers operate on solar or wind energy, aligning with national sustainability goals.

Spain captured a notable share of the European 5G services market in 2024. Barcelona and Madrid are rapidly emerging as key hubs, attracting global players like Telefónica and Vodafone. The country’s strategic focus on smart city initiatives has made it an ideal location for 5G-powered urban solutions. The commitment of Spain to bridging the digital divide is driving the Spanish market growth. According to a study by BBVA, 5G coverage in rural areas increased by 40% in 2023, thanks to government subsidies. Additionally, the rise of augmented reality (AR) and virtual reality (VR) applications has created new opportunities for localized 5G services. These factors collectively propel Spain’s prominence in the market.

Italy is anticipated to account for a prominent share of the Europe 5G services market over the forecast period. Milan and Rome are leading the charge, with over 70% of urban areas covered by 5G networks. The country’s rich cultural heritage and tourism industry have driven demand for innovative 5G applications. The integration of 5G in cultural preservation projects is further boosting the 5G services market growth in Italy. According to Telecom Italia, 5G-enabled drones monitored historical sites, reducing maintenance costs by 25% in 2023. Additionally, tax incentives introduced by the government have encouraged investments in 5G infrastructure. A report by Confindustria highlights those foreign direct investments in the sector grew by 30% in 2023, underscoring the nation’s rising prominence.

KEY MARKET PLAYERS

The major players in the Europe 5G services market include Ericsson, Nokia, Huawei, Vodafone Group Plc, Deutsche Telekom AG, British Telecommunications plc, Orange S.A., Telefónica S.A., Telecom Italia (TIM), Proximus Group, Telia Company, and Swisscom AG.

TOP 3 PLAYERS IN THE MARKET

Ericsson

Ericsson is a global leader in telecommunications technology, playing a pivotal role in shaping the Europe 5G services market. The company provides end-to-end 5G solutions, including radio access networks (RAN), core networks, and IoT platforms. Ericsson’s Dynamic Spectrum Sharing (DSS) technology enables seamless migration from 4G to 5G, making it a preferred choice for operators. By focusing on energy-efficient solutions, Ericsson has positioned itself as a trusted partner for achieving carbon neutrality. Its contributions extend beyond Europe, influencing global trends in 5G innovation.

Nokia

Nokia specializes in developing advanced 5G infrastructure, offering products such as AirScale RAN and cloud-native core networks. The company’s focus on network slicing and edge computing has made it a key player in enabling mission-critical applications. Nokia’s ReefShark chipset enhances network performance while reducing energy consumption, aligning with Europe’s sustainability goals. In Europe, Nokia has actively collaborated with governments and private entities to promote smart city initiatives. Globally, Nokia’s innovations in uRLLC have set new benchmarks for reliability and low latency.

Huawei

Huawei is renowned for its cutting-edge 5G technologies, particularly its Massive MIMO antennas and AI-driven network optimization solutions. Despite geopolitical challenges, Huawei remains a significant player in Europe, offering cost-effective and scalable 5G infrastructure. The company’s focus on research and development has resulted in breakthroughs such as 5G-powered smart grids and autonomous vehicles. In Europe, Huawei has partnered with local operators to deploy 5G networks in underserved regions. Its expertise in integrating renewable energy sources has strengthened its position both regionally and internationally.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Strategic Partnerships

Leading players in the Europe 5G services market have embraced strategic partnerships to expand their reach and enhance service offerings. For instance, collaborations with cloud providers enable companies to offer integrated solutions for enterprises. These alliances not only foster innovation but also ensure compliance with EU regulations, strengthening their competitive edge.

Investment in R&D

Investments in research and development are a cornerstone strategy for staying ahead in the market. Companies are focusing on developing AI-driven network optimization tools and energy-efficient technologies that cater to evolving customer needs. This approach allows them to address challenges such as spectrum efficiency and scalability while maintaining leadership in technological advancements.

Geographic Expansion

Expanding into emerging markets within Europe, such as Eastern Europe and Scandinavia, has become a priority for key players. By establishing localized facilities and distribution networks, companies can better serve regional demands while capitalizing on favorable regulatory frameworks. This strategy ensures sustained growth amid intensifying competition.

COMPETITIVE LANDSCAPE

The Europe 5G services market is characterized by intense competition, driven by the presence of global giants and regional innovators vying for market share. Major players like Ericsson, Nokia, and Huawei dominate the landscape, leveraging their extensive expertise in telecommunications technology. However, the market also features niche players specializing in vertical-specific solutions, creating a fragmented yet dynamic ecosystem.

Technological innovation is a key battleground, with companies investing heavily in AI, IoT, and edge computing to differentiate themselves. According to McKinsey, over 60% of European enterprises prioritize secure and scalable 5G solutions, intensifying competition among providers to offer cutting-edge technologies. Additionally, stringent EU regulations mandating digital inclusion have forced companies to innovate inclusively, further raising the stakes.

Mergers and acquisitions are another hallmark of the competitive landscape. Larger firms acquire smaller innovators to expand their product portfolios and geographic reach. Meanwhile, price wars and aggressive marketing strategies are common, particularly in saturated markets like Germany and the UK. Despite these challenges, the market remains ripe for growth, with opportunities in emerging segments such as smart cities and enterprise-grade solutions driving future competition.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, Ericsson partnered with Deutsche Telekom to deploy 5G networks in rural Germany. This initiative aims to bridge the digital divide and enhance connectivity in underserved regions.

- In June 2023, Nokia launched its AirScale Indoor Radio solution in the UK, enabling seamless indoor 5G coverage for enterprises. This launch underscores Nokia’s commitment to supporting mission-critical applications.

- In September 2023, Huawei collaborated with Orange Spain to develop 5G-powered smart city solutions. This partnership seeks to enhance urban infrastructure and improve quality of life.

- In January 2024, Vodafone expanded its 5G services in Italy by introducing affordable pricing plans for consumers. This move aims to accelerate 5G adoption and increase market penetration.

- In November 2023, Telefonica unveiled its 5G-enabled IoT platform in Spain, designed to support industrial automation and smart manufacturing. This initiative positions Telefonica as a leader in enterprise-grade 5G solutions.

MARKET SEGMENTATION

This research report on the Europe 5G services market is segmented and sub-segmented into the following categories.

By Communication Type

- Fixed Wireless Access (FWA)

- Enhanced Mobile Broadband (eMBB)

- Ultra-Reliable and Low-Latency Communications (uRLLC)

- Massive Machine-Type Communications (mMTC)

By Vertical

- Consumer

- Enterprises

- Manufacturing

- Public Safety

- Healthcare & Social Work

- Media & Entertainment

- Energy & Utility

- IT & Telecom

- Transportation & Logistics

- Aerospace & Defense

- BFSI

- Government

- Retail

- Mining

- Oil & Gas

- Agriculture

- Construction

- Real Estate

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key drivers of growth in the Europe 5G services market?

Key drivers include increasing demand for high-speed internet, advancements in IoT technologies, government initiatives for digital transformation, and investments from telecom operators.

What are the major challenges facing the Europe 5G services market?

Major challenges include high deployment costs, regulatory hurdles, cybersecurity concerns, and the need for significant infrastructure upgrades.

How are telecom operators in Europe preparing for 5G deployment?

Telecom operators are investing heavily in network infrastructure, conducting 5G trials, forming partnerships with technology providers, and acquiring necessary spectrum licenses to facilitate 5G deployment.

What technological advancements are expected to accompany the rollout of 5G in Europe?

Technological advancements expected with the 5G rollout include enhanced mobile broadband (eMBB), ultra-reliable low latency communications (URLLC), massive machine-type communications (mMTC), and advancements in edge computing and AI integration.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]