Europe In-Vitro Fertilization (IVF) Market Size, Share, Trends & Growth Forecast Report By Reagents & Media, Instruments, Technology, End Users & Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe In-Vitro Fertilization (IVF) Market Size

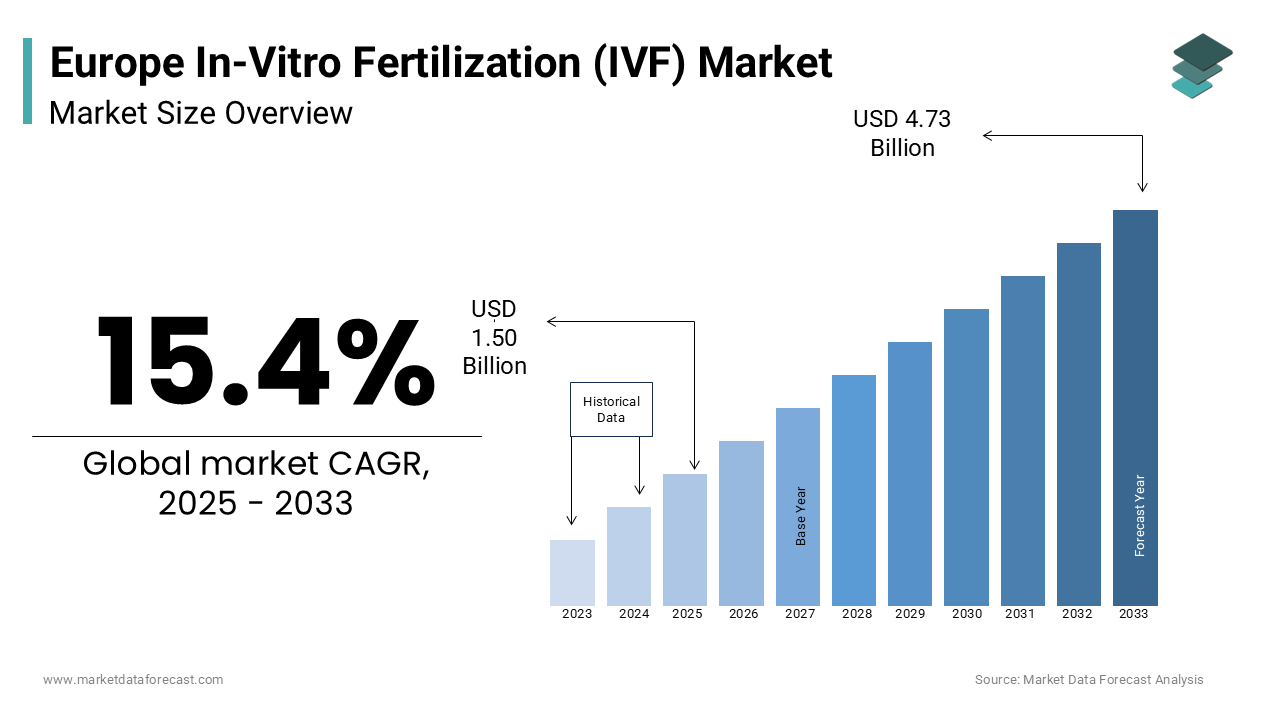

The size of the In-Vitro fertilization (IVF) market in Europe was valued at USD 1.30 billion in 2024. The European market size is expected to reach USD 4.73 billion by 2033 from USD 1.50 billion in 2025, growing at a CAGR of 15.4% during the forecast period.

MARKET DRIVERS

Declining Fertility Rate in Europe

In 2020, the EU5 (Germany, France, United Kingdom, Spain, and Italy) collectively accounted for around three-fifths of the European market share. Moreover, most fertility clinics in Europe offer services to the population to prevent infertility, due to which this region has witnessed a high and increased frequency of fertility clinics. The declining fertility rate is one of the major factors propelling the European IVF market growth. In recent years, Europe has seen a rapid decline in fertility due to several factors, such as increasing closures of several fertility centers during the pandemic and increasing infertility rates among men and women due to changes in their lifestyles. In addition, increasing obesity and adopting unhealthy lifestyles due to rising working hours is a significant issue among men and women, which causes infertility. In addition, the growing number of advancements in infertility treatment procedures are promoting the growth rate of the European IVF market. Researchers are focusing on developing various devices and equipment for making the infertility treatment process easy with a smaller number of sessions, less pain, and an increase in the success rate of the treatment. Increasing government investment also helps market growth. In addition, pharmaceutical companies are showing interest in manufacturing different types of drugs for treating infertility in people who are at an early age and have more chances to conceive by taking the pills.

The IVF market in European countries such as the UK, Germany, and France is growing consistently. The regulatory scenario in the UK, such as the U.K. Human Fertilization and Embryo Authority (HFEA), is tightly regulating the operation of in vitro fertilization treatments and research in the U.K., favoring regional market growth. The falling birth rate in Germany is plus to the market’s growth rate. The availability of reimbursement policies in the European region is anticipated to result in the IVF market growth in Europe.

In addition, factors such as rising public and private sector participation in the IVF market, increasing support for the growth of fertility clinics and infertility services across the European region, the growing focus of market participants towards fertility protection activities, and education to improve the network for sharing best practices and brief information on infertility and fertility are anticipated to drive the European IVF market. The number of IVF centers in Europe is growing considerably due to the growing population and rising trend of delayed pregnancy among women. Furthermore, as the age increases, the chances of natural conception decrease, leading to an increase in infertility problems; as a result, more women are forced to use in vitro fertilization banking services to increase the success rate, which is expected to boost market growth. In addition, because these centers strive to provide public funding for all lines of fertility treatment to eliminate the stigma associated with infertility, the IVF market is anticipated to grow further. Furthermore, the growing awareness regarding the availability of various treatment options for infertility is supporting the European IVF market growth. Furthermore, the increasing promotional efforts of the market participants to promote awareness of infertile centers and infertility treatment through social media and TV helps spread awareness about the treatment process and the cost, which helps in adopting the treatment among people in rural areas and uneducated people.

MARKET RESTRAINTS

High Costs

However, high costs associated with IVF treatments and strict government regulations are anticipated to hamper the growth rate of the regional market growth. In addition, a patient may need multiple pregnancy cycles due to the lower success rate of IVF procedures, which increases the total cost. The average cost of this procedure is approximately USD 15,125 to USD 25,300, which is often a significant barrier to adopting the technique. Besides, ethical considerations and lack of reimbursement are other challenges hampering the market's growth. In addition, the lack of reimbursements and ethical considerations against IVF further inhibit the European IVF market growth.

REGIONAL ANALYSIS

The European region enjoys an excellent reputation in the global IVF market, as it was the first to introduce the IVF procedure. Furthermore, among all the other regions of the world, Europe has always been at the forefront of providing assisted reproduction services, mainly due to the help and support from the European Society of Human Reproduction and Embryology. As a result, approximately 37% of the global in vitro fertilization (IVF) market was accounted for by Europe in 2020, which proves that the IVF market in Europe has the highest share among other regions. This is mainly due to various favorable government policies offered to women for infertility treatment, leading to growing support from health insurance players in this region.

The UK IVF market is expected to hold considerable of the European market during the forecast period. The added advantage of primarily offering services free of charge by the National Health Service in the United Kingdom is further leading to more adoption of fertility clinics, ultimately leading to the growth of the IVF services market. Nearly one in seven couples have difficulty conceiving in this region. Therefore, the United Kingdom government is focused on launching different facility centers for the infertile and training healthcare providers about the new types of procedures for the patients to increase the success rate. The IVF market in France accounted for the highest number of IVF cycles per year in 2022. The increasing number of infertility centers in France is one of the key factors promoting the market’s growth rate in France. The Spanish IVF market is one of the potential regional markets in the European region. It is estimated to grow at a healthy CAGR during the forecast period owing to the growing fertility tourism and the high success rates of the treatments provided.

KEY MARKET PLAYERS

Companies playing a dominant role in the European IVF Market profiled in this report are Cooper Surgical, Inc. (U.S.), Vitrolife AB (Sweden), Cook Medical, Inc. (U.S.), Irvine Scientific (U.S.), Thermo Fisher Scientific, Inc. (U.S.), EMD Serono, Inc. (U.S.), Genea Limited (Australia), ESCO Micro Pte. Limited (Singapore), IVFtech ApS (Denmark), and The Baker Company, Inc. (U.S.).

MARKET SEGMENTATION

This research report on the Europe IVF Market has been segmented and sub-segmented into the following categories.

By Reagents and Media

- Embryo Culture Media

- Cryopreservation Media

- Sperm Processing Media

- Ovum Processing Media

By Instruments

- Imaging Systems

- Sperm Separation Systems

- Ovum Aspiration Pumps

- Incubators

- Micromanipulator Systems

- Cryptosystem

- Other Instruments (Gas Analyzers, Laser Systems, Accessories)

By Technology

- Intra-Cytoplasmic Sperm Injection (ICSI)

- Pre-Implantation Genetic Diagnosis (PGD)

- Frozen Embryo Transfer/Replacement (FET/FER)

- Other Technologies

By End Users

- Fertility and Surgical Centers

- Hospitals and Research Laboratories

- Cryobanks

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

How big is the Europe IVF market?

The European IVF market is expected to be 1.3 billion in 2024.

Which countries held major share of the European IVF market in 2024?

The EU countries accounted for the largest share of the European IVF market in 2024.

What are the companies playing a notable role in the IVF market in Europe?

Cooper Surgical, Inc. (U.S.), Vitrolife AB (Sweden), Cook Medical, Inc. (U.S.), Irvine Scientific (U.S.), Thermo Fisher Scientific, Inc. (U.S.), EMD Serono, Inc. (U.S.), Genea Limited (Australia), ESCO Micro Pte. Limited (Singapore), IVFtech ApS (Denmark), and The Baker Company, Inc. (U.S.) are some of the noteworthy companies in the European IVF market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]