Europe Veterinary Healthcare Market Research Report – Segmented By Animal Type (Livestock Animals, Companion Animals), Product and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe) - Industry Analysis From 2025 to 2033

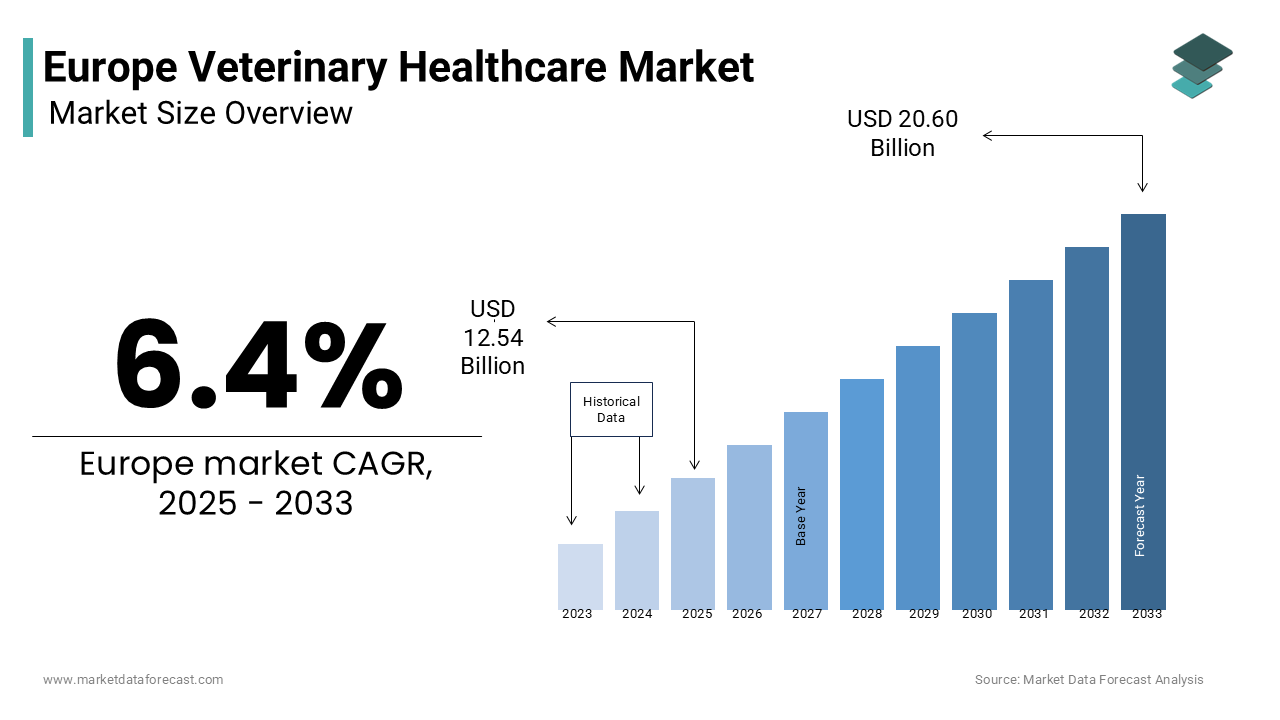

Europe Veterinary Healthcare Market Size

The europe veterinary healthcare market size was valued at USD 11.79 billion in 2024. The size of the market is expected to be worth USD 12.54 billion in 2025 and USD 20.60 billion by 2033, growing at a CAGR of 6.4% from 2025 to 2033.

The Europe veterinary healthcare market is a rapidly growing sector. It is driven by increasing pet ownership and advancements in animal health technologies. According to Eurostat, over 80 million households in Europe own at least one pet, with dogs and cats being the most popular companions. This trend has fueled demand for veterinary pharmaceuticals, diagnostics, and feed additives.

Additionally, stringent regulations governing livestock health, such as the EU Animal Health Law, have bolstered demand for preventive care and feed supplements. Germany leads the region in veterinary healthcare spending, accounting for a significant portion of total revenue, according to the German Veterinary Association. The rise of telemedicine and digital health platforms for pets has further accelerated market growth, aligning with broader healthcare trends.

MARKET DRIVERS

Rising Pet Ownership and Humanization of Pets

Rising pet ownership and the humanization of pets are significant drivers for the Europe veterinary healthcare market. According to the UK Pet Food Manufacturers’ Association, over 50% of European households now own a pet, with millennials and Gen Z consumers leading this trend. Pets are increasingly regarded as family members which is prompting owners to invest in premium healthcare services and products. For instance, a study reveals that pet healthcare spending notably grew annually between 2018 and 2022, driven by demand for advanced treatments like orthopedic surgeries and cancer therapies. Additionally, the growing awareness of preventive care has increased the use of vaccines and dietary supplements. The preventive healthcare makes up a considerable share of total veterinary expenditures, showcasing its importance in maintaining animal well-being.

Advancements in Veterinary Pharmaceuticals and Diagnostics

Technological advancements in veterinary pharmaceuticals and diagnostics are transforming the Europe veterinary healthcare market. Innovations such as point-of-care testing devices and molecular diagnostics enable early detection of diseases, improving treatment outcomes. For example, the use of rapid diagnostic kits increased in 2022, enhancing efficiency in clinical settings. Apart from these, the development of targeted therapies, such as monoclonal antibodies, has expanded treatment options for chronic conditions in companion animals. These advancements, coupled with government support for research and development, position veterinary healthcare as a key growth driver in the coming years.

MARKET RESTRAINTS

High Costs of Advanced Treatments

High costs associated with advanced veterinary treatments pose a significant restraint for the Europe veterinary healthcare market. This financial burden often discourages preventive care, particularly among low-income households. Besides, economic uncertainties, exacerbated by inflation and geopolitical tensions, have tightened household budgets. Also, discretionary spending on pet healthcare declined in recent years, reflecting reduced investment in non-essential treatments. While insurance schemes are gaining traction, their penetration remains limited, with only a small portion of pets insured in countries like France and Spain. This affordability gap hinders widespread adoption of advanced veterinary services, particularly in rural areas.

Stringent Regulatory Compliance Challenges

Stringent regulatory requirements pose significant challenges for manufacturers in the Europe veterinary healthcare market. Compliance with directives such as the EU Animal Health Law and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) demands rigorous testing and certification, increasing production timelines and costs. Also, non-compliance can result in hefty penalties, deterring smaller players from entering the market. In addition, frequent updates to these regulations create uncertainty, complicating product development. For instance, the introduction of stricter biosecurity standards has necessitated costly upgrades for livestock feed additives. A report reports that regulatory compliance accounts for a notable share of total project costs. These challenges limit innovation and slow market expansion, particularly for budget-constrained stakeholders.

MARKET OPPORTUNITIES

Expansion of Telemedicine and Digital Health Platforms

The expansion of telemedicine and digital health platforms presents a transformative opportunity for the Europe veterinary healthcare market. Moreover, these platforms offer remote consultations, prescription refills, and health monitoring, enhancing accessibility for pet owners in rural areas. Like, telemedicine reduces travel time and costs considerably, appealing to busy urban professionals. Additionally, governments across Europe are promoting digital health initiatives, such as the UK’s "Digital Health Innovation Hub," which provides funding for startups. This convergence of innovation and convenience positions telemedicine as a key growth driver in the coming years.

Growth of Preventive Healthcare and Wellness Products

The growing emphasis on preventive healthcare and wellness products presents a lucrative opportunity for the Europe veterinary healthcare market. Similarly, a substantial percentage of pet owners prioritize preventive care, including vaccinations, parasite control, and dietary supplements. This trend has spurred demand for innovative wellness products, such as functional pet foods and nutraceuticals. A report notes that sales of preventive healthcare products in Italy notably grew annually between 2019 and 2022, driven by consumer awareness campaigns. Additionally, the rise of subscription-based wellness programs, offered by companies like Zoetis and Boehringer Ingelheim, has enhanced customer retention. These programs provide regular health check-ups and personalized recommendations, aligning with modern lifestyle preferences.

MARKET CHALLENGES

Limited Awareness of Preventive Care in Rural Areas

Limited awareness of preventive care in rural areas remains a significant challenge for the Europe veterinary healthcare market. A significant number of rural households in Europe lack access to veterinary clinics, hindering early diagnosis and treatment. Besides, cultural perceptions about animal health often prioritize curative care over preventive measures, exacerbating disease prevalence. A study by the Spanish Ministry of Agriculture highlights that vaccination rates in rural livestock farms are significantly lower than in urban areas, increasing vulnerability to outbreaks. Governments and NGOs are addressing this issue through educational campaigns, but progress remains slow. This lack of awareness limits market penetration, particularly for preventive products and services, creating disparities in animal healthcare access.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages pose significant challenges to the Europe veterinary healthcare market. The ongoing semiconductor shortage has impacted the production of diagnostic devices, which rely on advanced sensors and control systems. Moreover, the lead times for critical components have increased, delaying project timelines. Additionally, rising prices of raw materials, such as antibiotics and vitamins used in feed additives, have escalated manufacturing costs. The European Feed Additives Association reports that raw material prices surged by 25% in 2022, affecting product affordability. These disruptions are compounded by logistical bottlenecks, particularly in cross-border shipments. As a result, manufacturers face delays and increased expenses, hindering their ability to meet growing demand.

SEGMENTAL ANALYSIS

By Animal Type Insights

The segment of companion animals dominated the Europe veterinary healthcare market by capturing 65.3% of total revenue in 2024. This growth of the segment is driven by the growing humanization of pets and increasing pet ownership across the region. In addition, the rise of premium healthcare services, such as orthopedic surgeries, dental care, and cancer treatments, has further propelled demand. Apart from these, the availability of insurance schemes for companion animals, particularly in the UK and Germany, has made advanced treatments more accessible.

The livestock animals segment is the fastest-growing segment in the Europe veterinary healthcare market, with a projected CAGR of 9.3% through 2033. This growth is fueled by stringent regulations governing livestock health, such as the EU Animal Health Law, which mandates preventive care and biosecurity measures. Additionally, the growing demand for high-quality animal-derived products, such as organic milk and meat, has encouraged farmers to invest in advanced healthcare solutions.

By Product Insights

The Pharmaceuticals segment was the top performer in the Europe veterinary healthcare market by accounting for 55.7% of total revenue in 2024. This is driven by the widespread use of vaccines, antibiotics, and specialized treatments for chronic conditions in companion and livestock animals. Also, pharmaceuticals account for a significant percentage of all veterinary expenditures, reflecting their critical role in disease prevention and treatment. Innovations such as monoclonal antibodies and targeted therapies have expanded treatment options, particularly for companion animals. Additionally, government initiatives promoting vaccination programs, such as those for rabies and avian influenza, have bolstered demand.

The feed additives segment emerged as the rapidly expanding product category in the Europe veterinary healthcare market, with a calculated CAGR of 10.7% through 2033. This progress is influenced by the increasing focus on livestock productivity and the rising demand for high-quality animal-derived products. Moreover, the use of feed additives such as probiotics, vitamins, and amino acids notably increased annually between 2019 and 2022, driven by consumer preferences for organic and antibiotic-free products. Besides, advancements in biotechnology have enabled the development of innovative additives that enhance animal health and growth rates. A study notes that feed additives noticeably reduce mortality rates in livestock farms, making them indispensable for modern farming practices.

REGIONAL ANALYSIS

Germany spearheaded the Europe veterinary healthcare market by accounting for 25.7% of total revenue in 2024. This dominance is propelled by the country’s robust agricultural sector and high pet ownership rates. Like, a significant portion of German households own a pet, creating steady demand for companion animal healthcare. In addition, Germany’s stringent regulatory framework ensures high standards of livestock management, driving demand for vaccines and feed additives. A study emphasizes that preventive healthcare accounts for 45% of total veterinary expenditures in Germany, underscoring its importance in maintaining animal well-being. The country’s advanced infrastructure and emphasis on innovation further solidify its leadership in the market.

France is the highest-growing market in the Europe veterinary healthcare segment, with a projected CAGR of 9.8% in the coming years. This growth is fueled by urbanization trends and government initiatives promoting digital health platforms. Also, the rise of organic farming has boosted demand for feed additives, aligning with consumer preferences for sustainable products.

The UK benefits from high pet insurance penetration, with gradual rise in number of pets insured. This trend has made advanced treatments more accessible, driving market growth. Italy’s artisanal livestock farming drives demand for premium feed additives, particularly probiotics and vitamins. Spain’s growing pet ownership rates, combined with rising disposable incomes, ensure steady growth across these regions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few of the noteworthy companies operating in the European veterinary healthcare market profiled in this report are Merck & Co., Inc., Bayer AG, Boehringer Ingelheim GmbH, Cargill, Inc., Ceva Santé Animale, Novasep, Eli Lilly and Company, Koninklijke DSM N.V., Novartis AG, Nutreco N.V., Sanofi S.A., SeQuent Scientific Ltd., Virbac S.A., Vétoquinol S.A., and Zoetis Inc.

The Europe veterinary healthcare market is highly competitive, characterized by the presence of global leaders like Zoetis, Boehringer Ingelheim, and Elanco, alongside regional players offering cost-effective solutions. Global players leverage innovation, offering advanced technologies such as point-of-care diagnostics, rapid diagnostic kits, and targeted therapies. Regional players compete on price and customization, targeting niche segments like small-scale livestock farms and budget-conscious pet owners. The market’s fragmentation intensifies competition, prompting manufacturers to differentiate through value-added services like extended warranties and rapid installation timelines. Stringent regulatory standards and the rise of digital health platforms have shifted focus toward sustainable and accessible solutions, creating opportunities for innovation. Collaborations with governments ensure stable demand, while investments in R&D drive technological advancements. Supply chain disruptions and economic uncertainties further shape the competitive landscape, pressuring companies to balance affordability with quality.

Top Players in the Europe Veterinary Healthcare Market

1. Zoetis

Zoetis dominates the Europe veterinary healthcare market. Its innovative solutions, such as vaccines, diagnostics, and monoclonal antibody treatments, cater to both companion and livestock animals, enhancing its global presence. Zoetis’ focus on sustainability aligns with Europe’s green initiatives, as seen in its development of eco-friendly feed additives. The company’s localized production facilities enable it to meet growing demand efficiently, while its investments in R&D drive technological advancements.

2. Boehringer Ingelheim

Boehringer Ingelheim is specializing in preventive care and wellness products, the company targets urbanization trends, ensuring consistent demand across Europe. Boehringer Ingelheim’s collaboration with French startups to develop telemedicine platforms has enhanced accessibility for rural pet owners. Additionally, its focus on livestock health, particularly through feed additives and vaccines, aligns with Europe’s stringent biosecurity standards. A study by the German Veterinary Society highlights that Boehringer Ingelheim’s innovations in livestock productivity have reduced mortality rates, reinforcing its leadership in this segment.

3. Elanco

Elanco accounts for a notable share of the market. Its focus on sustainability and digital health platforms strengthens its position globally. Also, Elanco’s subscription-based wellness programs, which offer personalized health recommendations for pets and livestock, have gained traction among modern consumers. Additionally, its commitment to developing antibiotic-free feed additives aligns with Europe’s regulatory landscape, positioning it as a key player in the feed additives segment.

Top Strategies Used by Key Players

Key players employ diverse strategies to maintain their competitive edge in the Europe veterinary healthcare market. Product innovation remains a cornerstone, with companies investing heavily in advanced technologies such as point-of-care diagnostics, targeted therapies, and eco-friendly feed additives. For instance, Zoetis’ monoclonal antibody treatments and Boehringer Ingelheim’s telemedicine platforms exemplify this trend. Geographic expansion is another critical strategy, with manufacturers targeting emerging markets in Eastern Europe to capitalize on urbanization trends. Strategic partnerships with governments and NGOs ensure compliance with stringent animal health regulations, while collaborations with retailers enhance accessibility. Companies also invest in digital platforms, such as mobile apps and online consultations, to streamline customer engagement and boost sales. Mergers and acquisitions consolidate market positions, enabling access to new technologies and customer bases.

RECENT MARKET DEVELOPMENTS

- In March 2023, Zoetis launched a new line of monoclonal antibody treatments in Germany, targeting chronic conditions in companion animals. This initiative strengthened its position in the pharmaceutical market by addressing unmet medical needs.

- In June 2023, Boehringer Ingelheim partnered with a French startup to develop a telemedicine platform for rural pet owners. This collaboration enhanced accessibility and customer engagement, particularly in underserved areas.

- In September 2023, Elanco acquired a Polish manufacturer, expanding its production capacity for feed additives in Eastern Europe. This move enabled the company to meet growing demand while reducing logistical bottlenecks.

- In November 2023, Merck introduced a rapid diagnostic kit in Spain, reducing testing times for livestock diseases by 50%. This innovation improved efficiency in clinical settings, appealing to veterinarians and farmers alike.

- In January 2024, Bayer launched a subscription-based wellness program in Italy, offering personalized health recommendations for pets and livestock. This program enhanced customer retention and aligned with modern lifestyle preferences.

MARKET SEGMENTATION

This research report on the europe veterinary healthcare market has been segmented and sub-segmented into the following categories.

By Animal Type

- Livestock Animals

- Companion Animals

By Product

- Pharmaceuticals

- Feed Additives

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

Which countries in Eastern Europe show the highest growth potential in the veterinary healthcare sector?

Poland and Hungary are emerging as key markets in Eastern Europe.

What factors contribute to the growth of veterinary diagnostics in Northern Europe?

The increasing adoption of advanced diagnostic technologies and rising awareness about pet health are major drivers in Northern Europe.

What factors are hindering the veterinary healthcare market in Switzerland?

High treatment costs and limited insurance coverage pose challenges to market growth in Switzerland.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]